Web3 is evolving rapidly, unlocking numerous avenues to deploy one’s resources effectively and generate income. Participating in blockchain consensus protocols stands out as a foundational method to engage with decentralized networks. Two predominant consensus mechanisms have emerged: Proof of Work (PoW) and Proof of Stake (PoS). Engaging with PoW is commonly called crypto mining while participating in PoS is known as crypto staking.

Both mining and staking are essential for maintaining the security and integrity of blockchain ecosystems. However, they require distinct strategies, resources, and skill sets. Mining typically demands substantial computational power and energy consumption, whereas staking involves locking cryptocurrency holdings to support network operations.

Understanding the nuances between these two approaches is crucial for individuals aiming to optimize their participation in the crypto space. This article explains the dynamics of crypto mining and staking, examining the associated skills, resources, strategies, and risks. By providing a comprehensive comparison, we aim to equip readers with the knowledge needed to determine which method aligns best with their goals and offers the most profitable outcomes.

What is Crypto Mining?

Crypto mining is the process by which participants, known as miners, engage in Proof of Work (PoW) consensus systems to validate transactions and secure blockchain networks. In this role, miners compete to solve complex mathematical puzzles, and the first to do so earns the right to add a new block to the blockchain. This process validates transactions and introduces new units of the native cryptocurrency into circulation, rewarding the successful miner.

The term "mining" parallels traditional mining, where individuals expend resources—such as electricity and computational power—to extract valuable commodities, in this case, digital currency.

Check What is Bitcoin Mining on the Coin Bureau for deeper insights into mining. You'd also do well to go over our top picks for the best cloud-based crypto mining platforms list.

Several prominent blockchain networks utilize mining as their consensus mechanism:

- Bitcoin: The pioneering cryptocurrency that introduced the PoW consensus, relying on mining to validate transactions and secure its decentralized ledger.

- Litecoin: Often considered the silver to Bitcoin's gold, Litecoin employs a PoW system with faster block generation times and a different hashing algorithm.

- Ethereum Classic: A continuation of the original Ethereum blockchain, Ethereum Classic maintains a PoW consensus mechanism to uphold its decentralized network.

Check the list of the Best Crypto to Mine on the Coin Bureau.

How Crypto Mining Works

The crypto mining process involves several key steps:

- Solving Complex Mathematical Puzzles: Miners utilize specialized hardware to perform rapid computations, aiming to solve intricate mathematical problems. The first miner to find the correct solution gains the right to add the next block to the blockchain.

- Selecting and Validating Transactions: Miners select transactions to include in the new block from the pool of unconfirmed transactions, known as the mempool. They verify the legitimacy of these transactions, ensuring that the sender has sufficient funds and that there is no double-spending.

- Constructing the New Block: Once transactions are validated, miners compile them into a new block, which includes a reference to the previous block, creating a continuous chain.

- Propagating the Block to the Network: After constructing the block, the miner broadcasts it. Other nodes then verify the block's validity, ensuring it adheres to the network's consensus rules.

- Earning the Newly Mined Cryptocurrency: Upon successful validation by the network, the miner receives a reward in the form of newly minted cryptocurrency and any transaction fees associated with the transactions included in the block.

A Blockchain Transaction | Image via Geeksforgeeks

A Blockchain Transaction | Image via GeeksforgeeksThis mining process is fundamental to the operation of PoW blockchains, ensuring security, decentralization, and the continuous addition of new blocks to the chain.

Crypto Mining Resource Requirements

Engaging in crypto mining requires substantial investment in resources to ensure efficient and profitable operations. Key requirements include:

- Specialized Hardware: Mining operations primarily utilize two types of hardware:

- Graphics Processing Units (GPUs): Initially popular for mining due to their versatility and availability.

- Application-Specific Integrated Circuits (ASICs): Purpose-built devices offering superior performance and energy efficiency for specific mining algorithms.

A Mining Farm Comprising Dedicated Hardware | Image via CCN

A Mining Farm Comprising Dedicated Hardware | Image via CCN- Stable and High-Speed Internet Connection: A reliable internet connection is crucial for timely communication with the blockchain network, ensuring prompt transaction validation and block propagation.

- Electricity Supply: Mining hardware consumes significant amounts of electricity. Access to affordable and consistent power is essential to maintain profitability and prevent operational disruptions.

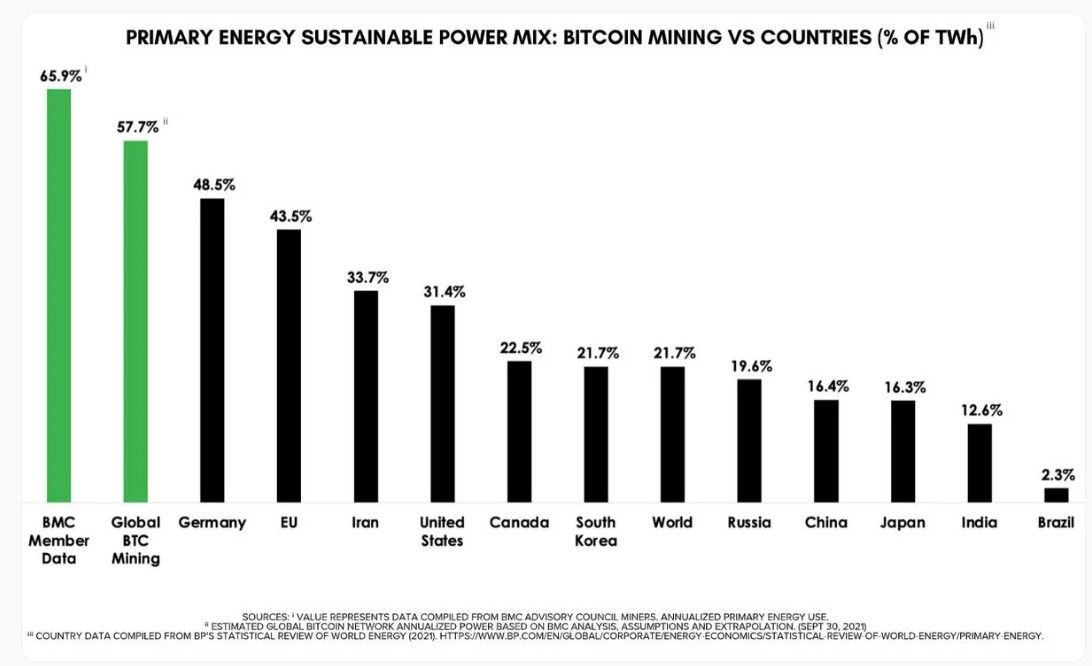

A Comparison of Bitcoin’s Energy Requirement With Countries | Image via buybitcoinworldwide

A Comparison of Bitcoin’s Energy Requirement With Countries | Image via buybitcoinworldwide- Supporting Infrastructure:

- Computers: To manage mining operations and monitor performance.

- Cooling Systems: Effective cooling solutions are necessary to dissipate heat generated by mining equipment, preventing overheating and hardware damage.

- Electrical Equipment: Proper wiring, power distribution units, and surge protectors are vital to handle the electrical load safely.

- Physical Space: Adequate space is required to house the mining setup, considering factors like ventilation, noise levels, and security.

- Technical Expertise: A solid understanding of mining software, hardware maintenance, and troubleshooting is beneficial for efficient operations.

The high resource demands and complexity of crypto mining underscore the need for careful planning and consideration before embarking on such ventures.

What is Crypto Staking?

Crypto staking involves using Proof of Stake (PoS) consensus systems as a validator node. In this role, stakers lock up a specific amount of cryptocurrency to support network operations, including validating transactions and securing the blockchain. This process is crucial for constructing new blocks during consensus, executing transactions, and updating the blockchain's state. Successful validators earn block rewards in the units of the network's native cryptocurrency, distributed proportionally based on the amount staked.

The term "staking" reflects committing cryptocurrency as collateral to gain the right to participate in the consensus process. This commitment incentivizes honest behavior, as validators who act maliciously or fail to perform their duties may face penalties, such as having a portion of their staked assets slashed. Many blockchain networks favor PoS due to its significantly lower energy requirements than Proof of Work (PoW) systems.

Several prominent blockchain networks employ staking:

- Ethereum 2.0: Transitioned from PoW to PoS to enhance scalability and reduce energy consumption.

- Solana: Utilizes a PoS mechanism combined with Proof of History to achieve high throughput and low latency.

- Cosmos: Employs PoS to enable interoperability between multiple blockchains within its ecosystem.

- Cardano: Built on a PoS protocol, Ouroboros emphasizes security and sustainability.

Check Coin Bureau's list of the Best Crypto Staking Coins.

How Crypto Staking Works

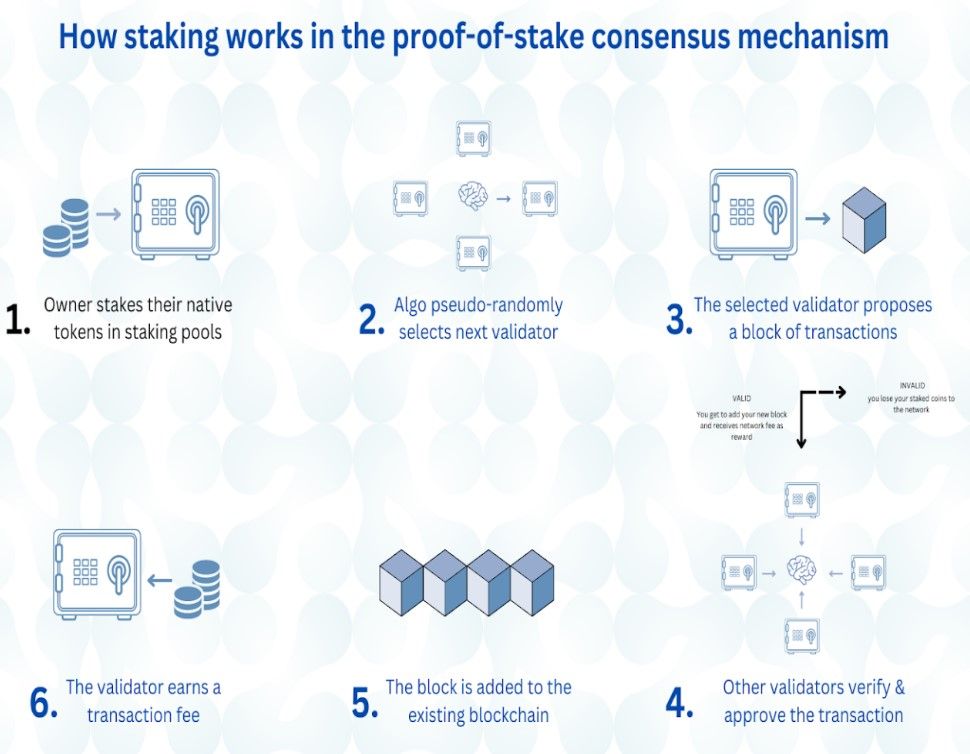

The staking process involves several key steps:

- Becoming a Validator: Participants stake a specified amount of cryptocurrency to become validator nodes, committing their assets to support network security and operations.

- Selection of Leaders: The protocol randomly selects a validator to propose a new block, with the probability of selection proportional to the amount staked relative to the total stake in the network.

- Block Proposal: The chosen validator assembles a new block by processing and verifying transactions, ensuring they are legitimate and adhere to network rules.

- Block Validation: Other validators review the proposed block, verifying its accuracy and validity. They then vote to accept or reject the block based on consensus rules.

- Earning Rewards: Upon successfully validating and including the block into the blockchain, the proposing validator receives rewards in the form of newly minted cryptocurrency. Additionally, transaction fees collected within the block are distributed among validators, providing further incentives for participation.

Refer to Coin Bureau’s Guide to Staking Crypto for deeper insights into crypto staking.

The Crypto Staking Process | Image via nasscomm

The Crypto Staking Process | Image via nasscommThis staking mechanism secures the network and offers participants the opportunity to earn passive income through their contributions to the blockchain's integrity and functionality.

Crypto Staking Resource Requirements

Participating in crypto staking demands significantly fewer resources compared to mining, making it a more accessible option for individuals and institutions alike. Below are the key requirements for staking:

- Basic Computer Hardware: Unlike crypto mining, staking does not require specialized hardware like GPUs or ASICs. A standard computer or server with basic specifications can run staking operations effectively.

- Stable and High-Speed Internet Connection: A reliable internet connection is crucial to maintain consistent communication with the blockchain network and avoid downtime, which could lead to penalties or missed rewards.

- Minimal Electricity Consumption: Staking operations consume far less electricity compared to mining. The power needed to run a basic computer is approximately 99% lower than the electricity requirements of Proof of Work mining rigs.

- Adequate Physical Space: Staking setups require minimal space, typically housing a single computer or server in a well-ventilated area, making staking more practical for home setups than the extensive space needed for mining farms.

- Cryptocurrency Holdings: A prerequisite for staking is owning the native cryptocurrency of the network you intend to participate in. The amount staked often determines the validator’s chances of being selected to propose blocks and earn rewards.

- Technical Knowledge: While more intensive than mining, understanding blockchain mechanics, staking software, and wallet management is beneficial to ensure efficient and secure staking operations.

In conclusion, the resource requirements for crypto staking are minimal compared to mining. This lower barrier to entry, coupled with its eco-friendly nature, makes staking an appealing choice for those looking to contribute to blockchain networks and earn rewards without significant investments in hardware or electricity. Check our Guide to Staking Ethereum to start staking ETH.

Key Differences Between Staking and Mining

Crypto mining and staking represent two fundamentally different approaches to blockchain consensus, each with unique characteristics and implications for participants. Below are the key differences between the two methods:

1. Consensus Systems

- Proof of Work (PoW): Mining is the backbone of PoW systems. Miners compete to solve complex mathematical puzzles, ensuring network security and transaction validation.

- Proof of Stake (PoS): Staking supports PoS systems, where validators lock cryptocurrency to participate in consensus, securing the network through economic commitment rather than computational power.

2. Energy Consumption

- Mining: Energy consumption is a significant expense, as mining operations require substantial electricity to power GPUs, ASICs, and cooling systems. Access to cheap and reliable electricity is crucial for profitability.

- Staking: Staking is far more energy-efficient, consuming only the electricity needed to run a basic computer setup. This reduced energy demand aligns with environmental sustainability goals.

3. Setup and Maintenance

- Mining: Setting up a mining operation involves acquiring costly hardware, such as GPUs or ASICs, and maintaining a purpose-built space with adequate ventilation and cooling. Mining hardware experiences wear and tear, reduced efficiency over time, and eventual obsolescence as technology advances.

- Staking: Staking requires only a basic computer or server, resulting in minimal setup and maintenance costs. The hardware used for staking undergoes little depreciation, making it easier to sustain in the long term.

Crypto Mining and Staking Are Vastly Different From Each Other. Image via Shutterstock

Crypto Mining and Staking Are Vastly Different From Each Other. Image via Shutterstock4. Risk of Loss

- Mining: The primary risk in mining is the sunk cost of resources, including energy and hardware. Participants face significant financial losses if mining rewards do not cover these expenses.

- Staking: Stakers risk losing a portion of their staked cryptocurrency if they fail to act in line with network protocols (e.g., downtime or malicious activity) through a process known as slashing.

5. Earning Potential

- Mining: Rewards depend on hardware performance and network difficulty. As more miners join, competition increases, and profitability may decline, especially with periodic block rewards halving (e.g., Bitcoin halving events).

- Staking: Rewards are proportional to the amount staked and determined by the blockchain’s rules. PoS networks often offer predictable returns, although they vary with network conditions.

6. Technical Knowledge and Soft Skills

- Mining: Successful mining requires advanced technical expertise to set up, optimize, and troubleshoot hardware. Understanding electricity management and cooling systems is also essential.

- Staking: Staking demands familiarity with wallets and staking protocols but is less technically intensive. Validators benefit from basic knowledge of network operations and blockchain mechanisms.

7. Accessibility and Barriers to Entry

- Mining: High initial costs, including hardware acquisition and infrastructure setup, create a significant barrier to entry. Mining is also less accessible in regions with high electricity costs or regulatory restrictions.

- Staking: Staking has a low barrier to entry, requiring only cryptocurrency holdings and a compatible wallet. Some platforms, like exchanges, further simplify the process with staking-as-a-service.

8. Environmental Impact

- Mining: Mining’s energy-intensive nature contributes to its high environmental impact, often criticized for its carbon footprint.

- Staking: PoS networks are lauded for low energy requirements, offering a sustainable alternative to PoW.

9. Economic Decentralization

- Mining: Mining often becomes centralized in regions with cheap electricity or dominated by large-scale operations, potentially undermining decentralization.

- Staking: While staking also poses centralization risks (e.g., large token holders dominating), networks often implement mechanisms to encourage decentralization, such as reward caps.

Conclusion

While mining and staking are essential to the security and operation of blockchain networks, their differing resource requirements, risks, and rewards make them suitable for different types of participants. Mining is best suited for those with access to cheap electricity, technical expertise, and a willingness to manage complex setups. Staking, however, is ideal for participants seeking an eco-friendly, low-maintenance way to earn rewards through active network participation.

Advantages of Crypto Mining

Crypto mining has the following advantages:

- High Earning Potential:

- Large-scale mining operations can generate significant profits by leveraging economies of scale.

- Small-scale miners can earn disproportionate rewards if they succeed in solving the computational puzzle first. For example, successfully mining a Bitcoin block rewards 3.125 BTC at present, a substantial incentive.

- Network Security:

- PoW mining contributes to the robust security of networks like Bitcoin.

- Manipulating the blockchain becomes prohibitively expensive due to the enormous computational power and energy required, ensuring high attack resistance.

- Customizability:

- Miners have full control over their hardware setup, allowing them to optimize their rigs for efficiency and performance.

- Geographic flexibility enables miners to establish operations in regions with lower electricity costs or favorable regulations, improving profitability.

- Economic Incentives for Innovation: The mining industry drives computing and energy efficiency advancements. Developments in ASIC technology and renewable energy integration often originate from mining demands.

- Potential for Scaling: Miners can expand operations incrementally by adding more hardware, allowing for scalability based on available resources and market conditions.

Large-Scale Mining Operations Can Generate Significant Profits. Image via Shutterstock

Large-Scale Mining Operations Can Generate Significant Profits. Image via ShutterstockAdvantages of Crypto Staking

Crypto Staking has the following advantages:

- Energy Efficiency and Eco-Friendly:

- Staking requires less energy than mining, making it an environmentally sustainable consensus mechanism.

- Staking aligns with the global push toward greener technologies and reduces the carbon footprint of blockchain networks.

- Accessibility:

- Staking eliminates the need for expensive hardware, making it accessible to more participants.

- Liquid staking further lowers the entry barrier, allowing users to earn rewards without locking up assets entirely.

- Steady and Predictable Rewards:

- Rewards in PoS systems are typically consistent and proportional to the amount staked, offering more predictable returns.

- This stability appeals to participants seeking reliable income from their crypto holdings.

- More Decentralized:

- PoS networks often achieve greater decentralization than PoW networks, as staking doesn’t require large-scale operations or centralized access to resources like electricity.

- Mechanisms like capped rewards for large stakers further enhance decentralization.

- Predictable Operating Costs:

- Unlike mining, staking has low and consistent operating costs, as it primarily involves maintaining a basic computer setup.

- This predictability makes financial planning simpler for individual participants.

- User-Friendly Participation:

- Staking can often be done through simple wallet interfaces or platforms that provide staking-as-a-service, requiring minimal technical knowledge.

- Native staking support in many wallets adds to the ease of use.

- Flexible Staking Options: PoS ecosystems offer various staking models, including delegated staking, where users delegate their stake to a validator without running a node.

Conclusion: Why Staking is More Economical for Individuals

Staking is a more practical and economical option for individual participants than mining. Its low resource requirements, predictable operating costs, and steady rewards make it accessible to a broader audience, including those with limited technical expertise or financial capital.

While mining offers high earning potential and network security contributions, its high costs, energy demands, and technical complexities make it challenging for individual miners to compete with industrial-scale operations. Conversely, staking's simplicity and eco-friendliness align well with the needs of individual users looking for sustainable and decentralized ways to participate in blockchain ecosystems.

Challenges and Risks of Mining and Staking

Here are some challenges and risks associated with crypto mining:

- High Upfront Costs: Mining requires a significant initial investment in specialized hardware, such as GPUs or ASICs, and infrastructure like cooling systems and electrical setups.

- High Maintenance and Hardware Depreciation:

- Mining hardware experiences wear and tear, reducing efficiency over time.

- Continuous advancements in mining technology often render older hardware obsolete, forcing miners to reinvest regularly.

- Decreasing Profitability in Bitcoin Mining: Bitcoin’s halving events, which halves the block rewards approximately every four years, lead to declining profitability for miners unless offset by rising market prices or reduced operational costs.

- Dominance of Large-Scale Operations:

- Large-scale operations and mining pools increasingly dominate mining with access to economies of scale, cheap electricity, and bulk hardware purchases.

- Individual miners often struggle to compete in this landscape.

- High Energy Consumption:

- Mining operations consume enormous amounts of electricity, making energy costs one of the most significant expenses.

- This dependency on affordable energy often ties mining operations to regions with low energy prices, which may not always align with favorable regulatory environments.

- Environmental Concerns and Regulation:

- The environmental impact of mining’s energy consumption has drawn criticism, leading to stricter regulations in some regions.

- Sudden policy changes can disrupt mining operations.

- Market Volatility: Fluctuations in cryptocurrency prices can directly impact mining profitability, leaving miners vulnerable to market downturns.

Crypto Mining and Staking Come With Challenges and Risks. Image via Shutterstock

Crypto Mining and Staking Come With Challenges and Risks. Image via ShutterstockHere are some risks and challenges associated with crypto staking:

- Locked Funds Reduce Liquidity: Staked funds are often locked for a specific period, limiting liquidity and preventing users from accessing their assets during emergencies or market opportunities.

- Risk of Slashing:

- Validators risk having their staked cryptocurrency slashed for network violations such as downtime or malicious behavior.

- Unlike mining, where resource investment is the primary risk, slashing directly impacts the validator’s financial assets.

- Rewards Dependence on Transaction Fees:

- In many PoS networks, staking rewards are partially derived from block transaction fees.

- Low network activity can reduce the overall reward pool, impacting validators’ earnings.

- High Upfront Staking Requirements:

- Some networks require participants to stake substantial amounts of cryptocurrency to become validators, creating a financial barrier to entry.

- For example, Ethereum 2.0 requires a minimum of 32 ETH to run a validator node.

- Penalties for Downtime:

- Validators who fail to maintain consistent uptime or meet network requirements may face slashing penalties or lose eligibility for rewards.

- Mining does not penalize downtime, making staking comparatively riskier in this regard.

- Dependency on Network Health:

- The value and security of staked funds depend on the overall health and adoption of the PoS blockchain.

- Poor governance or vulnerabilities in the protocol can jeopardize staked assets.

- Centralization Risks: Staking through centralized platforms or services may expose participants to third-party risks, including mismanagement or hacking of custodial funds.

- Market Volatility Impact on Rewards: While staking rewards are predictable, the value of those rewards is tied to the market price of the staked cryptocurrency, making earnings vulnerable to price fluctuations.

Conclusion

Both mining and staking come with their risks that participants must carefully evaluate. Mining demands significant upfront investments and is burdened by ongoing operational expenses, while staking locks up assets and carries risks of penalties for poor network behavior. However, the energy efficiency and lower maintenance requirements of staking make it more appealing to individuals, whereas mining’s high costs and competitive landscape often favor industrial-scale operations.

Choosing Between Mining and Staking

When deciding between crypto mining and staking, participants must assess their circumstances and preferences to determine which approach aligns best with their goals and resources. Below is a breakdown of key factors and ideal conditions for each method.

Factors to Consider

- Budget:

- Mining: Requires significant capital investment in specialized hardware (e.g., GPUs, ASICs), cooling systems, and infrastructure. Additionally, ongoing electricity costs are a major expense.

- Staking: Has a comparatively low entry cost. Most staking setups need only a basic computer or a wallet and the cryptocurrency to be staked. Liquid staking solutions further reduce barriers by allowing smaller contributions.

- Goals:

- Mining: Better suited for long-term investments and those willing to take on substantial initial costs with the expectation of significant returns over time, particularly in large-scale operations.

- Staking: Ideal for individuals seeking steady, predictable rewards and passive income. Staking also appeals to those looking to support eco-friendly blockchain solutions.

- Technical Expertise:

- Mining: Demands hands-on expertise in setting up, managing, and maintaining mining hardware, as well as knowledge of power management and troubleshooting.

- Staking: Offers plug-and-play options via staking platforms and wallets, making it more accessible to participants with limited technical skills.

- Energy and Environmental Concerns:

- Mining: Requires access to cheap and reliable electricity, with a high environmental impact due to significant energy consumption.

- Staking: Highly energy-efficient, making it a preferred option for environmentally conscious participants.

- Risk Tolerance:

- Mining: Risks include hardware obsolescence, high operational costs, and fluctuating profitability.

- Staking: Risks involve slashing penalties, network dependency, and locked funds, generally lower than mining risks.

Best Use Cases

Mining:

Mining is best suited for participants who:

- Have access to affordable electricity and a stable power supply.

- Own or can acquire high-performance hardware such as ASICs or GPUs.

- Have the technical expertise to optimize hardware performance and maintain mining rigs.

- Are prepared for long-term investments with high initial costs but the potential for significant rewards.

- Operate in regions with favorable regulatory environments for mining activities.

Staking:

Staking is ideal for participants who:

- Seek passive income with minimal maintenance requirements.

- Prefer an eco-friendly approach to participating in blockchain networks.

- Have lower upfront capital but hold the required cryptocurrency for staking.

- Want steady and predictable rewards without the complexity of running hardware-intensive operations.

- Value liquid staking options allow participation with smaller amounts or access to funds without strict locking periods.

- Favor a lower risk profile, with fewer operational expenses and reduced exposure to energy costs.

Closing Thoughts

Crypto mining and staking are two fundamental methods for participating in blockchain networks and supporting their operations. Throughout this article, we explored their definitions, processes, advantages, and risks, highlighting how each approach serves a distinct role in the decentralized ecosystem.

As the backbone of Proof of Work systems, mining offers high earning potential and significant contributions to network security but comes with substantial upfront costs, technical requirements, and environmental concerns. On the other hand, staking provides an energy-efficient and accessible alternative in Proof of Stake systems, offering steady rewards with lower resource demands. However, it involves risks like slashing and locked funds.

Factors such as budget, goals, technical expertise, and environmental priorities are critical for individuals deciding between the two. Mining is ideal for those with access to affordable electricity and advanced hardware while staking suits those seeking passive income and a low-maintenance, eco-conscious strategy.

Ultimately, choosing between mining and staking depends on personal circumstances and objectives. By providing a comprehensive comparison, this article aimed to equip readers with the knowledge needed to decide which approach aligns best with their goals and resources in the Web3 space.