2018 was indeed quite an epic year in the cryptocurrency industry. From extreme market movements to exchange hacks and the constant allure of "institutional adoption", it was a year to remember.

This was all fastidiously documented and summarized in a yearly review conducted by the team over at CoinGecko. The report is really insightful and covers numerous different topics from adoption to technological advancements and regulation.

I decided to pull some of the most interesting insights from the report and succinctly summarize these statistics and insights. Let's take a quick look at one of crypto's most memorable years to date.

Market Dynamics

2018 saw the price of Bitcoin fall from 19,000 to $3,100, while most Altcoins lost as much as 90% of their value. From 700 billion to 150 billion, the crypto markets experienced a 78.85% decline in market cap.

Despite these figures, trading volume remained consistent for most of the year, which can be attributed to the growing number of exchanges in the space, as well as an increasing level of global interest in the crypto markets.

As many investors sold their coins, many more decided to sign up to exchanges and become day traders, taking advantage of the high volatility that is unmatched by most other asset classes. This spike in day trading activity most likely contributed to the consistent trading volume.

Total Market Cap Performance in 2018. Source: CoinGecko

Total Market Cap Performance in 2018. Source: CoinGeckoQuarter 4 of 2018 saw a 44.25% drop in the crypto market cap. This was around the time where Bitcoin had finally broken the $6,000 support level after months of speculation. Many bearish trading analysis (including popular crypto trader Tone Vays) predicted that the price of Bitcoin would drop below $6k and reach the $5k level.

If the $5k level was broken, they anticipated that we could go as low as $3,000. At the time, most people thought $3k would be for too low for investors to not take advantage of. Yet 2 months later we are still ranging in between the $3k and $4k level without any clear signs of a breakout in either direction.

The top 5 coins in the crypto market lost between 66% and 93% of their value:

- BTC: -73%

- ETH: -82%

- XRP: -84%

- BCH: -93%

- EOS: -66%

Altcoins clearly suffered worse losses than Bitcoin. In the beginning of the year, bitcoin dominance among the top 30 coins was at 44%. By the end of the year it went up to 55%.

Ultimately, if there’s one thing that was clear about the markets in 2018, it’s that it paid to stay bearish.

Crypto Exchanges

As more traders flocked into the crypto space in 2018, the number and trading volume on crypto exchanges exploded.

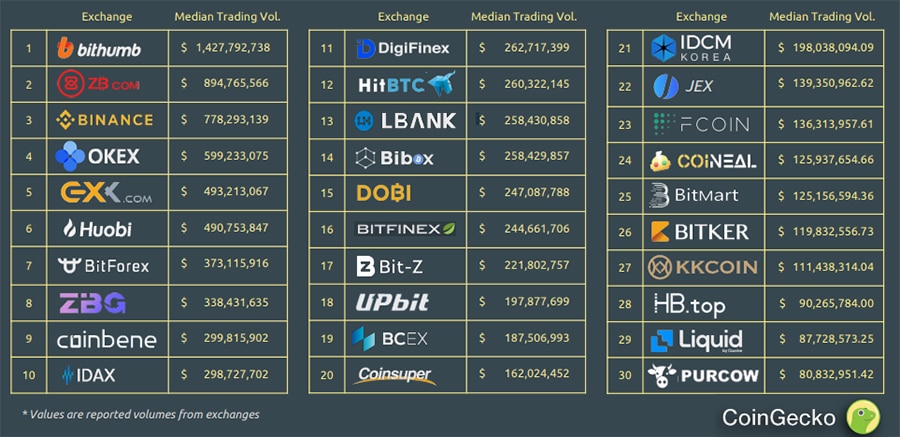

In quarter 4, the top 5 exchanges (ranked by trading volume) were Bithumb ($1.42B), ZB.com ($894m), Binance ($778m), OKEx ($599m) and Exx ($493m). It should be noted that trading volume is not always easy to verify and can often be faked.

In fact, another report that came out in December listed several popular exchanges along with their real trading volumes. Of all the top exchanges, only the Binance Exchange, (ranked #3), Bitfinex (ranked #16) and Liquid (ranked #29) showed 100% real trading volume.

Crypto Exchange Rankings in 2018. Source: CoinGecko Report

Crypto Exchange Rankings in 2018. Source: CoinGecko ReportThis calls into question how much of the volume in the crypto space is organically created by real traders, and not a result of wash trading (the act of selling coins back and forth yourself in order to manipulate trade volume).

Unsurprisingly, exchanges with transfer free mining were more dominant in 2018 due to the ability for traders to maximum profits by not having to pay transfer fees.

Q4 Major Events

Several major events defined the crypto space in 2018. Though a few stories were setbacks, the overall consensus was that we were edging closer to mainstream crypto adoption.

Government

South Korean regulators, once known for being very pro crypto, became more restrictive on ICO’s as the market declined rapidly and many of South Korea's top ICO’s failed to perform.

The UAE took a more optimistic viewpoint, and chose to embrace the ICO model as a way to boost capital markets..

In the US, the state of Ohio took a giant leap in accepting Bitcoin as a form of payment for taxes. This story was impressive because it showed that some lawmakers are willing to put in the effort to understand and embrace new technologies, but it was also ironic because of the fact that BTC has long been used as a tool to avoid reporting income and paying taxes.

Ohio lawmakers likely understood this and thought they would at least create a window for Bitcoin holders who may be scared to convert to US dollars and get audited to willingly pay their taxes through BTC.

Stablecoins started to see mainstream adoption over in Brazil, as the countries Bank began using the Ethereum blockchain to issue a stable coin.

Venezuela moved forward with their plans to adopt their own cryptocurrency – the petrodollar, which was presented at OPEC as the digital currency for oil.

Switzerland continued to demonstrate why they are miles ahead of other countries when it comes to crypto adoption by unveiling a legal blockchain framework in crypto valley association partnership.

Crypto

The bitcoin blockchain achieved a major breakthrough, claiming that block size increases would now be possible without a hard fork.

The Bitcoin cash split was arguably the most controversial story in crypto during 2018. The battle of egos between Craig Wright and Roger Ver was hard fought on both sides, and ultimately ended in a permanent split and the creation of 2 new coins: BCHABC and BCHSV. Based on the current prices, it doesn’t look like either coin faired better.

Lifestyle

Google CEO Sundar Pichai revealed that his teenage son is an Ethereum miner, while big name celebrities like DJ Khaled and Floyd Mayweather were both charged and fined by the SEC for shilling fraudulent ICO’s.

Mayweather agreed to pay $300,000 in disgorgement, a $300,000 penalty, and $14,775 in prejudgment interest. Khaled agreed to pay $50,000 in disgorgement, a $100,000 penalty, and $2,725 in prejudgment interest.

Upstarts

Several crypto startups were forced to layoff employees, including big names like Steemit, Civil, Consensys and one of Ethereum Classics development teams.

Binance announced their first crypto-fiat exchange in Uganda.

Crypto Thefts

Despite the security benefits that blockchain technology can bring, the crypto space experience dozens of high profile hacks that cast doubt on the ability for companies and individuals to secure their funds on crypto wallets any better than they would in Banks.

The estimated total loss of funds due to security breaches and scams in 2018 was $867.5 million, 50% more than all the previous years combined.

Some notable hacks and scams include:

- The Coincheck theft: $400m (500m XEM) was stolen

- Coinhoarder Phishing Scams: $50m

- BitGrail Theft: $170m (17m NANO)

- BTC Global Ponzi Scam: $50m

- Bithumb Hack: ($31m)

ICO Insights

The ICO market may seem like it had hit its peak in 2017, but it was actually 2018 that saw more money raised by more projects and a larger number of successful projects. Unfortunately, the average token return per project was significantly less in 2018 compared to 2017:

Some ICO statistics from 2018. Source: CoinGecko Report

Some ICO statistics from 2018. Source: CoinGecko ReportSingapore was the country with the most ICO’s at 228. United states claimed second with 195, the UK was third with 165, and the tiny country of Estonia was fourth with 112 ICO’s. A total of 247 ICO’s came from a random assortment of other countries, showing that the market for ICO’s had truly become a global phenomenon.

2018 saw a total of 943 projects completing their fundraising with average amount raised of USD $17.59 million. The most successful month for ICO funding in 2018 was June with $5.89 billion raised. This was the same month that EOS finished their year long ICO raise to claim the largest fundraising of the year at $4.2billion. The least successful month was December, with just $305m raised.

Stablecoins

Stablecoins became a trending topic in the crypto space last year. These are digital assets that aim to offer price stability to the cryptocurrency market by mirroring the value of traditional fiat currencies or assets.

They primarily function as a store of value particularly when crypto market prices are dropping and investors want to retain the current value of their Bitcoin or Altcoins. These are also an easier unit of account because they are pegged one to one fiat currencies (so instead of counting your money in Satoshi’s, you can count it in dollars or Euros).

The top 5 stable coins by Market cap in 2018 were Tether (~$2billion an a 75% market share), TrueUSD (~204m and a 7.4% market share), USD Coin (~$248m and a 9.1% market share), Paxos Standard or PAX (~$144m and 5.3% market share) Dai (~$69m and 2.5% market share).

TUSD, Dai, USDC and PAX grew by 30x, 20x, 15x and 10x respectively in 2018. Tether (USDT) lost significant dominance in 2018, only growing by 1.5x. This was largely due to the many scandals the stable coin received, including accusations that it did not have enough US dollar funds to match the number of Tether coins it was printing.

Bitcoin Cash Split

The Bitcoin Cash fork was arguable one of the most controversial events to occur in the crypto space in 2018. Bitcoin Cash was to designed to fork their blockchain every 6 months and implement a new software upgrade to include changes proposed by the open-sourced developers.

The conflict started when Bitcoin ABC Lead Developer, Amaury Séchet proposed a change to the November fork

- New opcode called OP_CHECKDATASIG which enables validation of messages from outside the blockchain and enables oracles and cross-chain atomic contracts.

- Canonical transaction ordering (CTOR) for massive scaling improvements in the future.

Dr. Craig Wright (founder of NChain) was against the proposal and disagreed that Bitcoin Cash should be used for non-cash transactions.

The disagreement ultimately led to a fork that would split Bitcoin Cash and created 2 new coins: Bitcoin ABC and Bitcoin SV. BCHABC now trades at $117, while BCHSV trades at $66.69. Prior to the split, Bitcoin cash was around $500-$600, so it’s clear that for now, the decision to split coins was not beneficial to the value of BCH.

Decentralized Apps

One of the things that make blockchain like Ethereum, EOS and Tron so popular is their utility as platforms for launching Decentralized apps (or Dapps). Many people believe these Blockchains can be for Dapps what Apple app store is for Apps. However in 2018, the numbers showed that the crypto space still has a long way to go before it can match the level of activity that the App store brings.

2018 only saw 1,432 Dapps being launched (1,045 for Ethereum, 235 for EOS, 97 for TRON and 46 for STEEM). The total number of unique Dapp users was only 1.4 million, with 279m total transactions and $6.7billion transacted. All though these numbers may seem high, when spread cross 1,432 Dapps, we’re only looking at ~977 users per Dapp, 194k transactions per Dapp and ~$4.5m transacted per Dapp.

The good news is the area of focus for Dapps began to spread out in 2018. In January, games accounted for a little over 50% of app Dapps, but by December, the dominance of games was reduced to around 30%, with more Dapps focused on Betting, decentralized exchanges, social networking and financial services starting to emerge.

Security Tokens

Arguably the second most hyped innovation after stable coins was Security Tokens. These are basically a digital representation of a security, such as a stock, bond, piece of artwork or any other traditional asset.

Security tokens have promised endless possibilities for investors because of the ability to take assets that have been traditionally only been accessible to the financial elites, and convert them into crypto currencies that can be traded in the same manner as Bitcoin or any other Altcoin.

Some of the assets that can be tokenized. Source: HackerNoon

Some of the assets that can be tokenized. Source: HackerNoonThrough Security Token Offerings (a fundraising mechanism similar to ICO’s) billions of dollars can enter the market to fund previously exclusive traditional assets, and also fund business and initiatives that may have struggles to acquire funding through the traditional routes (IPOs, Venture capital, etc).

Masternodes

Masternodes are cryptocurrency full nodes or computer wallets that keep the full copy of the blockchain in real-time. The number of master nodes and master node coins increased significantly quarter-on-quarter with double digit growth in Q2 and Q3 and triple digit growth in Q1. Masternode coins increased from 57 to 536, while Masternodes increased from 35,780 to 250,307.

However, although the number of master nodes and masternode coins increased their values decreased significantly in 2018, from $12.5billion to $530m market cap for Masternodes. Dash and PIVX were the top 2 Masternodes for 2017 and 2018.

Non-Fungible Tokens

Finally, Non-fungible tokens (ERC-721 tokens that offer unique characteristics which make them different non divisible and digitally scarce) continued to make noise in 2018.

Crypto Kitties were the first digital asset to prove the importance of scalability on the Ethereum blockchain. These non-fungible tokens continued to show heavy trading volume all through 2018, with $14.3million in trading volume.

Decentraland, the virtual reality marketplace for buying property saw $27m in trading volume. Non-fungible token sales also made headlines, with a piece of land on the Decentraland platform being sold for $175,578, and a Cryptokitty being sold for $172,794. In addition, the total number of NFT communities expanded from 10 to 50.

Conclusion

Overall, the crypto space experienced a variety of exciting events and saw growth in several areas that were not directly linked to price.

As more effort is put into development of Dapps, security tokens, Stablecoins and crypto legislation, we will ultimately arrive a place where the price of the crypto markets start to reflect its true value.

So, 2018 was indeed quite a year in the relatively young life of cryptocurrencies. Indeed, if the first month of 2019 is anything to go by, we are likely in for another exciting and eventful year.