Sweden tends to get saddled with the sort of clichés the rest of us can only dream about. It’s held up as a liberal paradise; a land of tall, blond and beautiful beings; peaceful, yet progressive; a place where capitalism and socialism have reached a happy understanding.

There’s open space and natural beauty, gender equality and work/life balance. It’s the land that gave us H&M, Ikea, Spotify and err… Abba. Everyone drives a Volvo and eats meatballs. Where do I sign?

Like all good clichés, the above are rooted in truth. The Swedes are by-and-large a healthy bunch when compared with almost every other developed nation. State-funded healthcare is accessible to all and there’s an outdoors culture that takes advantage of some truly stunning scenery.

Sweden, yesterday. Bring a good pair of boots and you’ll be fine. Image via Shutterstock

Sweden, yesterday. Bring a good pair of boots and you’ll be fine. Image via Shutterstock The country is indeed one of the most liberal democracies in the world, where men are expected to share much of the burden of childcare and women are not routinely excluded from the workplace. Workers’ rights are protected and entrenched, while there is strong state support for those who fall on hard times.

Taxes are high, but they support a strong social safety net. Yes, there are arguments to be made against fast fashion and cheap furniture, while plenty of musicians can tell you what’s wrong with Spotify.

As for Abba, well… let’s not get into that here. But no-one can deny that, for a nation of just over 10 million people (less than half the population of Sao Paulo), which enjoys just a few hours of sunlight a day in winter, Sweden has done pretty well for itself.

A Lot to Learn

All this isn’t to say that Sweden is a perfect society, though it perhaps comes closer than most. Many of the problems that afflict other rich nations can be found here too. A rise in immigration has seen tensions rise, with immigrants – many of them refugees – often blamed for rising crime rates and a loss of national identity.

Challenging the stereotype: Sweden Democrats leader Jimmie Akesson. Image via BBC

Challenging the stereotype: Sweden Democrats leader Jimmie Akesson. Image via BBC Gang violence is increasing, while state spending has declined. As a result, the far-right has reared its head here, like it has in so many other countries, with the Sweden Democrats making large gains in the 2018 general election. This party, which has its roots in the neo-Nazi movement, is opposed to immigration, open borders and the EU and has found willing ears for its populist message among many Swedes.

More recently, the Swedish government has come under fire for its response to Covid-19, having been initially praised by many for what was seen as an anti-authoritarian approach to the pandemic. This has arguably been a failure, as Sweden has to date suffered more coronavirus deaths than every other Scandinavian nation. They don’t, it seems, get things right all the time.

Leading the Way

So, what does all this have to do with the worlds of blockchain and cryptocurrency? As we’ve seen, Sweden is famed for its progressive approach and for setting trends that other countries then eagerly embrace. You need look no further than those aforementioned Swedish success stories H&M, Ikea, Spotify and yes, Abba, to see that where Sweden leads, the rest of the world often tends to follow.

If you’ve been keeping tabs on all things crypto in recent months, then chances are you’ll have noticed increased chatter surrounding the issue of central bank digital currencies (CBDCs). These are pretty much what it says on the tin: digital versions of national currencies issued by central banks such as the Bank of England or the US Federal Reserve. It so happens that, in this field as in so many others, the Swedes are ahead of the pack.

Sweden’s Riksbank: not exactly winning any beauty contests. Image via Shutterstock

Sweden’s Riksbank: not exactly winning any beauty contests. Image via Shutterstock Back in February of this year, just before the pandemic came along to well and truly flip the script, Sweden’s Riksbank announced that it was launching a pilot scheme for its e-krona, ‘a digital krona [that] should be simple, user-friendly as well as fulfil critical requirements for security and performance.’

The pilot, which was launched in partnership with Accenture, was intended to test the blockchain technology which would underpin the e-krona and to evaluate the use-case for a nationwide rollout of the scheme. In its own words, ‘the main aim of the pilot is for the Riksbank to increase its knowledge of central-bank issued digital krona.’

This pilot scheme is still ongoing and due to end early next year, but it is looking increasingly likely that it’s a case of when, not if, an e-krona will become a reality. It was reported in October that Stefan Ingves, the Riksbank’s governor, was pushing the Swedish government to start drafting legislation that would allow the e-krona to become legal tender. The world’s first functioning CBDC could soon be upon us.

CBDCs Explained

We covered CBDCs here at Coin Bureau back in September, while over on YouTube Guy did a deep dive on them more recently. However, before we look at the seemingly inevitable e-krona in depth, it’s worth doing a quick recap here for anyone who may still be unfamiliar with the concept.

On the face of it, CBDCs have a lot to recommend them. A digital currency that is pegged to the value of the national currency it represents has a number of advantages, most notably over physical cash. The use of cash is dying out across the world and for a number of reasons. In much of the developed world, increasing numbers of people are paying for everyday items with debit or credit cards and, in some countries, it’s quite possible to go about one’s daily life without having to use cash at all.

Beep! Image via Shutterstock

Beep! Image via Shutterstock Then there’s the rise of cryptocurrencies like good old bitcoin and all those altcoins that have followed in its wake. The number of merchants across the world that accept crypto is growing steadily, as more and more people get wise to the benefits of secure, peer-to-peer payments that cut out greedy middlemen such as banks.

In the developing world meanwhile, although cash is still popular, it’s use is declining. Many people live a long way from their nearest bank or ATM and are increasingly turning to their mobile phones as a more convenient way of spending and receiving money. Cash can be cumbersome and be lost, stolen or damaged. Paying with a phone or a pre-loaded payment card is much quicker and easier.

The benefits to central banks of replacing cash with a digitalised currency are obvious. They would not have to print, distribute and store so much cash, thus avoiding logistical overheads. They could also ensure that payments (for example Covid stimulus handouts) were distributed quicker and more efficiently.

Then there’s the big one: taxation. If there’s an immutable record of all transactions stored on a CBDC blockchain, it makes it much easier for central banks and tax authorities to see who owes what. And to make sure they pay up.

Boop!

Boop! Cash transactions are much harder to trace and thus tax, while cash is usually the preferred currency of criminals and tax dodgers. The advent of CBDCs could therefore make it much harder for those sorts of people to operate. But, while ease-of-use, traceability and accountability are all desirable enough, many have been quick to point out that the use of CBDCs will give governments and central banks a much tighter degree of control over our lives.

CBDCs in the Wild

Sweden is not alone in trialling a CBDC. Uruguay ran its own successful trial back in 2017/18 and is still evaluating the case for an e-peso. South Korea and Thailand have trials in the pipeline, while other countries such as Brazil, Canada and South Africa are thought to have trial schemes in development. The UK is said to be considering the technology and awaiting the results of trials in other countries.

Will China get there first? Image via Shutterstock

Will China get there first? Image via ShutterstockThen there’s China, which is conducting a trial of its own involving 28 cities across the country. If this proves successful then the Chinese government could steal a march on Sweden and be the first country to adopt a CBDC as part of its financial system. Given the power enjoyed by the Chinese Communist Party, it’s likely that they will be able to implement the policy without the sort of opposition that may be encountered in more democratic states.

The Case for an e-krona

China may well be turn out to be first to the party, but in many ways Sweden looks like an ideal testing ground for a nascent CBDC. For one thing, it’s already one of the most cash-free societies on earth, with cash use in seemingly terminal decline. According to Statista, in 2010 59% of small payments (those less than 100 SEK) were made using cash. By 2020 that had dropped to 12%. Over the same period, the Riksbank has shown that the proportion of people using cash has declined from nearly 40% to less than 10%.

Thanks to popularity of payment apps like Swish, Klarna and iZettle (all founded in Sweden itself) only a handful of mostly elderly Swedes still use cash on a regular basis. Indeed, Swish itself is becoming so popular that it’s become a standalone verb: ‘just Swish it to me.’ People are able to buy coffees, use public toilets and even give to beggars and street performers using just an app on their phones.

Pretty Swish. Image via payspacemagazine.com

Pretty Swish. Image via payspacemagazine.comThis precipitous decline in cash usage has its drawbacks of course, which are echoed in other parts of the world. For many elderly people, cash is all they have ever really known and they view the growth of technological payment options with deep suspicion.

For others, the alternatives to cash are confusing and daunting. Many vulnerable people – elderly or otherwise – still rely on cash for a wide variety of reasons and face getting left behind by the pace of innovation. Cash may have its drawbacks, but it’s not dead yet.

Nevertheless, Sweden is forging ahead without cash and is therefore likely to be more receptive than other societies to the introduction of a CBDC. The use of cashless payments has risen even faster thanks to the pandemic, with increasing numbers of people shopping online, even though Sweden did not resort to a national lockdown.

BankID

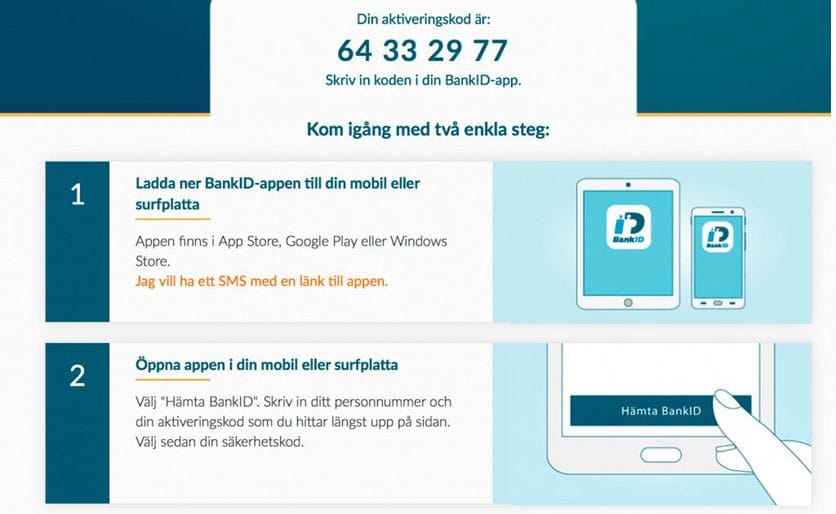

Swedes also use another popular app alongside the likes of Swish. BankID uses people’s Swedish personal ID number (similar to a UK National Insurance or US Social Security number) to access digital public services, as well as use online banking and even sign documents. As a result, these services are easily accessed and available without the need to remember logins and passwords for any number of different services.

BankID. Not sure what it says, but it looks clever. Image via Signicat

BankID. Not sure what it says, but it looks clever. Image via Signicat Sweden therefore has a significant amount of digital infrastructure already in place, coupled with a generally tech-savvy population. The adoption and integration of an e-krona will also surely be helped by the fact that Sweden is nowhere near as populous as some of the other countries looking into CBDCs. It may perhaps be only a question of scale, but it’s tempting to imagine that it will be easier to get eleven million people up to speed with a CBDC than it would be with over one billion.

Where Next?

The stars seem to be aligning in favour of an e-krona in the not-too-distant future. The trial is still underway and does not seem to have been derailed by the coronavirus pandemic. The governor of the Riksbank is in favour of the idea and it’s worth considering what he said in a memo back in October:

‘Money and the way we pay are undergoing significant changes now that the economy is being digitalised. Where we previously exchanged cash, we now mainly pay by moving funds between one another’s accounts. The changes have many advantages, but also entail disadvantages and risks. The Riksbank has the task of ensuring that payments can be made safely and efficiently and that the krona retains its value. For this to be possible, cash needs to be both protected and supplemented with a digital alternative.’

Ingves’s tone in the memo is interesting too, in that while he acknowledges the decline of cash, he also argues for it to be protected, even as a digital krona is introduced. He makes persuasive points about cash’s fungibility and its ability to be used without all of the digital infrastructure mentioned above. His view of a future e-krona is that it should work as ‘a digital complement to cash.’

How Would an e-krona Work?

The rise of crypto has paved the way for CBDCs in two ways. First, it has woken the world’s financial institutions up to the promise of digital currencies and shown that peer-to-peer digital payment networks are technologically possible. Banks and other payment providers no longer have a monopoly on moving money around.

Senondly, crypto has pushed forward that technology to make it possible for almost anyone with a smartphone and an internet connection to buy, store and spend those digital assets. Digital wallets have reached many people who may never have even had a bank account before.

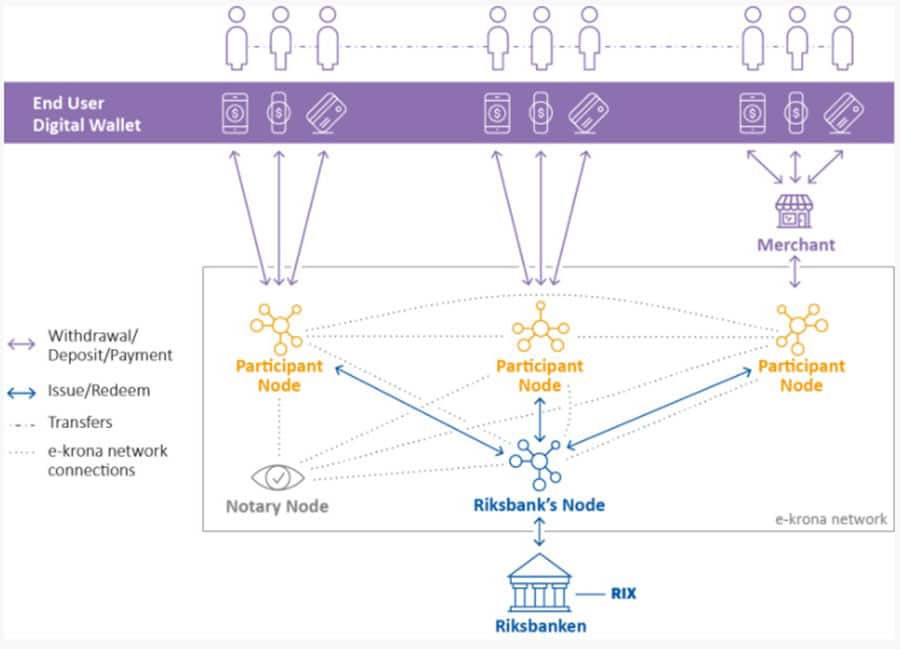

Conceptual architecture for the e-krona pilot. Image via Riksbank/Accenture

Conceptual architecture for the e-krona pilot. Image via Riksbank/Accenture This is helping to bring financial services to many who previously had no access to them. The more recent rise of stablecoins such as USDC has also served to drive crypto adoption by removing some of the risks involved in trading more volatile coins.

As such, the tools are there for CBDCs to be implemented, with many of the technological hurdles already overcome. The Riksbank envisages this digital wallet technology being key to the possible future adoption of the e-krona, as it will with all future CBDCs. Despite the unease that many in the crypto community feel towards the prospect of central banks issuing their own digital assets, their own beloved blockchains are making them possible.

An Uncertain Future

Like it or not, CBDCs are pretty much certain to be a part of our future. Governments and central banks the world over are not going to allow themselves to be stranded by the rising tide of digitalisation. The events of the last year have only served to accelerate the process, as it becomes clear that innovation is going to be needed to get us out of the hole that Covid-19 has plunged us into.

Sadly, it looks likely that while CBDCs may help bring millions of people into the global financial system, they won’t bring financial freedom to them or indeed the rest of us. Anything that makes financial transactions easier to track and trace will strengthen the hand of governments and taxmen.

A lot will depend on which central banks end up issuing their digital currencies over the next few years. A country like Sweden can offer hope in this regard, for, while it isn’t quite the Utopia it’s often made out to be, it maintains a respect for personal liberties and benign governance that is still the envy of much of the world. An e-krona could be our best hope for seeing a CBDC done right, in the interest of its citizens and with an acknowledgment that not everybody is willing to embrace a fully digitalised economy.

Sweden: still a lot to smile about. Image via Shutterstock

Sweden: still a lot to smile about. Image via Shutterstock Compare this with China, a country which views personal freedom quite differently. If the People’s Bank of China were to issue its own digital currency (which looks increasingly likely) then it’s hard to imagine the notoriously paranoid Chinese government passing up the opportunity to harness its surveillance potential.

This is despite the fact that China shares many of the same worries about the declining use of cash as other nations. Moreover, China’s determination to gain economic supremacy over the US will see it take any opportunity to tighten its grip over it citizens’ finances.

Sweden and China represent the two poles between which most CBDCs will fall. A respect for personal freedoms on the one hand, versus authoritarianism on the other. The hope is that most nations which put their own CBDCs into action will lean more towards the Swedish model than the Chinese one. It’s a nice thought, but overly optimistic.

The debts run up by governments across the world over the last few months are not going to quietly go away and the desire for tax revenues will be stronger than ever. Unfortunately, those having to foot the bill will be those who always do: the working and middle classes, while the rich, the banks and big business carry on as they always have. Unless CBDCs can hold these people to account, they’re unlikely to be anything for the rest of us to shout about.

So, as the Swedes might say: Bättre köpa lite Bitcoin!