You open a crypto app, tap “Earn,” and suddenly your idle coins are working for you. That’s the promise, and it’s a tempting one. But the real question isn’t whether the interface looks polished or the rates look attractive. It’s whether you understand what’s happening behind the scenes when you deposit, borrow, or try to withdraw during a stressful market move.

Nexo sits in that familiar CeFi middle ground: more convenient than self custody, less protected than traditional finance. So “Is Nexo safe?” is really shorthand for a few sharper questions: Who holds the keys? What happens if markets move fast? What protections exist if something breaks, gets frozen, or simply goes quiet? This guide breaks those questions down into plain English, so you can separate strong safeguards from comforting assumptions.

Nexo Safety at a Glance

Nexo Safety Rating Overview

This section explains how the Nexo Safety Score is built, which categories matter most, and what kinds of evidence can move the score up or down.

Overall Safety Score

A 4.7 out of 5 reflects a platform with meaningful security controls and some transparency, but with unavoidable CeFi risks that users cannot “turn off,” especially counterparty risk and regulatory access risk. This score is a structured risk snapshot, not a guarantee, and it is not comparable to bank style protections such as FDIC insurance.

Category Breakdown

Category | Weight | What we look at |

|---|---|---|

Security infrastructure | 25% | Custody stack such as Ledger and Fireblocks, account controls, security programs. |

Regulatory compliance | 20% | Jurisdiction specific licenses and registrations and major regulatory outcomes such as the SEC settlement. |

Financial stability and counterparty risk | 20% | Collateral model framing in the business model, plus what remains unverified about balance sheet and counterparties. |

User protection | 15% | Controls such as whitelisting and practical safety features users can enable. |

Technical reliability | 10% | Incident visibility through the status page and user reported patterns on Trustpilot. |

Transparency | 10% | Reserves attestation framework and clarity of disclosures such as insurance. |

Scoring Rules

- What moves a score up or down

- Up: Independently checkable custody and security controls, clearer insurance scope, consistent transparency outputs, clean regulatory record, reliable withdrawals across stress periods.

- Down: Unclear or outdated disclosures, significant enforcement actions, repeated user complaints around access and withdrawals, limited visibility into liabilities and counterparties.

- Minimum evidence threshold

- Official platform pages and legal terms, regulator registers and enforcement releases, court documents, third party audit or attestation publications, and dated incident records.

- How conflicting claims are handled

- When numbers disagree, we treat the most current verifiable statement as primary and label older figures as historical context, such as the difference between older insurance figures like $375 million and $150 million versus today’s less specific millions in coverage wording on its security page referenced above.

Our Nexo Safety Assessment Methodology

This review treats “safe” as a checklist: Where funds sit, how accounts are protected, what regulators say, and how the platform behaves under stress.

What We Evaluated

- Controls: Custody model, wallet controls, account security features.

- Insurance: Scope, exclusions, adequacy.

- Regulatory Footprint: Licenses/registrations, enforcement actions.

- Operational Risk: Outages, support failures, withdrawals.

- Counterparty Risk: Solvency signals, transparency limits.

- User Sentiment: Verified review patterns and timeline shifts.

Data Sources

- Official Nexo docs + Terms of Service and fee schedules, including the General Fee Schedule.

- Third-party audits / attestations referenced by Nexo, such as the Moore reserves attestation announcement referenced earlier.

- Regulatory registers + filings + enforcement releases.

- Court records / arbitration registries.

- Verified user reviews from Nexo’s Trustpilot profile and dated community threads.

Testing Timeline

- Testing period: Start–End dates (Month 2026).

- Total hours.

- Devices/browsers.

- Account type (verified/non-verified), feature set tested (earn, borrow, withdrawals, Nexo Pro).

Limitations

- You cannot audit internal reserves, lending book quality, or counterparty exposures.

- Insurance policies often aren’t fully public (you can verify claims, not every clause).

- User reviews are noisy (you mitigate by pattern + recency + cross-source matching).

Nexo Overview: What You Need to Know First

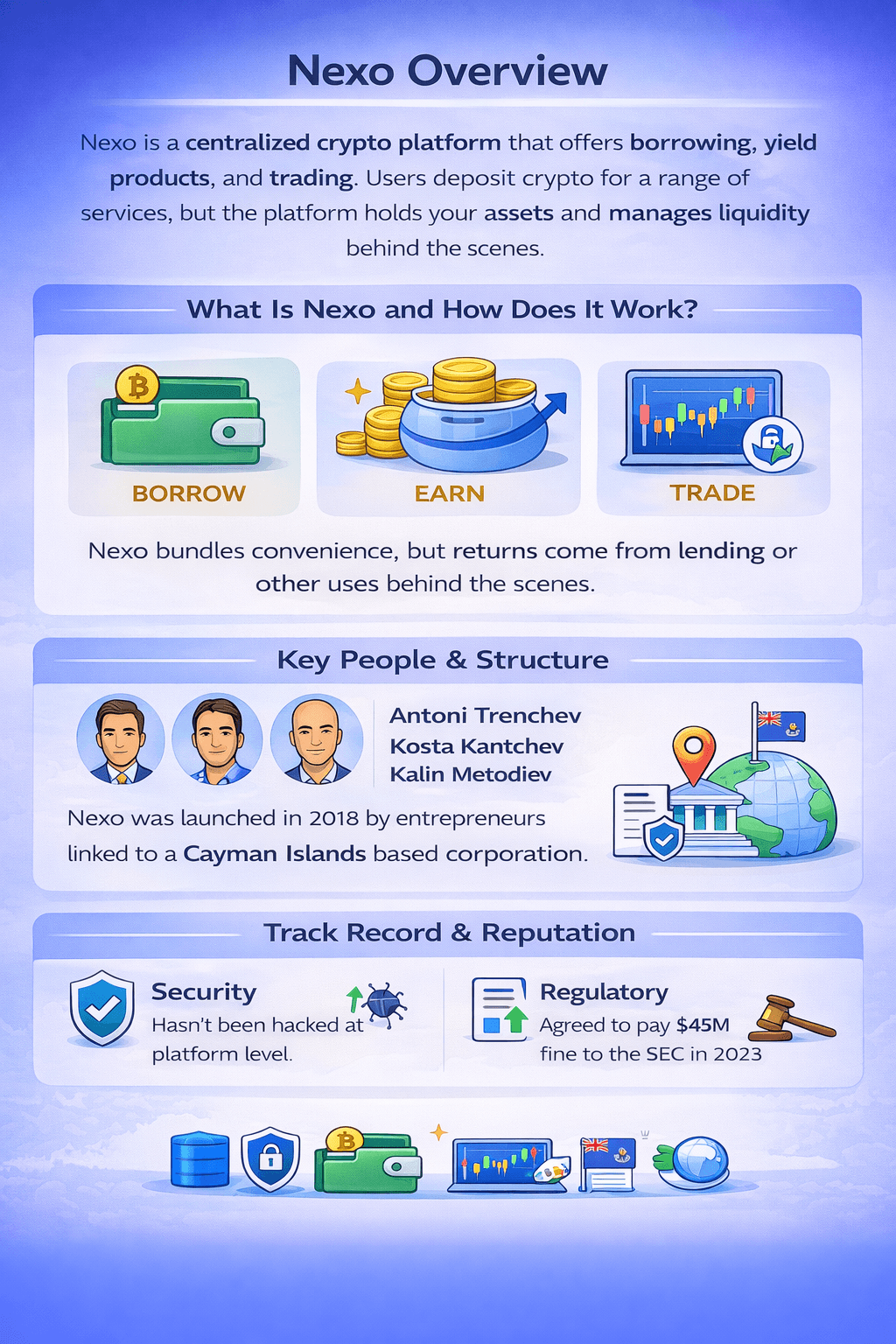

Nexo is a centralized crypto platform that bundles yield-style accounts, crypto-backed borrowing, and trading. That convenience can be useful, but it also changes the risk profile: instead of holding your own keys, you rely on the platform’s custody setup, liquidity management, and the legal protections that apply in your region.

Nexo is a Centralized Crypto Platform that Bundles Yield-Style Accounts, Crypto-backed Borrowing, and Trading

Nexo is a Centralized Crypto Platform that Bundles Yield-Style Accounts, Crypto-backed Borrowing, and TradingWhat Is Nexo and How Does It Work?

Nexo launched in 2018 and offers crypto-backed borrowing through Borrow, yield-style products through Earn, and spending features via the Nexo Card. For trading, it provides an Exchange experience and a separate interface in Nexo Pro.

On centralized platforms, “yield” typically depends on how customer assets are deployed behind the scenes, such as lending and other balance-sheet activity. The practical takeaway is simple: when returns depend on counterparties, your risk is tied to the platform’s risk management, not just your personal account security.

Key People and Corporate Footprint

Nexo has been publicly associated with founders and executives including Antoni Trenchev, Kosta Kantchev, and Kalin Metodiev. Corporate structure also matters because consumer protections vary by jurisdiction. Nexo has been described as a Cayman Islands corporation, which is one reason access and compliance rules can differ across major markets.

Nexo's Track Record and Reputation

When platforms say they’ve had “no major hacks,” it helps to define terms. Here, a “major hack” means a platform-level breach impacting custody or core systems, rather than individual account takeovers caused by phishing or weak passwords.

On the regulatory side, a January 2023 SEC announcement referenced in the table above, said Nexo agreed to pay $45 million and stop offering its crypto asset lending product to U.S. investors. In Europe, Bulgarian prosecutors said they closed their investigation in December 2023, citing no evidence of criminal activity.

For more, head over to our full Nexo review.

Security Infrastructure: What Protects Your Crypto?

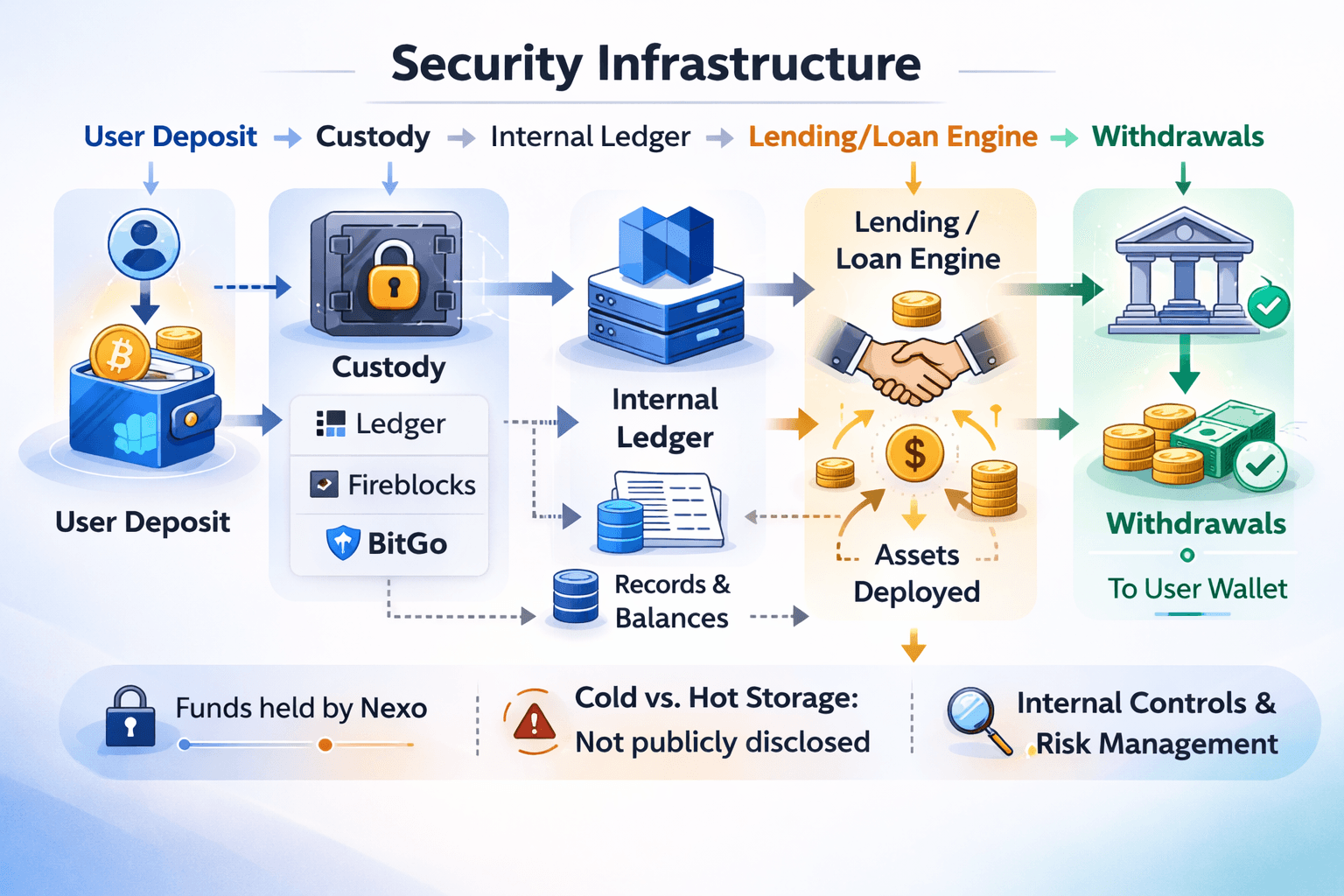

Centralized platform security is a layered system: part “vault,” part “alarm system,” and part “front-desk rules.” With Nexo, those layers include institutional custody tooling, in-app protections you can turn on, and a transparency layer that matters for platform-level risk.

Centralized Platform Security is a Layered System

Centralized Platform Security is a Layered SystemCustody and Storage

Nexo lists Ledger and Fireblocks in its security stack, and it has integrations with Ledger Vault and BitGo. Nexo does not disclose a consistent cold-vs-hot storage allocation. The practical implication is simple: users can’t independently gauge how much value is kept offline versus online, so they’re trusting the platform’s overall controls and operating discipline.

Account-Level Security

Nexo supports app-based 2FA and an email anti-phishing code, and it offers address whitelisting to limit withdrawals to saved destinations. Whitelisting is like a “pre-approved payee” list at a bank: even if an attacker logs in, sending funds to a new address becomes harder. Nexo also promotes an always-on Anti-scam Engine that can flag or pause suspicious withdrawals; users can see prompts and pauses, but can’t verify how effective the detection is across edge cases.

Technical Security Programs

Nexo's security page claims ISO/IEC 27001:2022 along with other security certificates. It also runs a public security disclosure program that is explicitly non-bounty. Nexo AES 256-bit SSL for data protection in transit, which is useful, but doesn’t, on its own, explain private-key storage.

Proof of Reserves and Transparency

Nexo has published a reserves attestation framework (referenced in the table earlier) intended to compare certain assets and liabilities. Even when available, attestations aren’t full audits and typically don’t reveal borrower quality, concentration risk, or off-platform exposures.

Nexo offers credible user-level safeguards, but the most important unknowns remain platform-level: storage allocation detail and counterparty risk that users can’t directly verify.

Insurance Coverage: What It Covers (and What It Won’t)

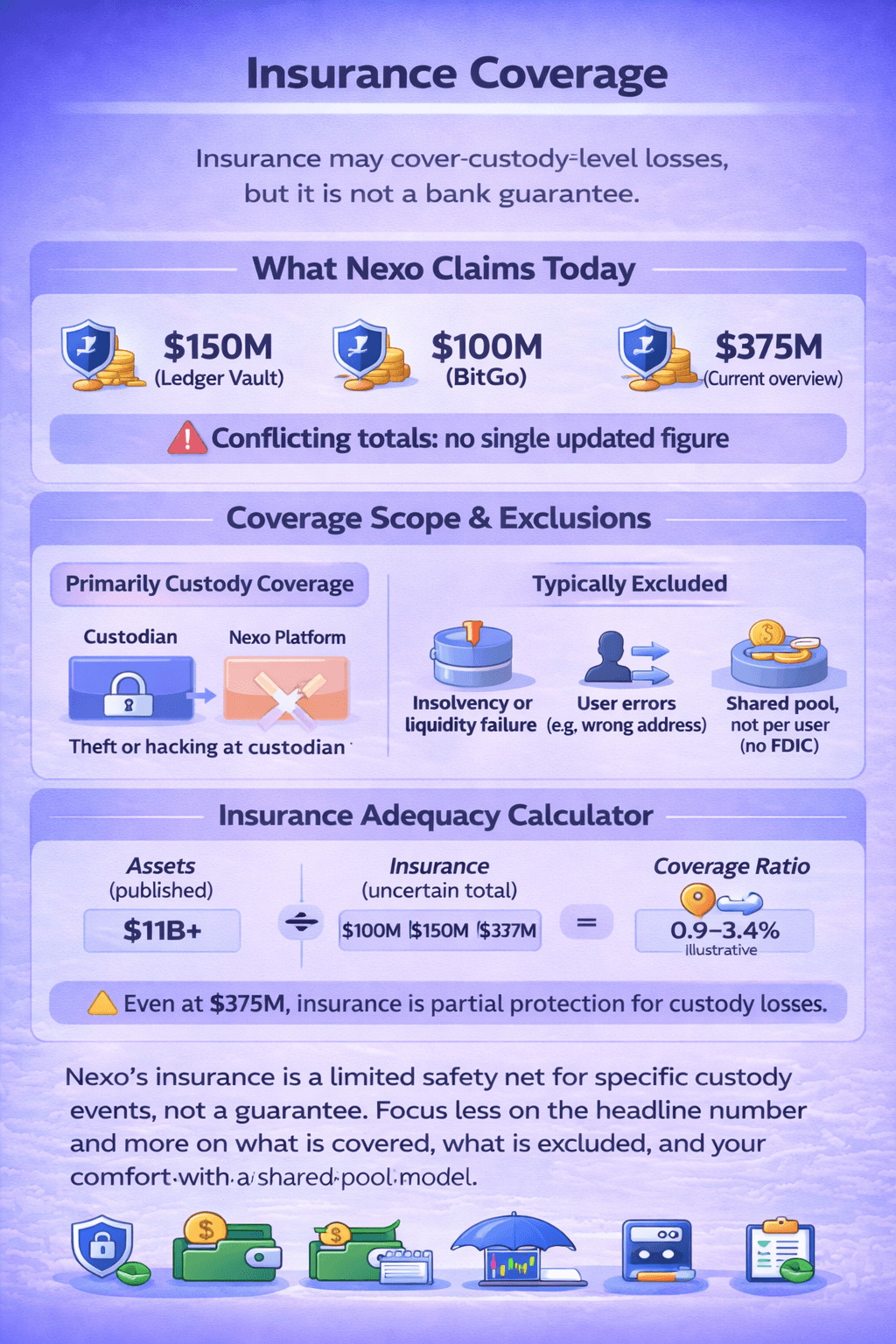

Insurance can help in a narrow set of loss scenarios, but it is not the same thing as a bank style guarantee. With Nexo, the most important question is what layer is insured and what events are actually covered.

Insurance in Crypto is not the same Thing as a Bank Style Guarantee

Insurance in Crypto is not the same Thing as a Bank Style GuaranteeWhat Nexo Claims

A detailed insurance overview lists $375 million in coverage tied to custody arrangements. A separate post tied to the Ledger Vault integration highlights $150 million..

These figures conflict because they come from different outdated resources, different custody contexts, and there is no single consistently updated public number that reconciles them.

Coverage Scope and Exclusions

The insurance described for Nexo is primarily custody level coverage. That means it is designed to respond to losses at the custodian layer, not platform level losses such as insolvency or liquidity failure. In simple terms, theft or hacking at the custody layer is treated differently from insolvency risk, and user error like sending funds to the wrong address is typically outside scope. Coverage is also a shared pool, not per user protection like FDIC deposit insurance.

Insurance Adequacy Calculator

An $11 billion plus assets figure appears on the security page, but the insurance total is not presented as a single current, verifiable number. Even at $375 million, insurance is best viewed as partial protection for defined custody incidents, not a promise of full repayment during mass withdrawals or insolvency.

Nexo’s insurance is best treated as a limited safety net for specific custody loss events, not a guarantee that user funds are protected in every scenario. If insurance is a deciding factor, the most practical takeaway is to focus less on the headline number and more on what it actually covers, what it excludes, and how much of your exposure you are comfortable placing under a shared pool model.

Regulatory Compliance and Legal Standing

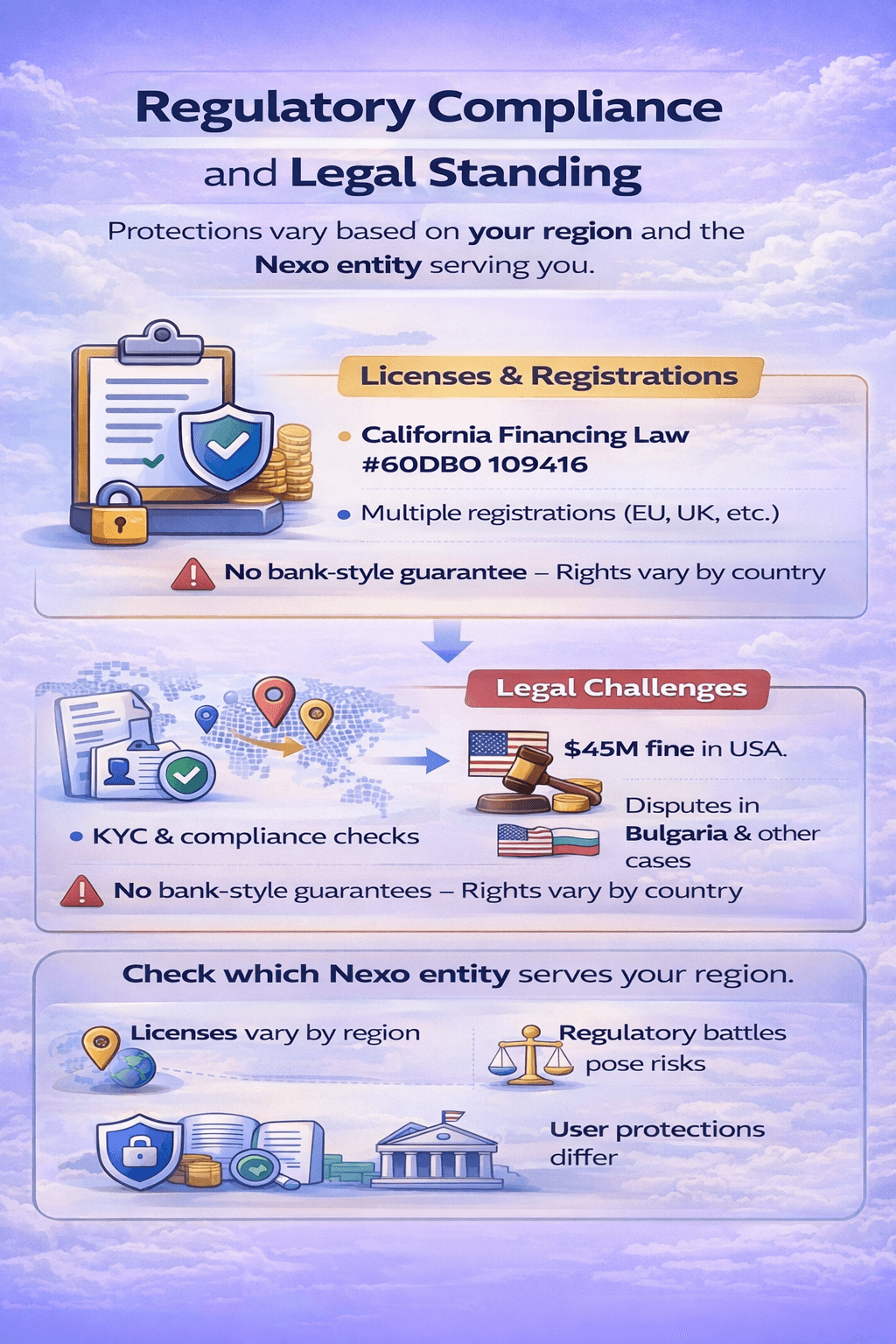

Regulation is rarely one universal approval that covers every product worldwide. What matters is which Nexo entity serves your region, what registrations apply there, and what protections you actually get if something goes wrong.

Know which Nexo Entity Serves Your Region, what Registrations Apply there, and what Protections You actually Get

Know which Nexo Entity Serves Your Region, what Registrations Apply there, and what Protections You actually GetLicenses, Registrations, and Where They Apply

Nexo holds a patchwork of registrations across jurisdictions, such as a California Financing Law license shown under 60DBO 109416, plus other market specific licenses and registrations listed on the security page. Identity verification and compliance checks are part of normal access. A license can signal oversight, but it does not guarantee bank style protections, and consumer rights vary widely by country and by product.

Legal Battles and Regulatory Challenges

January 2023, SEC settlement and NASAA settlement - High Impact

- Regulators said Nexo’s Earn Interest Product was offered without registration. Nexo agreed to pay $45 million and stop offering the product to U.S. investors, which directly affected availability and is a lasting credibility marker for how regulators view crypto yield products.

July 2023, Nexo Capital Inc v Shulev - Low Impact

- The court record references a settlement agreement under which Nexo would pay $1,000,000 in instalments and, in return, Shulev would hand over specified “assets” (including access materials like keys and credentials) and release any claims over the disputed BitMEX account and Nexo-related ownership interests, with further steps only if either side allegedly breaches the settlement terms.

Cress v Nexo in the U.S. Northern District of California (ongoing) - Impact = Medium

- The case centers on liquidation related allegations and remains in active procedural stages, so outcomes are not final.

Nexo and others v Bulgaria at ICSID (ongoing) - Impact = Medium

- Nexo is the claimant, and the case matters because it goes to operational disruption risk and reputational spillover across key markets.

Sokol Iankov matter - Impact = Low, unless the posture changes

- The UK High Court in Iankov v Kantchev upheld Nexo’s jurisdiction challenge and also granted strike-out/summary judgment on part of the ownership claim (valued by the claimant at $800m+).

Regulatory Gray Areas

Nexo operates across multiple jurisdictions and entities, which can create regulatory gaps when products are offered globally but supervised locally. In those cases, user protections depend on the specific Nexo entity serving your region, not the strongest sounding registration elsewhere.

Recourse can be limited if disputes must be handled in a specific venue or under offshore terms, and access can change quickly if regulators impose geo restrictions or ban certain lending and yield products, as noted in the January 2023 SEC settlement.

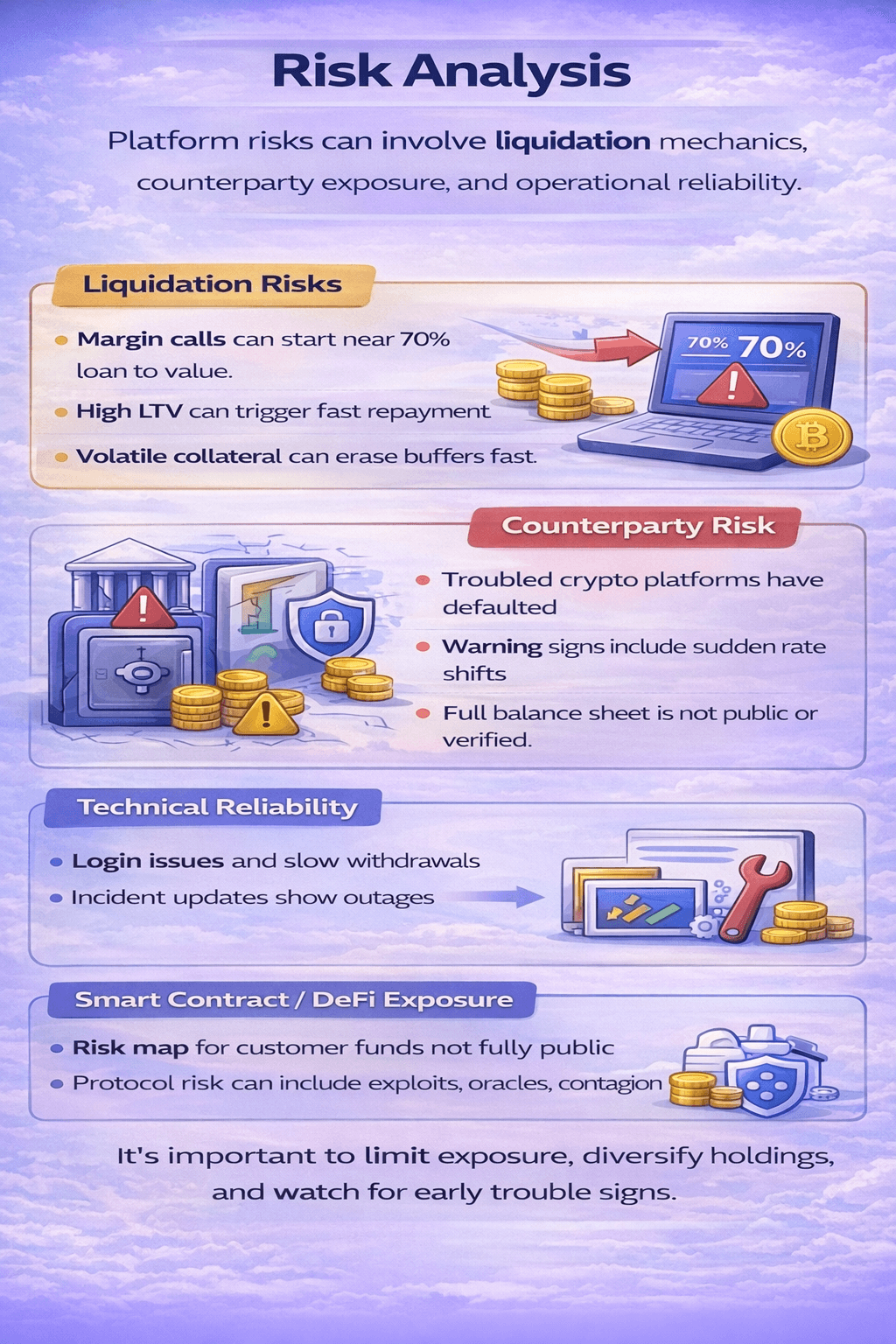

Risk Analysis: What Could Go Wrong?

Most risks on centralized platforms fall into borrowing mechanics, platform counterparty risk, and operational reliability. Some can be managed with conservative settings and sizing. Others can only be reduced by limiting exposure.

Most Risks on Centralized Platforms Fall into Borrowing Mechanics, Platform Counterparty Risk, and Operational Reliability

Most Risks on Centralized Platforms Fall into Borrowing Mechanics, Platform Counterparty Risk, and Operational ReliabilityLiquidation Risks

Liquidation risk comes down to loan to value and how fast it shifts when collateral drops.

Key mechanics:

- Margin call conditions can begin around 70 percent LTV.

- Higher LTV levels can trigger automatic repayments.

- Sharp drawdowns can erase buffers quickly, especially with volatile collateral.

Dated user cases often show the same pattern: borrowing near the limit leaves little time to react. A practical rule is to keep a wide buffer and treat maximum LTV as a ceiling, not a target.

Counterparty Risk

Counterparty risk is the risk that a platform cannot meet obligations because assets are impaired, tied up, or mismatched. The industry has clear failure examples, including Celsius halting withdrawals and insolvencies such as Voyager and BlockFi. Nexo’s business model describes a collateralized approach, but public materials cannot independently prove full balance sheet strength or counterparty quality.

Early warning signs:

- Sudden rate shifts that look out of step with market conditions.

- New withdrawal friction or unexplained delays.

- Noticeable changes in communication cadence or clarity.

Technical Reliability and Operational Risk

Operational risk shows up as login friction, withdrawal delays, and slow support during volatility. Incidents and maintenance updates appear on the status page, while recurring friction themes also surface in patterns on the Trustpilot profile.

Smart Contract / DeFi Exposure

Nexo had disclosed a DeFi related strategic investment, but a protocol level map showing whether and when customer funds route through DeFi is not consistently public.

What to take from that:

- Any DeFi rails would shift risk toward smart contracts and integrations, even if the interface looks centralized.

- Protocol specific audit evidence for fund routing is not independently verifiable from available disclosures.

- Third party protocol risk can include exploits, oracle failures, and contagion across connected systems.

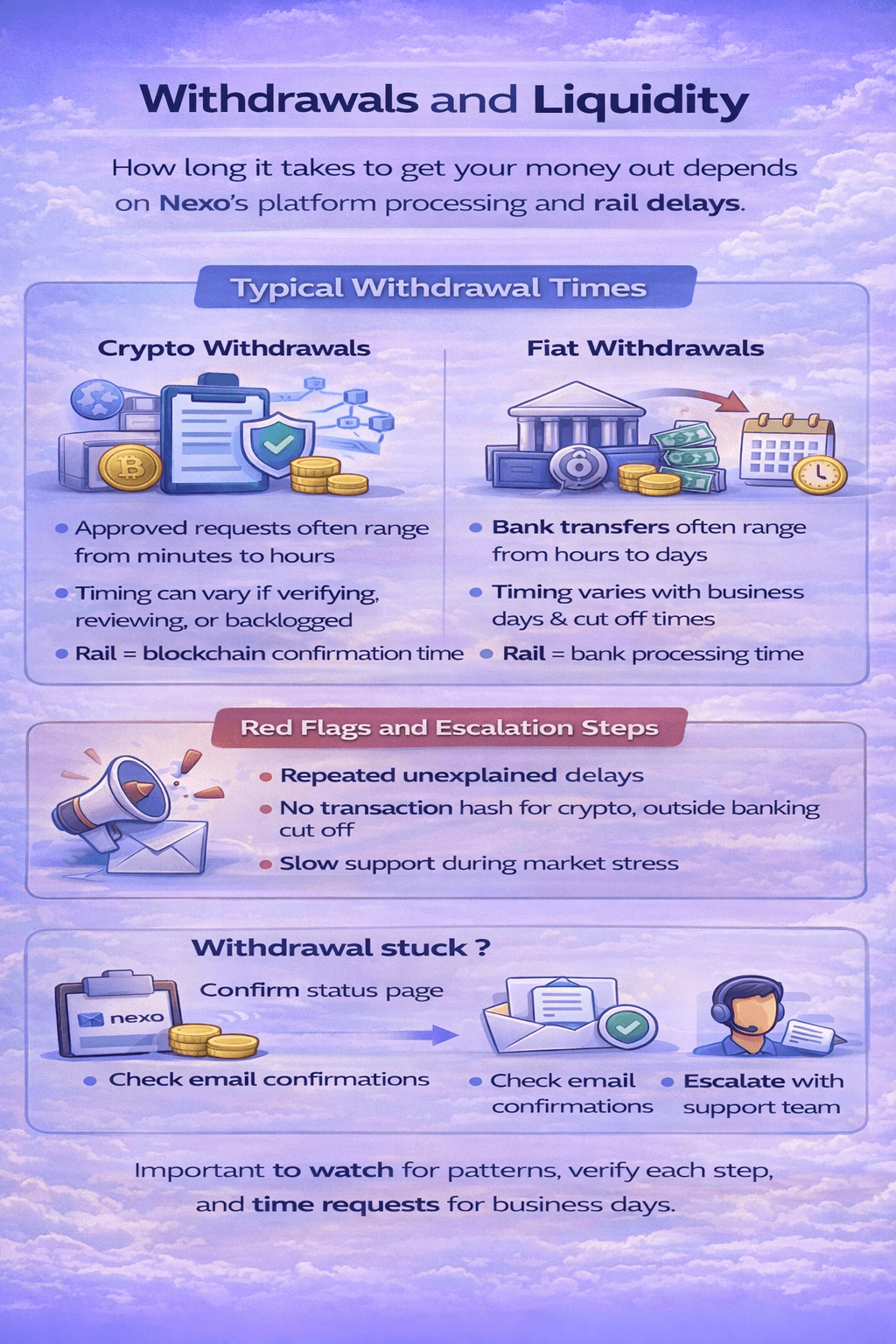

Withdrawals and Liquidity: Can You Get Your Crypto Out Fast?

Withdrawals are where “safety” becomes real. On Nexo, the time it takes to get funds out depends on two separate steps: Nexo’s internal processing and the rail that moves the money, meaning blockchain confirmations for crypto and banking networks for fiat.

Withdrawals are where “Safety” becomes Real

Withdrawals are where “Safety” becomes RealTypical Withdrawal Times

Crypto Withdrawals

For crypto withdrawals, the most common experience is that once a withdrawal is approved and broadcast, the remaining time is mostly a blockchain question. In normal conditions, users often report minutes to a couple of hours, while longer waits usually fall into two buckets: network congestion that slows confirmations, or platform-side processing that delays broadcast. Situations that can push timing out include additional verification checks, manual review triggers, or wider platform incidents reflected in the status page.

Fiat Withdrawals

For fiat withdrawals, timing is generally less predictable because banks do not run on crypto time. Card-based cashouts through withdraw to card can be fast but Nexo doesn't offer that, while bank transfers are constrained by business days, cut off times, and intermediary bank processing.

Worst-Case Scenarios and Red Flags

When withdrawals take significantly longer than usual, the likely causes tend to be platform incidents, verification friction, or processing checks. Dated user reports on the Nexo Trustpilot profile include complaints about withdrawal delays and support response time during stressful market periods, which is useful as a signal of worst-case experience even when individual claims cannot be fully verified.

Practical escalation steps if a withdrawal is stuck:

- Confirm the withdrawal request is completed and not waiting on email confirmation.

- Check for a known incident or maintenance window on the status page.

- If crypto, confirm whether a transaction hash exists. No hash usually points to platform-side delay, while a hash usually points to network confirmation time.

- If fiat, confirm banking cut off times and whether weekends or holidays apply.

- Escalate via support with the withdrawal ID, asset, amount, time submitted, and any error messages.

Red flags are repeated unexplained delays, sudden withdrawal friction that affects many users at once, or a noticeable drop in communication clarity during incidents.

Comparison to Peers

Withdrawal expectations differ by platform type.

- Large exchanges often prioritize high-throughput withdrawals, but can still pause or slow processing during incidents.

- Lending-style platforms like Nexo can add more checks because withdrawals are tied to broader risk controls and product mechanics.

- Self custody is the fastest path to “no platform risk” because you control the send button, but timing still depends on the blockchain and network fees, and mistakes are usually irreversible.

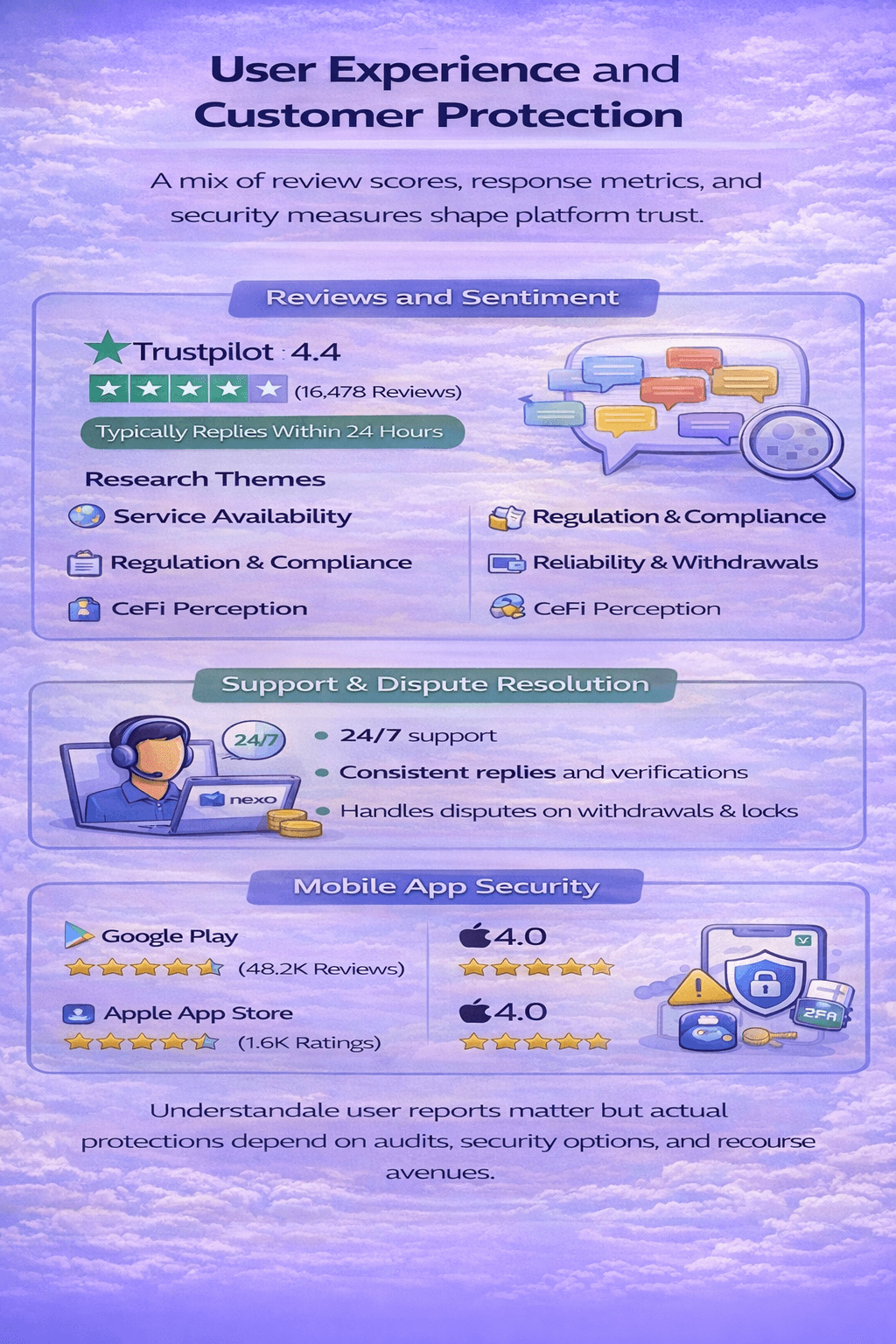

User Experience and Customer Protection

Nexo Offers 24/7 Client Care through in App Chat and Support Tickets, with a Public Help Center

Nexo Offers 24/7 Client Care through in App Chat and Support Tickets, with a Public Help CenterReviews and Sentiment

As of Feb 18, 2026, Nexo holds a 4.4 TrustScore from 16,478 reviews, with Trustpilot also showing the platform typically replies within 24 hours and responds to essentially all negative reviews.

On community forums, themes tend to cluster around a few repeat topics rather than one single recurring complaint:

- Service availability and geography: Threads about region access and timelines for product availability, including US focused discussions like this r/Nexo post from late 2025 to early 2026.

- Regulatory and compliance uncertainty: Questions about how upcoming rules might affect access, such as this r/Nexo MiCA related thread.

- Reliability, withdrawals, and account frictions: Recurring discussions about delays or security checks, for example this r/Nexo safety discussion.

- Broader market perception: In r/CryptoCurrency, Nexo often appears in the context of CeFi risk and regulation, including older threads tied to US actions such as the 2023 US exit discussion.

To reduce noise, we weight signals that are harder to fake and easier to compare over time:

- Recent, detailed reviews with consistent timelines and specific product context.

- Verified purchase style markers where a platform provides them, and repeated patterns across many independent posts.

- Cross checking the same complaint category across Trustpilot, app store reviews, and dated forum threads.

Support and Dispute Resolution

Nexo offers 24/7 client care through in app chat and support tickets, with a public help center for common issues. A practical public benchmark is that Trustpilot currently shows Nexo typically replies within 24 hours, but real response speed can still swing based on queue volume and issue type.

The most common dispute categories surfaced across reviews and threads tend to be:

- Account restrictions and verification related locks.

- Liquidation disagreements during fast market moves.

- Withdrawal checks or delays during elevated risk controls.

Mobile App Security and Permissions

On mobile, the goal is to reduce the chance that a stolen phone or hijacked number becomes a full account takeover. Nexo supports stronger login options like passkeys, and its help docs note that a password reset signs you out of active sessions and disables biometric authentication on linked devices, which is a useful containment measure if credentials are compromised. Google Play’s data safety section also discloses categories of data the app may collect and share, which matters for users who want tighter privacy defaults.

For app sentiment, Nexo currently shows:

- 4.0 on Google Play (with 48.2K reviews listed there).

- 4.0 on the Apple App Store (with 1.6K ratings listed there).

Practical mobile hardening tips that reduce the most common real world failure modes:

- Keep OS and apps updated.

- Prefer authenticator based 2FA or passkeys over SMS, since SIM swap attacks target phone based account recovery.

- Lock down your number with your carrier and use device level security such as a strong passcode and biometrics.

Check out our guide on how to avoid common Crypto Scams.

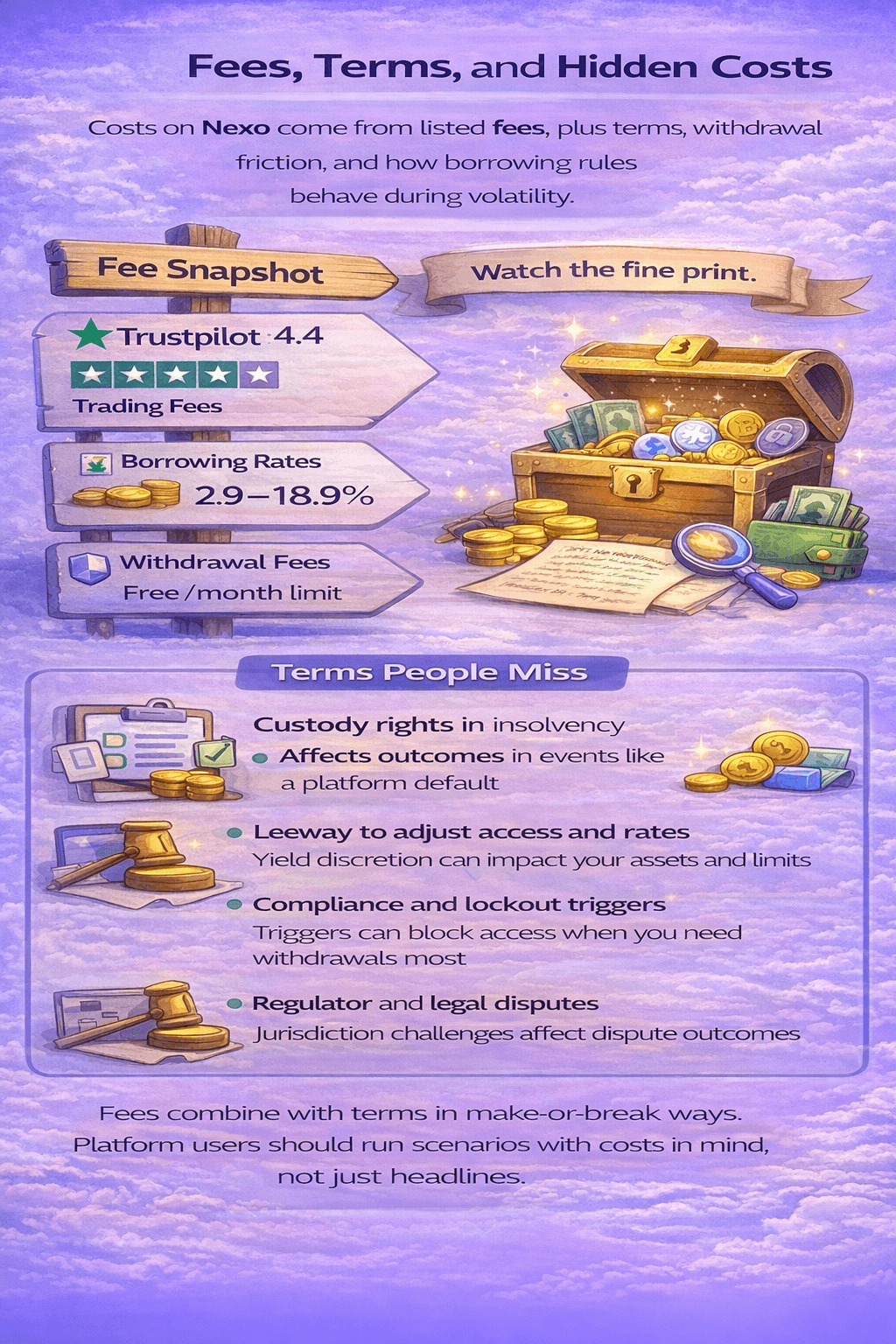

Fees, Terms, and Hidden Costs

Costs on Nexo are not just “fees.” They also come from terms, withdrawal friction, and how borrowing rules behave during volatility.

Trading Fees on Nexo Pro Use a Tier based Maker Taker Model

Trading Fees on Nexo Pro Use a Tier based Maker Taker ModelFee Schedule

- Trading fees on Nexo Pro use a tier based maker taker model, with base fees for makers/takers 0.3%/0.4%. Fees can be significantly low depending on your tier.

- Borrowing rates vary by product settings and tier, with published loan rates including 18.9 percent at Base and low cost credit lines for limited time periods or specific customers can go down to 2.9 percent.

- Earn rates vary by asset and structure, with headline rates shown up to 14 percent and BTC shown up to 6.25 percent.

- Withdrawal fees, limits, and method specific costs are best checked against the General Fee Schedule, since they can differ by asset, network, and product type.

- Conversion costs can include spreads, which are most visible when comparing quoted prices inside the platform versus external spot prices.

Terms People Miss

- Custody and ownership language can materially affect outcomes in insolvency scenarios, and some regulator records discuss user ownership framing in specific products, including references to users as beneficial and legal owners in certain contexts.

- Platform discretion clauses can be wide in yield style products, including language around the ability to use assets and adjust rates at sole discretion in documented terms.

- Service access can be restricted under compliance or risk triggers described in the Termination Policy, which matters when you need withdrawals most.

- Jurisdiction and dispute handling can depend on the serving entity and terms version, and enforcement records such as this consent order show why entity clarity affects recourse.

Cost Scenarios

Example 1, borrower at safe LTV versus aggressive LTV.

- Assumptions: $20,000 of collateral, $10,000 loan equals 50% LTV, $14,000 loan equals 70% LTV based on the 70 percent margin call level.

- If collateral drops 25%, collateral becomes $15,000.

- Safe LTV case: $10,000 divided by $15,000 equals 66.7%, which stays below 70%.

- Aggressive LTV case: $14,000 divided by $15,000 equals 93.3%, which can trigger automatic repayments and liquidation risk.

Takeaway: The same market move can be manageable at 50% LTV and catastrophic near 70% LTV.

Example 2, yield chaser versus conservative depositor.

- Assumptions: $10,000 deposit.

- At 14%, one year interest is about $1,400 using the headline Earn rate.

- At 6%, one year interest is about $600.

- Extra yield gained is about $800 per year, but it comes with greater exposure to platform level risks and any future access limits tied to regulation or internal policies.

Takeaway: Higher yield can be worth it only if the added return compensates for the extra risk and reduced flexibility.

Loyalty Tiers and the NEXO Token: Do “Perks” Increase Safety?

Loyalty tiers can lower costs and boost rates, but they do not change the fundamental safety question on a centralized platform. The core risks remain custody, liquidity, and counterparty exposure.

Nexo's Loyalty Program, Nexo Wealth, Offers Tiers that are Based on Your Portfolio Allocation to the NEXO Token

Nexo's Loyalty Program, Nexo Wealth, Offers Tiers that are Based on Your Portfolio Allocation to the NEXO TokenTier Mechanics

Nexo structures benefits through its Loyalty Program, now known as Nexo Wealth, with tiers that are based on your portfolio allocation to the NEXO Token.

- What is required: A higher tier requires holding a larger percentage of your portfolio value in NEXO.

- What changes: Higher tiers can improve earn rates, reduce borrowing costs, and change fee benefits.

- What does not change: The platform level risk profile remains the same regardless of tier.

Safety Reality Check

- Counterparty risk is the same across tiers because all users rely on the same platform balance sheet and operational resilience.

- Higher tiers can encourage larger deposits or larger NEXO holdings to “unlock” better terms, which can amplify exposure if conditions deteriorate.

- Holding NEXO adds market risk on top of platform risk because your benefits become partially dependent on the token’s price, which can move sharply during stress.

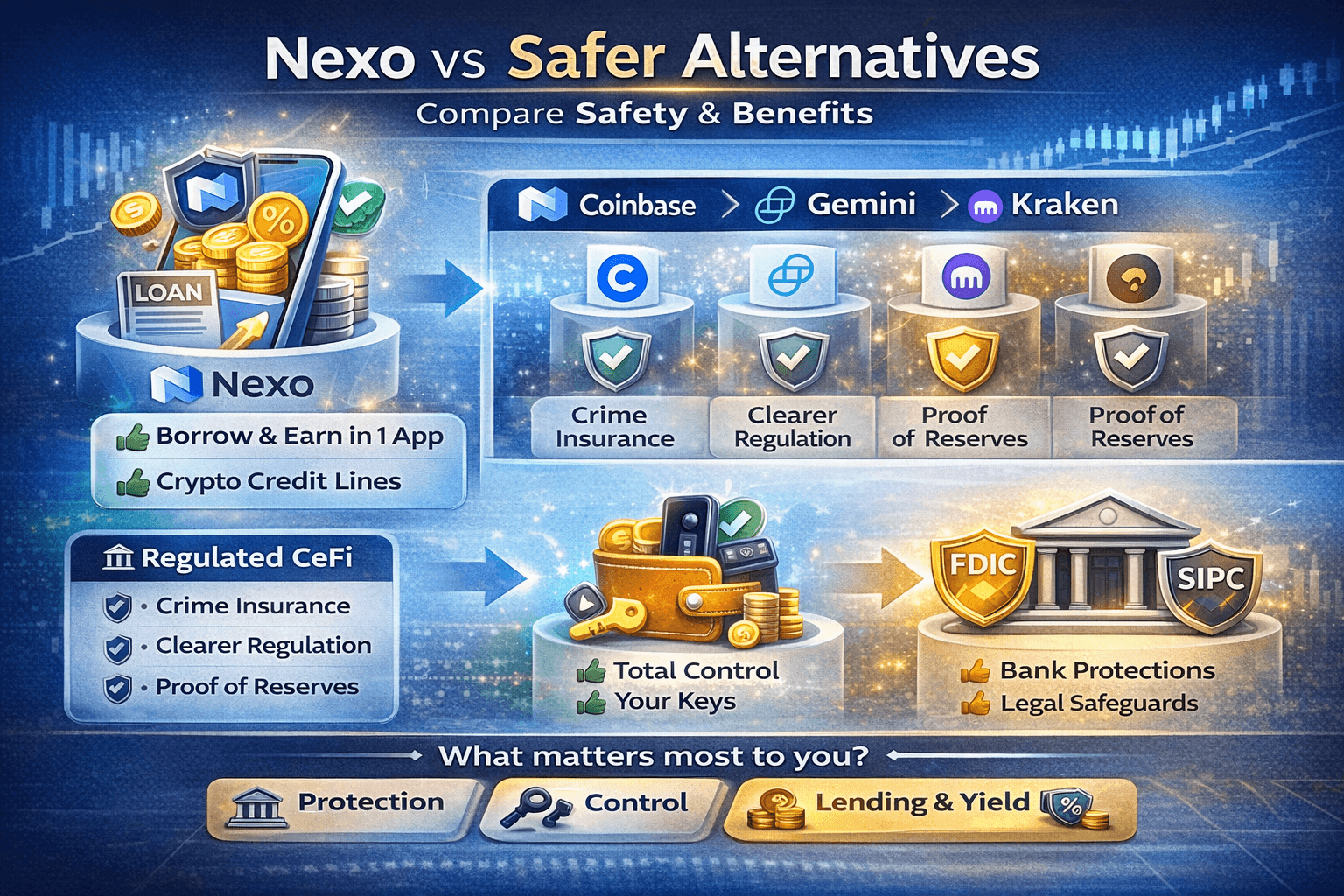

Nexo vs Other Alternatives

Choosing anoter option depends on what risk you are trying to reduce. This section compares Nexo against three common benchmarks: more regulated CeFi venues, self custody, and traditional finance protections.

Choosing a “Safer” Option Depends on what Risk You are Trying to Reduce

Choosing a “Safer” Option Depends on what Risk You are Trying to ReduceNexo vs “Regulated” CeFi Alternatives

Nexo vs Coinbase

- Coinbase does better: Coinbase publishes clearer commercial crime insurance disclosures that spell out scope and exclusions, including limits around individual account compromise. Nexo’s security page uses broader language and does not present one consistently updated, consolidated insurance figure.

- Nexo does better: Nexo integrates credit and yield style features such as Borrow and Earn in a single platform, which can reduce “platform hopping” for users who want borrowing and yield in one place.

Check out our exclusive Coinbase safety review for more details.

Nexo vs Gemini

- Gemini does better: Gemini operates as a New York regulated limited purpose trust company and has digital asset insurance for custody systems, giving it a more clearly defined supervisory frame than Nexo’s multi jurisdiction footprint summarized through licenses and registrations.

- Nexo does better: Nexo’s app experience is built around borrowing and credit lines as core functions through Borrow, which can be more streamlined than using an exchange plus separate borrowing tools.

We have a lot more detail on Gemini for you to read.

Nexo vs Kraken

- Kraken does better: Kraken publishes user verifiable Proof of Reserves with dated snapshots such as Sep 30, 2025. Nexo has a reserves attestation framework, but it is not presented in the same user verifiable snapshot format across the board.

- Nexo does better: Nexo’s core positioning is lending and credit, so users primarily borrowing against crypto may find its credit line flow more central than an exchange first interface.

Read up more on how safe Kraken is for better understanding.

Nexo vs Self-Custody

- Self custody does better: Self custody removes Nexo’s platform level counterparty exposure because you control the keys and can move funds without relying on Nexo’s processing or policies. In practice, that means your long term holdings are not affected by platform changes to lending products such as Earn or credit rules in Borrow.

- Nexo does better: Nexo provides convenience and integrated workflows like borrowing against collateral through Borrow and earning yield through Earn, plus a support layer through the help center. With self custody, losing a seed phrase or sending to the wrong address is typically irreversible, and there is no platform support to restore access.

Nexo vs Traditional Finance

- Traditional finance does better: Statutory consumer protection is stronger for cash and regulated securities, including FDIC deposit insurance for eligible bank deposits and SIPC protection for missing assets at member brokerages. Those protections generally do not apply to crypto balances held on platforms like Nexo.

- Nexo does better: Nexo offers crypto native services that TradFi typically does not, including crypto backed credit lines through Borrow and yield style products through Earn, without requiring users to move into a traditional banking or brokerage stack.

Overall, the “safer” choice depends on your goal: statutory coverage favors TradFi, control favors self custody, and a unified crypto lending workflow favors platforms like Nexo.

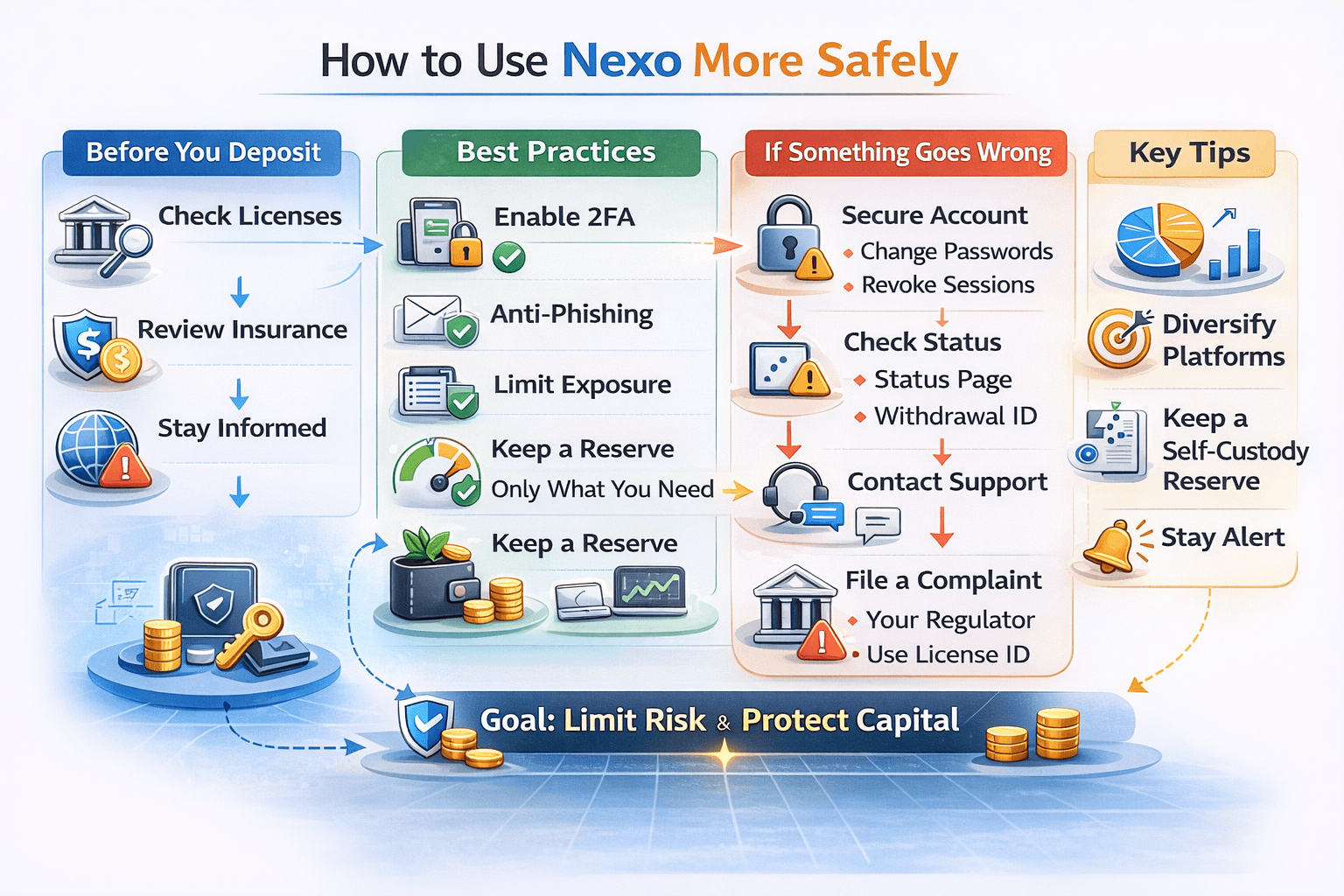

How to Use Nexo More Safely

Using Nexo more safely is mostly about reducing blast radius. You cannot remove platform risk completely, but you can limit how much damage a single mistake or adverse event can cause.

You cannot Remove Platform Risk Completely, but You can Limit how much Damage a Single Event can Cause

You cannot Remove Platform Risk Completely, but You can Limit how much Damage a Single Event can CauseBefore You Deposit

- Confirm which entity serves your region and verify any available licenses and registrations against the relevant regulator register where possible.

- Recheck the current insurance wording and scope, and treat older figures like 375 million dollars and 150 million dollars as historical context rather than a single live total.

- Review recent legal and regulatory changes that can affect access, using major milestones like the January 2023 SEC settlement as a reminder that availability can shift by market.

Best Practices

- Turn on app based 2FA, set an email anti phishing code, and enable address whitelisting. Use a unique password and keep devices updated.

- Cap exposure using a simple rule such as keeping only the amount you actively need on a platform and holding the rest in a personal wallet reserve.

- Diversify across platforms and keep a self custody reserve so a single platform event cannot lock up all funds at once.

- Borrow conservatively by staying well below the 70 percent zone and setting price alerts so you have time to top up collateral before stress triggers automatic repayments.

If Something Goes Wrong

- If you suspect account compromise, change passwords immediately, revoke sessions, and reset access using the steps in account security guidance, then freeze outbound risk by tightening withdrawal rules like whitelisting.

- If a withdrawal is stuck, confirm email confirmation, check for incidents on the status page, and escalate through support with the withdrawal ID and full details.

- If formal complaints are needed, file through the regulator relevant to your region and the entity serving you, using the license identifiers shown under registrations to route the complaint correctly.

- Use dated community channels for troubleshooting patterns, but treat direct messages and unofficial “support” accounts as scam risk, since impersonation is common around withdrawal issues.

You can also dive into our exclusive guide on mitigating risk in your trading life.

Final Verdict: Is Nexo Safe Enough for Your Crypto?

Nexo combines institutional custody tooling with consumer facing lending and yield products. The safety question is less about a single feature and more about whether the platform’s protections and transparency are sufficient for the level of exposure you are taking.

The Strongest Safety Positives

- Custody and infrastructure partnerships include Ledger and Fireblocks, plus integrations with Ledger Vault and BitGo.

- User controlled protections include app based 2FA, an email anti phishing code, and address whitelisting.

- Formal programs and standards include ISO 27001 and a public security disclosure program.

- A reserves attestation framework adds some transparency, but it is not a full audit and it does not remove platform risk.

The Biggest Unavoidable Risks

- Counterparty and solvency risk remains the central risk for any centralized lender, regardless of account settings.

- Regulatory uncertainty can change product access quickly, reflected in the January 2023 SEC settlement that affected availability in the US.

- Transparency limits remain around balance sheet quality, counterparty concentration, and a fully independently verifiable view of liabilities and exposures.

Who Should Use It (and Who Should Avoid It)

- Better fit users:

- Users who want integrated borrowing through Borrow and accept platform risk as a tradeoff.

- Users who keep balances modest and use strong security controls like whitelisting.

- Users who diversify across platforms and keep a self custody reserve.

- Users who should avoid:

- Anyone who cannot tolerate platform level counterparty risk or potential access restrictions.

- Users who need statutory protections similar to bank deposits or regulated securities accounts.

- Users planning to concentrate a large share of their net worth to chase yield through Earn.

- Users who borrow aggressively near liquidation thresholds.

Our Recommendation

Nexo is acceptable only if you treat it as a convenience layer, not a vault. That means keeping exposure capped to an amount you can afford to have temporarily locked, using strict security settings, staying well below liquidation trigger zones, and maintaining a meaningful self custody reserve. This assessment should be rechecked monthly because legal status, product availability, and platform disclosures can change quickly.