There has been a fierce battle raging for years between Bitcoin enthusiasts and Ethereum enthusiasts on which coin will ultimately be the largest coin by market cap. That title has always been held by Bitcoin which has had the highest market capitalization over any other cryptocurrency by a large margin, though Ethereum has been gaining on Bitcoin since its inception back in 2015 and has long held its position as the second-largest coin in terms of market cap.

As Ethereum continues to upgrade and more utility is being built on the network, ETH is enjoying faster rates of adoption and developer activity which leads many to believe that it is only a matter of time before Ethereum takes the crown from Bitcoin as the top dog in the crypto space.

The event of Ethereum passing Bitcoin is often referred to as, “The Flippening,” and is a term used by many crypto enthusiasts when they are referring to Ethereum “flipping” Bitcoin in terms of market capitalization.

In this article, I am going to point out why Ethereum could potentially flip Bitcoin in 2022 and highlight the reasons why Bitcoin may not drop that mantle without a fight.

Before I begin, I would like to point out that while many Ethereum moonies want the flippening to happen and many Bitcoin maxies say it will never happen, I personally look at it from a very unbiased point of view and could care less either way as I love them both for different reasons. I hold both ETH and BTC in my portfolio and they are both my favourite in their respective niches. To me, this argument is sort of like asking someone if they prefer air or water for survival or asking a parent which of their children they want to succeed, obviously both of them!

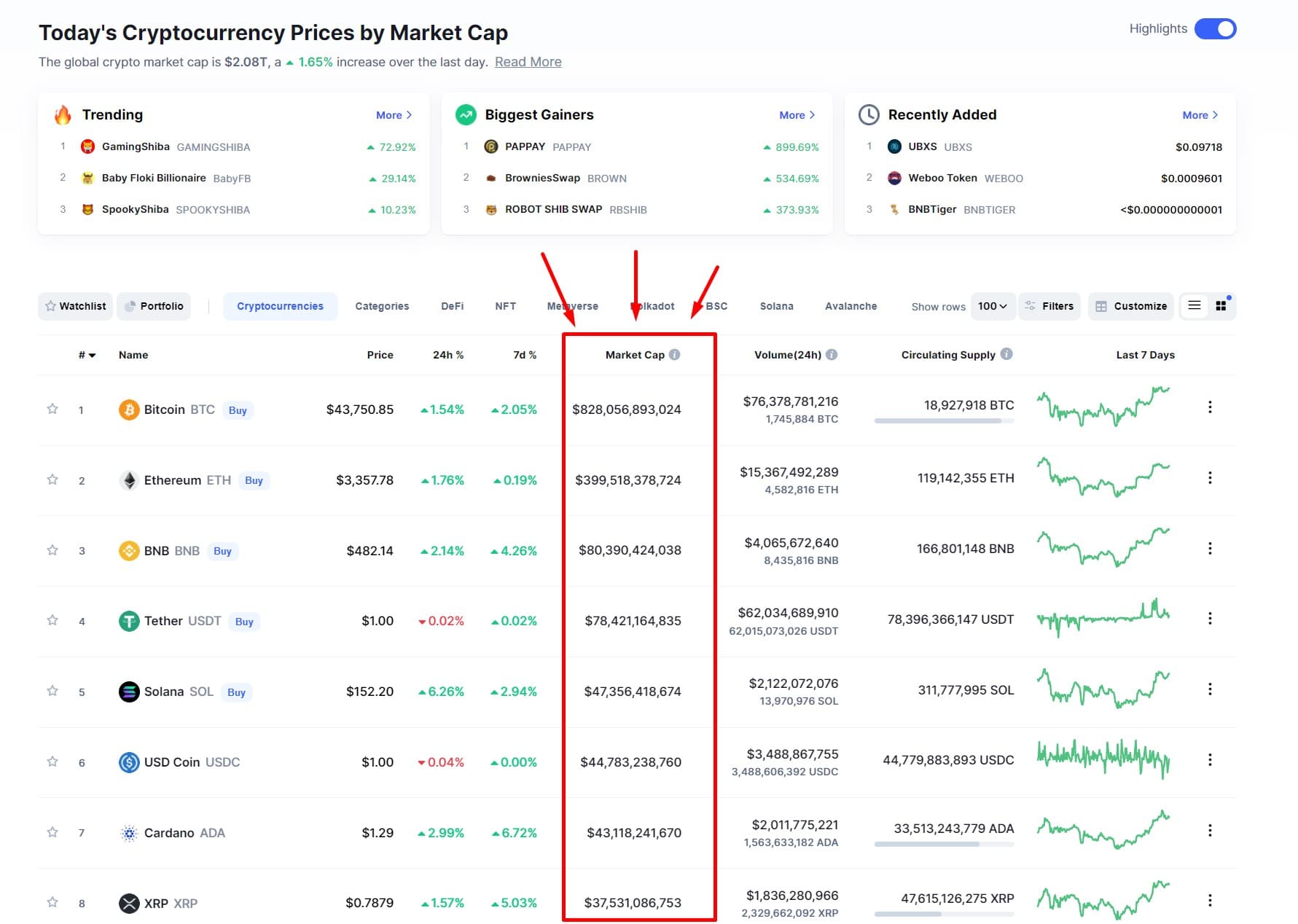

What is Market Capitalization?

Market capitalization for crypto is different to stocks and is calculated in a different way. For crypto, market capitalization is the total value of all the coins that have been minted. It is calculated by multiplying the number of coins in circulation by the current market price of a single coin. Market cap is used to gauge the size of a crypto asset and is important to note that the higher the market cap, the lower the volatility and the more stable the asset is likely to be.

This is because it takes a significantly more amount of money to move the asset drastically. This is also why smaller altcoins can sometimes pump 1000X in a short period of time as it only takes a few buying whales or a bunch of retail investors to jump in at once to pump an asset, while the larger cryptocurrencies like Bitcoin will likely never see a 1000x gain in a short time frame as that would take tens of billions of dollars worth of capital to flow into it. Conversely, this is also why Bitcoin is the safest cryptocurrency as anything that can go up 1000X can just as easily go down in the same way.

One of the Ways to Find a Tokens Market Cap is by Looking at coinmarketcap.com

One of the Ways to Find a Tokens Market Cap is by Looking at coinmarketcap.com Why is Market Cap Important?

The price of a token is just one way to measure value. Investors use market cap to be able to see the full picture and compare value across cryptocurrencies. It is a key statistic as it can indicate the growth potential of a cryptocurrency and whether it is a good buy compared to others.

Price alone cannot be used to determine the value of an asset, novice investors may look at Bitcoin with a price tag of 50k and think it is way too expensive then look at an asset like Cardano which they can buy for $1.50 and think Cardano is a better deal as it is much cheaper, but it doesn’t quite work like that as that is comparing apples to oranges. Let’s look at an example of two hypothetical coins:

A token called Tapioca token has 400,000 coins in circulation and each coin is worth $1, its market cap is $400,000

Another token called Rice Pudding token has 100,000 coins in circulation and each coin is worth 2$, its market cap is $200,000

Even though the price of Rice Pudding token is higher than Tapioca token, Tapioca token’s overall value is double that of Rice Pudding Token.

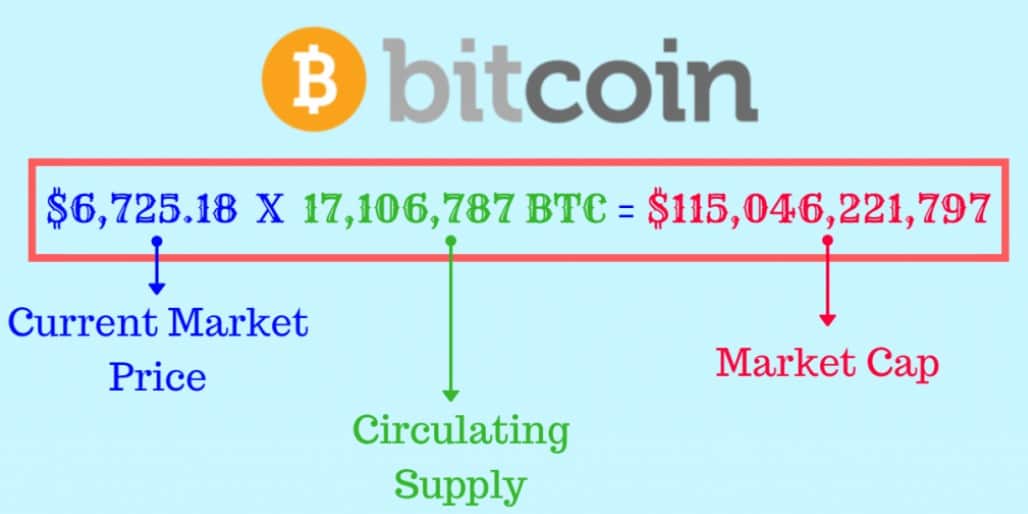

How to Calculate Market Cap Image via masterthecrypto.com

How to Calculate Market Cap Image via masterthecrypto.com Market Cap Showdown: BTC vs ETH

As of January 2022, Ethereum has a market cap of 48.4% the size of Bitcoin’s, just under halfway to having an equal market cap. A handy tool to view this metric and avoid having to do the math by hand can be found at blockchaincenter.net/flippening.

Ethereum Nearly Flipped Bitcoin Back in 2017 and Has Been Hovering Around 50% for the Past Year Image via blockchaincenternet

Ethereum Nearly Flipped Bitcoin Back in 2017 and Has Been Hovering Around 50% for the Past Year Image via blockchaincenternet When/if this chart/meter reaches 100%, that will mean that Ethereum has the same market cap as Bitcoin. Where it stands as of now, Ethereum will need to more than double to flip Bitcoin, not taking into account future Bitcoin market cap appreciation.

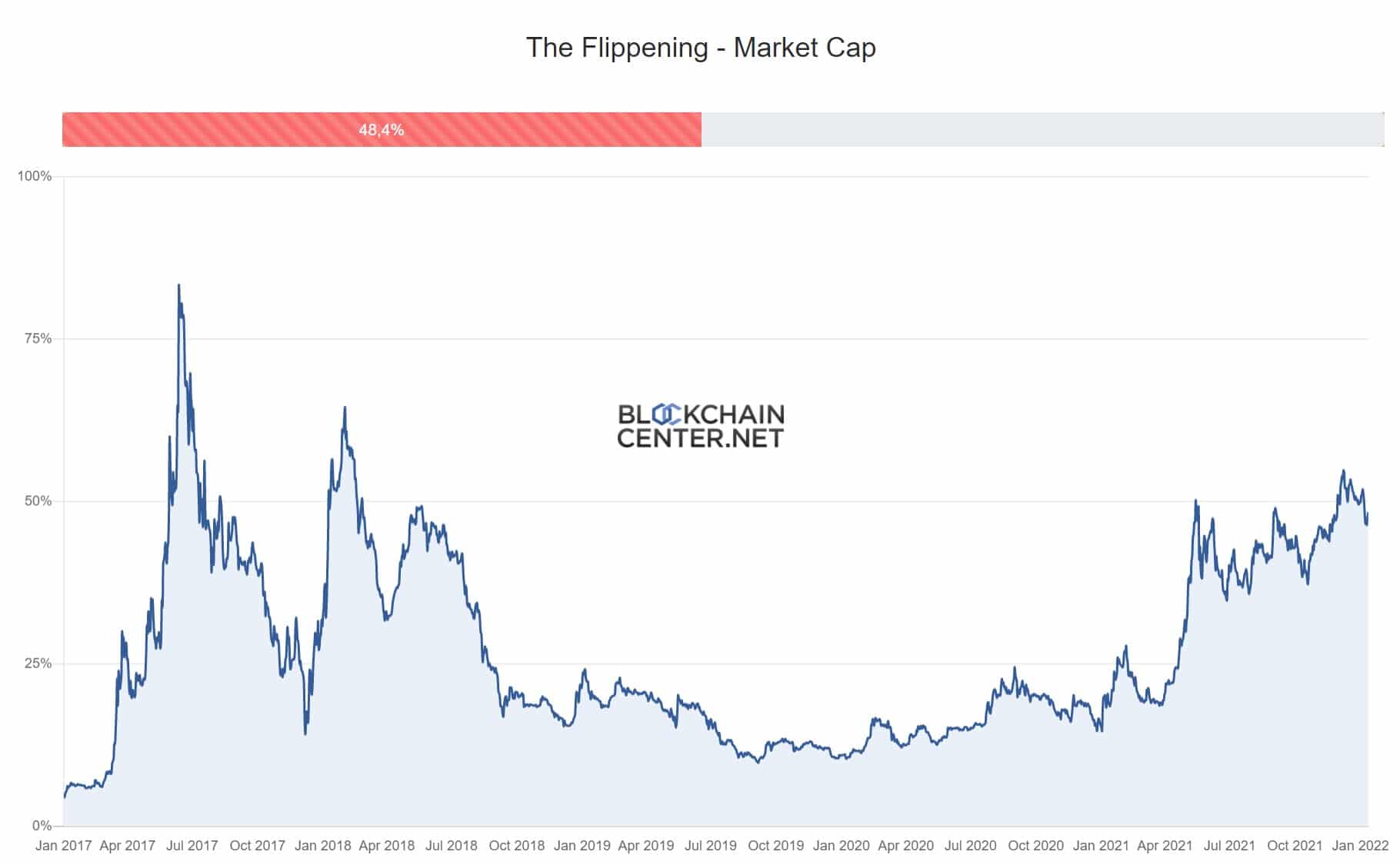

Ethereum Has Already Flipped Bitcoin in Some Key Metrics

I am going to point out where Ethereum is already outpacing Bitcoin and argue why Ethereum stands a good chance at beating big daddy Bitcoin as the number one crypto. Ethereum has already flipped Bitcoin in on-chain transactions, value settled, and transaction fees generated.

Transaction Count

This Shows the Relation of Total On-Chain Transactions That Happen on the Networks and Ethereum is Outpacing Bitcoin Over 500% Image via blockchaincenternet

This Shows the Relation of Total On-Chain Transactions That Happen on the Networks and Ethereum is Outpacing Bitcoin Over 500% Image via blockchaincenternet This signals that Ethereum is being used more widely and frequently within the cryptocurrency industry than Bitcoin. This comes as no surprise as Ethereum is the backbone of just about the entire DeFi, and NFT ecosystems and Ethereum transactions need to happen for every transaction on the network.

Here is something else to consider: Ethereum can provide the framework needed for Metaverses to be built as well as we already see with Decentraland and the Sandbox being built on the network. Imagine if Ethereum fuels Metaverses, Blockchain Gaming, DeFi and the very Web 3.0 itself as many believe it will, the use cases and potential for Ethereum are limitless.

As these industries grow, if they choose to build out on Ethereum vs the Ethereum competitors then there is almost no chance that Eth won’t flip Bitcoin someday.

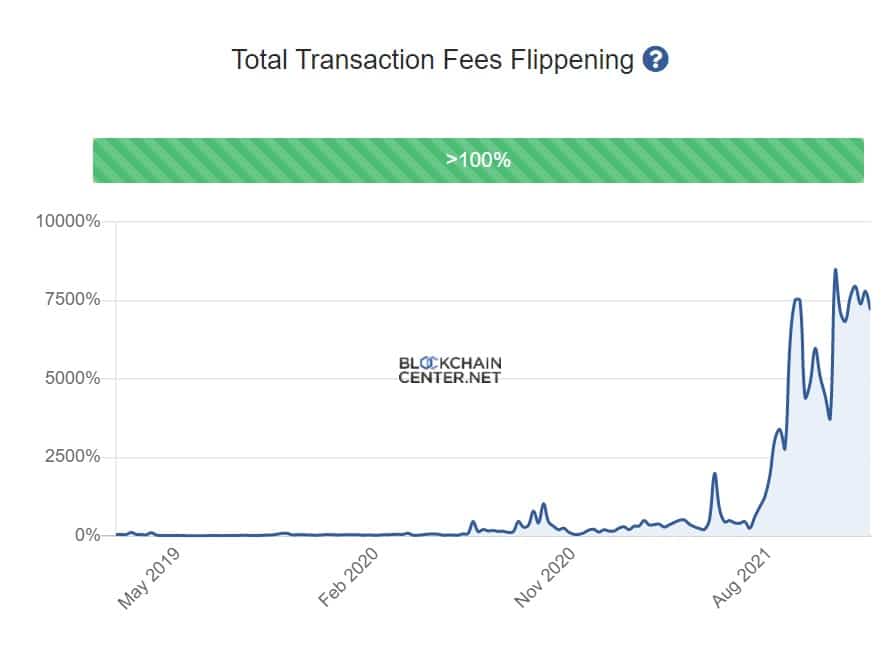

Transaction Fees

Chart Showing the Total USD Value of Fees Paid to Make a Transaction on the Network, Ethereum has Flipped BTC Here by Thousands of Percent Image via blockchaincenter.net

Chart Showing the Total USD Value of Fees Paid to Make a Transaction on the Network, Ethereum has Flipped BTC Here by Thousands of Percent Image via blockchaincenter.net A good blockchain has blocks filled with activity that people are willing to pay for. This can show how valuable a blockchain is as it literally translates to how much people are willing to pay to use the ledger. Ethereum crushes Bitcoin in this regard as it offers an attractive ecosystem with economic and social activities that people are willing to pay out the wazoo for.

4 of the top 5 are Ethereum Based Projects Image via newsletter.banklesshq

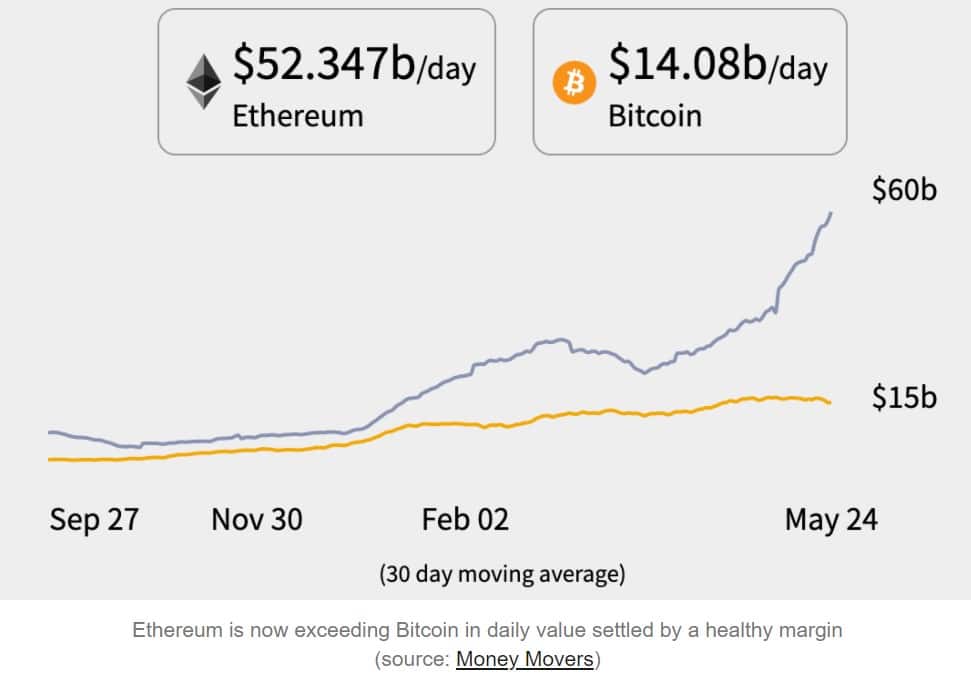

4 of the top 5 are Ethereum Based Projects Image via newsletter.banklesshq Value Settled- This is a measure of how much economic value is being settled on the blockchain. Blockchains are settlement layers and the amount of value settled on a blockchain indicates whether or not the network is being used, facilitating economic activity. This shows that more people are using Ethereum to settle transactions than Bitcoin.

Though before I give ETH maxies too much credit on this one, this makes sense if you compare Bitcoin to gold and Ethereum to oil, an analogy which I really like. People are more enticed to hold Bitcoin for years, never touching it and not using it for daily transactions, while people use Ethereum more so in day to day transactions. This would be like comparing the car that I drive to work every day to the gold bricks in my safe (I wish I had gold bricks).

Just because I use my car every day and not my gold bricks, it doesn’t mean that I like my car more, nor that it is worth more, so consider these metrics with an analytical mind.

Ethereum Showing it is Exceeding Bitcoin in Daily Value Settled Image via newsletter.banklesshq

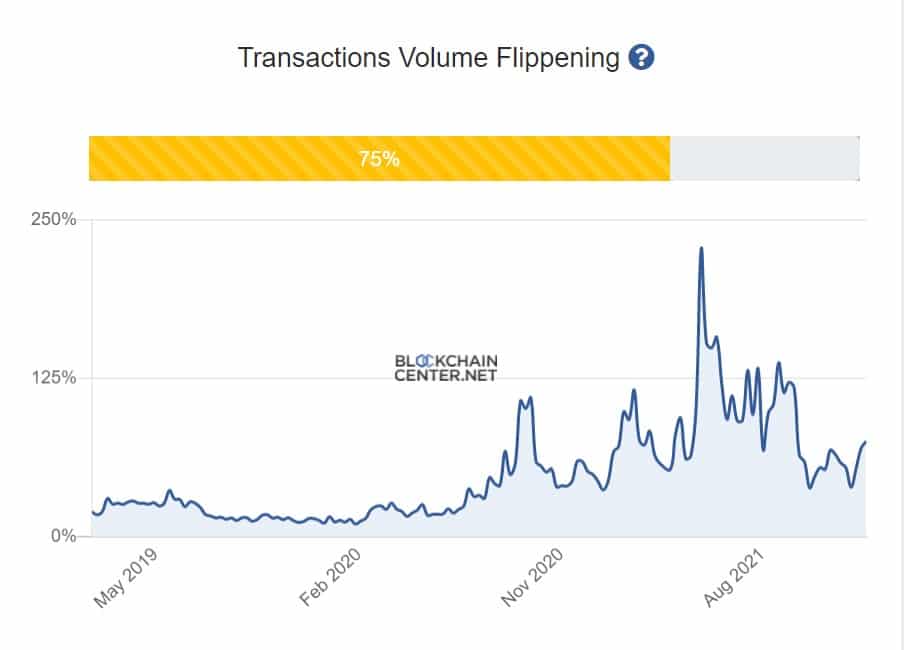

Ethereum Showing it is Exceeding Bitcoin in Daily Value Settled Image via newsletter.banklesshq It is worth looking at one more metric here as Ethereum and Bitcoin pass the potato back and forth regarding transaction volumes. This metric is important as it shows the total amount of USD that is sent over that network. This metric excludes stablecoin transfers as a note. This is an interesting metric as it highlights that there have been times that there is more money flowing through the Ethereum network than the Bitcoin network, a very telling metric.

The Total Transaction Volume Happening on the ETH and BTC Networks Image via blockchaincenter.net

The Total Transaction Volume Happening on the ETH and BTC Networks Image via blockchaincenter.net Ethereum is also catching up on other metrics such as active addresses and aggregated trading volume on exchanges.

Other Metrics Highlighting That ETH is Gaining, Though BTC Holds Dominance. Charts Found on blockchaincenter.net

Other Metrics Highlighting That ETH is Gaining, Though BTC Holds Dominance. Charts Found on blockchaincenter.net Will NFTs, DeFi and Metaverses be Enough to Seal the Deal?

Nobody was prepared for the explosion in popularity that NFTs would see in 2021, which is leading many to believe that NFT adoption alone will be enough to see ETH flip BTC in 2022. As the human race goes gaga for NFTs and everyone is jumping into the trend from celebrities to athletes, artists to gamers, as it stands now, the majority of NFT activity is taking place on Ethereum by a large margin.

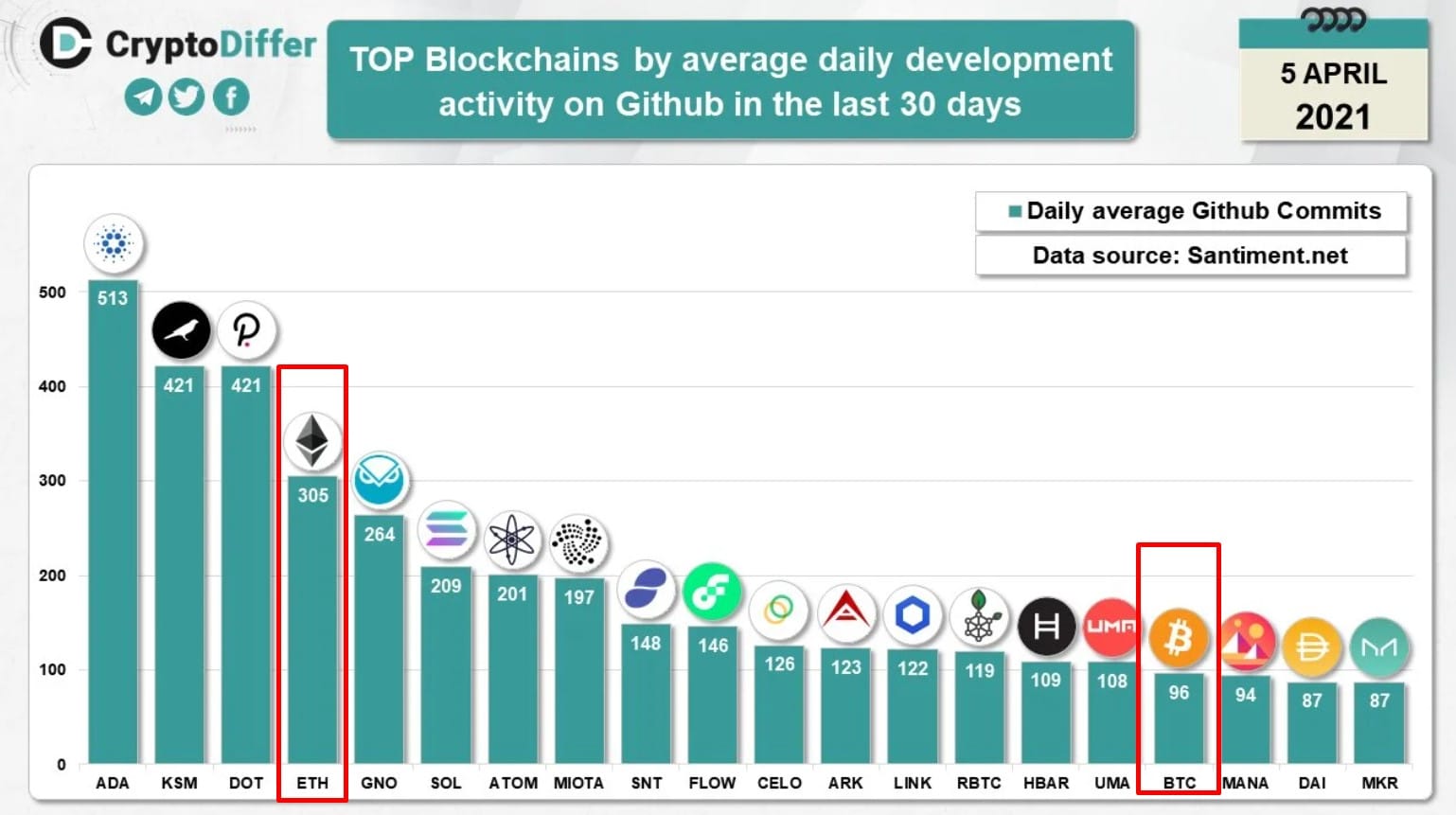

As already mentioned, Blockchain gaming, DeFi and the Metaverse are massive trends that are likely to continue to grow in 2022 and beyond. As network adoption and developer activity continue to outpace Bitcoin, there is a very good chance that Ethereum will someday flip Bitcoin, that is of course, if Ethereum can get moving on the much-needed Eth 2.0 upgrade and no other networks such as Cardano, Solana, Polkadot, Avalanche, Tezos or others win the race.

NFTs, Blockchain Gaming and the Metaverse could prove to be the pivotal driving force that introduces newcomers into the world of blockchain resulting in ETH market cap dominance in 2022. These sectors have the unique ability to attract millions of people to the space who could care less about cryptocurrencies themselves.

There are more people likely to get excited over NFTs, Gaming and Metaverses than there are people who care about crypto or are looking for a superior store of value, the freedom and sovereign attributes of DeFi or ledger technology as these do not appeal to the masses in the same way. This could be enough to result in Bitcoin living in Ethereum’s Shadow.

Developer Activity is an Important Metric as it Highlights the Creation of Utility on a Network Image via cryptodiffer.com

Developer Activity is an Important Metric as it Highlights the Creation of Utility on a Network Image via cryptodiffer.com Many key figures in the Crypto Space such as Macro investor Raoul Pal, Jurrien Timmer who is the director of Global Macro at Fidelity Investments, Nigel Green, the CEO of DeVere, as well as Dan Morehead, CEO of Pantera Capital along with many others confidently believe that the flippening is not a question of if, but when, and that the flippening is on the horizon with many believing that 2022 will be the year of Ethereum.

Highly Respected Macro Investor and CEO of Real Vision is Confident in the Flippening Image via dailyhodl

Highly Respected Macro Investor and CEO of Real Vision is Confident in the Flippening Image via dailyhodl Another big catalyst for Ethereum that cannot be understated is the impact of smart-contract functionality, as it has the capabilities of bringing many aspects of the traditional world into Blockchain. Take a gander at our article on Ethereum Smart Contracts if you would like to learn more about why the concept is so revolutionary.

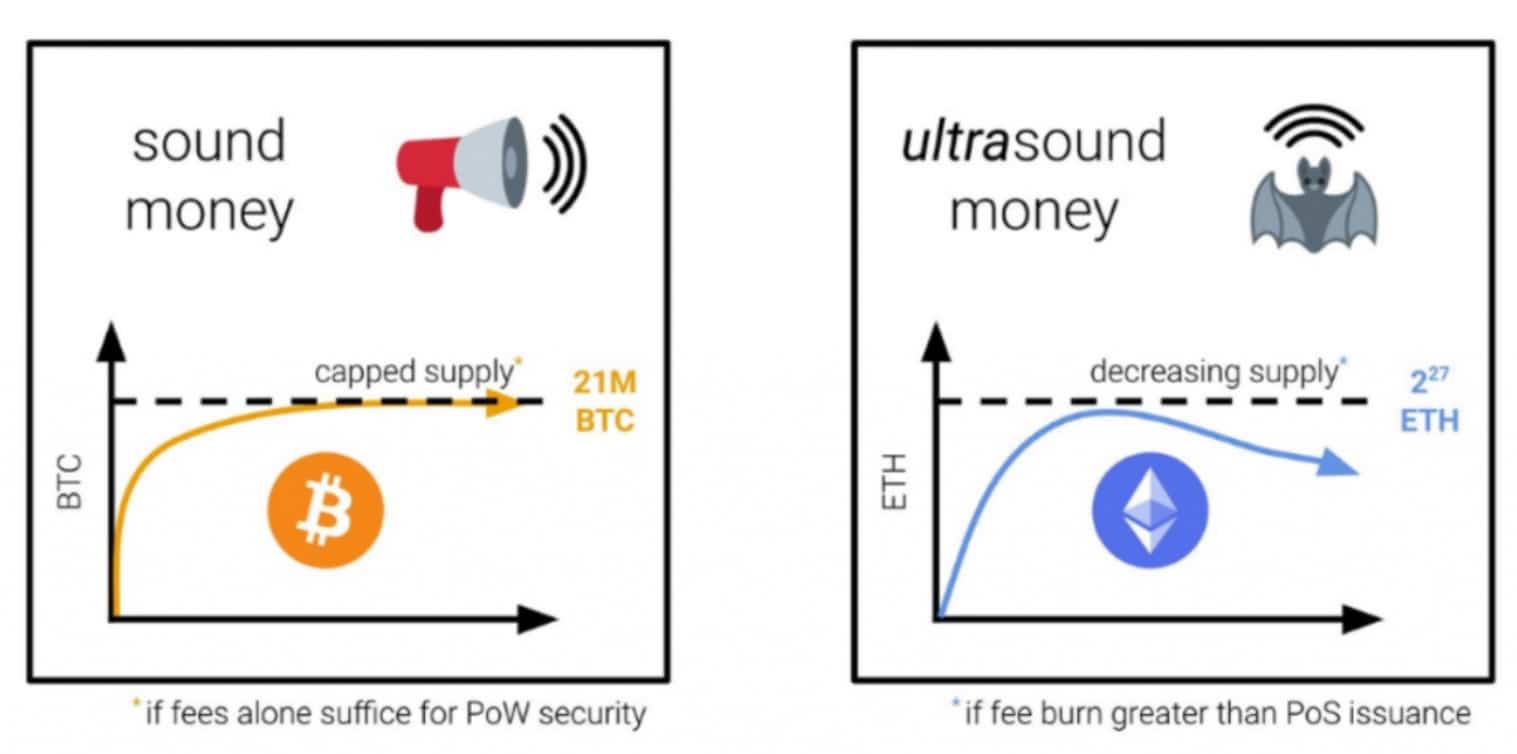

Ethereum as “Ultra-Sound” Money

While Bitcoin was quoted as being “Sound Money,” Ethereum pulled the classic, “hold my drink,” as proposal EIP-1559 was passed in 2021 resulting in ETH being burned for every transaction, creating a potentially deflationary asset and increasing its scarcity, potentially “one-upping” Bitcoin’s capped supply and slightly inflationary properties.

The creator of Bitcoin designed its inflation rate to mimic gold’s stable inflation rate which is not necessarily a bad thing depending on the point of view as inflation can increase an assets value over time, but Ethereum now actually has the potential to be deflationary, reducing its supply over time. If we all remember our basic economics, as supply goes down and demand goes up, price goes to the moon.

One of the Arguments for Ethereum Becoming “Ultra-Sound” Money is its Decreasing Supply Potential Image via via news.coincu.com

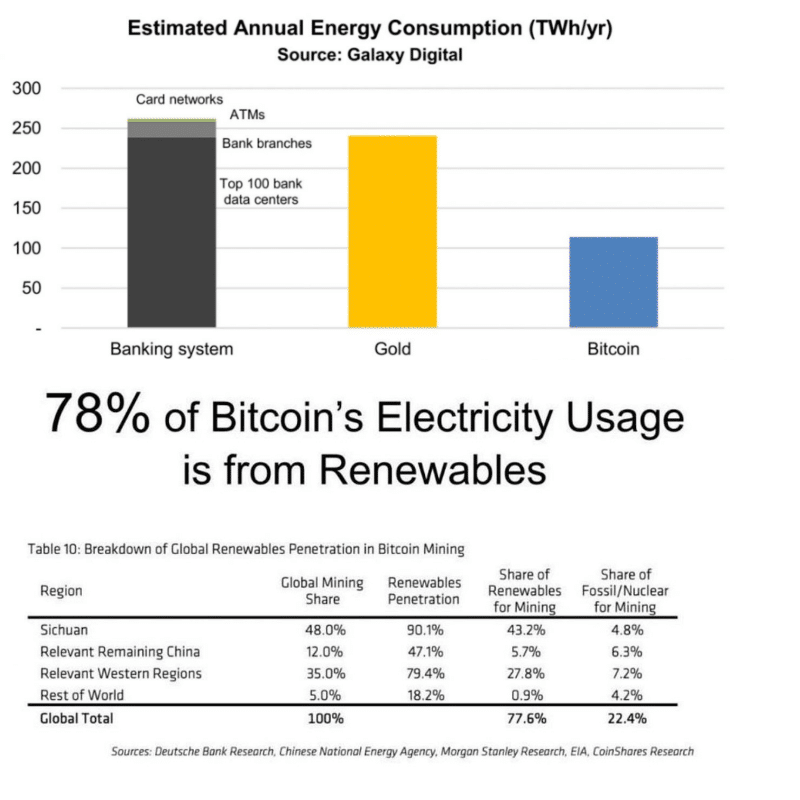

One of the Arguments for Ethereum Becoming “Ultra-Sound” Money is its Decreasing Supply Potential Image via via news.coincu.com There is also a fierce battle raging regarding how eco-friendly crypto mining is and Bitcoin has been placed directly in the crosshairs, coming under harsh attack and scrutiny. Like many crypto enthusiasts, this basic lack of understanding annoyed the heck out of me as many of us found this narrative to be grossly over-hyped and was exaggerated with many claims being far from true as unwarranted FUD was being spread.

Many of the same people who complain about Bitcoin’s energy consumption also run their air conditioners and heaters 24/7, drive cars and hang Christmas lights, using far more energy than Bitcoin mining. Not to mention that global traditional financial institutions use far more energy consumption than Bitcoin mining ever will, but for some reason few people decided to consider that. Be sure to check out our article on why Bitcoin mining energy worries are nothing more than FUD.

The media caused a lot of uninformed people to form an unfairly biased opinion, but I digress. Eco-friendly crypto IS an important topic and I agree that we need to take care of our planet. As Ethereum moves to a proof of stake consensus with the ETH 2.0 upgrade it will be considered to be more, “eco-friendly,” than Bitcoin which will draw more users to the network. Though it is also important to note that Bitcoin is already being mined with mostly renewable resources which is great to see.

Yup, Sure Looks Like Bitcoin Mining is the Problem. Let’s Just Ignore Everything Else That Uses Electricity Image via dailyadent.com and seudinheiro.com

Yup, Sure Looks Like Bitcoin Mining is the Problem. Let’s Just Ignore Everything Else That Uses Electricity Image via dailyadent.com and seudinheiro.com Why Bitcoin Isn’t Going Down Without a Fight

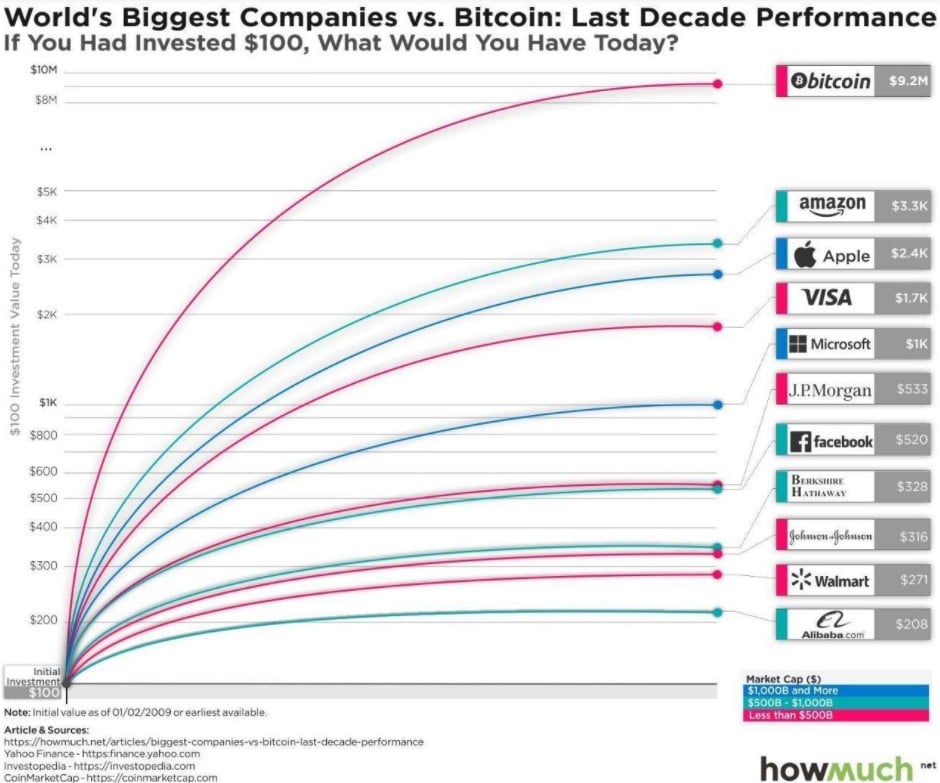

As the fear of inflation in world economies is heating up, investors are flocking to a safe-haven to park their money in and protect their wealth. This undisputed life raft in the digital space has been presented in the form of Bitcoin. We need to remember that the majority of the world still don’t understand the difference between Bitcoin and Ethereum, they just know that they need to park money someplace safe to diversify and they have been presented with Bitcoin as it is the bigger of the two and more of a household name.

Also, Bitcoin holds the title as the best performing asset of the decade so of course, it is turning some heads and gaining a lot of attention in the investment industry as people chase high returns.

Bitcoin takes the cake from an investor standpoint as we have seen many companies such as Tesla, Block (Previously Square), MicroStrategy and Ark Invest add Bitcoin to the company balance sheets. As more and more institutions, firms, and companies look to diversify into digital assets, Bitcoin is the clear winner in this space as it holds the narrative of being the ultimate “digital gold.”

Bitcoin's reputation as an inflation hedge, safe store of value, sound-money, and the apex asset of the human race will inevitably draw more and more institutional capital into the asset. As it stands now, we are not seeing nearly as much interest in Ethereum from an institutional or company viewpoint as we are with Bitcoin.

Figures Like These Drive Institutional Demand for Bitcoin Image via facebook/3commas

Figures Like These Drive Institutional Demand for Bitcoin Image via facebook/3commas Another factor to consider is that Ethereum is at high risk of being overthrown by its competitors and has already lost significant dominance to Ethereum alternatives. There are multiple networks such as Solana, Cardano, Polkadot, Tezos and Avalanche who are superior to Ethereum in many metrics.

Many believe the only reason that Ethereum is still in the lead is simply due to it having a first-mover advantage and attracting the most developer activity from the start, giving it a massive headstart in terms of network effect. I tend to agree with this narrative, if each of those networks launched for the first time tomorrow from scratch, Ethereum would get smoked and left in the dust. Who on Earth would choose ETH with its atrociously high gas fees and slow confirmation times over many of the alternatives?

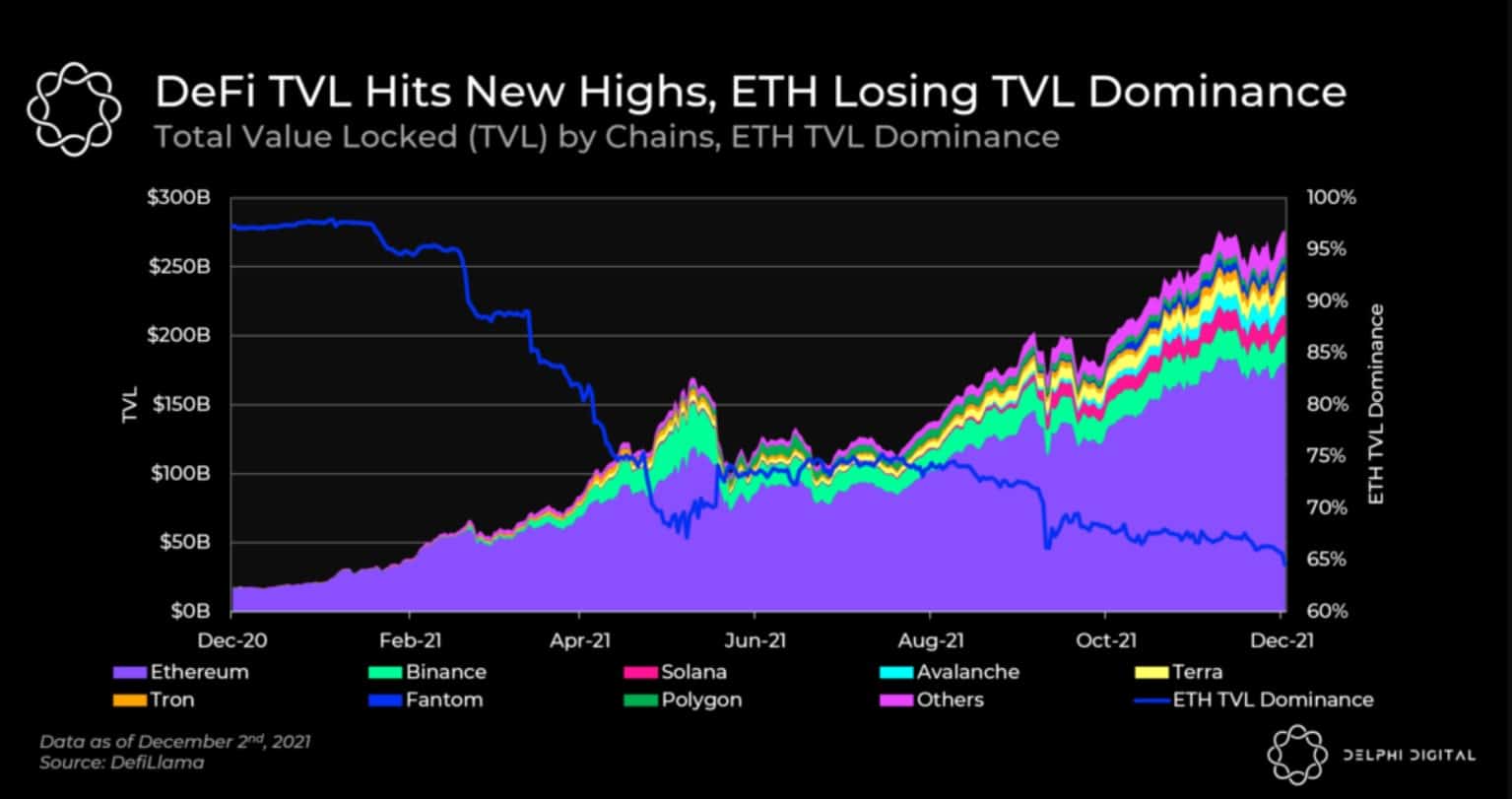

Ethereum is Losing Dominance to Superior Competitors at an Increasing Rate, Will First Mover Advantage and Developer Activity be Enough for ETH? Image via delphidigital.io

Ethereum is Losing Dominance to Superior Competitors at an Increasing Rate, Will First Mover Advantage and Developer Activity be Enough for ETH? Image via delphidigital.io What keeps Ethereum king of the non-Bitcoin layer ones is that it was simply there first and already had early developers building all the utility and features that people needed before its competitors were able to get off the ground. Plus the promise of Eth 2.0 release sometime in 2022 is keeping people encouraged and enthusiastic about Ethereum's Future.

Where Bitcoin has a massive advantage here is that there are really no viable alternatives or competition to Bitcoin in its niche and narrative as being the ultimate store of value. ETH has challengers looking to take the title while Bitcoin remains unchallenged unless you consider that Ethereum could someday do what Bitcoin does but better which is a possibility.

Bitcoin Has Far More Trust

ETH being referred to as “Ultra-Sound,” money was a direct shot at Bitcoin, a boasting reference from Eth enthusiasts who feel that ETH is a better store of value and has a better monetary policy to Bitcoin. Where many would disagree with the “Ultra-Sound” claim is that Bitcoin is far more trusted, fortified and battle-tested than Ethereum.

Bitcoin’s monetary policy is more credible and set in stone, everyone knows exactly what to expect from Bitcoin, and it's monetary metrics are not going to change. Ethereum on the other hand is undergoing experimental changes and there is a risk of failure with the launch of Eth 2.0. Nobody knows what is going to happen to ETH and it could result in a cataclysmic failure of the network as opposed to Bitcoin is just good old Bitcoin.

This concept can sort of be compared to living in a house. Would you prefer living in a house that is already built and good to go with a solid foundation, or live in one where workers are still building walls and putting up a roof that could collapse on you at any time? Bitcoin’s monetary policy will not change at any point in the future, Ethereum is changing as we speak and the future of Ethereum is unknown.

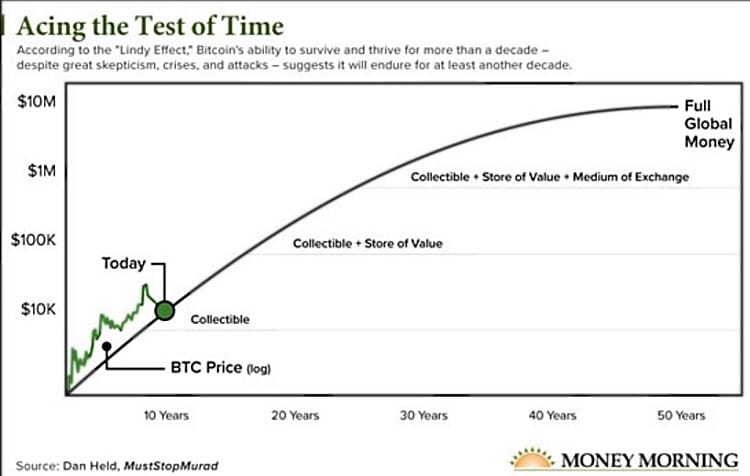

Many Bitcoiners also point to the “Lindy Effect,” which is an important consideration in the tech industry. The Lindy Effect, aka, Lindy’s Law is a theorized phenomenon by which the future life expectancy of a technology is proportional to its current age. The Lindy effect proposes that the longer something has survived, the longer it is likely to exist in the future. In the world of technology, 12 years seems to be a key milestone.

Statistics show that tech that has survived for 12 years has a much higher probability of existing into the future. Bitcoin has existed for 13 years, a very important metric for sure. As ETH implemented EIP-1559 it effectively reset itself and is now 12 years behind Bitcoin, resulting in the credibility of ETH’s monetary policy being reset to 0 by followers of Lindy's Law. This will happen again once ETH 2.0 is rolled out.

The other argument for ETH being “Ultra-Sound” money comes in the argument that it can become deflationary vs Bitcoin being slightly inflationary. This argument can be disputed quite easily as both inflationary and deflationary assets both have pros and cons and just because an asset may be deflationary does not mean it is automatically superior.

Lindy Effect Showing Potential Path for Bitcoin Image via moneymorning.com

Lindy Effect Showing Potential Path for Bitcoin Image via moneymorning.com Bitcoin Development has not Been Idle

Bitcoin is making large strides in terms of development with the rollout of the lightning network which overcomes Bitcoin’s limitations of slow transaction speeds and a low TPS. It also enjoyed the taproot upgrade in 2021 which attaches multiple signatures and transactions together, making it easier and faster to verify transactions. Taproot was crucial in allowing the Bitcoin network to scale, providing greater efficiency and privacy on the network and even unlocks the potential for smart contract and NFT functionality which could be a real game-changer.

We cannot talk about Bitcoin development without also mentioning the Stacks (STX) protocol which works with the Bitcoin network to unlock its full potential. Without getting into too much detail, Stacks is what will enable much of the DeFi, NFTs, apps, Metaverses and smart-contracts on Bitcoin. Stacks is also what made it possible for cities like Miami to become the first city to roll out their MiamiCoin powered by the Stacks protocol as it enabled smart-contracts on Bitcoin

Stacks Unleashes Bitcoin’s Potential Image via stacks.co

Stacks Unleashes Bitcoin’s Potential Image via stacks.co Metaverse, NFTs and DeFi Smart-Contracts on Bitcoin?

There has been developer activity and projects working on DeFi platforms, NFT applications, and even a Metaverse on the Bitcoin network. Many Bitcoin maximalists feel that it is only a matter of time until Bitcoin can do everything that Ethereum can do, and when that happens all other cryptocurrencies will simply fail and crumble as Bitcoin will be the only token and network needed.

I have my doubts on that, though if Bitcoin could do everything Ethereum can do someday, would we bother with both? While I believe in a multi-chain future, Bitcoin having all the functions of Ethereum would certainly be interesting and would likely take much of the market share away from ETH. In this scenario, I believe that they would likely exist side by side like a Coca-Cola and Pepsi scenario. In the unlikely scenario that Bitcoin is able to become a serious Ethereum competitor and perform all the same functions before Ethereum flips Bitcoin then I think it is highly unlikely that a flippening would ever happen.

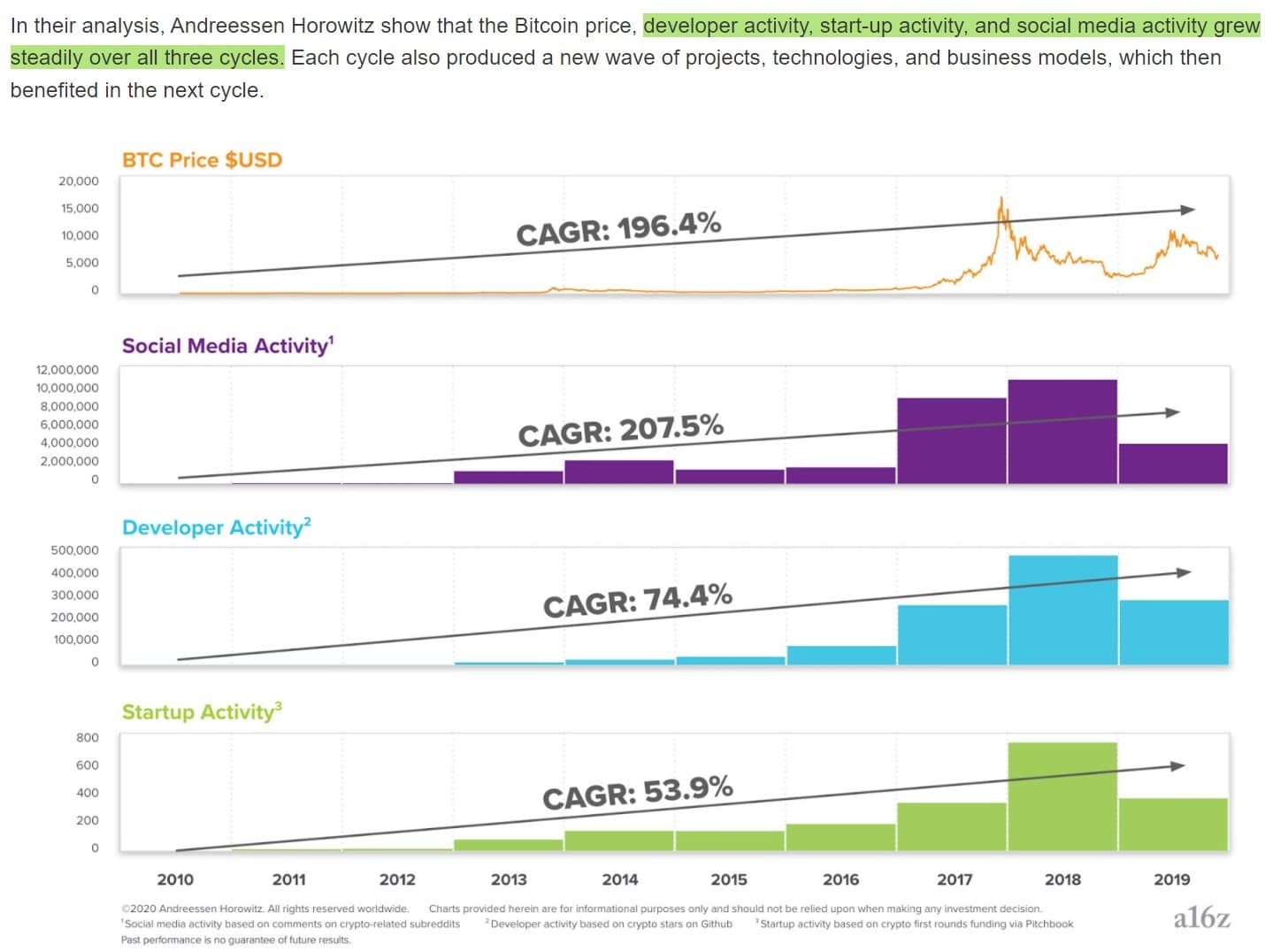

Metrics Showing Consistent Bitcoin Growth Across Developer, Social Media, and Startup Activity Image via invao.org

Metrics Showing Consistent Bitcoin Growth Across Developer, Social Media, and Startup Activity Image via invao.org Jack Dorsey, the Twitter Co-Founder and now CEO of Block has made it his life’s mission to bring DeFi protocols to Bitcoin and if anyone can do it, it’s certainly him with recent news of him integrating Bitcoin payments into Twitter and bringing the Lightning network to the CashApp. Other key players in the “Bitcoin will remain king,” camp are the likes of Michael Saylor, CEO of MicroStrategy, Saifedean Ammous, economics professor and author of the book The Bitcoin Standard, and Max Keiser, former Wall Street veteran.

Bitcoin Adoption is Unrivalled for “No-Coiners”

It is true that Ethereum adoption is outpacing Bitcoin adoption for those within the crypto space. For anyone seeking out crypto niches like DeFi, Metaverse, Blockchain Gaming and NFTs, yes, Ethereum is an unmatched Titan. But remember that there are WAY more no-coiners out there and they are adopting Bitcoin far faster than Ethereum.

Look no further than entire cities like Miami and New York launching city tokens on Stacks which works in conjunction with Bitcoin, and we are seeing a growing number of politicians, athletes and the general population asking to be paid in Bitcoin. Nobody is talking about being paid in Ethereum, no entire cities are launching coins on Ethereum, and with the gas prices, it’s no wonder. Bitcoin is the ultimate, “gateway crypto,” that is bringing the masses into the world of crypto.

Increasing Number of People are Wanting Their Salary in Bitcoin Image via ktvz.com

Increasing Number of People are Wanting Their Salary in Bitcoin Image via ktvz.com Tools such as Google search trends support the narrative that average people are trying to learn more about Bitcoin as it has become the common crypto household name. Ethereum and every other crypto….Aside from Dogecoin perhaps, are still relatively unknown to the wider population. Think of the people in your personal circle, for me, my grandmother, father, and mother all know that there is something called, “Bitcoin,” and has a rough idea of what it is.

The same cannot be said for Ethereum. If this trend continues and Bitcoin remains the number one coin at the forefront of the average person’s understanding of crypto, Ethereum will have a very hard time flipping it anytime soon.

Closing Thoughts

There are many arguments for both side of “the flippening” concept. It truly is a very fascinating race to watch play out. I often imagine crypto like a racetrack where Ethereum had a head start and is closer to the finish line over ETH competitors, but faster cars are now on the track and gaining, and it is anyone’s guess as to who will reach the finish line first. I think of Bitcoin vs ETH in the same way, but they are racing on different tracks that may or may not overlap in the future. It is possible for ETH to flip Bitcoin in 2022 but I really think it is highly dependent on mainstream crypto adoption itself.

If global crypto adoption rate slows down to a halt, and the only crypto dabblers that are left are those of us already here then I could easily see ETH flip Bitcoin in 2022 as once you have drank the Crypto Kool-Aid and you’re in it, many of us agree that Ethereum’s utility and everything being built on it will lead to an inevitable passing of Bitcoin. Though this is all dependent on how fast development happens on the Bitcoin network and an even bigger factor to consider is how fast the world adopts crypto. We need to consider the rate in which “no-coiner,” institutions, companies and individuals become “coiners.”

If that rate increases rapidly then Ethereum will stand no chance at a flipping in the short term as everyone is going to dip their toes into Bitcoin first and those, “toes,” from institutions could come in the form of hundreds of billions, if not trillions of dollars if large banks, institutions, and the top 1% of the world elite decide that they all want exposure to Bitcoin. Ethereum will not be able to keep pace in that scenario in my opinion as many of these people will likely have little understanding nor care about Ethereum and will mostly focus on BTC exposure.

Though many of you may disagree which I totally understand as it is fathomable to think that NFTs, DeFi, Metaverses and Blockchain gaming is ultimately what will onboard the masses. I guess it comes down to where is more money going to come from? Institutions and whales wanting Bitcoin exposure or the billions of us "minnows" who want access to all the utility of Ethereum.

It really comes down to opinion and what you think will grow first and the fastest. Is there a greater demand for the future of the internet and infrastructures that make up our lives, or the need for a more robust and secure global monetary system, and how close is each network to achieving that ultimate and final narrative?