Kraken is one of the OGs of the crypto exchange world. Known for its strong security, transparent operations, and regulatory compliance, it’s been a go-to for traders since 2011. It’s especially popular among those who appreciate a no-nonsense platform that prioritizes safety over flash.

But let’s be real: No platform can definitively be for everyone, and Kraken isn’t for everyone either.

Some users might find its interface a bit clunky. Others might not be thrilled with the fee structure. And depending on where you live, you might face restrictions or miss out on key features like margin or futures trading. That’s where alternatives come in—platforms that may offer lower fees, more altcoins, slicker interfaces, or fewer geographic limitations.

In this guide, we’ll cover everything from security and fees to user experience and altcoin availability. You’ll get side-by-side comparisons, pros and cons, and clear reasons why certain exchanges might be a better fit for your specific trading style.

What to Look for in a Kraken Alternative?

Thinking of swapping out Kraken? Whether it’s the fees, the interface, or you’re just ready for a change, choosing the right alternative means knowing what actually matters. Here’s what to keep on your radar:

Security Features

Security isn’t a bonus—it’s a basic requirement. In crypto, there are no do-overs after a hack. Look for exchanges that offer:

- Two-Factor Authentication (2FA) for login protection

- Cold wallet storage for keeping most funds offline

- Regular security audits to patch vulnerabilities

- Anti-DDoS protection to prevent downtime from attacks

- If a platform isn’t loud and proud about its security setup, take the hint.

Trading Fees

Fees might seem minor, but they quietly eat away at profits. The key is knowing where they hide. Most platforms charge:

- Maker and taker fees (with better rates for makers)

- Deposit/withdrawal fees, especially for fiat

- Spreads, the silent cost between buy/sell prices

Some exchanges offer fee discounts based on trading volume or native token usage. Always check the full fee schedule—don’t let “0% fees” headlines fool you. Our low-fee crypto exchanges analysis can help you.

Available Cryptocurrencies

Different platforms, different offerings. Make sure the exchange:

- Supports the coins you trade (especially altcoins)

- Has enough liquidity for smooth trading

More isn’t always better—but limited options can cramp your strategy.

Finding the Right Kraken Alternative about Matching the Platform to your Needs. Image via Shutterstock

Finding the Right Kraken Alternative about Matching the Platform to your Needs. Image via ShutterstockUser Experience & Accessibility

You shouldn’t need a tutorial every time you log in. Prioritize platforms that offer:

- Simple, clean interfaces

- Mobile apps that work well on the go

- Fast order execution without the lag

Trading should feel smooth, not stressful.

Regulatory Compliance

Last but not least—rules matter. Choose an exchange that:

- Follows KYC and AML regulations

- Is licensed or registered where it operates

- Has a track record of transparency

Regulation isn’t exciting, but it’s what keeps your funds from disappearing in the next big crackdown.

Top Kraken Alternatives

| Exchange | Best for | Key Features | Pros | Cons |

|---|---|---|---|---|

| Binance | Low fees; advanced trading | Huge liquidity, spot & derivatives trading, BNB perks | Low fees; vast coin selection | Not beginner-friendly; No built-in digital wallet |

| Coinbase | Beginners; regulatory compliance | Simple UI; fiat onramps, insured funds | Easy to use; strong security | High fees; lacks some advanced trading tools |

| Gemini | Security; U.S. regulation | FDIC-insured USD; cold storage; compliance-first | High security; fiat support | Limited coin selection; higher fees |

| Bitfinex | Pro traders; liquidity | Margin, derivatives, advanced order types | High liquidity; low fees for high-volume traders | Not beginner-friendly; past security breaches |

| HTX | Global reach; altcoin selection | 700+ assets, HT token perks, multi-language support | Wide selection; good liquidity | Not available in U.S.; complex interface |

| KuCoin | Altcoin hunters; trading perks | 900+ coins, KCS benefits, trading bots | Massive altcoin variety; low fees | Unregulated; limited fiat support |

| Poloniex | Crypto lending; niche altcoins | Margin & lending, low fees, basic UI | Lots of altcoins; lending options | No fiat trading; past security concerns |

| OKX | Derivatives; futures trading | Futures, perpetuals, staking, low fees | Strong derivatives market; competitive fees | Not available in U.S.; complex for beginners |

| Bitstamp | Simplicity; fiat onramps | Bank transfers, strong compliance, clean UI | Beginner-friendly; easy fiat access | Limited crypto selection; fewer advanced features |

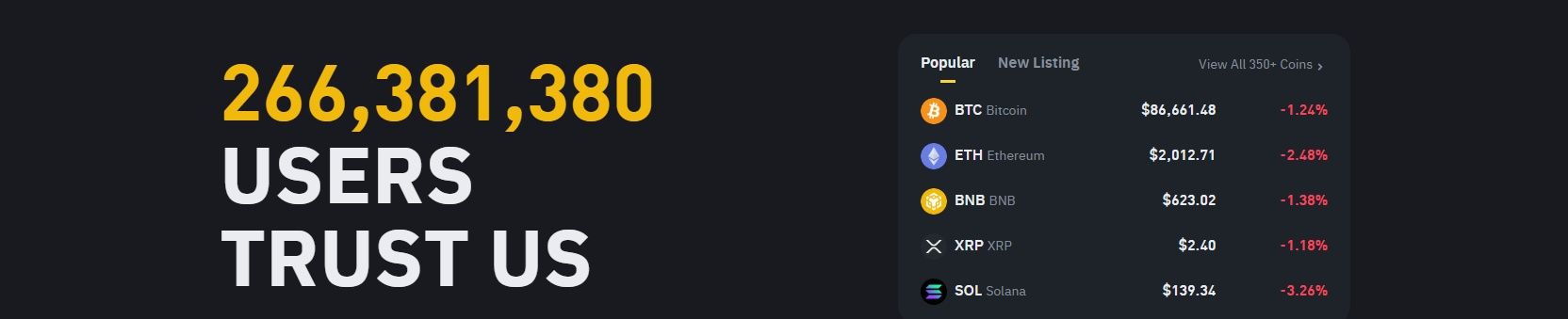

Binance

Binance Offers a Feature-Rich Design Making it a Solid Pick for both Beginners and Experienced Traders. Image via Binance

Binance Offers a Feature-Rich Design Making it a Solid Pick for both Beginners and Experienced Traders. Image via BinanceWhen it comes to cryptocurrency exchanges, Binance often tops the list. Launched in 2017, it quickly grew into one of the biggest and most widely used platforms in the world today. Its mix of accessibility, deep liquidity, and feature-rich design makes it a solid pick for both beginners and experienced traders alike.

Key Features

- Extensive Cryptocurrency Selection: Binance supports hundreds of digital assets, giving traders access to a huge variety of coins and tokens.

- Competitive Trading Fees: Standard fees are low, and traders can get additional discounts by using Binance Coin (BNB) to pay for them.

- High Liquidity: Massive trading volumes across major pairs help users enter and exit positions with minimal slippage.

- Diverse Trading Options: Binance offers spot, margin, futures, and even options trading—ideal for those who want more than just the basics.

- Binance Coin (BNB) Perks: BNB holders enjoy reduced trading fees, access to token launches, and other ecosystem benefits.

Pros

- Low fees, especially when paid with BNB

- Huge variety of supported cryptocurrencies

- Advanced trading tools and multiple order types

- Strong security infrastructure with user protections

Cons

- Not available in the US and UK

- Can be overwhelming for total beginners

- No built-in digital wallet

Why Users Like It

Binance strikes a strong balance between power and flexibility. It’s ideal for traders who want access to a wide range of markets, low fees, and professional-grade tools. While the learning curve can be a bit steep and the regulatory landscape a bit shaky at times, the sheer depth of what Binance offers keeps it at the top of many traders’ lists.

We have Binance covered in great detail right here.

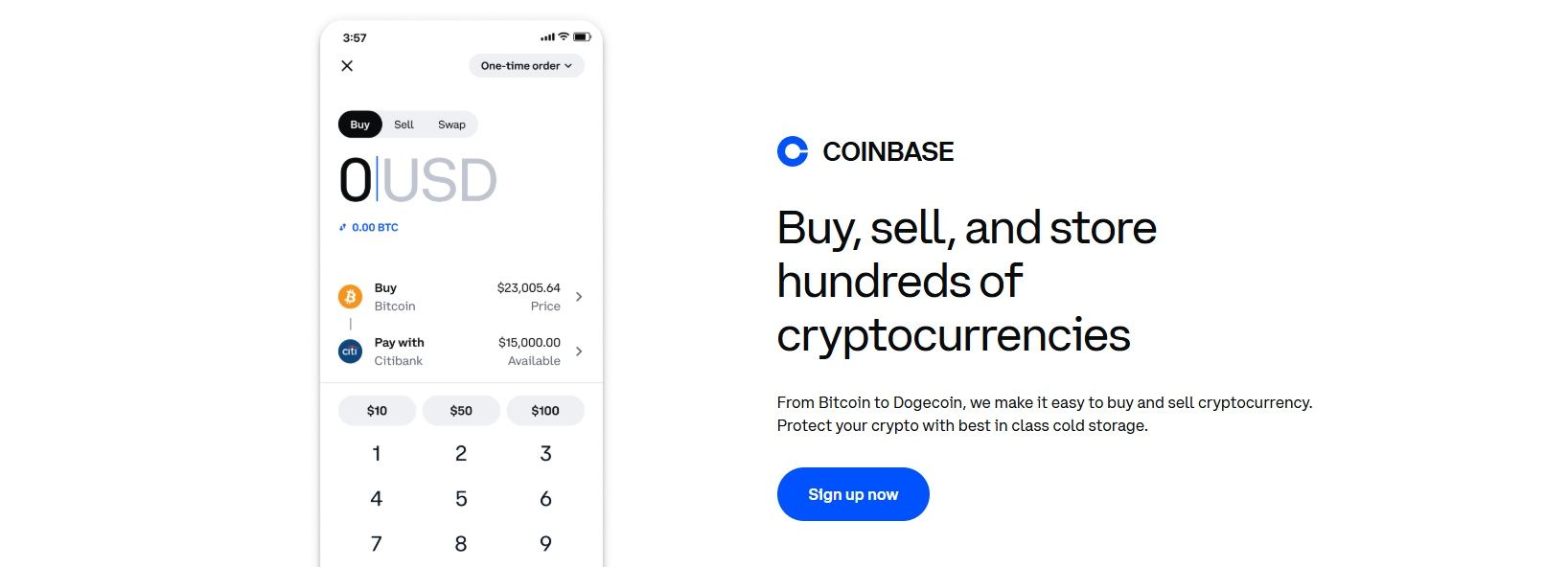

Coinbase

Coinbase has an Intuitive Design and a Commitment to Regulatory Compliance. Image via Coinbase

Coinbase has an Intuitive Design and a Commitment to Regulatory Compliance. Image via CoinbaseFounded in 2012, Coinbase has established itself as one of the most user-friendly and widely recognized cryptocurrency exchanges globally. Its intuitive design and commitment to regulatory compliance have made it a preferred choice for newcomers entering the crypto space.

Strengths

- Regulatory Compliance: Coinbase operates with a strong emphasis on adhering to financial regulations, ensuring a secure and trustworthy platform for its users.

- Fiat Onramps: The platform offers seamless integration with traditional banking systems, allowing users to effortlessly deposit and withdraw fiat currencies.

- User-Friendly Interface: Designed with simplicity in mind, Coinbase provides an easy-to-navigate platform suitable for users at all experience levels.

- Security Measures: Coinbase employs robust security protocols, including two-factor authentication and cold storage solutions, to protect user assets.

Pros

- Simple and beginner-friendly interface

- Helpful educational resources for new users

- Insurance coverage on custodial funds

Cons

- Higher fees compared to many competitors

- Lacks advanced trading features for pros

- Not for those seeking privacy

Why Users Like It

Coinbase's reputation for security, combined with its user-centric approach, makes it a top choice for those new to cryptocurrency. The platform's commitment to regulatory compliance and its comprehensive educational resources further enhance user confidence. While the fees may be higher than some alternatives, many find the ease of use and peace of mind worth the cost.

Do check out our exclusive Coinbase review.

Gemini

Gemini has Carved out a Reputation as a Secure and Regulation-Focused Cryptocurrency Exchange. Image via Gemini

Gemini has Carved out a Reputation as a Secure and Regulation-Focused Cryptocurrency Exchange. Image via GeminiLaunched in 2015 by Cameron and Tyler Winklevoss, Gemini has carved out a reputation as a secure and regulation-focused cryptocurrency exchange. Headquartered in New York, it offers a user-friendly platform that appeals to both novices and seasoned traders.

Security and Compliance Benefits

Gemini places a strong emphasis on security and regulatory adherence:

- Regulatory Compliance: As a New York trust company, Gemini is subject to stringent regulatory oversight, ensuring a high standard of operational integrity.

- Robust Security Measures: The platform employs two-factor authentication (2FA), supports hardware security keys, and utilizes cold storage for the majority of digital assets, safeguarding them from potential online threats.

- Insurance Coverage: Gemini provides insurance for digital assets held in their online hot wallet, offering users an added layer of protection against potential breaches.

Pros

- Clean, user-friendly interface

- Easy fiat-to-crypto support

- Solid educational content for beginners

Cons

- Smaller selection of supported cryptocurrencies

- Higher fees, especially on smaller trades

- Lower staking rewards

Why Users Like It

Gemini's strong commitment to security and regulatory compliance instills confidence among its users. The intuitive interface and educational resources make it an attractive option for those new to the cryptocurrency space. While the selection of cryptocurrencies is somewhat limited and fees are on the higher side, many users find the platform's security features and user-centric approach to be compelling reasons to choose Gemini as their preferred exchange.

We have Gemini covered in detail right here.

Bitfinex

Bitfinex is a Favorite Among Pros for its Precision, Flexibility, and Depth. Image via Bitfinex

Bitfinex is a Favorite Among Pros for its Precision, Flexibility, and Depth. Image via BitfinexBitfinex is one of the oldest active crypto exchanges, launched in 2012 and built with professional traders in mind. It’s known for its deep liquidity, powerful trading tools, and an interface designed for people who know what they’re doing.

High Liquidity and Advanced Trading

Bitfinex handles large volumes, especially in BTC and ETH pairs. That liquidity means less slippage on big trades—a major plus for active traders. The platform also offers:

- Margin trading with up to 10x leverage: Amplify your positions by borrowing funds, potentially increasing gains (but also risk) when trading volatile assets.

- Derivatives and perpetual contracts: Trade on future price movements of assets without holding the underlying tokens—ideal for hedging or strategic speculation.

- Advanced order types: Use tools like trailing stop to follow market trends, fill-or-kill to avoid partial orders, and iceberg orders to hide large trades for strategic execution.

- OTC trading for high-value private deals: Execute large trades directly with counterparties without affecting public market prices—useful for institutions or high-net-worth traders.

- API support for custom strategies and bots: Integrate your own trading algorithms or third-party bots for hands-free, programmable trading with full platform access.

Pros

- Excellent liquidity on major pairs

- Wide range of trading features

- Competitive, volume-based fees

- API access for algorithmic traders

Cons

- Not beginner-friendly—steep learning curve

- History of past security breaches

- Limited fiat currency options

Why Users Like It

Bitfinex is a favorite among pros for its precision, flexibility, and depth. It’s not the hand-holding kind of platform, but if you’re looking for control and performance, it’s one of the best in the game.

HTX

HTX Serves Millions of Users Across more than 160 Countries. Image via HTX

HTX Serves Millions of Users Across more than 160 Countries. Image via HTXEstablished in 2013 as Huobi, HTX has rebranded and continues to be a significant player in the cryptocurrency exchange arena. Headquartered in Seychelles, HTX serves millions of users across more than 160 countries, offering a comprehensive platform known for its deep liquidity and diverse asset offerings.

Global Reach and Asset Availability

HTX distinguishes itself with a broad selection of cryptocurrencies and robust international support:

- Extensive Cryptocurrency Selection: Offers over 700 digital assets, encompassing major tokens and a variety of altcoins.

- Fiat Currency Support: Facilitates transactions in multiple fiat currencies, including USD, EUR, AUD, and HKD, enhancing accessibility for a global user base.

- Multilingual Platform: Provides localized versions of its interface in several languages, catering to users from diverse regions.

- HTX Token (HT): The platform's native token offers several benefits:

- Trading Fee Discounts: Holders can enjoy reduced fees on transactions.

- Exclusive Event Access: Grants entry to special events and promotions.

- Governance Participation: Enables involvement in decision-making processes within the HTX ecosystem.

Pros

- Wide selection of cryptocurrencies across categories

- High liquidity for smoother trade execution

- Variety of trading options including futures, margin, and bots

Cons

- Not available in certain regions, including the U.S.

- Interface can be overwhelming for new users

Why Users Like It

HTX appeals to traders seeking a platform with a vast selection of cryptocurrencies and comprehensive trading tools. Its global reach and multilingual support make it accessible to a diverse audience. While new users may need time to familiarize themselves with the platform's extensive features, many appreciate the opportunities it provides for diversified trading and investment strategies.

Check out our detailed review of HTX right here.

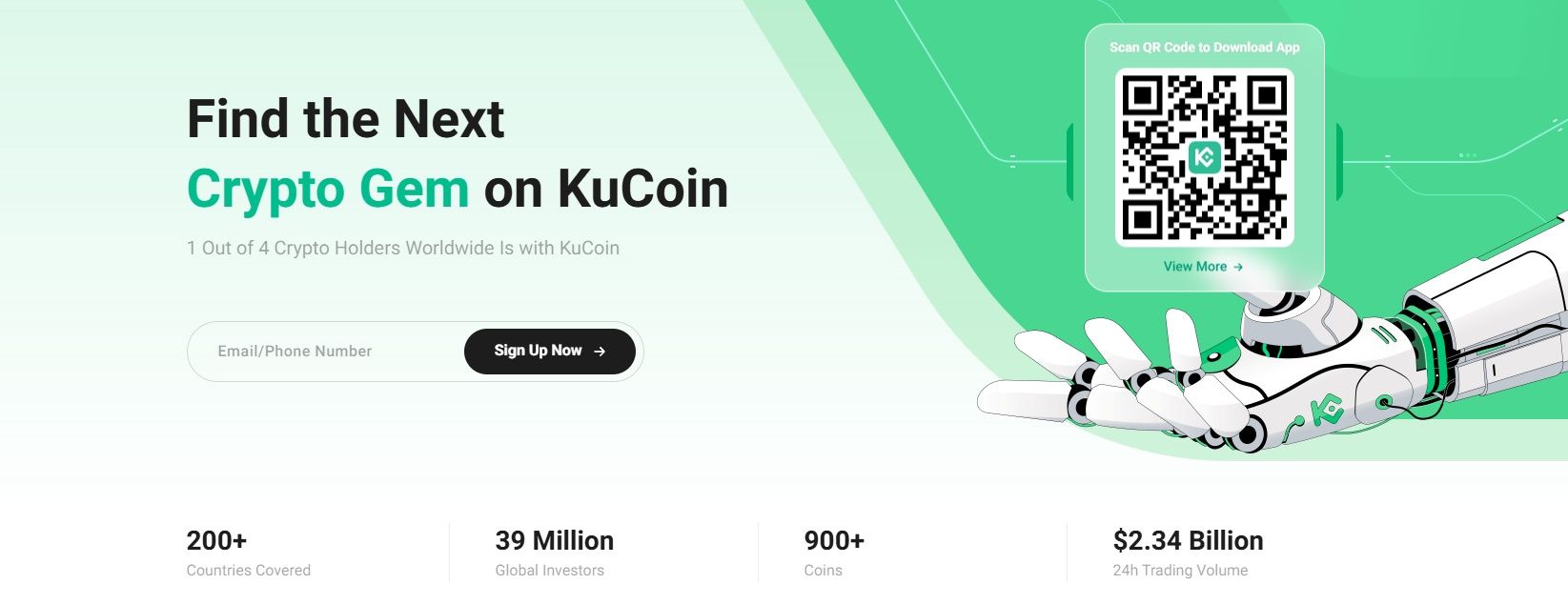

KuCoin

KuCoin has an Extensive Range of Supported Assets and User-Centric Features. Image via KuCoin

KuCoin has an Extensive Range of Supported Assets and User-Centric Features. Image via KuCoinKuCoin, established in 2017, rapidly gained recognition as a comprehensive cryptocurrency exchange, particularly favored by altcoin enthusiasts. Its extensive range of supported assets and user-centric features make it one of the top players in the crypto trading landscape.

Altcoin Selection and KuCoin Shares Benefits

KuCoin stands out for its impressive selection of cryptocurrencies, offering access to over 900 different digital assets. This vast array includes many hard-to-find altcoins, making it a go-to platform for traders seeking diverse investment opportunities.

The platform's native token, KuCoin Shares (KCS), provides several advantages to its holders:

- Reduced Trading Fees: Users can enjoy lower trading fees by holding KCS tokens.

- Profit Sharing: KCS holders receive a portion of the trading fee revenue generated by the exchange.

- Participation in Token Sales: Holding KCS grants access to exclusive token sales and promotions on the platform.

These benefits enhance the overall trading experience and incentivize user engagement within the KuCoin ecosystem.

Pros

- Huge selection of altcoins and trading pairs

- Low trading fees with extra discounts via KCS

- Margin, futures, and leverage trading available

- Beginner-friendly interface with pro-level tools

Cons

- Unregulated, which may raise compliance concerns

- Limited options for fiat deposits and withdrawals

Why Users Like It

KuCoin's extensive selection of altcoins and innovative features appeal to traders looking to diversify their portfolios beyond mainstream cryptocurrencies. The benefits associated with KuCoin Shares further enhance its attractiveness, offering financial incentives and exclusive opportunities. While there are areas for improvement, such as regulatory compliance, many users find the platform's offerings align well with their trading needs.

Do check out our detailed KuCoin review.

Poloniex

Poloniex Serves Traders Worldwide with a Solid Lineup of Altcoins and Trading Features. Image via Poloniex

Poloniex Serves Traders Worldwide with a Solid Lineup of Altcoins and Trading Features. Image via PoloniexPoloniex has been around since 2014, making it one of the earlier players in the crypto exchange scene. Originally U.S.-based, it has since shifted its focus to global markets and now serves traders worldwide with a solid lineup of altcoins and trading features.

Margin Trading and Lending Options

Poloniex caters to more advanced users with features that go beyond simple spot trading:

- Margin trading allows users to trade with leverage—boosting their buying power and potential returns (but also the risk).

- Cross-margin support means users can tap into their entire account balance to maintain positions, reducing liquidation risk.

- Crypto lending enables users to lend out their assets to margin traders and earn interest—essentially putting idle tokens to work.

- These features are baked into the platform, offering ways to either amplify trades or earn passive income depending on your strategy.

Pros

- Large selection of altcoins

- Low trading fees

- Built-in margin and lending options

Cons

- No direct fiat trading options

- History of security breaches

Why Users Like It

Traders who want access to a wide range of tokens and like having the option to borrow or lend within the platform find Poloniex a handy tool. It’s not the flashiest exchange, but for the right user, it checks a lot of the right boxes.

Check out our review of Poloniex here.

OKX

OKX is Renowned for its Extensive Range of Cryptocurrencies and Innovative Features. Image via OKX

OKX is Renowned for its Extensive Range of Cryptocurrencies and Innovative Features. Image via OKXOKX, established in 2016 and headquartered in Seychelles, has rapidly become a prominent cryptocurrency exchange, offering a comprehensive suite of trading services to a global user base. The platform is renowned for its extensive range of cryptocurrencies and innovative features, catering to both novice and experienced traders.

Derivatives and Futures Trading Advantages

OKX stands out in the derivatives market by providing a variety of trading options designed to meet diverse trading strategies:

- Futures Contracts: Traders can engage in futures trading with various cryptocurrencies, allowing them to speculate on the future price movements of digital assets.

- Perpetual Swaps: These contracts enable traders to hold positions indefinitely without an expiry date, offering flexibility in trading strategies.

- Options Trading: OKX offers options contracts, providing traders with the right, but not the obligation, to buy or sell an asset at a predetermined price, facilitating advanced hedging strategies.

- Leverage Opportunities: The platform supports leveraged trading, allowing users to amplify their positions and potential returns, though it's important to note that this also increases risk.

These features are complemented by OKX's robust trading engine, which ensures high-speed trade execution and deep liquidity, enhancing the overall trading experience.

Pros

- Extensive Cryptocurrency Selection

- Competitive Fee Structure

- Advanced Trading Features like spot, margin, and a variety of order types.

- Features like staking, savings, and DeFi services

Cons

- Not available in certain jurisdictions, including the United States

- Complexity for beginners

- Limited Fiat Withdrawal Options

Why Users Like It

OKX appeals to traders seeking a comprehensive and feature-rich platform that supports a wide range of cryptocurrencies and advanced trading options. Its competitive fees and innovative financial products make it attractive to those looking to maximize their trading strategies and investment opportunities. However, potential users should consider the platform's complexity and regional availability to ensure it aligns with their trading needs and experience level.

We have a lot more on OKX right here.

Bitstamp

Bitstamp a Reputation for Reliability, Regulatory Compliance, and being Beginner-Friendly. Image via Bitstamp

Bitstamp a Reputation for Reliability, Regulatory Compliance, and being Beginner-Friendly. Image via BitstampBitstamp is one of the oldest active cryptocurrency exchanges, founded in 2011. Based in Luxembourg, it has built a reputation for reliability, regulatory compliance, and being beginner-friendly. For many users, it's a trusted bridge between traditional finance and the crypto world.

Legacy Exchange and Fiat-Friendly Trading

Bitstamp keeps things simple—but solid. It’s a platform that doesn’t try to be everything, but what it does, it does well.

- Long-standing reputation: With over a decade of continuous operation, Bitstamp has proven it can weather crypto’s wild ups and downs. That kind of track record builds serious trust.

- Fiat support: It’s one of the few exchanges that still makes it easy to move money in and out via traditional methods—bank transfers, credit cards, and support for major currencies like USD, EUR, and GBP.

- Regulatory compliance: Bitstamp is fully licensed in the EU and the U.S., which adds a layer of security and peace of mind for users who care about operating within legal frameworks.

- Easy-to-use interface: The platform is clean and intuitive, with a layout that’s welcoming to beginners but still functional enough for everyday trading.

It may not be the flashiest exchange out there, but Bitstamp’s no-nonsense, regulation-first approach is exactly what many traders—especially those coming from the traditional finance world—are looking for.

Pros

- Trusted, long-established exchange

- Smooth fiat on/off-ramps

- Strong regulatory track record

Cons

- Limited number of listed cryptocurrencies

- Basic tools may not satisfy advanced traders

- Experienced a hack in 2015 (has since upgraded security)

Why Users Like It

Bitstamp is a go-to for anyone who wants a clean, secure, and straightforward trading experience—especially if they’re working with fiat. It’s not loaded with exotic altcoins or complex tools, but for reliability and ease of use, it’s tough to beat.

We have Bitstamp covered in detail right here.

Reasons To Look For An Alternative To Kraken

Kraken has built a solid name for itself in the crypto space—and for good reason. It’s secure, has a decent variety of assets, and caters well to both retail and institutional traders. But even the best exchanges aren't one-size-fits-all. Here’s why some users might be shopping around for a Kraken alternative.

1. Trading Fees

While Kraken’s fees are competitive, especially on Kraken Pro, casual users on the main platform might find the fee structure a little high compared to low-cost rivals like Binance or OKX. If you're not trading at high volumes, those costs can add up.

2. User Experience

Kraken is feature-rich, but its interface can feel a bit clunky or outdated, particularly for beginners. Some users report that the learning curve is steeper than necessary, especially when compared to platforms like Coinbase or Bitstamp.

Even the Best Exchanges aren't One-Size-Fits-All, and Kraken also has some Limitations for Some. Image via Shutterstock

Even the Best Exchanges aren't One-Size-Fits-All, and Kraken also has some Limitations for Some. Image via Shutterstock3. Limited Altcoin Exposure

Kraken covers most major assets, but when it comes to trending or low-cap altcoins, it’s not always the first to list them. Traders looking to explore newer tokens often find better selection on exchanges like KuCoin or HTX.

4. Geographic Restrictions and Compliance

Depending on your location, you might encounter limited access to Kraken’s services. As global regulations evolve, some features (like margin or futures) may not be available in your region.

5. Withdrawal Delays and Verification Times

Some users have expressed frustration over slow withdrawal processing or lengthy identity verification during account setup—issues that could push them to seek a smoother experience elsewhere.

At the end of the day, Kraken is still a solid platform—but it’s not the perfect fit for everyone. Whether it’s about fees, functionality, or flexibility, exploring alternatives can help you find a trading experience that better matches your style and priorities.

How to Choose the Right Exchange for You

Picking a crypto exchange isn’t just about going with the biggest name or the one that offers the most coins—it’s about choosing the one that fits you. Think of it like picking a gym. Some people want all the machines and classes, while others just need a squat rack and some peace and quiet. Same goes for trading platforms.

Assessing Personal Trading Needs

Start by asking yourself: what kind of trader are you? Are you brand new and just want to buy Bitcoin and let it sit? Or are you an active trader jumping between altcoins, futures, and leveraged plays?

If you're a beginner, prioritize user-friendliness, strong fiat support, and educational content. If you're more advanced, you'll likely want access to detailed charts, order types, leverage options, and a broad selection of coins. There’s no wrong answer—just what works best for your goals.

Comparing Fee Structures

Fees matter more than most people think—especially if you're trading often or working with smaller amounts. Look for:

- Maker vs. taker fee rates

- Discounts via native tokens (like BNB or KCS)

- Hidden costs like spreads and withdrawal charges

Over time, even small fee differences can really add up, so don’t overlook this part.

Checking Withdrawal/Deposit Methods

Not all exchanges make it easy to get your money in or out. Some are crypto-only, while others let you connect your bank, use a card, or even support PayPal. Check:

- Which fiat currencies are supported

- Deposit/withdrawal fees and limits

- Processing times for different methods

If your preferred method isn’t supported—or takes days to process—it’s going to get frustrating fast.

Final Thoughts

Kraken is solid, but it’s not the only fish in the crypto sea. Whether you’re after lower fees, a bigger altcoin menu, or just a cleaner interface that doesn’t make you squint, there are plenty of great alternatives out there.

Binance brings the firepower for active traders with low fees and tons of features. Coinbase shines with simplicity and regulatory credibility, perfect for beginners. Gemini’s all about security, while KuCoin and HTX go all-in on altcoin variety. Bitstamp? Great for fiat-friendly folks who like to keep it simple. The point is, there’s something for everyone.

The best exchange for you depends entirely on your needs—how you trade, what you trade, and what you expect from a platform. There’s no universal “winner,” just the one that fits your style like a well-worn hoodie.

So take your time. Compare features. Check out fee structures. Think about ease of use, asset selection, and security. The more you align an exchange with your goals, the better your trading experience will be.