Recently, there has been a lot of noise in the cryptocurrency markets about whether Ethereum is a security or not.

This is indeed the perfect example of a "black swan" event. These are events that no one really expects and are not likely to take place. They are tail risk events that many investors and traders do not place a great deal of emphasis on in their calculations.

But why does it matter? Why could simply calling Ethereum a "security" result in the entire cryptocurrency market crashing? In this piece, I will take an in-depth look at the current dynamics in the cryptocurrency market in order to break down the likely impact.

Ethereum's Place In The Crypto Market

Ethereum is the most popular decentralized application platform and is the second most valuable cryptocurrency. What is Ethereum used for?

In short, application developers can build their apps on the Ethereum blockchain, rather than going through the hassle of building their own. It’s a bit like apps in the Apple App store.

Why doesn’t every app build its own operating system to run on? It’s simply not viable and requires a different skill set. Instead, app developers focus on doing what they are good at and build on pre existing operating systems.

Ethereum also gives cryptocurrency projects the option to launch their Initial Coin Offering on the Ethereum network. This means that cryptocurrency projects can issue tradedable ERC-20 tokens, whilst they are building their product or service. Out of the over 1,600 cryptocurrencies in the space currently, over 500 projects have issued an ERC-20 token built on Ethereum.

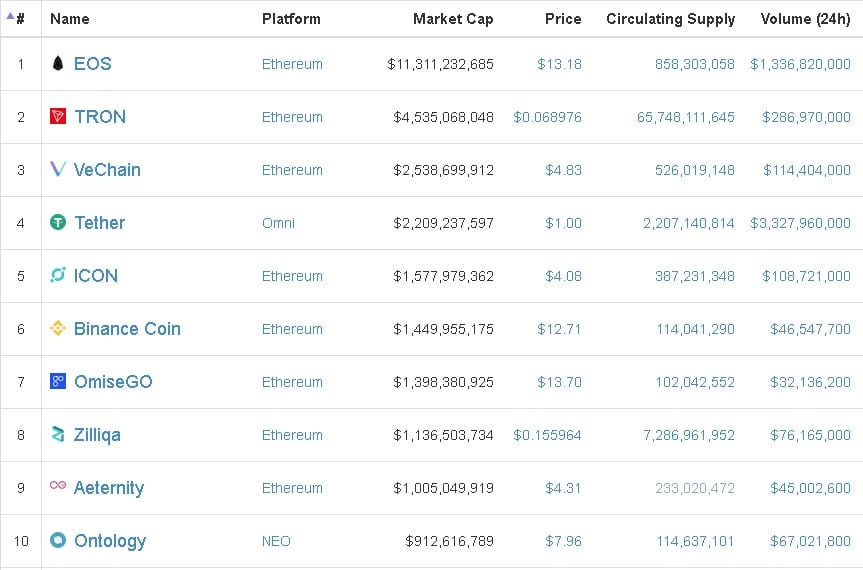

All you need do is take a look at the number of ERC20 tokens and the corresponding market capitalisations of all these tokens. Below is a mere sample of the top 10 tokens on CMC. As you can see, 8 of the 10 are ERC20 tokens. The combined market capitalisation of these top 8 coins is is near $36 billion.

Image via Coin Market Cap

Image via Coin Market CapWhether you like Ethereum or not, there is little doubt about how important the project is to the entire cryptocurrency space. If something were to happen to this cryptocurrency, it would almost certainly have a dramatic impact on the entire cryptocurrency space.

What Could Security Classification Mean?

The US Securities and Exchange Commission (SEC) is deciding whether Ethereum is a security or not. If Ethereum is classified as a security it will mean that only accredited investors could buy and sell Ethereum in the US, as well as subjecting the project to tougher regulation.

In the US the definition of an accredited investor is:

- A net worth of over $1,000,000

- Or an income of over $200,000 per year, over the last two financial year

With such a high threshold to attain accredited investor status, almost all US cryptocurrency investors would be prevented from buying or selling Ethereum. This sounds like a nightmare and it really is. To make things worse, the next likely step for the SEC would be to question if every single ERC-20 token was a security as well. That’s over 500 out of the 1,600 cryptocurrency projects out there, that could be impacted.

If Ethereum was classified as a security, not only would most US citizens not be able to buy or sell ETH, but consider what US residents would do if they were holding ERC-20 tokens? Most are going to dump them for fiat if they can, from fear that they too will be classified as securities.

Many of you may think that the US is one country and that the cryptocurrency markets are global. Surely, the exclusion of most US citizens cannot have that big an impact on the overall market.

Why The US Markets Matters?

The US is the richest country in the world and studies from sites like Finder.com have determined that around 8% of the US population own cryptocurrency. This may not sound a lot, but is significantly higher than adoption levels in other countries.

Looking into Google trends for cryptocurrency, the US consistently ranks in the top 10 countries most interested in cryptocurrency. Popular YouTubers have also revealed that the US is the most important country for him in terms of viewer numbers.

Image via Google Trends

Image via Google TrendsThe 325 million Americans matter in the cryptocurrency space. Yes, smaller countries may rank higher in google interest, but it is the USA’s population size and wealth that makes it so critical to cryptocurrency markets.

What Else Would Happen?

The classification of Ethereum would not only impact on Ethereum holders and potentially ERC-20 tokens. It would mean that cryptocurrency exchanges would be in hot water too. Why? It is because they would be trading in securities and would be forced to register with the SEC to continue operating legally.

Unlicensed security trading is a big deal. Not only could cryptocurrency exchanges be fined but people can end up in prison. The US Securities Act of 1933 can be used to send violators to prison for 5 years. It seems unlikely that people like the Winklevoss twins would want to take the risk. Cryptocurrency exchanges like Gemini (owned by the Winklevoss twins) would likely shut down Ethereum and ERC-20 trading.

This sounds like armageddon and it is. But the situation can get worse. The SEC also have the power to order the ‘disgorgement’ of unearned profits. What does that mean?

Disgorgement is the act of giving up something such as the profits obtained by illegal or unethical acts on demand or by legal compulsion. Court can order wrongdoers to pay back illegal profits to prevent unjust enrichment

It is no secret that cryptocurrency exchanges make a lot of money and hold a lot of cryptocurrency. If the SEC implements disgorgement it could mean a significant amount of crypto being dumped on the market from exchanges. This is more than likely going to result in a significant reduction in crypto prices.

Is Ethereum Actually A Security?

Image Source: thehill

Image Source: thehillThe SEC’s position on Ethereum has not been made yet. Gary Gensler, the former chairman of the Commodities Futures Trade Commission, has gone on record saying that Ethereum meets the criteria set out in the Howey Test (a test to determine if something is a security or not).

With Ethereum, the problem is that at the time of it’s ICO, the ETH token could not be used for anything. Therefore, it meets the criteria to be classified as a security. As many of you know, Ethereum is exceptionally useful today and certainly does have utility. Many commentators argue that although Ethereum might have been a security at ICO, it certainly is not now.

Sadly, no one knows what verdict the SEC will come out with. But it seems likely that the outcome will be that Ethereum was a security when it ICO’d, but is not a security now. The SEC could overlook the ‘illegal’ security sale or give the Ethereum Foundation a fine.

In the past the SEC has given Merrill Lynch a slap on the wrist by fining them a nominal amount of $1.8 million for the sale of unregistered securities. A similar outcome would probably cause minimal panic in the cryptocurrency markets.

Conclusion

If Ethereum is classified as a security, it would most likely crash the entire cryptocurrency market.

However, it does seem unlikely that the SEC will want to essentially exclude US citizens from cryptocurrency markets and the innovation happening in the space. Only time will tell, but as a cryptocurrency investor this risk is something you should be aware of.

Although the verdict of the SEC is currently uncertain, the question they must ask themselves is if they support US Tech and the freedom of their citizens to invest in it.