2021 was a year for many landmark moments in cryptocurrency mass adoption. We saw companies like Tesla, Microstrategy, Galaxy Digital, and Block (previously known as Square) add Bitcoin to the company treasuries, and another massive milestone was, of course, El Salvador making Bitcoin legal tender in the country.

Though one of the biggest letdowns felt by everyone in the crypto space was that the SEC continuously shot down Spot Bitcoin Exchange Traded Fund (ETF) applications in the United States. To the frustration of everyone, the SEC has chosen to play the role of judge, jury and ultimately, executioner for multiple high profile and reputable firms wanting to launch a Spot Bitcoin ETF such as the applications from Valkyrie, Kryptoin, Fidelity, Ark Investment Management, WisdomTree, and VanEck while delaying their decision on the highly anticipated Greyscale Bitcoin ETF.

This came as a frustration as a Bitcoin Future’s ETF was approved which had little impact, and their neighbour to the north Canada was able to approve more than one Spot Bitcoin ETF, one of which was applied for by none other than Fidelity after the US denied their application. Canada also beat the States to the punch by launching the first Ethereum ETF.

Other places such as Brazil, Germany, Switzerland, and Dubai have also approved Spot Bitcoin ETFs leaving many investors wondering why the US is dragging their feet. Many key figures in the crypto space feel that a US-based Spot Bitcoin ETF will be the main catalyst that drives crypto mass adoption. This article is going to explain why that is a possibility as well as explore other investment products outside of ETFs and highlight why crypto investment products may pave the way for mass adoption.

What Are Investment Products and Why are They Used?

Investment products have been around in traditional finance for as long as money itself. The main use case and need for investment products came from the simple desire for people to want to put their money to work for them, earning a return on their money by investing in companies, industries, commodities, metals, food, basically anything that could provide investors with a positive return on their money.

Investment products became popular, and necessary, as average people could rely on the experience and expertise of those who worked in the investment sector and utilize their research and networking to gain exposure to the appropriate investments for them.

An example of why these products were needed can be thought of in simple terms such as imagining a farmer who works 12 hours a day tending the agriculture and animals on their farm.

Before anyone assumes that I am about to bash farmers for not being tech or finance savvy, that could not be further from the truth. This is just an example and I have the utmost respect for the very difficult work that farmers do and thank any farmer who may be reading this. If it wasn’t for the work that they do, we would not be here…Literally. If you want to realize just how little most of us know about where our food comes from, look up how Brussel Sprouts grow, I had no idea! I wouldn’t last two days without farmers as I would probably wander into the woods and end up eating something poisonous my first day.

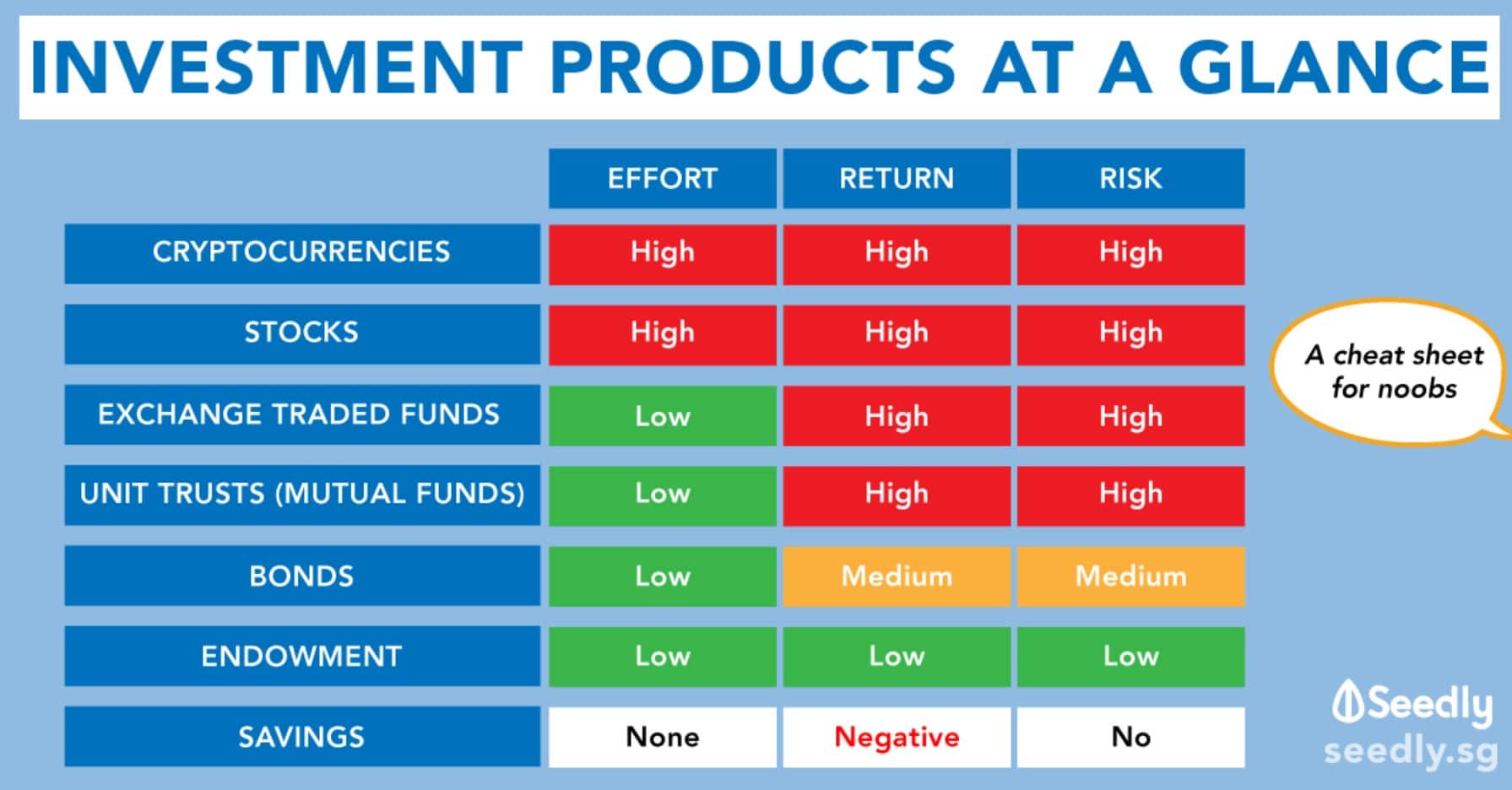

Investment Cheat Sheet for Noobs Image via blog.seedly

Investment Cheat Sheet for Noobs Image via blog.seedly Anyway, got off track there. The farmer likely does not have the time or resources to properly research all the different investment avenues as they are busy feeding the planet and all, so they would turn to a professional investment firm to manage their funds for them with the expectations that professionals and experts who specialize in investments will make better-informed investment decisions than the farmer could.

Traditional investment products can provide investment exposure to things like stocks, bonds, mutual funds, ETFs, derivatives, futures, indices, precious metals etc., but then the emergence of cryptocurrencies came about and investors were interested in gaining exposure to that asset class as well. Just as the farmer may not know how to purchase stocks or bonds, nor know which ones are savvy investment choices, the same applies to cryptocurrencies.

Many investors don’t know a Bitcoin from an Ethereum and don’t care, nor do they have any idea how to purchase these things so many have turned to crypto investment products to gain crypto exposure.

What Crypto Investment Products are Available?

Like many investment products, some crypto investments are only available to those fat-cat investors on wall-street. The world of investments has always been somewhat of an “exclusive club,” where they get first dibs and special institutional access to products not available to the public and some of these crypto products are similar, though many of these are available to retail investors.

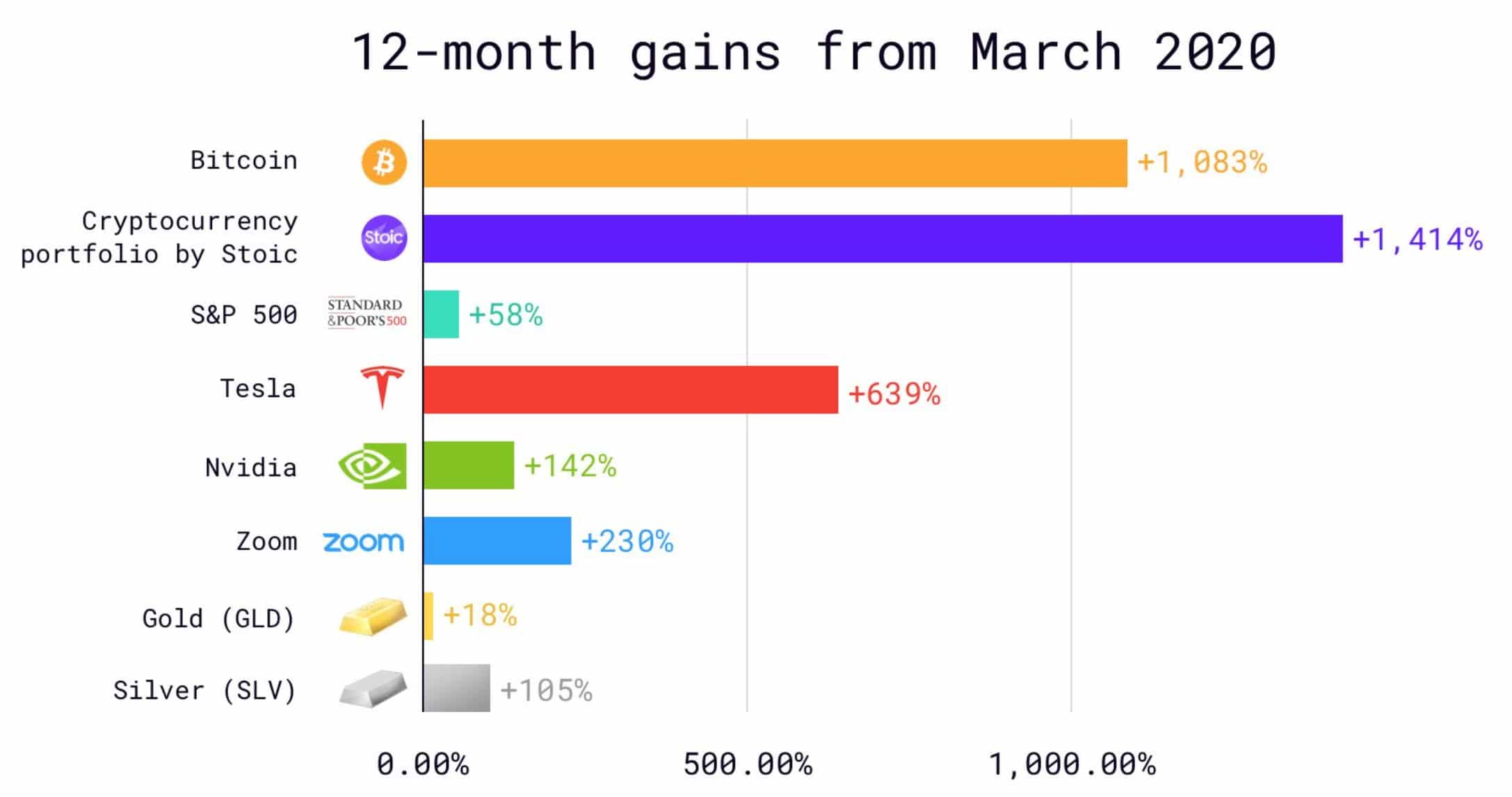

It’s Returns Like These That Result in Investors Wanting Crypto Exposure Image via Stoic

It’s Returns Like These That Result in Investors Wanting Crypto Exposure Image via Stoic Crypto Spot ETFs - Crypto Spot ETFs are the main vehicle in which investors can gain direct crypto exposure without needing to hold the physical crypto itself. As mentioned, these ETFs are already available in Canada, Brazil, Germany, Switzerland, Dubai and the list is growing. The Spot Bitcoin ETF in Canada was met with a very positive response from investors and exploded in popularity with over 145 million dollars worth of shares trading within the first day. A Crypto Spot ETF such as a Bitcoin Spot ETF tracks the current or “spot,” price movements of the underlying asset which is what makes a Spot ETF the closest thing to a crypto investment possible without actually owning the real thing.

A List of Crypto ETFs Applied for in the US. By the end of 2021, All Have Been Rejected But One Which is Still “In Review” Image via the coin

A List of Crypto ETFs Applied for in the US. By the end of 2021, All Have Been Rejected But One Which is Still “In Review” Image via the coin Futures ETFs - While crypto Spot ETFs keep being rejected in the United States, there are quite a few futures ETFs available such as the ProShares Bitcoin Strategy ETF in the US and other Futures Bitcoin ETFs now being a dime a dozen in other parts of the world.

The main distinction between a Bitcoin Futures and Bitcoin Spot ETF is that the Futures ETF does not invest directly in Bitcoin. The ProShares Bitcoin Future ETF invests in cash-settled, front-month Bitcoin Futures and can invest in things like Treasury Bills and Repurchase Agreements for cash positions. When choosing ETFs for any asset class the words “Spot,” or “Physical,” means direct exposure to the underlying asset class and tracks the price. Find out more about why a Bitcoin Futures ETF isn’t like the real thing by watching Guy’s video about Bitcoin ETFs.

Companies with Bitcoin Exposure and Blockchain ETFs - As the government refuses to allow people to invest in Spot ETFs, some clever investors have chosen to do the next best thing and that is to invest in portfolios made up of companies who hold, invest in, and are working with blockchain technology. Funds such as Global X Blockchain & Bitcoin Strategy ETF which is an actively managed ETF provides investors with exposure to Bitcoin Futures but also invest in blockchain-related equities. The Equities considered for selection include companies involved in digital asset mining, blockchain and digital asset transactions, and companies with blockchain applications and software services.

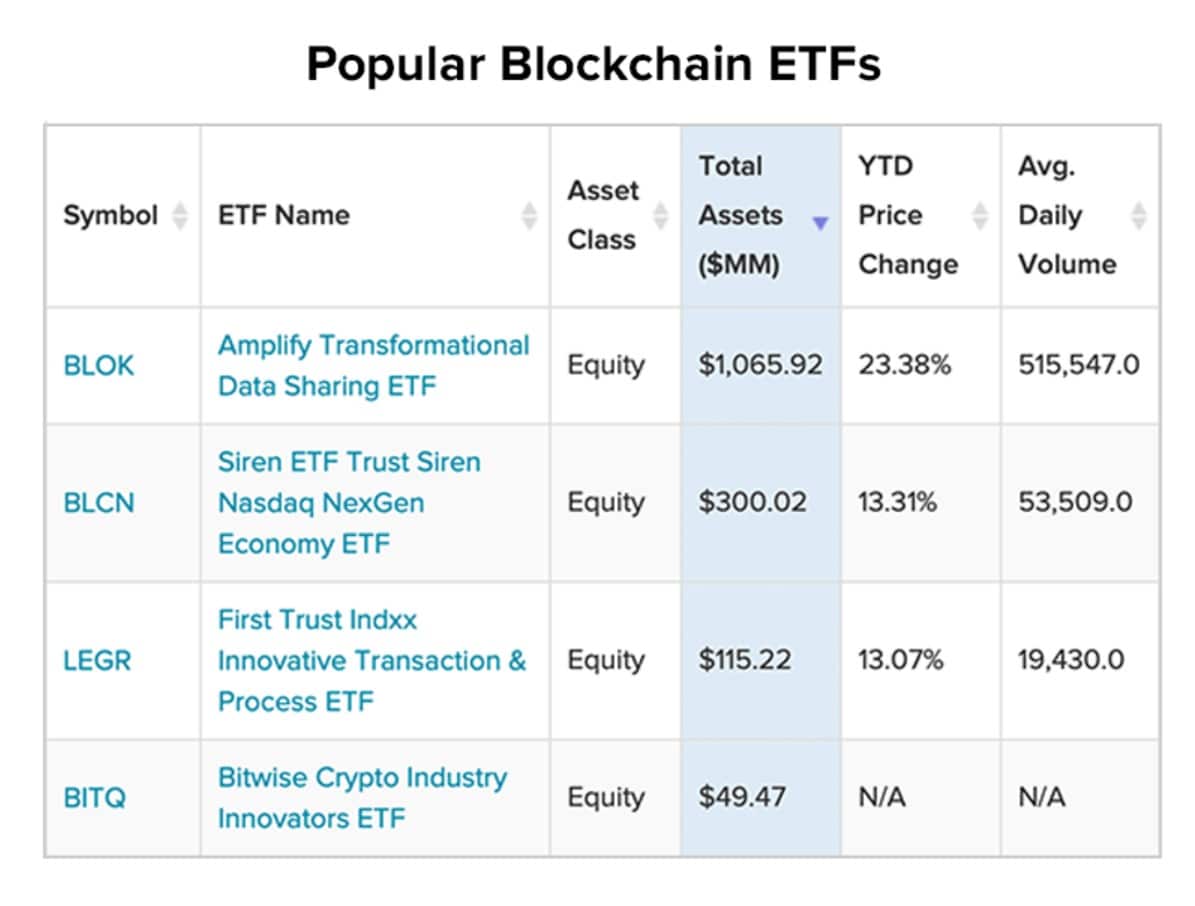

Blockchain ETFs have become quite popular. ETFs such as BLOK, BCLN and LEGR look to provide investors with exposure to the blockchain industry. The Amplify Transformational Data Sharing ETF (BLOK) is an actively managed ETF that invests a minimum of 80% of its net assets in stocks of companies engaged in the development and utilization of blockchain technologies.

The Siren Nasdaq NexGen Economy ETF (BCLN) tracks the Nasdaq Blockchain Economy Index which gauges the performance of companies involved in developing, researching, supporting, innovating or utilizing blockchain tech. Each blockchain ETF provides diversified exposure to different aspects of the blockchain industry, there are many great choices for investors to get involved with, more available than I am able to cover here.

Some of the Popular Blockchain ETFs Available Image via appinventiv

Some of the Popular Blockchain ETFs Available Image via appinventiv Individual Crypto Stocks and Exchange Traded Products/Notes (ETPs/ETNs) - With some investors not willing to purchase crypto directly but who are already well versed on how to purchase traditional investment products, a popular play has been holding stock for companies like Coinbase (COIN) or Block (SQ) which are heavily correlated with blockchain assets.

Another popular play is investors piling into Exchange Traded Products and Exchange Traded Notes (ETPs/ETNs) which can be thought of like a layer around an asset or group of assets such as Bitcoin or other cryptocurrencies that trade on an exchange similar to a security. Some of the most common crypto ETP/ETNs include 21 Shares Bitcoin ETP, VanEck Vectors Bitcoin ETN, WisdomTree Crypto Altcoins ETP and the list goes on. There are hundreds of these and they can fall under specific categories for a variety of tokens providing exposure to other coins such as Cardano and Polkadot.

A Growing Number of Crypto ETNs and ETPs Are Providing Investors With Multiple Ways to Gain Cryptocurrency Exposure Image via xetra.co

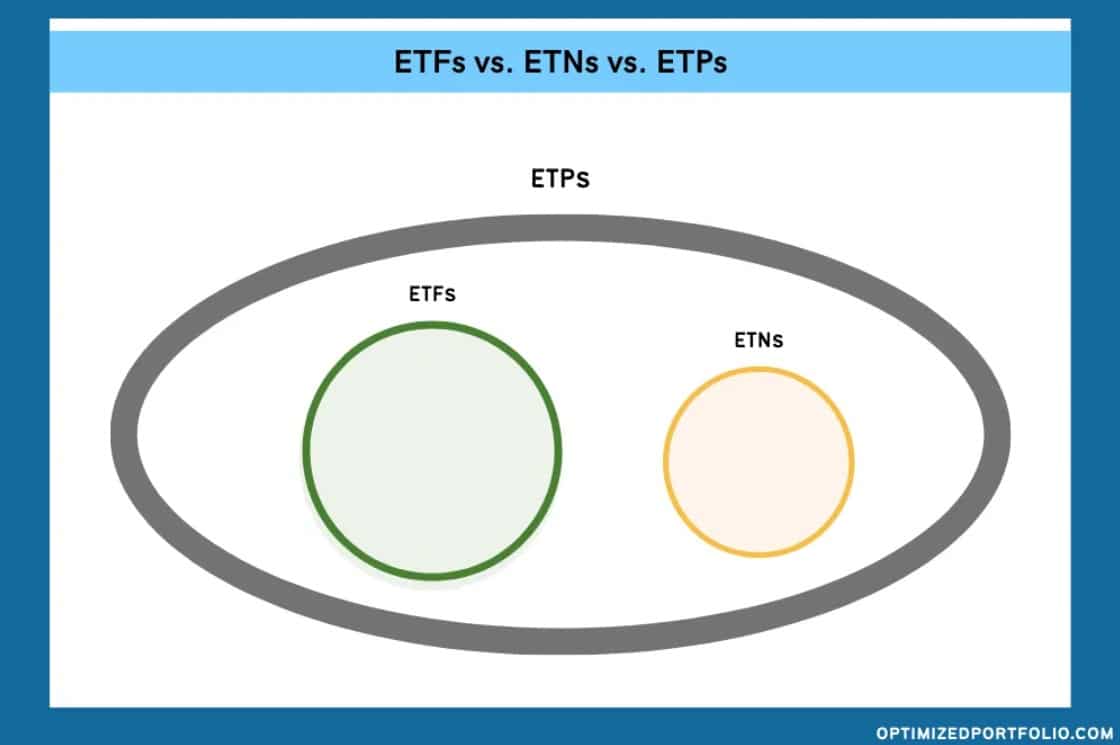

A Growing Number of Crypto ETNs and ETPs Are Providing Investors With Multiple Ways to Gain Cryptocurrency Exposure Image via xetra.co Funds traded on these exchanges can be accessed by most discount brokers as they trade on regular stock exchanges. The main difference between an ETF and ETP/ETN is that an ETF is a passive index or commodity tracking fund while an ETP/ETN is a financially engineered investment that bets for or against the indices that they track. An ETP can be thought of as betting on an index while an ETF is more like holding the assets within an index to put it simply. This Comparison Article between ETPs, ETNs and ETFs by Optimized Portfolio sums it up nicely.

Too Many 3 Letter Initials? This Diagram and Article Can Help Clear up the Confusion Image via optimizedportfolio.com

Too Many 3 Letter Initials? This Diagram and Article Can Help Clear up the Confusion Image via optimizedportfolio.com The largest ETP provider is Grayscale who launched the Bitcoin Trust (GBTC) which is by a large margin, the industry’s largest fund available in this category. Grayscale also offer ETPs for Ethereum (ETH), Basic Attention Token (BAT), Bitcoin Cash (BCH), Chainlink (LINK), Decentraland (MANA), Ethereum Classic, Filecoin (FIL), Horizen (ZEN), Litecoin (LTC), Livepeer (LPT), Solana (SOL), Stellar Lumens (XLM), Zcash (ZEC), and a DeFi Fund as well as a Digital Large Cap fund.

Crypto Index Funds - A few funds have been created such as the Bitwise 10 Index Fund (BITW) which tracks the performance of the Bitwise 10 Large Cap Crypto Index which represents the 10 largest investable cryptocurrencies by market cap. Index funds are a great option for investors who don’t care to do their own research into the top crypto projects or want to manually rebalance their portfolio as the top ten holdings change.

This is an actively managed fund that allows users to take a more set and forget approach, knowing that their portfolio will continuously be rebalanced to ensure a reasonable percentage of their invested funds will be allocated around the different top ten currencies.

The BITW launched in 2017 but did not become available to over-the-counter traders until December 2020. The demand for crypto investment vehicles became quite clear as the fund started trading with just $120 million in assets and grew over ten times in under a year. Crypto Index Funds can comprise of any basket of digital assets that investors may want exposure to.

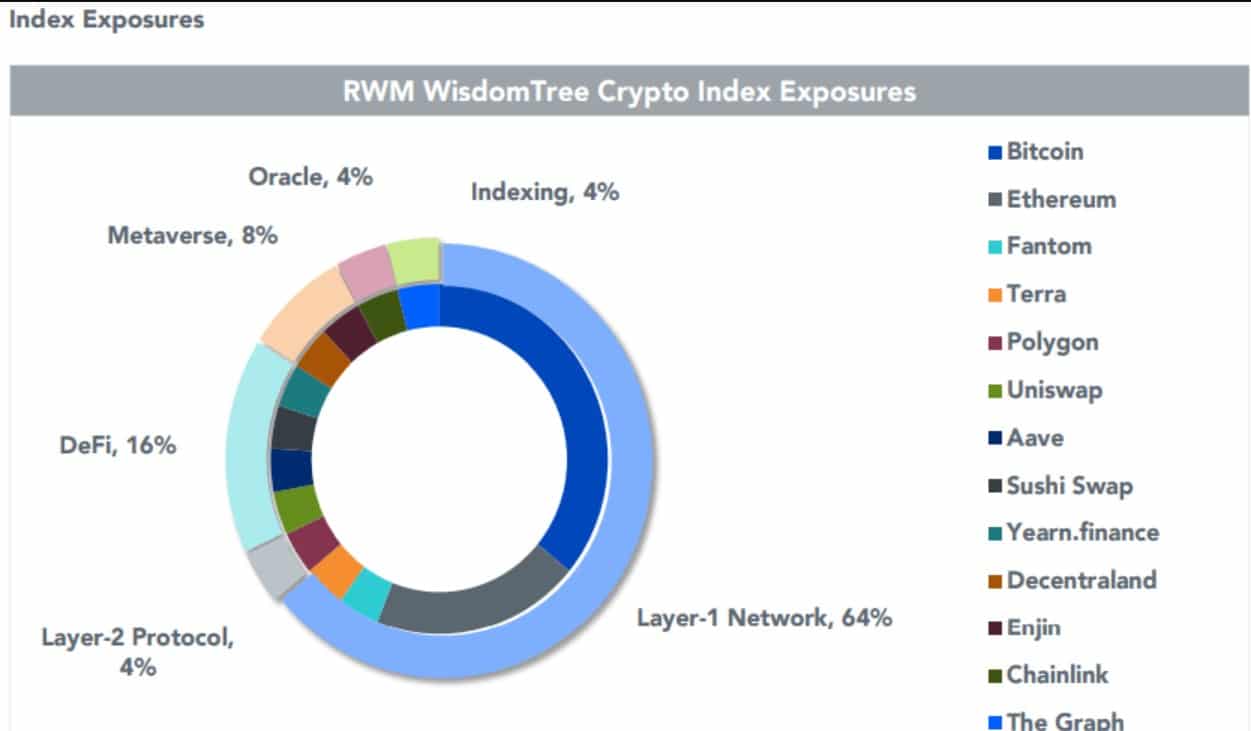

Another good example of this is the RWM WisdomTree Crypto Index which provides investors with diversified exposure to many different aspects of crypto such as DeFi, Layer-1's, Layer-2's, Metaverses etc.

WisdomTree’s Actively Managed Crypto Index Fund Exposure Provides Diversification Image via seekingalpha

WisdomTree’s Actively Managed Crypto Index Fund Exposure Provides Diversification Image via seekingalpha To summarize, there are hundreds of different ways that one can gain crypto exposure, far more than I can list here. For anyone who doesn’t want to, or cannot hold a crypto asset directly, investors can pile into an index that tracks a crypto’s performance, invest in companies who are blockchain-centric, place funds in ETNs such as the Trusts offered by Grayscale, or invest in funds that carry a basket of companies with diversified exposure to various dimensions of the blockchain industry.

While many crypto enthusiasts would state that the best way to gain crypto exposure is to self-custody the asset itself, there are some pros and cons to each which I will cover next.

Why Would Investors Choose Crypto Investment Products?

Aside from the obvious being that investors will choose whatever crypto exposure they can get, there are a few reasons why institution and retail investors would choose crypto investment products over holding the physical…or rather, digital asset itself.

Diversification - Some funds provide diversified exposure such as the index funds or other ETFs mentioned earlier. Instead of putting all your eggs in the Bitcoin basket, these funds can provide diversified exposure to companies who have multi-dimensional exposure to the entire blockchain industry as a whole, focusing on different aspects of blockchain features, functions, research, or different crypto asset holdings.

Many investors prefer ETFs such as the BLOK, BCLN and LEGR as they can speculate on the broader market which they feel is a safer bet. This would be comparable to betting on the entire tech sector comprised of companies like Google, Meta, Microsoft and Apple vs betting only on the iPhone, as they see that Bitcoin could fail, as could the iPhone, but the entire blockchain/tech industry as a whole is less likely to fail.

Features - Some of the funds mentioned provide more options than simply holding, such as exposure to Futures contracts, leverage options, hedging options, and not everyone is a perma-bull on crypto so some of these also offer inverse exposure which pay off when the crypto markets drop.

Some are Actively Managed - Many investors prefer a hands-off approach like our friendly farmer mentioned earlier or people who do not eat, breath, and sleep crypto as many of us do. Many investors just want a place to throw some money while letting someone else handle it. Many of these funds will be rebalanced, reallocated, monitored, and can have exposure and allocation percentages shifted as needed which can be a laborious task for investors who desire simplicity.

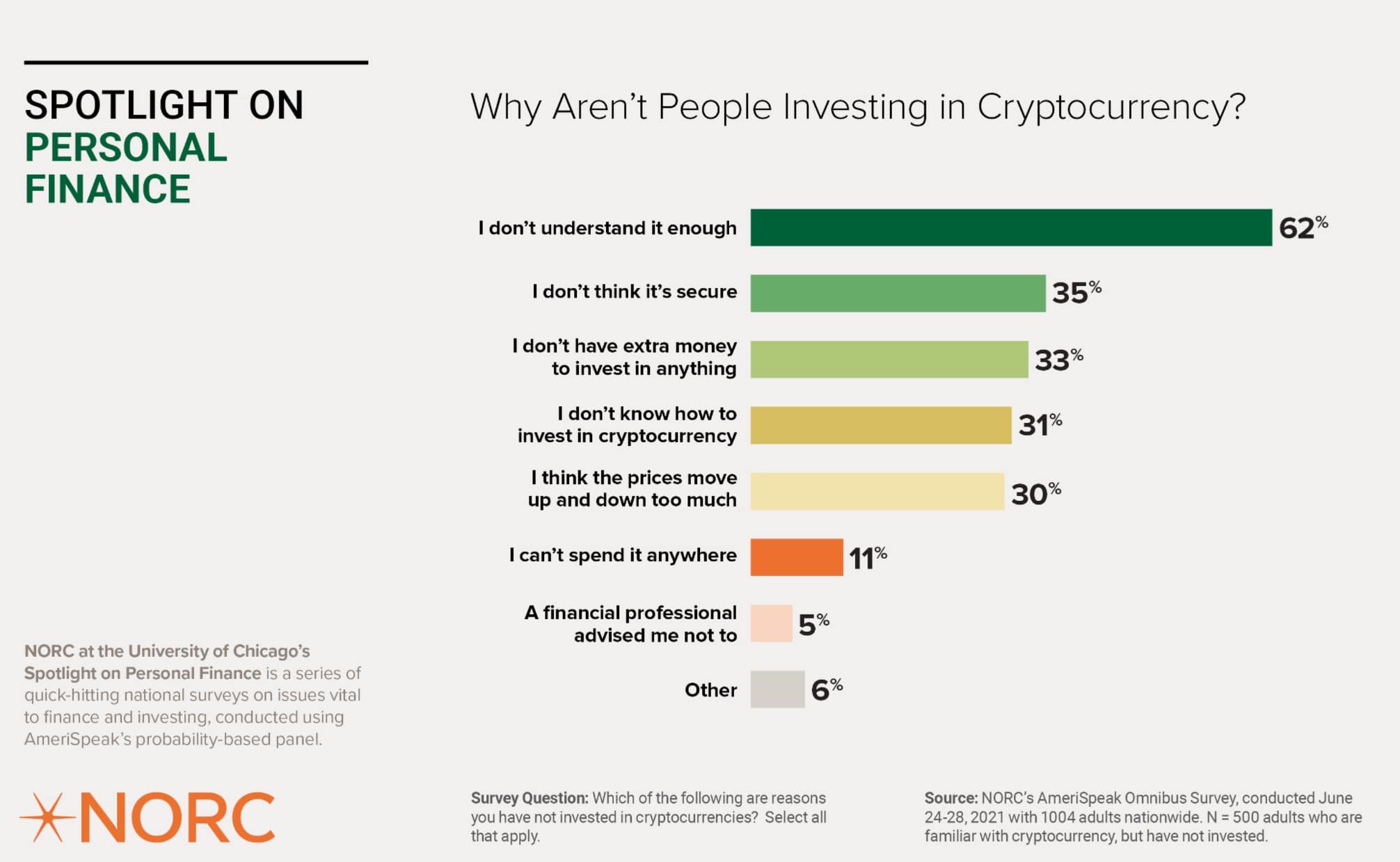

Crypto is Daunting - Many of us forget just how confusing and intimidating crypto was when we first got involved. I know for me personally, I would have gotten into crypto a couple of years earlier had a simple Bitcoin ETF been available. Like most investors, I already had ETFs in my portfolio and throwing money into another ETF would have been as easy as a couple of clicks.

It took a long time and a lot of research before I was finally convinced and confident enough to go, “all in,” on crypto. Think about having to explain to the least tech-savvy person you know, the step by step methods involved in signing up for an exchange, buying crypto, sending the funds to a wallet, then explaining software vs hardware wallets and how crypto transactions and fees/gas works, that is a heck of a learning curve and barrier to entry for many, preventing people from holding crypto. Crypto investment products can provide investors with crypto exposure without the need to understand it.

Lack of Crypto Understanding is One of The Major Barriers to Self-Custody Which Pushes Investors Towards Crypto Investment Products Image via norc.org

Lack of Crypto Understanding is One of The Major Barriers to Self-Custody Which Pushes Investors Towards Crypto Investment Products Image via norc.org Regulation, Security and Insurance - Professional investment firms are bound by legal and regulatory requirements. As long as there are legal and regulatory hurdles involved in crypto investing, investment firms won’t be able to participate, nor provide their clients with exposure which also acts as a red flag of fear for many retail investors.

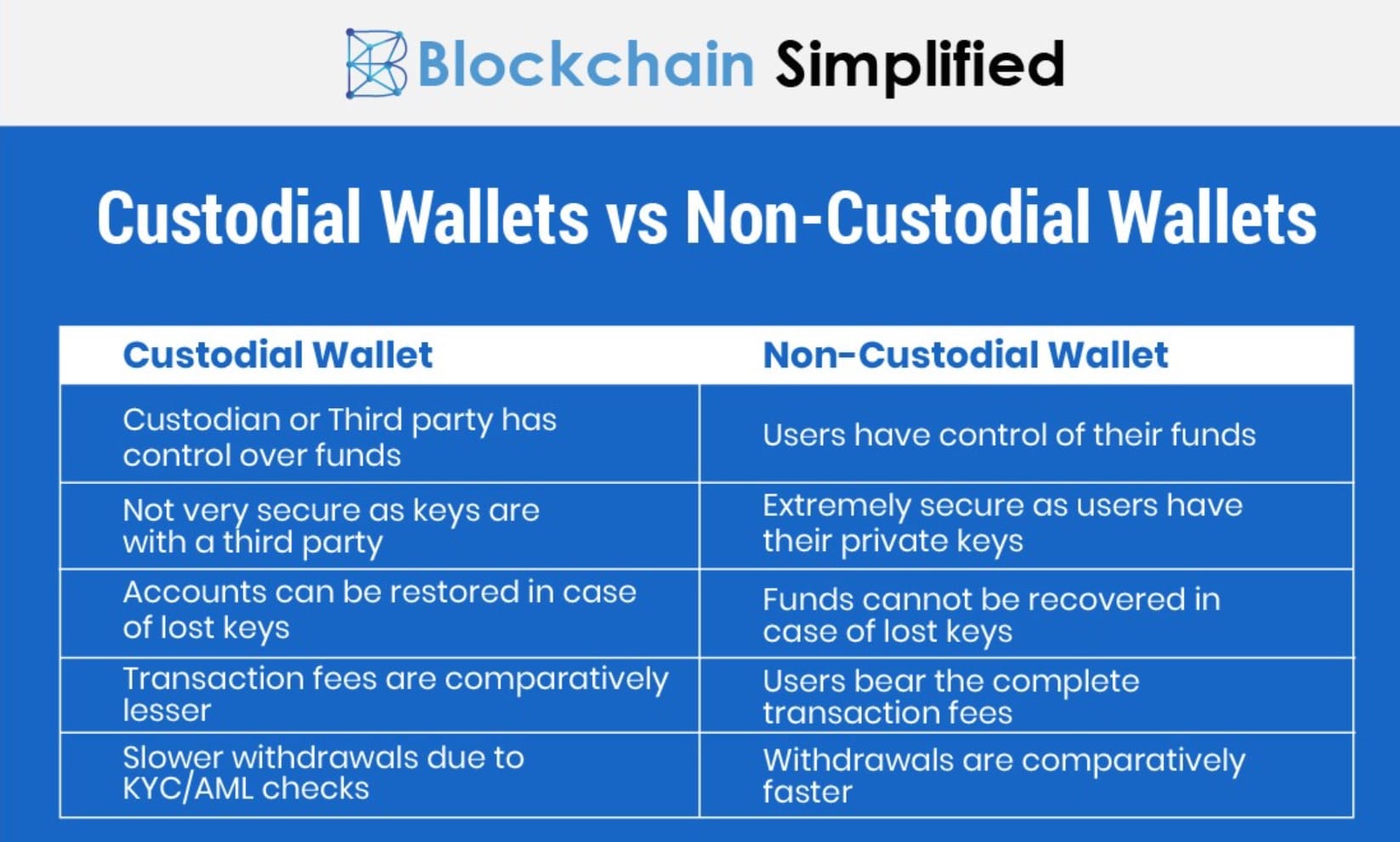

Where Bitcoin is like the wild west, controlled by nobody, many investors prefer the perceived safety behind regulated and reputable investment firms that stand behind these funds with their security features, customer support and insurance protocols firmly in place should things go south. There is no safety net for self-custodial Bitcoin holders but there are safety nets in place for actively managed and regulated firms offering these funds.

Can be Less Risky - This goes back to the safety net. Taking full responsibility for your own crypto without any help, knowing that nobody can come to the rescue for lost private keys or passwords puts a lot of people off holding their own crypto.

Just as most of us keep our life’s savings in the bank as opposed to burying stacks of cash under our mattresses at home, many people feel the same way and want a custodian involved in taking responsibility for their crypto. We have all heard countless stories of lost private keys and forgotten passwords, for these people, custodial solutions or managed crypto funds likely would have been the safer bet.

These firms also thoroughly vet the projects and tokens that they allocate funds to and only expose client funds to legitimate projects, so for anyone who lost their money buying scam coins like Squid token or who have been involved in rug pulls, investors who trust professional firms are less likely to lose funds by falling for scams.

Cons of Crypto Investment Products

You don’t own the underlying asset - Just as you don’t truly own the money in your bank account, and the bank or government can ultimately deny anyone access to their bank accounts at any time for any reason they see fit, the same is true with crypto investment products. Any time there is a centralized entity or custodian involved with anything, whether it is a bank, exchange, or non-custodial crypto wallet, the custodian holds the funds on your behalf and all you hold is an IOU, a promise that they will allow you access to the funds when you want them unless for whatever reason they choose not to give you access.

Custodial vs Non-Custodial Crypto Solutions Image via blockchainsimplified

Custodial vs Non-Custodial Crypto Solutions Image via blockchainsimplified Third-Party Risk - As you do not own the funds held by the centralized entity, you are open to any risks that they may face. These large companies and firms are enticing targets for hackers who know that they hold millions, if not billions under management. Users who invest with these companies are also open to the risk of company failure, poor management decisions and changes in government regulation.

Crypto firms and companies need to comply with the constantly changing crypto regulatory landscape which means users' funds could be at risk should sudden changes in laws and regulations happen. An extreme example of this would be if a country decided to ban Bitcoin overnight.

Any company or fund who had been holding Bitcoin on behalf of users in that country COULD deny any user access to their Bitcoin if the law demanded it, but anyone who held their own Bitcoin in a non-custodial wallet could still transact with their funds as the Blockchain itself cannot be restricted or Bitcoin holders could simply head to a country with their crypto wallet that is more crypto-friendly.

Any Bank or Custodial Crypto Firm Can Close or Deny Users Access to Their Funds at any Time. Do You Truly Own Your Funds? Image via thisismoney.co.uk

Any Bank or Custodial Crypto Firm Can Close or Deny Users Access to Their Funds at any Time. Do You Truly Own Your Funds? Image via thisismoney.co.uk Fees - Most managed funds have fees that pay the firm for things like portfolio rebalancing and management fees which can seriously eat away at profits or magnify losses. Self-custody and hodling are free.

Lack of Liquidity - If you need to sell your crypto for any reason, many of these funds will have things like minimum holding times or a multi-day delay between when an investor chooses to exit the investment to when they can actually have access to the funds making these investments less liquid as there is no instantaneous access to cash. Investors who self-custody can send their crypto to an exchange and sell their crypto within minutes or swap crypto for or other digital assets.

You Won’t Find That Rare 100x Altcoin - Investment firms have a responsibility to only expose clients’ funds to safe, “blue-chip” cryptocurrencies and blockchain projects. This is done to ensure they aren’t investing in anything that has a high likelihood of failure or may be a scam. This can be a good thing but also puts a ceiling on your investment potential as it means these funds won’t be getting involved in any ICOs or buying micro-cap highly speculative tokens which is where the biggest fortunes are made with the least amount of initial capital.

Though I wouldn’t be surprised to see funds opening up soon that do provide this type of exposure which would be awesome as that would be far easier than the hours of research that many of us put into searching for that next rare altcoin gem.

Why A US Approved Spot Bitcoin ETF Could be the Final Catalyst to Mass Adoption

As mentioned, there are already so many ways that investors can gain exposure to crypto assets without having to hold crypto, so why haven’t we already seen mass institutional adoption?

The American economy is the largest in the world, some would say second to the Chinese economy depending on the metric. Either way, the United States economy is massive and as it stands now, American and global institutional investors and many retail investors are awaiting the final approval of a US Spot Bitcoin ETF.

A Spot Bitcoin ETF will finally give institutions and retail investors the ability to come as close as possible to holding Bitcoin without needing to learn about it, how to buy it, where to buy it and how to self-custody it. While the investment products that are currently available are better than nothing, investors want direct exposure to Bitcoin itself and this isn’t possible with the current investment vehicles available.

The SEC approval of a Bitcoin ETF would also be a huge sign of confidence for investors who may be on the fence about whether or not Bitcoin is a safe option for fund diversification and allocation so the green light from the SEC would give investors both confidence in terms of security and also confidence in regulation. Many investors are wary about the changing regulatory and legal framework around cryptocurrencies and do not want to invest client’s or their own funds into anything that could come under regulatory or legal scrutiny.

Many institutions and retail investors outside of the US often look to the United States to make the first move as it can be economically detrimental to bet on an opposite horse to the horse that is being backed by the US. In the world of investments, it is often best to ride the wave being backed by the most institutional money.

For the world, that would be the economy backed by the United States. As the investment saying goes, it is better to swim with the whales instead of against them, so much of the world is likely holding their breath waiting for the biggest whale to make the first move and approve a Spot Bitcoin ETF before also going all-in on the Bitcoin bet. It would be pretty damaging to invest in something just to have the largest economy turn around and ban it so as soon as the United States becomes more Bitcoin-friendly, many believe that this could be the final catalyst needed to open up the flood gates to the world crypto adoption on a mass scale.

Crypto Investment Products Could Lead to Mass Adoption Image via cointelegraph

Crypto Investment Products Could Lead to Mass Adoption Image via cointelegraph When the SEC approved the ProShares Bitcoin Futures ETF, the fund instantly became one of the top ETFs of all time in terms of trading volume as capital flowed in, imagine the amount of capital that is waiting on the sidelines to go in on a Spot ETF. Many of us retail investors anxiously await this as well as the flow of capital would likely lead to Bitcoin shooting past its all-time highs and finally reach the coveted six-figure price mark.