Crypto mining in 2026 isn’t a gold rush. It’s closer to running a tiny power plant that spits out lottery tickets, where the odds change every time difficulty adjusts and your electricity bill shows up.

This guide breaks mining down into the few variables that actually matter, then maps the best mineable coins to the hardware people realistically have: ASICs for Bitcoin and Scrypt merged mining (Litecoin + Dogecoin), GPUs for flexible altcoin mining like Ethereum Classic and Zcash, and CPUs for niche but accessible options like Monero. You’ll also get a practical profitability snapshot based on late-2025 conditions, a coin-by-coin playbook for hardware, software, and pool setup, and the real-world constraints most “profitability calculators” ignore: heat, noise, downtime, scams, and taxes.

If you’re here to figure out what to mine, what it’ll cost, and whether it’s even worth the hassle in 2026, you’re in the right place.

Key Takeaways

Crypto mining is a margins game. These are the rules that actually decide outcomes.

- How much can I make? Most miners earn anywhere from “not much” to “meaningful”, and the swing is decided by electricity ($/kWh), network difficulty / hashrate, and hardware efficiency (hashes per watt). Change one input and the result can flip from profit to loss fast.

-

Quick hardware mapping:

ASIC

- BTC (SHA-256)

- LTC/DOGE (Scrypt, merged mining)

- DASH (X11)

GPU

- ETC (Etchash)

- ZEC (Equihash)

- Optional expansion: RVN (KawPow), KAS (kHeavyHash)

CPU

- XMR (RandomX, CPU-friendly and ASIC-resistant by design)

- Optional: CPU mining is typically niche; most “extra” CPU coins are small-cap and more volatile.

- Merged mining highlight: LTC + DOGE lets one Scrypt ASIC earn two reward streams from the same hardware and electricity, which can materially improve ROI versus single-coin mining.

- One-line reality check: Profitability swings hard, scams are everywhere, heat/noise can wreck home setups, and taxes can erase “paper profit” if you don’t track payouts.

Mining at a Glance

Pick a lane based on heat/noise tolerance, budget, and flexibility.

| ASIC |

Highest efficiency, highest noise

Best for BTC, LTC/DOGE, DASH where specialization wins.

Requires serious power, cooling, and often industrial-style setup.

|

|---|---|

| GPU |

Most flexible

Best for ETC, ZEC, and coin-switching (optionally RVN/KAS).

Easier to repurpose hardware if mining turns unprofitable.

|

| CPU |

Lowest barrier, lowest ceiling

Best for XMR and learning the mechanics. Quiet and manageable at home, but returns are usually modest.

|

| Mobile |

Learning tool, not income

Real PoW mining on a phone is not competitive. Treat “mobile mining” apps as high-risk noise.

|

Tip: If you only remember one thing, remember this: $ / kWh + difficulty + hashes per watt decides everything.

What Is Crypto Mining?

Crypto Mining Is How Nodes Show Proof-of-Work. Image via Shutterstock

Crypto Mining Is How Nodes Show Proof-of-Work. Image via ShutterstockCryptocurrency mining is the foundational mechanism that secures and validates transactions on a decentralized, public ledger known as a blockchain. It is a critical component of virtually all cryptocurrencies that employ a Proof-of-Work (PoW) consensus mechanism. In simple terms, mining is the competitive process by which a decentralized network agrees on a common, legitimate history of transactions. In return, miners are rewarded with newly created currency.

Proof of Work in Plain English

Proof of Work is the algorithm that sets the rules for this competition. It’s designed to be difficult and costly for miners to perform, but easy for anyone to verify. This cost, primarily electricity. This is what secures the network against fraudulent activities.

- Blocks: When a collection of transactions is ready to be added to the blockchain, it is bundled into a block. This block must be validated and "sealed" by a successful miner.

- Hashes: A hash is a fixed-length string of characters (like 00000000000000000001db103758b9...) generated by a cryptographic function. The mining hardware’s job is to run computational guesswork, testing billions or trillions of different combinations to find a specific input that, when run through the hashing function, produces a hash that meets the network’s current difficulty target. The role of hashrate and power, thus, becomes a very crucial component in determining your profitability.

- Difficulty Adjustment: The difficulty target (the number of leading zeros the resulting hash must have) is periodically adjusted by the network (e.g., every 2,016 blocks for Bitcoin). This adjustment is crucial: it ensures that, regardless of how many miners join or leave the network, a new block is found at a relatively constant time interval (e.g., approximately every 10 minutes for Bitcoin). As more miners join (increasing the hash rate), the difficulty rises, making it harder for individual miners to succeed.

- Rewards and Fees: The first miner to find a valid hash broadcasts the solution to the network. If other nodes verify the solution is correct, the block is added to the chain. The successful miner is then rewarded with a block reward (newly minted coins) plus all the transaction fees included in that block.

Check out our guide on crypto transaction fees.

What Miners Actually Get Paid In

A miner’s total revenue is a combination of two distinct payment streams: the block reward and transaction fees.

- Block Reward: This is the primary incentive, which consists of newly issued coins. The block reward is often reduced over time in a process known as a "halving" (e.g., Bitcoin’s reward is halved roughly every four years) to limit inflation and simulate scarcity.

- Transaction Fees: Every transaction submitted to the network includes a small fee paid by the sender. This fee incentivizes miners to include that transaction in their block.

While the block reward is a fixed amount for any given period, transaction fees are highly dynamic. During periods of network congestion, when demand for block space exceeds the supply, users may bid up fees to ensure their transaction is processed quickly.

For coins with low block rewards or those nearing a halving event, these fee spikes can dramatically increase a miner's daily profitability, sometimes briefly surpassing the value of the coin’s standard block reward. For example, during high-volume periods, the fee revenue on networks like Ethereum Classic (ETC) can become a significant percentage of a miner's total take.

The 4 Variables That Decide Profitability

Profitable mining is a highly granular, numbers-driven game. Four variables are the non-negotiable pillars of a successful operation:

Coin Price

- Definition: The current market value of the mined cryptocurrency (e.g., BTC/USD, ETC/USD).

- Impact: This is the revenue side of the equation. If the price of your mined coin drops significantly, your revenue decreases, and you may quickly become unprofitable unless your costs are exceptionally low. Likewise, a bull market can turn marginal operations into high-profit centers overnight. It is the most volatile and least controllable variable.

Network Difficulty / Hash Rate

- Definition: Difficulty is a numerical value that determines how difficult it is to find a hash below the target. Hash Rate is the total computing power (in hashes per second) being directed at a network. These two are directly correlated: as the total hash rate rises (more miners join), the difficulty automatically increases to maintain the target block time.

- Impact: This determines your share of the network’s total reward. If you contribute 1% of the total hash rate, you are statistically expected to earn 1% of the total block rewards over time. When difficulty spikes, your daily coin yield per unit of hardware decreases.

Electricity ($/kWh)

- Definition: The cost you pay your utility company for one kilowatt-hour of electricity, including all taxes, surcharges, and service fees.

- Impact: This is your primary operating cost. Since mining is a 24/7 process of converting electricity into computational work, the cost of power is the single greatest determinant of long-term profitability. An electricity rate of $0.06/kWh can be profitable for Bitcoin, while a residential rate of $0.20/kWh can make it impossible. This is why commercial-scale miners often relocate to regions with stranded energy or extremely low industrial power rates.

Hardware Efficiency (hashes per watt)

- Definition: A metric that measures how many hashes (or computational guesses) a specific piece of hardware can produce for every single watt of electricity it consumes.

- Impact: This is the core factor that separates a modern, profitable rig from an outdated, costly one. For example, a new-generation ASIC may produce 100 TH/s (Terahashes per second) for 3,000 watts, while an older model might produce 50 TH/s for the same 3,000 watts. The newer model is twice as efficient, meaning it produces twice the revenue for the same operational cost.

For a much more detailed and better understanding, check out our guide on what Bitcoin mining is.

7 Top Coins To Mine in 2026

Here are the Top 7 Coins To Mine in 2026. Image via Shutterstock

Here are the Top 7 Coins To Mine in 2026. Image via ShutterstockWhen evaluating the "top" coins to mine, a distinction must be made between coins that offer the highest theoretical profitability and those that are genuinely most mineable at home.

This guide mixes both, as readers come with different financial and logistical constraints. The most profitable coins often require expensive, specialized hardware (ASICs), while the most accessible (GPU/CPU) offer lower absolute returns but a much lower capital investment and greater flexibility.

Quick Comparison Table

| Coin | Algorithm | Hardware Type | Typical Miner Hash Rate Examples (Range) | Power Draw (Watts) | Pool Fee Typical (1-3%) | Notes (ASIC-Dominant vs ASIC-Resistant) |

|---|---|---|---|---|---|---|

| Bitcoin (BTC) | SHA-256 | ASIC | 100 TH/s - 250 TH/s | 3,000 W - 5,000 W | 1-2% | ASIC-Dominant. Pro-grade equipment only. |

| Litecoin (LTC) | Scrypt | ASIC | 8 GH/s - 12 GH/s | 3,400 W - 4,500 W | 1-3% | ASIC-Dominant. Can be Merged Mined with DOGE. |

| Dogecoin (DOGE) | Scrypt | ASIC | Merged with LTC | Merged with LTC | 1-3% | Merged-Mine Only (Practically). |

| Monero (XMR) | RandomX | CPU | 8 KH/s - 15 KH/s | 100 W - 300 W | 1.5-2.5% | Highly ASIC-Resistant. Best for low-cost entry. |

| Ethereum Classic (ETC) | Etchash | GPU | 50 MH/s - 150 MH/s | 100 W - 300 W | 1-3% | GPU-Dominant. Requires high VRAM GPUs. |

| Zcash (ZEC) | Equihash (Equihash 200,9) | GPU | 650 Sol/s - 1,500 Sol/s | 100 W - 300 W | 1-3% | GPU-Dominant, but has known ASIC models. |

| Dash (DASH) | X11 | ASIC | 1 TH/s - 1.5 TH/s | 3,000 W - 4,000 W | 1-2% | ASIC-Dominant, but with block reward split. |

Mining Profitability Breakdown (December 2025)

The calculations below are illustrative and based on a key assumption, which is detailed immediately after. Always use live, up-to-date data for your own calculations. Profitability is a moving target that changes every second.

(source of all info and assumptions of mining is from ASIC Mining Rigs, and it keeps changing: NOTE FOR EDITOR)

Profitability Table (Daily Output + Monthly Profit + ROI)

| Coin / Hardware Example | Hardware Cost (Est.) | Mined Per Day (Est. Coins) | Monthly Profit (Est.) | ROI Timeline (Est.) |

|---|---|---|---|---|

| BTC (250 TH/s ASIC) | $6,500 | 0.0000X - 0.0000Y | $300 - $600 | 11 - 22 Months |

| LTC/DOGE (10 GH/s ASIC) | $4,500 | 0.0Y LTC + 0.0Z DOGE | $200 - $450 | 10 - 20 Months |

| ETC (100 MH/s GPU) | $800 | 0.0XX | $35 - $80 | 10 - 23 Months |

| XMR (15 KH/s CPU) | $350 | 0.0YY | $5 - $15 | 23 - 70 Months |

Source: ASIC Mining Rigs

Note: The "Mined Per Day" and "Monthly Profit" figures are highly variable ranges based on the assumptions below and are for example purposes only.

Assumptions Behind These Numbers

All profitability calculations must be tied to a set of clear, non-negotiable assumptions. Changing any of these inputs will drastically alter the output.

- Electricity Assumption: The example profitability is calculated using a conservative, yet competitive, residential electricity rate of $0.12/kWh. This is the single most important lever. For industrial operations running BTC ASICs, this rate would need to be closer to $0.05/kWh to reach the high end of the profit range.

- Pool Fees: A standard pool fee of 2% is assumed. This is the commission taken by the mining pool for aggregating hash power and distributing rewards reliably.

- Hardware Depreciation: An annual hardware depreciation rate of 25% is factored in for ASICs due to the rapid obsolescence in the hyper-competitive BTC mining space. GPU and CPU rigs tend to depreciate more slowly as they have a higher resale value for gaming or general computing.

- Difficulty Changes + Price Volatility: The profitability range factors in anticipated difficulty increases and normal daily price volatility. No prediction for a major bull or bear market is included; the numbers reflect expected returns in a "stable" market regime of late 2025.

How To Calculate Your Own Profit (Step-by-Step)

Never rely on general profitability tables. Always use a mining calculator tailored to your exact costs and hardware specifications.

Select a Calculator

Popular, reliable online tools include WhatToMine and NiceHash Calculator. These tools pull real-time data for coin price and network difficulty.

Plug in the Inputs

You will need to accurately provide the following four core metrics from your setup:

- Hash Rate: The raw power of your hardware for a specific algorithm (e.g., 250 TH/s for SHA-256, 100 MH/s for Etchash).

- Power Draw: The actual measured power consumption of your entire rig at the wall (including the PSU, fans, and any associated network gear), measured in watts (W).

- Electricity Rate: Your precise cost per kilowatt-hour ($/kWh). This is found on your power bill.

- Pool Fees: The commission charged by the mining pool you plan to join (typically 1-3%).

Analyze the Output

The calculator will provide a highly accurate, real-time forecast of:

- Daily Revenue: The USD value of the coins you expect to mine per day before electricity cost.

- Daily Electricity Cost: Your 24-hour operational expense.

- Net Profit: Daily Revenue minus Daily Electricity Cost. This is your profit.

- Break-Even Date: Based on your hardware cost, this is the projected timeline for when your cumulative net profit will equal your initial hardware capital expenditure (the ROI timeline).

Coin-by-Coin Deep Dives (Hardware, Software, Costs, Returns)

To mine any cryptocurrency successfully, you must understand the technology, the required hardware, and the specific cost structure of that network.

How Does Bitcoin Mining Work in 2025. Image via Shutterstock

How Does Bitcoin Mining Work in 2025. Image via Shutterstock Bitcoin (BTC)

What You’re Mining and Why It Exists

You are mining new Bitcoin on the SHA-256 Proof-of-Work blockchain, the original and most secure cryptocurrency network. Miners are the backbone of the network, providing the computational work that prevents fraudulent double-spending and validates the entire history of the chain. Because of its security and status, Bitcoin is the most competitive coin to mine.

Recommended Hardware (With Hash Rate + Power)

Bitcoin mining is entirely dominated by specialized hardware known as Application-Specific Integrated Circuits (ASICs), which are microchips engineered for the sole purpose of performing the SHA-256 hash calculation, making them orders of magnitude more efficient than CPUs or GPUs.

| Example Rig | Model Name | Hash Rate (Approx.) | Power Draw (W) | Typical Price Range (USD) |

|---|---|---|---|---|

| High-End ASIC | Antminer S21 / Iceriver KAS | 200 TH/s - 250 TH/s | 3,500 W - 4,500 W | $5,000 - $7,000 |

| Mid-Range ASIC | Antminer S19 Pro | 100 TH/s - 110 TH/s | 3,250 W - 3,500 W | $1,500 - $3,000 |

Mining Software and Pool Options

- Software: ASIC firmware is typically pre-installed. The primary software interface is the ASIC's web dashboard for configuration. Tools like Braiins OS+ are popular for advanced power optimization features.

- Named Pools: The vast majority of BTC mining is concentrated in a handful of large, reliable pools: Foundry USA, AntPool, F2Pool, and ViaBTC.

Costs That Actually Matter

- Electricity, Cooling, and Maintenance: These are the three inseparable costs of ASIC mining. ASICs produce enormous amounts of heat and noise. Specialized infrastructure for cooling (immersion or liquid cooling) and sound dampening must be included in the capital cost, as residential basements or garages cannot handle the load of more than a couple of units.

- Pool Fees and Payout Methods: BTC pools typically use PPLNS (Pay Per Last N Shares) or PPS+ (Pay Per Share Plus) payout methods.

Expected Returns and ROI Reality Check

An ROI timeline for a new BTC ASIC is competitive, often ranging from 11 to 22 months under optimal conditions (sub-$0.08/kWh electricity and stable coin prices). This ROI is fragile and can be broken by two major factors: Difficulty Spikes (massive inflow of new hash power) and Price Drops (a sustained drop below your operational breakeven point). Home mining with residential electricity is extremely difficult in 2026, as a realistic breakeven electricity threshold for modern ASICs is often $0.07/kWh or less.

Pros and Cons

Pros

- Uses mature, highly efficient ASIC hardware with clear performance specs, established suppliers, and robust firmware tools.

- Deep, liquid market and strongest brand, so mined BTC is easy to sell or use as collateral and tends to track overall crypto growth.

- Many industrial‑grade pools, hosting providers, and management platforms exist, making scaling and remote monitoring straightforward.

Cons

- Requires expensive, noisy, power‑hungry ASICs and often industrial‑grade electrical and cooling setups, making home mining difficult.

- An extremely competitive network hashrate means slim margins; profitability is highly sensitive to electricity price and halving events.

- Hardware is single‑purpose; if BTC mining becomes unprofitable, ASICs have limited alternative uses or resale value

Take a look at the top picks for the best Bitcoin mining pools.

Litecoin (LTC)

Litecoin is the Silver of The Crypto Industry. Image via Shutterstock

Litecoin is the Silver of The Crypto Industry. Image via ShutterstockWhat You’re Mining and Why It Exists

Litecoin, often referred to as the "silver to Bitcoin's gold," is a decentralized digital currency using the Scrypt algorithm. It was designed to have faster transaction times and a greater coin supply than Bitcoin. For miners, its primary value proposition lies in its ability to be merged mined with Dogecoin.

Recommended Hardware (With Hash Rate + Power)

Litecoin is mined using high-performance ASICs, often referred to as "Scrypt ASICs."

| Example Rig | Model Name | Hash Rate (Approx.) | Power Draw (W) | Typical Price Range (USD) |

|---|---|---|---|---|

| Current Scrypt ASIC | Antminer L7 (9.5 GH/s model) | 8 GH/s - 12 GH/s | 3,400 W - 4,500 W | $4,000 - $6,000 |

Mining Software and Pool Options

- Software: Standard ASIC firmware. Configuration is done via the ASIC's web interface.

- Named Pools: You must choose a pool that specifically supports merged mining of LTC/DOGE. LitecoinPool, ViaBTC, and AntPool are among the most popular.

Costs That Actually Matter

- Electricity, Cooling, and Maintenance: The cost structure is similar to Bitcoin ASIC mining, with high electricity and cooling demands.

- Pool Fees and Payout Methods: The dual-revenue stream from merged mining effectively cuts the real electricity cost in half relative to a single-coin mining operation, making Scrypt ASICs more viable at higher electricity rates than a comparable BTC ASIC.

Expected Returns and ROI Reality Check

The single most important strategy for Scrypt mining is to merge mine with DOGE. The combined revenue significantly increases profitability. The ROI timeline is generally competitive, ranging from 10 to 20 months under assumed conditions.

Pros and Cons

Pros

- Scrypt ASICs (e.g., L7/L11 class) are efficient and widely available, with mature firmware and management tools.

- Can be merged-mined with Dogecoin, giving extra rewards without additional power draw and improving overall ROI.

- Long‑running network with relatively stable demand and established exchange support, making it easier to liquidate payouts.

Cons

- Still ASIC‑dominated, so entry costs remain high, and GPUs/CPUs are not competitive on Scrypt.

- Profitability is tightly coupled to LTC (and DOGE) market cycles; during downtrends, even efficient rigs may only break even at retail power prices.

- Fewer specialized software ecosystems than BTC (fewer advanced firmware and hosting options), making optimization slightly less mature.

Dogecoin (DOGE)

What You’re Mining and Why It Exists

Dogecoin, the original "meme coin," is secured by the same Scrypt algorithm as Litecoin. Critically, Dogecoin's network does not have its own independent hash rate; its security is entirely reliant on being a secondary chain in a merged mining operation with Litecoin. This unique relationship makes it impossible to solo mine DOGE profitably and necessitates the merged mining approach.

Recommended Hardware (With Hash Rate + Power)

- Hardware: Merged with LTC (Current Scrypt ASIC like Antminer L7).

- Hash Rate / Power Draw / Price: Merged with LTC.

Mining Software and Pool Options

- Software: Handled by the Litecoin ASIC's firmware/web interface.

- Named Pools: Same as Litecoin: LitecoinPool, ViaBTC, and AntPool.

Costs That Actually Matter

- Electricity, Cooling, and Maintenance: The marginal cost of mining Dogecoin is zero when merged mining, as it uses the same hardware and electricity as Litecoin.

- Pool Fees and Payout Methods: Pool fees are applied to the combined LTC/DOGE reward.

Expected Returns and ROI Reality Check

The combined revenue from merged mining is your profit multiplier. The extra Dogecoin rewards are essentially pure profit, drastically increasing the overall profitability of the Scrypt ASIC operation.

Pros and Cons

Pros

- Typically mined via merged mining with Litecoin, so miners earn DOGE “for free” on top of LTC with the same hardware and electricity.

- Strong retail and meme‑driven demand can create outsized upside in bull markets, amplifying the value of mined DOGE.

- No dedicated DOGE hardware is required; standard Scrypt ASICs and LTC pools support DOGE without additional setup complexity.

Cons

- Stand‑alone DOGE mining is rarely competitive; merged mining economics depend heavily on LTC ecosystem health and Scrypt ASIC demand.

- Returns are highly volatile because the DOGE price is more speculative and sentiment‑driven than BTC or LTC.

- Network and mining infrastructure are effectively tied to Litecoin (merged‑mining pools, software, difficulty dynamics), adding correlation and centralization risk.

Look at the comparison of Litecoin and Bitcoin to make an informed choice on which coin to mine.

Monero (XMR)

XMR is one of The Most mined Crypto After BTC. Image via Shutterstock

XMR is one of The Most mined Crypto After BTC. Image via ShutterstockWhat You’re Mining and Why It Exists

Monero is a privacy-focused cryptocurrency that uses the RandomX algorithm. RandomX is deliberately "memory-hard," requiring large amounts of fast, low-latency RAM. This design makes it highly inefficient for ASICs and GPUs, ensuring the network remains CPU-mineable (ASIC-resistant) and decentralized.

Recommended Hardware (With Hash Rate + Power)

Monero mining is ideally suited for modern, high-core-count CPUs.

| Example Rigs | CPU Model | Typical RandomX Hash Rate (H/s) | Power Draw (W) | Typical Price Range (USD) |

|---|---|---|---|---|

| Budget CPU | Ryzen 5 3600 / Core i5-10400 | 5,000 - 8,000 H/s | 65 W - 100 W | $80 - $150 |

| Mid-Range CPU | Ryzen 7 5800X / Core i7-12700K | 10,000 - 14,000 H/s | 100 W - 180 W | $200 - $350 |

| High-End CPU | Ryzen 9 7950X / Core i9-13900K | 15,000 - 22,000 H/s | 150 W - 300 W | $450 - $700 |

Mining Software and Pool Options

- Software: XMRig is the industry standard and most recommended open-source miner for Monero, supporting both CPU and GPU mining.

- Named Pools: Monero mining is heavily concentrated on pools like SupportXMR, MineXMR, and Nanopool.

Costs That Actually Matter

- Electricity, Cooling, and Maintenance: The total power draw is extremely low, making it ideal for a "low ceiling" beginner operation with manageable noise and heat. The primary cost is the initial CPU investment.

- Pool Fees and Payout Methods: Standard pool fees of 1.5-2.5%.

Expected Returns and ROI Reality Check

The profitability is very low. It is primarily a hobby or a way to accumulate a small amount of an ASIC-resistant coin. The ROI timeline is significantly longer, ranging from 23 to 70 months. It should not be viewed as a serious income stream.

Pros and Cons

Pros

- RandomX is optimized for CPUs, allowing mining with consumer hardware and giving a low‑cost entry using existing PCs and workstations.

- Strong privacy use cases and community support may sustain long‑term demand even when broader markets are weak.

- Mining can be relatively quiet and power‑efficient compared to ASIC farms, making it more suitable for home or office environments.

Cons

- CPU mining yields are modest; returns per watt and per dollar of hardware are generally lower than top‑tier ASICs.

- High CPU utilization generates additional heat and can shorten component lifespan or interfere with daily PC use.

- Regulatory and exchange scrutiny around privacy coins can limit liquidity and fiat off‑ramps, complicating cashing out mined XMR.

Interested? Then start mining Monero at home with these easy steps.

Ethereum Classic (ETC)

ETC comes From An Hard Fork fROM tHE Ethereum Blockchain. Image via Wikipedia

ETC comes From An Hard Fork fROM tHE Ethereum Blockchain. Image via Wikipedia What You’re Mining and Why It Exists

Ethereum Classic is the continuation of the original Ethereum blockchain. It uses the Etchash algorithm, a memory-hard algorithm that relies heavily on a large DAG (Directed Acyclic Graph) file, which must be loaded into the GPU's Video RAM (VRAM) to mine. This has kept ETC largely GPU-mineable.

Recommended Hardware (With Hash Rate + Power)

ETC is mined using GPUs, offering high flexibility as a hobbyist venture.

| Example Rig | Model Name | Hash Rate (Approx.) | Power Draw (W) | Typical Price Range (USD) |

|---|---|---|---|---|

| Budget/Starter GPU | RTX 3060 / RX 5700 XT | 30 - 50 MH/s | 90 W - 150 W | $250 - $400 |

| High-End GPU | RTX 4070 Ti / RX 7800 XT | 80 - 120 MH/s | 150 W - 220 W | $600 - $850 |

Mining Software and Pool Options

- Software: Popular and efficient GPU mining software includes T-Rex Miner, Gminer, and NBMiner.

- Named Pools: Ethermine ETC, 2Miners, and Nanopool are large, reliable options for ETC mining.

Costs That Actually Matter

- Electricity, Cooling, and Maintenance: GPU rigs generate a significant amount of heat and require dedicated ventilation or cooling solutions. They also require technical knowledge to optimize settings (voltage, power limit, clock speeds) to maximize efficiency.

- Pool Fees and Payout Methods: Standard pool fees of 1-3%. Transaction fees can become a significant percentage of a miner's total take during high-volume periods.

Expected Returns and ROI Reality Check

The ROI timeline is competitive for a hobbyist rig, ranging from 10 to 23 months under assumed conditions. For future-proofing your hardware spend, you should only consider GPUs with 8GB of VRAM or more, with 12GB+ VRAM being a strong suggestion due to the constantly growing DAG file.

Pros and Cons

Pros

- GPU‑mineable (Etchash), so existing gaming or workstation GPUs can be repurposed with flexible software (e.g., multiple miners and tuning tools).

- GPUs can be redirected to other coins or workloads (AI, rendering) if ETC mining becomes unprofitable, preserving hardware value.

- Mature mining pools and monitoring tools support ETC, making setup and payout configuration similar to older ETH workflows.

Cons

- Profit margins for GPU mining are thin; at typical residential power rates, many rigs earn little above electricity cost.

- GPUs require active tuning, drivers, and overclock/undervolt management, increasing operational complexity versus ASICs.

- ETC’s long‑term demand and security are weaker than BTC/LTC, so future block rewards and coin value are more uncertain.

Here is a detailed step-by-step guide for mining Ethereum Classic at home.

Zcash (ZEC)

Zcash Is One Of The First Privacy Focused Cryptocurrency. Image via Shardeum

Zcash Is One Of The First Privacy Focused Cryptocurrency. Image via ShardeumWhat You’re Mining and Why It Exists

Zcash is a privacy coin designed to offer optional shielding of transaction data. It uses a modified version of the Equihash algorithm. While generally considered a GPU-mineable coin, the network has seen the development of a few dedicated ASICs.

Recommended Hardware (With Hash Rate + Power)

- Hardware: GPU-Dominant, but ASICs exist.

- Hash Rate (GPU): 650 Sol/s - 1,500 Sol/s.

- Power Draw (GPU): 100 W - 300 W.

Mining Software and Pool Options

- Software: Common ZEC miners include EWBF's Cuda Miner and Gminer.

- Named Pools: Flypool and Nanopool are well-known Zcash pools.

Costs That Actually Matter

- Compliance and Delisting Risk: Due to its powerful privacy features, Zcash has faced significant regulatory headwinds. Miners should be clearly aware that they face a higher risk of exchange delisting or future compliance issues compared to non-privacy coins.

Expected Returns and ROI Reality Check

The profitability is determined by the Equihash algorithm's difficulty and price volatility.

Pros and Cons

Pros

- Uses Equihash ASICs that are more power‑efficient than GPUs for ZEC, improving hashrate per watt compared with generic hardware.

- Privacy‑focused design offers a differentiated niche, which can support value if zero‑knowledge features remain in demand.

- The mining ecosystem (pools, firmware, and profitability trackers) is established, so operational tooling is reasonably mature.

Cons

- Market demand and liquidity are lower than BTC/LTC, so mined ZEC may have wider spreads and fewer exchange pairs.

- Specialized Equihash ASICs have limited use outside a small set of coins, creating hardware‑specific risk similar to BTC ASICs.

- Regulatory pressure on privacy coins could reduce exchange support over time, impacting both price and cash‑out options.

Dash (DASH)

DASH Coin Runs on the X11 Algorithm. Image via DASH Investopedia

DASH Coin Runs on the X11 Algorithm. Image via DASH InvestopediaWhat You’re Mining and Why It Exists

Dash is a payments-focused cryptocurrency that utilizes the X11 algorithm, a chain of 11 different hashing algorithms. The network features an innovative two-tier structure where miners validate transactions (Proof-of-Work), and Masternodes provide extra services like InstantSend and PrivateSend.

Recommended Hardware (With Hash Rate + Power)

Dash mining is ASIC-dominant.

| Example Rig | Hash Rate (Approx.) | Power Draw (W) | Typical Price Range (USD) |

|---|---|---|---|

| Current X11 ASIC | 1 TH/s - 1.5 TH/s | 3,000 W - 4,000 W | $2,500 - $5,000 |

Mining Software and Pool Options

- Software: Handled by the ASIC's firmware.

- Named Pools: Standard ASIC pools supporting the X11 algorithm.

Costs That Actually Matter

- Block Reward Split Explanation: Dash's block reward is split into three main components, which is crucial for miners to understand: 45% goes to the Miners, 45% goes to the Masternodes, and 10% goes to the Treasury. The miner’s portion is significantly lower than in other networks.

Expected Returns and ROI Reality Check

The expected returns are based on the 45% miner share of the block reward. The coin benefits from a more stable network with robust, advanced features supported by the Masternode and Treasury system.

Pros and Cons

Pros

- Uses X11 ASICs, which are well‑understood and efficient compared to attempting to mine Dash with GPUs.

- Long‑running chain with masternode and payments narrative, providing some ongoing transactional and speculative demand.

- Existing pools and management tools make deployment and monitoring straightforward for those already familiar with ASIC workflows.

Cons

- X11 ASICs are niche; if Dash mining economics deteriorate, there are few profitable alternative coins for this hardware.

- Dash’s market share has declined relative to newer L1s and stablecoins, translating to more uncertain long‑term returns.

- Block rewards and price may not justify new hardware purchases at typical power prices, especially outside industrial‑rate regions.

Merged Mining: How Litecoin and Dogecoin Pay You Twice

Merged mining is an essential concept for Scrypt-based coins and represents one of the best strategies for maximizing revenue from a single hardware investment.

What Merged Mining Is

Merged mining allows a miner to use the computational work (the hash) they perform for one blockchain (the "host" chain, e.g., Litecoin) to simultaneously secure another blockchain (the "auxiliary" chain, e.g., Dogecoin).

- Auxiliary PoW in Simple Terms: The proof of work generated for the Litecoin block is packaged in a way that is also a valid proof for a Dogecoin block. You are not performing two separate, power-intensive computations. You are performing one computation whose result is accepted by two different networks.

- "Same Hardware + Same Electricity + Two Reward Streams": This is the core appeal. A single Scrypt ASIC, using a single power source, connected to a single pool, generates a reward in LTC and a reward in DOGE. It drastically increases the overall profitability and is the only viable way to mine Dogecoin.

How To Set It Up

- ASIC Requirement (L7 Example): You must use an ASIC designed for Scrypt (like the Antminer L7), as GPUs cannot compete. The hardware configuration on the ASIC itself is standard; the merged mining capability is handled by the pool.

- Pool That Supports Merged Mining: You must join a mining pool (e.g., LitecoinPool, ViaBTC) that has specifically configured its software to support this dual-block submission process.

- Wallets for Both Payouts: You need to provide the pool with two separate, valid wallet addresses: one for your Litecoin rewards and one for your Dogecoin rewards. The pool will automatically split the payments.

Profitability Example

The merged mining scenario is vastly superior to single-coin mining:

- Litecoin Only: Revenue = Block Reward (LTC) - Electricity Cost - Pool Fee (on LTC).

- Dogecoin Only: Revenue = None (The network's difficulty is too high to be solo-mined effectively, and its security relies on LTC miners).

- Merged (Combined): Revenue = Block Reward (LTC) + Block Reward (DOGE) - Electricity Cost - Pool Fee (on LTC/DOGE).

The combined revenue is your profit multiplier. Even if Dogecoin's price is low, its marginal cost is zero, making the extra rewards pure profit. You must ensure you factor in the applicable pool fees and the minimum payout thresholds for both coins, as some pools will not release small balances.

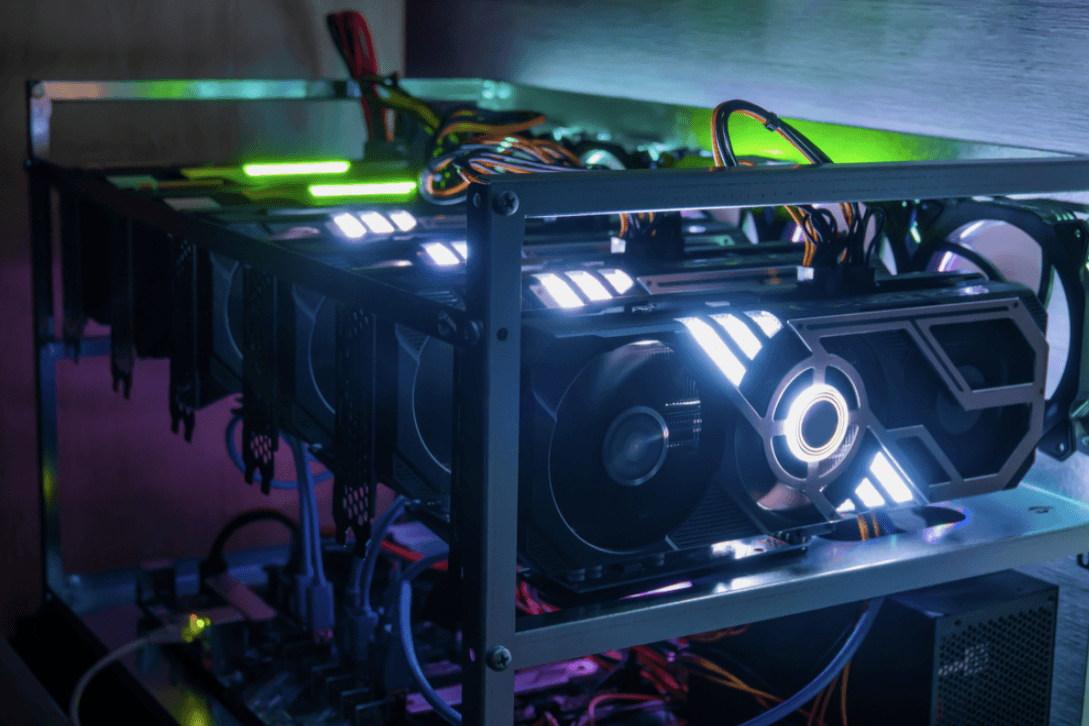

Types of Crypto Mining

Mining operations are classified by the type of hardware used. Each type has its own barrier to entry, cost profile, and optimal use case.

CPU Mining

CPU mining uses a computer’s central processing unit to run hashing algorithms that validate transactions and add new blocks to a proof‑of‑work blockchain, earning block rewards in return.

- Best For:

- Low Barrier to Entry: Requires only a modern home computer (no specialized hardware).

- Learning: An excellent, low-risk way to learn the fundamentals of mining pools, software, and wallet configuration.

- Heat/Noise Manageable: A single CPU generates very little extra heat or noise, making it fully compatible with a home office or living space.

- Tradeoff:

- Low Ceiling: The profitability is very low. It is primarily a hobby or a way to accumulate a small amount of an ASIC-resistant coin like Monero (XMR). It should not be viewed as a serious income stream.

GPU Mining

GPU mining uses one or more graphics processing units to perform these hashing calculations in parallel, offering higher hash rate and better efficiency than CPUs for most mineable coins.

- Best For:

- Flexibility (Switch Coins): A GPU rig can be programmed to mine dozens of different algorithms. If one coin's profitability drops, the miner can instantly switch to a more profitable coin (a process called "hash rate switching"). This is the key advantage over inflexible ASICs.

- Hobbyist Rigs: Ideal for the intermediate miner who wants to maximize coin yield without the prohibitive cost and infrastructure of ASIC mining.

- Tradeoff:

- Tuning: Requires significant technical knowledge to optimize settings (voltage, power limit, clock speeds) to maximize efficiency.

- Heat: A GPU rig generates a significant amount of heat and requires dedicated ventilation or cooling solutions.

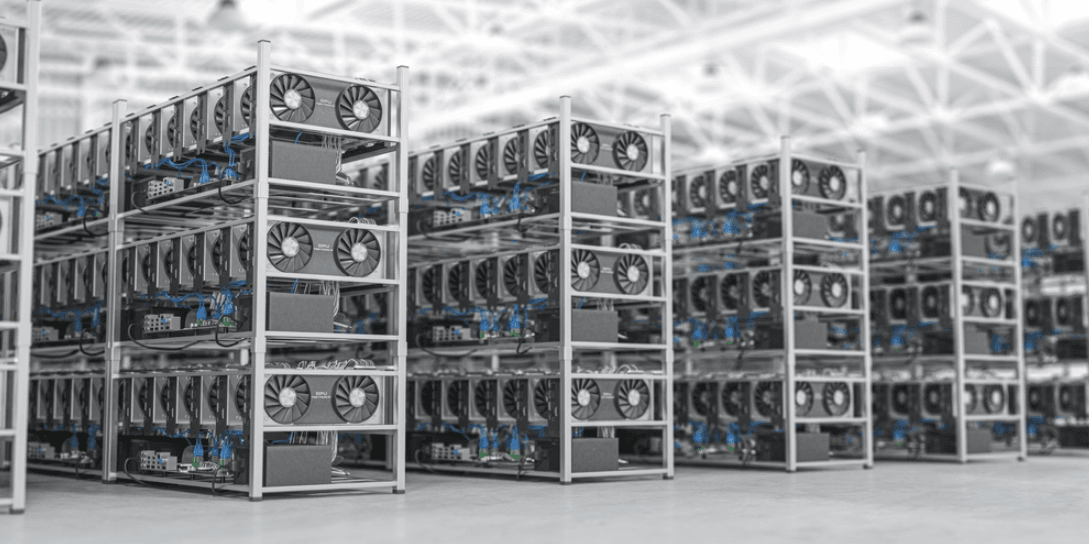

ASIC Mining

ASIC mining uses application‑specific integrated circuits—chips built solely for one or a few algorithms—to deliver the highest hash rate and energy efficiency, but only for the specific coins they are designed to mine.

- Best For:

- Efficiency + Scale: ASICs offer the highest hashes per watt for their specific algorithm, providing the best return on electricity. They are the only way to profitably compete with major chains like Bitcoin.

- Tradeoff:

- High Capital: The initial investment for ASICs and the necessary electrical/cooling infrastructure is massive.

- Limited Flexibility: An ASIC can only mine one algorithm. If that coin's price crashes or the algorithm is changed, the hardware can become an expensive paperweight.

Solo Mining vs Pool Mining

Solo mining means a miner points their hardware directly at the network and competes alone to find blocks, receiving the entire block reward when successful, but facing highly irregular and often very long payout intervals. Pool mining means multiple miners combine their hash rate in a coordinated mining pool, share the work of finding blocks, and split rewards proportionally to contributed hash power, which smooths income at the cost of paying pool fees.

Joining a mining pool is the standard, practical solution for almost all miners today.

- Why Pools Reduce Variance: In a solo mining operation, you must compete with the entire global hash rate to find a block. For a small home miner, the odds are astronomical—you might go years without finding a block, followed by a massive, unpredictable payout. A mining pool aggregates the hash power of thousands of miners. When the pool finds a block, the reward is split proportionally among all participants based on the amount of work (shares) they submitted. This turns unpredictable, massive payouts into small, steady, and reliable daily income streams.

- Typical Fees (1–3%): Pools charge a small commission (fee) on the rewards they distribute, typically between 1% and 3%, to cover their operational costs.

- Payout Methods in 2–3 Sentences: Pools use various methods to calculate your reward share. PPS (Pay Per Share) offers the lowest variance by giving you a fixed amount for every share you submit, regardless of whether the pool finds a block. PPLNS (Pay Per Last N Shares) is the most common method; it pays you based on the shares you submitted relative to the last number of shares needed to find a block, which incentivizes miner loyalty to the pool.

Best Coins by Mining Hardware Type

Selecting a coin based on your hardware is the most sensible starting point for a profitable venture.

| Coin | Typical Daily Output (Est.) | Est Monthly Profit (Est.) | Entry Cost (Est.) | Why It Works |

|---|---|---|---|---|

| Monero (XMR) | 0.005 - 0.015 XMR | $5 - $15 | $350 (CPU only) | Uses the RandomX algorithm, which is optimized for CPU cache and memory, making ASICs useless. |

Best Coins for CPU Mining

CPU mining is about efficiency and targeting networks that actively discourage specialized hardware.

Recommended CPUs List:

- Budget: Ryzen 5 3600 / Core i5-10400

- Mid-Range: Ryzen 7 5800X / Core i7-12700K

- High-End: Ryzen 9 7950X / Core i9-13900K

Best Coins for GPU Mining

GPU mining offers the most choice due to the hardware's versatility and is where the "hobbyist" can compete.

| Coin | Algorithm | Example Hash Rate (MH/s) | Est Monthly Profit (Est.) |

|---|---|---|---|

| Ethereum Classic (ETC) | Etchash | 100 MH/s | $35 - $80 |

| Ravencoin (RVN) | KawPow | 25 MH/s | $15 - $30 |

| KASPA (KAS) | kHeavyHash | 1,000 MH/s | $50 - $110 |

Recommended GPUs List:

- Budget: NVIDIA RTX 3060 (12GB) / AMD RX 5700 XT (8GB)

- Mid-Range: NVIDIA RTX 4060 Ti (16GB) / AMD RX 7800 XT (16GB)

- High-End: NVIDIA RTX 4090 / AMD RX 7900 XTX

Best Coins for ASIC Mining

This category is about pursuing the absolute maximum efficiency and revenue for the largest, most secure networks.

| Coin | Algorithm | Example Hash Rate | Est Monthly Profit (Est.) |

|---|---|---|---|

| Bitcoin (BTC) | SHA-256 | 250 TH/s | $300 - $600 |

| Litecoin/Dogecoin | Scrypt | 10 GH/s | $200 - $450 |

| Dash (DASH) | X11 | 1.5 TH/s | $150 - $250 |

Recommended ASICs with Hash Rate and Power

- BTC: Antminer S21 (200-250 TH/s, 3500-4500W)

- LTC/DOGE: Antminer L7 (10 GH/s, 3400W)

- DASH: Goldshell X11-series (1-1.5 TH/s, 3000-4000W)

Best Coins for Mobile Mining

This is an area of high confusion and high risk for beginners.

Very Explicit: "Learning tool, not an income stream." Mobile mining is a proof-of-concept and a way to distribute tokens, not a path to generating income. Any app promising significant profit is a scam.

Warnings:

- Battery Wear: Running any mining process severely degrades phone battery life and lifespan.

- Scams: Most "cloud mining" or "mobile BTC mining" apps are Ponzi schemes or simply data harvesters.

- Privacy/Data Risks: These apps often require excessive permissions to your phone's contact list and storage.

| Coin/App | Realistic Monthly Profit Range (Est.) | Risk Level |

|---|---|---|

| Pi Network / Bee Network | $0.00 - $0.05 | Medium (Time/Data) |

| Electroneum (ETN) | $0.00 - $0.01 | Low |

Technical Comparison: Mining Algorithms Explained

At the core of every cryptocurrency that can be mined is its hashing algorithm. This algorithm is the set of mathematical rules that determines the competition structure, the resulting block hash, and, most importantly, the type of hardware required to compete. Understanding the algorithm is key to making a profitable hardware purchase.

Algorithm Table

This table summarizes the primary algorithms for the coins discussed, highlighting the specific hardware they favor.

| Algorithm | Coin Examples | Hardware Dominance | Key Characteristic |

|---|---|---|---|

| SHA-256 | Bitcoin (BTC) | ASIC | ASIC-Friendly. Simple, easily parallelized, and computationally intensive. Led to the development of highly efficient, dedicated ASIC machines. |

| Scrypt | Litecoin (LTC), DOGE | ASIC | ASIC-Friendly (Historical). Initially memory-hard, but quickly fell to Scrypt ASICs. Allows for Merged Mining, making it a dual-revenue stream. |

| RandomX | Monero (XMR) | CPU | Highly ASIC-Resistant / Memory-Hard. Relies on fast, low-latency CPU access to large amounts of RAM (memory-hard), making ASICs and GPUs highly inefficient by design. Ideal for modern, high-core-count CPUs. |

| Etchash | Ethereum Classic (ETC) | GPU | Memory-Hard. Requires loading a large, constantly growing DAG (Directed Acyclic Graph) file into the GPU's VRAM. This memory requirement keeps dedicated ASICs out, favoring high-VRAM GPUs. |

| Equihash | Zcash (ZEC) | GPU / ASIC | Memory-Hard / Solution-Based. The algorithm requires large amounts of fast memory, which favors GPUs, though some dedicated ASICs have emerged. The metric is 'Solutions per second' (Sol/s), not hashes. |

| X11 | Dash (DASH) | ASIC | Multi-Algorithm. A chain of 11 different hashing algorithms. Was initially GPU-mineable but is now completely dominated by specialized X11 ASICs. |

| KawPow | Ravencoin (RVN) | GPU | ASIC-Resistant. Designed to frequently update the hashing sequence, making it computationally prohibitive to design a single-purpose ASIC. This ensures the network remains accessible to GPUs, but it's more power-intensive than Etchash. |

Why Algorithms Decide Your Hardware Options

The core design of the hashing algorithm determines whether a coin is viable for a CPU, GPU, or ASIC.

Memory-Hard vs. ASIC-Friendly:

- ASIC-friendly algorithms (like SHA-256) are simple and mathematically repetitive. An ASIC chip can be built to perform only this repetitive math at maximum efficiency.

- Memory-Hard algorithms (like RandomX or Etchash) deliberately require high-speed access to a large pool of memory, changing the computation regularly. This prevents a simple ASIC from being effective. This is why Monero (RandomX) is best mined by a CPU (which has fast, low-latency access to RAM) and ETC (Etchash) is best mined by a GPU (which has dedicated VRAM).

- ASIC Resistance Commitments: Some projects, like Monero, have made a formal commitment to update their algorithm if an ASIC is successfully developed for it. This commitment guarantees the network will remain accessible to commodity hardware, primarily CPUs, which is a key part of their decentralization philosophy.

- GPU VRAM / DAG Concept: For algorithms like Etchash (Ethereum Classic), the mining process requires a large, specialized file called the DAG (Directed Acyclic Graph). The entire DAG must be loaded into the GPU's onboard memory, the VRAM, to perform the hashing. As the network matures, the DAG file grows larger. If your GPU's VRAM capacity is smaller than the DAG file size, your card is effectively rendered useless for mining that coin. This is why a minimum of 8GB of VRAM is necessary for ETC mining in 2026, with 12GB+ highly suggested for future-proofing.

Future-Proofing Your Hardware Spend

To ensure your investment remains profitable for as long as possible, consider the following:

- GPUs: The single most important factor is VRAM. Stick to the 12GB+ VRAM suggestion for any serious GPU mining rig. VRAM capacity is the non-negotiable barrier to entry for memory-hard algorithms, and it will only increase over time.

- ASICs: Accept the high risk of algo changes (unlikely for BTC/LTC, but possible for smaller coins) and the rapid obsolescence dictated by competitors. Newer ASICs are exponentially more efficient. Your only hedge is finding a unit with a strong resale value on the secondary market for older models (e.g., if you sell to regions with extremely low electricity costs).

- CPU: Focus on efficiency and undervolting basics. Since CPU mining is a low-profit game, minimizing electricity draw is critical. Learn to undervolt your CPU (reducing the voltage supplied to the chip) to maintain a high hash rate while drastically lowering power consumption, which can be the difference between a small net profit and a net loss.

How To Pick The Best Coin to Mine

How To Pick The Best Coin to Mine. Image via Shutterstock

How To Pick The Best Coin to Mine. Image via Shutterstock Choosing a coin is not just about its current price. It's a strategic decision based on your personal constraints, your risk tolerance, and the long-term vision of the coin's network.

Start With Your Electricity Rate

Electricity cost is the single largest operating expense in mining. Before you buy any hardware, you must know your precise electricity rate ($/kWh) and calculate your break-even point.

- If your rate is above $0.15/kWh: Avoid all high-power ASIC mining (BTC, LTC/DOGE, DASH). Focus solely on highly efficient GPU or CPU mining (ETC, XMR) where the power draw is 90W–300W per unit, not 3,000W–5,000W.

- If your rate is above $0.10/kWh: Bitcoin (BTC) mining becomes extremely marginal. Only the newest, most efficient ASICs will turn a profit. Look instead to Merged Mining (LTC/DOGE), where the dual-revenue stream can compensate for a higher electricity cost.

- If your rate is below $0.08/kWh: You have the green light for industrial-scale ASIC mining. This is the only bracket where older, less-efficient ASIC models may still be profitable.

Use ROI, Not Block Reward, as Your North Star

Many new miners make the mistake of choosing a coin based on its large block reward or its impressive price tag.

- Why block reward alone is a trap: A coin with a massive block reward might also have an enormous, highly concentrated network difficulty. Your slice of that large reward pool may be tiny. What truly matters is the net profit after electricity, or, more importantly, the Return on Investment (ROI) timeline.

- Mention difficulty and competition: A seemingly cheap, easy-to-mine coin might be undergoing a massive difficulty spike as new miners join the network. This quickly lowers your daily coin yield. Always use a mining calculator that pulls real-time difficulty data, not just coin price.

Consider Liquidity + Cash-Out Reality

Mining a coin that can’t be easily sold defeats the purpose of the operation.

- Exchange availability: Ensure your coin is listed on major, reputable exchanges (like Coinbase, Binance, Kraken) that you can legally access in your region. Mining a highly obscure coin means lower liquidity, and you may have to sell it at a disadvantageous price.

- Spreads, withdrawal restrictions: Small, illiquid coins often have wider spreads (the difference between the buy/sell price), which cuts into your profit. Pools for small coins may also have high minimum payout thresholds, meaning it takes weeks or months to receive your first payment.

Regulation and Compliance

Mining is an economic activity and must be treated as such.

- Region-based considerations (high level, no legal advice): The legal classification of your mined coins varies by country. In many major jurisdictions (US, UK, Canada, Germany), newly mined coins are considered taxable income at their fair market value (FMV) on the day you receive them. The later sale of the coin is usually a second taxable event, subject to capital gains tax. Always consult a tax professional.

What Do You Need to Start Mining?

Get Your Hardwares,, Softwartes and Wallets Right Before You Mine. Image via Shutterstock

Get Your Hardwares,, Softwartes and Wallets Right Before You Mine. Image via ShutterstockRegardless of whether you choose a CPU, GPU, or ASIC path, you need to establish the foundational infrastructure, the hardware, the software, and the administrative setup. For mining, set up a dedicated wallet plus a payout plan that balances security, convenience, and tax tracking.

Hardware Checklist

A successful mining operation requires more than just the main hardware. The support infrastructure is critical for safety, longevity, and uptime.

- PSU (Power Supply Unit): This is the most underrated component. You must have a high-efficiency PSU (e.g., 80 Plus Platinum/Titanium rated) that can handle the continuous, 24/7 load. Never skimp on the PSU, as a cheap one is a fire risk.

- Wiring: For ASIC and large GPU rigs, you will need dedicated, high-gauge electrical wiring and possibly a 240V circuit. Standard 120V residential outlets cannot safely handle the power draw of multiple units.

- Surge Protection: Connect all equipment to commercial-grade surge protectors, not just cheap power strips. This protects your expensive hardware from power spikes and lightning strikes.

- Cooling: Heat is the enemy of efficiency and lifespan. For ASICs, this means dedicated ventilation, an isolated room, or immersion cooling. For GPU/CPU rigs, this means high-airflow case fans and optimizing the room's ambient temperature.

- Noise Planning: ASICs are incredibly loud (70-85+ decibels, comparable to a vacuum cleaner or jet engine). You must plan for noise dampening, as this is a non-negotiable factor for home mining.

Software Checklist

Once the physical hardware is running, the software stack connects you to the blockchain and the reward pool.

- Official Downloads Only: Mining software is frequently targeted by malware. Always download your chosen mining software (e.g., XMRig, T-Rex Miner) directly from the official developer source (usually a verified GitHub page).

- Wallet Setup: A secure, local, or hardware wallet is necessary to receive your payouts. This should be set up before you start mining.

- Monitoring: Implement monitoring software (often built into the ASIC firmware or the mining pool dashboard) to track your hash rate, power consumption, and hardware temperature. This ensures you catch performance issues immediately.

Wallets and Payout Setup

Security best practices require a separation of duties for your cryptocurrency holdings. Never use the wallet where you store your primary, long-term cryptocurrency holdings as the receiving address for your mining pool payouts. Use a dedicated, high-frequency "hot" wallet for pool payouts, and then periodically transfer the accumulated coins to a secure "cold storage" or hardware wallet for long-term holding. This limits the risk in case the pool or your mining setup is compromised.

- Choose the right wallet type

- Hardware wallet (best for long‑term holdings): Devices like Ledger Nano X/S or Trezor keep private keys offline and are widely recommended for storing larger BTC/LTC/XMR balances.

Use this as the “vault” where you periodically sweep mined coins, not as the direct payout address for high‑frequency micro‑payouts. - Software/mobile/desktop wallet (for daily payouts): Multi‑asset wallets such as Exodus, Trust Wallet, or Coinbase Wallet are common choices for miners who want easy access and swaps.

For privacy coins, use project‑specific wallets (e.g., Cake Wallet or Monero GUI for XMR) and then periodically transfer to hardware storage if supported.

- Exchange account (use cautiously)

- Pools can pay directly to exchanges like Binance or Coinbase, but this adds counterparty risk and sometimes violates pool TOS.

- Prefer self‑custody; if you use an exchange for auto‑convert, withdraw regularly to your own wallet.

- Set up payout addresses in pools

- One clean address per coin: Generate a fresh receive address in your wallet for BTC, LTC, XMR, etc., and paste it into each mining pool’s payout settings.

- Check minimum payout and fees: Pools offer different minimum thresholds; low thresholds mean more UTXOs/records, while higher thresholds mean less on‑chain fee overhead but more funds left on the pool temporarily.

- Label addresses for accounting: In your wallet or portfolio tool, label addresses like “Mining – BTC – F2Pool” to keep tax and ROI tracking manageable.

- Understand pool payout methods

- PPS / FPPS: Fixed per‑share payouts with very low variance; FPPS also shares transaction fees, often with 2–4% pool fees.

- PPS+: Block subsidy is PPS, transaction fees are shared PPLNS‑style, giving a mix of stable income and fee upside.

- PPLNS: Higher variance but usually lower pool fees; rewards depend on luck and your contribution when blocks are found, better for long‑term loyal miners.

For most small/medium miners who care about predictable cash flow, FPPS or PPS+ is usually preferable; PPLNS can outperform in the long run if you stay on one pool.

- Automate payouts and conversions

- Auto‑payout: Enable automatic daily or weekly payouts once you reach the minimum threshold; this reduces counterparty risk on the pool.

- Auto‑convert (optional): Some pools/exchanges automatically convert rewards (e.g., LTC+DOGE to USDT); this can lock in fiat value but may have spread/fees and tax consequences.

- Cold‑storage sweeps: On a monthly cadence, move accumulated balances from hot wallets or exchanges to your hardware wallet “vault.”

- Record‑keeping for taxes and ROI

- Export pool payout history (CSV) and wallet transaction history into a tax tool or your own sheets.

- Track date, coin, amount, fiat value at receipt, fee, and destination wallet; this is essential for income recognition and later capital‑gains calculations.

Pool Setup Basics

A mining pool is the middleman that aggregates your hash power and distributes rewards.

- Choosing Payout Type: Understand the pool's payout system: PPLNS (Pay Per Last N Shares) rewards long-term loyalty, while PPS (Pay Per Share) offers lower-risk, immediate payouts. Choose the one that matches your risk tolerance.

- Minimum Payout Thresholds: This is the smallest amount of coin the pool will transfer to your wallet. If you are a small miner, ensure the threshold is not so high that it will take you months to reach.

- Fees: Pool fees are typically 1–3%. Be sure to confirm whether the fee is charged only on the block reward or on the transaction fees as well.

Quick Start Mining Guide by Experience Level

Quick Start Mining Guide by Experience Level. Image via Shutterstock

Quick Start Mining Guide by Experience Level. Image via ShutterstockThe right starting point depends entirely on your technical comfort, available budget, and tolerance for heat and noise. Below are three paths based on experience level.

Complete Beginner (CPU)

This path is the fastest, cheapest, and lowest-risk way to learn the entire mining process.

Coin Example: Monero (XMR), due to its CPU-friendly RandomX algorithm and highly efficient mining software.

- Expected Setup Time: 30–60 minutes.

- Realistic Profit Band: $5–$15 per month (assumed at $0.12/kWh), mainly covering a small fraction of the computer's operational cost.

5-Step Quick Start

- Wallet: Download and set up the official Monero GUI Wallet. This will generate your receiving address.

- Miner: Download the latest official release of the XMRig software.

- Pool: Choose a low-fee Monero pool (e.g., SupportXMR) and note the pool's URL and port.

- Config: Use the pool's configuration generator to create your config.json file, plugging in your Monero wallet address.

- Monitor: Start the miner and monitor the temperature of your CPU and your hash rate on the pool's website to ensure your system is stable.

Intermediate (GPU)

This path is for hobbyists who have access to a gaming PC or are willing to build a dedicated rig. It offers flexibility and higher returns.

Coin Example: Ethereum Classic (ETC), using its Etchash algorithm, which is highly efficient on high-VRAM GPUs.

7-Step Optimization Guide

- Hardware & VRAM Check: Ensure your GPU has at least 8GB (ideally 12GB+) of VRAM.

- Wallet & Pool Setup: Set up your ETC wallet and choose a pool (e.g., Ethermine ETC).

- Miner Software: Download a GPU miner (e.g., T-Rex Miner) and configure the batch file with your wallet and pool details.

- Driver Optimization: Install the latest stable GPU drivers and ensure you are running a supported operating system.

- Optimize Power Limit + Temps: This is the most crucial step. Use GPU tuning software (like MSI Afterburner or AMD Adrenalin) to reduce the Power Limit and lower the Core Clock while increasing the Memory Clock. This process, called undervolting, drastically cuts power consumption (and electricity cost) while maintaining the memory-hard hash rate.

- Test Stability: Run the miner for 24 hours while monitoring the temperature (keep below 70°C/158°F) and watching for "invalid share" errors, which indicate an unstable overclock.

- Calculate Net Profit: Use a tool like WhatToMine with your optimized hash rate and power draw figures to calculate your true net monthly profit and track your ROI.

Advanced (ASIC)

This path is for professional-minded miners with significant capital and a low-cost electricity source. It demands specialized infrastructure.

Coin Example: Bitcoin (BTC) (if power is extremely cheap) or Litecoin/Dogecoin Merged Mining (for dual-revenue efficiency).

10-Step Operational Checklist

- Electrical Capacity: Hire an electrician to verify your power supply can handle the 3,000W–5,000W draw of each ASIC unit and install a dedicated 240V circuit.

- Ventilation: Plan and install dedicated exhaust venting to remove the high heat load. This cannot be skipped.

- ASIC Purchase: Source your ASIC from an authorized seller (verify the serial number) to avoid scams.

- Initial Setup: Connect the ASIC to your network, access its web dashboard via IP address, and change the default administrative password.

- Pool Configuration: Enter the pool URL, port, and your wallet address into the ASIC's dashboard.

- Monitoring Alerts: Configure a local or cloud-based monitoring service (like Braiins OS+) to send critical alerts if the hash rate drops or the chip temperature spikes.

- Baseline Test: Run the unit at its factory settings for 48 hours to confirm stability.

- Power Optimization (Optional): Use custom firmware (if available) to underclock the ASIC slightly, improving the Hashes per Watt efficiency at the expense of a small drop in raw hash rate.

- Maintenance Budget: Allocate an annual budget for fan replacements, dust cleaning, and potential chipboard repairs.

- Tax Planning: Begin meticulous record-keeping immediately to track electricity costs and the Fair Market Value of every coin received.

Mining Scams to Avoid

Ponzi Patterns to Fake Mining Apps, Avoid All Mining Scams. Image via Shutterstock

Ponzi Patterns to Fake Mining Apps, Avoid All Mining Scams. Image via ShutterstockThe high-profit potential and technical complexity of crypto mining make it a prime target for various scams. The two most common and costly scams are cloud mining schemes and fraudulent hardware sales.

Cloud Mining Ponzi Patterns

Cloud Mining is the practice of paying a third party to rent hash power in their industrial facility. While legitimate operations exist, the vast majority of consumer-facing cloud mining contracts are scams

Red Flags Checklist:

- Guaranteed Daily Profit: Legitimate mining cannot guarantee a profit, as it is dependent on volatile coin prices and network difficulty. Any "guaranteed ROI" or fixed daily return is a near-certain scam.

- Lifetime Contracts: Mining hardware degrades and becomes obsolete. No legitimate contract can last "forever."

- No Address/Facility Transparency: Scammers will provide no public information about their physical mining facility (name, address, energy partner).

- High Affiliate Bonuses: Schemes that heavily incentivize recruiting new members are characteristic of a Ponzi structure.

- Payments Only in Crypto: A legitimate business will accept standard fiat payments and credit cards.

Fake Mining Apps

Most mobile mining apps are designed to harvest user data or push low-value rewards in a non-tradable token, not provide actual income.

"Mine Bitcoin on your phone" needs a reality check. A modern Bitcoin ASIC is hundreds of thousands of times more powerful than a smartphone's processor. Attempting to mine a serious PoW coin like BTC, ETC on a phone will yield no measurable return and will severely damage your phone's battery and CPU. The mobile apps that exist are, at best, teaching tools or, at worst, data harvesting scams.

ASIC Reseller Scams

The high demand and limited supply of ASICs (especially the newest models) have created a massive market for fraudulent resellers who take a deposit and never deliver the hardware.

- Authorized Seller Guidance: Always purchase directly from the original manufacturer (e.g., Bitmain, Canaan) or from a single, globally recognized authorized distributor with a long track record.

- Verification: Before transferring funds, ask for a video call to see the hardware with today's date visible, or an in-person inspection if possible.

Malicious Mining Software

Unverified mining software can steal a miner’s profits or compromise their computer.

- Official Sources Only: Only download mining software (e.g., XMRig, T-Rex Miner, Gminer) from the developer's official website or their verified GitHub repository.

- Checksums: Always check the published cryptographic checksum (hash) of the downloaded file against the one provided on the developer's site. If they do not match, the file has been tampered with and contains malware.

Hardware Purchase Verification Checklist

Before sending a large deposit for high-cost ASIC or GPU equipment, use this checklist:

- Seller has a verifiable business address and contact. (A P.O. box or an anonymous contact form is a major red flag.)

- Multiple payment options available (not just crypto). (Scammers often demand irreversible crypto payments.)

- Warranty and return policy are clearly stated. (A reputable seller offers a 6–12 month manufacturer warranty.)

- Reviews on independent platforms (Trustpilot, Reddit). (Do not trust reviews only on their own website.)

- Can verify serial numbers with the manufacturer. (The most secure step: contact the ASIC manufacturer to confirm the unit's serial number is tied to the seller's authorized distribution batch.)

Real-World Mining Scenarios: What to Expect

Electricity cost is Everything While Determining Real-World Mining. Image via Shutterstock

Electricity cost is Everything While Determining Real-World Mining. Image via ShutterstockMining is a business of margins. Here are three realistic scenarios based on common miner profiles to help set accurate expectations for profit and operational complexity.

Scenario 1: Beginner Home Miner (CPU)

This is the lowest-risk entry point, often running on a single modern CPU in an existing desktop computer.

| Metric | Example Value (Monero - XMR) |

|---|---|

| Hardware | Ryzen 7 5800X ($350) |

| Electricity Rate | $0.12 / kWh (global assumptions) |

| Hash Rate (Approx.) | 12,000 H/s |

| Power Draw (System Total) | 180 W |

| 3-Month Averages | Fluctuating |

| Net Profit | $5 - $15 / month |

| ROI (Estimated) | 23 - 70 Months |

| Operator Quote | "I use it to learn the process and accumulate XMR without buying a rig. It barely covers the power, but it's zero-risk and zero-noise." |

Scenario 2: Serious Hobbyist (GPU Rig)

This involves a dedicated rig of several GPUs, often in a garage or basement, providing the best flexibility for coin-switching.

| Metric | Example Value (Ethereum Classic - ETC) |

|---|---|

| Hardware | 4x RTX 4070 Ti Rig ($3,000) |

| Electricity Rate | $0.10 / kWh |

| Hash Rate (Approx.) | 300 MH/s (Optimized) |

| Revenue | $150 - $250 / month |

| Power Cost | $60 - $80 / month (Total rig power) |

| Net Profit | $90 - $170 / month |

| Coin-Switching Strategy | Miner uses a calculator to switch coins (e.g., from ETC to RVN or KAS) whenever the network difficulty makes the primary coin unprofitable for a period, maximizing USD revenue. |

Scenario 3: Professional Operation (ASIC + Merged Mining)

This is a high-capital, industrial-scale operation focused on maximum efficiency and scale

| Metric | Example Value (LTC/DOGE Merged Mining) |

|---|---|

| Hardware | 10x Antminer L7 ASICs ($45,000) |

| Commercial Power Rate | $0.06 / kWh (Emphasis) |

| Hash Rate (Approx.) | 95 GH/s (LTC) |

| Revenue | $6,500 - $8,000 / month (LTC + DOGE) |

| Net Profit | $2,500 - $4,000 / month |

| ROI (Estimated) | 10 - 20 Months |

Lessons From Real Miners

Regardless of the scenario, the same operational lessons are repeated by all profitable miners:

- Electricity cost is everything: Your rate ($/kWh) is the single greatest determinant of whether you succeed or fail.

- Pools reduce variance: Solo mining is not a serious option; pools ensure a small, steady income stream rather than unpredictable, high-risk rewards.

- Maintenance budget: Hardware fails. Fans break, dust builds up, and power supplies die. Allocate 5–10% of your annual gross revenue to a maintenance budget.

- Tax planning: Keep a log of every payout and the fair market value of the coin on that date. Treat it as a small business from day one.

Is Crypto Mining Still Profitable in 2026?

Is Crypto Mining Still Profitable in 2026? Image via Shutterstock

Is Crypto Mining Still Profitable in 2026? Image via ShutterstockThe question of profitability is not a simple yes or no. The landscape is mature, competitive, and highly segmented. Profitability is a function of scale, efficiency, and location.

Short Answer

“Yes, but…” Mining is still profitable, but the "but" comes with clear qualifiers:

- It is no longer a source of passive income for the casual user.

- Profitability requires a strategic advantage in one of the three core variables: cheap electricity, efficient hardware, or smart coin-switching.

- The path to profit for a home miner is now fundamentally different from that of an industrial miner.

Bitcoin Mining: Pro Game Now

Bitcoin mining is now a competition for multi-million dollar corporations and large-scale, industrial operations.

- When it works (cheap power + latest ASICs + scale): Bitcoin mining works only for those who have secured power contracts at or below $0.07/kWh, utilize the latest generation of hyper-efficient ASICs, and operate at a scale large enough to afford professional management and cooling. It is a commodities business driven by capital and engineering.

- When it doesn’t (residential power + old units): If you are running an ASIC on residential power (typically $0.10/kWh or higher) or using any ASIC model that is more than three years old, you are almost certainly mining at a net loss to the electricity company.

Altcoin Mining: Where Home Miners Still Compete

The opportunity for the hobbyist and home miner has shifted to specialized altcoins, primarily those using GPU and CPU algorithms.

- CPU + GPU opportunities: Networks that are aggressively ASIC-resistant (Monero, Ravencoin, Kaspa) or memory-hard (Ethereum Classic) rely on commodity hardware. This gives the home miner a fighting chance because large, specialized ASIC farms cannot efficiently dominate the network.

- Flexibility advantage (switching): The biggest edge for a GPU miner is the ability to instantly switch to the most profitable coin of the day (hash rate switching), something a single-purpose ASIC cannot do. This flexibility is key to surviving market volatility.

Break-Even Electricity Cost Table

This table illustrates the maximum sustainable electricity rate for various hardware to remain profitable at average market conditions in late 2025. If your rate is above the maximum, you are almost guaranteed to be losing money.

| Hardware Type | Coin Example | Max Profitable $/kWh (Approx.) |

|---|---|---|

| ASIC | BTC | $0.07 - $0.08 |

| ASIC | LTC/DOGE | $0.10 - $0.12 |

| GPU | ETC | $0.18 - $0.22 |

| CPU | XMR | $0.30 - $0.35 |

Market Regimes: Bull vs. Bear

Profitability is also highly dependent on the overall market cycle. In a bull market, coin prices rise faster than network difficulty can keep up, leading to a temporary surge in profitability. In a bear market, coin prices drop faster than difficulty drops, forcing many miners to shut down and creating a lag where only the most efficient miners can survive.

- HODL (Hold On for Dear Life): Mining at a loss during a bear market to accumulate coins, betting on a price recovery. This requires significant capital to cover the ongoing electricity cost.

- Immediate Sell: Converting mined coins to fiat or stablecoins immediately to guarantee a profit margin and cover operational costs. This is the safer strategy for all but the most well-capitalized miners

How Is Cryptocurrency Mining Taxed?

hMined Crypto Does Not Mean It's Tax Free. Image via Shutterstock

hMined Crypto Does Not Mean It's Tax Free. Image via ShutterstockCrypto taxation is one of the most complex, yet most ignored, aspects of crypto mining. Failing to understand your tax obligations can erase any financial gains you have made.

The Core Concept

The fundamental issue in mining taxation is that a single mining event can trigger two separate taxable events.

- Mined coins as income at receipt (general principle, varies): In many countries (including the US, UK, Canada, and Germany), when you successfully mine a coin and receive the block reward (the "mining income"), that reward is considered ordinary income at its Fair Market Value (FMV) on the date and time it hits your wallet. This is taxed similarly to a salary or self-employment income.

- Later sale triggers capital gains in many places: If you hold the mined coin, and its value changes, when you eventually sell, trade, or spend it, that is a second taxable event. Any increase in value between the FMV at receipt (your cost basis) and the selling price is a capital gain (or loss), which is taxed at a separate capital gains rate.

Country Snapshots (High Level)

The classification of mining income is not uniform worldwide, resulting in varying taxation strategies.

- US: Mining is generally considered self-employment income subject to ordinary income tax rates plus self-employment taxes (Social Security/Medicare) at the time of receipt.

- UK: The tax treatment depends on the scale and organization. A hobbyist may be subject to Income Tax, while a professional operation is treated as a trade, subject to Corporation Tax.

- Germany: A major distinction is made between professional trading and a hobby. Mined coins are taxed as income, but if held for longer than one year, the later capital gain is often tax-exempt.

- Canada: Commercial mining is treated as a business, and income is taxed at ordinary rates. Hobby mining is generally not subject to income tax on the coins received, but capital gains apply upon disposal.

Record-Keeping Checklist

Since you are essentially operating a micro-business, maintaining impeccable records is necessary to deduct your business expenses (like electricity and hardware) and accurately calculate your cost basis.

- Timestamp: Record the exact date and time of every pool payout.

- FMV at Receipt: Record the Fair Market Value (in your local currency, e.g., USD, EUR, CAD) of the coin for every payout at the moment of receipt. This is your cost basis.

- Pool Statements: Retain monthly or annual statements from your mining pool showing your total rewards and the fees taken.

- Electricity/Hardware Receipts: Save all receipts for hardware, electricity bills (with the mining power calculated), and cooling/maintenance costs. These can often be deducted from your mining income.

Here is an in-depth review of the tax implications of crypto mining at home for your better understanding, and our top picks for tools that will help simplify your crypto tax management.

Disclaimer: This is not legal or tax advice; always consult a licensed tax professional in your jurisdiction.

Final Thoughts on Crypto Mining

Crypto mining is a rewarding technical pursuit, but its financial viability is selective. It is a commitment that demands technical skill, financial discipline, and a willingness to manage volatility. It is not for everyone.

Who Mining Is For

Mining is an excellent endeavor for a specific profile of an individual:

- People with cheap power: If you have access to highly subsidized power (ideally below $0.10/kWh), you have a non-negotiable competitive edge.

- Patience: Mining is a long-term game. It takes months or years to reach ROI, and daily net profits are often small and volatile.

- Willingness to manage hardware: You must be comfortable with configuration, temperature management, noise mitigation, and troubleshooting inevitable hardware failures.

- A desire for decentralization: You believe in the philosophical mission of securing a decentralized network and are willing to contribute to it.

Who Should Avoid It

You should avoid mining if you fall into any of these categories:

- High electricity: If your residential rate is above $0.15/kWh, the economics are overwhelmingly stacked against you.

- Expecting passive income: Mining is not a "set it and forget it" activity. It requires constant monitoring, maintenance, and optimization.

- No tolerance for troubleshooting: When your rig stops hashing, you must be prepared to fix it yourself, often involving complex software or hardware diagnostics.

Best “Starter Paths” Recap

To begin your journey, choose a starter path that aligns with your available resources: