Note: Check out our updated S&P 500 vs. Crypto ROI in 2023 article if you are interested.

Ah, the stock markets…Giving investors and bankers a place to throw money around since its inception in 1602 for the Dutch, 1773 for the Brits, and 1790 for the Americans, with Wall Street being born in 1792.

When people refer to “The Markets,” they are generally referring to the S&P 500 which stands for the Standard & Poor’s 500 Index which was created in 1957. The S&P 500 is a market-capitalization-weighted index of the top 500 publicly traded US companies at any given time. By combining the top 500 publicly traded companies into one index, this gives bankers, investors, economists, and basically anyone who wants to pull up a chart, insight into the overall health of the stock markets and the underlying economy.

While there are thousands of different indices measuring everything from individual markets like oil, corn, soybeans, gold, silver, to indices that follow European markets, UK markets, to indices that track separate sectors like tech, healthcare, education etc., the S&P 500 is the granddaddy of them all and is used as the main economic indicator, influencing the state of the global markets.

The S&P 500’s relationship to the overall stock market can be compared to what Bitcoin’s relationship is to the overall crypto market and is the main focus for the majority of the investment world.

When the S&P 500 is up, global markets are generally healthy and trending upwards, similar to when Bitcoin is doing well, crypto, in general, is doing well, and when the S&P 500 is dropping, that shows that the top 500 companies are struggling and if their valuations are dropping, then the rest of the global economy is likely dropping as well, similar to when Bitcoin dumps, all the Altcoins generally dump worse.

Disclaimer: I hold many of the crypto assets mentioned in this article as part of my personal portfolio.

S&P 500 Historical Performance

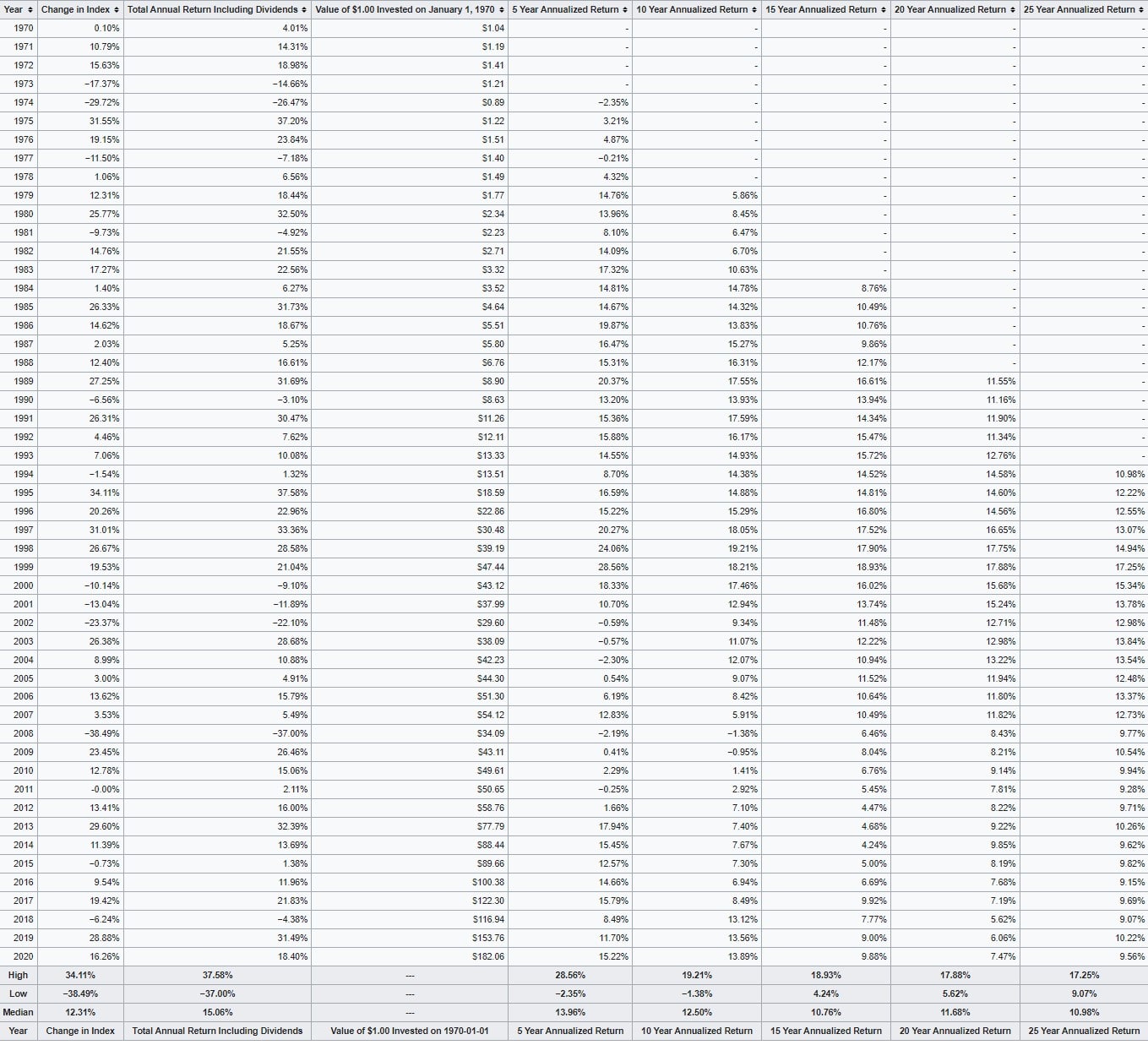

Since the beginning of the S&P 500 in the 1950s, investors have come to expect average returns of around 10-15% per year, with the best performing year being 1995 where the index rewarded investors with a fantastic return of 37.58% and the worst return beating investors up with a return of -37% in 2008. The S&P 500’s annual return on investment average has set the bar for the traditional investment space, with most traditional investors being thrilled with a 10% return per year.

The S&P 500 Performance since 1970 Image via Wikipedia

The S&P 500 Performance since 1970 Image via Wikipedia I know many crypto enthusiasts are thinking, “huh? That’s it?” most of us in the crypto space don’t even get out of bed for 10% and chase returns that were once thought impossible by investors just ten years ago with the introduction of small-cap altcoins like Axie Infinity which has rewarded investors with an unconceivable 71,910.71% in one year (certainly no longer considered a small-cap altcoin!).

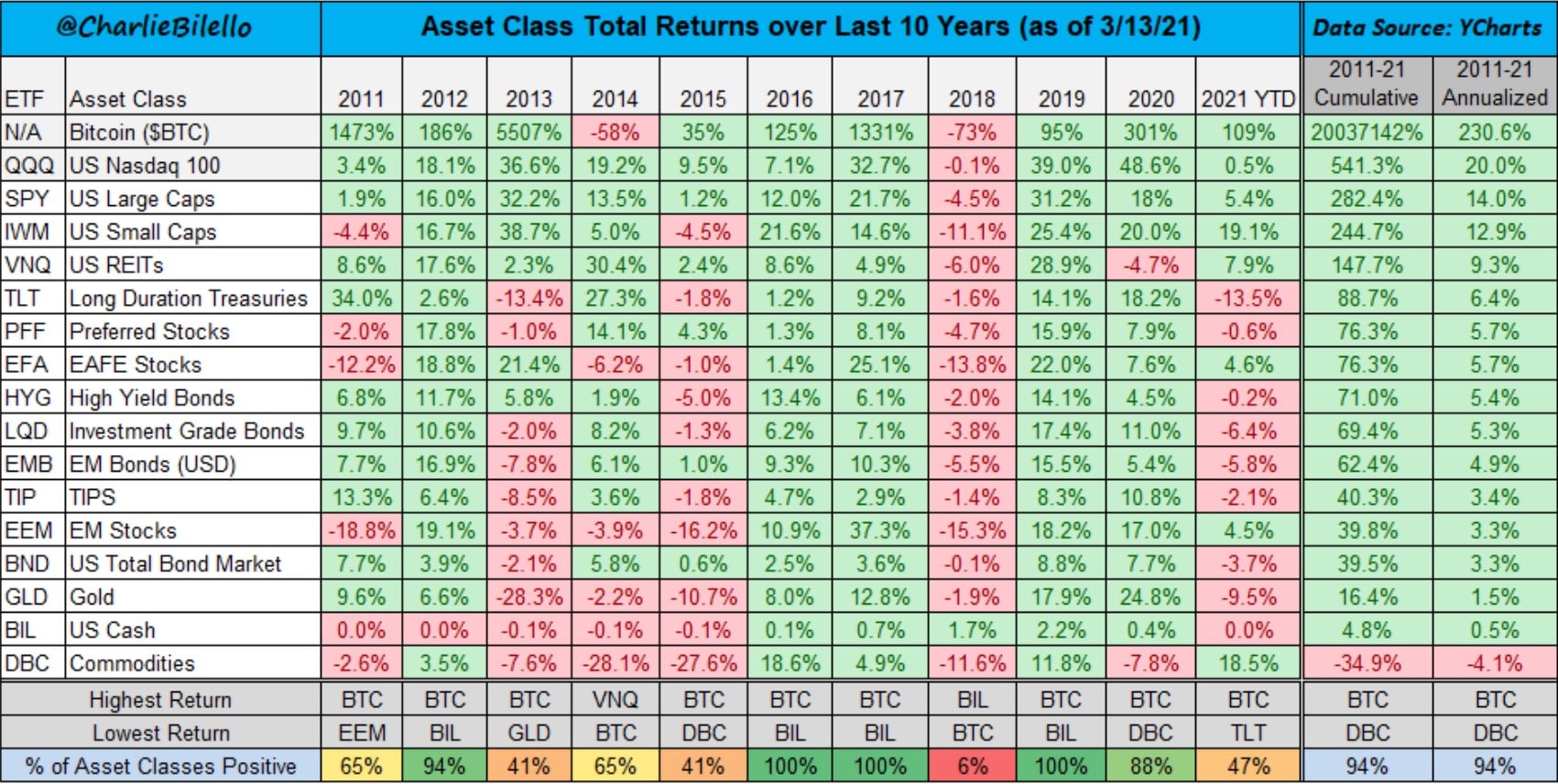

With traditional investors unable to conceive nor anticipate returns like the return Bitcoin had in 2013 of over 5000% and the return that Ethereum had in 2017 of an astonishing 10,000%, many investors were, and still are suspicious and skeptical about the sustainability of the returns enjoyed by Crypto industry investors.

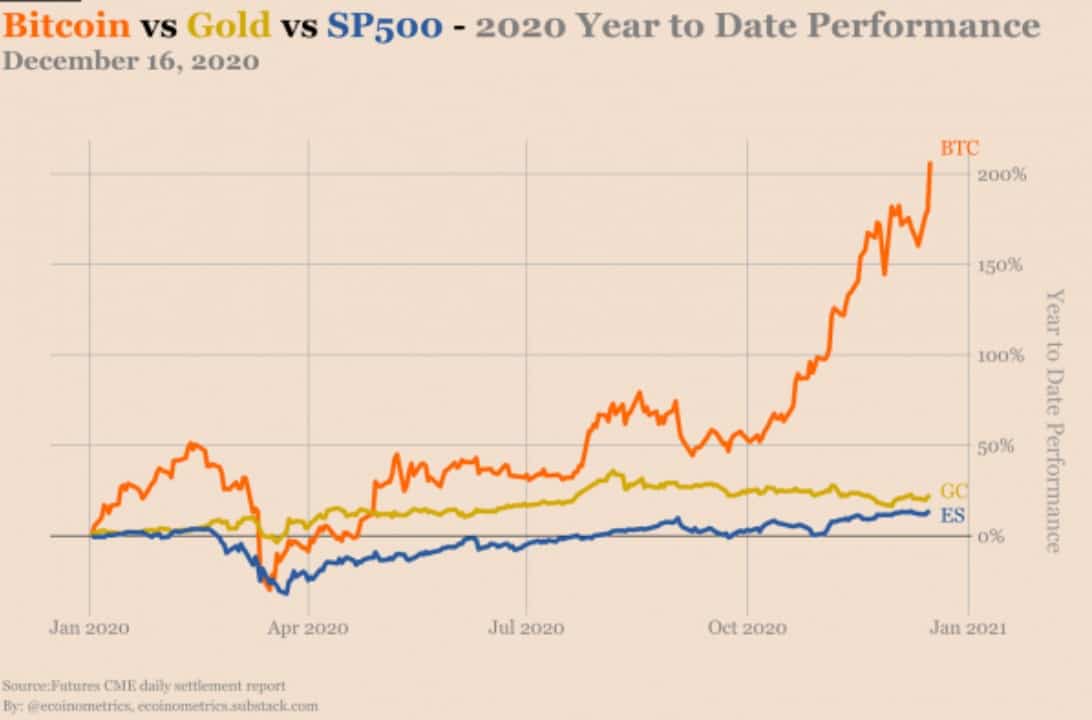

Bitcoin Performance Vs Gold Vs S&P 500 in 2020 Image via Nasdaq.com

Bitcoin Performance Vs Gold Vs S&P 500 in 2020 Image via Nasdaq.com Top 10 Blue Chip Crypto Historical Performance

While the top 10 cryptocurrencies change frequently with many new contenders such as Solana and Cardano coming onto the scene, making their entry into the top 10 this year and other long-time favourite coins such as Litecoin, Dash, EOS and Tron falling further down the list, we can get a sense of how the top cryptos are performing by using indices such as the Crypto Market Index 10 (CMI10) index which tracks the performance of the top 10 cryptocurrencies.

We know that the S&P 500 enjoys an average performance of 10-15% per year, let’s compare that to some of the main coins in the space, then have a look at a top ten crypto investment fund and the index itself later in this article.

Bitcoin

Over the past 5 years, the average return of Bitcoin has boasted an impressive 3,456% which is more than 70x higher than the average return of the largest 5 indices. It is those types of returns that are enticing not only retail, but institutional investors as well, with major firms and banks such as BNY Mellon, Citibank, JP Morgan, Goldman Sachs and others to invest in this digital gold.

While many investors disregarded Bitcoin in the early years, Bitcoin’s value as an asset class, store of value and inflation hedge is now difficult to dispute. Investment firms such as Grayscale, Ark-Invest and Osprey have been pressured to meet high client demand for the grandfather of crypto and now offer exposure to Bitcoin via Bitcoin Trusts and investment products with crypto exposure while Europe and Canada have allowed investors to gain exposure to Bitcoin through Bitcoin Spot ETFs.

Bitcoin’s 5 Year ROI has Exceeded Major Indices by 70x Image via ffnews

Bitcoin’s 5 Year ROI has Exceeded Major Indices by 70x Image via ffnews Ethereum

With Bitcoin often being referred to as digital gold, Ethereum can be thought of as digital oil, powering nearly the entire decentralized finance space and making massive strides in the development of web 3.0. Ethereum has stolen much of the limelight from Bitcoin as many crypto enthusiasts feel that Bitcoin has no real utility other than a store of value, while Ethereum is the backbone of the entire DeFi sphere.

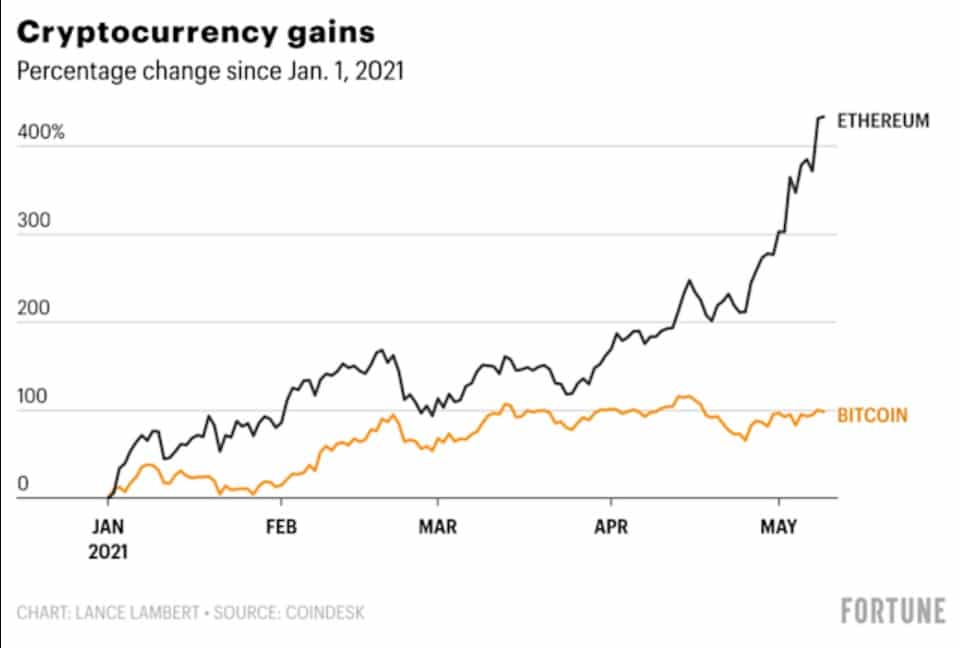

Many people feel that Ethereum will someday actually flip Bitcoin as developer activity and projects increase on the Ethereum network faster than any other network and that Ethereum will take the mantel as the number one crypto. Ethereum is the second-largest crypto at the time of writing, holding the second spot since shortly after its creation in 2017 and Ethereum investors have enjoyed an average annual return of 2,383%

Ethereum has Largely Outperformed Bitcoin in 2021 Image via finance.yahoo

Ethereum has Largely Outperformed Bitcoin in 2021 Image via finance.yahoo Cardano

While Bitcoin has claimed the title of best-performing asset of the decade, it comes nowhere close to the returns that Cardano has seen in 2021. As of mid-2021, Bitcoin had returned 277%, Ethereum one-upped that with 625% and Cardano left both assets in its dust returning 1,421% according to data compiled from CryptocurrencyChart.

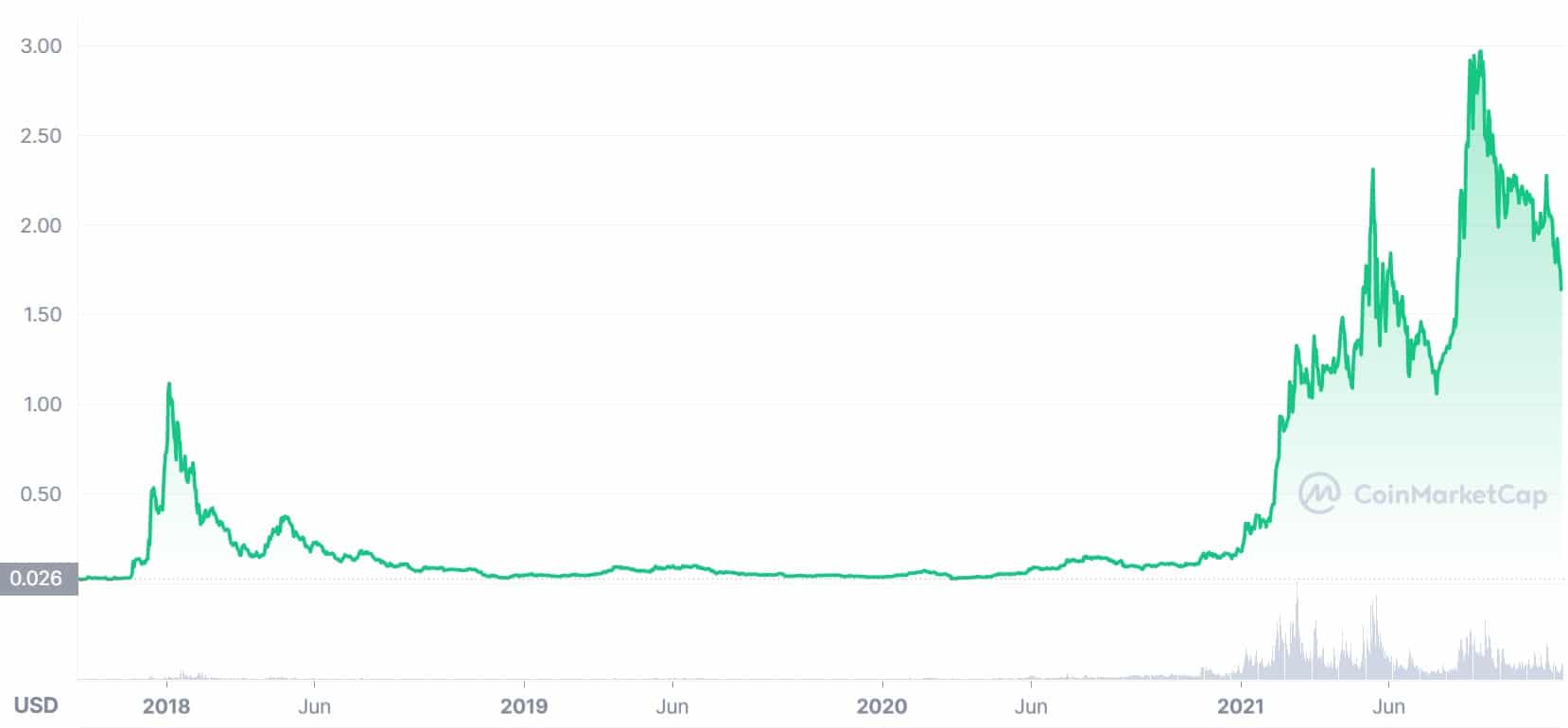

Cardano has Enjoyed Impressive Gains Since its Inception in 2017 Image via CoinMarketCap

Cardano has Enjoyed Impressive Gains Since its Inception in 2017 Image via CoinMarketCap Binance Coin

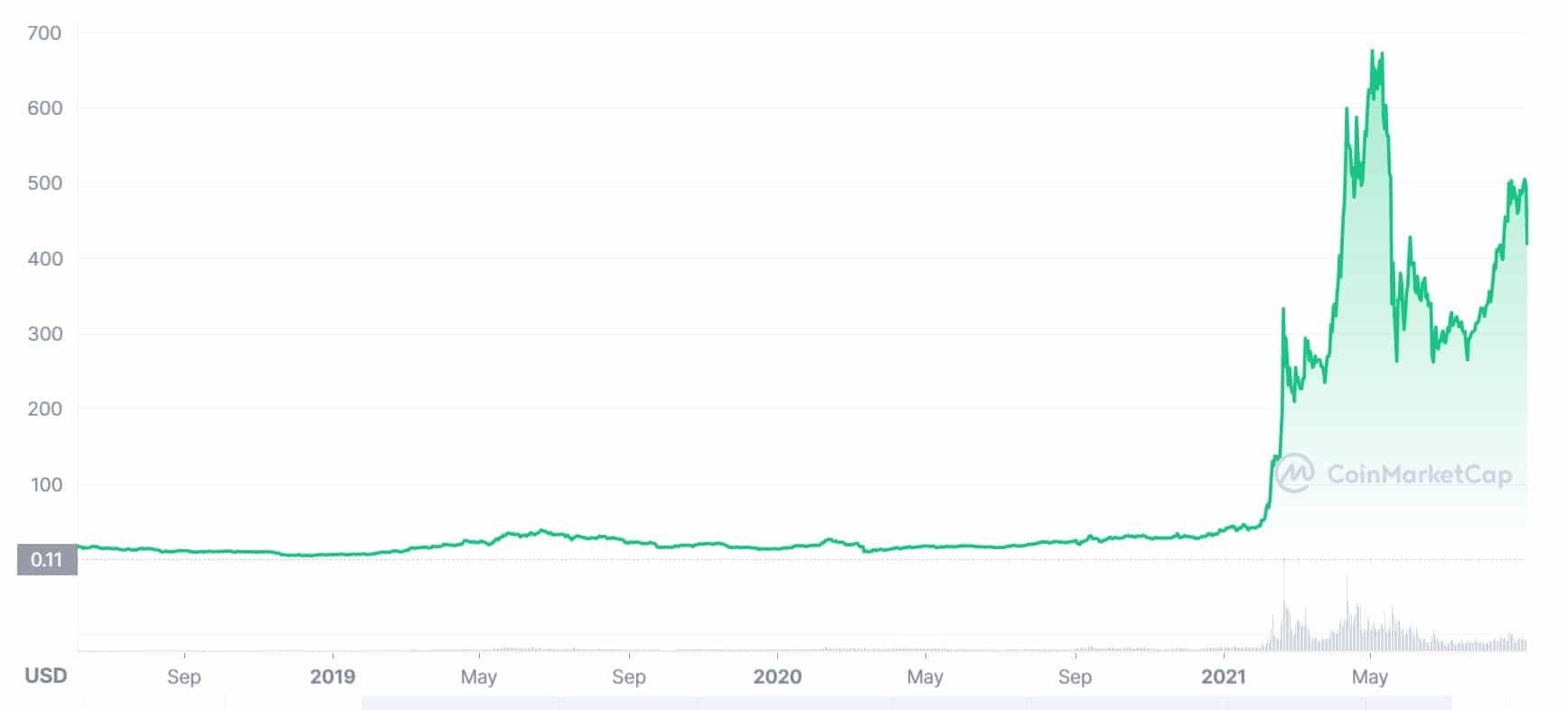

Cryptocurrency exchange utility tokens such as Binance’s BNB token and Crypto.com’s CRO token have also seen impressive gains over the years with Binance’s BNB token comfortably sitting among the top 5 coins for most of the year. Created in 2017, BNB was initially offered to the public for only $0.15 per coin and has seen an astronomical rise to its $690 dollars per coin all-time high this year.

BNB Going From $0.15 per Coin to $690 per Coin Image via CoinMarketCap

BNB Going From $0.15 per Coin to $690 per Coin Image via CoinMarketCap The picture is very similar for all the cryptocurrencies holding the top ten spots, with investors essentially being able to close their eyes and throw a dart at a board of top ten coins to invest in and see fantastic returns during a bull run, such as the one we enjoyed in 2017 and again in 2021. For investors who are unsure of how to purchase and store specific coins directly, some popular funds such as the Bitwise 10 Crypto Index Fund track the top ten crypto assets and provides investors with a degree of diversified exposure to the top ten cryptocurrencies.

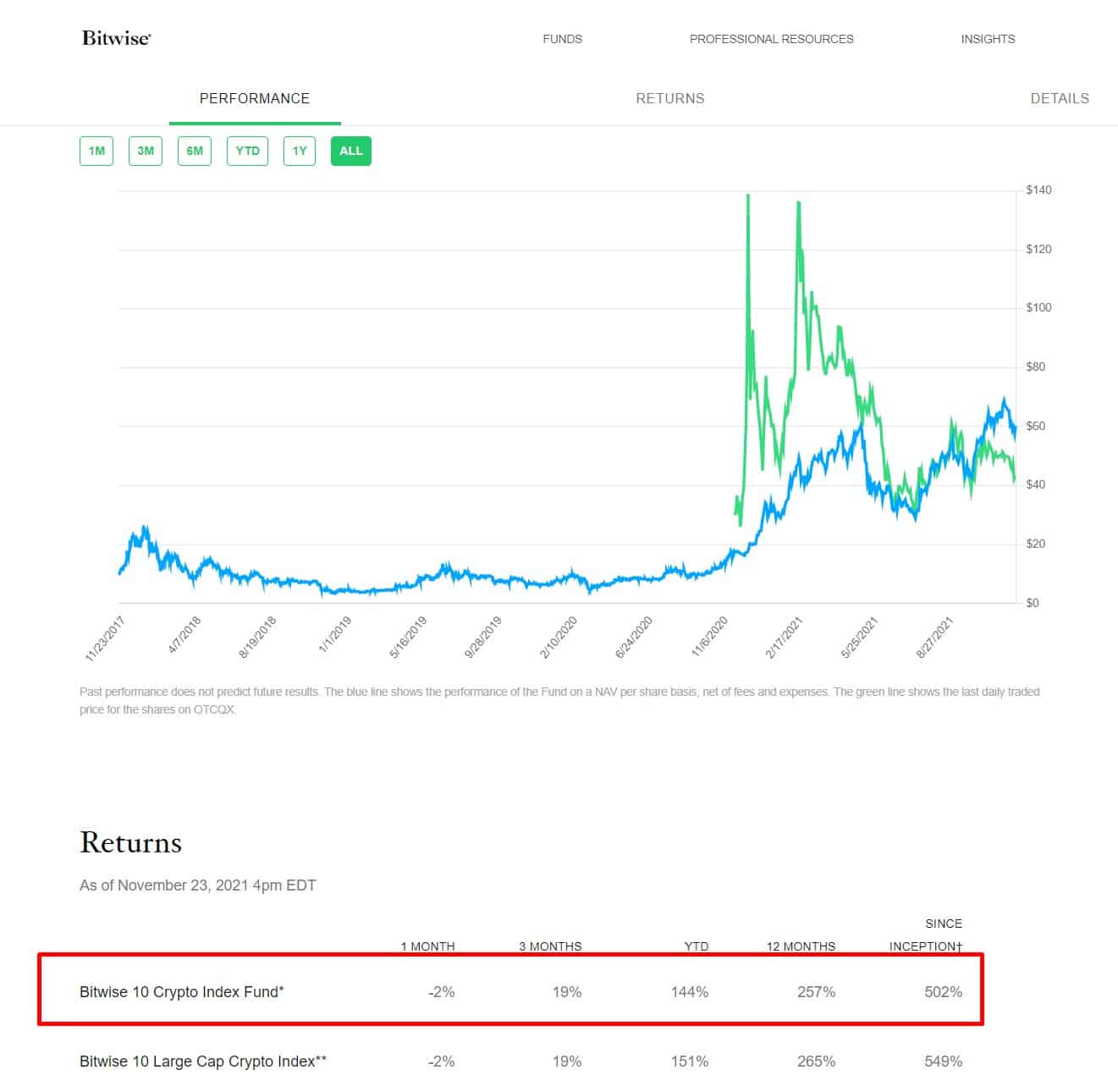

The Bitwise top ten index fund (BITW) has been around since 2017 and has provided investors with a total return of 502% since its inception.

Bitwise Index Fund Tracking the Top 10 Cryptos has Rewarded Investors with a 502% Return on Investment Since 2017 Image via Bitwise investments

Bitwise Index Fund Tracking the Top 10 Cryptos has Rewarded Investors with a 502% Return on Investment Since 2017 Image via Bitwise investments If you are in the process of doing some research into whether or not cryptocurrency investing is right for you, I would recommend checking out our guide on cryptocurrency investing.

S&P 500 vs Top 10 Crypto Returns 2017-2021

The S&P 500 has been performing very well since 2017, outpacing its average 10-15% ROI per year. An investor who invested in the S&P 500 in January 2017 would have enjoyed a total 114% ROI by 2021 if they reinvested dividends and did not withdraw any funds while exposure to the top 10 cryptocurrencies in a fund like the one offered by Bitwise Investments since January 2017 would have been rewarded with 502% ROI.

Of course, crypto investors with a keen eye would have fared far better than that by getting into top ten projects like Cardano, Solana or Binance Coin early before their entries into the top ten and would have seen returns in the thousands of percent.

There have been countless stories of investors turning hundreds of dollars into thousands or thousands into millions in the crypto space, something that has never been possible to this scale with traditional investment vehicles.

A quote from young Bitcoin millionaire Erik Finman via CNBC states,

“Never before have young people been able to change economic classes so quickly”

A quote that I whole-heartedly agree with aside from the “young” part as crypto has given everyone an opportunity to vastly increase their wealth regardless of age or background.

New York Times Article Headline Highlighting Crypto’s Ability to Increase Fortunes Image via New York Times

New York Times Article Headline Highlighting Crypto’s Ability to Increase Fortunes Image via New York Times Crypto has provided many investors with the opportunity to create life-changing wealth as we see with stories such as people in the Philippines being able to purchase homes with their Axie Infinity investment earnings and Venezuela battling hyperinflation through crypto-assets.

Exposure to crypto-assets has created more millionaires than any other asset class in history. Of course, it would be irresponsible if I did not mention that many of these assets can also lose 90% or more of their value so while crypto has made many millionaires, it has also wiped out vast amounts of investor’s portfolios and lost life savings which is why many crypto investors state that you should never overexpose yourself to this highly volatile asset class.

Diversification is key and investors should only be investing an amount into crypto that they can afford to lose.

Cryptocurrency Skeptics

While I of course am heavily biased in favour of crypto investment exposure, it is important to listen to alternative views and ensure that we are not stuck in our own “echo chambers.” It is important to note that there are some very intelligent people, and some of the most brilliant investors of our time who are avidly against crypto and digital assets, and it is worth listening to what they have to say.

The investor mogul himself Warren Buffett has gone on record twice stating that Bitcoin is “rat poison,” then later doubled down on his opinion literally by stating that Bitcoin is “rat poison squared.”

Buffett’s arguments against Bitcoin seem to stem from the fact that he feels that cryptocurrencies have no real value and no use cases, a point that many economists, technological innovators, developers and crypto enthusiasts avidly disagree with. Maybe Mr. Buffett should watch this inspiring Ted Talks by Anne Connelly on how Bitcoin can drastically make the world a better place.

I guess making the world a better place isn’t a good enough use case for Warren. Here is an article highlighting Warren Buffett’s most popular “anti-crypto” quotes.

After Years, Warren Buffett is Still Avidly Anti-Crypto Image via Investinblockchain

After Years, Warren Buffett is Still Avidly Anti-Crypto Image via Investinblockchain Peter Schiff who is another brilliant investor, and the CEO and Chief Global Strategist for Euro Pacific Capital Inc is also anti-Bitcoin. Schiff is a loud and proud supporter of Gold and is heavily in favour of precious metals as being a superior investment to crypto, despite the fact that all the data and metrics on Bitcoin returns vs Gold returns clearly paints a different picture.

Schiff spends much of his time battling Bitcoin enthusiasts on Twitter, time that perhaps would be better spent trying to further understand and be open-minded about crypto assets.

Other notable mentions in the anti-crypto camp are CNBC’s Jim Cramer, JPMorgan Chase CEO Jamie Dimon, and Nobel Prize-winning economist Paul Krugman who also happened to say in 1998 that the internet will have no greater impact on the economy than fax machines, so it sounds like Mr Krugman may not have the greatest grasp of emerging tech.

Bitcoin has Been the Best Performing Asset of the Decade Image via twitter/charliebilello

Bitcoin has Been the Best Performing Asset of the Decade Image via twitter/charliebilello

I don’t know why crypto has so many skeptics and haters. Perhaps some folk are jealous that they didn’t jump in early or have the foresight to get involved before other investors, or if they just have not taken the time to fully understand the potential for this tech to revolutionize and change the world.

It seems that many people want to selfishly see something burn if they didn’t think of it first or if it doesn’t benefit them, and instead of admitting that they may be mistaken, they would rather drag the name of something through the mud. Who knows, but I guess everyone is entitled to their opinions.

Crypto Advocates

While the Crypto Industry has its fair share of skeptics, there are also a lot of heavy hitters who are advocates for this emerging and potentially life-changing technology. First, we have the Dogefather himself Elon Musk who is a Bitcoin and Dogecoin supporter. Love him or hate him, Elon Musk is one of the most influential and innovative minds of our time, if he can get behind and see the potential of Blockchain technology, who am I to disagree?

Next, we have famous billionaire entrepreneur Mark Cuban who not only holds Bitcoin but is a big advocate and holder of Ethereum, DeFi and NFT assets. Richard Brandon, the founder of the multi-billion dollar Virgin Group is backing Bitcoin-based businesses and Jack Dorsey, co-founder and CEO of Twitter and Square believes that Bitcoin will help bring about world peace and is a long time advocate of the Bitcoin blockchain.

Twitter’s Jack Dorsey Believes Crypto can Make the World a Better Place Image via CNBC

Twitter’s Jack Dorsey Believes Crypto can Make the World a Better Place Image via CNBC We have a plethora of big-name investors and firms backing this innovative tech as well such as Cathy Wood of Ark Invest who is pushing for a Bitcoin ETF in the States and famous businessman and entrepreneur Kevin O’Leary who is notable as he was a crypto critic but now supports the asset as he learned more about the underlying tech and use cases.

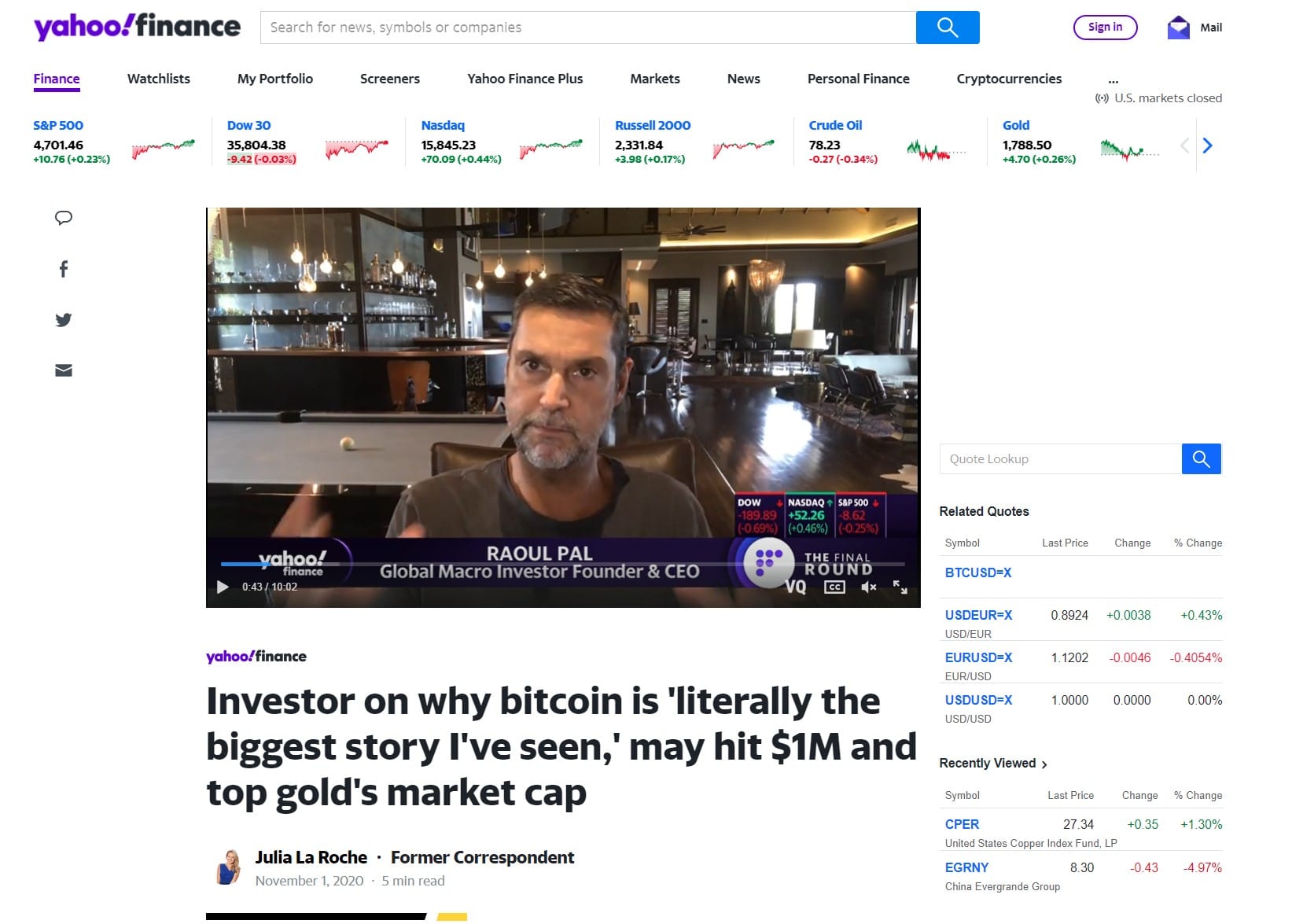

Former Goldman Sachs executive and now CEO of Global Macro Investor and Real Vision Group Raoul Pal is also a very well-spoken intellectual and advocate for crypto, and we can’t exclude Michael Saylor, CEO of MicroStrategy who refers to Bitcoin as the “apex” asset class and “the most desirable property in space and time.” We also have a slew of celebrities such as Snoop Dogg, Paris Hilton, Tony Hawk, Kanye West and Tom Brady getting involved in the industry with many professional athletes and Politicians in New York and Miami now accepting their pay in crypto.

Raoul Pal Speaks to Yahoo about the Future Potential and Impact of the Crypto Markets Image via Yahoo Finance

Raoul Pal Speaks to Yahoo about the Future Potential and Impact of the Crypto Markets Image via Yahoo Finance Performance of Top 10 Cryptos vs S&P 500 in 2021

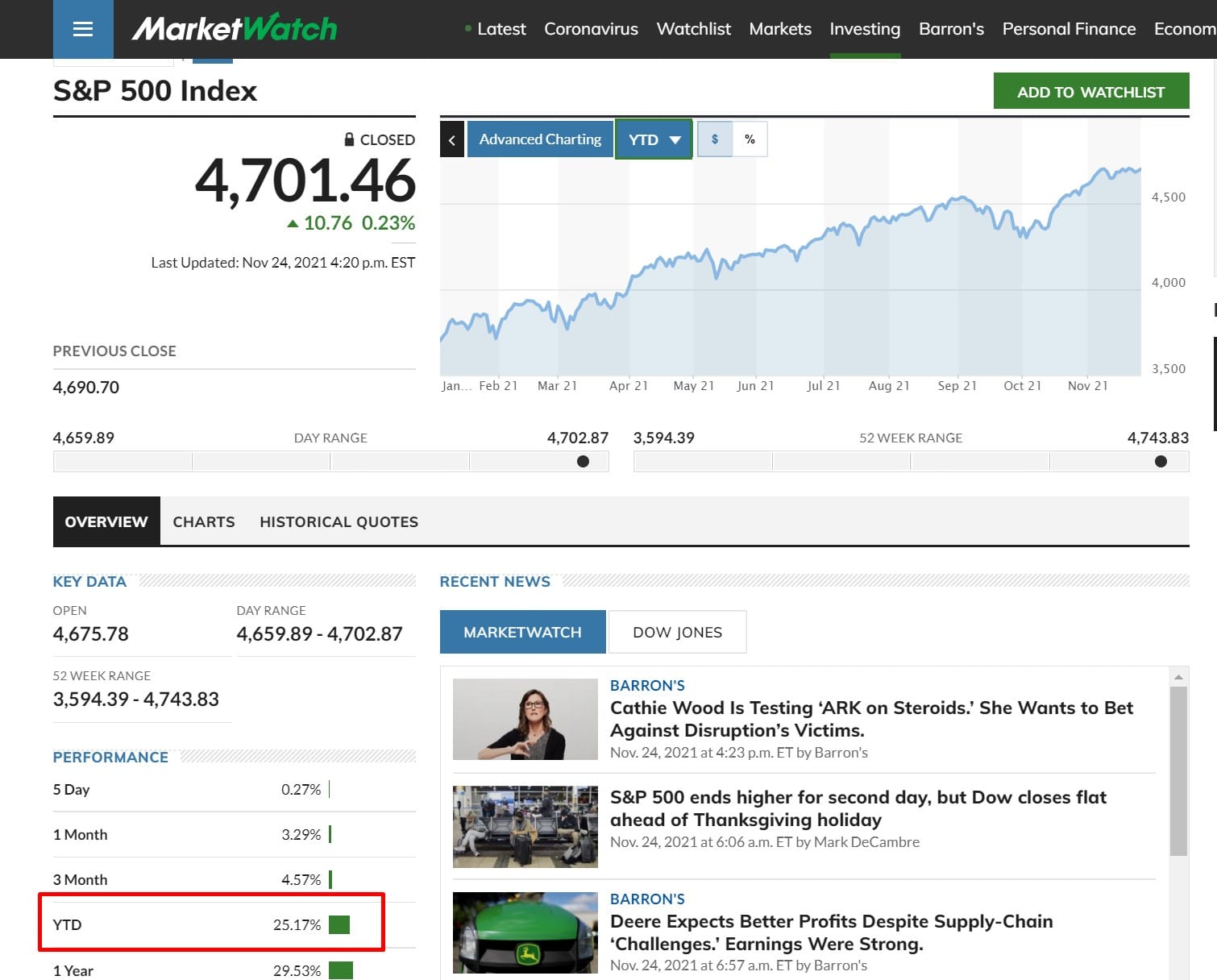

Despite the troubles and hardships the world has faced in 2021 with the pandemic, to many investors’ surprise, it has been a fantastic year for investments. With all the money that world governments have been pouring into the economy in the form of stimulus packages to offset the economic damage caused by lockdowns, much of the money has found its way into both the stock markets and crypto, resulting in an incredible year for investors with the S&P 500 continuously reaching new all-time highs and the current year to date return on investment being 25%.

The S&P 500 has Reached Multiple All-Time Highs in 2021 with a YTD ROI of 25% Image via Market Watch

The S&P 500 has Reached Multiple All-Time Highs in 2021 with a YTD ROI of 25% Image via Market Watch While 25% on the S&P 500 is great, leaving many investors impressed, that performance does not come close to the returns achieved by the top ten cryptocurrencies. Nearly every crypto in the top 10 aside from XRP has reached all-time highs in 2021 and have made many investors a boatload of money. Here are the stats compiled from Cryptorank and Marketwatch for the top ten cryptocurrencies in Q4 of 2021:

- Bitcoin- 98% YTD ROI reaching an ATH of $68,521

- Ethereum - 476% YTD ROI reaching an ATH of $4,800

- Binance Coin- 1,400% YTD ROI reaching an ATH of $689

- Solana- 13,673% YTD ROI reaching an ATH of $260

- Cardano- 812% YTD ROI reaching an ATH of $3.09

- Ripple XRP- 356% YTD ROI

- Polkadot- 314% YTD ROI reaching an ATH of $54.94

- Dogecoin- 4,552% YTD ROI reaching an ATH of $0.75

- Avalanche- 3,643% YRD ROI reaching an ATH of $146

- Crypto.com Coin- 1,465% ROI reaching an ATH of $0.96

Now, if I can remember back to my days in math class to figure out the average year-to-date (YTD) return on investment (ROI), we can take each cryptocurrency’s year-to-date return, add them together and divide by the number of coins to give us an average return of 2,678.9% for the top ten coins. While the S&P 500 had a fantastic year with a 25% return, I think I will stick to crypto with the top ten crypto returns rewarding the brave investors of this new frontier with over a 2,500% return, Wowza! So when it comes to crypto vs S&P 500, crypto certainly takes the win.

It is important to make the distinction that when we look at funds such as the Bitwise crypto top 10 index fund, or any other crypto index funds, the ROI’s can be drastically different as there are differently weighted holdings in different crypto assets. Bitwise has 60% of the total funds allocated to Bitcoin and 28% to Ethereum with a much smaller percentage allocated to other cryptos and still holds cryptocurrencies that have fallen out of the top ten long ago.

The Bitwise crypto top ten fund provided investors with a YTD ROI of 139% which is still pretty darn good for investors who don’t have time to keep up on the individual crypto assets and just want to park their capital in a professionally managed fund.

It is also important to understand that much of the 2,678% average return of the current top ten cryptos were made by coins before they were in the top ten, and it was those explosive gains that propelled them into the top 10. By only investing in top ten cryptos, investors would have already missed the boat on the early explosive moves.

If investors would have reallocated their portfolios to only hold cryptos in the top ten they would have enjoyed the highest YTD ROI of 179.77% in 2021 according to the Crypto Market 10 Index.

Index Tracking the top 10 Cryptocurrencies Showing the Highest ROI of 2021 at 179.77% Image via Tradingview

Index Tracking the top 10 Cryptocurrencies Showing the Highest ROI of 2021 at 179.77% Image via Tradingview Crypto vs S&P 500: Conclusion

There are so many reasons to be bullish on the potential future performance of crypto and it is easy to see why so many investors are looking into this space as an investible asset class capable of high returns. There is a growing trend that we see of younger generations, the leaders and entrepreneurs of tomorrow being more bullish on crypto than ever before with a recent CNBC article reporting that nearly half of millennial millionaires have at least 25% of their total wealth held in cryptocurrencies.

With countries like El Salvador making crypto legal tender, and major cities like New York wanting to be the next crypto capital and Miami creating their own cryptocurrency, it is unlikely that this industry is going to be going away any time soon and will continue to provide investors with returns outpacing traditional investible asset classes for years to come. While this is not financial advice, just my opinion, I do think cryptocurrency exposure is a great way to diversify a portfolio as long as investors are able to withstand the volatility and dips that come with it.

Many of my favourite crypto memes allude to the stressful nature of crypto investing and the strong fortitude needed by crypto investors. When the stock markets drop by 2% it sends Wall Street running for the hills and causes panic in the streets with 10% drops being given dramatic titles like “crash” and causing devastation. To paraphrase a quote often used by one of my favourite crypto personalities Rob from Digital Asset News: “ A 10 percent drop? in crypto we call that a regular Tuesday,” so the speculative nature of crypto investing may not be for the faint-hearted