Welcome, Cryptonauts. It looks like It’s everybody’s favourite time of year again: Tax season. 🥳 🙄

It is no secret that tax reporting can be complex, especially for crypto holders, as trying to navigate the constantly changing crypto tax landscape with a lack of a structured taxation framework is an administrative nightmare.

Luckily, with the rise of crypto tax confusion, companies such as CryptoTrader.Tax have been on the rise, saving the day and making the lives of crypto holders easier when it comes to tax time. The folks over at CryptoTrader.Tax understand the ins and outs of crypto taxes better than anyone. Fortunately, for the crypto community, they have a suite of crypto tax software to assist in this area to help keep crypto investors up to speed and compliant, so we can file our taxes in the most accurate way possible without having to worry about Uncle Sam kicking our doors in and hauling us off to crypto jail for making tax mistakes.

The tax professionals at CryptoTrader.Tax have recently released a very insightful report on the State of Crypto Tax Reporting in 2022, which we will be covering in this article. I will give a brief overview of what CryptoTrader.Tax is and provide an overview and summary of the report.

If you would like more info on crypto tax tools and software, be sure to check out our article on The Top 8 Tax Tools for Crypto.

Why You Should Consider Using Crypto Tax Tools

Taxes can be a seriously time-consuming, stressful, and tricky subject, and making mistakes can be costly! Failing to report taxable events can lead to fines, hefty tax bills, even jail time! So you definitely want to make sure that you are dotting all your I’s and crossing all your T’s. That is why highly educated accountants and tax professionals can be hired and why tax tools have been created, as trying to navigate taxes yourself may not be the best idea and can lead to mistakes.

For Sure! Fortunately, There Are Tax Tools That Can Help Image via worldwideinterweb

For Sure! Fortunately, There Are Tax Tools That Can Help Image via worldwideinterweb Traditional taxes were difficult enough before crypto. Crypto gets really murky because there are so many layers when it comes to crypto and understanding what constitutes a taxable event. Crypto taxes go far beyond simple capital gains and losses from selling. Here are some potential taxable events to be considered that many people do not think of:

- Was crypto sold for fiat at a profit or loss?

- Was one digital asset exchanged for another one on a DEX or centralized exchange?

- Did you receive any airdrops?

- Sell any NFTs?

- Earn income from blockchain games?

- Are you staking any crypto and earning interest income?

- Are you providing liquidity or yield farming?

- Using CeFi lending platforms like Celsius or BlockFi?

- Utilizing crypto loans?

- Crypto mining?

- Using crypto debit cards?

- Earning rental/advertisement income from digital land?

There are so many ways to earn an APY with crypto, many of which may need to be declared on your taxes. Many crypto users participate in at least a few of the events mentioned above; if you are a frequent trader or participate in a variety of different APY generating events, keeping track of your transactions for tax purposes would be nearly impossible without tax tools like CryptoTrader.Tax.

If you want to avoid or minimize your crypto tax obligations (legally, of course!), check out our article on the Most Crypto Tax-Friendly Jurisdictions

The Government Can Track Your Crypto Transactions

In the early days of crypto, many crypto users thought crypto may have been a good way to avoid taxes as world governments were not caught up to speed yet on how it all works, and KYC was seldom required. Those days are gone, and governments are cracking down on exchanges and crypto traders in a big way. Crypto tax enforcement is on the rise. Government agencies now have the tools and resources needed to track crypto users. So rest assured, if you have ever made a crypto purchase on an exchange where you entered KYC, the government knows you have crypto.

We have an entire article that covers this topic here.

CryptoTrader.Tax

Note that in the coming weeks, CryptoTrader.Tax will be changing their name to CoinLedger. You can find the official announcement here.

So, what is CryptoTrader.Tax?

According to the website, this platform allows users to complete their taxes in “the easiest and most reliable way.” Sounds good!

CryptoTrader.Tax supports tonnes of different exchanges, crypto wallets, and DeFi platforms, allowing users to import their trade and activity history. The platform will automatically calculate gains, losses, and activity history for the entire year.

Image via CryptoTrader.Tax

Image via CryptoTrader.Tax One of the best features is that the platform will automatically create and populate reports in the proper format needed for tax filing, such as IRS form 8949. In addition, CryptoTrader.Tax can be used to create an Audit Trail Report, a Short & Long-Term Sales report, a Cryptocurrency Income Report, Tax-Loss Harvesting reports and others.

Once these reports are generated, they can be downloaded, and users can simply upload the data into tax software like TurboTax, TaxAct etc. or send the reports to their accountant.

Traders can get started for free with the platform, and if they use it to file, there is tiered pricing from $49 to $299 per tax year based on the number of trades imported. CryptoTrader.Tax also has a team of tax professionals on board who can be hired through the platform to look over everything and assist before filing.

That is enough of the who and the why; let's dive into the report.

The State of Cryptocurrency Tax Reporting in 2022: A Report by CryptoTrader.Tax

Summary

This report was commissioned by CryptoTrader.Tax and carried out by YouGov.

- Sample Size: 1,000 US Adults (18+) who own or invest in crypto

- The study was done between Nov. 22, 2021- Dec. 4, 2021.

- The survey was completely anonymous and done online.

Takeaways

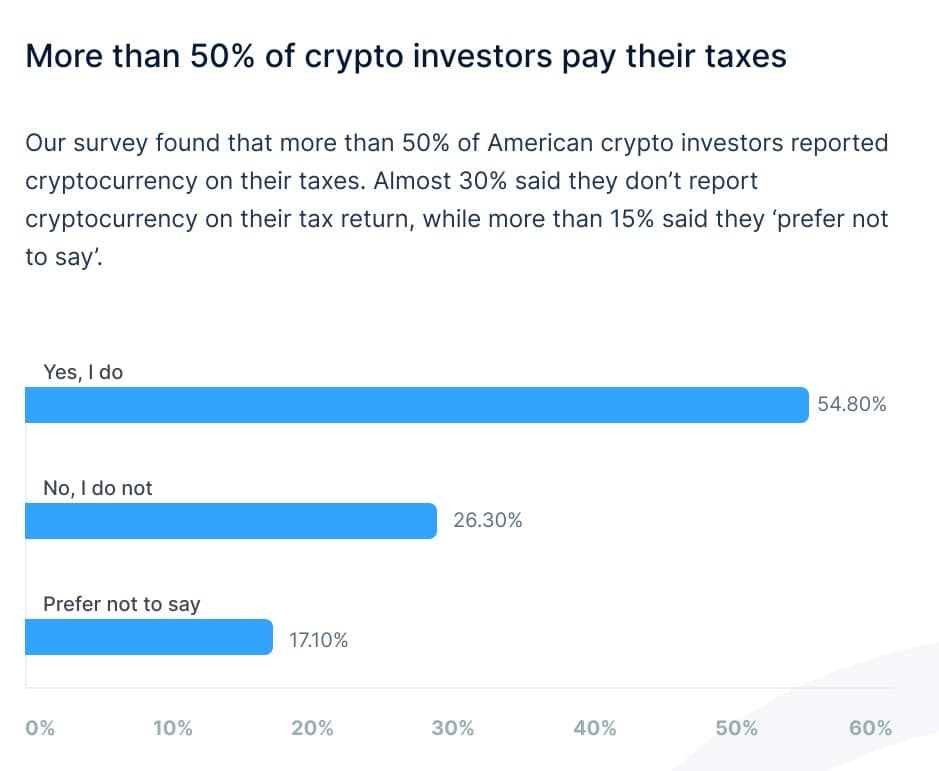

- 55% stated they reported crypto on their taxes.

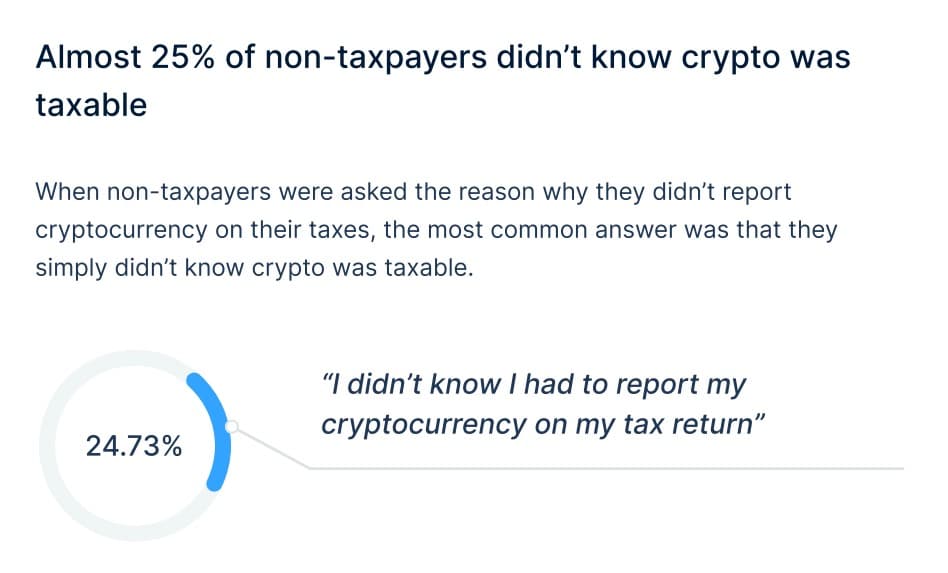

- Nearly 25% of investors who didn’t report crypto on their taxes stated that they did not realize crypto was taxable.

- Nearly 20% of investors who did not report crypto on their taxes stated they did not know how to do so.

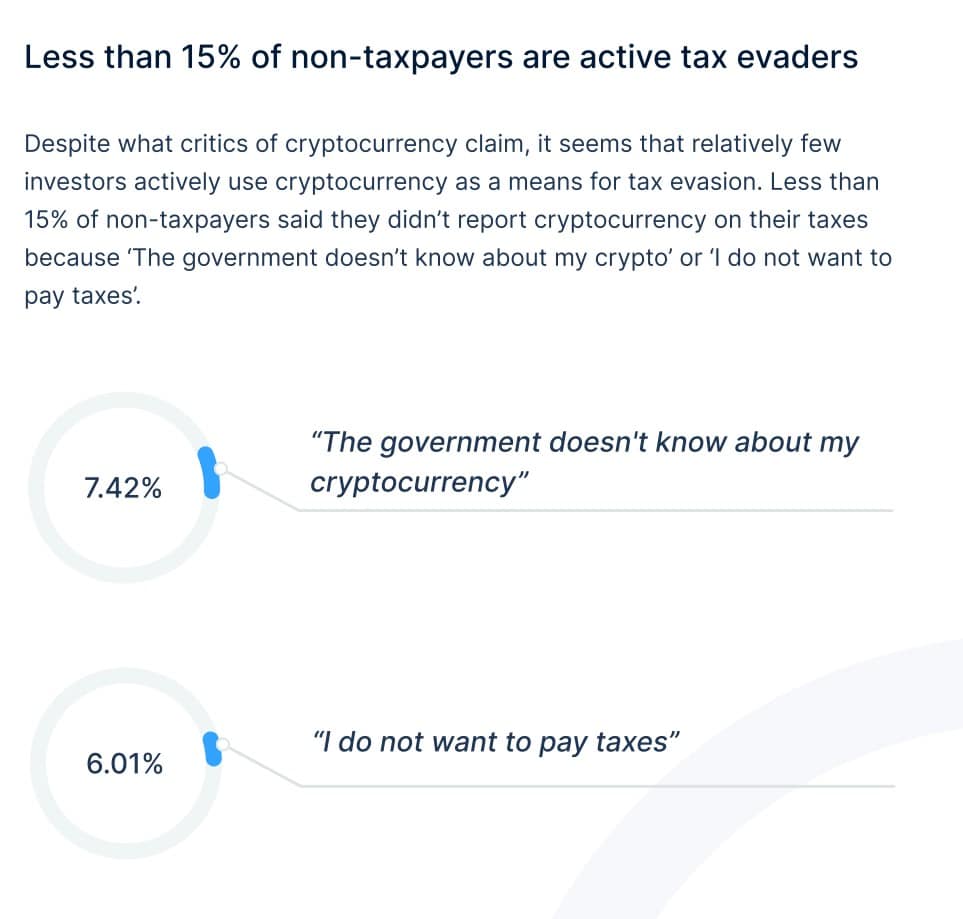

- Less than 15% of investors stated that they did not report crypto on their taxes because “the government doesn’t know about my cryptocurrency” or “I do not want to pay taxes.”

- Over 70% of crypto investors said that politicians and regulators drafting cryptocurrency laws do not understand crypto.

- Over 20% of crypto investors said they do not have the software tools to properly account for their crypto transactions, while nearly 30% reported having trouble keeping track of their capital gains and losses.

The Aim of the Report

As crypto enjoyed a massive leap towards mainstream adoption in 2021, CryptoTrader.Tax partnered with YouGov to conduct a survey to better understand crypto investors and where they stand concerning crypto taxation. The intention was to answer the following questions:

- What percentage of crypto investors report on their taxes?

- What are the most common reasons crypto investors don’t report their taxes?

Findings:

More Than 50% of Crypto Investors Pay Their Taxes.

Interestingly, crypto tax reporting is trending up significantly over time. Perhaps this is due to the crackdowns on exchanges and now forcing them to collect KYC of their customers and the crackdowns on crypto investors for failing to report crypto earnings. Another possibility may be because now more law-abiding and accredited investors, businesses, and institutions are investing in crypto. A similar study conducted in 2018 by Credit Karma found that fewer than 0.04% of users reported crypto gains and losses on their taxes.

Image via CryptoTax.Trader Report

Image via CryptoTax.Trader Report My personal take on this is that this number seems much higher than I would consider accurate. It's pure speculation on my part, but I feel that the people taking this survey may have been afraid to honestly state that they did not pay their crypto taxes. Although the survey was done anonymously, it was still done online, and I would have been worried that the results could be tied to my IP address. I would never admit to not paying taxes or doing anything illegal over the internet in any form. I believe nearly any online information can be found and traced if one searches hard enough.

Another reason I feel that this number may be higher than what is true is that if I were someone who did not want to pay crypto taxes, it would be in my best interest to try and skew the results to make it look like more people are paying their taxes than not, in an attempt to make harsh crackdown measures less of a high priority. For example, if 90% of people say they pay taxes, the government may be less likely to take immediate action than if 0.04% of people say they paid their taxes.

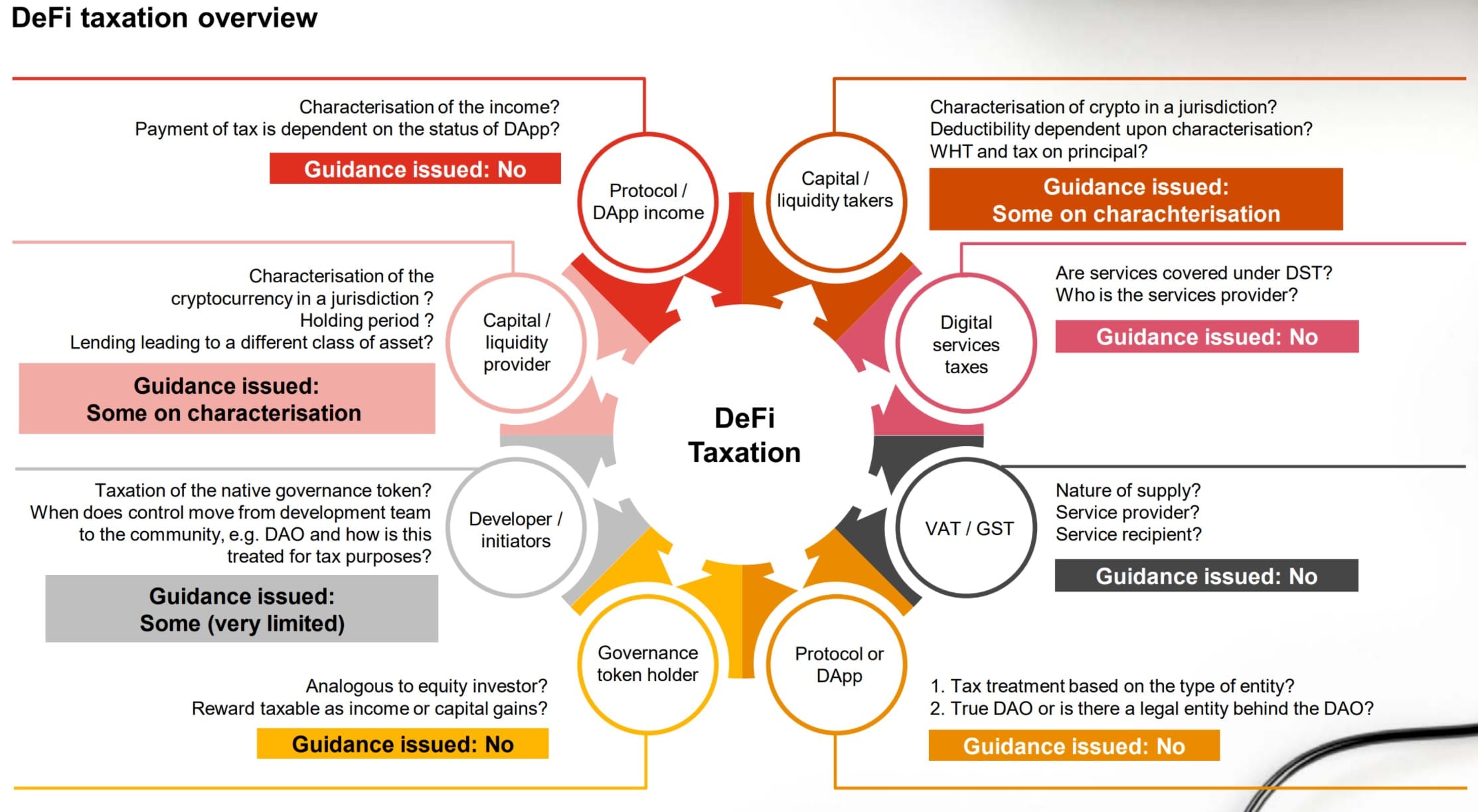

The third reason I feel this number is likely too high revolves around the complexity of DeFi and the near-impossible task of accurately tracking complex DeFi transactions. More on that later.

Nearly 25% of Those Not Paying Their Taxes Simply Stated That They Did Not Know Crypto Was Taxable

There are a few reasons why crypto users may not have known that crypto was taxable. First, because cryptocurrency is relatively new, many investors may not have been aware of crypto tax treatment and that digital assets are often treated as property rather than currency. Another possible reason is that cryptocurrency is popular among younger generations who are relatively new to investing and may not be accustomed to tax reporting obligations.

Image via CryptoTrader.Tax Report

Image via CryptoTrader.Tax Report The article explains that the IRS is yet to release clear guidance on common DeFi and NFT transactions. DeFi users who have wrapped tokens stablecoins, provide liquidity or take out crypto loans enter a grey area in tax reporting rules, likely resulting in not declaring taxes.

My personal take on this is that I agree with the report’s findings. It has been long debated whether crypto should be treated as an asset, property, or security, what triggers a taxable event, and what constitutes interest income. In addition, there has been very little clear regulatory framework created for investors to work within. When the governing bodies are unclear on taxing something, and the rules are fuzzy, the average person is also likely to be unclear.

Image via CryptoTrader.Tax Report

Image via CryptoTrader.Tax ReportI also agree with crypto being popular among young people leading to this figure being high. Many younger investors may not only not realize that crypto is taxable but are also not familiar with broader tax obligations in general. I feel that another factor contributing to this number being high due to younger investor interest stems from another reason:

Investors in their early 20s are typically at the lower-earning end of the scale in their careers and therefore have less capital to invest. Someone making a small profit from 50 bucks thrown into a crypto project may be less likely to feel that looking into tax reporting is worthwhile for such minimal amounts versus someone in a higher earning bracket and investing significantly more of their net worth into a higher earning asset. Investors who invest small amounts may feel that the government is unlikely to find out or come after someone who made a few dollars versus someone who has earned substantial amounts.

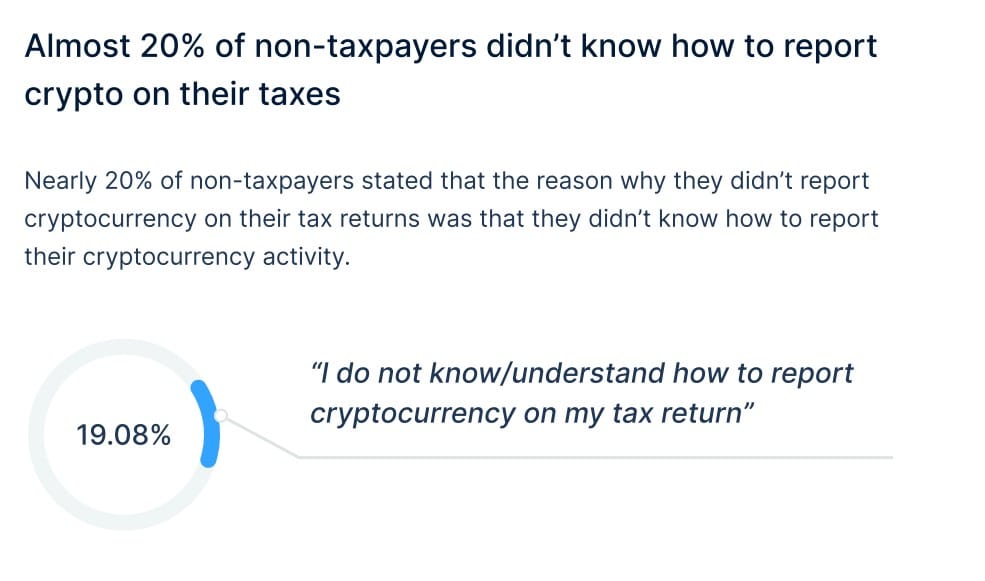

Almost 20% of Non-taxpayers Didn’t Know How to Report Crypto on Their Taxes

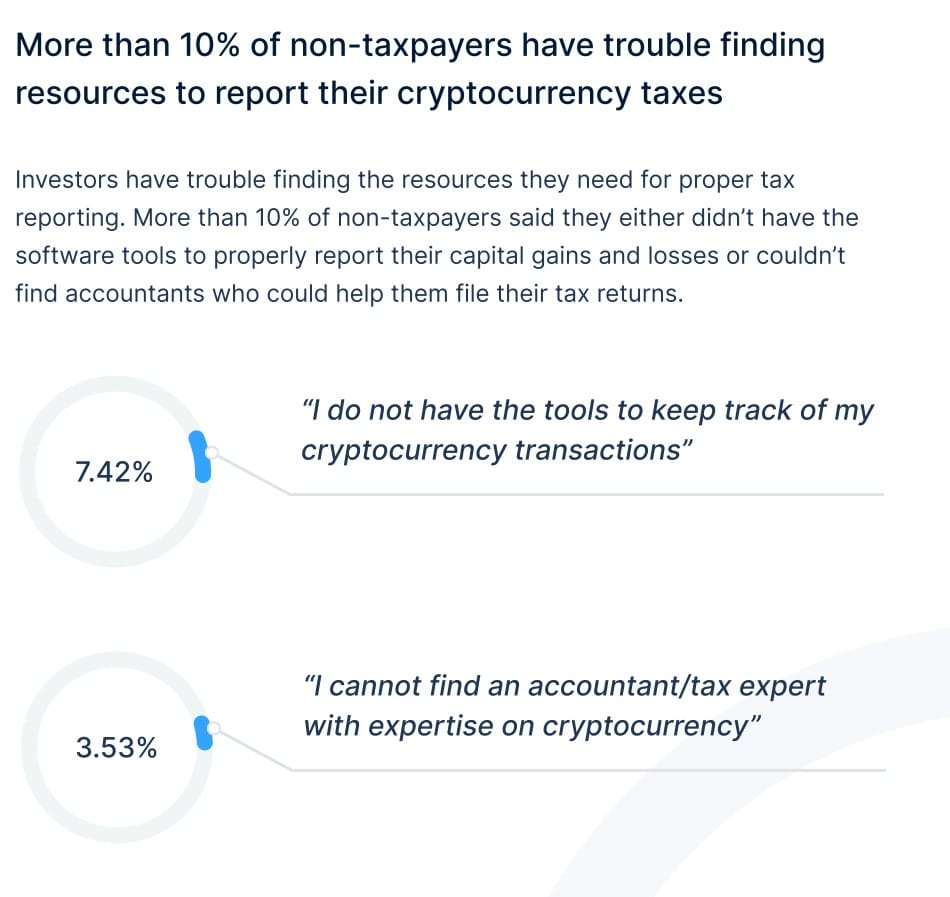

This one goes back to the unclear framework mentioned above and the lack of information available for crypto tax reporting. Over 10% of non-taxpayers stated that they had trouble finding the resources and tools to report their crypto taxes or couldn’t find any accountants who could help.

Image via CryptoTrader.Tax Report

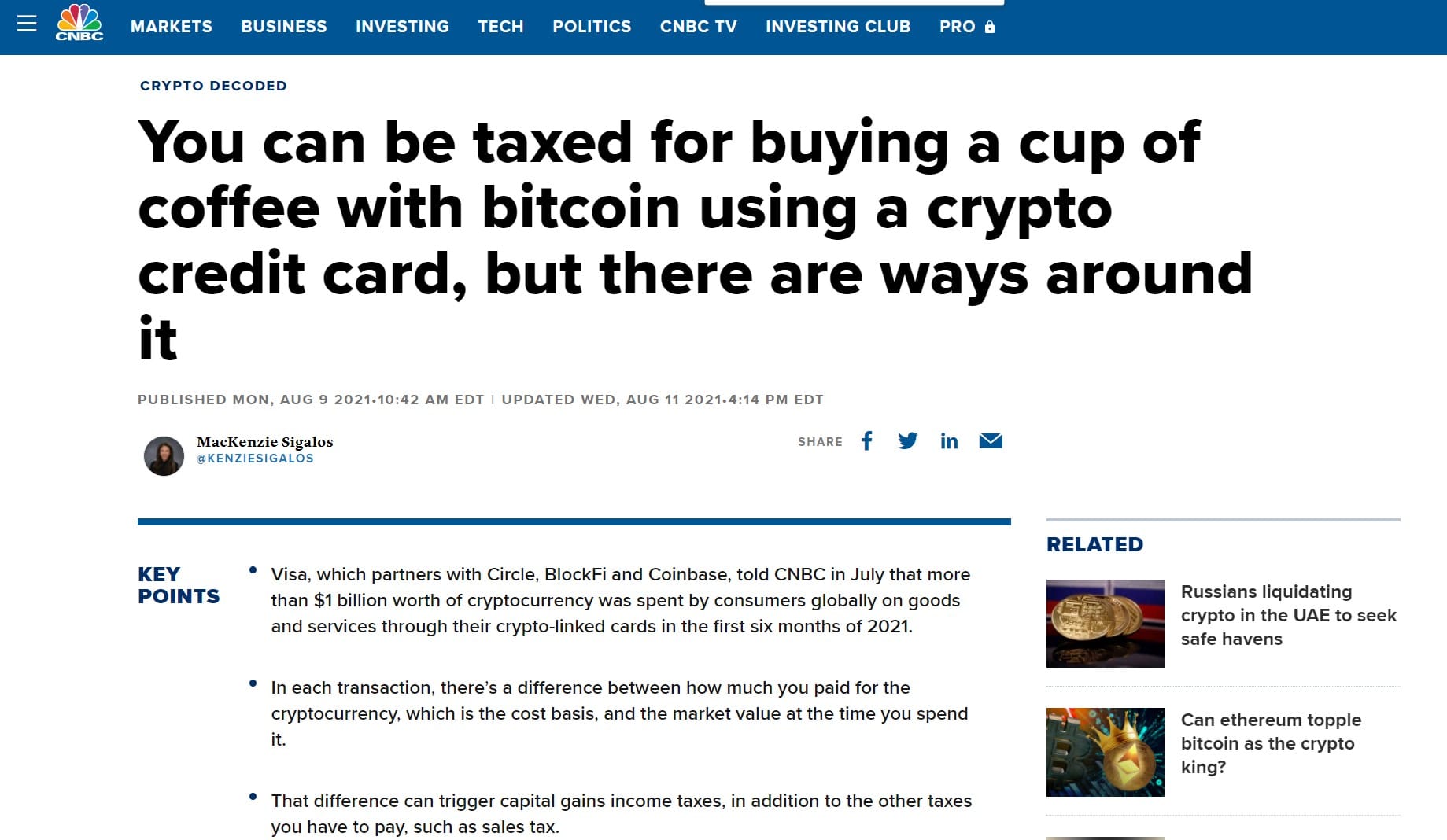

Image via CryptoTrader.Tax Report I agree with this one completely and am surprised this figure isn’t higher. I remember reading articles about the headaches that come with crypto debit cards from a tax perspective. It was suggested that for the crypto cards that convert crypto to cash at the point of sale, the point of sale should technically be a taxable event. Many users of these cards pushed back, saying that it is not feasible as these cards get used for multiple everyday purchases such as cups of coffee. Trying to enforce someone to keep track of every single one of their daily purchases for taxation purposes is a big ask, very difficult and inconvenient without proper tools. Users may be unlikely to attempt such as task or make plenty of mistakes due to the mountainous effort that would be required.

Image via CNBC

Image via CNBC The same goes with complex DeFi. Without proper tools, framework or guidance, it is challenging to begin to understand how many of these transactions should be taxed or how to even keep track of the ins and outs of these protocols. We will dive deeper into this in the next part of the report on why crypto tax reporting is difficult.

Why is Crypto Tax Reporting so Difficult?

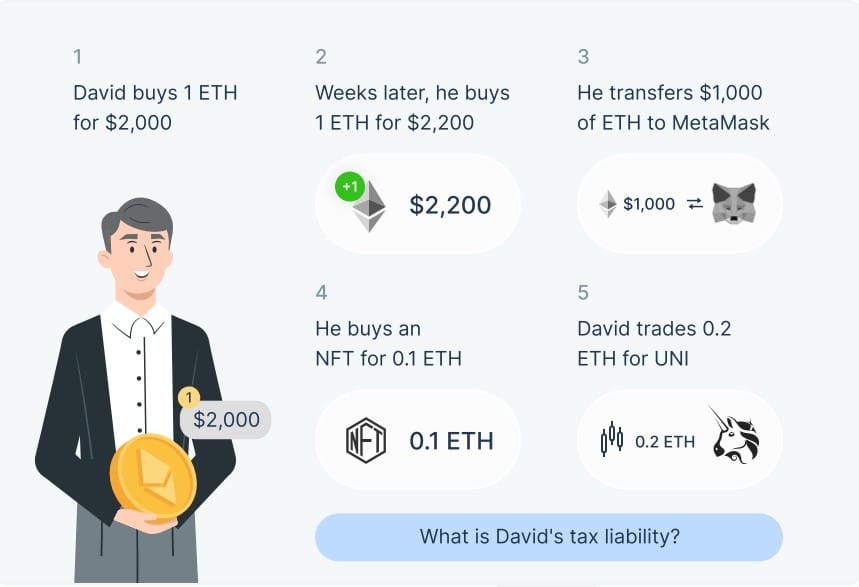

Transfers between crypto wallets can happen frequently and are often needed for investors to interact with DeFi protocols, making keeping track of gains and losses incredibly difficult. Swaps between different crypto assets are also complicated to tax as a user needs to know the dollar value of each digital asset at the time of the swap, minus the fees. Anyone who has been kicking around the crypto space knows how difficult this can be as crypto assets fluctuate wildly, and the fees can be highly variable.

Image via CryptoTrader.Tax Report

Image via CryptoTrader.Tax Report To report on swaps, a user would need to take time to research how to track cost basis, search records for the original purchase, and find the exact time of the swap to find the fair market value of the crypto at the time of the disposal in fiat terms just to figure out the capital gain or loss.

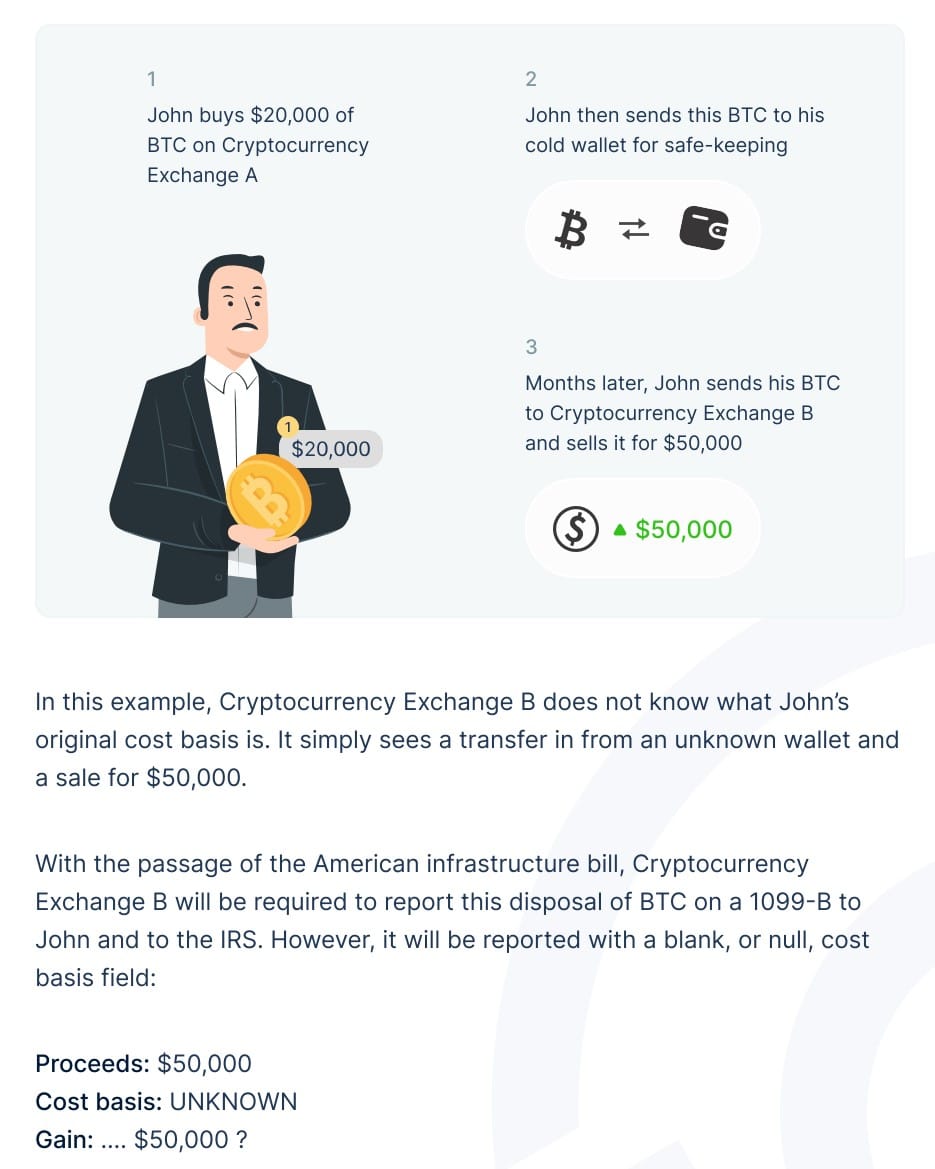

Here is a “simple” scenario highlighting these complexities from the report. Reporting accurately on these activities would be incredibly difficult.

Image via CryptoTrader.Tax Report

Image via CryptoTrader.Tax Report And that is just for swapping assets. Many crypto traders perform similar tasks as outlined above multiple times a week or even in a day. The report labels the above scenario as “relatively simple,” what about users who routinely participate in liquidity providing, mining, yield farming, baking, delegating, validating etc. There is also uncertainty about when an event should become taxable, as we have seen with the couple from Nashville suing the IRS for forcing them to pay income tax on unrealized Tezos staking rewards.

Less Than 15% of Non-taxpayers are Active Tax Evaders

Despite criticisms from many that crypto is only used as a means to avoid tax, the survey found that fewer than 15% of crypto investors purposely do not pay taxes because “the government doesn’t know about my crypto,” or “I don’t want to pay taxes.”

Image via CryptoTrader.Tax Report

Image via CryptoTrader.Tax Report As many of you likely know, using crypto to avoid taxes or do anything illegal is a very terrible idea as blockchain is a public ledger viewable by everyone, and the records are there on the blockchain for all time. With crypto exchanges now complying with KYC and anti-money laundering requirements, linking identities to crypto addresses is easier than ever.

The IRS is also now working with private sector companies such as Chainalysis to analyse blockchain data to prevent tax fraud and money laundering. However, there is no hiding from the crypto tax man when it comes to crypto and the transparency of every single transaction.

Image via CryptoTrader.Tax Report

Image via CryptoTrader.Tax ReportThe tax professionals at CryptoTrader.Tax continue in the report to suggest why the approved crypto tax forms will lead to issues. This is an incredibly important consideration for Americans to understand when filing their taxes.

Why 1099-B Forms will Lead to Problems

The new 1099-Bs were designed to help the IRS keep track of which Americans are investing in crypto and their capital gains, though the report from CryptoTrader.Tax highlights why this may lead to problems. They state that the forms may contain incomplete or misleading information for taxpayers who wish to calculate their gains and losses.

As discussed in this article, cryptocurrency exchanges do not always have the data on a cost basis due to the interoperable nature of cryptocurrencies. They argue that because digital assets can be easily transferred to and from exchanges, it can be difficult to calculate total gains and losses to determine tax liabilities. They provide a handy visual example:

Image via CryptoTrader.Tax Report

Image via CryptoTrader.Tax Report So essentially, because crypto investors play “musical chairs” with exchanges, if a user purchases from one exchange but sells at another when the IRS receives a copy of the 1099-B, they will simply see that a user sold crypto, but they will not be able to see the actual capital gain amount as the form will not show the price at which the crypto was purchased. It will be up to the crypto holder to prove the cost basis for the price at which the crypto was purchased. Suppose the crypto holder cannot verify the price at which they purchased the crypto. In that case, they could be stuck paying capital gains on 100% of the value of the sold asset, not considering the price at which it was purchased.

The Future of Crypto Tax Reporting

The survey showed that over 50% of crypto investors who did not pay taxes on their crypto either did not know how or did not have the available tools and resources. However, the team at CryptoTrader.Tax believes that as crypto matures as an asset, it is likely that investors will become more aware of how to accurately file their crypto taxes and that accountants and tax professionals will become more well versed in this area and able to assist clients with crypto tax obligations.

They continue to state that the IRS is lagging behind in building guidelines for Cryptocurrency, DeFi and NFTs, but as clarity starts to emerge in the near future, taxation should be more easily understood by crypto investors.

Finally, they state that as companies such as CryptoTrader.Tax continue to build more comprehensive taxation software and tools. Once investors and accountants understand crypto taxation requirements, they will help crypto investors meet their tax obligations accurately.

Closing Thoughts

I felt that this survey and report released by CryptoTrader.Tax gave some fantastic insight into where people are with their mindsets regarding their crypto tax reporting obligations. I know many crypto holders feel a lot of stress/fear/anxiety and uncertainty about their crypto taxes and do not have a clue where to start with it all. It is nice to know that they are not alone and that many of us in the crypto community feel the same way.

CryptoTrader.Tax are not only creators of software but are also tax professionals themselves. They deserve serious kudos from the crypto community for going to bat on our behalf and highlighting the issues with the state of current tax reporting and the shortfalls of the 1099-B tax form. This report uncovers that a lack of certainty is the main reason for crypto investors not paying tax and that the majority of people are not avoiding tax for malicious or nefarious purposes. This is an important discovery and will hopefully be considered when the authorities decide how to handle crypto investors who make mistakes on their taxes or fail to report on certain crypto activities.

I would like to see another survey done, offline and anonymous, canvassing a larger number of people with a focus on crypto traders who use DeFi/NFTs and who are involved with more complex crypto activities. This survey highlighted that 55% of crypto investors claim that they do pay their crypto taxes, which is a figure that I am highly sceptical of as I don’t feel that this is likely, perhaps not even possible in the realm of DeFi without more comprehensive taxation tools and resources available.

DeFi Taxation Overview Highlighting Complexities and uncertainties Image via cryptonews.com

DeFi Taxation Overview Highlighting Complexities and uncertainties Image via cryptonews.com I believe it is likely that the people who claimed they do pay their crypto taxes are likely paying taxes on things like capital gains for the buying and selling crypto assets and maybe some interest, as that is relatively straightforward, which is great. However, as this report highlighted, the IRS has not even provided a framework or clarity for taxation on more complex DeFi crypto transactions, which leads me to believe these events are not being reported on taxes. If a crypto investor has no idea and no guidance on the tax obligations or how to pay them, how are they stating that they are paying taxes on such events?

Perhaps many crypto investors have great accounting professionals that know the ins and outs, but when I consider the millions of users dabbling in DeFi, buying and selling NFTs, yield farming, liquidity providing, investing in launchpads, lending, using cross-chain bridges and wrapped assets, buying/renting digital land, participating in Polkadot Slot Auctions, buying physical items with crypto, receiving airdrops, swapping altcoins daily on a DEX like Uniswap and so on, I very much doubt that over 50% of these users are reporting every single one of these events on their taxes and if they are, it would be nearly impossible to do it accurately with the current tools available.

Some Good General DeFi Guidelines to Follow Image via coinpanda.io

Some Good General DeFi Guidelines to Follow Image via coinpanda.io Allow me to clarify that I do not mean to make it sound like I believe there are any appropriate reasons to purposely avoid meeting tax responsibilities. It is great to see over half of crypto users paying or at least trying their best to pay their taxes. However, for digital assets to become widely adopted and if Bitcoin is ever going to become a widely accepted global financial network, taxes and regulation will be needed to some degree.

My personal opinion, which is supported by this report, is that many of the people who are not reporting their crypto taxes are simply not doing so as it is very confusing, there is a lack of regulatory clarity, it is massively inconvenient and nearly impossible to track each taxable event, and ultimately, users do not know how to. If there were easier tools and more clarity on guidance, I would imagine that the majority of DeFi and crypto users would be fine paying their share of taxes. Tools and resources to help with crypto taxes are constantly being explored and developed. Once they are widely available and crypto tax becomes better understood, the issue of tax avoidance will likely be a thing of the past.

As it stands now, I feel that leaving each crypto user to spend countless hours researching, tracking complex blockchain transactions and trying to understand and navigate the ever-changing regulatory framework themselves with little clarity on rules is too large of an ask. With many tax professionals unwilling or not knowing how to assist with crypto, imagine how difficult it is for the average hodler. Just look at the mess with the SEC vs Ripple case; the SEC provided no guidance or clarity when Ripple sold their XRP token but later went after them, saying they broke laws and rules regarding securities. How can users know if they are breaking the rules if there are no clearly defined rules to follow? And trying to punish those for not following unknown rules seems unfair to me. Rules should be clearly defined before they are enforced, in my opinion, which is similar to Ripple’s “fair notice defence,” which may lead to them winning the trial.

Rules Should be Clearly Defined Before Being Enforced Image via finance.yahoo

Rules Should be Clearly Defined Before Being Enforced Image via finance.yahoo It is my opinion that if governments expect crypto users to pay taxes, they should invest in the resources and tools to make it easy, convenient, and straightforward for crypto users to understand and follow. The authorities should also be more supportive and lenient as we all try and navigate this new landscape together, not enforcing harsh penalties and crackdowns that leave crypto users afraid to ask questions or seek guidance for fear of punishment, as we saw with Coinbase when they approached the SEC looking for clarity and permission only to receive a legal threat in return.