DeFi yield can feel like walking into a bustling market without a map. Prices flash, tokens tempt, and every stall promises a bargain.

This guide gives you the map. We start with clear definitions, then show how yield is actually produced and what can go wrong. You will get a quick selection framework, ranked platform cards, side-by-side comparisons, and practical checklists for a safe first deposit. Beginners can follow the steps end-to-end. Experts will find data windows, strategy ideas, and developer notes to fine-tune execution.

Quick Picks

| Pick | Typical APY | Risk | Notes |

|---|---|---|---|

| Best Overall, Aave, Curve + Convex, or Yearn vaults on major pairs | Stables between 3% and 5%, majors 2% to 4%. | Low to Medium | Large TVL, audits, active bounties |

| Best Stablecoin Yields, Curve stables with Convex boosts, or Maker/Spark DSR | Curve stables 1% to 5%, DSR 2% to 6% | Low to Medium | Monitor de peg risk in stables |

| Best Auto-Compounder, Yearn, Beefy, or Harvest | 2% to 10% by vault and chain | Medium | Include performance and management fees |

| Lowest Fees, PancakeSwap on BNB Chain, plus Polygon and Base | Stables 1% to 5%, majors 0.5% to 2%, LST 3% to 7% | Low to Medium | Cheaper networks for small tickets |

| Best for Liquid Staking, Lido stETH or Rocket Pool rETH on Curve or Balancer | LST base ~2.6% to ~2.7%, LST pairs 3% to 7% | Medium | Watch basis and withdrawal queues |

| Best on TRON, JustLend money markets for stables and majors | Stables 2% to 6%, majors 0.5% to 3% | Low to Medium | Very low network costs |

| High APY, Synthetix perps incentives, Balancer weighted pools with incentives | About 4% to 12%, program dependent | High | Incentives shift, monitor weekly |

APYs are variable; check live vault pages before depositing. Data current as of Jan. 28, 2026.

What Is DeFi Yield Farming?

Yield farming is the practice of putting crypto to work in decentralized finance to earn a return. This section sets clear definitions, explains where yields originate, and highlights the core risks to watch.

Farming vs Staking vs Liquidity Provision

- Yield farming usually involves lending or providing liquidity, so the activity generates a share of rewards. Think of it as renting out tools you already own.

- Staking secures a proof-of-stake network by locking tokens to validate transactions and earn protocol rewards, which is closer to holding an interest-bearing bond that supports the system.

- Liquidity provision typically means depositing two or more assets into an automated market maker (AMM, automated market maker) such as Uniswap so traders can swap between them. Fees generated by the pool are shared with liquidity providers (LPs).

In farming, people often combine these elements with smart contracts that automate steps.

Where Yields Come From

Yields generally come from four sources.

First, trading fees on AMMs like Uniswap. Second, borrow interest on lending markets such as Aave. Third, token incentives that bootstrap or steer liquidity. Fourth, derivative rates from liquid staking tokens (LSTs, liquid staking tokens) issued by providers like Lido.

Farmers may stack these sources, for example, placing an LST in a pool to earn fees and incentives while the token also accrues staking yield.

Core Risks

Impermanent loss can erode returns when asset prices in a pool diverge. Smart contract issues and cross-chain bridges introduce additional attack surfaces. Depegging happens when a stablecoin or an LST trades away from its intended value. Governance decisions can shift fees or incentives. Oracle failures can misprice assets and trigger liquidations. When comparing offers, focus on the stated APY (annual percentage yield) and the mechanism behind it, not only the headline number.

Keep three ideas in view. Understand what the strategy does, confirm how the yield is generated, and identify what could go wrong. This mindset keeps decisions grounded in mechanics rather than headline rates.

Side-by-Side Comparisons

In this section, we compare yield ranges, incentive mix, chains, and real costs across our picks so you can choose the right venue fast.

Yield and Pool Types (Date checked: Jan. 28, 2026)

| Protocol | Best for (Stables, LST, Majors, Synths) | Typical APY ranges | Emissions vs fees % |

|---|---|---|---|

| Aave | Stables, majors | Stables between 3% and 5%, majors 2% to 4% | N/A — interest model |

| Compound | Stables, majors | Stables 2% to 5%, majors 0.2% to 1.2% | N/A — interest model |

| MakerDAO and Spark | Stables | Stables 2% to 6% | N/A — DSR and market rates |

| Curve Finance | Stables, LST | Stables 1% to 5%, LST pairs 3% to 7% | Fees plus CRV, mix varies by gauge |

| Convex Finance | Stables, LST, majors via Curve | Stables 1% to 5%, majors 0.3% to 2%, LST pairs 3% to 8% | Curve fees plus CRV, boosted by Convex |

| Lido | LST | LST base ~2.6% | Protocol rewards net of fee |

| Yearn Finance | Stables, majors, LST via vaults | Stables 2 to 8%, majors 0.5% to 3%, LST pairs 3% to 8% | Strategy dependent mix of fees and incentives |

| Balancer | Stables, LST, majors | Stables 1% to 5%, majors 0.2% to 2%, LST pairs 3% to 7% | Pool fees plus BAL or partner incentives (where applicable) |

| Uniswap v3 | Stables, majors, LST pairs | Stables 1% to 5%, majors 0.5% to 3%, LST pairs 3% to 7% | Fees 100%, emissions 0% |

| Sushi | Stables, majors, LST pairs | Stables 1% to 5%, majors 0.5% to 2%, LST pairs 3% to 7% | Trading fees plus periodic incentives |

| PancakeSwap v3 | Stables, majors, LST pairs | Stables 1% to 5%, majors 0.5% to 2%, LST pairs 3% to 7% | Trading fees plus periodic incentives |

| Harvest Finance | Stables, majors, LST via integrations | Stables 2% to 10%, majors 0.5% to 3%, LST pairs 3% to 8% | Strategy dependent |

| Beefy | Stables, majors, LST via integrations | Stables 2% to 10%, majors 0.5% to 3%, LST pairs 3% to 8% | Strategy dependent |

| Synthetix | Synths and perps incentives | sUSD 2% to 6% | Trading fees plus program incentives |

| JustLend | Stables, majors | Stables 2% to 6%, majors 0.5% to 3% | N/A — interest model |

Cost and Chain Footprint (Date checked: Jan. 28, 2026)

| Protocol | Chains | Est. gas to deposit and stake | Harvest cost | UI clicks | Hardware wallet friendly |

|---|---|---|---|---|---|

| Aave | Ethereum, Arbitrum, Optimism, Base, Polygon | Higher on Ethereum, lower on L2 | Low to moderate | Few steps | Yes |

| Compound | Ethereum, Arbitrum, Base, Polygon | Higher on Ethereum, lower on L2 | Low to moderate | Few steps | Yes |

| MakerDAO and Spark | Ethereum | Higher on Ethereum | Low to moderate | Few steps | Yes |

| Curve Finance | Ethereum and multichain | Higher on Ethereum, lower on L2 | Low | Few steps | Yes |

| Convex Finance | Ethereum and multichain | Higher on Ethereum | Low to moderate | Few steps | Yes |

| Lido | Ethereum | Higher on Ethereum | Not applicable | Few steps | Yes |

| Yearn Finance | Ethereum and multichain | Higher on Ethereum, lower on L2 | Low to moderate | Few steps | Yes |

| Balancer | Ethereum and multichain | Higher on Ethereum, lower on L2 | Low | Few steps | Yes |

| Uniswap v3 | Ethereum and multichain | Higher on Ethereum, lower on L2 | Not applicable | Few steps | Yes |

| Sushi | Ethereum and multichain | Higher on Ethereum, lower on L2 | Low | Few steps | Yes |

| PancakeSwap v3 | BNB Chain and multichain | Low | Low | Few steps | Yes |

| Harvest Finance | Ethereum, Arbitrum, Base, Polygon, zkSync Era | Higher on Ethereum, lower on L2 | Low to moderate | Few steps | Yes |

| Beefy | Many EVM chains | Low | Low | Few steps | Yes |

| Synthetix | Ethereum | Higher on Ethereum | Not applicable | Few steps | Yes |

| JustLend | TRON | Very low | Low | Few steps | Yes |

Our Top Picks

Before diving into each platform, please note that APY percentages fluctuate, so be sure to check the latest figures when you need to confirm.

1. Aave

Upcoming Changes are Tracked in the Aave V4 Launch Roadmap. Image via Aave

Upcoming Changes are Tracked in the Aave V4 Launch Roadmap. Image via AaveAave is a non-custodial money market where users supply assets to earn interest and borrow against collateral through on-chain liquidity pools and the V3 protocol.

Typical APY ranges: stables between 3% and 5%, majors 2% to 4%.

Security

Audit materials, an active bug bounty, and risk resources are maintained in the security hub.

Best for

Users who want a large asset selection and deep liquidity across major networks, with feature details in the V3 overview.

Fees and costs

The protocol does not charge deposit or withdrawal fees. Rates are determined by market interest models and per market parameters listed under Parameters. Network gas applies to each action.

Watch outs

Positions are liquidated if the health factor drops below one, as described in Liquidations. Upcoming changes are tracked in the Aave V4 launch roadmap.

2. Compound

Positions are Subject to Collateral Factors, Liquidation Thresholds, and Oracle Inputs. Image via Compound

Positions are Subject to Collateral Factors, Liquidation Thresholds, and Oracle Inputs. Image via CompoundCompound is a money market where users supply assets to earn interest and borrow against collateral, with cTokens in v2 and the Comet architecture in v3.

Typical APY ranges: stables 2% to 5%, majors 0.2% to 1.2%.

Security

Audit history, security notes, and community oversight are documented under Security and Governance.

Best for

Conservative lenders and borrowers who prefer transparent interest models and deep liquidity in major assets, outlined in the V3 protocol docs as shared above.

Fees and costs

The protocol does not charge deposit or withdrawal fees. Supply and borrow rates are set by interest rate models and the reserve factor. Liquidations and collateral settings are configured per market in Comet parameters. Network gas applies to each action.

Watch outs

Positions are subject to collateral factors, liquidation thresholds, and oracle inputs. Price feeds and liquidation mechanics are described in Price Feed and Liquidation.

3. MakerDAO / Spark

Spark is Lending Platform that Spun out of the OG MakerDAO Ecosystem. Image via Spark

Spark is Lending Platform that Spun out of the OG MakerDAO Ecosystem. Image via SparkSpark is a lending platform that spun out of the OG MakerDAO ecosystem. MakerDAO lets users open collateralized debt positions to generate DAI and earn on idle balances through the Dai Savings Rate. Spark provides a lending market that taps Maker liquidity and parameters for DAI-focused borrowing and lending.

Typical APY ranges: stables 2% to 6%, majors 0.5% to 3%, LST pairs 3 to 6%.

Security

Core protections are described in Maker’s security portal. Spark publishes security and audits and maintains a bug bounty program.

Best for

Stablecoin savers who use the DSR, and borrowers who prefer conservative collateral settings through Spark.

Fees and costs

Maker applies a stability fee per vault via the Rates module and a liquidation penalty defined in Liquidation 2.0. Spark enforces a close factor of 50 percent during liquidation. Network gas applies to each action.

Watch outs

DAI can experience peg pressure during stress. Collateral and debt limits are adjusted through Maker governance, with prices sourced by Maker oracles that also influence liquidation behavior.

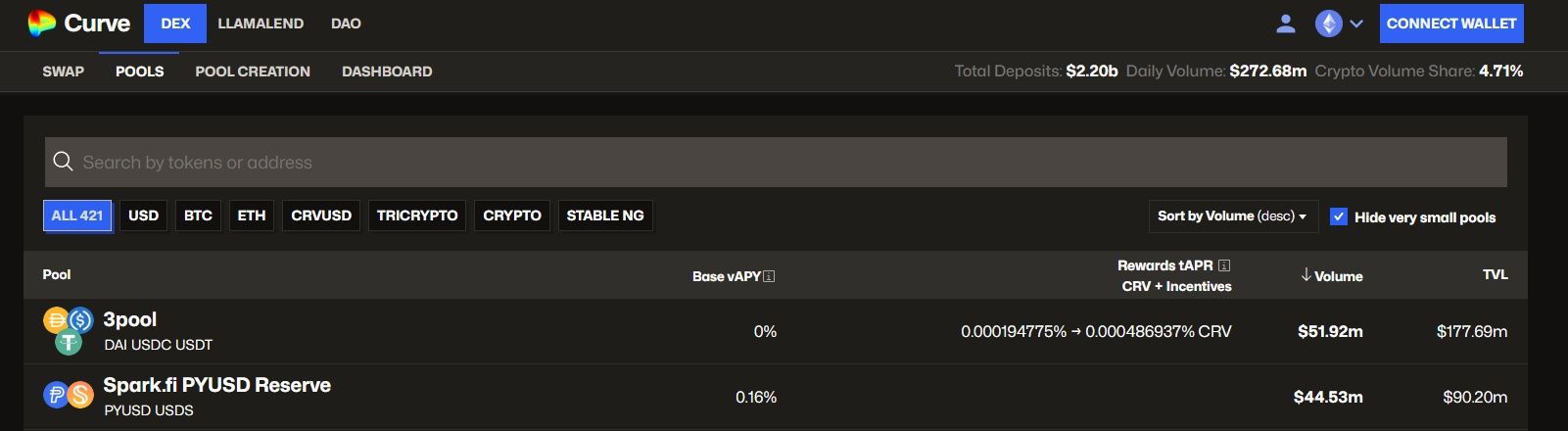

4. Curve Finance

Trading Fees are Pool specific and a Portion is Shared with veCRV Holders. Image via Curve Finance

Trading Fees are Pool specific and a Portion is Shared with veCRV Holders. Image via Curve FinanceCurve is an automated market maker focused on efficient swaps between like assets, with pool types documented in the technical docs and a factory that supports stable and volatile pairs in the pool factory.

Current metrics

Typical APY ranges: stables 1% to 5%, majors 0.2% to 2%, LST pairs 3% to 7%.

Security

Audit references and risk guidance are maintained in Security and Audits, with pool-level risk notes under Liquidity Pool Risks.

Best for

Stablecoin swaps and LST pairings where deep liquidity and low slippage matter, with rewards boosted through veCRV.

Fees and costs

Trading fees are pool-specific and a portion is shared with veCRV holders, as described under fee collection and distribution. Balanced deposits and withdrawals are free; unbalanced actions can incur up to 50% of the swap fee. Network gas applies to each action.

Watch outs

De pegs in stablecoins or LSTs can affect returns. CRV emissions vary by gauge weight voting, and staking Liquidity Provider tokens in gauges is required to earn CRV.

5. Convex Finance

Reward Levels Depend on Gauge Weights and Voting on Curve, so Emissions can Shift. Image via Convex Finance

Reward Levels Depend on Gauge Weights and Voting on Curve, so Emissions can Shift. Image via Convex FinanceConvex boosts rewards on top of Curve by aggregating LP tokens and veCRV voting power, with user flows documented in Convex for Curve and cvxCRV mechanics explained in Understanding cvxCRV.

Typical APY ranges: stables 1% to 5%, majors 0.3% to 2%, LST pairs 3% to 8%.

Security

Formal reviews are listed under Audits, and the program offers tiered rewards for responsible disclosure in Bug bounties. General risk notes are maintained in Risks.

Best for

Curve liquidity providers and CRV holders who want boosted rewards without managing a personal veCRV lock, with steps outlined in Staking Curve LP tokens and Converting CRV and staking cvxCRV.

Fees and costs

Convex takes a 17% fee on CRV revenue from Curve LP rewards, distributed as 10 percent to cvxCRV stakers, 4.5 percent to CVX stakers, 2 percent to the treasury, and 0.5 percent to the harvest caller. There are no deposit or withdrawal fees listed in the docs. Network gas applies to each action.

Watch outs

Converting CRV to cvxCRV is one way. Reward levels depend on gauge weights and voting on Curve, so emissions can shift. Pool-level risks still apply because deposits remain exposed to the underlying Curve pools.

6. Lido

Lido Issues stETH when Users Stake ETH and Credits Rewards Daily. Image via Lido

Lido Issues stETH when Users Stake ETH and Credits Rewards Daily. Image via LidoLido issues stETH when users stake ETH and credits rewards daily through its protocol and staking app. Redemptions use an asynchronous withdrawal queue that returns ETH once processed by the protocol oracles.

Typical APY: LST base rate ~2.7%. Stables and majors are not applicable.

Security

Reviews are published under audits, and an ongoing bug bounty offers rewards for responsible disclosure.

Best for

ETH holders who want liquid staking exposure, daily reward accrual, and broad DeFi integrations while retaining the ability to exit via the protocol withdrawal flow.

Fees and costs

Lido applies a 10% protocol fee on staking rewards, split between node operators and the DAO treasury. Network gas applies to staking, wrapping, and withdrawals.

Watch outs

stETH can trade at a discount to ETH during stress, and withdrawal processing depends on validator exits managed by the oracle mechanism. Queue times vary with demand and validator availability.

7. Yearn Finance

Returns Depend on the Underlying Strategies and the Pools they Access. Image via Yearn Finance

Returns Depend on the Underlying Strategies and the Pools they Access. Image via Yearn FinanceYearn aggregates deposits into vaults that deploy capital across multiple strategies and auto-compound returns, documented in the yVaults overview and accessed through the Yearn app.

Typical APY ranges: stables 2% to 8%, majors 0.5% to 3%, LST pairs 3% to 8%.

Security

Security practices and third-party reviews are outlined in Yearn security, with additional guidance in risk methodology.

Best for

Users who prefer automated strategy selection and compounding with portfolio style exposure, introduced in the Vaults product page.

Fees and costs

Vaults use performance and management fees that are defined per product. See Protocol fees and the user-facing vaults about page for fee behavior. Network gas applies to deposits, harvests, and withdrawals, and some strategies include additional steps described in strategy guides.

Watch outs

Returns depend on the underlying strategies and the pools they access. Review risk scoring and confirm the target asset and withdrawal process on the vault detail page before depositing.

8. Balancer

Balancer is an Automated Market Maker that Supports Weighted Pools, Stable Pools, and Boosted Designs. Image via Balancer

Balancer is an Automated Market Maker that Supports Weighted Pools, Stable Pools, and Boosted Designs. Image via BalancerBalancer is an automated market maker that supports weighted pools, stable pools, and boosted designs. Pool types and mechanics are described in the docs, including boosted pools that route idle liquidity into external lenders and linear pools that pair a token with its yield-bearing wrapper.

Typical APY ranges: stables 1% to 5%, majors 0.2% to 2%, LST pairs 3% to 7%.

Security

Balancer maintains security references and guidance in the security section and runs a public bug bounty.

Best for

Providers who want flexible portfolio style pools, stablecoin swaps, or Aave boosted liquidity with deep integrations, while capturing swap fees and external yield within a single position.

Fees and costs

Swap fees are set at the pool level and configurable by pool type, with protocol fee handling controlled by the ProtocolFeesController and governance protocol fees. Network gas applies to joins, exits, and swaps.

Watch outs

Returns and emissions depend on gauges and gauge onboarding, which are subject to governance. Rate providers in boosted and linear pools can introduce external protocol risk, and de pegs in wrapped assets can affect performance.

9. Uniswap v3

Uniswap v3 brings Concentrated Liquidity for Efficient, Low-Slippage Swaps. Image via Uniswap

Uniswap v3 brings Concentrated Liquidity for Efficient, Low-Slippage Swaps. Image via UniswapUniswap v3 is an automated market maker that lets liquidity providers concentrate capital within custom price ranges, which improves capital efficiency and fee capture. The mechanism and design are outlined in the concentrated liquidity docs and the v3 white paper.

Typical APY ranges based on fee earnings: stables 1% to 5%, majors 0.5% to 3%, LST pairs 3% to 7%.

Security

v3 smart contracts were reviewed by independent firms, with reports linked from Uniswap resources, including the Trail of Bits assessment and ABDK audit. Uniswap also runs an ongoing bug bounty program and documents security guidance in the docs.

Best for

Active LPs who want to target ranges on major pairs and stablecoin pools, and traders who benefit from deep liquidity and low slippage on widely used routes, all accessible through the Uniswap app.

Fees and costs

v3 uses predefined fee tiers of 0.01%, 0.05%, 0.3%, and 1% set at the pool level. There are no protocol deposit or withdrawal fees. Network gas applies to mints, burns, and swaps.

Watch outs

Impermanent loss can offset fee income when relative prices move, and positions that sit out of range earn no fees until price reenters the chosen band. For integrations and analytics, review the oracle design, which provides a time-weighted average price from pool observations.

10. Sushi

Best for Liquidity Providers who want Cross Chain Coverage with both Classic and Concentrated Liquidity. Image via Sushi

Best for Liquidity Providers who want Cross Chain Coverage with both Classic and Concentrated Liquidity. Image via SushiSushi provides automated market making across classic pools and concentrated liquidity in Sushi v3, and offers staking for SUSHI into xSUSHI to share in protocol fees.

Typical APY ranges: stables 1% to 5%, majors 0.5% to 2%, LST pairs 3% to 7%.

Security

Sushi maintains an official security page that links to audits and the active bug bounty.

Best for

Liquidity providers who want cross-chain coverage with both classic and concentrated liquidity, plus optional staking via the Sushi Bar.

Fees and costs

LPs earn 0.25% of every swap fee. Swap fees are set per pool and displayed on each pool page. A share of fees is directed to the treasury and xSUSHI, with fee handling explained in the fee help page. Network gas applies to adds, removes, and swaps.

Watch outs

Concentrated liquidity earns only when price trades inside the selected range, and out-of-range positions earn zero until reentered. These concepts are covered in the v3 liquidity guide. Impermanent loss still applies to all market-making positions.

11. PancakeSwap v3

PancakeSwap v3 brings Concentrated Liquidity on BNB Chain for Efficient Swaps and Custom LP Ranges. Image via PancakeSwap

PancakeSwap v3 brings Concentrated Liquidity on BNB Chain for Efficient Swaps and Custom LP Ranges. Image via PancakeSwapPancakeSwap v3 is an automated market maker that lets liquidity providers concentrate capital within custom price ranges for greater efficiency, documented in the concentrated liquidity overview. Trading and routing behavior is explained in the Exchange guides.

Typical APY ranges: stables 1% to 5%, majors 0.5% to 2%, LST pairs 3% to 7%.

Security

Audit references are listed in Audits. The team operates a bug bounty with top rewards routed via Immunefi.

Best for

Liquidity providers who want low fees on BNB Chain and the ability to tailor ranges for efficient stablecoin and blue chip pairs, with optional yield stacking through Farms.

Fees and costs

v3 pools use fee tiers of 0.01%, 0.05%, 0.25%, and 1% chosen at pool creation. Trading fees do not auto-compound in v3, and earned fees are claimed from the position page as noted in liquidity pool guidance. Network gas applies to mints, range edits, and removals.

Watch outs

Positions that sit out of range earn no fees until price reenters the chosen band, and concentrated ranges increase exposure to price moves. Basic range setup and management are covered in how to add or remove liquidity.

12. Harvest Finance

Returns Depend on the Underlying Protocols Integrated by each Strategy. Image via Harvest Finance

Returns Depend on the Underlying Protocols Integrated by each Strategy. Image via Harvest FinanceHarvest aggregates deposits into vaults that deploy capital across external protocols and auto compound returns, with product and usage details in the platform docs and live access via the app.

Typical APY ranges: stables 2% to 10%, majors 0.5% to 3%, LST pairs 3% to 8%.

Security

References to third-party reviews and program status are listed under Audits, formal risk notes are maintained in Risks, and the active bug bounty is coordinated through Immunefi.

Best for

Users who want automated strategy selection and compounding across multiple chains without managing individual farm positions, with strategy behavior described in Strategy development.

Fees and costs

Network gas applies to deposits, harvests, and withdrawals. Vault level behavior and performance accounting are documented in Vaults, as shared above. The protocol funds strategy operations and APY tracking, as noted in strategy development, also shared above.

Watch outs

Returns depend on the underlying protocols integrated by each strategy, so external risks and depegging can flow through to vault performance. Historical incidents and mitigations are recorded in Incidents, and pool-level risks are outlined in the Risks section.

13. Beefy

Best for Users who want Automated Strategy Selection and Compounding Across many Chains. Image via Beefy

Best for Users who want Automated Strategy Selection and Compounding Across many Chains. Image via BeefyBeefy aggregates deposits into vaults that deploy capital across external protocols and auto-compound returns, with platform details in the docs and live access through the app.

Typical APY ranges: stables 2% to 10%, majors 0.5% to 3%, LST pairs 3% to 8%.

Security

Audit materials are catalogued in the public audits repository. The project runs a bug bounty and publishes safety guidance, including the Beefy Safety Score.

Best for

Users who want automated strategy selection and compounding across many chains without managing individual farms, with behavior explained in the strategy contract overview.

Fees and costs

Beefy applies a performance fee that is distributed to stakeholders, with a maximum structure of up to 9.5% as outlined in the official fees breakdown. Operational gas costs apply to approvals, deposits, and withdrawals, and new deposits typically require two transactions. Fee batching and distribution mechanics are described under Fee Batch.

Watch outs

Returns depend on the external protocols used by each vault and can change with pool incentives, liquidity depth, and oracle behaviour. Review vault-specific data in the app and consider the risks of underlying pools described throughout the docs before depositing.

14. Synthetix

Synthetix provides Liquidity for Onchain Derivatives, including Perpetual Futures and Synthetic Assets. Image via Synthetix

Synthetix provides Liquidity for Onchain Derivatives, including Perpetual Futures and Synthetic Assets. Image via SynthetixSynthetix provides liquidity for on-chain derivatives, including perpetual futures and synthetic assets. Product coverage is outlined in the Synthetix docs, and the current focus on Mainnet trading is introduced on the homepage.

Typical APY for sUSD via Curve + StakeDAO: ~4%–12%, which varies.

Security

Synthetix publishes audits by independent firms and runs a public bug bounty administered through Immunefi.

Best for

Traders and integrators who want on-chain perps exposure with deep liquidity and SNX stakers who share in protocol fees, as outlined under Products and Staking.

Fees and costs

Trading uses maker and taker fees that adjust with market conditions through dynamic exchange fees and a price impact function documented in perps research. Network gas applies to deposits, trades, and staking actions.

Watch outs

Rewards and incentives can shift with governance programs and market conditions, including periodic trading incentives. sUSD yields depend on external pools described in sUSD staking guides, so stablecoin liquidity and pool health remain important.

15. JustLend

JustLend is TRON’s Official Money Market. Image via JustLend

JustLend is TRON’s Official Money Market. Image via JustLendJustLend is TRON’s official money market. Users supply assets to earn interest and borrow against collateral through on-chain markets documented in the JustLend docs and accessed via the app.

Typical APY ranges: stables 2% to 6%, majors 0.5% to 3%, LST pairs 3% to 6%.

Security

Core risks and mitigations are outlined in Risks. The protocol describes its pricing design under Price Oracle and provides an overview of the Comptroller risk module.

Best for

TRON users who want stablecoin lending and borrowing with low network costs, plus access to native products such as staked TRX and energy rental.

Fees and costs

The protocol does not charge deposit or withdrawal fees. Liquidations follow a close factor of up to 50% per event and apply a liquidation fee to seized collateral. Network costs on TRON are paid in bandwidth and energy, which users can reduce through the Energy Rental feature.

Watch outs

Positions can be liquidated if collateral value drops or debt rises above safe levels, as described in Liquidations. Price integrity depends on the oracle design, and stablecoin depegging or thin liquidity can affect borrow rates and collateral health.

Technical Implementation Guide

This guide focuses on a practical setup that reduces avoidable risk and cost. Think of it as a checklist you can run before each deposit.

With Reliable Data Sources in Place, you can Track Changes and React before Risks Compound. Image via Freepik

With Reliable Data Sources in Place, you can Track Changes and React before Risks Compound. Image via FreepikWallet Approvals and Allowances

Use the smallest approval that still lets the strategy function. Approve per use for higher risk tokens. Approve max only when you will interact often and trust the contract. Review and revoke stale allowances with the Etherscan Token Approvals tool. Where supported, Permit2 can reduce repeated approvals and lower friction.

Gas Optimization

Batch actions in a single session to avoid repeated setup costs. Prefer efficient networks such as Arbitrum, Optimism, and Base for routine farming. Re use stable approvals, then rely on contract workflows rather than fresh approvals each time. Multicall can combine reads and writes in one transaction; see the Maker Multicall reference. Protect large moves from miner extractable value by sending through private relays such as Flashbots Protect.

Cross-Chain Bridges and Risks

Prefer native bridges for canonical assets where available. Understand how messages are passed and how rate limits and circuit breakers are configured. Wrappers and synthetic representations add an additional trust layer. If a bridge holds significant value, treat it like a counterparty and size positions accordingly.

Reading Vault Math

Distinguish APY from APR. Add performance and management fees before comparing offers and consider the effect of compounding frequency. Backtests are informative but assume stable conditions. Favor strategies with transparent fee schedules and clear harvest rules published in product documentation.

Data and APIs

Pull TVL and APY from subgraphs where available, using The Graph. Use protocol SDKs for reliable contract calls. For dashboards and exports, consult Dune docs. Where official feeds are missing, the DeFiLlama API offers broad coverage for monitoring and alerting.

Keep approvals narrow, combine actions to save gas, bridge only when needed, and sanity check the math behind the yield. With reliable data sources in place, you can track changes and react before risks compound.

Risk Management

Treat risk like a preflight check. Confirm what can go wrong, how it appears in your position, and how you will respond.

Confirm what can go Wrong, how it Appears in your Position, and how you will Respond. Image via Freepik

Confirm what can go Wrong, how it Appears in your Position, and how you will Respond. Image via FreepikImpermanent Loss

Impermanent loss is the gap between holding assets and providing them to a pool when prices move.

Example: Deposit one ETH at $2,000 plus 2,000 USDC in a 50/50 pool. If ETH rises to $2,400, you withdraw less ETH and more USDC. Profit may remain, yet it trails buy and hold. Narrow ranges amplify this once the price moves outside the band. Stable-to-stable pools usually show low drift. LST pairs add basis risk whenever the derivative trades away from the underlying.

Smart Contract, Oracle, and Bridge Risk

Audits reduce risk but never guarantee safety. Oracles can be manipulated if markets are thin or updates are delayed. Bridge issues can impact every asset that depends on the bridge, so think in terms of blast radius and size accordingly.

De peg and LST specifics

Watch stablecoin pegs and how they are defended. For instance, crvUSD uses a lending-based stabiliser described in the crvUSD overview. With LSTs, monitor withdrawal queues and validator exits.

Governance and Emissions Risk

Emissions shift with gauge votes and bribes. Protocol parameters change through governance. Track proposals before deploying size.

Operational Playbook

Define position tiers, set stop deposit rules, and choose a harvest cadence that preserves net yield. Keep testing wallets separate and maintain a short runbook for incidents.

Know the mechanism, monitor weak points, and plan exits in advance. This keeps attention on the process rather than on the headline yield.

Strategies to Maximize

Treat these like building blocks. Pick one approach, size it modestly, and add the next only after results match expectations.

Start with Stable Stacks, Add LST Exposure Carefully, and Only then Consider Optimizers and Incentives. Image via Freepik

Start with Stable Stacks, Add LST Exposure Carefully, and Only then Consider Optimizers and Incentives. Image via FreepikStablecoin Stacks (Low risk)

Use deep stable pools on Curve and boost through Convex. Add a cash style core with Maker DSR or Spark. Spread deposits across several baskets so one pool or chain issue does not dominate outcomes.

LST Flywheel (Medium)

Pair Lido stETH or rETH on Curve or Balancer, then layer lending on Aave or boosts via Convex. Track basis and de-peg risk between the LST and its underlying. Keep position sizes smaller than your stable stack.

Auto Compounders (Low to Medium)

Yearn, Beefy, and Harvest can simplify setup and harvesting. Fees trade convenience for time saved, which is often worth it for smaller accounts or multi-chain portfolios.

Incentive Farming (Medium to High)

Target pools with active emissions or bribes. Set timelines before entering and monitor exit liquidity. When incentives fade, rotate rather than waiting for yields to drift lower.

Advanced (High)

Yield tokenization with Pendle, delta-neutral loops that balance borrowing and supplying, and synth perps incentives on Synthetix can lift returns but require strict risk limits and active oversight.

Start with stable stacks, add LST exposure carefully, and only then consider optimizers and incentives. Use advanced tactics when you can monitor them closely.

How to Start Safely

Here's a step-by-step guide on how you tread your chosen platform in a safe manner.

10 Minute Safe Pilot

- Pick a low-fee chain and allocate fifty dollars

- Approve the token once

- Deposit a small amount

- Wait one reward cycle

- Harvest

- Withdraw to the same wallet

- Verify balances after each step and save transaction links

Pre-Deposit Checklist

- Read recent audits and incident notes

- Confirm pool depth and recent volume

- Check the oracle design and historical APY range

- Recreate the fee math, including gas and protocol fees

- Assess de peg risk for stables and LSTs

- Limit allowance to the smallest needed amount

- If bridging, use the canonical route and test with a tiny amount first

Monitoring

- Set alerts for APY changes, TVL shifts, depeg thresholds, and gauge votes

- Keep a simple runbook with links to app, docs, dashboards, and contacts

- Review positions weekly and adjust size or rotate when conditions change

- Start small, confirm each step, keep records, and scale only when the process is smooth.