In extreme market boredom, when interest in DeFi is calmer than a pond on a windless day, the Cardano ecosystem has displayed immense staying power. Despite being years late to the smart contract game and repeated delays in releasing critical protocol updates, Cardano has remained relevant and maintained its status as one of the top 10 cryptocurrencies in September 2023.

Cardano proclaims itself as the third-generation blockchain (following Bitcoin and Ethereum), focusing on sustainability, scalability, and transparency. Today, the Ethereum ecosystem has become synonymous with DeFi, which begs the question of how Cardano has maintained a strong position in the evolving Web3.

This article will touch on Cardano use cases and explore the unique innovation happening in its ecosystem that may help it shape the future of Web3 and the global economy. From tokenizing real-world assets to pioneering solutions in supply chain management, we will explore Cadano’s far-reaching initiatives in connecting blockchain technology with real-world applications.

Cardano Overview

Cardano is a proof of-stake (PoS) blockchain originating from a series of academic research papers. It was founded by ex-Ethereum builders Charles Hoskinson and Jeremy Wood in 2015. The Cardano blockchain and its native settlement cryptocurrency, ADA, went live through a multi-stage ICO in September 2017.

Three key facilitators back Cardano -

- The Cardano Foundation: A Swiss non-profit that drives Cardano adoption and ecosystem growth. They develop the core digital infrastructure.

- EMURGO: The for-profit venture capital arm that creates business opportunities across financial services, supply chain management, retail, healthcare, public sectors, and the Internet of Things.

- IOG (Previously IOHK): A blockchain research and technology company that designs and maintains the Cardano platform.

We go into greater detail on the Cardano protocol and its history in our dedicated Cardano Analysis article.

Cardano Roadmap

Divided into five stages, the Cardano roadmap sets the path to evolve the blockchain into a multi-chain smart contract-capable network run by a decentralized on-chain governance model. The stages are summarized as follows:

- Byron - Launched in September 2017, Byron marked the mainnet launch of the Cardano blockchain as a federated network that could only support ADA transactions. It ran on the Ouroboros Proof of Stake consensus protocol.

- Shelly - This stage began in July 2020 and opened the Cardano network for third-party node participation. The goal was to have most nodes run the community and implement a frictionless transition from federation to decentralization. Shelly also opened staking delegation as an integral feature of the protocol.

- Goguen - In September 2021, Cardano achieved a key milestone on its roadmap that added smart contracts support to the Cardano network, opening doors to DeFi within the ecosystem. Goguen also introduced the core infrastructure to create new tokens in the ecosystem, supporting a multi-currency ledger. Some new programming tools were also introduced -

- Plutus - A smart contract development language built using Haskell functional programming language.

- Marlowe - High-level smart contracts programming language for financial contracts.

- Marlowe Playground - An application-building platform for non-programmers.

- Basho - Currently in progress, this stage is all about enabling scalability and interoperability. Basho introduces sidechains - a layer 2 scaling design used for creating interoperable blockchains atop the Cardano mainnet, implementing a sharding mechanism and allowing support for an account-based ledger-keeping system like in Ethereum.

- Voltaire - This final stage in Cardano’s journey optimizes its governance towards decentralization and self-sustainability. It implements a community treasury, a voting mechanism to pass Cardano Improvement Proposals (CIPs). Voltaire is progressing in parallel with Basho and will mark the exit of IOHK’s federated management of the network.

Cardano Technology

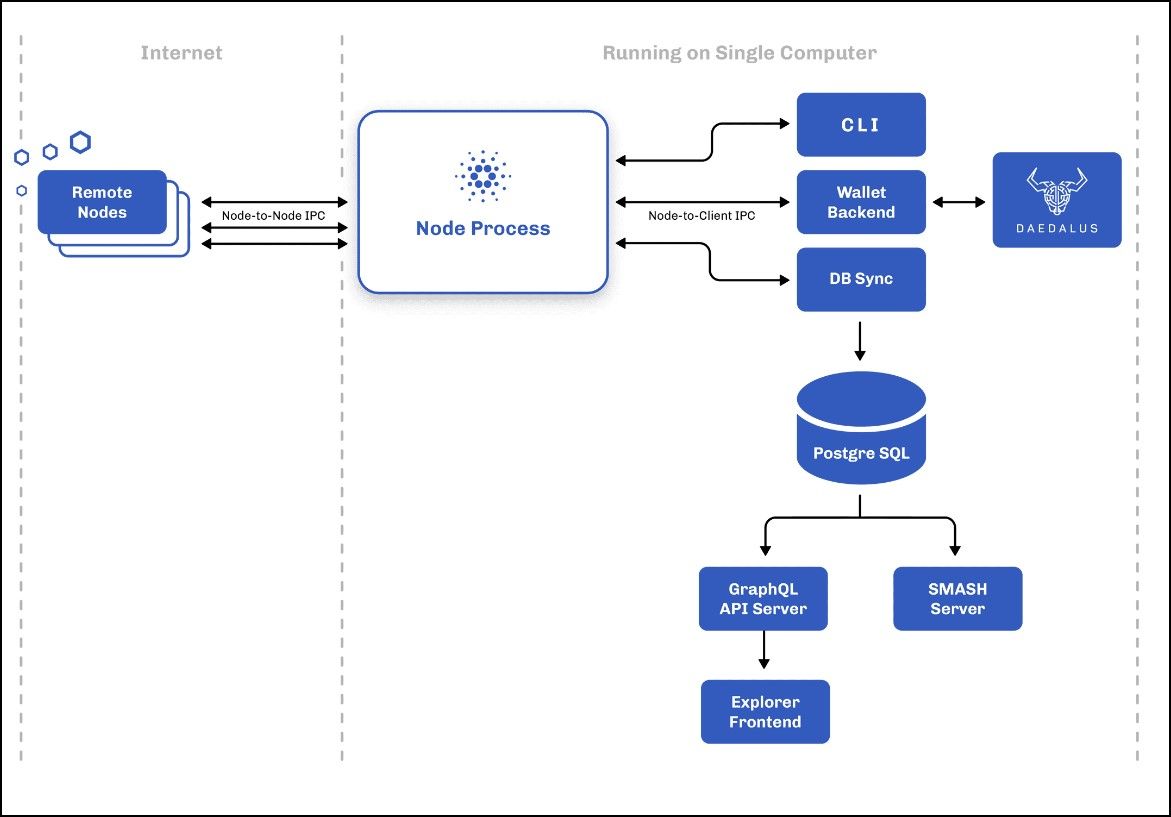

The Cardano technology stack consists of the following components -

- Ouroboros Proof of Stake

- Cardano accounting standards

- Native tokens

- Staking

- Cardano sidechains

- Programming languages

Cardano High-Level Architecture | Source: Cardano Documentation

Cardano High-Level Architecture | Source: Cardano DocumentationA brief rundown of these elements provides the necessary context for the trends and innovations we will explore shortly. Let’s dive in!

Ouroboros Proof of Stake

As the Ouroboros consensus protocol, Cardano was one of the first blockchains to adopt the PoS mechanism. Ouroboros lets users delegate their ADA holdings in a staking pool, which is unlike Ethereum, where delegation services are provided by a third party (like Lido Finance and RocketPool).

Like the larger Cardano roadmap, Ouroboros is going through a multi-stage evolution, summarized as follows -

Ouroboros Classic

As Ouroboros' first iteration, Classic laid the foundation for a mathematically provable PoS blockchain system and an incentive mechanism to participate in the consensus. One standout feature of Classic was a verifiable random function (VRF) used to designate a random number to nodes. VRF made it harder to predict PoS patterns, improving the security of the network.

Ouroboros BFT

Ouroboros Byzantine Fault Tolerance (BFT) primed the protocol for decentralization it was set to achieve with the Shelly upgrade. Ouroboros BFT allowed a distributed network of nodes to stay synchronized while conducting the PoS consensus.

Ouroboros Praos

Praos introduced significant security and scalability improvements to the Classic implementation. Praos introduced semi-synchronous consensus, where nodes do not necessarily have to verify all blocks together — allowing for some wiggle room, where several nodes verify a block gradually, and finality occurs later, allowing for more scalability and throughput.

Praos also introduced private-leader selection and key-revolving signatures to prevent anyone from predicting the next slot leader and targeting an attack. Praos is the current iteration of Ouroborous.

Ouroboros Genesis

As the fourth iteration of Ouroboros, Genesis will add a novel chain selection rule to make it easier for new nodes to join the network. It achieves this by eliminating the need for trusted checkpoints while bootstrapping from the genesis block.

Ouroboros Crypsinous

Crypsinous adopts SNARKs to introduce new privacy-preserving guarantees to the protocol. While not scheduled to be implemented on the Cardano mainnet, other chains can use it to implement privacy-preserving settings.

Ouroboros Chronos

Chronos is a clock synchronization protocol that helps new or inactive nodes use a cryptographically synchronized, on-chain clock to sync with the network's latest propagated block. Chronous eliminates the need for a centralized Global clock to synchronize the nodes, increasing blockchain nativity.

Cardano Accounting Standards

Like Bitcoin, the Cardano blockchain follows the UTXO (Unspent Transaction Output) format to record ledger balances and transactions between addresses. A UTXO format is one where an address owns unspent outputs rather than a cumulative balance, like in blockchains like Ethereum. An unspent output becomes the input for a new transaction.

Extended UTXO (eUTXO)

Cardano builds upon Bitcoin’s UTXO model. It allows UTXOs to store additional logic in the form of scripts. The scripts can hold arbitrary logic, metadata, or smart contract functions, passing programmable instructions with the eUTXO. One benefit of eUTXO is that validators can perform multi-token transactions at the same time. They can also process multiple eUTXOs simultaneously as long as they are mutually exclusive.

Cardano Monetary Policy

The Voltaire upgrade from the Cardano roadmap, where the protocol enables decentralized governance, is set to introduce decentralized voting and the Cardao Treasury. The treasury will fund the maintenance and further research on the Cardano protocol.

Decentralized voting through staking pools is designed to maintain a reward equilibrium between all saturated pools to ensure all participants are rewarded optimally, where all stake is delegated uniformly. The protocol will split the transaction fees collected from the users between staking pool rewards and the treasury.

Cardano Native Tokens

On Cardano, all fungible or non-fungible tokens are supported by the Cardano accounting ledger, with built-in functionality to track ownership and transfer assets like with ADA. Unlike Ethereum, this feature allows token deployment without the use of smart contracts. This feature potentially reduces the overheads of deploying and transferring tokens on Cardano rather than Ethereum while eliminating smart contract risk associated with ERC-20 and ERC-721 tokens.

Cardano Staking

Cardano pools the transaction fees collected in an epoch (a bunch of blocks within a specific time) and distributes it evenly to all the pools that produced blocks in that epoch, maintaining an equitable distribution of rewards.

The Cardano governance decides a percentage of the pooled revenue that goes into the treasury rather than to stakers. Currently set at 20%, this figure may change with future governance proposals.

Feel free to check out our guide on How to Choose a Cardano Staking Pool if you decide to get involved in ADA staking.

How Cardano Solves Real-World Problems

A few of the Cardano community’s key focuses are sustainability, scalability, and transparency. Cardano hopes to become a fully open-source and decentralized project that delivers state-of-the-art resilient infrastructure for financial and social applications that are fair, inclusive, and adopted globally. Let’s explore how well the project has fared in realizing this initiative.

Tokenizing Real-World Assets With Cardano

The tokenization of assets on the blockchain saw its initial applications as NFTs. A non-fungible token is an on-chain asset linked to some data (most commonly in the form of digital art). The idea behind tokenization is to improve asset mobility and streamline its financialization. The advantages of tokenizing real-world assets (RWAs) include storing and recording the ownership of a tangible asset, like real estate, a house, or precious metals, on a blockchain ledger. Some advantages of tokenizing RWAs are -

- Reducing friction by removing middlemen and inefficient bureaucracy.

- Improves asset liquidity and velocity.

- Reduces barriers to entry through features like asset fractionalization.

- As blockchains propagate perpetually, it removes time-related barriers.

Several projects within the Cardano ecosystem are working on tokenizing RWAs. Here are some examples -

- HouseAfrica and Seso Global: Lack of transparency in land ownership and prevalent gender inequality and illiteracy have made it challenging for Africans to legally own land in their country. HouseAfrica and Seso Global are addressing land ownership issues in African countries with solutions like blockchain-powered e-marketplaces and transparent land transactions.

- TVVIN: This platform is tokenizing precious metals by leveraging the Cardano blockchain. Metals like gold and silver are revered as essential investment vehicles. The tokenization of gold eases its trade and acquisition through features like fractionalization, making it cheaper to gain exposure to gold.

- Indigo Protocol: This is a synthetic assets protocol on Cardano. Indigo allows anyone to create synthetic assets using stablecoins or ADA, called iAssets. Indigo allows the trade of externally located assets like BTC, ETH, and USD in the Cardano ecosystem.

- AtalaPRISM: It is a self-sovereign digital identity platform built on Cardano. Atala offers the infrastructure to issue DIDs (Decentralized Identifiers) on the Cardano blockchain.

These solutions have proven groundbreaking in unlocking opportunities in third-world countries without adequate infrastructure or confidence in societies to support basic needs. For instance, the Ethiopian education ministry uses Atala as a student credential system. World Mobile Network subscribers in Zanzibar can access Atala for digital services like banking and healthcare. Seso Global has already listed several properties for sale on its website.

Cardano in Supply Chain Management

Blockchain technology has displayed the potential to improve supply chain management. Here are some projects leveraging Cardano to enhance supply chain traceability, transparency, and efficiency -

- Scantrust - It is a connected goods and packaging platform partnered with Cardano to build the Cardano-Scatrust solution. The solution allows brand owners to use Scantrusts' QR codes with the Cardano blockchain for fast, low-cost supply-chain traceability.

- Beefchain - Cardano partnered with Wyoming-based traceability solution company Beefchain to help ranchers track beef from farm to table.

- Baia’s Wine - A Georgian wine company has collaborated with Cardano to authenticate the supply chain of their wine from farm to table by storing the entire supply chain data on-chain.

DeFi on Cardano

Cardano and Ethereum are both decentralized PoS and smart contracts-capable blockchains. However, they differ significantly in several critical aspects, from their programming language to their block design. Here’s a quick summary of some design differences -

| Feature | Cardano | Ethereum |

|---|---|---|

| Accounting Standards | eUTXO | Account Balance |

| Smart Contract Language | Haskell | Solidity |

| Staking | Liquid | Static |

| Multi-chain | Native | External |

| Governance | Federated | Decentralized |

| Tokens | Native | Smart Contracts |

| Design | Layered | Monolithic |

Cardano emphasizes a research-driven and peer-reviewed approach in developing its ecosystem that enforces rigorous testing standards in its roadmap, which naturally requires significant control over the network, which may be why Cardano still needs to adopt the DAO model Ethereum did very early in its development process.

Cardano is deceptively similar to Ethereum, delivering broadly similar services but fundamentally different in operation. These design choices present several advantages over Ethereum and some clear tradeoffs.

For instance, UTXO can process transactions in parallel, and the native token format requires fewer overheads than processing them as smart contracts. In-built liquid staking and multi-chain support offer better security guarantees than similar externally managed services on Ethereum.

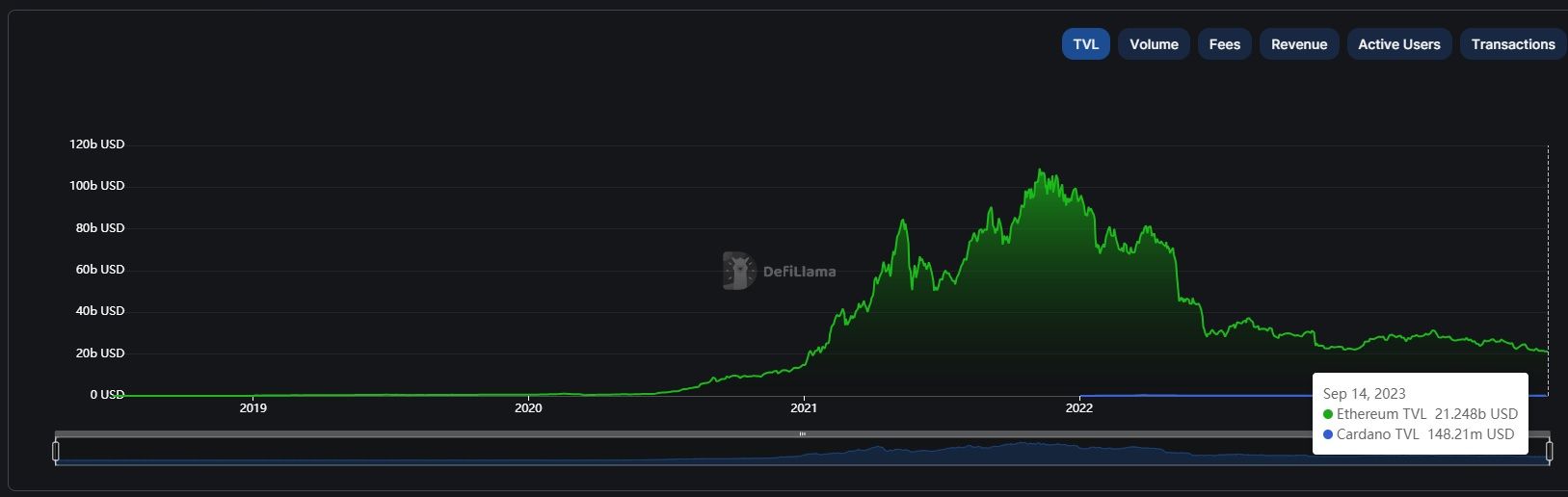

Cardano's TVL is a Fraction of Ethereum's. Image via DefiLlama

Cardano's TVL is a Fraction of Ethereum's. Image via DefiLlamaThese advantages come at a significant cost. The Cardano ecosystem may be efficient, but the Ethereum network is the undeniable centre of DeFi activity, research, and innovation. Cardano is behind Ethereum in the smart contracts game by several years, during which Ethereum has matured as the primary spot for DeFi activity and innovation. Ethereum is the most secured PoS network, and its future upgrades are set to improve scalability several times than its current performance.

Haskell is an entirely different language than Solidity, meaning developers must rebuild their Dapps from the ground up for the Cardano ecosystem. The cost of this transition may outweigh its rewards in the long haul.

However, Cardano has received considerable attention since the Alonzo hard fork. Where TVL in Ethereum has been declining, Cardano has been much more resilient to economic factors and has shown growth in the value locked in its ecosystem since 2022. A few noteworthy developments in on-going in the Cardano ecosystem -

Scalability Solutions

Cardano offers three scalability solutions - Hydra, Mithril, and Sidechains.

Hydra

Hydra is a layer 2 scalability solution for Cardano capable of isomorphic state transfer between the blockchains. This means the consensus and security mechanism, accounting standards, network topology, and other cryptographic metrics are similar across both layers, making layer 2 development significantly smoother.

Hydra Head is the first suite of protocols under Hydra. It is an off-chain mini ledger that works similarly to the Cardano mainnet, but faster.

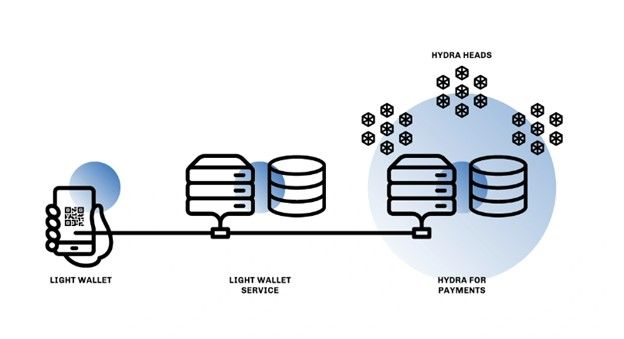

Hydra for Payments

Input Output Global (IOG) collaborated with Obsidian Systems to develop Hydra for Payments — an open-source set of developer tools to implement micro-payment solutions on Cardano. The solution will enable developers to leverage Hydra protocol’s composable and deeply integrated environment to reduce operating developing costs while improving the network's throughput.

Hydra for Payments Architecture | Source: IOHK

Hydra for Payments Architecture | Source: IOHKMithril

Mithril is a stake-based threshold signature scheme. A threshold signature scheme (TSS) is a signature aggregation protocol where a set number of participants can sign a cryptographic commitment with a valid signature. Unlike a multi-signature scheme, TSS combines participants' signatures to construct a single valid signature, which does not reveal the number of signing parties and their identities.

Mithril leverages participants’ stakes to weigh their signatures. It improves scalability by reducing the overheads associated with storing multiple signatures during a signing process and propagating this data across other nodes in the network.

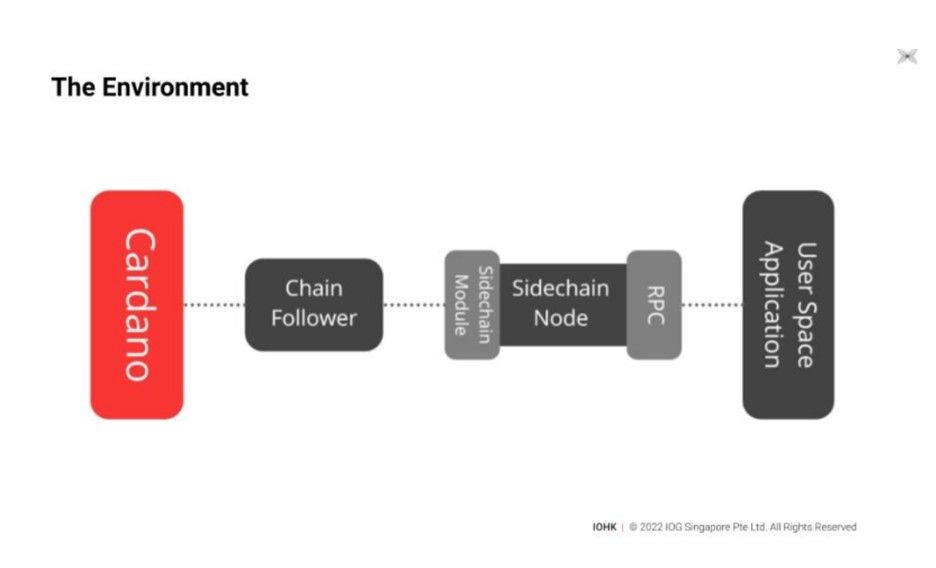

Sidechains

A sidechain is a blockchain, typically with a higher throughput, that connects to a layer-1 chain like Cardano or Ethereum. Sidechains may operate with proprietary consensus schemes, allowing asset and information exchange with the main chain via bridges. Cardano provides a toolkit for building custom sidechains for the Cardano ecosystem.

Cardano Sidechains Architecture | Source: Cardano Docs

Cardano Sidechains Architecture | Source: Cardano DocsSome noteworthy sidechains on Cardano include:

- Milkomeda C1 is a Cardano sidechain working on Cardano wallets that can support EVM smart contracts.

- Midnight is a data-protection-focused Cardano sidechain built to safeguard commercial and personal data.

- World Mobile is extending its partnership with Cardano to integrate the World Mobile Chain as a Cardano sidechain. As the chain is built with Tendermint, the World Mobile Chain will establish bridging solutions between Cardano and the Cosmos mainnet.

- Wanchain, a layer 1 blockchain, plans to become interoperable with Cardano sidechains to support multi-chain RealFi (tokenizing RWAs) applications.

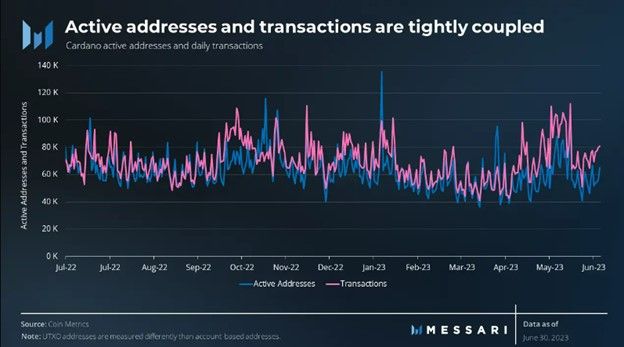

Cardano Blockchain Activity | Source: Messari

Cardano Blockchain Activity | Source: MessariA steady flow of transactions and active address in the Cardano ecosystem, despite economic downturns, is a testament to the Cardano ecosystem’s ability to maintain active interest in the protocol.

Cardano Philanthropy and Charity Initiatives

Cardano is involved in several philanthropy and charity initiatives through projects and partnerships. Some examples include:

- Project Catalyst - It is a decentralized funding platform that allows the Cardano community to propose, evaluate, and vote on projects that promote the growth of the Cardano ecosystem. It has successfully conducted nine funding rounds until September 2023 and launched numerous contracts on the Cardano blockchain.

- Save the Children - Cardano partnered with Save the Children Foundation in Rwanda to install a payment gateway supporting ADA to allow crypto donations to the platform.

- MDP - Mission Driven Pools is a collective of Cardano stake pool operators with the mission to help charitable organizations worldwide and encourage other operators to give back to society.

Cardano Mission Driven Pools Statistics | Source: MDP

Cardano Mission Driven Pools Statistics | Source: MDPCardano Public Sector Partnerships

Here are two public sector initiatives by the Cardano ecosystem -

Identity Digitization in Ethiopia

In August 2012, Cardano’s parent company, IOHK, partnered with the Ethiopian government to build a national ID blockchain system. The ID system would use blockchain for a universal student credentialing system for millions of students across over 3,500 schools nationwide. Cardano founder Charles Hoskinson told Yahoo Finance that the IDs issued by this system will access Learning Management Systems (LMS) data and machine learning to help tailor tuition and curriculum.

Hoskinson believes that the model will promote education and employment in the East African nation, opening doors to a more extensive national ID architecture down the road.

Promoting Blockchain Research in Zurich

Another example of a public sector initiative is the Cardano Foundation’s partnership with the University of Zurich (UZH). In association with the Blockchain Center of UZH in September 2022, Cardano sponsored a Ph.D. position in Blockchain Analytics, which will look into the economic applications of UTXO-based blockchain systems.

Closing Thoughts

In this article, we've examined how Cardano aims to be more than just another blockchain platform; it aspires to address multiple facets of the real-world economy and society. Its initiatives in tokenizing real-world assets, enhancing supply chain management, and contributing to education suggest a broad scope of application.

What differentiates Cardano is its research-driven approach, anchored in principles of sustainability, scalability, and transparency. This model positions it as a potential candidate for tackling challenges like African land ownership and digital identity management in Ethiopia's educational system. These efforts indicate Cardano's ambition to use blockchain for pragmatic, real-world solutions.

Furthermore, Cardano's public sector partnerships, such as those with the Ethiopian government and the University of Zurich, imply a willingness to extend blockchain's utility beyond financial transactions to broader governance and educational systems. These initiatives prompt a rethinking of how blockchain technology can contribute to various societal functions.

As the global economy continues to become more complex, there's an emerging need for systems that are secure, efficient, and decentralized. Cardano is attempting to position itself at the forefront of this transformation, focusing on real-world applications. While it faces challenges and competition, particularly from well-established players like Ethereum, its approach offers a different pathway for applying blockchain to solve complex, non-blockchain-native problems.