There are two distinct groups in the crypto community: those who sing the praises of BCC, and those who are unabashed in calling BCC and its associated lending platform an all-out Ponzi scheme that could come crashing down at any moment.

Indeed, there’s little room between these two impassioned camps. So what gives?

In today’s piece, then, we’ll be breaking down the top concerns the community has with the chart-surging, yet much-maligned, BCC.

About the BCC token

First thing’s first, right?

Like other cryptocurrencies, the BCC token is a non-fiat, digital asset with an accompanying blockchain.

Yet, unlike most other cryptos, BCC employs both Proof-of-Work (Pow) and Proof-of-Stake (PoS) consensus models simultaneously, meaning BCC can be both mined and staked.

BCC users who hold their tokens on the BitConnect platform are rewarded interest on their balance; in theory, this dynamic provides security inasmuch as it prevents a massive sell-off from occurring all at once.

The 1st block of the BCC blockchain was mined on December 24th, 2016. Surprisingly, then, the token has already eclipsed a whopping $1 billion-dollar market capitalization in less than a year, with the cryptocoin currently sitting in the 15th position by market cap on Coincap.io.

The BitConnect platform allows you to lend out BCC in order to get interest on your token loans—sort of like how a bank would lend out fiat, or at least that’s the claim.

You can’t purchase BCC with fiat, though. You must transfer Bitcoin onto the BitConnect platform and thereafter trade BTC for BCC tokens to get your hands on some through their native process.

And it’s the platform’s lending program—which has a Multi-Level Marketing-esque (MLM) referral system—that has generated a great deal of chatter in the community.

Per YouTube talking heads and promoters of the platform, the BCC lending program’s alleged trading bot nets lenders 1% returns daily on average—with daily returns sometimes as high as 2, 3, 4%.

Big if true, right?

Many say it’s not a scam, many strongly disagree

There are dozens of prominent crypto personalities, like YouTuber Craig Grant, who proclaim they’ve made a lot of money so far through BitConnect.

But for every Craig Grant, there’s a Michael Gu—the popular crypto explainer at the Boxmining crypto channel.

In a recent comment to his followers, Gu perfectly summarized why so many people in the space have grievous doubts about the veracity of BitConnect’s claims:

If trading bots can reliably make 3-5 % per week, everyone would be using them and there wouldn't be a market for normal traders. That would be like printing money and everyone would be a millionaire. Just because they post performance information doesn't make it real.

Breaking down the red flags

Let’s dig a little deeper into the details. Skeptics of BCC have identified numerous red flags with the project:

- Numerous amateur spelling errors on the BitConnect website

- Utter lack of transparency around their alleged trading bot

- Overall atmosphere of non-transparency with the company (location, founders, staff, etc.)

- Referral system literally structured like a pyramid, Ponzi-esque

- You move from decentralized to centralized buying BCC with BTC

- 4.8 million BCC were pre-mined, BCC staking their own coins

- Guaranteed, eye-popping returns that are unsustainable over the long-term

Regarding that last point, BitConnect promises lenders .25% daily returns if you invest over $10k, which would come out to 91% yearly returns—seemingly impossible.

Or think about it like this: if you invested $100,000, then you’d have $4 million after one year of 1% daily returns through BitConnect. On the surface, that’s clearly too good to be true.

It’s all very sketchy when taken together.

Circling back, one of the more common complaints levied against BitConnect is that it’s web copy is littered with typos and is thus unprofessional, which reflects poorly on the project’s seriousness. In preparing this article, the author visited the BitConnect website and within 30 seconds of browsing found two typos.

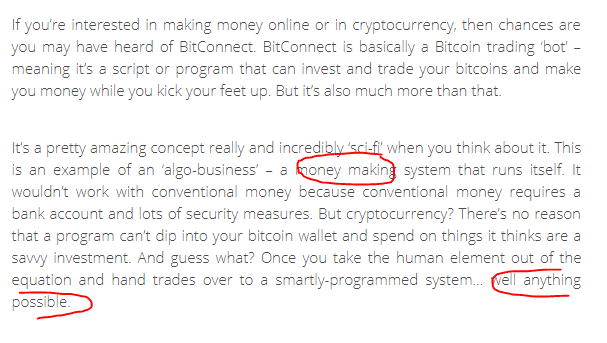

See for yourself. The screenshot below is from BitConnect’s homepage.

It should read “money-making” and “anything is possible.” If they don’t take their copy seriously, do they take your crypto investments seriously?

Ethereum creator Vitalik Buterin chimes in

After Twitter user @bccponzi called Vitalik Buterin out for not speaking against BitConnect before, Buterin responded immediately: “I actually have no idea what bitconnect is.”

@bccponzi explained that the platform offered lenders 1% daily returns, to which Buterin wasted no time in rendering a judgement:

Buterin’s smarter than most humans in general. It’s undoubtedly wise to defer to his intelligence here, too.

Final Thoughts

If BitConnect really does end up being a scam, countless crypto users will be burned by the zero-sum game BCC’s founders have been running.

This collapse would likely damage the reputation of the crypto space indefinitely, setting the community back years.

Let’s hope it never comes to that. But if they are scammers, they deserve justice—they should be stopped from ruining more lives.