Crypto prices took a hit today as a double whammy of bad news unsettled the markets. First it was revealed that US president Donald Trump had tested positive for COVID-19, along with his wife, Melania.

Not exactly surprising and you’d be forgiven for wondering how it took so long, but it’s still the sort of news that tends to give investors the jitters.

More serious for the crypto community though was the news that the Commodity Futures Trading Commission (CFTC) has hit trading platform BitMEX with a number of charges, including unregistered trading and failure to comply with anti-money laundering (AML) regulations.

The Knock on The Door

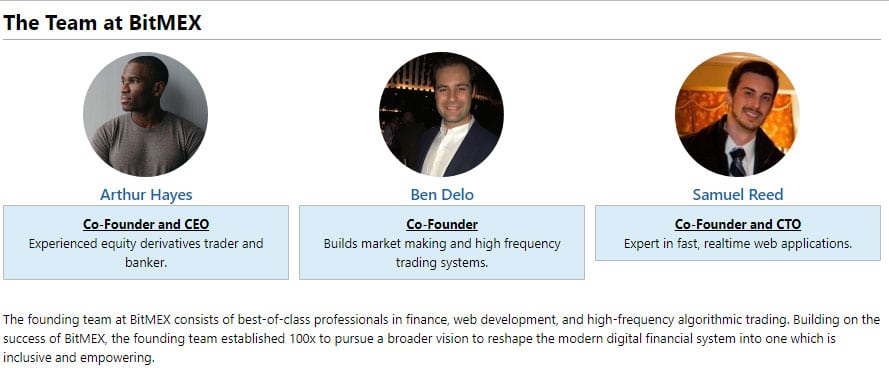

Various news outlets report that the company’s owners, Arthur Hayes, Ben Delo and Samuel Reed have all been charged, along with the web of companies that operate and control BitMEX.

The Three BitMEX Founders. Image via BitMEX

The Three BitMEX Founders. Image via BitMEX Reed has been arrested and warrants are out for the other two, along with BitMEX’s first employee, Gregory Dwyer. All four are also being charged with violating the Bank Secrecy Act (BSA) of 1970.

The charges being brought by the CFTC are serious ones and will have major repercussions for the crypto space beyond the recent blow to prices. Before we look at these charges in more detail and consider their implications, let’s first take a look at what BitMEX is and why it has managed to attract the ire of the US authorities.

BitMEX: A Potted History

The platform is one of the older names in the world of cryptocurrency, having been around since 2014. It quickly made a name for itself by offering bitcoin derivatives and margin trading with up to 100x leverage.

Its ‘perpetual bitcoin leveraged swap’ feature proved insanely popular, as it allowed users to trade up to $100 worth of bitcoin for every dollar they put up as collateral.

WorldWide Exchange or Dodgy Business?

WorldWide Exchange or Dodgy Business? These high-risk trading options attracted a lot of business and the exchange is reported to have handled $11 billion in deposits while raking in more than $1 billion in fees.

Another attractive proposition for many investors was BitMEX’s cavalier attitude towards know-your-customer (KYC) procedures. By allowing users of the platform to operate anonymously, BitMEX fell under the suspicion of being the go-to exchange for money launderers and other criminals, as well as other unorthodox traders and those unwilling to pay tax on their crypto assets.

The company gained added notoriety for the brazen way it flouted the rules and ignored the demands from authorities to put KYC procedures in place.

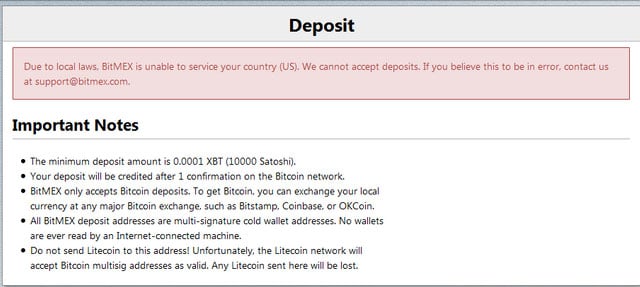

Lack of KYC at BitMEX Caused Issues. Image via Shutterstock

Lack of KYC at BitMEX Caused Issues. Image via Shutterstock Such behaviour was bound to make BitMEX a target for the regulators and, as a result of it having many customers in the United States, the authorities there had it firmly in their sights.

The CFTC is thought to have had BitMEX under investigation since at least July 2019 and in August this year, almost certainly in response to this scrutiny, the platform announced that it was finally going to start implementing mandatory identity verification.

Although BitMEX was founded in Hong Kong (where Hayes, Delo and Dwyer are currently thought to be) it is incorporated in Seychelles through HDR Trading Ltd, one of its several parent entities.

The BitMEX Bribe with Coconuts. Image via Shutterstock.

The BitMEX Bribe with Coconuts. Image via Shutterstock. This incorporation beyond US jurisdiction is key to the CFTC’s list of charges, as Hayes is said to have boasted that the regulatory authorities in Seychelles are easier to bribe. His boast that a mere ‘coconut’ was all that was necessary to grease the palms of officials there may yet come back to haunt him.

United States of America vs BitMEX

BitMEX was courting trouble by accepting orders from US-based customers. In order to comply with US regulation, KYC and AML procedures are required from any exchange looking to operate there.

CFTC Press Release Charging BitMEX

CFTC Press Release Charging BitMEX BitMEX failed to put any of these in place, all the while actively courting US customers in defiance of the CFTC. The CFTC states that:

BitMEX has failed to register with the CFTC, and has failed to implement key safeguards required by the CEA and CFTC’s regulations designed to protect the U.S. derivatives markets and market participants.

It is further alleged that Hayes, Delo and Reed knew that BitMEX was being used by money launderers and other criminals. It is also thought to have been used by countries such as Iran to circumvent US sanctions imposed on their economies. The accused have been warned that they face fines and possible jail time if convicted.

In response to the filing of the CFTC’s charges and the arrest of Reed, spokespeople for Dwyer and BitMEX have both refuted the allegations and vowed to fight them. Dwyer’s attorneys issued a statement, saying that their client ‘always worked in good faith to comply with all applicable regulations and requirements,’ and furthermore: ‘was never so much as invited to speak with prosecutors in the United States Attorney’s Office in Manhattan.’

Meanwhile BitMEX, through a statement issued by HDR Global, countered the allegations, saying:

We strongly disagree with the U.S. government’s heavy-handed decision to bring these charges, and intend to defend the allegations vigorously … From our early days as a start-up, we have always sought to comply with applicable U.S. laws, as those laws were understood at the time and based on available guidance

Clamping Down

For many people, part of crypto’s appeal is the anonymity it can offer. Not everyone seeking to keep their identity hidden is a criminal and many users have a deep (and often well-founded) distrust of traditional financial institutions.

The financial crash of 2008 shook many peoples’ faith in banks and the banking system, especially as hardly anyone from the sector was held accountable for what had taken place on its watch.

The emergence of bitcoin and the wave of other cryptocurrencies that followed in its wake was seen as a unique opportunity to chip away at the power of central banks and put individuals in sole control of their own money. Anonymity played a big part in this and there are plenty of strong arguments for keeping banks and bankers at bay.

Anonymous and Easy to Launder Funds. Image via Shutterstock

Anonymous and Easy to Launder Funds. Image via Shutterstock Sadly, not everyone was motivated by the desire for a fairer and more equal financial system. Bitcoin swiftly gained notoriety as the currency of the dark web, where it was used to buy drugs, weapons and worse.

Money launderers have found it an ideal tool to help them ply their trade, while people across the world use it to keep money hidden from the taxman. The public image of crypto is still stained by its associations with crime and misdemeanour.

It was always inevitable that regulatory bodies and law enforcement would get involved once crypto really started to take off. There was no way this new and unpredictable asset class could be allowed to grow and flourish without some sort of oversight.

The sector has been rocked by more than its fair share of scandal during the short span of its existence. Exchanges have been hacked, funds have been stolen and countless scams have been perpetrated. Nobody could reasonably expect the authorities to simply sit back and watch the mayhem unfold.

BitMEX Started Blocking IPs from Restricted Zones

BitMEX Started Blocking IPs from Restricted Zones Yet as regulation has been imposed on the sector, there has been a growing acceptance of crypto from the powers that be. Initial hostility has softened into acceptance in some cases and enthusiasm in others. Governments across the world have come to realise that - like it or not - crypto is here to stay.

The result has been that the crypto sector has been gradually brought into line. The US authorities have been at the forefront of this and have worked hard to ensure that exchanges and other platforms adhere to matters like KYC and AML. The old days of the crypto wild west are receding into history.

Throwing the book at BitMEX

The advent of bitcoin futures and the risks they entailed, especially when traded with leverage, only added to the sense of urgency surrounding cryptocurrency regulation.

Financial products that are hard for most people to understand play into the hands of those offering them and it's hard to criticise the US authorities for wanting to protect their citizens from exposure to such risk.

Perhaps the most remarkable aspect of the BitMEX tale - and this latest chapter in it - is the fact that Hayes, Delo and Reed felt able to defy the CFTC for so long.

Arthur Hayes Playing with Fire. Image via Twitter

Arthur Hayes Playing with Fire. Image via Twitter By ignoring the repeated calls to register the platform in the US and put KYC and AML procedures in place, all three were making some powerful enemies.

They must surely have been aware that, by failing to actively prevent money laundering through the platform, they were in breach of the BSA and thus liable for eventual prosecution under federal law.

Arthur Hayes must also have had an inkling that his ‘coconut’ comments might stoke the ire of the authorities. There are certainly plenty of people who would give a lot more than a penny for Samuel Reed’s thoughts as he sits in a jail cell right now.

The Consequences

Many people have pointed out that, although the price of bitcoin took a knock as news got out about the CFTC indictment and Reed’s arrest, it wasn’t as big as might have been expected.

This may in part be due to the fact that BitMEX’s share of the bitcoin derivatives market isn’t as big as it once was. Competitors like Binance, HTX and OKX have overtaken BitMEX in recent years, as the popularity of leveraged trading has continued to soar.

Bitcoin Price Reacts to BitMEX News. Image via CMC

Bitcoin Price Reacts to BitMEX News. Image via CMC If the CFTC had acted a couple of years back, when BitMEX had much more of the futures market cornered, the impact could have been greater.

There is a worry that the bitcoin price may take another, possibly bigger hit if BitMEX’s US-based customers are forced off the platform and resort to selling their holdings. The dumping of large numbers of these bitcoins on the open market could act to push prices down.

Despite BitMEX’s loss of pre-eminence, some are predicting that its troubles could help bring some stability to the market. Whenever price swings took place, it was known that BitMEX’s perpetual swaps made them worse, as margin calls liquidated positions. The spot market could well benefit from a respite from these in the future.

It’s likely that the severest consequences of all this will be reserved for the exchanges themselves, however. The issue of accommodating US traders has been a thorny one for a while now and is likely to pose even more of a headache now that the CFTC and the Department of Justice have started flexing their muscles.

US Regulators are Flexing their Muscles. Image via Shutterstock

US Regulators are Flexing their Muscles. Image via Shutterstock US authorities are not fond of leveraged trading: they see it as far too risky and a trap for the unwary. It is permitted, but at nowhere near the levels of leverage that BitMEX and others offer. 100x just ain’t happening. The highest level for a US-regulated bitcoin futures contract is currently 3x - hardly the sort of stuff to get the blood racing.

There is also a growing concern that the CFTC’s actions could have a negative impact on the decentralised finance (DeFi) space too. A large part of DeFi’s appeal derives from not only its decentralised nature but also its relative lack of regulation.

Although such decentralisation makes these projects and platforms harder to target, the US authorities can still put the squeeze on individuals. If a project’s developers are targeted that could be enough to discourage people from using it altogether, regardless of whether or not those devs have access to the admin keys.

In a series of Twitter posts crypto and DeFi expert Adam Cochran has outlined the threat posed to DeFi by the actions of the CFTC and the DoJ. The point he makes is that DeFi is perhaps not as insulated against the attention of regulators as it might like to think.

Risks of SEC Action in Defi. Image via Twitter

Risks of SEC Action in Defi. Image via Twitter The BSA has a long reach and gives regulatory bodies like the CFTC a great deal of power. Many will now be waiting to see whether that power gets exercised against DeFi.

Conclusion

By moving against BitMEX, the CFTC has issued a stark warning to exchanges everywhere: if you want to serve US customers then get regulated or get out of town.

Many in the industry admit in private that a lot of exchanges are guilty of operating in a similar way to BitMEX and may well be next in the firing line.

BitMEX’s brashness in flouting the rules and refusing to toe the line was probably what put it at the front of the queue for a dressing down. There will doubtless be some worried folks at other platforms wondering if it will be their turn next.