We are all aware of the common practice in the cryptocurrency ecosystem called Airdrops.

These are essentially free giveaways of coins that are "airdropped" on a group of cryptocurrency enthusiasts. It is the quickest way to distribute your coins in the market short of doing an Initial Coin Offering (ICO).

However, how do Airdrops fit into the current regulatory framework as laid out by the Securities and Exchange Commission? Could airdrops be a less burdensome way for the developers to fund their projects?

We will take a look at the current regulatory environment and how cryptocurrency airdrops are likely to fit into that.

How Airdrops Work

The mechanics of an Airdrop is really pretty simple.

A developer team will take a snapshot of an already established cryptocurrency chain. This will then give them an overview of the addresses that are currently on the chain. They will then release their free tokens to all of those holders.

The developers of that token will "fork" their chain from the legacy chain and then build off of that technology. Some of the largest cryptocurrencies available right now are the result of these including Bitcoin Cash (BCH).

It is also really quite simple to initiate an airdrop. For example, you can head on over to Open Zeppelin and use one of their smart contract templates for the the Ethereum blockchain.

You will then take a snapshot of the blockchain and you will distribute a certain number of the coins in some sort of a ratio to the ETH that they already hold. The developers will also hold onto a certain percentage of all available coins.

Why Airdrop Coins?

Image via Fotolia

Image via FotoliaApart from distributing your coins as widely as possible, there are other really important incentives for a project to airdrop coins. It is an easy way for the developer team to fund their project.

Yes, they are not raising crypto or Fiat through an ICO or a seed round, but they are keeping a large stake in the coins that they have airdropped.

If the project keeps doing well and the public starts to take notice then the value of the tokens is likely to increase. Hence, the team funds will become valuable and they can then sell some of these tokens to fund the project in question.

They are also a lot more cost effective than completing an ICO or trying to secure funding in a seed round. These methods of financing are now becoming incredibly expensive as investors are demanding much more than a simple whitepaper.

Airdrops could also be less burdensome in terms of regulation.

Securities Regulations and Crypto

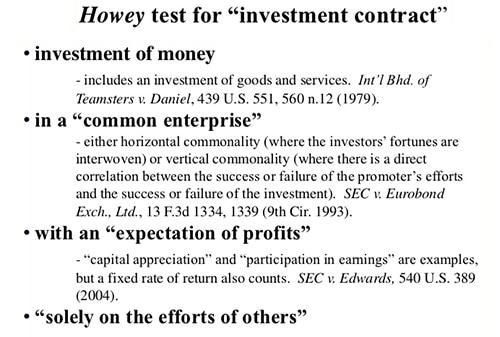

If a cryptocurrency asset is classified as a security then it falls under the jurisdiction of the SEC and hence will have to meet all the requirements. Whether it is classified as such depends on whether it passes the Howey Test.

This is the rule of thumb that is used to determine whether an asset will be classified as a security. More particularly, an investment contract is defined as:

A contract, transaction or scheme whereby a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party

Under this definition, it is quite clear that many of the ICOs today could be classified as such. In fact, there was even speculation that Ethereum may have been classified as a security when they did their ICO.

Yet, how are the airdrops viewed by the SEC?

Airdrops And Securities

"Investment Contract" Criteria. Source

"Investment Contract" Criteria. SourceNot surprisingly, there is no legal precedent for giveaways.

Airdrops are free giveaways of the coins and the ICO developers are not raising funds from the population. The investors are not putting any funds at risk and hence they cannot claim that they had expectations of a return on their investment.

However, what about the cases when the tokens eventually hit the market and secondary investors buy the tokens on an exchange? Here they are indeed buying these tokens in the expectation of a profit.

While they may be expecting a return on their investment, can they really be classified as investing in a "common enterprise"? Are these investors not just speculating on the price of an asset much like they will do when the purchase Forex, Commodities or even other cryptocurrencies such as Bitcoin.

Moreover, can this really even be considered investing?

Tokens are not like equity in a company or debt securities. Many of them are "utility tokens" meaning that they have an underlying use case. Hence, one can realistically claim that they are buying the token for a purpose other than speculation.

Those who are buying the tokens on an exchange are buying it from other people and not from the developers themselves. Hence, you cannot claim that the developers are the main recipients of the investors’ funds.

All this means that it would be incredibly nonsensical for the SEC to claim that an airdrop is a security. This could be akin to them claiming a free giveaway of any good on the street can also be considered a security.

Moreover, what will the SEC do to those coins that have already been airdropped and have no central authority? Who will they target in any sort of enforcement action when the network is decentralised?

Conclusion

Airdrops are a quick and easy way for developers to get their coins out into the ecosystem and start work on the project. The SEC has still not given their judgement on ICOs yet but many think that it is only a matter of time.

Indeed, it seems that they are getting that much more active with their enforcement. There have been a number of ICOs that have received cease and desist letters in operation "crypto sweep".

So, should airdrops be the preferred option? Not quite.

While they are less burdensome, an airdrop is much less effective of an fundraising method as an ICO or other methods of seed funding.

The development team will still have to wait before there is any sort of market for their coins before they can sell some and use the proceeds. Building ground breaking technology is not cheap and these developers still have to put food on the table.

In the end, it will have to come down to the needs, preferences and risk that the developers are willing to take.