Launchpads have traditionally served as structured intermediaries between early-stage crypto projects and retail investors. A typical process involves teams applying for listing, undergoing due diligence, either by centralized teams or DAOs, and getting community-backed support via staking. Investors gain early access to tokens and, if the project succeeds post-TGE, potentially reap significant returns.

Memecoin launchpads, however, operate on an entirely different logic.

Instead of emphasizing fundamentals or utility, these platforms are optimized for speed, virality, and speculative trading. The barriers are minimal. There’s often no vetting, no team disclosure, and no roadmap beyond price action. Many of these platforms thrive on chains like Solana, where low fees and fast finality allow rapid token creation and high-volume meme trading.

This article profiles the most prominent memecoin launchpads, breaking down how they work, what sets them apart, and how you can participate, while understanding the risks that come with trading in the “wild west” of crypto.

Key Takeaways

- The top memecoin launchpads in 2025 are Pump.fun, SunPump, Moonshot and Four.meme, each offering different trading experiences across Solana, TRON, and BNB Chain.

- Memecoin launchpads prioritize speed and virality over utility or fundamentals, allowing tokens to go viral purely on memes, momentum, and community engagement.

- No-code token creation, bonding curves, and fair launch models make memecoin launchpads easy to use for anyone, regardless of technical background.

- Trading memecoins carries extreme volatility and high risk, with frequent rug pulls and tokens often crashing shortly after launch.

- To participate, users need a compatible non-custodial wallet, a small amount of native chain tokens, and the ability to act quickly in fast-moving markets.

What is a Memecoin Launchpad?

Memecoin launchpads flip the script on what launch platforms are traditionally meant to do. In conventional setups, launchpads act as intermediaries connecting early investors with promising blockchain projects through structured, often DAO-driven, due diligence. The process filters serious projects, allocates tokens via staking, and rewards supporters if the project performs well after launch.

Memecoin launchpads abandon that model entirely.

Instead of focusing on fundamentals or long-term growth, these platforms prioritize speculation. The goal isn’t to back innovation, but to capture attention, ride trends, and spin up tokens that might 100x purely on momentum.

Most memecoins launched this way follow the same trajectory: pump, dump, then obscurity. But for participants, it’s not about sustainable ecosystems, it’s about fast, viral plays where the line between gambling and investing gets blurry.

Purpose and Role in the Crypto Ecosystem

Memecoin launchpads are user-friendly web apps designed for quickly deploying meme-inspired tokens with minimal friction. Deployers often require no coding experience, and costs from blockchains like Solana, Tron or BNB Chain, where this model thrives. The ethos is that anyone can spin up a token in under a minute and capitalize on cultural moments like memes, jokes, or societal trends.

Their role in the crypto-ecosystem depends on what such launchpads represent for different individuals in the crypto space. Critics view them as a platform rife with scams and rug pulls. Technical enthusiasts view them as an example of a chain’s responsiveness and ability to handle traffic, while proponents argue they embody crypto’s permissionless and trustless spirit.

How Memecoin Launchpads Work

While memecoin launchpads thrive on the “casino” dynamic and rely on the chance of disproportionate gains, they foster an automated model that emphasizes fair launches. The core objective is to provide equal access to a token for everyone, although risks persist once trading begins.

Since Its Launch in February, the TRUMP Memecoin Has Dumped 90% | Image via CoinGecko

Since Its Launch in February, the TRUMP Memecoin Has Dumped 90% | Image via CoinGeckoDrawing from benchmarks like Pump.fun, here is a common mechanic of how they typically work:

Token Generation and Setup

Anyone can initiate a token launch without community approval or expertise. Typical steps involve:

- Creating a wallet

- Uploading a meme or graphic, the face of your memecoin

- Add basic details like a name, symbol, and a short description.

- Tokenomics and supply are platform-dependent, often fixed at 1 billion for simplicity.

After these inputs, the platform deploys a smart contract for your token and initiates a bonding curve. Deployment fees are minimal; usually $1-5 covers platform + blockchain gas fees in its native token.

Token Distribution

Launchpad’s distribution differs significantly from independent memecoins and adds more credibility. Independent memecoins often scam owners by having promoters control a major supply dump on buyers upon launch.

In contrast, Memecoin launchpads ensure fair launch: no presales, no whitelists, no pre-mints. Creator might receive a small initial airdrop or a share of trading fees, but the incentive is always public knowledge, regardless.

On-chain Trading

Memecoin trading begins immediately upon launch on the launchpad itself, often against the base chain’s token (like SOL), creating a bond-curve and enabling price discovery.

The Bond Curve:

As users buy more tokens, the protocol mints new units. Sells reverse this process, burning tokens, lowering the price, and refunding funds. This system creates instant liquidity and avoids needing deep liquidity pools.

If a token hits a certain threshold (e.g. $1M market cap or $10,000 price), it “graduates”: accumulated funds create a liquidity pool on a DEX like Raydium or SunSwap, amplifying discovery and potentially volatility.

The Bond Curve: As users buy more tokens, the protocol mints new units. Sells reverse this process, burning tokens, lowering the price, and refunding funds. This system creates instant liquidity and avoids needing deep liquidity pools. If a token hits a certain threshold (e.g. $1M market cap or $10,000 price), it “graduates”: accumulated funds create a liquidity pool on a DEX like Raydium or SunSwap, amplifying discovery and potentially volatility.

Bond Curve Progress Shows TVL Required To Graduate | Image via Pump.fun

Bond Curve Progress Shows TVL Required To Graduate | Image via Pump.funMemecoin launchpads enable price discovery without deep order books and make memecoin trading more equitable. Still, this space is prone to manipulation and rugs to the point where it may be its core feature that attracts many speculators.

Criteria for Evaluating a Memecoin Launchpad

In a market where hype and social momentum can make or break a token’s trajectory, choosing the right memecoin launchpad starts with one of the most visible signals: follower count on X. A large follower base doesn’t guarantee quality, but it does suggest the platform has reach. It's everything in the memecoin game. When visibility translates into virality, early traction can snowball into real volume.

Launchpads Have Standardized Trading Memecoins | Image via Webopedia

Launchpads Have Standardized Trading Memecoins | Image via WebopediaThat said, follower count is just the entry filter. Above that threshold, a few deeper criteria matter more:

Community Engagement and Virality

This is the heart of a memecoin launchpad’s value. Platforms that consistently attract and retain users are measured through active users, Telegram/Discord activity, social mentions, and integrations with meme-savvy influencers, which are far better positioned to help tokens go viral. Memecoins don’t grow through utility or product; they grow through attention. The platform must not just enable launches but amplify them.

Launch Activity and Trading Volume

Volume is a proxy for life. The more tokens launched and traded daily, the more vibrant the ecosystem. Key indicators here are weekly token launch counts, daily trading volume, and on-chain transaction numbers. A prominent level of launch activity suggests that creators trust the platform and that users are actively speculating. It also means more liquidity for new tokens and a healthier feedback loop between traders and projects.

Security and Fairness Features

Memecoin trading is inherently volatile, but the platform shouldn’t stack the odds unfairly. Bonding curves should be designed to prevent manipulation while still allowing early momentum. Mechanisms to “graduate” successful tokens to external DEXs help ensure deeper liquidity and longer lifespan. Creator wallet locks, fair distribution rules (no presales or team allocations), and basic anti-rug protections are critical. Some platforms also implement smart contract audits or public dashboards to flag suspicious behavior.

Fees and Accessibility

The barrier to entry needs to be low, both technically and financially. Platforms should offer no-code token creation that anyone can use without prior knowledge. Launch fees and trading fees must be minimal, often under $5 in native gas, to keep the system viable for mass participation. On chains like Solana, this is feasible. But on higher-cost chains, fee structures can severely limit memecoin experimentation. A good launchpad keeps both gas and friction low.

Top Memecoin Launchpads in 2025

Here is a table summarizing the key details about them:

| Launchpad | Chain | Followers (X) | Token Creation Cost | Trading Fee | Volume (Peak / Current) | Unique Features |

|---|---|---|---|---|---|---|

| Pump.fun | Solana | 500K+ | Free | 1% (buy/sell) | $3.3B peak / $146M weekly | Raydium migration, viral origin stories |

| SunPump | TRON | 359K | 20 TRX | 1% (buy/sell) | $25M peak / ~$50K daily | Auto DEX seeding to SunSwap, sharp decline in activity |

| Moonshot | Solana | 175K | 0.5% (drops to 0.3%) | $12B monthly (April, unverified) | Mobile-only, Apple Pay & Face ID integration | |

| Four.Meme | BNB Chain | 276K | 0.005 BNB (~$1.5–2) | 0.5%–2% (configurable) | $489M+ top token / ~500 launches daily | Custom bonding curves, PancakeSwap migration, prior hacks |

1. Pump.fun

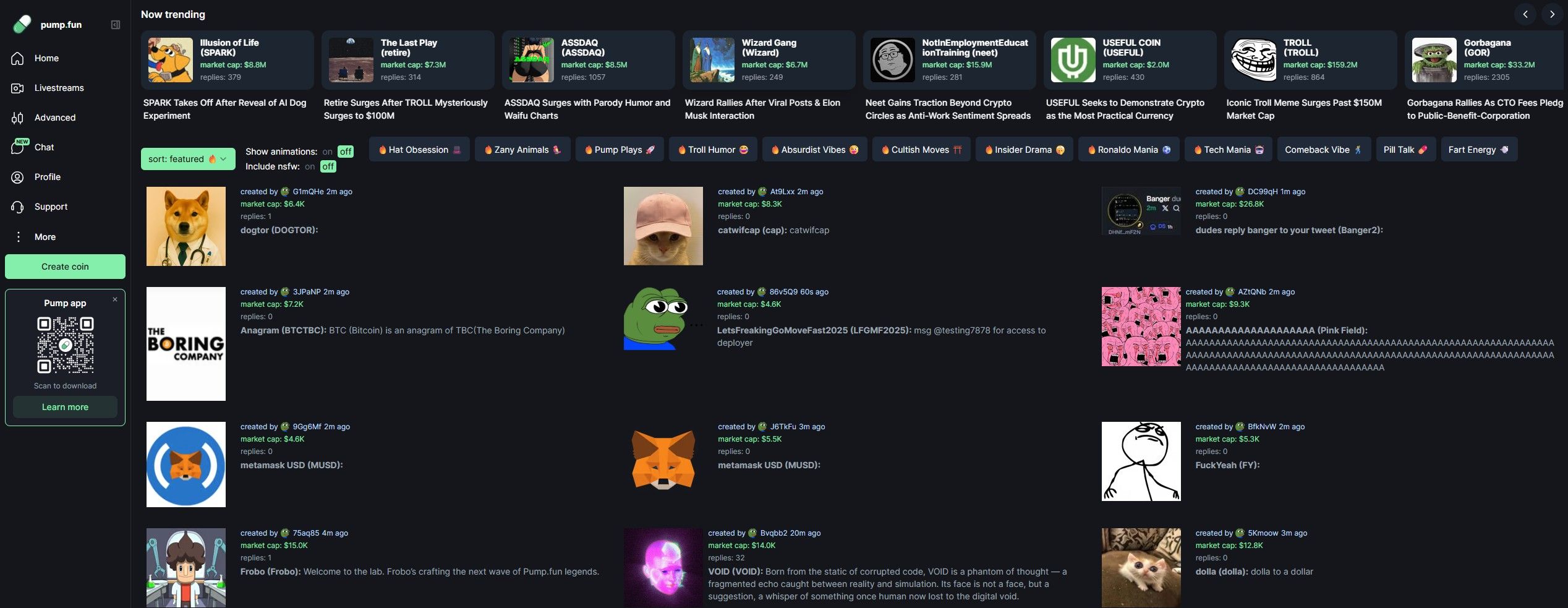

Pump.fun is the launchpad that put memecoins on the map in 2024 and cemented its dominance in early 2025. Built on Solana, it pioneered the "no-code fair launch" model that now defines the entire category. With over 500,000 followers on X and a sprawling community across Telegram and Discord, Pump.fun became the default entry point for anyone looking to gamble on the next viral coin.

Part of what made Pump.fun iconic was the wave of culturally tuned, absurdist tokens that exploded from its platform. Coins like $MICHAEL, inspired by a random Solana dev, or $NAFO, spun out from a pro-Ukraine meme movement, captured the internet’s attention and briefly pulled in seven-figure trading volumes. Even $BONKKILLER, a satirical jab at the BONK ecosystem, managed to rack up enough traction to graduate to a DEX listing on Raydium. The fact that these tokens could go from idea to viral in hours with no VCs, no team bios, no whitepapers was exactly the point.

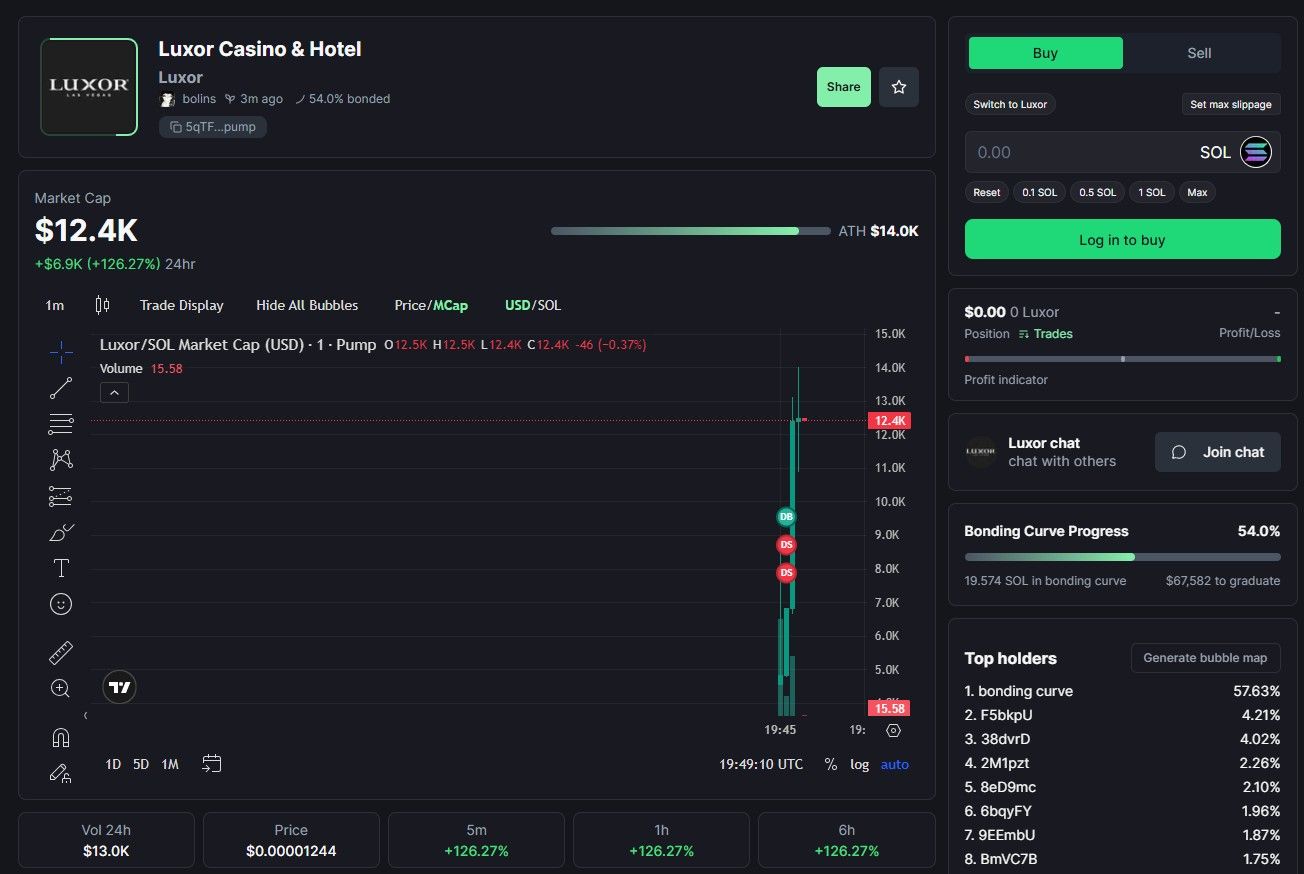

A Look at The Pump.fun Launchpad | Image via Pump.fun

A Look at The Pump.fun Launchpad | Image via Pump.funAt its peak in December 2024, Pump.fun saw a staggering $3.3 billion in weekly trading volume. Even in a cooled market, it continues to process over $140 million weekly, a testament to its staying power as a memecoin casino built on rails.

Creating a token on Pump.fun is free. Anyone can generate a coin with a meme image and basic info in under a minute. Trading, however, carries a 1% fee collected on both buys and sells, which sustains the platform. Tokens that reach a predefined threshold (usually $69,000 in bonded value) “graduate” to a liquidity pool on Raydium, enabling broader trading and bot integrations.

Pump.fun didn’t just launch memecoins; it launched a movement.

✅ Pros

- Most recognized memecoin launchpad, with over 500K X followers and strong brand recognition in the Solana ecosystem.

- No-code, frictionless token creation, allowing anyone to launch a coin in under a minute.

- Fair launch model with no presales or team allocations, creating a level playing field.

- Graduation to Raydium DEX provides deeper liquidity for successful tokens.

- Consistently high trading activity, with weekly volumes still above $140M.

❌ Cons

- Oversaturated ecosystem, with the majority of tokens failing to sustain beyond the initial hype.

- Minimal safeguards against scams or low-effort projects, rug pulls are common.

- Lack of project curation makes it difficult for new users to filter credible tokens.

2. SunPump

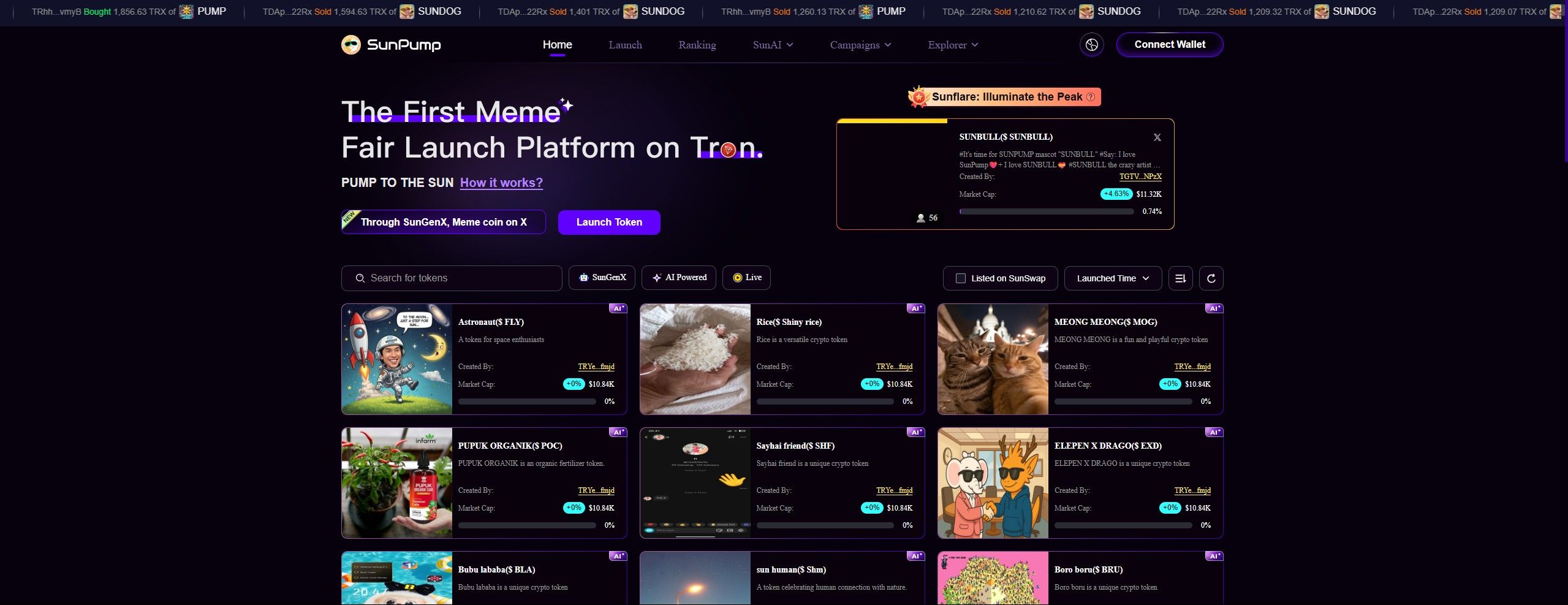

SunPump launched in mid-August 2024 as TRON’s first memecoin launchpad, spearheaded by Justin Sun and his SUN.io team. It boasts over 359,000 million followers on X, positioning it among the most visible launchpads outside Solana.

Notable memecoins on SunPump include SUNDOG, which soared to a ~$53 million market cap within eight hours of launch, along with SUNCAT, Fofar, Tron Bull (TBULL), and Tron Inu (TINU), all gaining significant traction post-launch.

Performance Metrics

At its peak in August 2024, SunPump reached approximately $25 million in volume and saw over 7,350 token launches in a single day (per DappRadar), generating around $585,000 in revenue in just over a week, and briefly surpassing Pump.fun in token creation. However, activity has drastically declined: by mid‑2025, daily volume has dwindled to roughly $50K+ per day with only 377 active wallets interacting, highlighting a sharp drop-off in user engagement.

Sunpump UI Seems Inspired By Pump.fun | Image via Sunpump

Sunpump UI Seems Inspired By Pump.fun | Image via SunpumpToken Launch Mechanics & Fees

SunPump follows a no-code fair launch model:

- Creation is a one-time fee (~20 TRX).

- Trading incurs a 1% fee on both buys and sells, paid in TRX.

- When a token hits 100% bonding curve threshold, it is auto‑seeded into SunSwap V2 liquidity pool, with ~3,000 TRX deducted to cover costs.

- No presales or insider allocations, tokens mint progressively as users buy via the bonding curve.

✅ Pros

- Massive visibility on TRON backed by a strong X presence (~359K followers).

- Rapid token creation and liquidity migration via automated mechanics.

- Built on TRON’s low-fee, high-throughput infrastructure, making minting and trading fast and cheap.

❌ Cons

- Explosive early activity reversed into a sharp decline: from millions in volume to just $50K+/day and minimal active users.

- Ecosystem oversaturation, the vast majority of tokens fail to gain traction, and very few graduate to DEX liquidity on Sunswap.

- Persistent risk of rug pulls and manipulation despite fair launch design, especially in a low-volume, low-transparency environment.

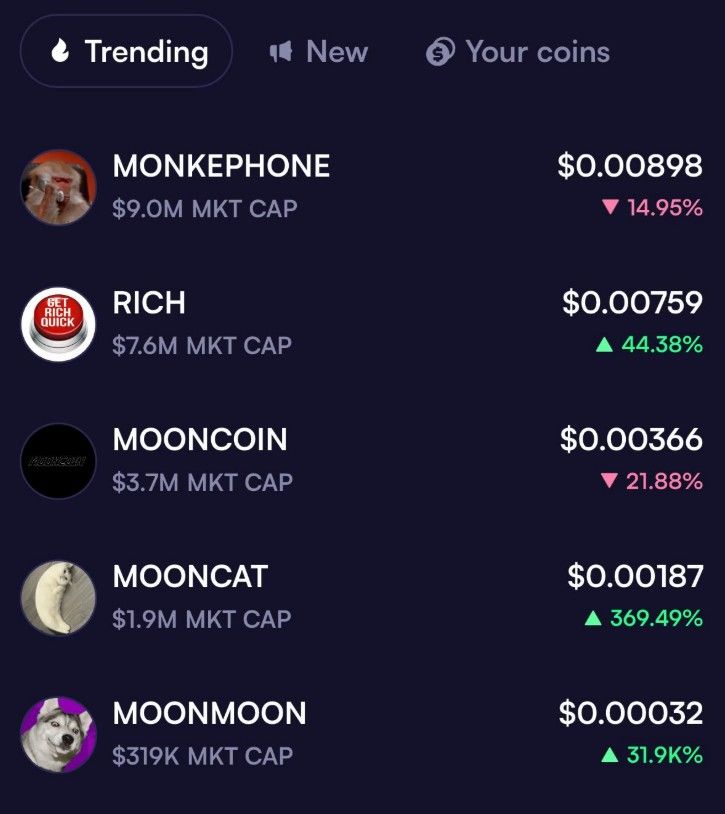

3. Moonshot

Moonshot is a Solana‑based memecoin launchpad that differentiates itself by operating exclusively on smartphones, with no web interface available. Since its debut in June 2024, the platform has drawn roughly 175K followers on X, positioning it as a prominent mobile-only competitor on Solana.

Unlike Pump.fun, technical metrics for Moonshot are scarce; details on launch velocity, active users, or token count aren’t widely tracked by the community. Still, a source cited that Moonshot reached a staggering $12 billion in monthly trading volume on Solana in April 2025, though independent verification is limited. The platform charges a 0.5% trading fee, which decreases to 0.3% after the token reaches bonding status, and creators earn up to half of swap fees post-bonding.

Moonshot is a Mobile-Only Platform | Image via X

Moonshot is a Mobile-Only Platform | Image via XMechanics & User Experience

Moonshot is tailored for mobile-first users:

- Token creation is simplified entirely via the app: upload an image, name the token, pay a fee (e.g., 0.02 SOL / ~$3) and launch directly from your phone.

- No presales or insider allocations; tokens launch via bonding curve mechanics and ramp up as users buy.

- Bonding triggers liquidity seeding to Raydium when a threshold (typically 500 SOL, ~ $70K) is hit, along with auto token burns to reduce circulating supply.

- App integrates Apple Pay, Face ID, and fiat on-ramps to streamline onboarding for non-crypto users.

✅ Pros

- True mobile-first experience, iOS/Android only, designed for lowered friction in token creation and trading.

- Intuitive onboarding with Apple Pay, Face ID, and fiat rails.

- Dynamic fee structure with creator revenue sharing post‑bonding (up to 50%).

❌ Cons

- Very limited transparency: no clear launch or activity stats tracked externally.

- Community reach pales in comparison to Solana’s dominant launchpads (~175K followers vs. hundreds of thousands).

- Few tokens graduate to broader liquidity; visibility remains confined within Moonshot’s app.

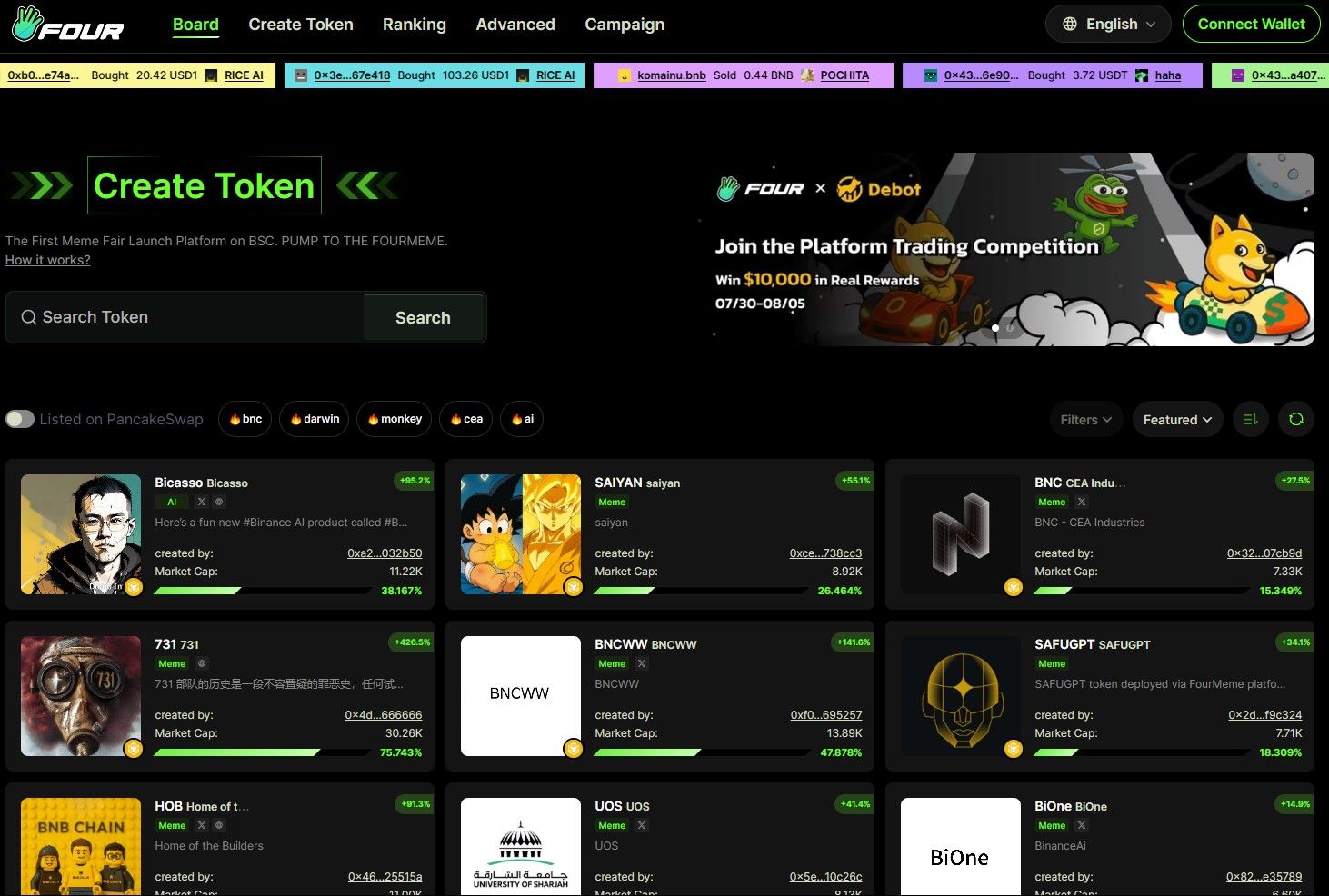

4. Four.Meme

Four.meme is built on the BNB Chain and has amassed approximately 276,000 followers on X, positioning it as one of BNB’s better-known memecoin launchpads. Activity is modest compared to giants in the space: around 4,000 active users and 500 token launches in the past 24 hours, per community tracking. Its TVL remains low, just $2 million according to DeFiLlama.

This UX is Also Heavily Inspired by Pump.fun | Image via Four.meme

This UX is Also Heavily Inspired by Pump.fun | Image via Four.memeNotable Token and Hack History

Four.meme gained visibility early through the Test (TST) token, which spiked near a $489 million market cap after being featured in a BNB Chain tutorial video. That hype was amplified when Binance’s ex-CEO Changpeng Zhao quickly clarified the mention was not an endorsement.

However, the platform’s growth was marred by security issues:

- On February 11, 2025, Four.meme suffered a $183K exploit, where an attacker created malicious liquidity pools on PancakeSwap before the official launch, siphoning assets through transfer restrictions bypass.

- Less than a month later, a second breach resulted in the loss of around $130K, again via liquidity manipulation. The launch function was suspended temporarily and later resumed, with Four.meme committing to compensate victims.

Launch Mechanics & Fees

Four.meme offers:

- Customizable bonding curves, allowing token creators to define price discovery models.

- Automatic migration to PancakeSwap once bonding thresholds are met.

- A token launch fee of just 0.005 BNB, making it highly accessible.

- A trading fee between 0.5% and 2%, depending on the token’s pricing behavior and bonding curve parameters.

✅ Pros

- Low-cost, no-code token creation with instant migration to PancakeSwap.

- Custom bonding curve flexibility for creators.

- Solid visibility on the BNB ecosystem with ~276k followers.

- Fair launch mechanics with no presales or team allocations.

❌ Cons

- Low TVL (~$2M) and user activity; low liquidity limits token longevity.

- Security risks with two major hacks in early 2025 casting doubts over reliability.

- Though active, it remains far smaller in scale than Solana-based platforms.

- Many tokens fail to gain traction or graduate to broader liquidity.

Centralized vs. Decentralized Launchpads

Launchpads exist across both CeFi and DeFi environments. In the centralized world, Binance Launchpad is the most well-known example. On the DeFi side, platforms like Polkastarter have led permissionless token launches for years. While both formats serve the same fundamental purpose: bootstrapping new tokens and connecting them with early-stage capital, the way they operate and the kinds of projects they attract differ significantly.

Censorship and Accessibility

CEX-hosted launchpads are constrained by regulation. Because centralized exchanges are bound to operate under regional laws, their launchpads are curated with strict compliance in mind. Tokens without clear utility, a doxxed and verifiable team, or a well-defined roadmap generally never make the cut. That’s why memecoins, with their anonymous teams and speculation-first ethos, rarely launch through CeFi routes.

However, this strict filtering does give CEX launches a degree of quality assurance. Strong narratives, clear tokenomics, and legal backing often accompany tokens that do pass the bar. Projects like LayerZero and Space ID launched on Binance Launchpad with major public attention and institutional interest behind them.

DeFi launchpads, on the other hand, are permissionless by design. They do not impose KYC, and many actively protect the anonymity of token creators. Listing decisions are either automated or governed by DAOs, with little to no centralized oversight. Because DeFi launchpads don’t enforce the same legal or structural hurdles, they allow virtually anyone to deploy a token. This openness is what makes memecoin launchpads possible in the first place.

The trade-off is risk. Most tokens that launch via DEX routes are never vetted, never audited, and carry high rug potential. But for early investors, that’s often part of the appeal. Since new tokens typically launch in DeFi long before any CeFi debut, DeFi participants often access tokens at significantly lower valuations.

Advantages and Disadvantages of Each Model

Centralized launchpads have the following advantages and disadvantages:

✅ Pros

- Strict compliance reduces scams and low-effort launches

- Greater media exposure and exchange marketing support

- More likely to attract institutional capital

❌ Cons

- High barrier to entry for developers and users alike

- Limited access to “retail-first” narratives like memes or social tokens

- Geofenced access and regional legal limitations reduce global participation

Decentralized launchpads have the following advantages and disadvantages:

✅ Pros

- Fully permissionless: anyone can launch, anyone can participate

- Faster access to new tokens—often before centralized listings

- Supports niche and speculative narratives like memecoins

❌ Cons

- No built-in investor protection; rug pulls are common

- Lack of curation leads to signal-to-noise issues

- Liquidity can be thin or temporary, depending on token quality

In short, CeFi launchpads offer compliance and credibility at the cost of access and speed. DeFi launchpads offer exposure and early access at the cost of safety. For memecoins, only DeFi makes sense. The volatility, anonymity, and thrill that define this market segment simply wouldn’t survive under centralized scrutiny.

Benefits of Using a Memecoin Launchpad

Memecoin launchpads aren't just tools for launching tokens; they offer a unique blend of financial risk, cultural momentum, and on-chain experimentation. When used with the right mindset, they can be equal parts opportunity and entertainment. Here are some of the key benefits:

Disproportionate Earnings Potential

Most memecoin launches offer asymmetric upside: users risk a few dollars for the chance to catch a 10x or 100x. It’s not a guaranteed outcome, rug pulls and hype cycles are common, but the appeal lies in the potential to turn pocket change into outsized returns. In a space built on viral reflexes, that upside often plays out in minutes.

Short Time Span

Memecoins typically follow fast life cycles. From launch to peak to collapse, the entire curve can play out in hours or days. This short time span creates rapid price discovery and high exchange velocity, allowing traders to enter and exit positions quickly, ideal for those seeking high-tempo market action.

Entertainment and Community

For many users, memecoins are less about structured investment and more about being part of an inside joke. Launchpads double as cultural exchanges, where trends, memes, and narratives converge into tradable tokens. When not abused, the process is genuinely entertaining, especially when communities rally around a coin organically.

Ease of Use

Most memecoin launchpads are designed to be frictionless. No-code token creation, embedded trading interfaces, and low gas fees. Especially chains like Solana make it easy for anyone to participate, regardless of their technical background.

Early Access

Launchpads enable direct participation at the point of token generation. There's no waiting for exchange listings or TGE announcements; users trade immediately after deployment, often gaining access before a token appears on DEX aggregators or CEX platforms.

Transparent and Equitable

Fair launch mechanics are baked into most platforms: no presales, no team allocations, and no insider advantage. Tokenomics are visible upfront, and creator wallets are often restricted or time-locked. It’s not perfect protection, but it’s more transparent than most ICO-era models.

Risks and Considerations for Investors

Memecoin launchpads can be fun—just like gambling is fun when approached with moderation. The thrill, speed, and unpredictability are part of the appeal. But just like gambling, they carry risks that shouldn't be ignored. Here are the key considerations for anyone thinking about participating:

Potentially Addictive

The fast feedback loop of wins and losses, paired with the social buzz of virality, mimics the mechanics of a casino. The experience can be addictive—especially when a few lucky bets pay off early. Left unchecked, it can lead to compulsive behavior, overtrading, and chasing losses.

Extreme Volatility

Price action on memecoins is often chaotic. Without fundamentals, price discovery is driven by hype, momentum, and timing. Rug pulls aren’t rare—they’re common, sometimes even expected. And because there’s no reliable method to analyze these coins, users operate in an environment of pure speculation.

No Utility, By Design

In this space, the lack of fundamentals is part of the product. Most memecoins launched through these platforms have no team, no roadmap, no use case, and no audit. Their entire value is meme appeal and market momentum. For some, that’s fine. For most, it’s a recipe for rapid depreciation.

Disproportionate Winnings

A small percentage of traders—usually the earliest buyers—extract the lion’s share of value. Everyone else ends up holding the bag. The odds of losing money are significantly higher than making it, and gains are rarely evenly distributed. This is a market where most people lose, and a few win big.

How to Participate in a Memecoin Launchpad

While every launchpad has its quirks, the general process is relatively consistent across platforms. Here's a quick breakdown using Pump.fun as a reference point.

- Set Up a Wallet: Start by creating a non-custodial crypto wallet compatible with the platform’s base chain. For Pump.fun, that’s Solana, so wallets like Phantom or Backpack are ideal. Fund it with a small amount of SOL to cover transactions and token purchases.

- Connect to the Launchpad: Visit the Pump.fun app and connect your wallet via the in-app prompt. No registration, KYC, or approval is needed—just a browser wallet connection.

- Buy Into a Token Launch: Browse trending or newly created tokens. Click “Buy” on any listing to participate. Tokens are sold using a bonding curve, so the earlier you buy, the lower the price. There are no presales or staking requirements on Pump.fun, everything is instant.

- Monitor or Sell: Your tokens appear in your wallet automatically. You can track them on Pump.fun or in your wallet interface. Selling is just as simple: hit “Sell” to reverse the bonding curve and cash out—minus a 1% trading fee.

- Graduation and DEX Trading (Optional): If the token reaches the bonding threshold (e.g., $69K), it “graduates” to a Raydium liquidity pool. You can continue trading there via standard DEX interfaces.

Final Thoughts

Memecoin launchpads are best suited for users who understand the game they're playing. If you're a thrill-seeker, it’s just entertainment. High-risk speculators may appreciate the volatility and asymmetric upside. And if you're a community-driven investor, you probably already know how memecoins live and die on attention cycles. R

egardless of your angle, pairing launchpad use with strong information flows: Telegram groups, Twitter Spaces, Discord communities, and on-chain tracking tools can dramatically improve your odds. In this space, the edge often goes to those who act fast.