Copy trading has simplified how people approach cryptocurrency trading. By allowing individuals to replicate the strategies of seasoned investors, it opens the door to trading tactics that have long been associated with the pros. The best part? No extensive experience or deep market knowledge is needed.

For novices, this means an easy entry into the world of crypto trading. But copy trading isn’t just for beginners. Experienced traders can also benefit. By following the strategies of other successful investors, they can diversify their tactics or become copytraders themselves.

BloFin is one of the many crypto exchanges offering copy trading. In this BloFin copy trading review, we’ll explore its features, understand the associated fees and evaluate its pros and cons.

Before we begin, you'd do well to check out our top picks for the best crypto copy trading platforms.

What is BloFin?

Founded in September 2019, BloFin is a cryptocurrency exchange based in the Cayman Islands. It offers a wide range of services, including perpetual and futures trading with up to 150x leverage, spot trading, copy trading, crypto buying, wealth management, educational resources, and API access. The name "BloFin" combines "Blo," representing blockchain, and "Fin," symbolizing finance, reflecting the exchange's commitment to integrating these two critical components of the modern financial ecosystem.

BloFin is a Comprehensive Cryptocurrency Trading Platform. Image via BloFin

BloFin is a Comprehensive Cryptocurrency Trading Platform. Image via BloFinBloFin ensures fund security through advanced measures such as Merkle Tree proof of reserves, wallet-as-a-service custody, and Fireblocks insurance. It maintains a 1:1 proof of reserves policy, guaranteeing that all customer assets are fully backed and transparent. Partnerships with industry-leading firms like Chainalysis and AnChain.AI further bolster BloFin’s risk management and regulatory compliance capabilities.

The platform offers an extensive range of trading pairs and services. With over 320 USDT-M trading pairs, users can trade popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). BloFin features a user-friendly interface and high liquidity, making it an attractive choice for advanced traders.

BloFin's ecosystem is designed to support traders at every level. The platform offers easy deposits and withdrawals in over 80 fiat currencies, competitive trading fees, and comprehensive customer support available 24/7. Additionally, the BloFin Academy provides educational resources to help users stay informed about the latest developments in the cryptocurrency world.

The key features of BloFin are:

- Futures Trading: USDT-M perpetual contracts with advanced features

- Copy Trading: Allows users to follow and replicate top traders' strategies at no cost.

- Spot Trading: Provides access to numerous cryptocurrencies with deep liquidity.

- Crypto Purchasing: Supports buying and selling with over 80 fiat currencies.

- Earn: Staking and savings options to maximize asset value.

- Affiliate Program: Offers up to 50% commission on futures trading fees.

- Security: Utilizes advanced measures such as Merkle Tree proof of reserves, wallet-as-a-service custody, Fireblocks insurance, and partnerships with Chainalysis and AnChain.AI.

- Ease of Use: Features a user-friendly interface, high liquidity, easy deposits and withdrawals in over 80 fiat currencies, and 24/7 customer support.

- Educational Resources: BloFin Academy provides educational content to keep users informed about cryptocurrency developments.

If you'd like to know more, you can read our full BloFin review.

What is Copy Trading?

Copy trading is akin to having a GPS for your investment journey, guiding you based on the routes taken by successful traders. This method allows individuals to automatically replicate the trades of experienced investors, making it a popular choice among those new to trading or looking to diversify their strategies without extensive research.

At its core, copy trading connects novice traders with seasoned professionals. Imagine being able to shadow a chess grandmaster's moves in real time — copy trading offers a similar advantage in the financial markets. By following a proficient trader, your trades mimic theirs automatically.

How Copy Trading Works

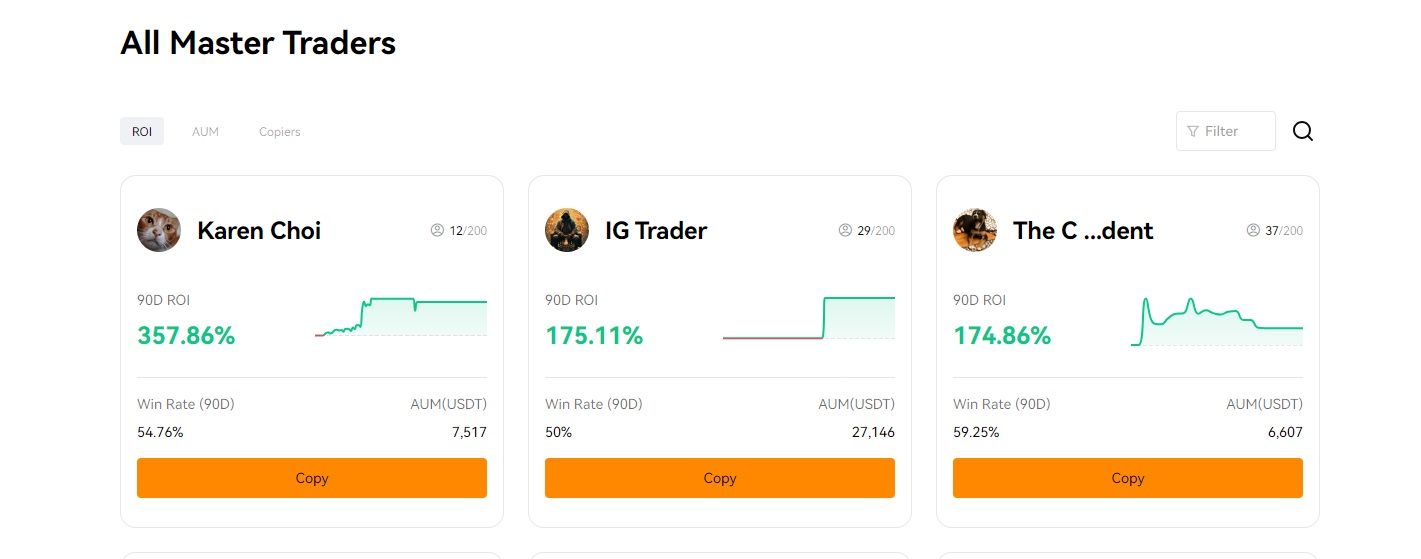

- Selection of Traders: Platforms typically provide a list of top traders, complete with performance metrics, trading history, and risk profiles. This transparency helps users choose a trader whose strategy aligns with their goals.

- Replication of Trades: Once a trader is selected, the platform automatically mirrors their trades in the user's account. For example, if the chosen trader buys Bitcoin, the same trade is executed in the follower's account proportional to their investment.

- Automated Management: One of the primary appeals of copy trading is its automation. Users can engage in the market without constant monitoring.

Copy trading offers a unique blend of automation, education and accessibility, making it a good choice for both novice and experienced traders. While it provides significant advantages, this method is not invincible and even the best can falter (more on that later). So, it is crucial to carefully select traders to follow and remain aware of the associated risks and costs.

What is BloFin Copy Trading?

BloFin categorizes copy traders into two buckets:

- Master Traders are seasoned investors who have demonstrated proficiency in trading and have fetched followers interested in replicating their strategies.

- Copiers, who replicate the trading strategies of experienced investors. Copiers entrust their trading decisions to the expertise and track record of experienced traders.

BloFin Copy Trading Operates By Linking a User's Account to That of a Top-Performing Trader. Image via BloFin

BloFin Copy Trading Operates By Linking a User's Account to That of a Top-Performing Trader. Image via BloFinMaster Traders

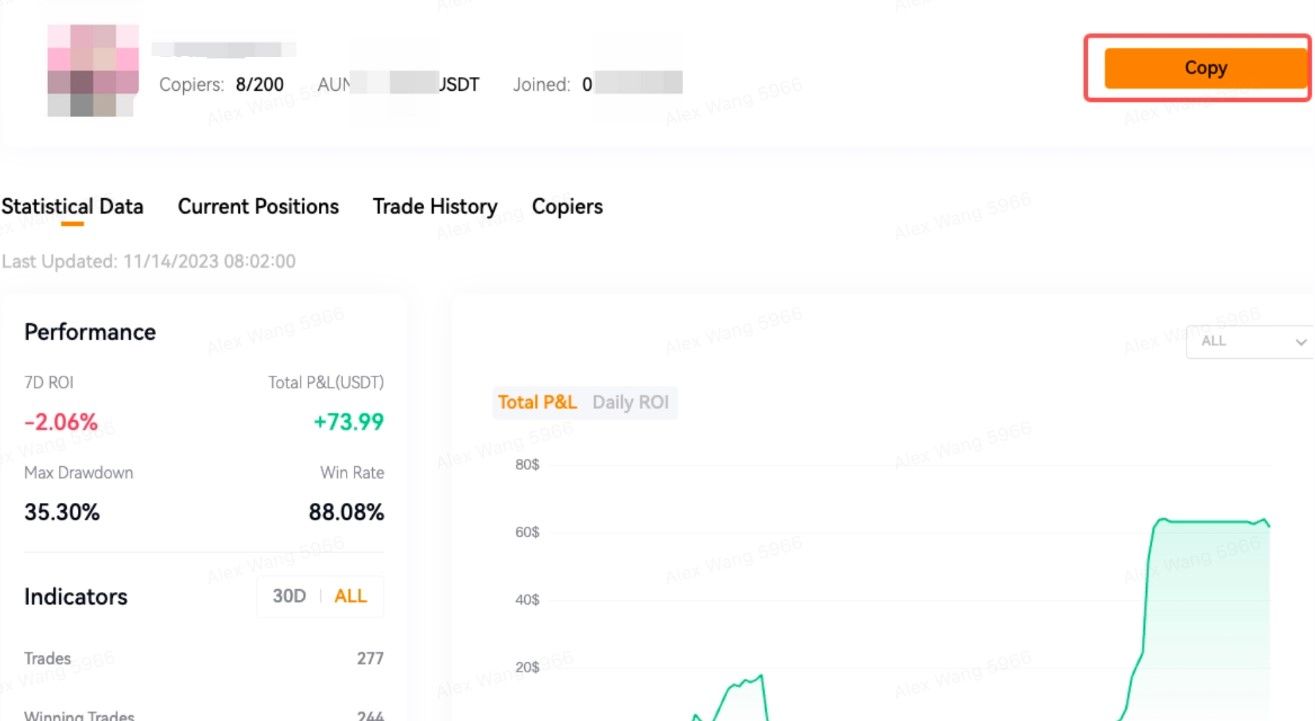

Master Traders are seasoned investors who develop and implement trading strategies based on their market analysis and expertise. They execute trades in real-time, which are then automatically copied by their followers. These traders provide detailed information about their strategies, risk management techniques, and past performance to attract more Copiers. BloFin supports all trade pairs for copy trading, with no limit on the number of pairs. It supports both cross-margin and isolate margin modes, and allows setting TP/SL at the order level. Master Traders face no leverage limitations, can use market and limit orders, and can modify open orders. Additionally, they earn 10% of the profits made by their Copiers.

Copiers

Copiers are individuals who replicate the trades of Master Traders, making this role ideal for those lacking the time, experience, or confidence to trade independently. BloFin supports two copy modes for Copiers:

- Fixed Amount (a set margin amount per order)

- Fixed Ratio (proportional to the Master Trader's position size).

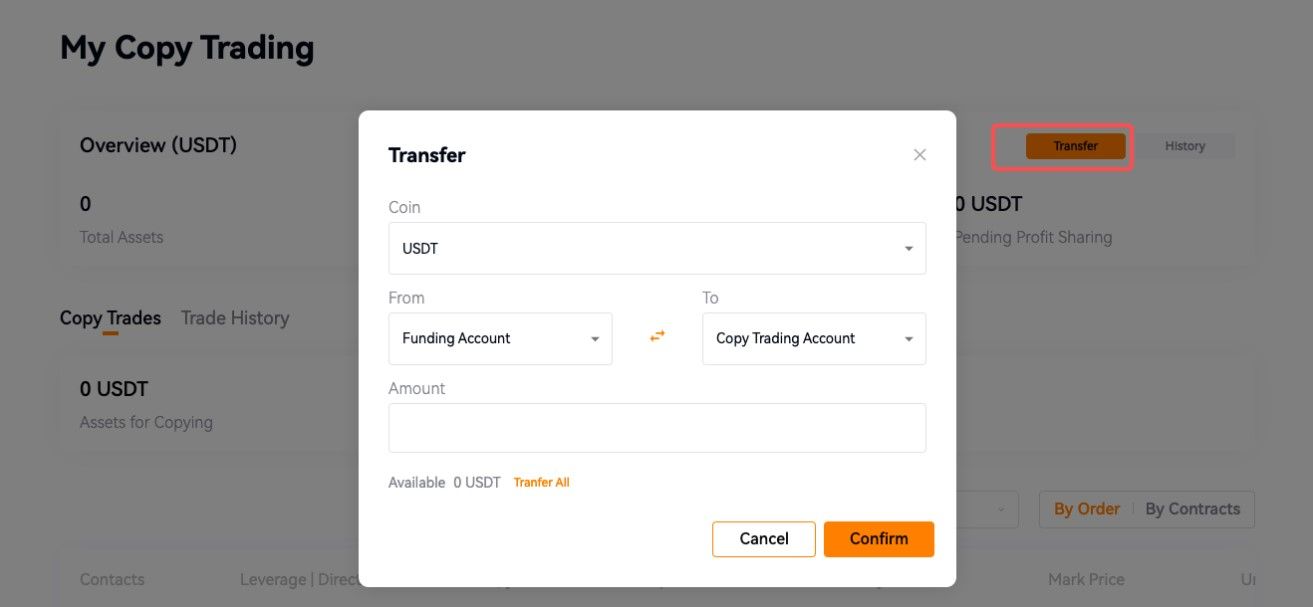

Copiers must transfer assets to their copy trading account before starting.

In futures trading, leverage is represented by a margin, which means investing a smaller amount relative to the leverage rate. Copiers have specific margin settings:

- Fixed Amount: Ranges from 10 to 1,000 USDT per copy trade.

- Total Amount for Copy Trading: Maximum trade volume ranges from 10 to 50,000 USDT.

- Margin Token: USDT is used.

Copiers can choose from three margin modes:

- Copy Trader's Margin Mode: Replicates the Master Trader's margin mode.

- Cross Margin: Uses all available funds to prevent liquidation.

- Isolated Margin: Limits the margin to a specific trade, isolating it from the rest of the account's funds.

How to Start Copy Trading on BloFin

Starting copy trading on BloFin is a straightforward process designed to be user-friendly and accessible, even for beginners. Here's a step-by-step guide to help you get started.

STEP 1: Click [Copy Trading] on the homepage.

STEP 2: Once there, Go to [My Copy Trading] > [Transfer] to move assets to your copy trading account.

Starting Copy Trading on BloFin is a Straightforward Process. Image via BloFin

Starting Copy Trading on BloFin is a Straightforward Process. Image via BloFinSTEP 3: After transferring assets, choose a master trader to follow.

You Can See a Master Trader's History. Image via BloFin

You Can See a Master Trader's History. Image via BloFinSTEP 4: In the final step, you'll set the margin, trade amount, and leverage, then click [Submit]. Your position will follow the chosen trader.

It's important to note that there two modes for opening a copy trade:

Fixed Amount Mode

- Cost Per Order: Set the margin for each order copied from the trader.

- Total Investment: Total margin for all orders with the trader.

- Margin Mode: Options include Copy trader's margin mode, Cross margin, and Isolated margin.

- TP/SL Setting: Set Take Profit/Stop Loss in advance.

- Leverage: Choose between copy trader's leverage mode or fixed leverage.

Fixed Ratio Mode

- Total Investment: Total margin for all orders with the trader.

- Proportion: Set margin as a multiple of the trader's investment size. The margin per order is calculated as Multiplier * master trader's order value / your fixed leverage.

- Margin Mode: Options include Copy trader's margin mode, Cross margin, and Isolated margin.

- TP/SL Setting: Set Take Profit/Stop Loss in advance.

- Leverage: Choose between copy trader's leverage mode or fixed leverage.

BloFin Copy Trading Fees

BloFin does not specify any particular fees for its copy trading services.

For reference, major exchanges typically impose fees for copy trading that can range from 0.05% to 0.1% of the trade value, according to CoinWire. Heck, you can even find platforms that do not charge any copy trading fees.

Benefits of Copy Trading

Copy trading offers numerous advantages, making it an attractive option for both novice and experienced traders. Here are some of the key benefits of engaging in copy trading.

A Sampling of Master Traders. Image via BloFin

A Sampling of Master Traders. Image via BloFin- Accessibility for Beginners: One of the most significant benefits of copy trading is its accessibility. New traders often face a steep learning curve when entering the cryptocurrency market. Copy trading simplifies this process by allowing beginners to mirror the trades of seasoned professionals.

- Learning Opportunity: Copy trading provides a unique educational experience. By observing the decisions and strategies of successful traders, users can gain insights into market analysis, risk management, and trading techniques.

- Time Efficiency: For many, trading can be time-consuming, requiring constant monitoring of the market and timely decision-making. Copy trading automates this process, allowing users to participate in the market without dedicating significant time to analysis and execution.

- Diversification: Copy trading enables users to diversify their investment portfolios. Instead of relying on a single strategy or asset, users can follow multiple traders with different strategies and risk profiles.

- Risk Management: Experienced traders often employ sophisticated risk management strategies to protect their investments. By copying these traders, users can benefit from these strategies without having to develop them independently.

- Emotional Control: Trading can be emotionally challenging, especially during market volatility. Copy trading helps mitigate emotional decision-making by automating trades based on a predefined strategy.

Drawbacks of Copy Trading

While copy trading offers several benefits, it also comes with its share of drawbacks.

- Dependence on Trader Performance: The success of copy trading is directly tied to the performance of the traders you choose to follow. If a selected trader makes poor decisions, those losses will be mirrored in your account.

- Lack of Control: Copy trading automates the replication of trades, which means users have limited control over individual transactions. Once you start following a trader, you are essentially trusting their judgment without the ability to intervene in specific trades.

- Risk of Over-Reliance: Relying heavily on copy trading can lead to complacency. While it’s convenient to follow successful traders, it can also discourage you from learning about market analysis and developing your own trading skills. Over time, this dependence can limit your ability to make independent trading decisions and adapt to changing market conditions.

- Market Risks: Copy trading does not eliminate the inherent risks of the cryptocurrency market. Market volatility, regulatory changes, and other external factors can still affect the performance of trades. Even the most successful traders cannot predict market movements with certainty, and their strategies may not always be profitable in all market conditions.

- Delayed Execution: In some cases, there can be a slight delay between the execution of a trade by the lead trader and its replication in your account. This delay, although often minimal, can result in different entry and exit points, potentially affecting the profitability of trades.

- Potential for Fraud: While reputable platforms like BloFin implement strict verification and monitoring processes, the risk of fraud or misrepresentation by lead traders cannot be completely ruled out. It’s crucial to conduct thorough due diligence on the traders you choose to follow and use platforms that prioritize transparency and security.

Questions to Ask Yourself Before Copy Trading

Before diving into copy trading, it’s essential to ask yourself some critical questions to ensure it aligns with your financial goals and risk tolerance. Here are key questions to consider:

1. What are my investment goals?

Determine whether your primary objective is to generate short-term profits, build long-term wealth, or diversify your investment portfolio. Understanding your goals will help you choose traders whose strategies align with your aspirations.

2. What is my risk tolerance?

Assess how much risk you are willing to take. Copy trading involves following the decisions of others, which can be unpredictable. Make sure you are comfortable with the level of risk associated with the traders you plan to follow.

3. How much capital am I willing to invest?

Decide on the amount of money you are prepared to allocate for copy trading. Ensure that you are not investing more than you can afford to lose and that you maintain a diversified portfolio to spread risk.

4. Have I researched the traders?

Thoroughly research the profiles of traders you intend to follow. Look at their trading history, performance metrics, risk levels, and strategies. Make sure their approach matches your investment goals and risk tolerance.

5. Do I understand the fees involved?

Be aware of the fees associated with copy trading. Calculate how these costs will impact your potential returns to ensure that copy trading remains a cost-effective strategy for you.

6. Am I prepared for market volatility?

Understand that the cryptocurrency market is highly volatile. Even the best traders can experience losses during market downturns. Ensure you are prepared for this volatility and have a plan to manage it.

7. Do I have a contingency plan?

Have a strategy in place for when things don’t go as expected. This might include setting stop-loss limits, diversifying across multiple traders, or having criteria for stopping copy trading if performance declines.

8. Am I willing to continuously monitor my investments?

While copy trading can save time, it still requires regular monitoring. Be prepared to review your portfolio periodically and make adjustments as needed based on the performance of the traders you follow.

Continuous Learning

Even while engaging in copy trading, it's essential to prioritize continuous education about market trends and trading strategies. This ongoing learning process can help users develop their own skills, enabling them to make more informed decisions and adapt to changing market conditions over time.

Is Copy Trading only for Beginners?

Copy trading is often perceived as a tool primarily for beginners, but its benefits extend to traders of all experience levels. Here’s a brief overview of why copy trading can be valuable for both novices and seasoned investors.

Every Crypto Journey Comes Down to Informed Decisions. Image via BloFin

Every Crypto Journey Comes Down to Informed Decisions. Image via BloFinFor Beginners

- Learning Tool: Copy trading allows beginners to learn by observing the strategies and decisions of experienced traders. This can accelerate their understanding of market dynamics and trading techniques.

- Reduced Complexity: It simplifies the trading process, making it accessible for those who may find direct trading too complex or time-consuming.

For Experienced Traders

- Diversification: Experienced traders can use copy trading to diversify their portfolios by following different strategies and markets that they might not actively trade themselves.

- Time Efficiency: It provides a way to engage in additional trading activities without dedicating extra time to research and market analysis.

- Supplementary Strategy: Seasoned traders can use copy trading as a supplementary strategy, leveraging the expertise of other successful traders to enhance their overall performance.

We must understand that copy trading is more of a versatile tool that offers significant advantages to both beginners and experienced traders. While it simplifies trading for novices, it also provides opportunities for diversification and efficiency for seasoned investors.

BloFin Copy Trading Review: Closing Thoughts

BloFin Copy Trading provides a user-friendly platform that democratizes advanced trading strategies by allowing users to replicate the trades of experienced investors. It caters to both beginners and seasoned traders with robust security, educational resources, and strong community support, creating a reliable and informative trading environment.

However, users should be mindful of potential drawbacks, such as reliance on the performance of chosen traders and associated fees that can affect profitability. Thorough research on traders and fee structures is essential for optimizing strategies.

Overall, BloFin balances simplicity and sophistication, providing a robust platform for traders at all levels.