2025 wasn’t supposed to play out like this.

For years, people in the industry talked about the “big moment” as if it were guaranteed. The turning point. The chapter where crypto finally shook off the image of being a chaotic trading pit and settled into the role of a serious financial layer. And on paper, yeah, that moment arrived. New laws went through, Wall Street rolled out spot ETFs, stablecoins blew past every previous milestone, and RWAs went from a niche experiment to something everyone suddenly had an opinion about.

But living through it felt different.

The year had this constant push and pull. On one side, you could see genuine maturity taking shape: better rails, clearer rules, institutions that once watched from the sidelines now jumping in with both feet. On the other side, you had exhaustion. Retail traders got drained after wave after wave of dilution. Memecoin mania burned bright and then burned out. Risk appetite dried up. And the broader macro picture made the entire space feel heavier than usual.

So for this piece, we asked the people who actually lived inside the chaos. We asked them three simple questions:

- When you look back on 2025, what moment or shift truly defined the year for crypto?

- What belief did you start the year with that didn’t survive?

- And if you had to stuff 2025 into a single word, which one would you choose, and why?

What follows isn’t a eulogy or a hype piece. It’s a straight look at 2025 from the people who were in the trenches while the rest of us tried to make sense of it from the outside.

How Was 2025 For Crypto?

Crypto markets reached dizzying highs before falling to terrifying lows in 2025.

The year started sunny: Total market capitalization climbed above $4 trillion for the first time, mobile wallet adoption rose 20% year over year, a16z crypto said in a report, and stablecoin supply moved past $300 billion, led by Tether and USDC, according to the IMF.

The U.S. introduced two laws: the GENIUS Act, which was signed into law in July 2025, and the CLARITY Act, which has been delayed to 2026. Both are aimed at defining the regulatory path for digital assets.

However, the mood turned dour in the back half of the year as the second half brought a sharp market correction in what some news outlets referred to as the Great Crypto Crash of 2025.

October 2025 witnessed the most severe event. Crypto markets recorded $19 billion in liquidations in a single day, making it the largest liquidation event in the history of digital assets. A toxic cocktail of high leverage, thin liquidity and a sudden macro shock drove rapid forced selling. According to a post-mortem by CoinDesk, Bitcoin dropped to roughly $106,560, Ether fell to $3,551, and Solana reached about $174. The depegging of the stablecoin USDe to $0.65 on Binance added more stress. Average token declines reached 47%, and the scale surpassed the May 2021 crash, CoinDesk reported. October, usually dubbed “Uptober” for its bullish streak, closed down 3.69% for Bitcoin, CoinGlass data shows.

The market rout continued in the fourth quarter of 2025. Bitcoin, which reached an all-time high in October 2025, is currently 31.5% below that ATH, according to CoinMarketCap data. The Fear and Greed Index is currently at 16 (extreme fear). All told, the crypto market shed $1 trillion in value. With a decline of 17.67% November ended even worse than October for Bitcoin, according to CoinGlass.

Meanwhile, regulated investment products advanced. The United States approved the first spot Solana ETFs in October, with launches in November. Several companies filed, and some received approval, for spot XRP ETFs, including Grayscale, CoinShares, ProShares, Teucrium and Franklin Templeton. In addition, ETFs for memecoins like DOGE, TRUMP, BONK and PENGU were also filed.

With some major 2025 events happening out of the way, it's time to see what our experts think.

The Defining Shift in Crypto for 2025

When industry leaders look back on 2025, they point to very different forces that shaped the year. Some see it as the moment crypto finally matured into core financial infrastructure. Others view it as a year dominated by economic pressure and geopolitical upheaval. And for many, the surge into regulated stablecoins stands out as the clearest turning point.

“2025 was the year crypto finally moved beyond the ‘new asset class’ narrative and started evolving into the backbone of finance.”

“Definitely the shift in global trade relations.”

“The global rush into stablecoins will be remembered as the defining theme of 2025.”

What The Experts Think

2025 was the year crypto finally graduated from being seen as a “new asset class” and started functioning as a core part of global finance, Dan Mulligan, chief marketing officer at Reserve, told The Coin Bureau. Reserve is a DeFi platform backed by Sam Altman and Peter Thiel.

He pointed to the U.S. dollar moving on-chain at scale, stablecoin supply pushing past $300 billion, and monthly settlement volumes topping $1 trillion by September. In his view, the real story was that payments, not speculation, became the main driver of activity. Tokenized T-bills and money-market funds also became a preferred yield tool for corporate treasurers, driving real-world asset value on-chain into the tens of billions, with BlackRock and Securitize taking the biggest share. Spot Bitcoin ETFs, he added, blended into normal portfolios and were no longer treated as “an edgy side bet,” which he sees as the kind of mainstream acceptance the industry has been waiting for.

Shifting to a very different perspective, Daniel Keller, CEO and co-founder at InFlux Technologies, told The Coin Bureau that the most defining force of 2025 wasn’t technological at all but geopolitical. He pointed to the impact of Trump’s tariffs, which tightened budgets, forced companies to close, and sent crypto prices tumbling. Keller said people simply didn’t have the disposable income needed to take on speculative digital assets this year. He noted that fear and greed indices show sentiment at record lows as traders brace for more rate hikes and worsening geopolitical tensions.

Adding another dimension to the conversation, Paul Brody, global blockchain leader at EY, told The Coin Bureau that the year will be remembered for the global race into stablecoins. He said there is still a long runway before all the announced plans make it to market, but the GENIUS Act and the move by the world’s major banks into issuing stablecoins mark a real historical turning point. Brody argued that “good stablecoin regulation” would unlock the broader crypto ecosystem, and he believes 2025 will ultimately be seen as the start of a new era for crypto and blockchain.

What Changed Their Minds in 2025

Each leader pointed to a moment when reality diverged sharply from their expectations. Their answers reveal how unpredictable 2025 turned out to be, even for people at the center of the industry.

“I expected spot ETFs to cannibalize on-chain activity. They didn’t.”

“That 2025 would usher in the most significant bull wave we have ever seen.”

“If you had told me on January 1 that one of the only things done in the US in 2025 with bipartisan support would have been a crypto regulation bill, I would have urged you to seek counseling and get a grip on reality — but that's what happened.”

What The Experts Think

Mulligan began the year convinced that spot Bitcoin ETFs would eat into on-chain activity. Instead, the opposite happened. ETFs “professionalized the top of the funnel,” while stablecoin payments and on-chain usage surged at the same time. He said the “DeFi mullet” model proved itself: regulated, familiar products up front like ETFs, neobanks, brokerages, and payment apps, with permissionless rails in the back such as stablecoins, AMMs, and tokenized T-bills. Rather than cannibalizing each other, the two tracks worked together. As he put it, “the mullet architecture lowered customer acquisition cost and compliance risk while still tapping on-chain liquidity and yield.” It wasn’t glamorous, but it scaled.

Keller entered 2025 expecting the strongest bull market the industry had ever seen. With institutional adoption accelerating, the Genius Act passing, and the most pro-crypto administration in office, it felt like the perfect setup. Yet the year turned out to be the opposite. Aside from an early memecoin surge, token performance was weak across the board. Even assets tied to high-utility projects failed to regain the momentum seen in past cycles.

For EY's Brody, the biggest shift in his thinking came from Washington. “If you had told me on January 1 that one of the only things done in the US in 2025 with bipartisan support would have been a crypto regulation bill,” he said, “I would have urged you to seek counseling.” But that’s exactly what happened. By year’s end, he felt certain the industry had reached a point of no return. For him, the political and institutional support that emerged in 2025 means “we’ve come too far” for the country to ever turn back on crypto and blockchain.

One Word That Captured 2025

When industry leaders tried to compress an entire year of turmoil, progress, surprises, and contradictions into a single word, their choices revealed just how fragmented and complex 2025 felt across the crypto landscape.

What The Experts Think

Mulligan described the year as “mullet.” The year proved that the “DeFi mullet” model wasn’t a meme but a real architectural shift. Consumer-facing products leaned into trusted, compliant interfaces while the actual engine ran on permissionless rails underneath, he said. Spot ETFs filled the top of the funnel, and stablecoins plus tokenized treasuries powered real revenue and settlement behind the scenes.

Keller chose “misunderstanding.” The industry entered 2025 expecting a repeat of the explosive bull markets of the past, especially after Bitcoin hit new highs and institutional adoption accelerated. Instead, extreme dilution events in altcoins, the Pump.fun chaos, and Bitcoin’s dominance crushed most expectations. Even as projects continued building, the market’s assumptions about the year were completely off.

Brody summed up 2025 with one word: “corruption.” He said 2025 opened with potential, and the GENIUS Act did usher in a powerful wave of stablecoin and blockchain adoption in the US. Yet, the simultaneous rise in corruption tied to blockchain exposed an uncomfortable truth: despite the industry’s efforts to brand itself as a force for inclusion, the biggest beneficiaries still tended to be “those who already have a lot of money and very little ethics.”

The Big Narrative Arcs of 2025

When you zoom out from the noise, a few threads define the year more clearly than the daily headlines ever could.

The Year of the On-Chain Dollar

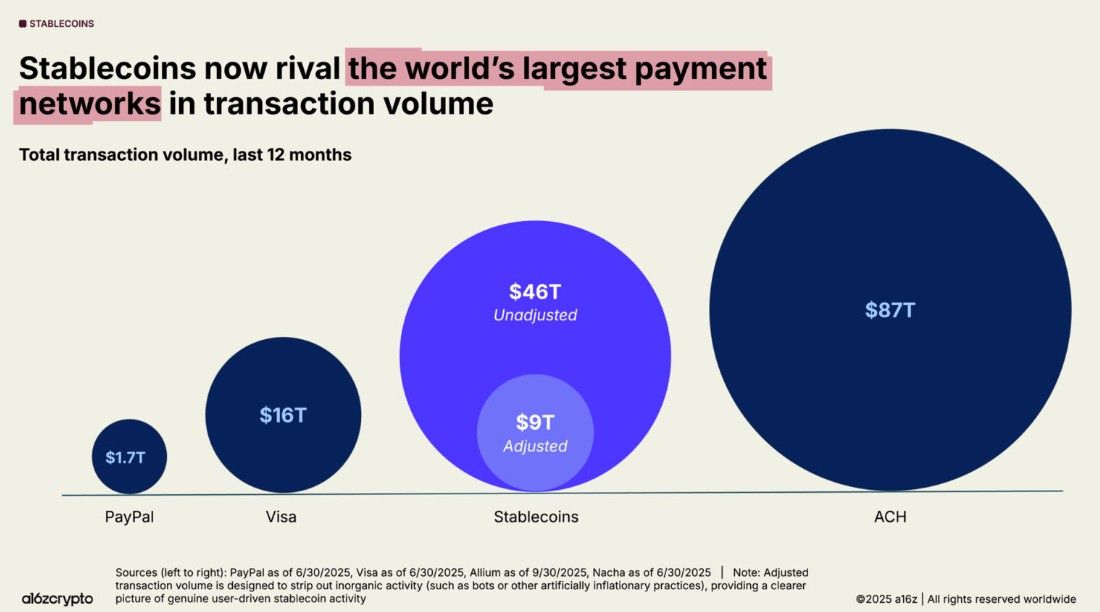

If 2020 was the year stablecoins found product–market fit, 2025 was the year they became unavoidable. Dollar-backed tokens became the core plumbing of crypto. According to a report by Andreessen Horowitz, these digital tokens processed $46 trillion in total transaction volume over the past year, a 106% increase year over year.

Stablecoin Payments Now Rival Traditional Payments. Image via a16zcrypto

Stablecoin Payments Now Rival Traditional Payments. Image via a16zcryptoMore importantly, the dollar’s move on-chain wasn’t abstract anymore. It showed up in real usage: payroll experiments, treasury operations, B2B settlements (PwC report) and fintech integrations that ran quietly behind the curtain. Currently, it has become hard to argue that on-chain dollars weren’t becoming part of the global financial infrastructure.

Tokenized Treasuries and RWAs Become the New Yield Hunt

This was the year real-world assets finally stopped being a prediction and turned into a market with genuine depth. Tokenized T-bills and money market funds became a common tool for institutions looking for safe yield without the operational headaches of legacy institutions.

A Snapshot of Tokenized Treasuries. Image via rwa.xyz

A Snapshot of Tokenized Treasuries. Image via rwa.xyzThe numbers told the story: $9.16 billion in tokenized U.S. Treasuries circulating on-chain, with BlackRock and Securitize capturing a huge portion of the flow. What mattered more, though, was why it worked. Yields were good, the rails were fast, and custody offerings were finally mature. The risk-adjusted return was simply too compelling to ignore.

In a market where speculation softened, RWAs gave crypto something it desperately needed: A real business case.

ETFs Go Mainstream and Normalize Crypto Exposure

Spot Bitcoin ETFs changed who touched crypto and how they did it. Financial advisors stopped whispering about Bitcoin. Portfolio managers stopped categorizing BTC as an eccentric hedge. ETFs made crypto feel like a normal part of asset allocation, not an adventure into uncharted territory.

Note: The spot Bitcoin ETF data above is sourced from The Block and updates automatically.

The big surprise for many insiders was this: ETFs did not drain liquidity from on-chain markets. Instead, they widened the funnel. Institutions got their compliant, familiar wrapper. Meanwhile, stablecoins and on-chain products kept growing in parallel. Both sides fed each other, not cannibalized each other.

Altcoin Dilution and Retail Exhaustion

If the top end of the market matured, the long tail suffered. Retail interest didn’t vanish, but it thinned out dramatically. The biggest culprit wasn’t regulation or macro; it was dilution. New tokens, new chains, new incentives, new airdrops. Supply far outpaced demand.

Then came the Pump.fun chaos, which turned the memecoin meta into a factory line of instant hype and instant abandonment. Bitcoin held up. A few narratives held up. But the rest of the market felt like a never-ending uphill climb, especially for projects with real utility that couldn’t break through the noise.

By midyear, the mood had shifted. People weren’t angry; just tired.

The Rise of “Mullet Architecture” in Fintech and Banking

The funniest term of the year ended up becoming the most accurate one. “DeFi mullet” — business in the front, party in the back. User-facing products started looking more and more like traditional fintech apps or brokerage platforms. Clean interfaces, full KYC, regulatory compliance, customer support teams, the whole package.

Behind the scenes, the rails were anything but traditional. Stablecoins for settlement. AMMs for liquidity. Tokenized T-bills for yield. Permissionless infrastructure doing the heavy lifting while the front-end keeps regulators and customers comfortable.

It wasn’t glamorous, but it scaled. And it made crypto feel usable in a way that pure on-chain UX never quite achieved.

The Policy Pivot

A bipartisan crypto bill passing with broad support? If you pitched that storyline a year ago, most people would’ve laughed it off.

Yet it happened, and it rewired the industry’s expectations overnight. Regulatory uncertainty, which had hung over the U.S. market for years, suddenly had a roadmap. Banks got the clarity they needed to enter stablecoins. Major financial firms poured resources into tokenization pilots. Entrepreneurs felt like they had permission to build again.

The act didn’t solve everything. It didn’t erase the industry’s darker episodes or remove the risk of bad actors. But it did something important: it established a direction.

For an industry that spent years battling regulators, that change alone was seismic.

Closing Thoughts

2025 didn’t give the industry the year it expected, but it did give it a year that mattered. Stablecoins, RWAs, and ETFs pushed crypto deeper into mainstream finance, even as retail exhaustion and constant dilution dragged sentiment to new lows. Our interviews make one thing clear: no single story defined the year. Progress and pain happened at the same time.

If there’s a takeaway, it’s that crypto is no longer driven by one narrative or one market cycle. It’s a mix of regulated rails, permissionless infrastructure, geopolitical pressure, and real-world adoption all pulling in different directions. The market may not have soared, but the foundations laid in 2025 will shape everything that comes next.