Algorithmic trading, or "algo trading," has been around for decades, first dominating stock markets before making its way into forex and commodities. In crypto, it started as a niche tool for tech-savvy traders but has since exploded, with bots now executing a huge chunk of daily trading volume.

With growing institutional adoption, improved exchange APIs, and clearer regulations, automated strategies have become more sophisticated and accessible. Whether you're a retail trader or a hedge fund, ignoring algo trading could mean getting left behind.

Algo trading brings speed, efficiency, and automation to crypto markets. Bots can analyze data, execute trades, and react to price movements in milliseconds, giving traders a serious edge over manual trading. Strategies like market-making, arbitrage, and high-frequency trading allow for higher potential returns with minimal emotional bias.

But it’s not all profits and passive income. Over-optimizing a bot can lead to unexpected failures, and market volatility can wipe out gains in seconds. Traders also rely on stable exchange APIs, and if an API goes down mid-trade, things can get ugly fast. A well-built strategy is only as good as its risk management.

Core Features to Look For In An Algo Trading Platform

Algorithmic trading isn’t just about having a great strategy—it’s also about executing that strategy on the right platform. Speed, reliability, and security are non-negotiable for algo traders. Here’s what matters most.

API Performance and Reliability

Your trading bot communicates with a platform through an API (Application Programming Interface). A weak API can cripple performance, so look for:

- Comprehensive Documentation – Clear, well-structured API docs help developers integrate their bots efficiently.

- Low Latency – Every millisecond counts in algo trading. A slow API increases slippage and can ruin high-speed strategies.

- High Data Throughput – Some platforms limit the number of API calls per second, which can throttle a bot’s ability to trade effectively.

A reliable API should have near-zero downtime because when an API fails, your trades do too.

Market Data and Analytics Tools

Algo traders rely on precise, real-time market data to execute trades. Without it, bots are essentially trading blind.

- Real-time data feeds – Price delays mean missed opportunities. The best platforms offer lightning-fast price updates.

- Historical data access – Backtesting is crucial for fine-tuning strategies. Platforms that provide deep historical data allow traders to simulate performance before going live.

- Order book visibility – For strategies like market-making, deep order book access is essential to assess liquidity and trade impact.

Bad data leads to bad trades. Always choose a platform with a robust data infrastructure.

Speed, Reliability, and Security are Non-Negotiable for Algo Traders. Image via Shutterstock

Speed, Reliability, and Security are Non-Negotiable for Algo Traders. Image via ShutterstockSecurity Measures and Governance

A compromised bot or API key can lead to instant losses. A secure platform should offer:

- Cold storage & insurance – Most funds should be held in offline wallets to prevent hacks.

- Regulatory compliance – KYC and AML policies signal a safer, more stable platform.

- API key protections – Features like IP whitelisting and withdrawal restrictions help prevent unauthorized access.

Security is more than just protection—it ensures operational continuity for your trading strategy.

Top Crypto Platforms for Algo Trading in 2026

| Platform | Algo-Friendly Features | Pros | Cons | Futures Fees | Subscription Fees |

|---|---|---|---|---|---|

| Binance | REST & WebSocket APIs, Futures API, sub-accounts, Binance Broker Program |

|

| 0.02% (maker) / 0.05% (taker) | No subscription fees |

| Kraken | REST & WebSocket APIs, Futures API, Kraken Terminal, dark pool trading |

|

| 0.02% (maker) / 0.05% (taker) | No subscription fees |

| KuCoin | REST & WebSocket APIs, Futures API, built-in trading bots, sub-accounts |

|

| 0.02% (maker) / 0.06% (taker) | No subscription fees |

| Pionex | REST & WebSocket APIs, 16 free built-in bots, grid and DCA bots |

|

| 0.02% (maker) / 0.05% (taker) | No subscription fees |

| 3Commas | REST & WebSocket APIs, Smart Trading Terminal, copy trading, bot marketplace |

|

| Depends on the connected exchange | $49/month for Pro $79/month for Expert |

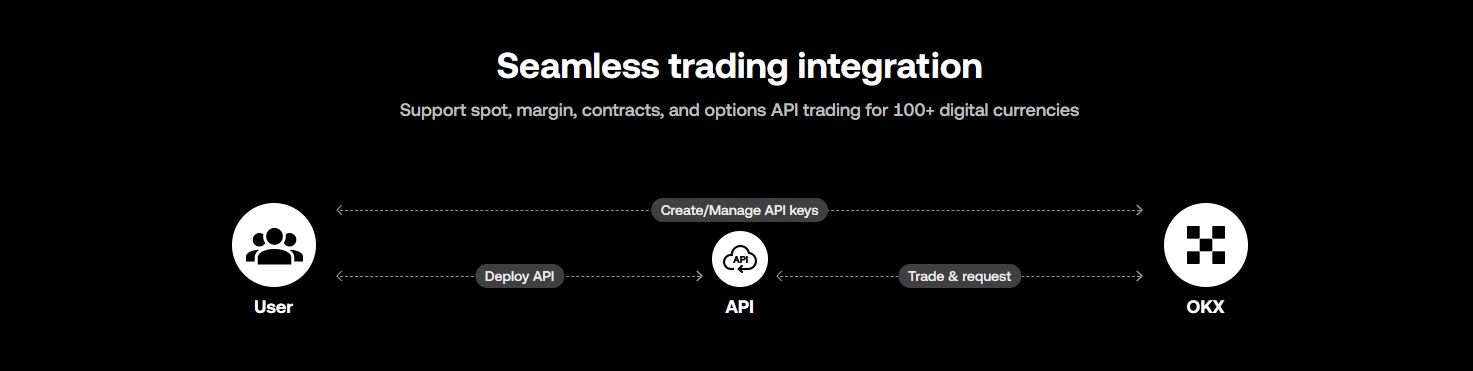

| OKX | REST, WebSocket & FIX APIs, algo orders, high API rate limits, portfolio margining |

|

| 0.02% (maker) / 0.05% (taker) | No subscription fees |

| SpeedBot | REST & WebSocket APIs, multi-exchange compatibility, pre-built & custom bots |

|

| Depends on the connected exchange | $15 – $250 per month |

Binance

Binance is the Go-To Exchange for Millions of Crypto Traders Worldwide. Image via Binance

Binance is the Go-To Exchange for Millions of Crypto Traders Worldwide. Image via BinanceBinance isn’t just a crypto exchange—it’s an ecosystem built for traders. Whether you're running high-frequency strategies or automating trades with bots, Binance provides the speed, liquidity, and API infrastructure needed for algo trading.

👉 Sign Up For Binance – Exclusive 20% Trading Fee Discount For Life + $600 Bonus

Algo-Friendly Features

Binance offers RESTful and WebSocket APIs, making it one of the most efficient platforms for automation.

- REST API – Executes trades, manages accounts, and retrieves market data.

- WebSocket API – Streams real-time market updates with ultra-low latency.

- Futures API – Optimized for high-frequency trading with leverage.

- Supported Languages – Works with Python, Java, C++, and more, allowing seamless bot integration.

Beyond APIs, Binance provides a suite of advanced tools for algo traders:

- Sub-accounts & API Key Management – Ideal for institutions running multiple strategies.

- Binance Broker Program – Grants institutional traders access to deep liquidity.

Pros

- High liquidity ensures smooth execution.

- Fast API with thousands of requests per second.

- Supports spot, margin, futures, and options trading.

Cons

- Regulatory restrictions in some countries.

- API rate limits can affect high-frequency traders.

Fees

- Spot: 0.10% for makers/takers (lower with VIP levels & BNB discounts).

- Futures: 0.02% (maker) / 0.05% (taker).

We have a review on Binance right here!

Kraken

With Institutional-Grade Security and Advanced Trading Features, Kraken is a Solid Choice for Algo Traders. Image via Kraken

With Institutional-Grade Security and Advanced Trading Features, Kraken is a Solid Choice for Algo Traders. Image via KrakenKraken has built a reputation as one of the most secure and regulatory-compliant crypto platforms. While it may not match Binance in sheer volume, it makes up for it with strong API support, institutional-grade security, and advanced trading features, making it a solid choice for algorithmic traders.

Algo-Friendly Features

Kraken offers a well-documented API infrastructure, supporting a range of automation needs:

- REST API – Executes trades, retrieves account balances, and manages orders.

- WebSocket API – Provides real-time market updates with low latency.

- Futures API – Designed for leveraged trading with support for advanced order types.

- Supported Languages – Works with Python, JavaScript, and C++, catering to a wide range of developers.

Kraken also offers additional tools to enhance algo trading:

- Kraken Terminal – A professional-grade interface for technical analysis and strategy execution.

- Dark Pool Trading – Allows traders to execute large orders without impacting market prices.

- Advanced Order Types – Includes stop-loss, take-profit, and conditional close orders for automated risk management.

Pros

- Highly secure – One of the most trusted platforms with strong regulatory compliance.

- Advanced trading tools – Supports complex order types and dark pool trading.

- Good liquidity – While not the highest, it’s solid for major crypto pairs.

Cons

- Lower trading volume compared to Binance, which may lead to slightly higher spreads.

- Higher API latency than some competitors, which could affect high-frequency traders.

Fees

- Spot Trading: Starts at 0.25% (maker) / 0.40% (taker), can be lower with discounts for high-volume traders.

- Futures Trading: Starts at 0.02% (maker) / 0.05% (taker).

We have Kraken covered in detail for you here.

KuCoin

KuCoin Offers Advanced API Functionality, Competitive Ffees, and a Strong Focus on Automation. Image via KuCoin

KuCoin Offers Advanced API Functionality, Competitive Ffees, and a Strong Focus on Automation. Image via KuCoinKuCoin is often called the "People’s Exchange" due to its wide range of supported cryptocurrencies and trader-friendly features. While it may not have the sheer liquidity of Binance, it makes up for it with advanced API functionality, competitive fees, and a strong focus on automation—making it a great choice for algorithmic traders.

👉 Sign Up For Kucoin – Trading Fee Discount of Up To 60% + FREE Trading Bot!

Algo-Friendly Features

KuCoin provides a well-structured API framework designed for automation and bot trading:

- REST API – Handles trade execution, order management, and account balance retrieval.

- WebSocket API – Provides real-time market data updates with low latency.

- Futures API – Supports perpetual contracts and leverage trading.

- Supported Languages – Works with Python, Java, Go, Node.js, making it easy to integrate trading bots.

Beyond APIs, KuCoin offers additional tools tailored for algo traders:

- KuCoin Trading Bot – A built-in feature that allows users to automate trading without third-party software.

- Sub-Accounts & API Permissions – Great for institutions and traders running multiple strategies.

- Advanced Order Types – Includes stop-market, stop-limit, and iceberg orders for automation.

Pros

- Low trading fees – Some of the most competitive rates in the industry.

- Built-in trading bots – No need for external automation tools.

- Good liquidity on major pairs – Ensures smooth execution.

Cons

- Security concerns – KuCoin has faced hacks in the past, though they’ve strengthened security.

- Lower liquidity on smaller altcoins – Algo traders working with niche tokens may experience slippage.

Fees

- Spot Trading: Starts at 0.1% (maker/taker), with discounts for high-volume traders and KCS (KuCoin token) holders.

- Futures Trading: Starts at 0.02% (maker) / 0.06% (taker).

We have a detailed review of KuCoin right here.

Pionex

Pionex is Built with Automation in Mind. Image via Pionex

Pionex is Built with Automation in Mind. Image via PionexPionex is a bot-focused crypto platform that stands out by offering 16 free built-in trading bots, making it one of the best choices for traders looking to automate their strategies without relying on third-party software. With low fees and a user-friendly interface, it caters to both beginners and experienced algo traders.

Algo-Friendly Features

Pionex is built with automation in mind and offers an API infrastructure suited for advanced traders:

- REST API – Allows traders to execute orders, manage accounts, and retrieve data.

- WebSocket API – Streams real-time market data with low latency.

- Supported Languages – Works with Python and JavaScript, making it accessible for developers.

Beyond APIs, Pionex's standout feature is its built-in trading bots, including:

- Grid Trading Bot – Automates buying low and selling high within a price range.

- Infinity Grid Bot – Similar to grid trading but without an upper price limit.

- Leveraged Grid Bot – Adds leverage for increased returns.

- DCA (Dollar-Cost Averaging) Bot – Automates recurring purchases for long-term investing.

Pros

- 16 free built-in trading bots – No need for third-party automation.

- Low trading fees – Lower than most major exchanges.

- User-friendly interface – Ideal for beginners getting into algo trading.

Cons

- Limited API flexibility – Not as advanced as Binance or Kraken for custom bots.

- No futures trading – Focused on spot trading, limiting high-frequency strategies.

Fees

- Spot Trading: Flat 0.05% maker/taker fee, significantly lower than industry standards.

- Futures Trading: 0.02% (maker) / 0.05% (taker).

You can also check out our detailed analysis of Pionex.

3Commas

3Commas is a Trading Automation Platform that Connects to Multiple Exchanges. Image via 3Commas

3Commas is a Trading Automation Platform that Connects to Multiple Exchanges. Image via 3CommasUnlike traditional exchanges, 3Commas is a trading automation platform that connects to multiple exchanges, allowing traders to deploy algorithmic strategies across different markets. It’s a one-stop shop for bot trading, offering a powerful API, pre-built strategies, and portfolio management tools.

Algo-Friendly Features

3Commas provides a robust API that integrates with major crypto exchanges, enabling seamless automation:

- REST API – Connects bots to supported exchanges for trade execution and portfolio tracking.

- WebSocket API – Streams live price data for real-time decision-making.

- Supported Languages – Works with Python, JavaScript, and C++, allowing for customized bot development.

Beyond APIs, 3Commas offers powerful automation tools, including:

- Smart Trading Terminal – Advanced trade management with stop-loss, take-profit, and trailing orders.

- Pre-Built & Custom Bots – Includes grid bots, DCA bots, and futures bots.

- Copy Trading & Signal Marketplace – Lets users follow successful traders and automated signals.

Pros

- Supports multiple exchanges – Trade across Binance, Kraken, KuCoin, and more.

- Powerful automation tools – Customizable bots and portfolio tracking.

- User-friendly interface – Great for both beginners and experienced traders.

Cons

- Subscription-based model – Unlike exchanges, 3Commas charges a monthly fee.

- Dependent on third-party exchanges – Doesn’t offer direct trading but relies on API connections.

Fees

- Subscription Plans: Ranges from $49 per month and $79 per month, depending on features (Pro or Expert), with subscription plans with discounts if you opt for annual or biannual payments.

- Trading Fees: No additional fees beyond what’s charged by the connected exchange.

Check out our detailed review of 3Commas here.

OKX

OKX is Known for its Low Fees, High Liquidity, and Innovative Features. Image via OKX

OKX is Known for its Low Fees, High Liquidity, and Innovative Features. Image via OKXOKX is a feature-rich exchange known for its high-performance APIs, deep liquidity, and advanced trading tools. With a strong focus on derivatives and algorithmic trading, OKX is a top choice for both retail and institutional traders looking for low-latency execution and automation-friendly features.

👉 Sign Up For OKX – Exclusive 40% Spot Trading Fee Discount + Get Up To $20K In Bonuses

Algo-Friendly Features

OKX provides a highly optimized API infrastructure, catering to high-frequency and automated trading:

- REST API – Executes trades, retrieves market data, and manages accounts.

- WebSocket API – Delivers real-time price updates and order book depth.

- FIX API – A low-latency protocol designed for institutional traders.

- Supported Languages – Compatible with Python, Java, and C++, making it accessible for algo developers.

Additional tools for automated trading include:

- Algo Order Types – Supports iceberg orders, TWAP (Time-Weighted Average Price), and stop orders.

- High API Rate Limits – Ideal for high-frequency traders needing rapid order execution.

- Portfolio Margining – Reduces margin requirements for traders running multi-strategy portfolios.

Pros

- Fast API with low-latency execution.

- High liquidity across spot and derivatives markets.

- Advanced order types and risk management tools.

Cons

- Some regulatory restrictions in certain regions.

- User interface can be complex for beginners.

Fees

- Futures Trading: Starts at 0.02% (maker) / 0.05% (taker), with lower fees for VIP traders.

- API Trading: No additional costs beyond standard trading fees.

Check out a complete overview of OKX here.

SpeedBot

SpeedBot Provides Customizable Algo Strategies, Real-Time Execution, and Multi-Exchange Support. Image via SpeedBot

SpeedBot Provides Customizable Algo Strategies, Real-Time Execution, and Multi-Exchange Support. Image via SpeedBotSpeedBot is a crypto trading automation platform designed specifically for high-frequency and algorithmic trading. Unlike traditional exchanges, it provides customizable algorithmic strategies, real-time execution, and multi-exchange support, making it an excellent choice for traders looking for precision automation.

Algo-Friendly Features

SpeedBot offers a versatile API infrastructure and automation tools that cater to both retail and institutional traders:

- REST API – Facilitates trade execution, order management, and market data retrieval.

- WebSocket API – Streams real-time market data with ultra-low latency.

- Multi-Exchange Compatibility – Works with major exchanges, allowing traders to execute cross-platform strategies.

Additional algo-friendly tools include:

- Pre-Built & Custom Bots – Offers grid trading, scalping, arbitrage, and market-making bots.

- Strategy Marketplace – Traders can create, sell, or buy automated trading strategies.

- Risk Management Features – Includes stop-loss, circuit breakers, and real-time portfolio monitoring.

Pros

- Multi-exchange compatibility – Allows algo traders to deploy strategies across different platforms.

- Advanced trading bots – Supports pre-built and fully customizable strategies.

- Real-time execution – Low-latency order processing ensures fast trade execution.

Cons

- Not a traditional exchange – Requires connecting to third-party exchanges.

- Subscription-based model – Traders must pay for premium features and bot access.

Fees

- Subscription Fee: Starts from $15 - $250 per month, with free trial option as well. Pricing varies based on bot usage, feature access, and subscription plans. Annual payment options give extra discounts.

- Trading Fees: Standard exchange fees apply based on the connected platform.

Evaluating Trading Bot Integrations

While some platforms offer built-in automation tools, many traders prefer third-party bots and platforms for greater flexibility and advanced features.

Popular Bots and Algo Platforms

There are two main ways to access trading bots: built-in platform tools and third-party automation platforms.

Widely Used Trading Bots:

- Pionex Bots – Includes 16 built-in trading bots for grid trading, DCA, and leveraged strategies.

- 3Commas Bots – Offers smart trading terminals, customizable grid bots, and copy trading.

- SpeedBot Strategies – Provides pre-built and custom algorithmic strategies for multiple platforms.

Bot Marketplaces & Reputable Providers:

Some platforms allow traders to buy, sell, or copy existing automated strategies:

- 3Commas Marketplace – Offers access to user-generated trading strategies.

- SpeedBot Strategy Store – Allows traders to purchase and customize automated bots.

When selecting a bot provider, consider:

- Transparency – Look for platforms with clear documentation and user feedback.

- Security – Ensure API keys are encrypted and withdrawals are restricted.

- Customizability – The ability to fine-tune strategy parameters is crucial for advanced traders.

Many Traders Prefer Third-Party Bots and Platforms for Greater Flexibility. Image via Shutterstock

Many Traders Prefer Third-Party Bots and Platforms for Greater Flexibility. Image via ShutterstockOpen-Source vs. Proprietary Solutions

Open-Source Bots:

- Free or low-cost alternatives.

- Fully customizable for unique trading strategies.

- Requires technical knowledge to set up and maintain.

- Security risk if using unverified scripts.

Proprietary Bots (Paid Solutions):

- User-friendly, often with drag-and-drop functionality.

- Customer support and regular updates.

- Can be expensive, especially subscription-based models.

- Less control over code, meaning limited customization.

Security & Reliability Considerations

- Open-source bots offer flexibility but pose security risks if not sourced carefully.

- Proprietary bots are easier to use but depend on third-party providers for updates and security patches.

Choosing between open-source and proprietary bots depends on your skill level, security concerns, and need for customization. For traders who prioritize flexibility, open-source solutions may be ideal, while casual traders may prefer premium, plug-and-play options.

Advanced Strategies and Execution

Two of the most popular and profitable approaches in algo trading are High-Frequency Trading (HFT) and Arbitrage/Market-Making. While both require sophisticated execution, they serve different objectives.

High-Frequency Trading (HFT)

HFT involves executing thousands of trades per second to profit from small price inefficiencies. To succeed, traders need:

- Proximity Hosting – Running bots on servers close to exchange data centers minimizes order execution delays.

- Ultra-Low Latency APIs – Binance, Kraken, and KuCoin offer APIs optimized for speed, essential for HFT strategies.

- High-Speed Data Feeds – Real-time WebSocket connections help bots react instantly to market movements.

Risks of HFT in Crypto Markets:

- Extreme Market Volatility – Crypto’s wild price swings can lead to unexpected losses.

- Exchange Rate Limits – Some platforms restrict API requests, limiting trade execution speed.

- Infrastructure Costs – Running an HFT operation requires expensive servers and premium exchange access.

Arbitrage and Market-Making

These strategies leverage price inefficiencies across platforms or within order books to generate consistent profits.

Arbitrage Trading:

- Cross-platform Arbitrage – Buying low on one platform and selling high on another.

- Triangular Arbitrage – Exploiting price differences between three trading pairs within the same platform.

Market-Making:

- Placing Limit Orders – Traders act as liquidity providers by placing buy and sell orders at slightly different prices.

- Earning from Spreads – Profits come from the difference between the bid and ask prices.

- API Order Execution – Market makers need fast, reliable APIs to adjust orders in real time.

While arbitrage offers short-term profit opportunities, market-making provides a steady revenue stream—but both require advanced execution tools to be profitable.

Risk Management for Algo Traders

Even the best trading algorithms can fail if risk management isn't a priority. Algo trading moves fast, and without proper safeguards, a profitable strategy can turn into a disaster. Managing risk involves spreading capital wisely and using automated protections to prevent catastrophic losses.

A Smart Trader Plans for the Worst-Case Scenario—Before it Happens. Image via Shutterstock

A Smart Trader Plans for the Worst-Case Scenario—Before it Happens. Image via ShutterstockDiversification Across Platforms

Relying on a single platform exposes traders to counterparty risk—the danger of a platform freezing withdrawals, going offline, or even collapsing. Spreading capital across multiple platforms helps mitigate this risk.

Why Diversification Matters:

- Platform Failures – History has shown that even major platforms can face hacks or liquidity issues.

- Reduced Downtime Risk – If one platform goes down, another remains operational.

- Access to Better Liquidity – Different platforms offer varying liquidity levels for specific trading pairs.

Balancing Fees vs. Safety:

- Some exchanges, like Binance and KuCoin, offer lower fees, but regulatory uncertainty may be a concern.

- Kraken provides strong security, but trading fees are higher.

- API Rate Limits Vary – Running bots across multiple platforms ensures uninterrupted execution even if one platform throttles requests.

Stop-Losses, Circuit Breakers, and Other Safeguards

Trading bots operate 24/7, and without proper safeguards, a sudden market crash can wipe out an account in minutes.

Essential Risk Controls:

- Stop-Loss Orders – Automatically exits positions when losses reach a predefined threshold.

- Trailing Stops – Adjust stop-losses as prices move favorably, locking in profits.

- Circuit Breakers – Some platforms allow traders to set limits that halt trading if volatility spikes.

24/7 Monitoring is Crucial

Even with automation, bots should never run unsupervised.

- Regular Performance Checks – Ensuring algorithms are working as intended prevents losses from technical failures or API issues.

- Adjusting to Market Conditions – Volatility can impact strategies differently, requiring manual intervention when needed.

Proper risk management separates successful algo traders from those who get wiped out. A smart trader plans for the worst-case scenario—before it happens.

Getting Started: Best Practices for Beginners

Jumping into algorithmic trading without preparation is a recipe for disaster. Before putting real money on the line, new traders should test their strategies in a risk-free environment and learn how to minimize trading costs.

Backtesting and Paper Trading

Backtesting and paper trading help refine strategies without financial risk. Testing a bot against historical market data shows how it would have performed, while paper trading simulates live execution using real-time data but with virtual funds.

Why It’s Essential:

- Identifies weaknesses in strategies before real trading.

- Builds confidence by letting traders tweak their bots.

- Reduces costly mistakes from poor parameter settings.

Tools for Beginners:

- 3Commas – Provides backtesting and paper trading features within its smart trading terminal.

- SpeedBot – Allows traders to simulate strategies before deploying them live.

- Demo Accounts – Some platforms (like Binance and Kraken) offer paper trading environments.

Minimizing Execution Costs

Even profitable algo traders can lose money to fees, slippage, and spreads.

Key Cost-Saving Strategies:

- Use Maker Orders – Placing limit orders can reduce or even earn rebates on fees.

- Choose Low-Fee platforms – Binance and KuCoin offer competitive rates for high-volume traders.

- Monitor Slippage – Avoid low-liquidity trading pairs that cause price discrepancies.

Controlling costs is just as important as having a winning strategy—even the best algo can fail if fees eat into profits.

Conclusion

Algo trading has transformed crypto markets, offering speed, efficiency, and automation to traders looking for an edge.

The key to success lies in choosing a platform with fast APIs, deep liquidity, low fees, and strong security. Whether you're running high-frequency trades, arbitrage strategies, or market-making bots, the right platform can make all the difference. Traders should focus on platforms that align with their goals and risk tolerance, ensuring their automation efforts are both profitable and sustainable.

To stay ahead, traders must adapt, refine their strategies, and embrace innovation.