Stepping into the world of cryptocurrency in the UK has never been easier, with millions now holding digital assets like Bitcoin and Ethereum.

As the market grows, so do the choices. For many new investors, the sheer number of available trading platforms can feel overwhelming. Picking the right exchange is incredibly important, as it directly shapes your entire trading experience. Things like fees, security, how fast transactions happen, and how well you're supported by customer service can all vary a lot.

This guide is here to help you navigate those choices. We'll explore the leading crypto exchanges in the UK, covering all the crucial details, from their fee structures and unique features to their security measures and regulatory standing.

Key Takeaways

- The best FCA-registered crypto exchanges in the UK include Coinbase, Kraken, eToro, OKX, Crypto.com, and Gemini.

- Always check for FCA registration to ensure the exchange is operating legally and complies with anti-money laundering and KYC standards.

- Top platforms prioritize strong security practices such as 2FA, cold storage, insurance coverage, and a clean hacking history.

- GBP deposits are fastest and cheapest via Faster Payments; some platforms also support Apple Pay, debit cards, or PayPal.

- For altcoin access and advanced tools, OKX and Kraken stand out, while Coinbase and eToro are better suited for beginners.

How We Tested and Reviewed UK Crypto Exchanges

This guide combines hands-on testing with regulatory checks and fee validation to assess which crypto exchanges are genuinely usable for UK residents in 2026. Our goal is practical: identify platforms that are legally accessible, reliable for GBP funding, transparent on costs, and strong on security controls.

What we tested

- Onboarding + KYC friction (UK): Account creation flow, ID checks, time-to-verification, and where features become gated.

- GBP deposits and withdrawals: Faster Payments availability, bank transfer speed, card/Apple Pay/PayPal support (where offered), and withdrawal reliability.

- Real trading costs (not just advertised fees): Maker/taker schedules versus spread-based pricing, plus “instant buy” vs advanced trading screens.

- Market depth + execution quality: Basic liquidity checks on majors (BTC/ETH) and representative altcoins, slippage on small vs mid-size orders, and limit order behavior.

- Product scope for UK users: Spot, recurring buys, staking/earn features, derivatives access (where legally available), and whether features are restricted by region.

- Security and account protections: 2FA/passkeys, withdrawal whitelists, session/device controls, phishing protections, and clarity around incident response.

- Transparency signals: Proof-of-reserves (if published), audit/attestation cadence, and disclosure quality (what is verifiable vs marketing).

- Support and escalation paths: Help centre accuracy, ticket responsiveness, and whether there’s a clear complaints process suitable for UK consumers.

Our data sources and verification rules

To keep the guide grounded, we only treat the following as “verified” inputs:

- Official fee schedules and product pages (GBP funding, staking availability, regional restrictions)

- FCA register status and UK-facing disclosures (where applicable)

- Published proof-of-reserves/audit materials when they are independently verifiable (not just “we have PoR” claims)

- Direct in-app observations from the testing flows above

What We Didn't Test

To keep this guide focused, we excluded the following:

- Full solvency audits or balance-sheet verification beyond publicly disclosed proof-of-reserves

- Institutional and OTC trading (block trades, bespoke fee agreements, custody services)

- Extreme market stress performance (outages, liquidations during major crashes)

- Advanced derivatives edge cases (funding anomalies, auto-deleveraging behavior)

- Liquidity quality for every listed token, especially long-tail altcoins

- End-to-end staking lifecycles across all assets (lockups, early exits, tax timing)

- Bank-by-bank GBP funding success rates across all UK financial institutions

- Large-scale customer support benchmarking across multiple issue types

- Independent security or code audits of the exchange infrastructure

Top FCA-Registered Crypto Exchanges in the UK (2026)

FCA registration is the minimum legal requirement for operating a crypto exchange in the UK. But it also signals deeper trust and long-term viability. Each platform here meets the regulatory threshold and offers services tailored to UK users.

Below is a table comparing the top FCA-approved crypto exchanges available in the UK.

| Exchange | FCA Registration | Supported Cryptos | GBP Support | Trading Fees | Security Features | Best For |

|---|---|---|---|---|---|---|

| Crypto.com | Yes | Yes | Yes | 1% (spread-based) | 2FA, cold storage | Beginners, social trading |

| eToro | Yes | 100+ | Yes | 1% (spread-based) | 2FA, cold storage | Beginners, social trading |

| Kraken | Yes | 290+ | Yes | 0.02%–0.26% (maker/taker) | 2FA, cold storage, proof of reserves | Advanced traders, security |

| Coinbase | Yes | 240+ | Yes | 0.4%–0.6% (maker/taker) | 2FA, insurance, cold storage | Beginners, mobile app |

| Gemini | Yes | 150+ | Yes | 0.00%–0.40% (maker/taker) | 2FA, cold storage, insurance | Compliance, staking |

| OKX | Yes | 350+ | Yes | 0.08%–0.10% (maker/taker) | 2FA, cold storage | Altcoins, advanced trading |

The table above provides a quick overview of some trusted options. To help you make a more informed decision, we'll now take a closer look at each of these FCA-registered exchanges, detailing what makes them stand out.

1. Crypto.com

Crypto.com is a globally recognized exchange offering a comprehensive suite of crypto services for UK users, including spot trading, staking, a Visa debit card, and an easy-to-use mobile app. The platform supports over 350 cryptocurrencies and provides a variety of payment methods, including GBP bank transfers, debit/credit cards, Apple Pay, and Google Pay.

Crypto.com is Trusted by 140M+ Users Worldwide. Image Via Crypto.com

Crypto.com is Trusted by 140M+ Users Worldwide. Image Via Crypto.comFeatures:

- Regulatory Compliance: Licensed in multiple jurisdictions, though not available in New York.

- Fee Structure: Maker/taker fees start at 0.075%, with CRO staking unlocking discounts.

- Asset Support: Access to 350+ cryptocurrencies and support for over 20 fiat currencies.

- Trading Options: Includes spot, margin, derivatives, and trading bots.

- Staking: Earn interest on more than 1,000 assets via an integrated DeFi wallet.

- NFT Marketplace: Buy, sell, and mint NFTs with a 1.99% transaction fee.

- Integrated Ecosystem: Mobile app, Visa debit card with cashback, and custodial DeFi wallet.

Fees

- 1% (spread-based)

✅ Pros

- FCA-registered, offering strong compliance and user confidence.

- Supports over 350 cryptocurrencies, giving users a wide choice.

- Offers an integrated Visa debit card for spending cryptocurrency and earning cash back.

- Features a user-friendly mobile app for easy trading and portfolio management.

- Provides competitive trading fees, with further discounts available.

❌ Cons

- Has a complex fee structure that can be confusing for various services.

- Customer support can be slow, particularly during peak periods.

- Lacks advanced trading tools compared to some other platforms.

- Charges fees for withdrawing funds from the platform.

Crypto.com suits users looking for an all-in-one ecosystem. It’s great for mobile-first traders, CRO holders, and those wanting to earn, spend, and trade all in one app.

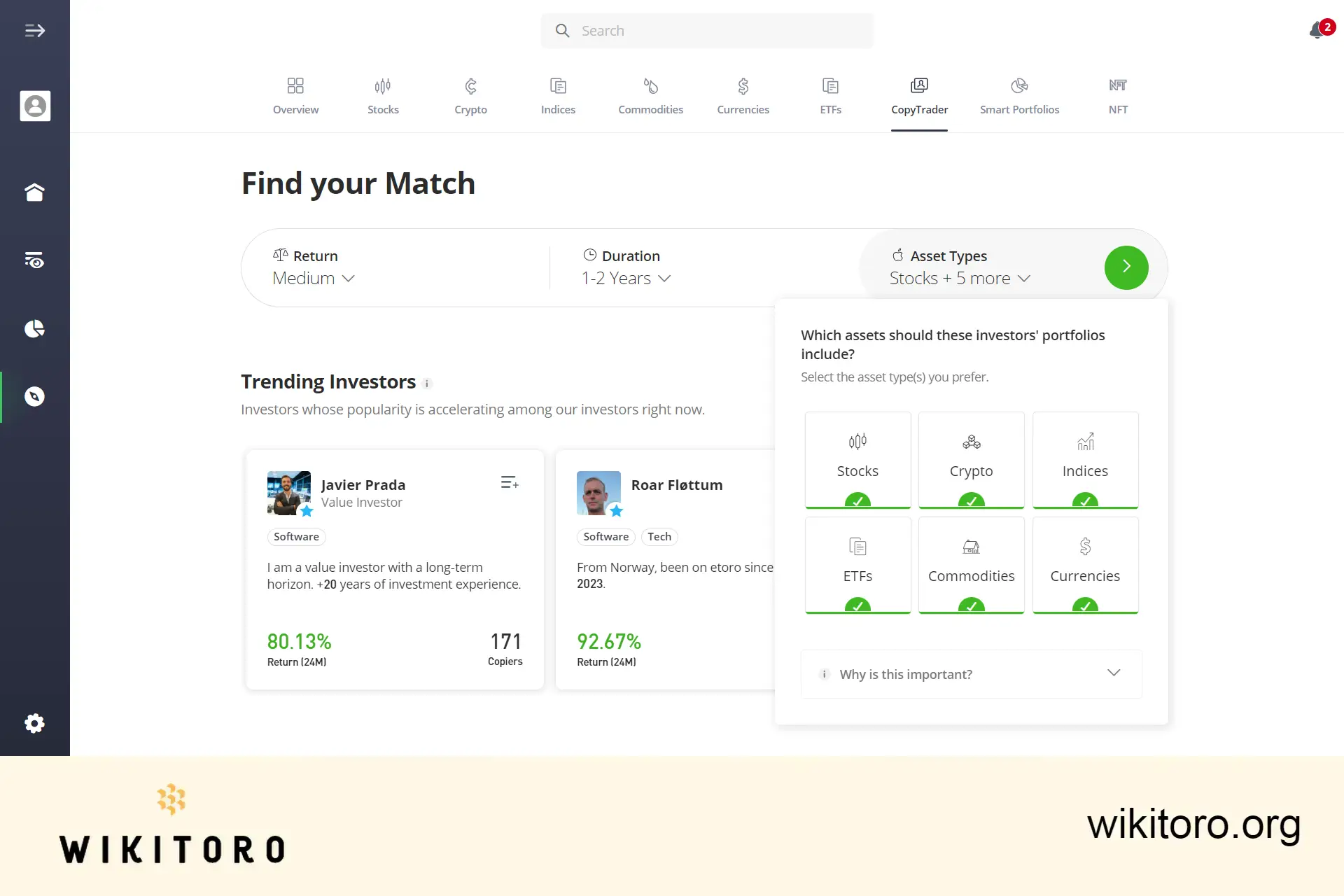

2. eToro

eToro is a multi-asset FCA-registered platform known for combining crypto trading with traditional financial instruments like stocks, ETFs, and commodities. It is popular in the UK for its beginner-friendly layout and social trading features. One of its standout features is CopyTrader, which allows users to mimic the trades of top investors in real-time.

Disclaimer

Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

etoro Website. Image via etoro.

etoro Website. Image via etoro. Features

- Regulatory Compliance: FCA-regulated in the UK, and licensed in the U.S., EU, and Australia.

- Fee Structure: Charges a 1% flat fee per trade plus asset-specific spreads.

- Asset Support: Offers 130 cryptocurrencies, plus traditional assets like stocks and ETFs.

- Trading Options: Spot trading and CFDs available (CFDs depend on jurisdiction).

- Social Trading: Use CopyTrader to automatically replicate top investor strategies.

- Multi-Asset Access: Manage crypto alongside stocks and commodities within one platform.

Fees

- 1% (spread-based)

✅ Pros

- Fully FCA-regulated and safe for UK residents

- Very easy to use for beginners

- CopyTrader allows passive or social investing

- All-in-one platform for crypto, stocks, and more

- Demo account for learning without real money

- Supports GBP with local payment methods

❌ Cons

- Charges a 1% spread on crypto trades (no maker/taker model)

- Doesn’t support as many altcoins or DeFi tokens as others

- No access to advanced features like futures or margin trading

- Users don’t control their private keys unless using the wallet app

eToro is best for new investors who want simplicity, education, and passive investing via copy trading. Great for those managing crypto and traditional assets together.

3. Kraken

Kraken is one of the most respected crypto exchanges in the UK and globally, known for its strong security standards, low fees, and advanced trading tools. It is fully FCA-registered, supports GBP funding, and appeals to both institutions and professional traders.

Kraken is a secure, regulated crypto platform trusted worldwide. Image via Kraken

Kraken is a secure, regulated crypto platform trusted worldwide. Image via KrakenFeatures

- Regulatory Compliance: FCA-registered and compliant with major global frameworks.

- Fee Structure: Maker/taker model with fees starting at 0.02% and 0.26%.

- Asset Support: Supports 290+ cryptocurrencies, including stablecoins and altcoins.

- Trading Options: Offers spot, margin, and futures with multiple order types.

- Staking: On-chain and off-chain staking options are available for supported coins.

- Advanced Tools: Kraken Pro provides access to detailed charting, analytics, and APIs.

Fees

- 0.02%/0.26% maker/taker

Additionally, GBP transfers take longer as it doesn’t support Faster Payments, relying instead on SWIFT or FPS via third-party rails.

✅ Pros

- FCA-registered and one of the most trusted names in crypto

- Very low trading fees (as low as 0.02% for makers)

- Offers margin, futures, and advanced order types

- Strong security with proof of reserves and cold storage

- Staking is available for multiple assets

❌ Cons

- The interface and tools may confuse beginners

- Slower GBP deposits and withdrawals compared to rivals

- No support for credit card funding

- Staking options are slightly more limited than OKX or Binance

Kraken is perfect for users who value security, compliance, and advanced trading tools. Best suited for experienced traders and institutions.

Read our full Kraken review.

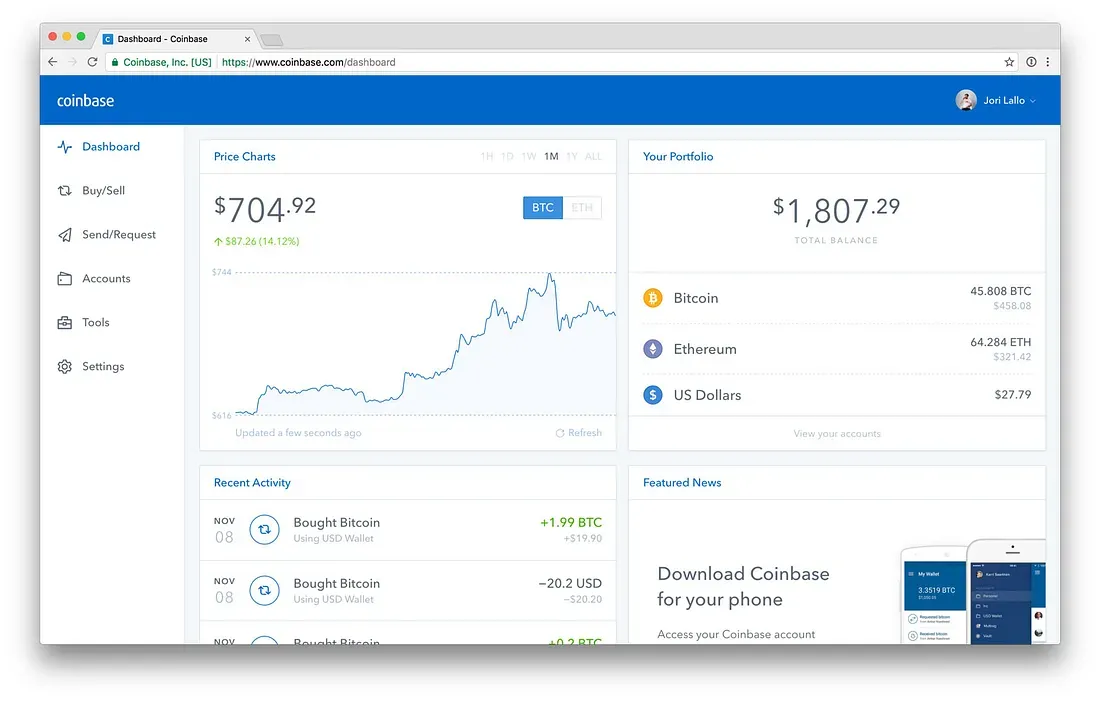

4. Coinbase

Coinbase is one of the most recognisable and beginner-friendly crypto platforms in the UK and worldwide. It is FCA-registered, publicly listed on the NASDAQ, and trusted by millions of users.

One of the world’s most trusted platforms to buy, sell, and manage crypto. Image via Coinbase.

One of the world’s most trusted platforms to buy, sell, and manage crypto. Image via Coinbase.Features

- Regulatory Compliance: FCA-registered, publicly listed on NASDAQ, and FinCEN compliant.

- Fee Structure: Variable fees, lower rates with Coinbase Advanced (0.4%/0.6%).

- Asset Support: Trade over 250 cryptocurrencies, including major and trending tokens.

- Trading Options: Includes recurring buys and real-time market orders.

- Staking: Offers staking for ETH, ADA, SOL, ATOM, and others.

- User Experience: Award-winning mobile and web apps, plus Learn & Earn modules.

Fees

- 0.4%/0.6% maker/taker

Our full Coinbase review covers all that and much more.

✅ Pros

- One of the easiest and safest platforms for beginners

- Fully FCA-compliant and publicly traded

- Fast GBP deposits and withdrawals via Faster Payments

- High-quality mobile and web apps

- Staking rewards for major assets like ETH and ADA

❌ Cons

- Higher trading fees than other top exchanges

- Fewer altcoins and DeFi tokens compared to OKX or Binance

- Limited advanced trading tools unless using Coinbase Advanced

- Customer support response times can be slow

Coinbase is ideal for new UK users seeking a secure, intuitive platform. It’s best for long-term holders, learners, and casual traders.

5. Gemini

Gemini is a US-based exchange with strong UK operations and a focus on compliance, custody, and security. It is FCA-registered and well-suited for users who want regulatory assurance.

The platform also offers both a simplified trading interface and a pro-grade terminal called ActiveTrader, catering to both beginners and experienced traders.

Gemini Website. Image via Gemini Website

Gemini Website. Image via Gemini WebsiteFeatures

- Regulatory Compliance: FCA-registered and SOC 2 Type 2 certified for cybersecurity.

- Fee Structure: 1.49% instant fee + 0.50% convenience fee; lower fees via ActiveTrader.

- Asset Support: Supports 80+ cryptocurrencies and select stablecoins.

- Trading Options: Simple buy/sell interface and professional-grade ActiveTrader terminal.

- Staking: Gemini Earn enables interest on eligible crypto assets.

- Security: Assets are insured, held in cold storage, and with strong KYC enforcement.

Fees

- 0.00%/0.40% maker/taker

✅ Pros

- FCA-registered and built with a strong focus on compliance

- Excellent security with insurance, 2FA, and cold storage

- Two interfaces to suit both casual and professional traders

- Supports staking with regular rewards

- Reliable GBP deposit and withdrawal options

❌ Cons

- Limited number of altcoins compared to OKX or Kraken

- Higher trading fees on the standard platform

- KYC is mandatory before trading or depositing

- No access to margin or futures trading

Gemini is best for safety-first investors and those who want insured storage. Great for UK users who value compliance and simple design.

Head over to our full Gemini review to learn more.

6. OKX

OKX is a global exchange with a vast asset range, advanced trading features, and DeFi integration. It’s popular among international traders for its versatility and low fees.

OKX Is a Secure, Transparent and Low-Fee Crypto Trading. Image via OKX

OKX Is a Secure, Transparent and Low-Fee Crypto Trading. Image via OKXFeatures

- Regulatory Compliance: Not available in the U.S.; expanding FCA-regulated services.

- Fee Structure: Maker/taker fees as low as 0.08%/0.10%, discounted with OKB.

- Asset Support: 320+ cryptocurrencies and altcoins.

- Trading Options: Spot, futures, options, and perpetual swaps.

- Staking & DeFi: DeFi wallet, NFT marketplace, and yield farming.

- Web3 Integration: Built-in DEX tools and NFT markets.

Fees

- 0.08%/0.10% maker/taker

You can click here to read our full OKX review.

✅ Pros

- Huge altcoin and stablecoin support

- Extremely low trading fees

- Access to DeFi, NFTs, and passive income tools

- High-speed, pro-grade interface

- Flexible trading for every level

❌ Cons

- Not available in the U.S.

- Fiat withdrawals can be complex

- Lower liquidity on some smaller coins

- Not ideal for beginners

OKX is great for experienced traders, DeFi users, and anyone seeking a low-fee, high-volume trading experience. Best for those outside the U.S.

Key Considerations When Choosing a UK Crypto Exchange

There are many crypto platforms in the UK, but not all exchanges offer the same experience. Some focus on low fees, others offer powerful tools or better customer support.

The best choice depends on your needs. Here are the most important factors to consider.

Regulation and FCA Compliance

The Financial Conduct Authority (FCA) is the top regulator for UK crypto firms. Any exchange serving UK users must register with the FCA. This rule helps protect users from fraud and unsafe platforms.

If an exchange does not appear on the FCA register, avoid it. Without FCA approval, a platform cannot operate legally in the UK.

FCA registration also comes with its own rules. Every exchange must follow anti-money laundering (AML) laws, and it must also verify customer identity through Know Your Customer (KYC) procedures.

This means users must verify their identity before trading, and so most platforms will ask for a photo ID and proof of address. This step adds a layer of protection for both users and the platform. Adding to the FCA regulations, one must still follow their due diligence, and so being aware of the most important security practices is an important thing.

Security Features

Crypto ownership comes with risks. One small error, one phishing link, or one unsecured account can wipe out your entire financial balance. That’s why choosing a platform with strong security practices is essential.

Here are the core security features you should look for:

- Two-Factor Authentication (2FA): This is the first layer of defense. It prevents login with just a password. Good platforms use authenticator apps rather than text messages, which can be intercepted.

- Cold Storage: Reputable exchanges keep most funds offline. Hackers can’t access coins stored on cold wallets. This dramatically reduces the chance of losing your assets.

- Withdrawal Protection: Many platforms allow address whitelisting. That means only approved wallet addresses can receive your crypto. If someone gets access to your account, they still can’t move funds without verification.

- Insurance Coverage: Some platforms ensure that digital assets are stored on their servers. This can cover theft from hacks, but the insurance policies vary, and not all cover user errors or phishing.

- Security History: Before choosing an exchange, research its track record. Has it ever been hacked? If so, how did it respond? Did it refund users or deny responsibility? Past incidents are always powerful indicators of future risk.

Not All Crypto Exchanges Offer The Same Experience. Image via Shutterstock

Not All Crypto Exchanges Offer The Same Experience. Image via ShutterstockFees and Pricing Transparency

Every exchange earns money through fees. These may seem small at first, but they add up over time. Choosing the right fee structure can make a huge difference in your profits.

Here are the common fees to look for:

- Maker/Taker Fees: These apply when you trade crypto. A “maker” adds liquidity to the market. A “taker” removes it. Most exchanges charge between 0.1 percent and 0.4 percent per trade. Lower fees usually apply if your trading volume is higher.

- Spread-Based Fees: Some platforms do not charge direct fees. Instead, they apply a spread — the difference between the buying and selling price. You often pay more without realizing it. Spread-based pricing can sometimes be worse than percentage fees.

- Deposit and Withdrawal Fees: Check if the platform charges for depositing GBP via bank transfer or card. Some platforms offer free deposits but charge for withdrawals. Fees vary widely. Always read the fine print.

- Hidden Charges: Look for costs buried in conversion rates or transfer systems. If you deposit in GBP but trade in USD, the platform might apply a bad exchange rate.

Looking for a step-by-step guide on how to buy crypto in the UK? We've got you covered.

Top Exchanges for Beginners

A beginner-friendly exchange must offer simplicity without sacrificing safety. These platforms balance usability with clear support and fast GBP access.

| Exchange | User Interface | Mobile App | Education | Min. Deposit | Support |

|---|---|---|---|---|---|

| Coinbase | Very Easy | iOS/Android | Extensive | £10 | Chat, Email |

| eToro | Very Easy | iOS/Android | Good | £10 | Chat, Email, Phone |

| Gemini | Easy | iOS/Android | Good | £10 | Email, Chat |

One of the most critical aspects for beginners is the user interface (UI) and mobile application design. A well-designed UI can greatly reduce the learning curve and increase confidence in navigating crypto markets.

Coinbase, widely regarded as one of the most beginner-friendly platforms globally, has a strong presence in the UK.

Coinbase's User-Friendly Interface. Image via Coinbase

Coinbase's User-Friendly Interface. Image via Coinbase It features a minimalist dashboard that provides clear price tracking, easy-to-follow buy/sell options, and a seamless mobile app. Coinbase’s mobile application is frequently praised for its intuitive design, which mirrors the desktop interface and allows quick transaction execution.

eToro, a platform originally designed for stock and forex trading, has integrated crypto trading with an emphasis on usability. Its "CopyTrading" feature is particularly attractive to newcomers, allowing them to mimic the trades of experienced investors.

eToro's Copy Trading Dashboard. Image via WikiToro

eToro's Copy Trading Dashboard. Image via WikiToroeToro’s mobile app integrates these features in a highly visual and accessible format, ensuring ease of use for people with little to no background in financial trading

Kraken, another UK-compliant exchange, also provides an extensive educational hub called "Kraken Learn," which includes articles and videos that cater to beginner, intermediate, and expert traders. The exchange further enhances the user experience with 24/7 live chat support and a responsive ticketing system.

Top Exchanges for Advanced Traders

Advanced users require more than ease of use. They want fast order execution, low latency, rich APIs, margin options, and tools for automated trading. The following platforms meet those needs and are ideal for high-frequency or technical traders.

| Exchange | Advanced Tools | API Access | Derivatives | Staking | Liquidity |

|---|---|---|---|---|---|

| Kraken | Yes | Yes | Yes | Yes | High |

| OKX | Yes | Yes | Yes | Yes | High |

| Gemini (ActiveTrader) | Yes | Yes | No | Yes | Medium |

One of the most vital components for advanced traders is access to the best technical analysis tools. These allow users to study historical price movements, apply technical indicators, and execute strategic trades based on market signals.

Kraken supports margin and futures trading. The Pro version offers custom charts, leverage, and volume-based discounts. APIs allow automation and third-party bot connections. For algorithmic traders, this is a powerful platform.

OKX supports high-leverage derivatives, DeFi trading, and real-time order books. It offers both REST and WebSocket APIs. The platform also provides grid trading tools and copy-trading features for pros who want social performance. API and advanced order types are available for algorithmic traders.

Gemini ActiveTrader targets institutional users and day traders. It includes order depth views, block trading options, and direct fiat pairs.

Gemini 's Provides Active Trader Dashboards To Optimize the Trading Experience. Image via Gemini

Gemini 's Provides Active Trader Dashboards To Optimize the Trading Experience. Image via GeminiWhile it lacks derivatives, it excels in reliability and speed.

These platforms suit users who understand limit orders, stop-loss placements, and latency impact. Beginners must start on the earlier discussed list before jumping into these environments.

For a better understanding of the top tools for tracking your crypto investments, check out our guide to the best crypto portfolio trackers.

Top UK Crypto Exchanges for Altcoin Trading

The altcoin market is where innovation happens. DeFi tokens, gaming coins, meme tokens, and new chains often launch before they hit mainstream listings. If you want access to these assets, choose platforms with wide token support.

| Exchange | Supported Tokens | DeFi Access | Stablecoins | DEX Integration |

|---|---|---|---|---|

| OKX | 350+ | Yes | Yes | Yes |

| MEXC | 11,000+ | Yes | Yes | No |

| Kraken | 290+ | No | Yes | No |

OKX truly stands out for its vast selection of digital assets and its deep integration with decentralized finance (DeFi) tools. On this platform, users can explore trading a wide range of synthetic assets, tokens that generate yield, and various stablecoins. It seamlessly connects with numerous decentralized applications and provides handy tools for bridging between different blockchain networks.

MEXC, on the other hand, is notable for its incredibly broad array of listed tokens. Many new coins often make their debut on MEXC before appearing elsewhere. However, it's worth noting that this platform is not registered with the FCA, which might be a key consideration for UK residents who prioritize local regulatory oversight.

Kraken manages to find a sweet spot, offering a good balance between supporting a variety of alternative coins and maintaining a strong reputation for trustworthiness. While it may not list every single digital asset, its selection of over 290 assets includes many popular DeFi coins and stablecoins, catering to a diverse range of interests.

For anyone focused on trading altcoins, it's always a good idea to carefully review an exchange's listing policies, assess its trading volume, and understand its withdrawal options before making a choice. Try to steer clear of platforms with limited activity or those where transactions might cost you more due to price fluctuations.

While centralized exchanges (CEXs) dominate fiat onboarding and security, they cannot match decentralized exchanges (DEXs) in token variety.

Decentralized Exchanges Integrations

Many UK users diversify their exposure by combining CEX trading with DEX integrations or non-custodial tools.

Uniswap, the most prominent Ethereum-based DEX, offers access to nearly any ERC-20 token. UK users can connect their wallets (e.g., MetaMask or Crypto.com DeFi Wallet) to Uniswap for full access to new and experimental tokens. Similarly, PancakeSwap on BSC and Raydium on Solana provide access to a wide range of low-cap assets and liquidity farming opportunities.

Exchanges like KuCoin and OKX support this bridge by integrating third-party wallet connectivity. KuCoin’s platform enables quick withdrawal to MetaMask or Trust Wallet, easing transitions into DEX trading. OKX’s Wallet Connect tool facilitates direct connections to a host of DeFi applications and NFTs via third-party partnerships.

Knowing about an exchange's features is one thing, but getting your money onto the platform is the first practical step. For UK traders, reliable ways to deposit Great British Pounds are essential.

Fiat On-Ramp Options: GBP Support

Fast GBP deposits and withdrawals are essential for UK users. Without proper fiat access, you may lose time and money in unnecessary conversions.

Below is a list of FCA-registered exchanges supporting GBP.

- Kraken

- Gemini

- Coinbase

- OKX

- eToro

- Crypto.com

- CEX.IO

- Revolut

These exchanges largely accept GBP in deposits via the following methods:

- Bank transfer using Faster Payments

- Debit card

- Apple Pay or Google Pay on some platforms

- PayPal on select exchanges

Faster Payments is the best option for UK residents as it’s usually free and instant. Other than that, debit card deposits are quick, but they may incur additional costs.

Withdrawal speed varies. Some platforms process GBP withdrawals within one business day, while others may take longer or apply flat fees.

Always check the platform’s FX rates if it requires GBP to USD conversion for trading, as a bad rate can eat into your gains.

Staking and Passive Income Features

Staking is one of the most accessible forms of passive income in the crypto world. It allows users to lock up their tokens in proof-of-stake (PoS) networks in exchange for rewards, typically in the same token or in the platform’s native asset. For UK residents, only a subset of exchanges provides fully compliant staking services due to FCA oversight.

Staking with Kraken

Kraken has long been a leader in staking. UK users can stake assets like Ethereum (ETH), Cardano (ADA), Solana (SOL), and Polkadot (DOT) directly through the Kraken platform.

Rewards vary depending on the coin. For example, ETH2.0 currently offers 3–6% APY, while DOT and SOL may yield even higher (Kraken, 2024). Importantly, Kraken provides both "on-chain" staking and "off-chain" staking (through Kraken’s pooled system), offering flexibility in reward frequency and withdrawal terms.

For those exploring such options on the Solana blockchain, check out our list of the 10 best Solana wallets for secure storage and easy access.

Staking Is An Accessible Form Of Passive Income In The Crypto World. Image via Shutterstock

Staking Is An Accessible Form Of Passive Income In The Crypto World. Image via ShutterstockCrypto.com's Earn Program

Crypto.com is another major player with different offerings for staking available to UK customers. Users can stake tokens, including CRO, ETH, and stablecoins like USDC, via the Crypto.com Exchange or DeFi Wallet.

The Earn program, although technically a fixed-term deposit product rather than traditional staking, offers competitive APYs and flexible or fixed durations (Crypto.com). For example, stablecoins like USDC can yield between 3% and 10% APY depending on staking duration and the user’s CRO holdings.

OKX's DeFi Staking

OKX also supports staking for major PoS assets and integrates with their Web3 wallet for DeFi staking options. Staking services on OKX are paired with detailed analytics, giving users visibility into lock-up periods, APY, and validator performance, which are key considerations for those serious about passive income strategies.

What To Watch Out For

While the appeal of passive income is strong, UK investors must evaluate the risk factors associated with staking and savings products.

These include:

- Custodial Risk: When staking via centralized platforms like Binance or Kraken, users typically give up control of their private keys. If the exchange fails (e.g., like FTX), staked assets may be unrecoverable.

- Smart Contract Risk: For DeFi staking or using yield aggregators like Yearn Finance or Convex, funds are locked into smart contracts. Bugs or hacks can result in permanent loss of funds.

- Lock-up Periods: Many staking and savings products require locking funds for a fixed period. Users may be unable to access assets during market downturns or liquidity needs.

- Regulatory Uncertainty: Some products, especially interest-bearing accounts, have been reclassified as securities by regulators in the US and may face similar treatment in the UK. The FCA has not fully clarified its stance on crypto yield products, making them a grey area for compliance.

- Volatility Risk: Yield earned on altcoins or DeFi tokens is subject to the price volatility of the asset itself. A 12% APY may not be meaningful if the token's value drops 40%.

UK investors are encouraged to diversify across platforms, avoid locking all assets in high-risk products, and consider stablecoins or major PoS coins with good validator reputation and liquidity.

Mobile and Desktop Experience

Top UK crypto exchanges such as Coinbase, Kraken, Crypto.com, Gemini, and eToro offer both mobile apps and desktop platforms designed to accommodate different trading preferences.

Mobile Apps

These are typically streamlined for ease of use, with intuitive navigation and simplified buy/sell options. Most leading exchanges have highly rated iOS and Android apps, praised for their user-friendly interfaces and fast onboarding.

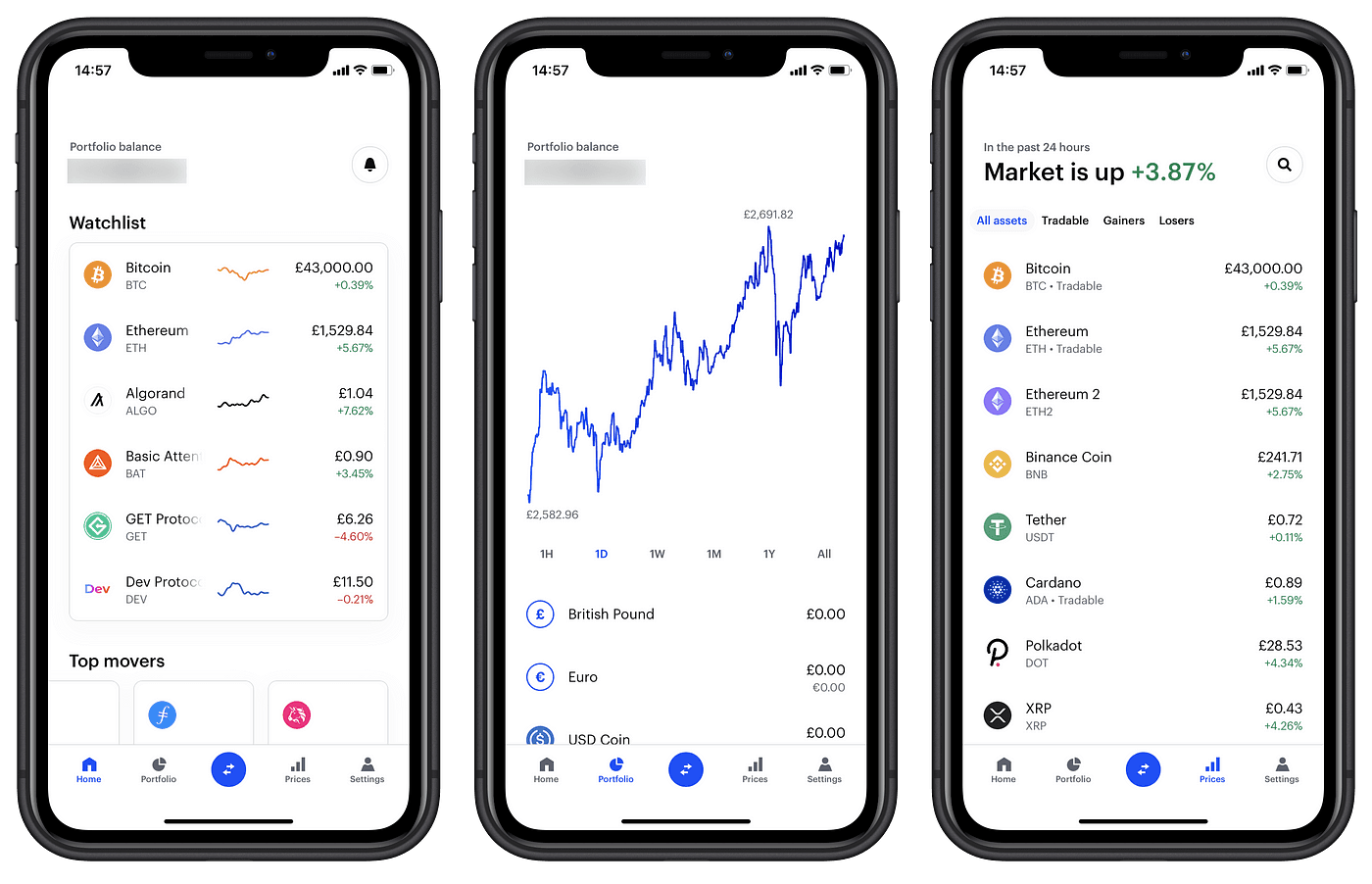

Coinbase Mobile Application Interface. Image via Medium

Coinbase Mobile Application Interface. Image via MediumFor example, Coinbase and Crypto.com are frequently highlighted for their clean design and accessibility, making them ideal for trading on the go.

Desktop Platforms

Desktop versions often provide more advanced features, such as detailed charting, multiple order types, and in-depth portfolio analytics.

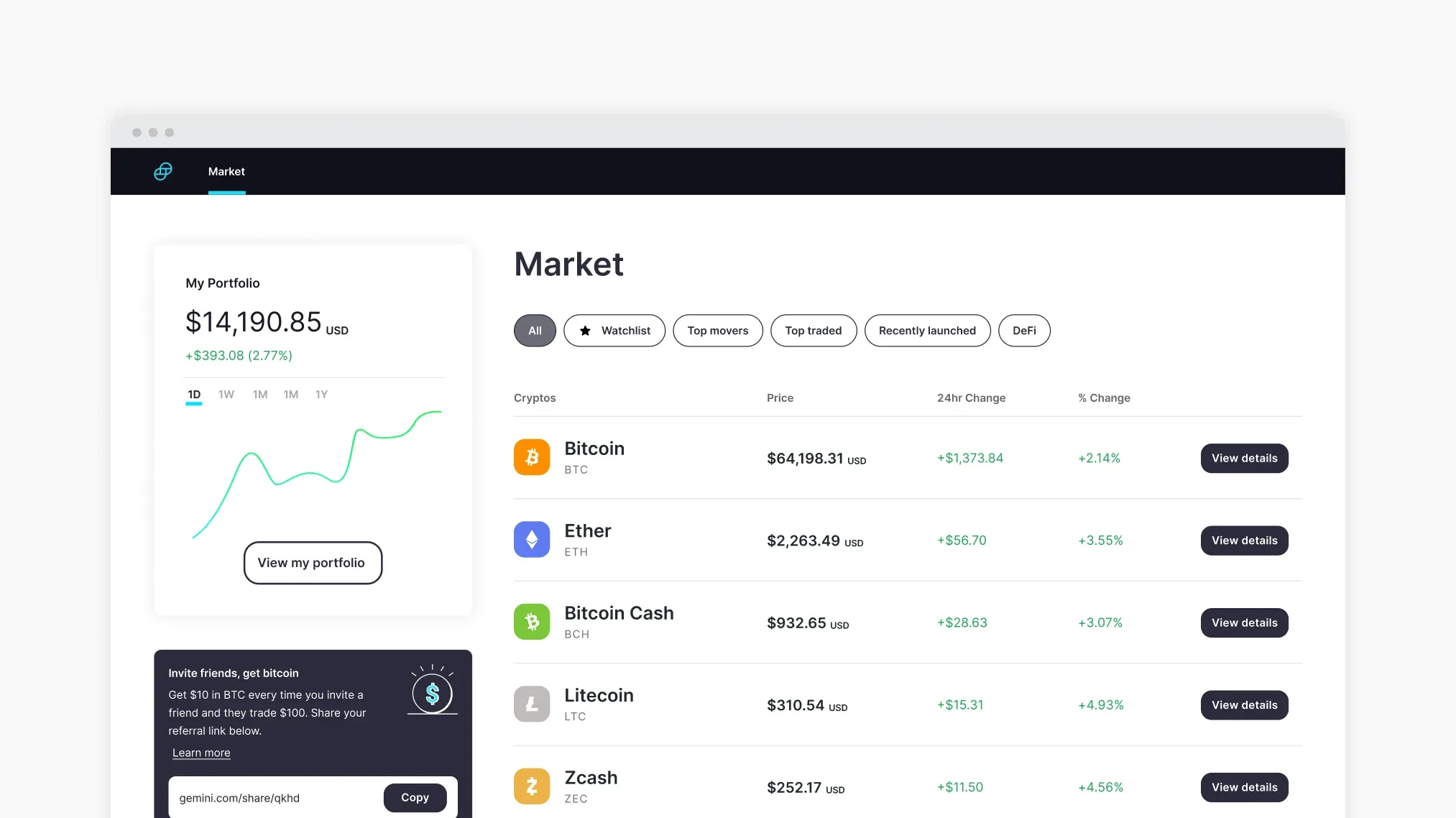

Gemini Desktop Interface. Image via Gemini

Gemini Desktop Interface. Image via GeminiKraken and Gemini’s desktop interfaces are noted for offering pro-level trading tools and greater customization, which appeals to experienced and institutional traders.

App Speed, Reliability, and Security

User reviews consistently mention the importance of app speed and reliability, especially during periods of high market volatility. Kraken and Coinbase, for instance, are praised for their fast transaction processing and stable app performance, even under heavy load. However, some platforms may experience occasional outages or slowdowns during major market events.

Security is also a top priority across all reputable UK exchanges. Features include two-factor authentication (2FA), biometric logins, device whitelisting, and regular security audits. Exchanges like Crypto.com and Coinbase also employ cold storage for the majority of user funds, insurance against cyber breaches, and compliance with international security standards such as ISO 27001 and PCI DSS.

Customer Support and Reputation

When issues arise, timely and effective assistance can make all the difference. Let's take a look at how the UK's top exchanges do this.

- Live Chat: Many leading exchanges (e.g., Crypto.com, Coinbase, Kraken) now offer live chat support for immediate assistance, especially for urgent issues like account lockouts or failed transactions.

- Ticketing Systems: For more complex queries, users can submit support tickets. Response times vary, while some platforms aim to resolve issues within hours, others may take several days, particularly during periods of high demand.

- Email Support: Email remains a standard support channel. Crypto.com, for example, acknowledges complaints within two business days and strives to provide a final response within 15 days.

- Phone Support: This is less common, but some platforms (such as eToro) offer limited phone support for account-related issues.

Timely And Effective Assistance Can Make All The Difference. Image via Shutterstock

Timely And Effective Assistance Can Make All The Difference. Image via ShutterstockCommunity Reviews and Trustpilot Scores

Trustpilot and App Store Reviews

User feedback on platforms like Trustpilot and the App Store provides insight into overall satisfaction. While many exchanges receive mixed reviews, common positives include ease of use and strong security, while negatives often focus on customer service delays and withdrawal issues.

For example, Crypto.com has received a whole range of reviews, with some users praising their features and others citing slow support or technical glitches.

Reddit and Community Forums

Community-driven platforms like Reddit offer unfiltered user experiences, highlighting both the strengths and weaknesses of each exchange. These forums can be valuable for gauging real-world support quality and platform reliability.

Track Record in Addressing User Complaints

FCA-registered exchanges are required to have formal complaints procedures. Crypto.com, for instance, registers every complaint, acknowledges receipt promptly, and aims for fair, unbiased resolution. If a user remains dissatisfied, escalation procedures are available, sometimes even involving external arbiters.

Some exchanges, like CEX.IO, have publicly addressed support delays and outlined steps to improve response times, demonstrating a commitment to customer satisfaction.

While most major exchanges eventually resolve user complaints, the process can sometimes be slower than desired, especially during surges in new users or market volatility.

Risks of Using Unregulated or Offshore Exchanges

Unregulated exchanges are not bound by UK consumer protection laws. If funds are lost due to hacks, fraud, or platform insolvency, users have little to no legal recourse. There is often no access to compensation schemes or ombudsman services. Some of the other risks include

- Increased Fraud and Scam Risk: Without regulatory oversight, the risk of scams, exit frauds, and market manipulation is significantly higher. Users may encounter fake exchanges or platforms that disappear with customer funds.

- Data Security and Privacy Issues: Offshore exchanges may not adhere to strict data protection standards, increasing the risk of personal information leaks or misuse.

Examples of UK Crackdowns or Exchange Bans

- FCA Enforcement: The FCA has taken action against several high-profile exchanges, including denying or revoking registration, issuing consumer warnings, and blocking marketing efforts. Notably, Binance was barred from offering regulated services to UK residents due to compliance failure.

- Upcoming Legislation: From 2026, all crypto platforms serving UK customers be it domestic or overseas, must report detailed user data to HMRC, further tightening the regulatory environment and making it harder for unregulated platforms to operate legally.

- Public Offerings Ban: New rules will prohibit public crypto offerings except via regulated exchanges, aiming to protect consumers and ensure due diligence on listed assets.

How to Verify Platform Legitimacy

Always verify if an exchange is registered with the FCA by searching the official FCA register. Only FCA-registered platforms are authorized to serve UK residents legally. However, the check does not end here.

- Look for a verifiable company address, legitimate contact numbers, and clear regulatory disclosures. Be cautious if these details are missing or appear suspicious.

- Research the platform’s history, read user reviews, and check the domain registration date for signs of legitimacy. New or anonymous exchanges pose higher risks.

- Beware of platforms with only chatbots for support, no clear ownership, or promises of guaranteed returns—these are common scam indicators.

That being said, if you ever lose access to your crypto wallet, our recovery guide can help you regain control quickly and safely.

Final Thoughts

Crypto is becoming more accessible across the UK, but where you choose to trade matters. The best exchanges combine ease of use, strong security, and FCA compliance to give you peace of mind while investing.

Security and regulation should always come first. Platforms that follow UK rules help protect users against fraud, while strong security features like 2FA and cold storage reduce the risk of loss.

As crypto adoption grows and regulations tighten, using well-established, compliant exchanges is the best way to stay safe. Take time to evaluate your options and select the platform that aligns with your goals.

Also Read

You can also watch our video on the best crypto exchange below: