Remember when you first heard about Pi Coin and thought, “Wait... I can mine crypto on my phone by just tapping a button?” Yeah, same. It sounded like a joke, or a genius move. Joke, most probably. Fast forward a few years, and Pi Network has grown into a global movement with tens of millions of users and a mainnet launch that’s got everyone asking: Where can I actually trade this thing?

If you’re sitting on a pocketful of Pi and wondering how to turn it into something spendable, or even track its value, you’re in the right place. In this guide, we’re breaking down the best platforms to buy, sell, and trade your PI safely and smartly.

Key Takeaways

- The top Pi Coin exchanges are OKX, Bitget, MEXC, Gate.io, CoinW, BitMart and LBank, each offering unique advantages for spot or futures trading.

- To buy, sell, or trade Pi, users must first migrate their mined tokens to the Open Mainnet and complete KYC verification.

- Not all platforms support Pi yet. Major exchanges like Binance and Coinbase have yet to list it, making niche exchanges your go-to options for now.

- Exchange features vary, from copy trading and staking (CoinW, BitMart) to fee-free promos (MEXC) and early mainnet integration (OKX).

- Always verify token listings, review fee structures, and use secure wallets to store Pi if planning to hold long-term.

What Is Pi Coin and Why Is It Gaining Popularity?

Pi Coin is the native cryptocurrency of the Pi Network, a bold experiment launched in March 2019 by two Stanford PhDs, Dr. Nicolas Kokkalis and Dr. Chengdiao Fan. Their vision? To break down the high technical and financial barriers that historically shut out everyday folks from cryptocurrency mining.

Background of the Pi Network project

Kokkalis and Fan asked a simple question: why can't anyone with a smartphone start crypto mining? So they built a mobile-first platform that's all about inclusivity, accessibility, and community. By March 14, 2019, (“Pi Day”), the beta app rolled out, with early adopters, or “Pioneers,” serving as the backbone of a trust-based network.

Want to learn how Pi mining really works and whether it’s worth your time? Check out Coin Bureau’s step-by-step guide.

Founders and vision behind the platform

The founders’ goal is straightforward: create a peer-to-peer economy “secured and operated by everyday people”. With their academic backgrounds in social computing and blockchain systems, they designed Pi to be more humane with no intimidating tech jargon, no upfront investment, and no machinery humming away in basements.

It's unique mobile-first mining approach

Here’s where it really gets interesting: mobile mining. Instead of GPUs grinding through complex algorithms, you just open the Pi app once a day and tap a lightning bolt. That’s it. No battery drain, no data hogging, just a daily tap.

Why does it work? Pi uses a trust graph and the Stellar Consensus Protocol (SCP), not brute computing power. SCP lets users verify each other via “Security Circles,” forming the backbone of the network’s integrity, powered solely by user connections, not hash rates.

Curious whether Pi Coin is legit or just hype? Discover that and more in our in‑depth breakdown.

Instead of GPUs Grinding through Complex Algorithms, you just open the Pi App Once a Day. Image via Pi Network

Instead of GPUs Grinding through Complex Algorithms, you just open the Pi App Once a Day. Image via Pi NetworkWhat Makes Pi Coin Different from Other Cryptocurrencies?

- No financial investment required to mine: Unlike Bitcoin or Ethereum, where mining rigs cost a few thousand dollars and require insane electricity, Pi is free. All you need is your phone and a few seconds a day. That zero-cost entry is a game-changer, especially in emerging markets.

- Community-based growth model: Pi’s referral system is the lifeblood of the network. Invite friends, family, anyone, and earn a bonus. Build a Security Circle, and your mining rate gets another boost. It's a social-first crypto: your network is your security.

- Early-stage development and future roadmap: It’s still early days. As of now, over 60 million users (the accuracy of this figure is debated) have signed up, with 19 million completed KYC and over 10 million migrated to the mainnet since Feb. 20, 2025. The network transitioned from Beta (2019–2021) to Testnet (2021–2023) to Mainnet (launched February 20, 2025). The next frontier? Real-world usage includes DApps, peer-to-peer transactions, marketplaces, and more. The roadmap is clear; now it’s about delivering.

In essence, Pi Coin isn’t about moonshots; it's about accessibility and community-driven evolution. We’re still in the early chapters of this story, but the fact that millions can mine crypto without tech know-how is pretty compelling.

Can You Trade Pi Coin Right Now?

Yes, but it’s complicated.

Pi Coin has finally entered its Open Mainnet phase, which kicked off on February 20, 2025. That’s when the doors officially opened for trading, transferring, and using Pi beyond the test environment. But like many things in crypto, the answer to “can I trade this?” isn’t always a simple yes or no.

Many Platforms Tend to Wait for more Network Maturity, Clearer Tokenomics, and Proven Liquidity. Image via Pi Network

Many Platforms Tend to Wait for more Network Maturity, Clearer Tokenomics, and Proven Liquidity. Image via Pi NetworkYou can technically trade Pi Coin now, but the experience isn’t what you’d call plug-and-play for everyone. It depends on a few big factors, most importantly, whether you’ve migrated to the Mainnet and passed KYC.

Is Pi Coin Listed on Major Exchanges?

- Clarifying Availability

Pi is being traded on select platforms. However, you won’t find Pi on many of the top-tier, globally dominant exchanges just yet. Big names like Binance, Coinbase, and Kraken currently do not support Pi Coin trading. These platforms tend to wait for more network maturity, clearer tokenomics, and proven liquidity before jumping in.

- Status of Mainnet and Limitations

Now, about that Mainnet; it’s live, but still in a transitional phase. Over 10 million users have migrated, but millions more are still in line. Only those who’ve:

- Completed KYC verification,

- Locked in their wallet,

- And officially migrated their coins to the Mainnet,

…are eligible to actually trade, send, or use Pi in the real world.

If you’re still sitting on “pre-mainnet” Pi (basically testnet coins), you’re not able to trade them externally yet. And even for those on the Mainnet, trading comes with caveats like transferability limits, partial token locks, and some uncertainty around valuation.

Looking for the best way to store your PI safely? Check out our comprehensive review of top Pi Coin wallets.

Top Pi Coin Exchanges (Ranked & Reviewed)

Before we dive into details, let's take a quick overview of how things compare:

| Exchange | Spot Fees | Futures Support | Leverage | Notable Features |

|---|---|---|---|---|

| OKX | 0.08% maker / 0.10% taker | Yes | Up to 1.5% funding fee cap | Early Pi integration, Web3 & DeFi support, strong security |

| Bitget | 0.1% (0.08% with BGB) | Yes | Up to 50× | Frequent promotions, CandyBomb airdrops, Innovation Zone |

| MEXC | 0%–0.04% spot / 0.01%–0.04% futures | Yes | Moderate | Zero-fee promo, early access tools, copy trading |

| Gate | 0.10% flat | Yes | Up to 50× | NFT marketplace, bots, advanced order types |

| CoinW | 0.20% → 0.01% (VIP) | Yes | Up to 200× | Copy trading, bots, yield options for Pi |

| BitMart | 0.1%–0.6% | Yes | Up to 100× | BitMart Academy, staking & launchpad, 24/7 support |

| LBank | 0.10% | Yes | Up to 50× | Beginner-friendly, cold storage, wide asset variety |

1. OKX

OKX was the first major exchange to list Pi Coin, aligning its listing precisely with Pi’s Open Mainnet launch. Deposits began on Feb. 12, 2025, a call auction kicked off Feb. 20, and spot trading (PI/USDT) launched on the same day, with withdrawals enabled on Feb. 21.

Offers Comprehensive Trading Options like Spot, Margin, Futures, Yield. Image via OKX

Offers Comprehensive Trading Options like Spot, Margin, Futures, Yield. Image via OKXFeatures

- Supports DeFi, NFTs, and more alongside regular crypto trading.

- Hundreds of assets and very competitive trading costs.

- Includes cold storage, 2FA, withdrawal whitelisting, and proof-of-reserves.

- The trading suite includes spot, margin, USDT margined perpetual futures, and a Simple Earn program for yields.

Fees

- Spot trading: 0.08% maker / 0.10% taker on Pi USDT pairs (standard for OKX mid-tier accounts).

- Futures funding: Initially capped at 0.5% until February 20, then reverted to the standard maximum of 1.5%.

✅ Pros

- Numerous products and features.

- Comprehensive trading options like spot, margin, futures, and yield.

- Solid liquidity and robust infrastructure from day one.

❌ Cons

- Initial limits with no market orders and a $10k trade cap may frustrate volume traders.

- Margin and futures involve higher risk.

- Regional restrictions apply as some countries, like China, are restricted from Pi trading.

Do check out our detailed review of OKX.

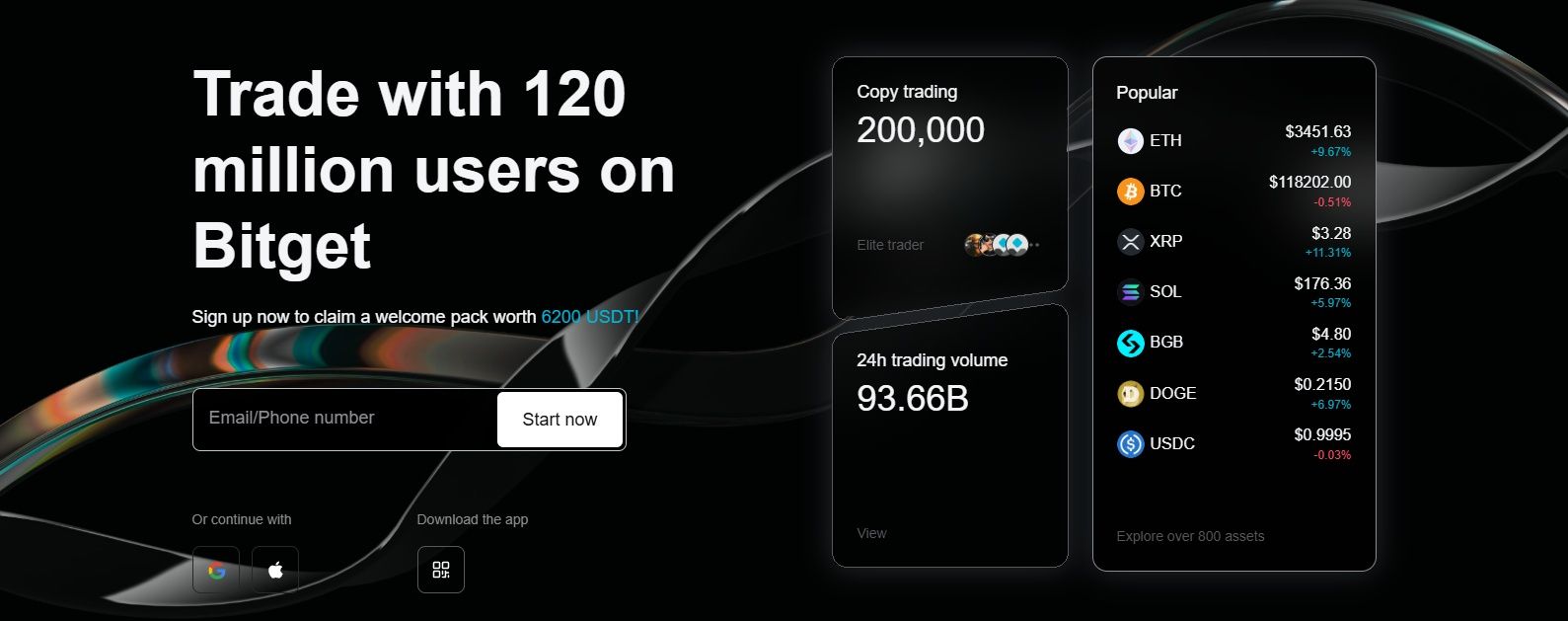

2. Bitget

Bitget listed Pi Coin in its Innovation/Web3 Zone, launching spot trading (PI/USDT) on Feb. 20, with deposits open and withdrawals enabled.

Lower Spot Fees with BGB Discounts which is Great for Frequent Traders. Image via Bitget

Lower Spot Fees with BGB Discounts which is Great for Frequent Traders. Image via BitgetFeatures

- Placed under Bitget’s Innovation Zone, which is ideal for trending, early-stage tokens.

- Allows various order types: limit, market, and stop-limit in the spot market.

- Dual fee payment options mean you pay trading fees in USDT or get a 20% discount by using Bitget’s BGB token.

- Active marketing promotions like a “CandyBomb” airdrop of 150,000 PI reward pool.

Fees

- Spot trading: 0.1 % maker & taker fee, can be reduced to 0.08% when paid with BGB.

- Futures trading: 0.02 % maker / 0.06 % taker.

- Crypto deposits are free; withdrawals vary based on network fees.

✅ Pros

- Lower spot fees with BGB discounts which is great for frequent traders.

- Liquidity via early listing and strong community engagement.

- Strong promotional offers like airdrops for active participation.

- Multi-tiered trading tools like various order types and futures support.

❌ Cons

- Innovation Zone listings can experience higher volatility and thinner order books initially.

- KYC is mandatory before trading or withdrawals.

- Futures and margin products may be too advanced or risky for beginners unfamiliar with leverage.

You can read a lot more about Bitget in our full review.

3. MEXC

MEXC launched Pi Coin in its Innovation Zone right alongside the Mainnet debut as spot trading (PI/USDT) went live on Feb. 20, with deposits enabled immediately and withdrawals opening by Feb. 22.

Good for Innovative Trading Tools and Early Access Options. Image via MEXC

Good for Innovative Trading Tools and Early Access Options. Image via MEXCFeatures

- Listed under the Innovation Zone, designed for early-stage and trending assets.

- Low fees, with free spot trading during the promotional phase, which is perfect for cost-conscious Pi traders.

- Extensive cryptocurrency selection.

- Full support for limit, market, and stop-limit orders in spot trading.

- Robust security measures, including 2FA and cold storage.

- Copy trading and DeFi-style savings and staking.

Fees

- Spot trading: 0% maker ~ 0.040% taker for PI. The standard taker fee is 0.050%.

- Futures: 0.01% makers and 0.04% takers.

- Crypto deposits: Free.

- Withdrawals: Subject to variable network fees based on chain activity.

✅ Pros

- The fee-free window makes it very cost-effective for trading.

- Innovative trading tools and early access boost participant excitement.

- Backed by one of the more liquid and UX-friendly mid-tier platforms.

❌ Cons

- Innovation Zone tokens can be volatile with thinner order books initially.

- While MEXC supports fiat deposits, direct fiat withdrawals are restricted.

- Mandatory KYC verification is required before accessing trading and withdrawals.

- MEXC faces some regulatory challenges.

Check out more details in our MEXC Review.

4. Gate

Gate joined the Pi Coin party right on time when spot trading (PI/USDT) went live on Feb. 20, with deposits enabled immediately. The exchange also rolled out a PI perpetual futures contract offering up to 50× leverage and hosted related staking/promotional events around the launch.

NFT Trading and Minting Services makes it more Attractive for a Broader User-Base. Image via Gate

NFT Trading and Minting Services makes it more Attractive for a Broader User-Base. Image via GateFeatures

- Robust and feature-rich trading interface.

- Spot and perpetual futures (USDT-margined) are available right away.

- Supports up to 50× leverage on PI perpetuals.

- Huge asset support.

- Early promotions include deposit rewards and staking incentives.

Fees

- Spot trading: flat 0.1% maker / 0.1% taker for standard users (VIP 0).

- Futures trading: maker fee is 0.02%, taker 0.05%, depending on VIP level.

- Discounts apply via GT token holdings and Gate Points.

- Crypto deposits are free; withdrawals incur network-dependent fees.

✅ Pros

- Comprehensive trading suite: spot, futures with high leverage, and staking/rewards programs.

- Early liquidity and activity with strong trading volume and user incentives right from launch.

- NFT trading and minting services.

- Bots and other useful tools.

- Fee discounts are available through VIP tiers and GT token holding.

❌ Cons

- The platform is a bit hard to navigate.

- The futures fee model is complex and may confuse casual traders.

- High-leverage products are risky for beginners.

Check out more details in our Gate review.

5. CoinW

CoinW, founded in 2017 and based in Dubai, is a global exchange serving over 200 countries. It supports Pi Coin (PI/USDT) with both spot and futures options, making it a newcomer-ready platform aligned with mainnet needs.

Enables both Automated Bot Strategies and Real-Time Copy Trading. Image via CoinW

Enables both Automated Bot Strategies and Real-Time Copy Trading. Image via CoinWFeatures

- Offers competitive spot access plus futures with up to 200× leverage, covering aggressive trading strategies.

- Enables both automated bot strategies and real-time copy trading, which is great for Pi traders who want guidance or passive execution.

- Flexible and fixed staking options allow Pi holders to earn passive yield while holding.

- Spot fees start at 0.20%, but drop substantially for high-volume VIPs, down to even 0.01% which is helpful for frequent Pi traders.

Fees

- Spot: Maker/Taker starts at 0.20%/0.20%, dropping to 0.01% at VIP level 6.

- Futures: Fixed at 0.01% maker / 0.06% taker.

- Crypto deposits: Free; withdrawal fees vary by coin and network usage.

✅ Pros

- High leverage & advanced tools, including bots and copy trading, appeal to active Pi traders.

- Yield options suit users wanting to hold Pi with passive income potential.

- VIP fees reward high-volume traders with ultra-competitive pricing.

❌ Cons

- Security basics are not enabled by default, so 2FA, withdrawal whitelist, and trading password require manual activation.

- No direct bank transfers; fiat on/off ramp only via third-party providers.

- Restricted for U.S. residents.

You can find a lot more in our CoinW review.

6. BitMart

BitMart started offering PI/USDT spot trading on Dec. 31, 2022, well before the mainnet era. Deposits and withdrawals became available over the following days.

BitMart Academy Provides Tutorials, Guides, and Market Insights for Beginners. Image via BitMart

BitMart Academy Provides Tutorials, Guides, and Market Insights for Beginners. Image via BitMartFeatures

- Offers spot trading for PI/USDT, built for global users (excluding the U.S.).

- Provides spot & margin trading (up to 100x leverage) across over 1,700 cryptocurrencies.

- Features include staking, savings, a Launchpad, and an NFT marketplace to earn while holding assets.

- BitMart Academy provides tutorials, guides, and market insights for beginners.

Fees

- Trading fees: Standard maker/taker rates apply; specific discount tiers aren't publicly stated. Our recent information shows fees ranging between 0.1% maker and 0.6% taker for spot and 0.2% maker to 0.6% taker for futures.

- Deposits: Free.

- Withdrawal fees: Vary based on the blockchain and network conditions.

✅ Pros

- Long-standing Pi listing gives it an edge in stability and reputation.

- A massive range of assets and access to margin and futures trading.

- Live support is available at all hours.

❌ Cons

- Only PI futures trading is active now, while spot trading seems unavailable or delisted in some cases.

- Withdrawal availability may fluctuate, depending on network traffic.

- Lacks a dedicated proof-of-reserves page, making it harder for users to verify asset backing.

- Not accessible to U.S. residents.

Do take a look at our detailed review of BitMart.

7. LBank

LBank Exchange is a centralized crypto exchange founded in 2015 that enables users to trade cryptocurrencies in over 100 fiat currencies using more than 20 payment methods. LBank listed Pi Coin (PI/USDT) right at the heart of its MEME Zone on Feb. 20, 2025, matching the mainnet launch, and began withdrawals from Feb. 21.

LBank is Easy for Beginners with a User-Friendly Interface.. Image via LBank

LBank is Easy for Beginners with a User-Friendly Interface.. Image via LBankFeatures

- Available in both spot trading (PI/USDT) and USDT-margined perpetual futures with up to 50× leverage.

- Early access to new coins and tokens before they launch.

- Easy for beginners with a user-friendly interface.

- Access to copy trading and other tools.

- Access professional customer service and local Telegram communities.

Fees

- Spot trading: standard maker/taker fee at 0.10%.

- Futures trading: 0.02% maker / 0.06% taker.

- No fees on crypto deposits; withdrawals incur network-dependent charges.

✅ Pros

- Wide range of cryptocurrencies and trading pairs.

- Both spot and high‑leverage futures give flexibility to traders.

- Stores the majority of user funds in cold storage wallets.

- Holds licenses from multiple regulatory bodies (see details).

❌ Cons

- Limited customer support options.

- Limited public details about the team running the exchange.

- LBank’s MEME Zone listings can be volatile and riskier for casual investors.

Check out our detailed review of LBank.

Factors Considered in Our Rankings

Many crypto exchanges employ different strategies, especially when it comes to newly listed assets like Pi. So, when ranking the top platforms, we looked beyond marketing hype and dug into what actually matters for real traders.

Liquidity

We only looked at platforms where traders could buy or sell Pi without excessive price swings or endless wait times for orders to fill. A liquid market is a healthy market.

KYC/AML Compliance

While crypto is known for being open and permissionless, exchanges still need to play by certain rules. Platforms requiring identity verification for withdrawals or trading help reduce scams and regulatory risks.

Fee Structures

That includes trading fees, deposit and withdrawal costs, and whether platforms offer discounts through loyalty tokens or programs. Transparency was key with no fine-print fee traps.

Trading Volume & User Trust

Platforms with consistent volume show real user interest. We also looked at uptime history, platform stability, and how the wider crypto community views their reputation, especially in terms of support and fund security.

How to Choose the Right Pi Coin Exchange

So, you’ve seen the options and maybe even favorited a few exchanges. But how do you pick the one that fits you best? Just like choosing a crypto wallet or your next favorite pizza spot, it depends on what matters most to you. Let’s break it down.

Not every Exchange Suits Everyone, so Pick what Works Best with your Requirements. Image via Freepik

Not every Exchange Suits Everyone, so Pick what Works Best with your Requirements. Image via FreepikFactors to Evaluate Before Signing Up

Security Measures (2FA, Cold Storage): This should always be at the top of your checklist. Look for exchanges that offer two-factor authentication (2FA), withdrawal whitelisting, and cold storage for the majority of user funds. If you’re trading Pi or any other asset, you want peace of mind that your balance won’t vanish in a security breach.

Fiat On-Ramp/Off-Ramp Support: Not everyone’s entering crypto with a wallet full of USDT. Some folks need to buy Pi starting with USD, EUR, or other fiat currencies. A good fiat on-ramp (and more importantly, a clean off-ramp) can make your life a lot easier, especially when it's time to cash out your Pi gains or losses.

Reputation and Longevity of the Exchange: If an exchange has been around for years and hasn’t had a major hack, rug pull, or scandal, that’s a good sign. Bonus points if they’ve weathered bear markets and come out stronger. Dig around Reddit, X (formerly Twitter), and Trustpilot, as they can help expose the vibe.

Customer Service Responsiveness: One of the most underrated things. If your funds are stuck or your Pi deposit is lost in cyberspace, you want support that answers quickly. Look for exchanges with 24/7 live chat, ticket systems that get responses, and good public feedback on resolution time.

You can get an overall education on risk management with your trading in our exclusive risk management guide.

Best Pi Coin Exchange Based on Your Goals

Different traders, different needs. Whether you’re just starting out, trading on the go, keeping things low-key, or prepping for Pi’s long-term play, here’s how to find your perfect fit:

Best for Beginners – MEXC

MEXC nails it for first-timers. Why? The interface is clean, the learning curve is shallow, and they even launched Pi trading with zero fees for 30 days, which is a perfect example for when you're figuring things out. Plus, no advanced jargon, pop-ups, or overwhelming pro tools.

Best for Mobile Trading – Gate

Gate’s mobile app balances ease of use with robust functionality. It supports spot and futures trading, real-time alerts, and reward programs, all optimized for on-the-go users.

Best for Anonymity – LBank

For those who prefer to fly under the radar, LBank offers some KYC-lite features and has been friendlier to traders in regions with limited ID access. Just note: with lower KYC, expect caps on withdrawals and access to fewer features.

Best for Future Mainnet Access – OKX

OKX is playing the long game. With a structured Pi launch, integration into its Simple Earn program, and early signals of deeper mainnet support, it’s ideal for users who want to engage with Pi beyond just trading, like staking, DApps, and rewards down the line.

Best for Passive Trading – CoinW

CoinW stands out for its built-in trading bots and copy trading tools, which are ideal for users who prefer automated strategies or want to mirror experienced traders without micromanaging every trade. Combined with its high leverage options and flexible fee tiers, it’s a solid pick for hands-off Pi trading.

Closing Thoughts

So we have tried to decode your Pi treasure map. Whether you’re here to cash in on your mobile-mined riches or just dip a toe into the trading pool, choosing the right exchange is the key to not turning that Pi into a pie-in-the-face moment.

We’ve covered the top contenders, broken down their strengths, and flagged the “watch out!” points. From fee-free trades to mobile mastery and mainnet momentum, there’s something here for every type of Pi-oneer. But remember, this ecosystem is still evolving. Pi may be tradable now, but its real utility is just warming up.

Stick with platforms that match your goals, keep your security tight, and stay updated as the Pi Network rolls out new features.