Which bot should I use, and what can go wrong? That is the right question to ask. Crypto bots can feel like power tools. They make hard jobs faster and cleaner, but they do not turn anyone into a master builder overnight. Bots automate execution and discipline. They do not create an edge by themselves.

In this article, we go beyond glossy feature lists. You will find a clear security section that shows how to protect your keys, a breakdown of what each platform calls AI and what that really means, a short list of emerging AI-first tools to watch, and a practical selector guide so you can match a bot to your goals and your risk limits.

Quick Verdict

Key Takeaways

- Best for active traders: Users who want automation for entries, exits, and sizing but are willing to review performance and adjust rules.

- Not set-and-forget: Bots need oversight, especially during volatility spikes, exchange outages, or liquidity drops.

- PionexGPT: Plain-English prompts generate bot configurations directly on the exchange, lowering setup friction for beginners.

- Cryptohopper Algorithm Intelligence: Scores and rotates strategies based on market conditions, useful for users who switch approaches frequently.

- Bitsgap AI Assistant: Suggests bot parameters and portfolios across multiple exchanges from a single terminal.

- HaasScript: Full scripting control for advanced traders who want custom logic, market making, or arbitrage beyond templates.

- Risk surface: API keys increase attack exposure; always use trade-only permissions, IP allow lists, and key rotation.

- Backtests can lie: Overfitting, ignored fees, and unrealistic fills can inflate results. Validate with paper trading before scaling.

What AI Can and Cannot Do

In most cryptocurrency platforms, “AI” typically refers to the use of AI trading bots powered by machine learning to rank or filter signals, generate recommendations for entries/exits, adjust adaptive position sizing when volatility changes, and translate natural-language prompts into ready-made rules. A helpful analogy is a GPS: it suggests routes and recalculates when conditions shift, but you still choose the destination and how cautiously to drive. Many tools also guide basic backtesting and embed light risk management guardrails.

What AI does Not Do is Predict Black Swans or Guarantee Profits. Image via Shutterstock

What AI does Not Do is Predict Black Swans or Guarantee Profits. Image via ShutterstockWhat AI does not do is predict black swans or guarantee profits. These systems learn from historical and observed data; when markets look unfamiliar, outputs can be unreliable, and language models may hallucinate confident but incorrect suggestions. Authorities emphasize testing, monitoring, and human oversight in frameworks like NIST’s AI Risk Management Framework and the EU’s AI Act.

If you are new to this space, start with our primer on AI trading bots so the rest of this guide lands cleanly.

Our Top Picks for Crypto AI-Powered Trading Bots

| Bot name | Exchanges | Strategies | Customization | AI features | Paper trading or demo | Pricing (annual plans) | Best for |

|---|---|---|---|---|---|---|---|

| 3Commas | Binance, Bybit, OKX, Kraken, KuCoin, and others | DCA, grid, SmartTrade workflows, signal routing | Visual SmartTrade workspace, rule controls, alerts | AI trading bot and assistant driven suggestions in SmartTrade | Basic simulation and backtesting | Starts from $12.42 per month, and so on | Multi exchange control with structured entries and exits |

| Cryptohopper | Binance, Bybit, OKX, Coinbase Advanced, Kraken, KuCoin, and others | Rule strategies, marketplace templates, copy trading | Visual Strategy Designer, signal subscriptions | Algorithm Intelligence for strategy rotation | Backtesting and paper trading | Pioneer Free, Explorer package begins at $24.16 per month, and so on | Marketplace and strategy switching users |

| Coinrule | Binance, OKX, Bybit, Bitget, Coinbase Advanced, Kraken, KuCoin, and others | If then rules, templates, stops and targets | No code editor with reusable templates and controls | AI Trading for adaptive optimization | Demo exchange | Starter Free, Investor $29.99, per month, and so on | No code rule builders |

| Pionex | Pionex exchange | Grid, DCA, infinity grid, signal following | In venue setup with guided parameters | PionexGPT for plain English configs | No separate paper mode noted; Demo Trading | Spot 0.050%, Leverage 0.100%, Futures 0.020% Maker | Beginners who want built-in bots and low overhead |

| TradeSanta | 9 major exchanges, including Binance, Kraken, OKX, etc. | Template strategies, indicator rules, trailing take profit | Cloud terminal with rule editor and alerts | Rule based automation; no model driven predictions claimed | Demo trading available | Basic Plan starts from $18 per month, and so on | Template first, quick cloud setup |

| Bitsgap | Binance, Bybit, OKX, Coinbase Advanced, Kraken, KuCoin, Bitget, and others | Grid, DCA, COMBO futures, manual Smart Trade | Unified terminal with advanced order control | AI Assistant suggests configurations | Demo mode and backtests | Basic Plan starts from $18 per month, and so on | One terminal for many exchanges |

| HaasOnline | Binance, Bybit, OKX, Kraken, KuCoin, Bitget, and others | Market making, arbitrage, scalping, custom logic | HaasScript visual and code editors | Scripting centric customization rather than AI | Built in backtesting and paper trading | Starter package from $23 per month, and so on | Advanced traders and developers who want deep control |

Note: Data sourced as of Jan. 2, 2026. Be sure to check the latest pricing when you subscribe.

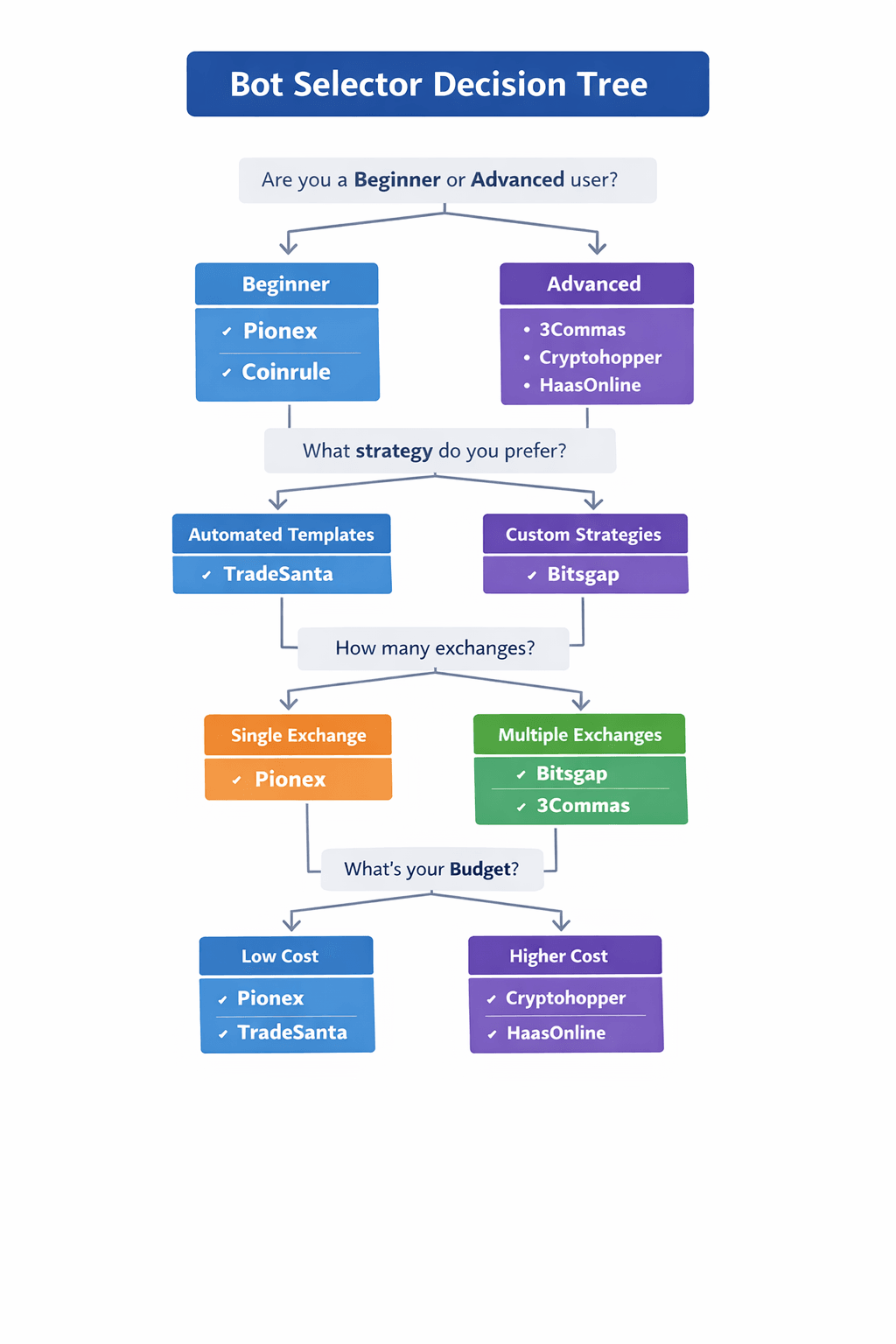

This Decision Tree Will Help You Choose The Right Bot For Your Needs

This Decision Tree Will Help You Choose The Right Bot For Your NeedsQuick Selection Guide

Use this as a fast match between your workflow and the bot’s core strengths.

- Choose 3Commas if you want multi-exchange control with SmartTrade workflows, signal routing, and hands-on management suited to active traders.

- Choose Pionex if you are a beginner who wants built-in bots, low overhead, and plain-English strategy creation through PionexGPT on a single exchange.

- Choose Cryptohopper if you prefer a strategy marketplace, copy trading, and automated strategy switching powered by Algorithm Intelligence.

- Choose Bitsgap if you trade on many exchanges and want a unified terminal with bot configurations guided by the AI Assistant.

- Choose HaasOnline if you code or want deep, developer-grade customization using HaasScript for advanced logic and execution control.

- Choose Coinrule if you want no-code “if-then” rules, reusable templates, and structured automation without programming.

- Choose TradeSanta if you want a template-first experience with quick cloud setup and minimal configuration overhead.

How We Reviewed And Tested These Bots

Criteria for Inclusion

We only included platforms that met a practical baseline for real users:

- Reputation: Established track record, identifiable team/company, and meaningful user adoption.

- Functionality: Core bot types (grid, DCA, rule-based automation, or advanced scripting) plus essential controls.

- Ease of Use: Clear onboarding, sensible defaults, and an interface that reduces configuration mistakes.

- Exchange Support: Coverage of major venues and reliable API connectivity for the strategies offered.

- Security Features: Support for trade-only keys, granular permissions, and optional IP allowlists where exchanges provide them.

- Pricing Transparency: Clear plan tiers, feature gating, and visible costs without confusing add-ons.

Our Testing Approach

We used a repeatable process focused on usability, controls, and operational reliability:

- Demo/paper trading where available to validate end-to-end order flow without risking capital.

- Simulated portfolios ($500 to $1,000) run through multiple market conditions (range-bound, trending, and higher volatility periods).

- Hands-on evaluation of setup time, UX clarity, monitoring and alerts, strategy controls (risk limits, stops, cooldowns), and error handling (API throttling, partial fills, disconnects).

What We Did Not Test

- We did not attempt to rank bots by profitability or publish a performance leaderboard.

- We did not assume backtests translate directly to live results or model “best-case” execution.

- We did not standardize one strategy across all bots, since outcomes vary by market regime, fees, slippage, liquidity, and exchange-specific execution rules.

1. 3Commas

3Commas is an automation platform that brings a unified SmartTrade workspace together with DCA bots, grid bots, and TradingView alert routing. It connects to major venues through API keys and helps you plan entries, exits, and risk with one consistent interface.

3Commas Works Best when you Monitor Results and Adjust Rules as Conditions Change. Image via 3Commas

3Commas Works Best when you Monitor Results and Adjust Rules as Conditions Change. Image via 3CommasBest For

Multi-exchange traders who want SmartTrade flows with signal-driven execution.

Standout Features

- The SmartTrade terminal centralizes orders, targets, and stops so you can manage positions from one screen instead of juggling separate tickets.

- DCA and grid automation apply structured scaling rules so you can review historical behavior and go live with clearer expectations.

- TradingView alerts can route to connected exchanges, which turns external signals into actual orders.

AI Enhanced Features

- AI trading bot and an assistant that analyzes trend and volatility to propose entries, risk settings, and targets you can review before launch.

- SmartTrade surfaces model driven suggestions in the same workspace so you can review and adjust parameters prior to launch.

Supported Exchanges

Major exchanges include:

- Binance

- Bybit

- OKX

- Coinbase Advanced

- Kraken

- KuCoin

Pricing

- Starter: $12.42 per month

- Pro: $30 per month

- Expert: $91.58 per month.

Data as of Jan. 2, 2026. Prices based on annual subscriptions.

Set up in 5 Steps

- Create account

- Connect an exchange API

- Set trade-only permissions

- Choose a bot in SmartTrade

- Paper trade before going live

Risk Note

Protect API keys with trade-only permissions and IP allow lists, and pair DCA with stop loss rules and cooldowns.

Who Should Skip It

Users who want a complete set and forget experience. This platform works best when you monitor results and adjust rules as conditions change.

Don't miss out on our detailed review of 3Commas.

2. Cryptohopper

Cryptohopper combines a visual Strategy Designer, a curated Marketplace, and Social trading in a cloud environment that connects to major exchanges through API keys. It helps you move from an idea to an automated plan without running your own server.

Social Trading Allows you to Copy Experienced Traders with Controls over Risk and Allocation. Image via Cryptohopper

Social Trading Allows you to Copy Experienced Traders with Controls over Risk and Allocation. Image via CryptohopperBest For

Marketplace users who want ready-made strategies and traders who switch strategies as conditions change.

Standout Features

- The Strategy Designer lets you assemble rules with indicators and test variations so you can turn a concept into a structured strategy.

- The Marketplace offers strategies, templates, and signals that you can subscribe to and manage from one account.

- Social trading allows you to copy experienced traders with controls over risk and allocation.

Algorithm Intelligence Platform

- Algorithm Intelligence scores strategies using inputs such as trend strength, volatility, and volume, then rotates the active choice.

- In the builder, signals receive a score from negative one to one to help you compare options before going live.

Supported Exchanges

Major exchanges include:

- Binance

- Bybit

- OKX

- Coinbase Advanced

- Kraken

- KuCoin

Pricing

- Pioneer: Free

- Explorer: $24.16 per month

- Adventurer: $57.5 per month

- Hero: $107.5 per month.

Data as of Jan. 2, 2026. Prices based on annual subscriptions.

Set up in 5 Steps

- Create account

- Connect an exchange API

- Set trade-only permissions

- Pick or design a strategy

- Backtest or paper trade before going live

Risk Note

Marketplace strategies and copy trading can diverge from your risk profile, and parameter mismatches can lead to unexpected drawdowns. Review allocations against your risk management rules before scaling.

Who Should Skip It

Traders who want a single, stable strategy they can set once and leave running. Cryptohopper works best when you actively review strategy performance, rotate Marketplace tools, and adjust parameters as market regimes shift.

You can read a lot more in our exclusive Cryptohopper review.

3. Coinrule

Coinrule is a no-code automation platform for building rules with simple conditions and actions. You can start from templates or design your own logic, connect an exchange through API keys, and run strategies in the cloud.

Coinrule is a No Code Automation Platform for Building Rules with Simple Conditions and Actions. Image via Coinrule

Coinrule is a No Code Automation Platform for Building Rules with Simple Conditions and Actions. Image via CoinruleBest For

Coinrule suits beginners and non-programmers who want to assemble strategies in a visual editor. Templates and position controls provide a guided workflow while you learn.

Strategy Depth

Rules follow if-then logic with configurable conditions and actions. You can trigger a buy on a moving average cross and attach a take profit and a stop loss, then rehearse on a demo exchange to check backtesting assumptions.

Automation And Intelligence

This is primarily rule-based automation. AI Trading adds adaptive optimization that learns from execution data while you still define intent and risk limits.

Supported Exchanges

Major exchanges include:

- Binance

- OKX

- Bybit

- Bitget

- Coinbase Advanced

- Kraken

- KuCoin

Pricing

- Starter: Free

- Investor: $29.99 per month

- Trader: $59.99 per month

- Fund: $749 per month

Data as of Jan. 1, 2026. Prices based on annual subscriptions.

Set up in 5 Steps

- Create account

- Connect an exchange API key

- Set trade-only permissions

- Load a template or build a rule

- Use the demo exchange before going live.

Risk Note

Rule conflicts, indicator lag, and weak regime detection can still cause losses. Start small, monitor fills, and apply strict risk management before scaling.

Who Should Skip It

Users looking for deep model-driven decision making or hands-off automation. Coinrule is powerful for rules, but it still requires you to define logic, review conditions, and intervene when markets move outside your assumptions.

4. Pionex

Pionex is an exchange with built-in trading bots. You connect an account, select a bot, and run it directly on the venue without separate hosting. The fee model is simple and there is no subscription for bots.

Pionex is an exchange with built in trading bots. Image via Pionex

Pionex is an exchange with built in trading bots. Image via PionexBest For

Beginners who want built-in automation with low overhead and a guided setup.

Built-In Bots Overview

Core options include grid, DCA, infinity grid, and tools that follow external signals through the Signal Bot.

PionexGPT Integration

PionexGPT turns plain English prompts into a configuration with suggested parameters and backtesting ideas. Example prompts include “build a grid for BTC within a two percent band and add a stop loss” and “create a weekly DCA plan for ETH with a five percent max drawdown.”

Exchange Model And Liquidity

Bots execute inside the exchange environment, so orders route directly to the venue order book rather than through a third party. This reduces setup friction and keeps management in one place.

Pricing

- Spot: 0.050% Makers/Takers

- Leverage: 0.100% Makers/Takers

- Futures: 0.020% Makers and 0.050% Takers

There is no separate bot subscription.

Data as of Jan. 1, 2026. Prices based on annual subscriptions.

Set up in 5 Steps

- Create account

- Fund the wallet

- Choose a bot

- Configure or prompt PionexGPT

- Run and monitor

Risk Note

Grid strategies can accumulate inventory during prolonged trends. Parameters can drift away from market conditions, so review stop loss settings and monitor fills as conditions change.

Who Should Skip It

Advanced traders who want cross-exchange routing, custom execution logic, or granular control over strategy internals. Pionex prioritizes simplicity over flexibility and is best suited to guided, exchange-native bots.

We have a detailed review of Pionex that will help you take a deep dive into its AI Trading sphere.

5. TradeSanta

TradeSanta is a cloud automation platform that lets you run crypto bots without managing servers. You connect exchange accounts through API keys, choose a template or build your own rules, and automate orders with monitoring and alerts.

Tradesanta Offers Template based Cloud Bots where you want Quick Setup and a Hosted Environment. Image via TradeSanta

Tradesanta Offers Template based Cloud Bots where you want Quick Setup and a Hosted Environment. Image via TradeSantaBest For

Template-based cloud bots where you want quick setup and a hosted environment.

Features That Matter

Key tools include trailing take profit and order management inside a trading terminal, plus indicator-based rules and strategy templates you can adapt to your pairs. A demo trading mode allows practice without risking funds.

Automation And Intelligence

This is primarily automation. Articles on the TradeSanta site discuss AI themes, but core features revolve around rule-based bots and indicator signals rather than model-driven predictions.

Supported Exchanges

Some exchanges include:

- Binance

- Kraken

- OKX

- Huobi

- HitBTC

Pricing

- Basic $18 per month

- Advanced $32 per month

- Maximum $45 per month

Plans scale bot counts and feature access. Promotions on the page may reduce the effective monthly rate.

Data as of Jan. 1, 2026. Prices based on annual subscriptions.

Set up in 5 Steps

- Create account

- Connect exchange API keys

- Set trade-only permissions

- Pick a template or build rules

- Demo trade or backtest before going live

Risk Note

Heavy reliance on indicators can fail during regime shifts, and a template that fits one pair may not fit another. Align settings with your risk management rules and test on the demo before scaling.

Who Should Skip It

Traders who rely on complex strategies or adaptive models. TradeSanta’s template-driven approach favors simplicity, but it can feel limiting if you want fine-grained control or frequent parameter optimization.

6. Bitsgap

Bitsgap is a multi-exchange terminal that brings bots and manual trading into one workspace. You connect your exchange accounts through API keys, choose a bot, and monitor everything from a single interface. It suits active users who want one place to manage spot and futures strategies.

Bitsgap is a Multi Exchange Terminal that brings Bots and Manual Trading into one Workspace. Image via Bitsgap

Bitsgap is a Multi Exchange Terminal that brings Bots and Manual Trading into one Workspace. Image via BitsgapBest For

Multi-exchange traders who want one terminal with both automation and a full trading desk.

Bots and Tools

Core options include grid, DCA, and COMBO for futures, plus a Smart Trade terminal for advanced order control.

AI-Powered Bot Recommendations

The AI Assistant asks about balance and risk tolerance, analyzes conditions, and suggests configurations you can review before launch. It can also group AI bots into one portfolio for tracking.

Supported Exchanges

Some major exchanges include:

- Binance

- Bybit

- OKX

- Coinbase Advanced

- Kraken

- KuCoin

- Bitget

Pricing

- Basic $23 per month

- Advanced $55 per month

- Pro $121 per month

Plans scale active bots, backtest depth, and futures features.

Data as of Jan. 1, 2026. Prices based on annual subscriptions.

Set up in 5 Steps

- Create account

- Connect exchange API keys

- Set trade-only permissions

- Choose a bot or use AI Assistant

- Paper trade in demo before going live

Risk Note

Futures add leverage and liquidation risk, and funding rates and slippage can erode results. Start small, validate settings in demo, and apply strict risk management before scaling.

Who Should Skip It

Passive users who do not want to manage leverage, funding rates, or execution nuances. Bitsgap delivers powerful tools, but it rewards traders who actively monitor performance and understand the risks of multi-exchange and futures trading.

Check out our detailed review of Bitsgap for more information.

7. HaasOnline

HaasOnline is a non-custodial automation platform with deep scripting support. You connect exchange accounts through API keys, design strategies with HaasScript, and test ideas with historical and live simulated data in the TradeServer environment.

HaasOnline is a Non Custodial Automation Platform with Deep Scripting Support. Image via HaasOnline

HaasOnline is a Non Custodial Automation Platform with Deep Scripting Support. Image via HaasOnlineBest For

Advanced traders and developers who want full control over logic, indicators, and execution across multiple venues.

HaasScript and Customization

You can build market-making, arbitrage, scalping, and custom rule sets using visual and code editors. The scripting language and editors are designed for automated trading and rapid iteration.

Testing and Tooling

Backtesting and paper trading are built in so you can validate strategies before you place real orders. The Backtest Lab and Backtest History help you configure runs and review results.

Supported Exchanges

Some major exchanges include:

- Binance

- Bybit

- OKX

- Kraken

- KuCoin

- Bitget

Pricing

Enterprise $125.99 per month

Coming Soon:

- Starter $16.79 per month

- Standard (coming soon) at $41.99 per month

- Pro at $83.99 per month

Cloud plans labeled Starter, Standard, and Pro are shown as coming soon with published monthly prices. A three-day Pro trial is advertised on site.

Data as of Jan. 1, 2026. Prices based on annual subscriptions.

Set up in 5 Steps

- Create account

- Connect exchange API keys

- Set trade-only permissions

- Design or load a script

- Paper trade before going live

Risk Note

Complex strategies can be misconfigured and strategy bugs can slip through simple tests. Start with small sizes, validate with paper trading, and apply strict risk management before scaling.

Who Should Skip It

Beginners or traders looking for a plug-and-play experience. HaasOnline is built for hands-on users who are comfortable testing, debugging, and refining strategies rather than relying on presets or guided automation.

Emerging AI-First Platforms to Watch

A growing set of tools describes itself as AI native, which means models and automation are core to the product rather than add ons. Teams that take this approach usually pair model development with clear evaluation and controls based on an AI Risk Management Framework.

An AI Native Platform is Built around Data Pipelines, Model Training, and Automated Execution. Image via Shutterstock

An AI Native Platform is Built around Data Pipelines, Model Training, and Automated Execution. Image via ShutterstockWhat “AI native” means

An AI native platform is built around data pipelines, model training, and automated execution from day one, not just rule engines. Human oversight remains essential to keep outcomes aligned with user goals and risk limits, as reflected in NIST AI RMF guidance.

1. Stoic AI

Stoic AI positions itself as an automated crypto portfolio management. Users link an exchange account, select a strategy, set risk bounds, and let the app manage orders within those constraints.

2. AlgosOne

AlgosOne markets a multi-asset approach. The site claims continual model updates across markets and presents prebuilt plans with stated return targets, which require careful risk framing by the user.

3. Intellectia.ai

Intellectia.ai advertises real-time news scanning, pattern detection across assets, and volatility-aware sizing. Their crypto section highlights coin-specific signals and alerts.

How to evaluate these safely

Demand proof. Look for transparent documentation, audited or verifiable performance claims, a live paper trading mode, strong withdrawal controls, independent reviews, and a visible track record tied to company's identity.

Treat AI-first platforms as candidates rather than conclusions. Verify claims with small tests, keep custody on reputable exchanges, and scale only after the evidence matches your goals and risk limits.

Best Free Trading Bots

Free tools fall into two buckets. Some are exchange-based with bots built into the venue, while others are open-source frameworks you run yourself. The trade-off is convenience versus control. Exchange bots are easy to start, but limited to that venue. Open source frameworks demand setup but offer full customization.

Free Bots give you a Clear Choice between Convenience and Control. Image via Shutterstock

Free Bots give you a Clear Choice between Convenience and Control. Image via Shutterstock Quick Comparison Table

| Bot | Type | Skill level | Setup requirements | Best strategies | Exchanges | Hosting needs | Best for |

|---|---|---|---|---|---|---|---|

| Pionex | Exchange with built in bots | Beginner | Account on Pionex | Grid trading, DCA | Pionex | None, runs in the cloud | One click automation on a venue |

| Hummingbot | Open source framework | Intermediate | Python basics, CLI, VPS or dedicated machine | Market making, arbitrage, cross exchange | Many CEX and DEX via connectors | Self host | Full algorithmic control without subscriptions |

| Gekko | Open source platform | Beginner to intermediate | Node.js or Docker, local UI | Backtesting, paper mode, simple live trading | Select CEX connectors | Self host | Learning and experimentation |

| Catalyst | Open source library | Advanced | Strong Python and Zipline familiarity | Research workflows and custom models | Historic support for several CEX | Self host | Data science style strategy research |

Pionex (Beginner-friendly)

Pionex is an exchange with built-in bots that run 24/7 in the cloud, so you configure and execute strategies directly on the venue without hosting your own server. The core lineup includes venue-native automations such as grid trading and DCA, and Pionex markets these bots as free to use (you only pay trading fees).

The official fee schedule lists spot at 0.05% per trade, with no separate subscription for the bots, which keeps the total cost of ownership straightforward for beginners. These characteristics make it a quick on-ramp if you value convenience over cross-exchange flexibility.

Hummingbot

Hummingbot is a community-driven, open-source Python framework you install and run yourself, designed for algorithmic strategies like market making and arbitrage. Its modular “connector” system lets the client interact with many CEXs and DEXs via standardized interfaces, and the docs emphasize extensibility for custom logic.

A paper-trading mode is available to simulate executions before committing capital, which is helpful for testing parameters on your own infrastructure. Expect a CLI-first experience and self-hosting responsibilities in exchange for full control and no platform subscription fee.

Gekko

Gekko is an open-source Node.js platform that provides backtesting, a paper trader, and optional live trading against supported exchanges, aimed at learning and simple experimentation. Importantly, the official GitHub repository is archived and explicitly “not maintained anymore,” so users should be comfortable relying on community forks or doing their own fixes if needed.

If you’re evaluating it today, treat it as a legacy tool that’s still useful for basic concepts and offline testing rather than an actively supported trading stack.

Catalyst by Enigma

Catalyst is an open-source Python library for quantitative crypto research and backtesting (built around the Zipline ecosystem) with tutorials that cover data ingestion and research workflows. However, the official repository has been archived and is read-only, which means no active maintenance from the publisher. It remains a solid reference for research-heavy backtests and prototyping in a data-science workflow, but plan for self-support or forks if you need updates.

Free bots give you a clear choice between convenience and control. Exchange-based options are fastest to start, while open source frameworks offer flexibility if you can handle setup. Begin with backtesting, rehearse with a demo or paper mode, and apply strict risk management before you scale real capital.

Paid vs Free Trading Bots

Paid platforms charge for convenience and guardrails. You are paying for reliable uptime, a clean user experience, customer support, and safety features that keep positions and permissions within sensible limits. You also get native integrations that reduce setup work, plus access to strategy marketplaces and signal routing that can shorten the path from idea to live trading. If you value speed to deployment and guided configuration, paid tools remove many moving parts.

You Pay for Reliable Uptime, a Clean User Experience, Customer Support, and Safety Features. Image via Freepik

You Pay for Reliable Uptime, a Clean User Experience, Customer Support, and Safety Features. Image via FreepikWhat You Actually Pay For

Convenience, uptime, user experience, responsive support, built-in guardrails, broad integrations, and curated marketplaces that bundle strategies and signals in one place.

Hidden Costs of Free

Time to install and maintain software, hosting a machine or VPS, continuous monitoring, debugging when connectors change, and strict security hygiene for API keys. Frameworks like Hummingbot offer full control but expect command-line comfort and ongoing maintenance. Reinforce your setup with solid risk management practices.

Is Premium Worth it

If you need multi-exchange management, signal integrations, responsive support, and guided configurations, a paid platform often wins because it reduces operational risk. If you can self-host, code, and maintain operations, free and open source tools can be superior thanks to flexibility and full transparency.

Choose paid when you want speed, support, and safety rails, and choose free when you want maximum control and can run your own stack with disciplined processes.

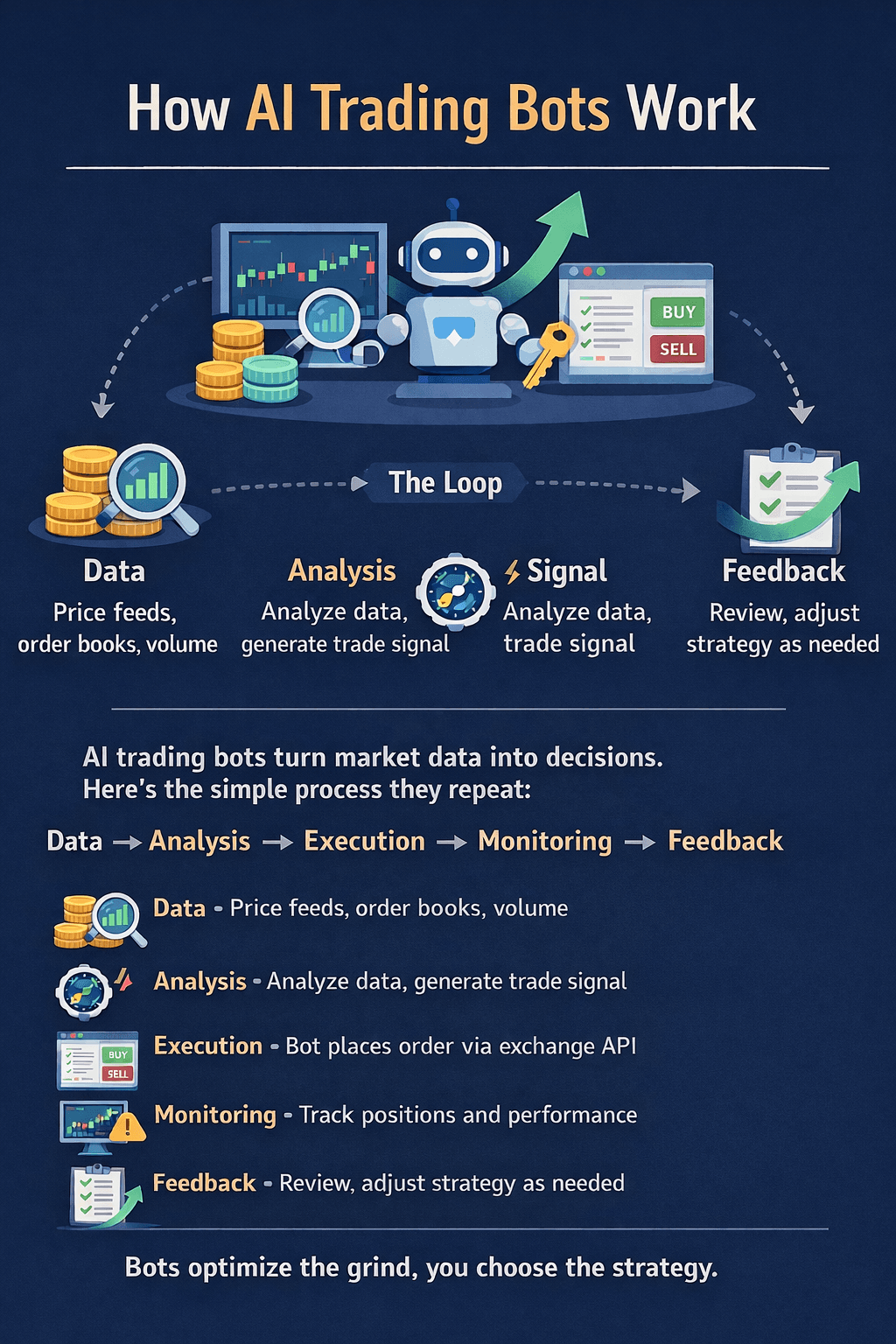

How AI Trading Bots Work

AI trading bots follow a repeatable workflow. They turn market data into decisions and then into orders that you can monitor and refine. Think of it like an automatic coffee machine. You choose the beans and strength, the machine handles grinding, brewing, and timing, and you taste the result to decide if you will keep the same recipe or make a small tweak.

AI Bots Turn Market Data into Decisions and then into Orders that you can Monitor and Refine

AI Bots Turn Market Data into Decisions and then into Orders that you can Monitor and RefineThe Loop

In practice, AI trading bots parse price streams and order flow, a model scores trade ideas, a rules engine produces a signal, the bot places an order through an exchange API, and you review results to adjust parameters or backtesting assumptions.

This is what a typical flow looks:

Data → analysis or model → signal → execution → monitoring → feedback

Think of a trading bot as an assembly line for decisions. Each stage does one job, then hands the result forward.

- Data: Raw inputs. Price feeds, order books, volume, funding rates, on-chain metrics, or macro data. If the data is delayed, noisy, or biased, everything downstream suffers.

- Analysis/Model: The brain. Indicators, statistical models, or machine learning systems process the data to identify patterns, trends, or probabilities. This is where the bot “forms an opinion.”

- Signal: A clear instruction. The model converts analysis into actionable outputs like buy, sell, hold, or adjust position size, often with confidence thresholds.

- Execution: Turning intent into trades. The bot sends orders to the exchange, choosing order types, timing, and routing to minimize slippage and fees.

- Monitoring: Constant supervision. The bot tracks open positions, fills, latency, errors, and market conditions to ensure everything behaves as expected.

- Feedback: Learning and adjustment. Performance data feeds back into the system to refine parameters, update models, or shut the strategy down if conditions change.

What Data Do They Use

Common inputs include price and volume, technical indicators, and the order book when available. Some platforms also factor in volatility regimes and funding, plus social and news sentiment signals when permitted.

Where Things Break

APIs can fail or throttle. You can check live incidents on an exchange status page. Latency and slippage affect fills, and derivatives introduce funding costs. Spreads can widen in thin markets, and rate limits or exchange-specific constraints can block rapid updates.

Bots automate the mechanics but still need human judgment. Start with reliable data, verify the loop with paper trades, and watch for bottlenecks that can quietly erode results.

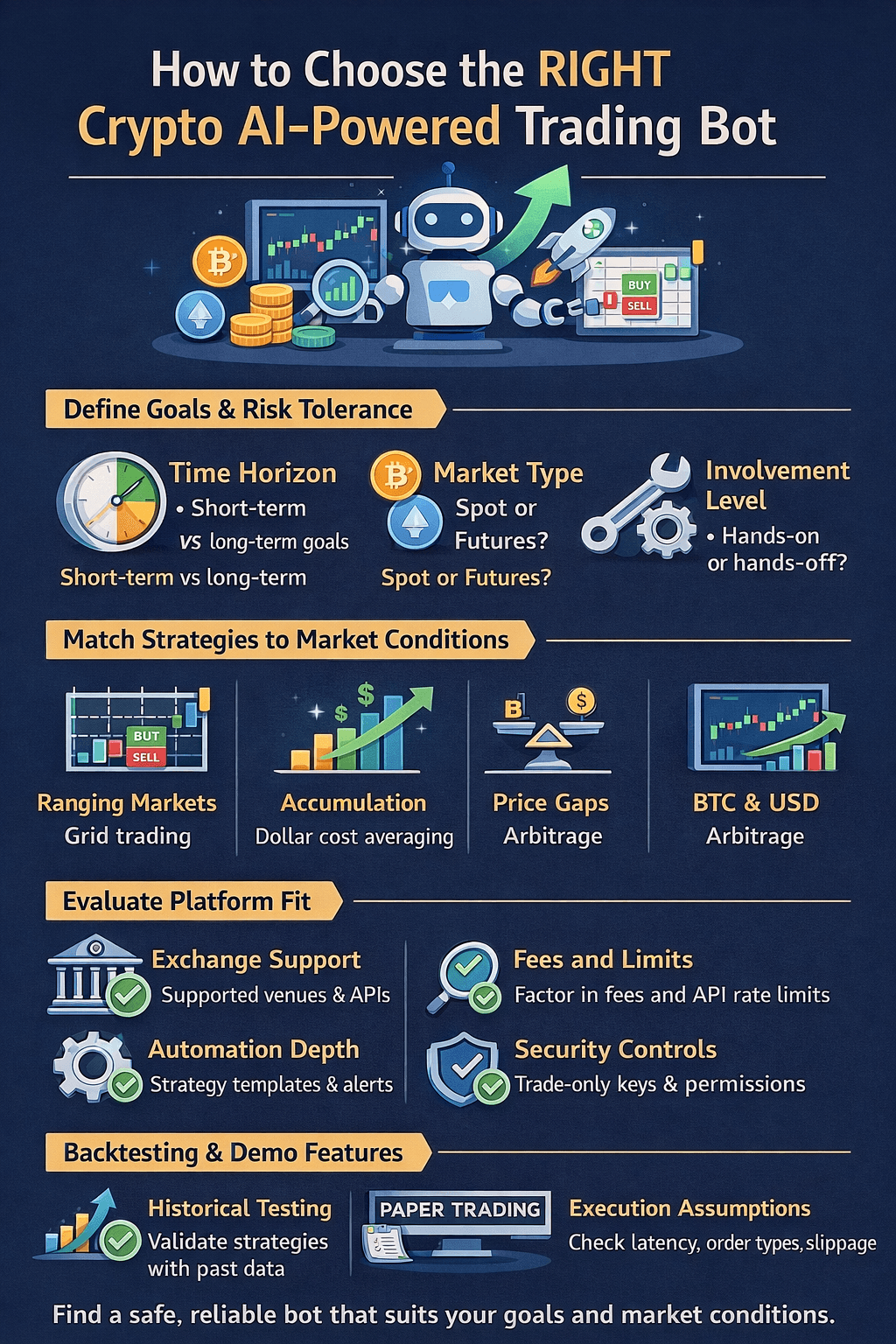

How to Choose the Right Crypto AI-Powered Trading Bot

The right bot is the one that fits your goals, your risk tolerance, and the market conditions you plan to trade.

The Right Bot is The One That Fits your Goals, Your Risk Tolerance and Market Conditions

The Right Bot is The One That Fits your Goals, Your Risk Tolerance and Market ConditionsDefine Goals and Risk Tolerance

- Time Horizon: Short-term traders accept more variability than long-term investors. Be clear about whether you want frequent trades or steady accumulation. A short horizon needs tighter controls and faster review cycles.

- Market Type: Spot avoids leverage and is usually simpler for beginners. Futures enable hedging and directional views but add complexity and risk. Review risk tolerance and read futures basics before you automate.

- Involvement Level: Decide if you want a hands-on setup or a hands-off routine. Beginners can start with AI trading bots and add stricter risk management as confidence grows.

Match Strategies to Market Conditions

- Ranging Markets: Grid trading suits sideways price action by placing layered buy and sell orders within a band.

- Accumulation: Dollar cost averaging spreads entries over time and reduces the pressure to pick a perfect price.

- Price Gaps: Arbitrage looks for small differences across venues and is sensitive to fees and latency. Always confirm your venue costs with the spot fee schedule.

Evaluate Platform Fit

- Exchange Support: Confirm your preferred venues are supported and that the exchange API exposes the endpoints your bot needs.

- Fees and Limits: Check futures fees and API rate limits so your strategy assumptions are realistic.

- Automation Depth and UX: Look for strategy templates, alerting, and a workflow you can operate without confusion. A clear interface reduces configuration errors.

- Security Controls: Prefer platforms that support trade-only keys, IP allow lists, and granular permissions within the API dashboard on your exchange.

Backtesting and Demo Features

- Historical Testing: Use structured backtesting to validate logic with fees and slippage included.

- Paper Trading: Rehearse live flow with paper trading to surface order handling and timing issues before real capital is at risk.

- Execution Assumptions: Document latency, order types, and slippage. Recheck these after any exchange or bot update to avoid drift.

Pick a bot that matches your goal, your risk limits, and the current market regime. Validate with data, test in a safe environment, then scale gradually as results remain consistent.

Performance Metrics That Matter When Backtesting

Backtesting is a dress rehearsal that helps you judge how a strategy behaves across different environments. Treat the results like a car dashboard. One number can look great on its own, but you need the full panel to know whether the engine is healthy. Use a small set of clear metrics, read them together, and then verify your assumptions with a controlled practice run.

Combine a Handful of Solid Metrics with Robust Validation. Image via Freepik

Combine a Handful of Solid Metrics with Robust Validation. Image via FreepikCore Metrics to Track

- A risk-adjusted return measure that compares excess return to volatility. A higher value suggests the strategy earned more per unit of variability, which is useful when you compare options with similar goals.

- The largest peak-to-trough decline in the test. It shows worst-case pain and how long recovery might take. Deep or frequent drawdowns can make a strategy hard to hold.

- The percentage of trades that finished profitably. It is not a standalone quality signal. A high win rate can hide a few very large losses, so pair it with drawdown and profit factor.

- Gross profits divided by gross losses. Values above one indicate net profitability. Watch how this changes across different market regimes, not just the full period.

Interpreting Results the Right Way

High Return with Deep Losses is a Warning

- A very high return paired with severe drawdowns often means the strategy took large risks during favorable periods. Check the path of returns, recovery time, and whether the equity curve relied on a few outsized trades.

Watch for Overfitting

- Too many parameters, very short test windows, or a perfectly smooth equity curve are classic red flags. Use a validation plan that separates tuning data from evaluation data so that your conclusions are based on general performance, not lucky patterns.

Minimum Reliability Checklist

Multi-Period Tests

- Cover trending, ranging, and high volatility segments so the strategy is tested beyond a single favorable phase.

- Hold back data and evaluate after tuning. Repeat across different windows to confirm stability.

Fees and Slippage

- Include explicit trading costs and a realistic fill model. Confirm your venue costs with the official fee schedule before you trust the results.

Realistic Execution Assumptions

- Respect API rate limits and order handling rules. Rehearse with paper trading to surface latency, queue position, and partial fill behavior.

Combine a handful of solid metrics with robust validation. If small changes in inputs flip the outcome, treat that as a signal to simplify the rules and retest before you scale.

Security Considerations for AI Trading Bots

AI trading bots need exchange API access, which expands the attack surface. An API key with broad permissions can let an attacker place trades or move funds if it is exposed. Keep custody on reputable venues, restrict permissions, and treat keys like passwords.

AI Trading Bots need Exchange API Access, which Expands the Attack Surface. Image via Freepik

AI Trading Bots need Exchange API Access, which Expands the Attack Surface. Image via FreepikThe Core Risk

Bots require API keys to place and manage orders. Limit permissions to trading only, avoid withdrawal rights, and enable IP allow lists so keys work only from approved addresses. Use strong two-factor authentication on both the bot account and the exchange.

Security Incident Context

In December 2022, 3Commas confirmed that some users’ API data had been disclosed and asked exchanges to revoke affected keys. The incident underlined two lessons that remain relevant in 2025. Restrict keys to trade only and rotate or revoke them quickly when in doubt.

Essential security practices checklist

- Trade only keys with no withdrawals, stored securely on the exchange dashboard.

- Two-factor authentication on the bot and on your exchange account.

- IP whitelisting wherever the venue supports it, such as Binance.

- Separate read-only keys for monitoring dashboards.

- Monthly audits and key rotation to limit exposure.

- Immediate revocation of any unused or suspicious permissions via your venue’s API manager, for example, Kraken.

Minimize what a key can do, limit where it can be used, and rotate or revoke at the first sign of risk.

Using Crypto AI Trading Tools Responsibly

Automation does not replace oversight. Treat your bot like a pilot on instruments. You define the route, watch the gauges, and step in when something looks wrong.

Automation does not Replace Oversight. Image via Freepik

Automation does not Replace Oversight. Image via FreepikMonitoring is mandatory

Set scheduled check-ins, track a small set of KPIs, and enable alerts. Useful signals include win rate, profit factor, maximum drawdown, and slippage versus your backtest. Platform and exchange alerts help you react quickly when conditions change, and an exchange status page can explain execution issues.

Revisit our guides to backtesting and risk management to calibrate targets.

Stop loss configuration

Stop losses can fail during gaps or on illiquid books because there may be no bids at your level. Use conservative position sizes, define a maximum loss per trade, and prefer stop orders that convert to market when triggered. For basics, review stop orders from a regulator and your venue’s order types.

Common pitfalls

Overfitting, revenge parameter tweaks after a loss, martingale-style DCA escalation, ignoring fees, leverage creep, and running too many pairs at once. Keep changes small and test them in a safe environment before you go live.

Practical risk management

Define position sizing rules, a maximum daily loss, and cooldown rules after drawdowns. Withdraw profits on a schedule, and keep a contingency plan for outages that includes venue API limits and failover steps.

Treat automation as an assistant, not a replacement. Keep positions small, monitor a few clear metrics, rehearse changes before going live, and pause quickly when rules are not behaving as expected.

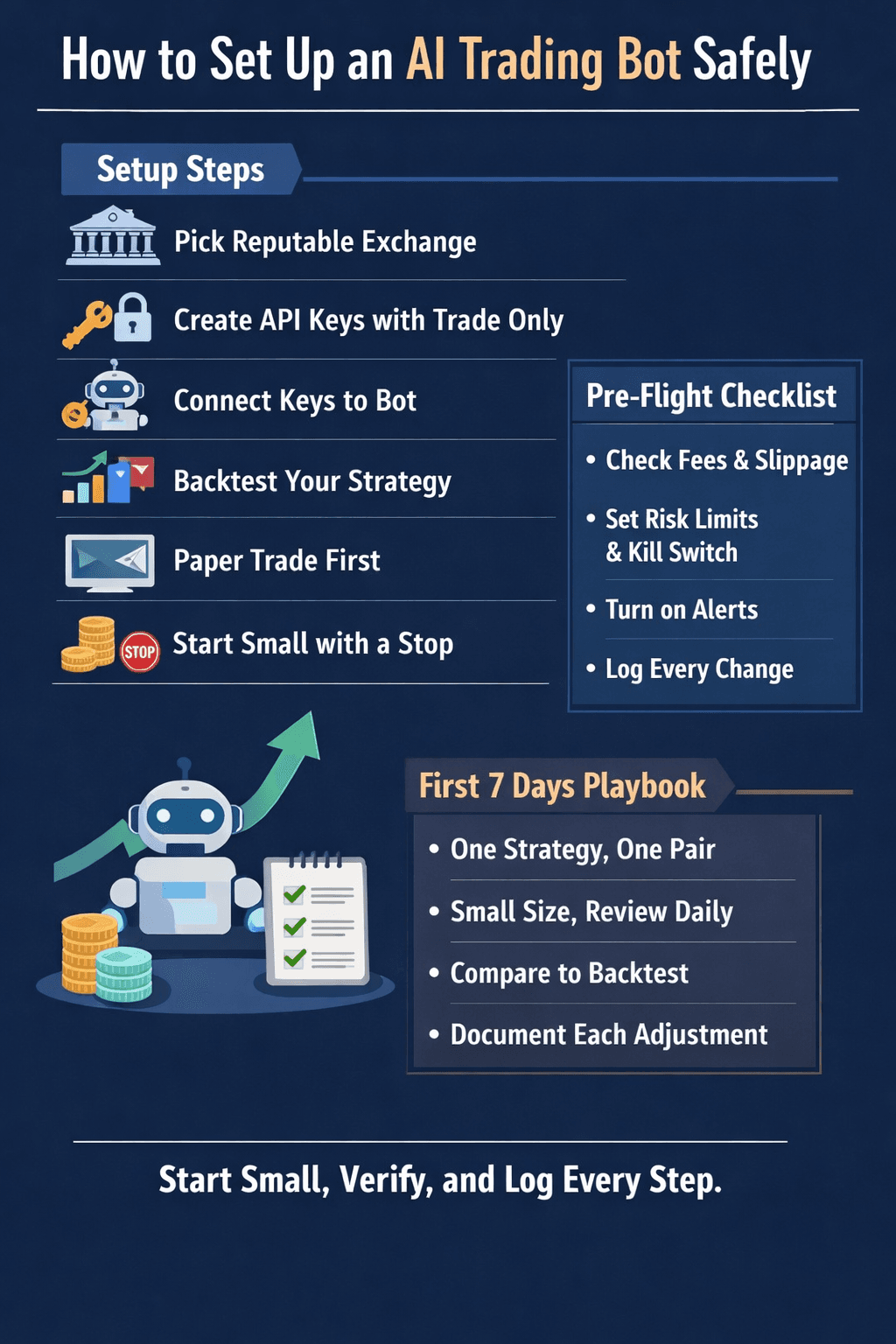

How to Set Up an AI Trading Bot Safely

A safe setup keeps control on your side from the first click. You will prepare the venue, restrict permissions, rehearse the flow, and only then commit real funds. Treat it like a flight checklist. You confirm each item before takeoff and keep a plan for what to do if something looks wrong.

A Safe Setup keeps Control on your Side from the First Click

A Safe Setup keeps Control on your Side from the First ClickStep-by-step setup workflow

- Choose a reputable exchange that supports API keys.

- Create keys with trade-only permissions and keep withdrawals disabled.

- Connect the keys to your bot.

- Select a simple strategy and confirm the logic with backtesting.

- Practice the live flow with paper trading.

- Go live with small capital and a clear stop for the first week.

Pre-flight checklist

Confirm fees and include slippage in your assumptions. Set risk limits and a manual kill switch. Turn on alerts for fills, errors, and drawdowns. Decide your monitoring cadence and log each change so you can undo mistakes quickly.

First 7 days playbook

Use conservative settings with one strategy and one pair. Keep sizing small, review results daily, and compare live fills to your backtest. Adjust only one variable at a time and document every change in your journal to avoid guesswork.

Prove the workflow before you scale. Limit permissions, start small, and let measured data guide each change.

Choosing the Right Crypto Trading Tool (Closing Thoughts)

Pick the tool that fits your strategy, your skill level, and the market you are facing. A grid in a calm channel, a DCA plan for slow accumulation, or a flexible terminal when you want fine control. The match matters more than the buzzword.

There is no set-and-forget. Keep security first, test with small stakes, and let data nudge your next tweak.

Ready toput theory into practice? Start with Create Your Crypto Trading Bot Guide and build from a safe foundation.