On December 1st, 2020, Ethereum 2.0 went live. Great! But what does it mean? What even is Ethereum 2.0? Where can you get your hands on some 2.0 ETH tokens? Is it even worth it? And how come “Ethereum 1.0” is still live? How will Ethereum 2.0 impact the price of Ethereum?

Image via Status

Image via Status These are just a few of the many questions people have been asking since Ethereum 2.0 launched. Here at the Coin Bureau, we have been keeping an eye on these questions. While you will find some of the answers in our recent video about Ethereum 2.0, others are going to need some more attention.

By the end of this article, you will have a good grasp of Ethereum 2.0 and will also have the answers to just about every question you might have about it.

What is Ethereum?

If this is the first question that came to mind when you saw one of the many headlines about Ethereum 2.0, we recommend you read our in-depth article about Ethereum first. In short, Ethereum is a cryptocurrency that doubles as a platform on which you can build applications.

A few of the applications built on Ethereum.

A few of the applications built on Ethereum. Applications built on Ethereum are similar to those you find on your computer or on the internet. The difference is that applications built on Ethereum are decentralized – they are not kept on a single computer or server.

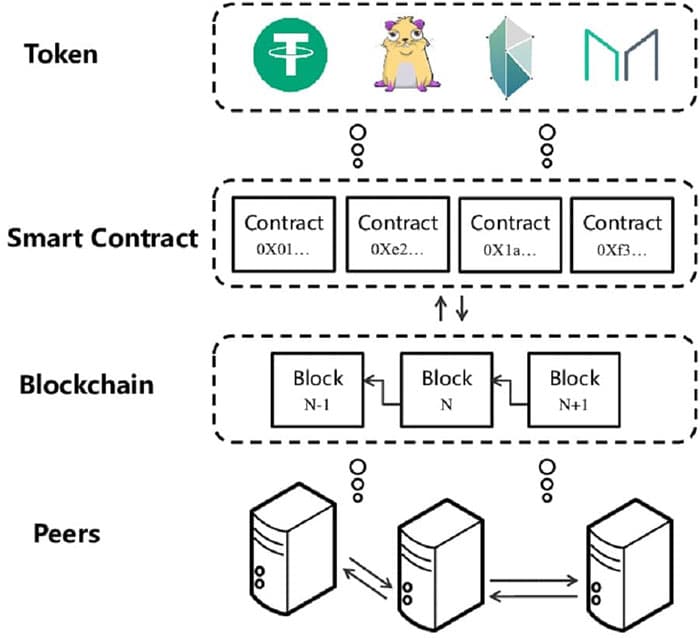

A more technical overview of the Ethereum blockchain. Image via Researchgate

A more technical overview of the Ethereum blockchain. Image via Researchgate Instead, applications on Ethereum are stored across the multiple computers that are connected to its blockchain network. This means that it is virtually impossible for any applications made on Ethereum to experience downtime. It also makes it hard for regulators to restrict access to them or shut them down.

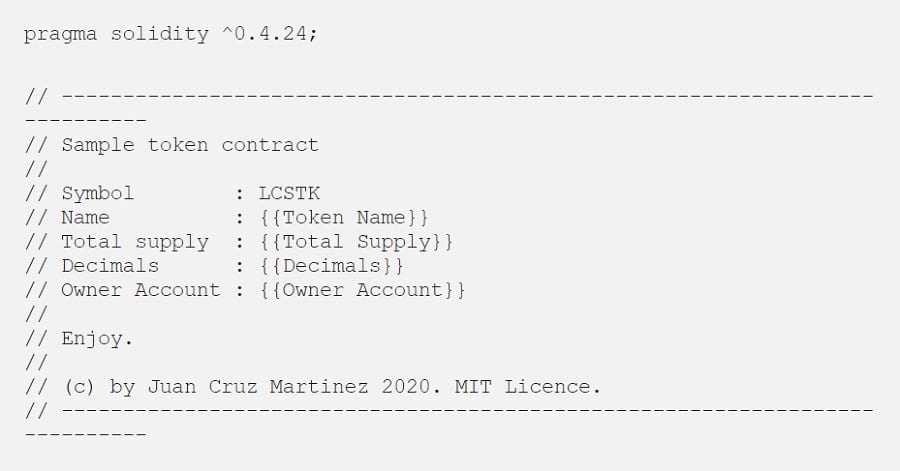

The Ethereum script required to create an ERC-20 token is incredibly simple. Image via Medium

The Ethereum script required to create an ERC-20 token is incredibly simple. Image via Medium In addition to applications, Ethereum allows you to easily create digital tokens. Instead of having to build your own cryptocurrency from scratch, you can use a sort of “template” provided by Ethereum.

This template is called the ERC-20 standard, and over 200 000 different tokens have been made on Ethereum so far. Some have very unique qualities programmed into them (check out Ampleforth).

Why is Ethereum Important?

There is a reason why Ethereum is the second largest cryptocurrency by market cap. It sustains the largest ecosystem of applications in the cryptocurrency space, and over half of the top 100 cryptocurrencies are built on the Ethereum blockchain as ERC-20 tokens.

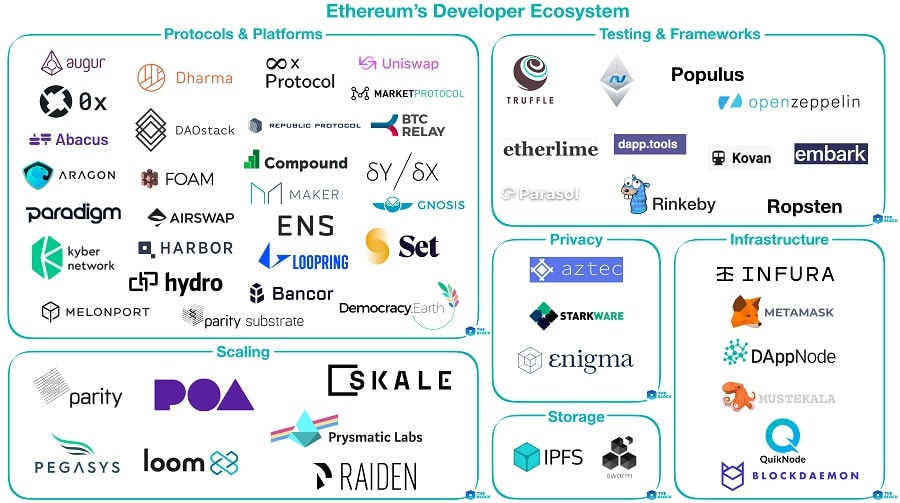

Much of Ethereum's ecosystem (excluding the 200 000 tokens, of course). Image via TheBlockCrypto

Much of Ethereum's ecosystem (excluding the 200 000 tokens, of course). Image via TheBlockCrypto Most importantly, almost the entire decentralized finance space is built on Ethereum. The DeFi space consists of a couple dozen applications that let you do things like trade, lend, and borrow ERC-20 tokens without a centralized entity like a cryptocurrency exchange or bank.

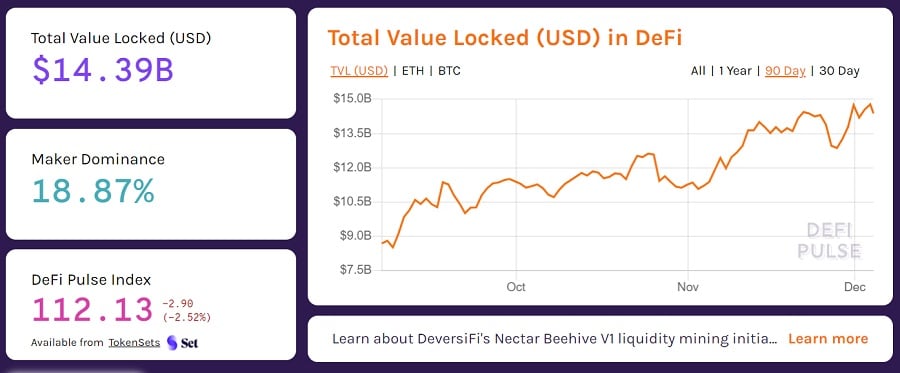

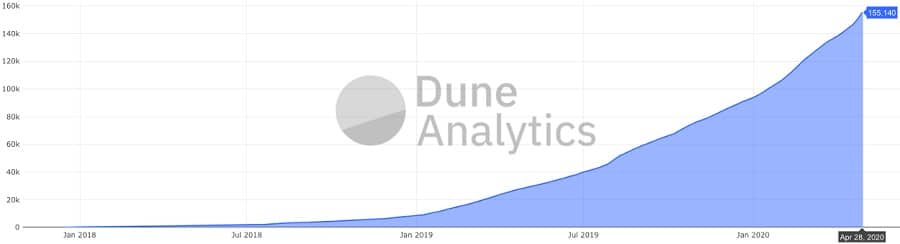

DeFi has seen significant growth in 2020.

DeFi has seen significant growth in 2020. As it turns out, cutting out the middleman is quite lucrative. Annual interest rates in Ethereum DeFi protocols can be anywhere between 3-10 000%+ (though the extreme APYs are rare and short lived). This has attracted nearly 15 billion dollars of cryptocurrency to the DeFi space, which is growing by the day.

Image via Ethgas

Image via Ethgas The ETH token is used to pay for Ethereum’s network fees known as gas, and this is measured in a unit called gwei. As demand for tokens and applications grows, so too does the demand for ETH. This is why some believe Ethereum may someday overtake Bitcoin to become the largest cryptocurrency.

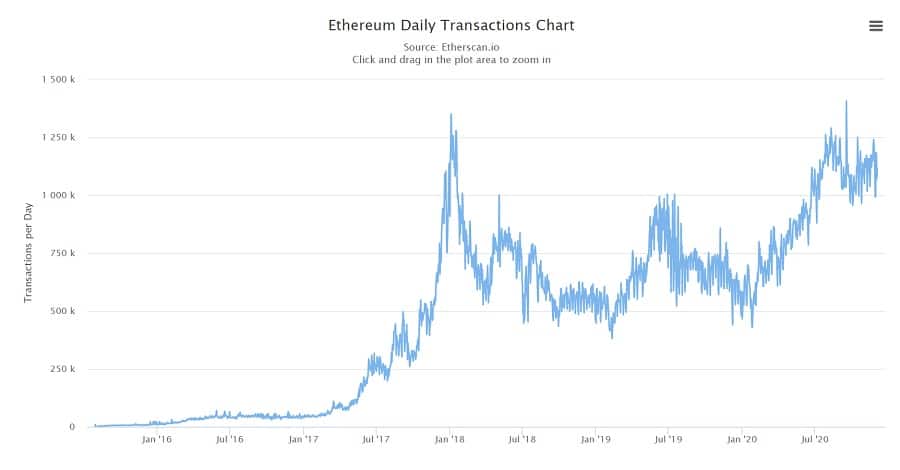

The number of transactions on the Ethereum network has been rising steadily since its release.

The number of transactions on the Ethereum network has been rising steadily since its release. Ethereum is also the largest smart contract platform in the world. Smart contracts are important to understand as they have limitless potential and astronomical use cases as they allow traditional sectors to be ported into blockchain. To learn more about them, check out our educational piece: What are Ethereum Smart Contracts.

There is just one problem: the Ethereum network can only handle around 15 transactions per second. This means that the ever-increasing number of people using Ethereum applications is not sustainable. Ethereum cannot scale, and it is only a matter of time before there are too many users for the network to support. High network fees on Ethereum have already been in the news for months.

This is where Ethereum 2.0 comes in.

What is Ethereum 2.0?

Ethereum 2.0 is Ethereum’s solution to its scaling problem. It has been in the works since Ethereum’s creation in 2015 when it was known by the name Serenity. You can think of Ethereum 2.0 as the next stage of Ethereum’s evolution as a cryptocurrency platform.

How Does Ethereum 2.0 Work?

Ethereum 2.0 consists of an entirely new blockchain called the Beacon Chain. The Beacon Chain uses something called sharding to increase Ethereum’s performance. This essentially involves creating additional blockchains called shards that attach to the main chain (in this case, the Beacon Chain).

Since you no longer rely on a single blockchain to process transactions, you can allocate certain applications to specific shards. For example, you could have a sharded chaid for all the virtual worlds built on Ethereum such as Decentraland, and another shard that is exclusively for DeFi protocols like yEarn.

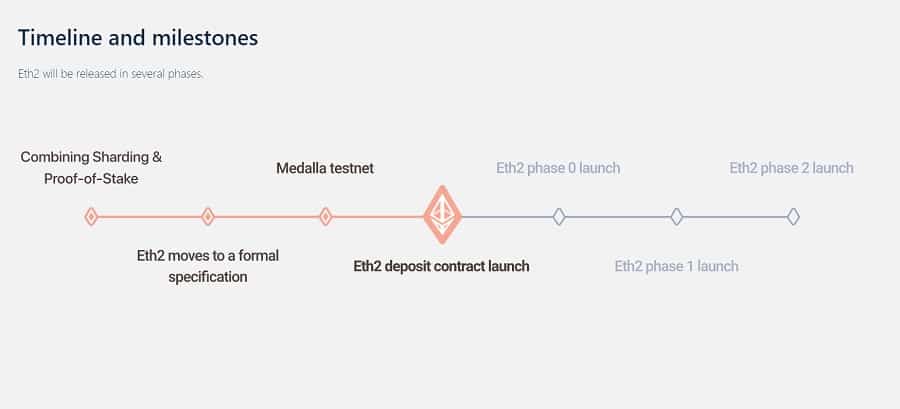

The roadmap for Ethereum 2.0 and where we are.

The roadmap for Ethereum 2.0 and where we are. The rollout Ethereum 2.0 is divided into multiple stages. Even though the Ethereum 2.0 network technically went live on December 1st, there is still a long way to go before it is fully operational. In other words, you will not be seeing any applications or DeFi protocols on Ethereum anytime soon.

The full rollout of Ethereum 2.0 is expected to take around 2-3 years (from the time of writing). Until it is complete, Ethereum and Ethereum 2.0 will exist in parallel. This will have some interesting effects on the price and economics of the ETH cryptocurrency. These will be discussed at length later in the article.

Differences Between ETH 1.0 & ETH 2.0?

There are two major differences between Ethereum and Ethereum 2.0: network speed, and how ETH cryptocurrency is mined. Whereas Ethereum can only process 15 transactions per second, Ethereum 2.0 can theoretically process around 100 00 transactions per second.

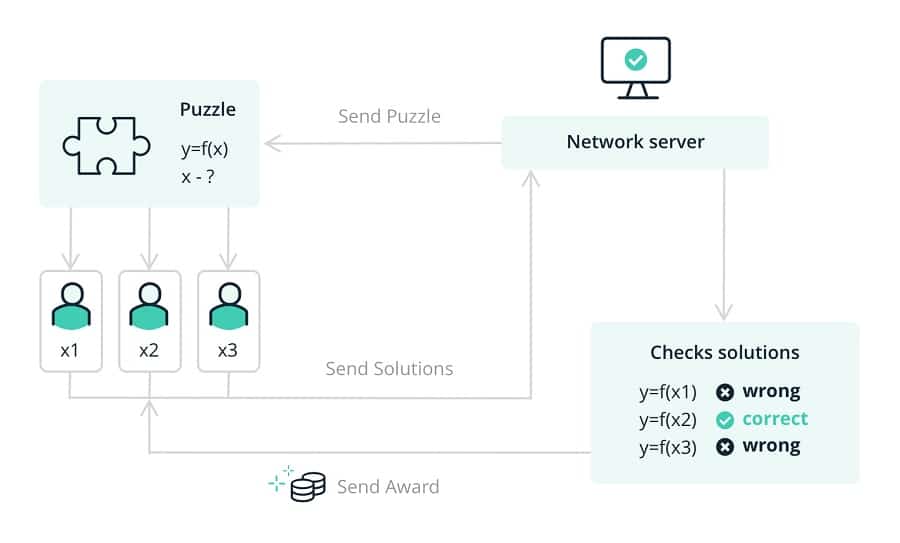

Image via Ledger.

Image via Ledger. In Ethereum, new ETH is given as reward to miners who dedicate their computing power (usually in the form of specialized cryptocurrency mining equipment) to verify transactions by solving cryptographic puzzles on the Ethereum blockchain. This is called proof of work mining and it is the same mining process used in Bitcoin.

Image via Ledger

Image via Ledger Instead of proof of work, Ethereum 2.0 uses proof of stake. This involves putting down a large amount of ETH to act as a node (using a regular computer) which validates transactions on the Ethereum blockchain in exchange for more ETH. The twist is that if you stay offline for too long or try to manipulate the network, you can lose some or even all your staked ETH.

Ethereum 2.0 Staking FAQs

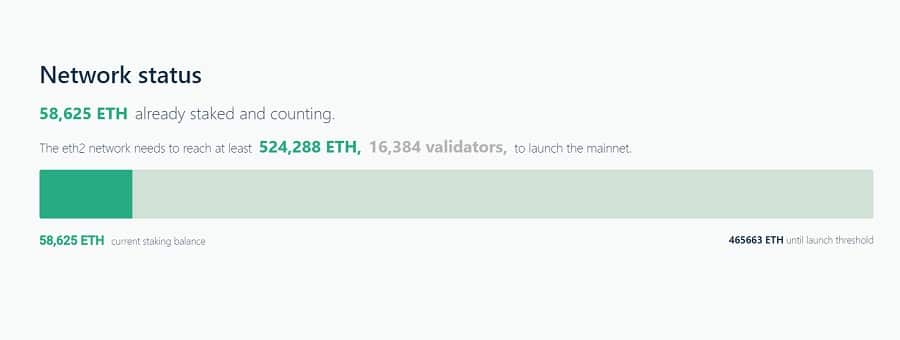

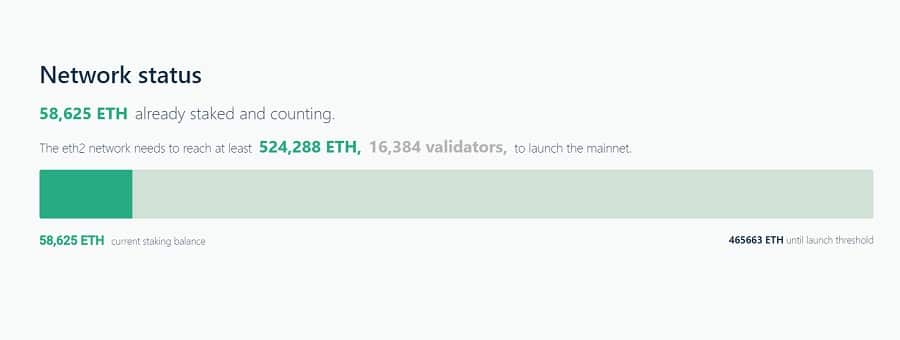

After years of testing Ethereum 2.0, the official staking contract for Ethereum 2.0 launched on November 4th, 2020. This was a sort of “accumulation phase” wherein a minimum of just over 525 000 ETH needed to be staked by over 16400 unique validators for the next phase to begin.

Participation was quite low at the start of the Ethereum 2.0 launch phase.

Participation was quite low at the start of the Ethereum 2.0 launch phase. This accumulation phase necessary to ensure that the network was sufficiently decentralized before launching. Ethereum was having a hard time reaching this threshold at first, but the minimum amount of participation was achieved just in time for the December 1st launch.

Ethereum 2.0 Staking Rewards

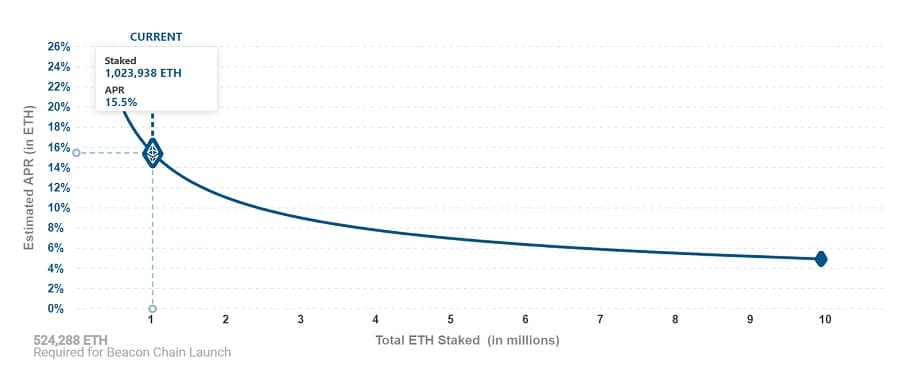

Staking rewards on Ethereum 2.0 range from around 22% to 5% per year (paid in ETH) depending on the amount of ETH being staked on the network.

Current annual returns for staking on Ethereum 2.0.

Current annual returns for staking on Ethereum 2.0. As you can see, the more ETH that is staked on Ethereum 2.0, the lower the annual returns. This reward schedule is intended to strike a delicate balance between incentivizing people to stake and protecting the ETH cryptocurrency from experiencing too much inflation.

How do I stake Ethereum 2.0?

You can stake on Ethereum 2.0 in one of two ways. The first way is to run your own validator node which requires 32 ETH, a solid internet connection, and a moderately powerful computer. You can read all the details about what you need if you want to run a validator node on Ethereum 2.0 by clicking here.

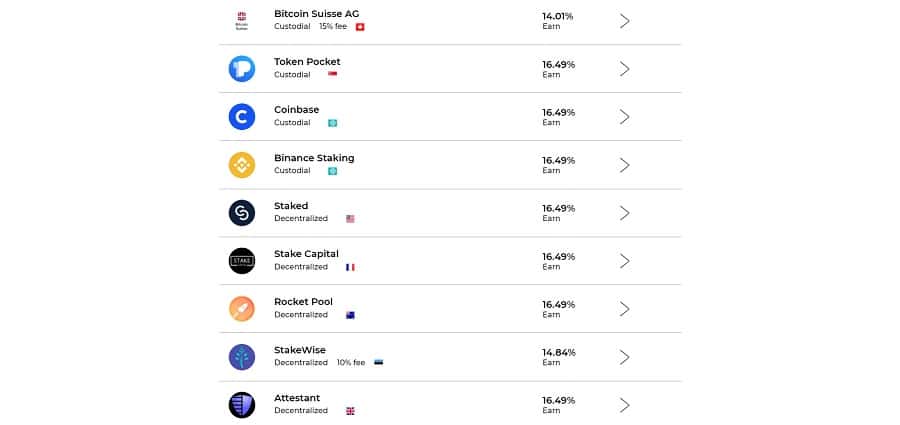

A few of many staking pools for Ethereum 2.0

A few of many staking pools for Ethereum 2.0 The second way to stake on Ethereum 2.0 is to join a staking pool. At the time of writing, there are dozens of staking pools for Ethereum 2.0. Most major exchanges have also added support for Ethereum staking. If you use an exchange like Binance, Coinbase, or Kraken, you can stake your ETH there.

But before you do, there is some fine print you should know about.

Ethereum 2.0 Staking Conditions

There are a few important things you need to keep in mind before you stake on Ethereum 2.0. The first is that for the time being, it is a one-way trip. In other words, once you commit your ETH to the Ethereum 2.0 network, there is no turning back – you cannot convert it back into 1.0 ETH.

Second, if you decide to run your own validator node on Ethereum 2.0, any downtime you experience (e.g. your internet goes down) can result in you losing some of your staked ETH. This is called slashing, and it can even occur by accident if there is an error in the network, and you will not be compensated.

Third, you will not be able to move your staked ETH until the next phase of Ethereum 2.0, which will occur in the next 1-2 years. This means you will not be able to withdraw, trade, or do anything with that staked ETH. That is unless of course you decide to stake your ETH in a pool that offers tokenized ETH 2.0.

What Is Tokenized Ethereum 2.0?

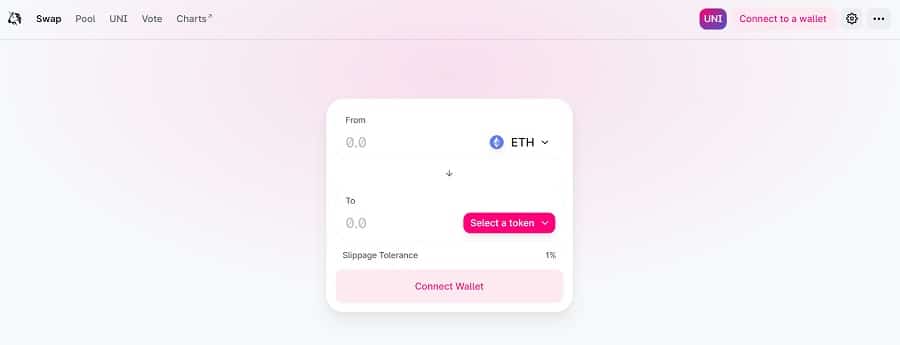

Also referred to as ETH 2.0 or Beacon Chain ETH, tokenized Ethereum 2.0 is an ERC-20 on the original Ethereum blockchain which represents ETH that has been staked on the 2.0 network. You can consider it to be a clever workaround to the 1-2 year lock up period for staking on Ethereum 2.0.

The Uniswap decentralized exchange, one of the most popular applications built on Ethereum.

The Uniswap decentralized exchange, one of the most popular applications built on Ethereum. This tokenized ETH is basically a sort of IOU – you stake your ETH on Ethereum 2.0 in a special staking pool, and a custom Ethereum application created by the staking pool provider will mint (create) an ERC-20 version of the ETH you have staked in the 2.0 pool. You can freely trade this tokenized Ethereum 2.0 if you wish (though you will probably have to use a decentralized exchange like Uniswap to do so).

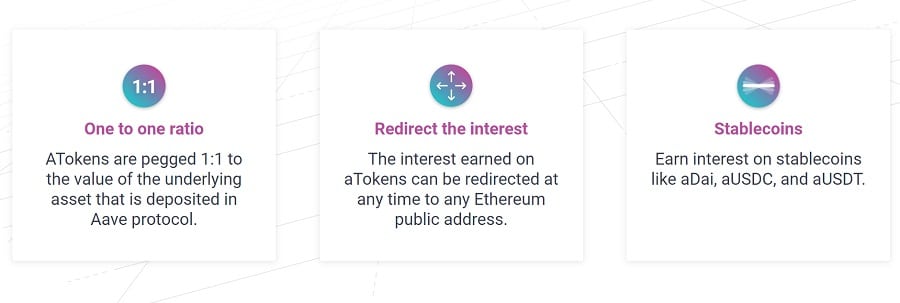

So called "interest bearing tokens" such as aTokens issued by Aave are popular in the DeFi space.

So called "interest bearing tokens" such as aTokens issued by Aave are popular in the DeFi space. The nifty thing is that this tokenized Ethereum 2.0 will accrue a portion of the interest being earned by your staked ETH in real time! Also, whoever holds that tokenized Ethereum 2.0 will be able to redeem the staked ETH it represents when it becomes possible to move it in the next 1-2 years.

The benefit to the staking pool operator for providing this tokenized Ethereum 2.0 is that it will likely attract more stakers to their pool, increasing the pool provider’s staking rewards. The benefit to you is that you still have access to your staked ETH.

How Can I Get Ethereum 2.0?

While you cannot actually buy Ethereum 2.0 yet, you will soon be able to get a tokenized version of ETH being staked on Ethereum 2.0 (as discussed in the previous subheading).

Rocket Pool's recent announcement regarding their development of tokenized Ethereum 2.0.

Rocket Pool's recent announcement regarding their development of tokenized Ethereum 2.0. Rocket Pool is currently developing the technology to do just that and expects to make tokenized Ethereum 2.0 a reality some time in early 2021. The FTX cryptocurrency exchange is also considering launching a staked ETH token.

Should I Stake Ethereum 2.0?

This depends on whether you are in it for the long haul or not. If you are just looking to make a quick buck from your ETH, you will probably be better off not staking. We are at the start of another cryptocurrency market bull run, and you might miss out on a good selling opportunity if your ETH is locked on the Ethereum 2.0 network.

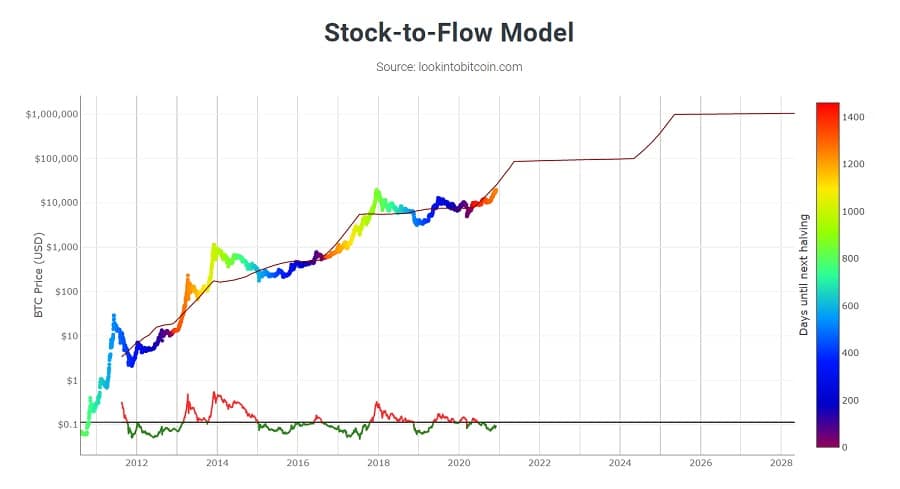

Bitcoin's stock to flow model is said to influence cryptocurrency market trends. Image via Lookintobitcoin

Bitcoin's stock to flow model is said to influence cryptocurrency market trends. Image via Lookintobitcoin However, if it becomes possible to tokenize the ETH staked on Ethereum 2.0, this will allow you to sell your staked ETH by proxy when the price is right. Obviously if you are in it for the long haul, the question of staking or not should be a no brainer. Note that this is not financial advice, and the decision to stake is ultimately yours to make.

If any questions about Ethereum 2.0 staking were not answered here, check out the Ethereum Launchpad.

Will Ethereum 2.0 affect Ethereum price?

The short answer is yes. How exactly Ethereum 2.0 will affect Ethereum’s price however is something that is a bit more complicated. Here are a few scenarios to consider. It is likely that we will see some combination of all of these in the near future.

Scenario 1: Reduced ETH Supply Increases The Price Of ETH

As you have read, any ETH that is staked on Ethereum 2.0 will be locked up for 1-2 years. This means that any ETH that is staked is effectively not in circulation. This would have a positive impact on the price of Ethereum, because assuming demand stays the same, a limited supply means an increase in price.

Participation was quite low at the start of the Ethereum 2.0 launch phase.

Participation was quite low at the start of the Ethereum 2.0 launch phase. At the time of writing, just over 1 million ETH is being staked on the Ethereum 2.0 network. This is slightly less than 1% of Ethereum’s total supply. While this may not have a very restrictive impact on supply, it certainly will if the amount of staked ETH was to rise to say, 10-20% of ETH’s total supply.

Scenario 2: Tokenized Ethereum 2.0 Leads To Unsustainable Price Growth

Things get a bit more complicated when you throw tokenized Ethereum 2.0 into the mix. Having a tokenized version of ETH that accrues interest and can be freely traded would be incredibly valuable, especially to those using DeFi applications.

Many have speculated that tokenized Ethereum 2.0 will be in very high demand if released.

Many have speculated that tokenized Ethereum 2.0 will be in very high demand if released. The demand for tokenized Ethereum 2.0 would be incredibly high and could even be so high that tokenized Ethereum 2.0 would be worth more than Ethereum. This price imbalance would likely be temporary as it would motivate people to stake their ETH to create tokenized Ethereum 2.0 that they can sell at a premium.

This is where things could get messy though, because if the demand for tokenized Ethereum 2.0 becomes too high, it could eventually lead to a crash of the Ethereum network and price of ETH.

Higher prices leading to higher demand leading to higher prices is a vicious cycle. Image via Financial Times

Higher prices leading to higher demand leading to higher prices is a vicious cycle. Image via Financial Times A high demand for tokenized Ethereum 2.0 motivates people to stake more ETH on the Ethereum 2.0 network. This reduces the circulating supply of ETH, making ETH more valuable. This makes tokenized Ethereum 2.0 even more valuable, leading to an even higher demand and consequently more staking.

In short, tokenized Ethereum 2.0 could take the price of ETH higher than ever before, but it could do so in a way that is unsustainable and could even crash the network.

There are only around 200 000 DeFi users. Image via Medium

There are only around 200 000 DeFi users. Image via Medium Thankfully there will probably not be enough demand for tokenized Ethereum 2.0 for this to happen, simply because there are not enough people who understand DeFi.

Scenario 3: ETH Prices Crash Temporarily After Ethereum 2.0 Can Be Traded

As you read this, there are tens of thousands of validators on Ethereum 2.0 earning interest in ETH. They are not able to sell the ETH they have earned… yet. When it does become possible for them to do so, it is very unlikely they will simply continue to sit on that ETH.

Miners tend to sell their crypto sooner than we do.

Miners tend to sell their crypto sooner than we do.You see, many of the validators on Ethereum 2.0 are or used to be Ethereum miners. They are there to make a profit, and they regularly sell any ETH they have earned as a way of making that profit. After two years of no profit, they would be itching to sell most if not all the ETH they have accumulated.

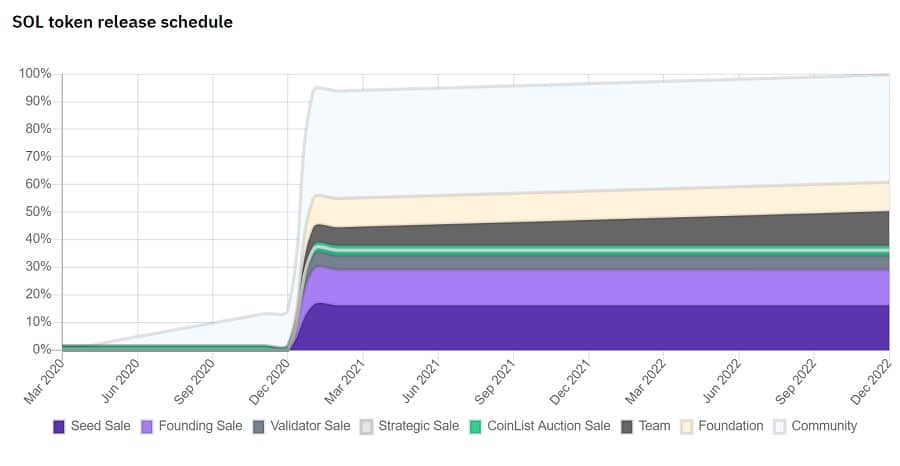

Token emission schedules such as this one for Solana's SOL token can have a negative impact on price. Image via Binance

Token emission schedules such as this one for Solana's SOL token can have a negative impact on price. Image via Binance Basic economics dictates that this massive supply of ETH being sold at once could crash its price. This would likely be temporary however, and developers at Ethereum could also mandate a sort of cool-down period wherein these validators would not be able to move more than a certain amount of ETH at one time.

Scenario 4: Ethereum 2.0 Fails And ETH Prices Crash

This is probably the least likely scenario, but it is certainly one to keep in mind. If something goes terribly wrong with Ethereum 2.0, that could have a devastating impact on the price of ETH. For the time being, Ethereum essentially has no competition – they are the largest cryptocurrency in their genre by far.

A few of Ethereum's competitors. Image via Medium

A few of Ethereum's competitors. Image via Medium That said, there is technically competition, namely from projects like Polkadot and Cardano which were both created by former co-founders of Ethereum. If anything was to go wrong with Ethereum 2.0 or during the transition from Ethereum to Ethereum 2.0, faith in the network would switch quite quickly along with the money currently invested in it.

This begs the question, if Ethereum is so slow, how will it survive until Ethereum 2.0 is completed?

What Will Happen To Ethereum?

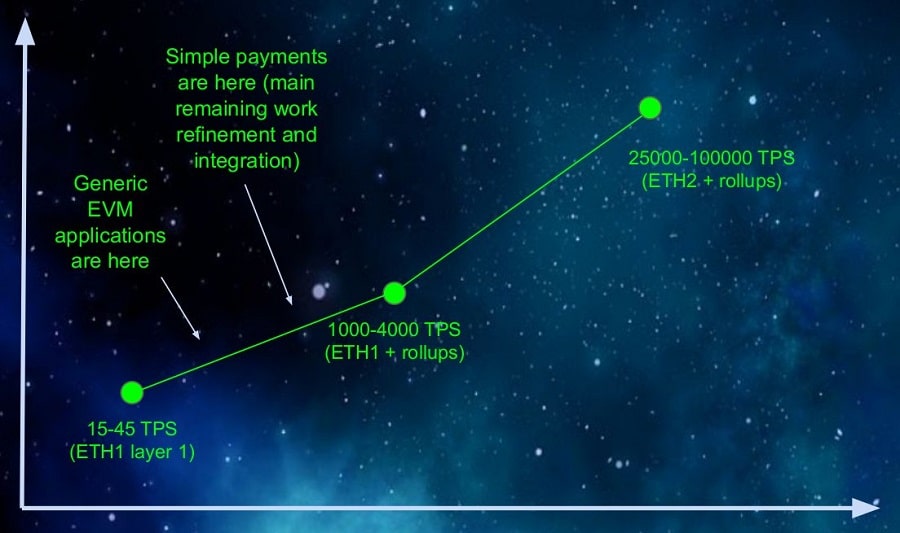

Ethereum is not going anywhere for the next few years. This is in large part due to the plan by Vitalik Buterin and other Ethereum developers to implement layer-2 scaling solutions onto the network. They believe that this will allow Ethereum to remain competitive against other similar cryptocurrencies until Ethereum 2.0 is finished.

The timeline for Ethereum scaling as outlined by Vitalik Buterin.

The timeline for Ethereum scaling as outlined by Vitalik Buterin. Most layer-2 scaling solutions basically involve processing some portion of transactions on a separate blockchain and then recording them on the Ethereum blockchain in a batch as a single transaction. These types of scaling solutions are referred to as rollups, zkrollups, or zksnarks.

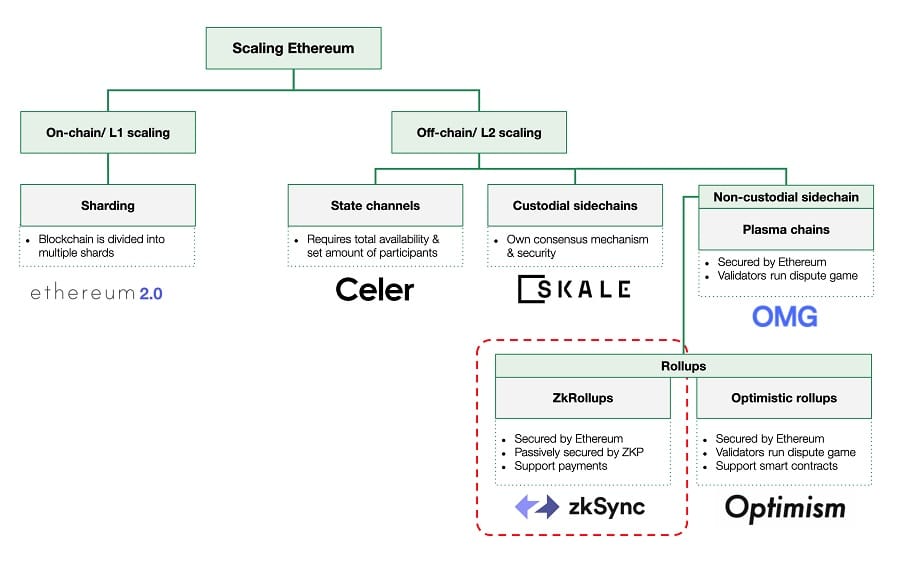

An overview of a few scaling solutions for Ethereum. Image via Twitter

An overview of a few scaling solutions for Ethereum. Image via Twitter Layer-2 scaling solutions will bump Ethereum’s transactions per second from 15 to anywhere between 1-4000. If are curious to know how this is accomplished or want to know about some layer 2 projects, check out OMG Network and Loopring.

Once Ethereum 2.0 is finished, everything built on Ethereum will have to be migrated to Ethereum 2.0. This process will likely begin long before Ethereum 2.0 is open for business and will probably be the make or break moment for the project.

If this migration is too turbulent or if there are any significant issues with the 2.0 network, Ethereum could potentially lose some or all its ground to its competitors. If all goes well however, Ethereum might just surpass Bitcoin as the largest cryptocurrency by market cap.