It has only been 15 years since the launch of the Bitcoin network in 2009, yet the progress made in blockchain technology within this relatively short period is nothing short of revolutionary. Originally conceived as a simple distributed ledger for peer-to-peer transactions, blockchain has since evolved into the foundation of what we now refer to as Web3 — a new era of the internet characterized by decentralization, transparency and user empowerment.

Today, web3 is far more than just a financial system. It represents a vast, decentralized compute layer comprising hundreds of blockchains, each functioning as a state machine. These state machines are not merely about processing transactions; they handle complex programs, manage vast amounts of information, and enable seamless value exchanges between users worldwide.

The vibrant and diverse ecosystem has over 54 million active addresses participating in various activities beyond traditional finance. People are engaging in gaming, purchasing and trading NFTs, building and fostering online communities, storing data securely, communicating across decentralized networks, and exploring countless other possibilities that were once inconceivable.

The rapid pace of innovation in blockchain did not happen overnight. It results from numerous technological advancements, fundamentally altering how blockchains are designed, deployed, and utilized. From the simple transactional network of Bitcoin to the smart contract platforms of Ethereum and now to today's scalable, interoperable, and privacy-focused blockchains, the evolution has been driven by the need to address challenges, meet growing demands, and explore new use cases.

This article will take a closer look at the evolution of blockchain networks, tracing the key developments that have shaped the industry from its inception to the present day. We will also venture into the future of blockchain technology, exploring the potential advancements that could further transform how we interact with digital systems.

If you need to refresh your basics before heading into these concepts, check out our beginner's guide to blockchain technology.

How Blockchain Networks Evolve

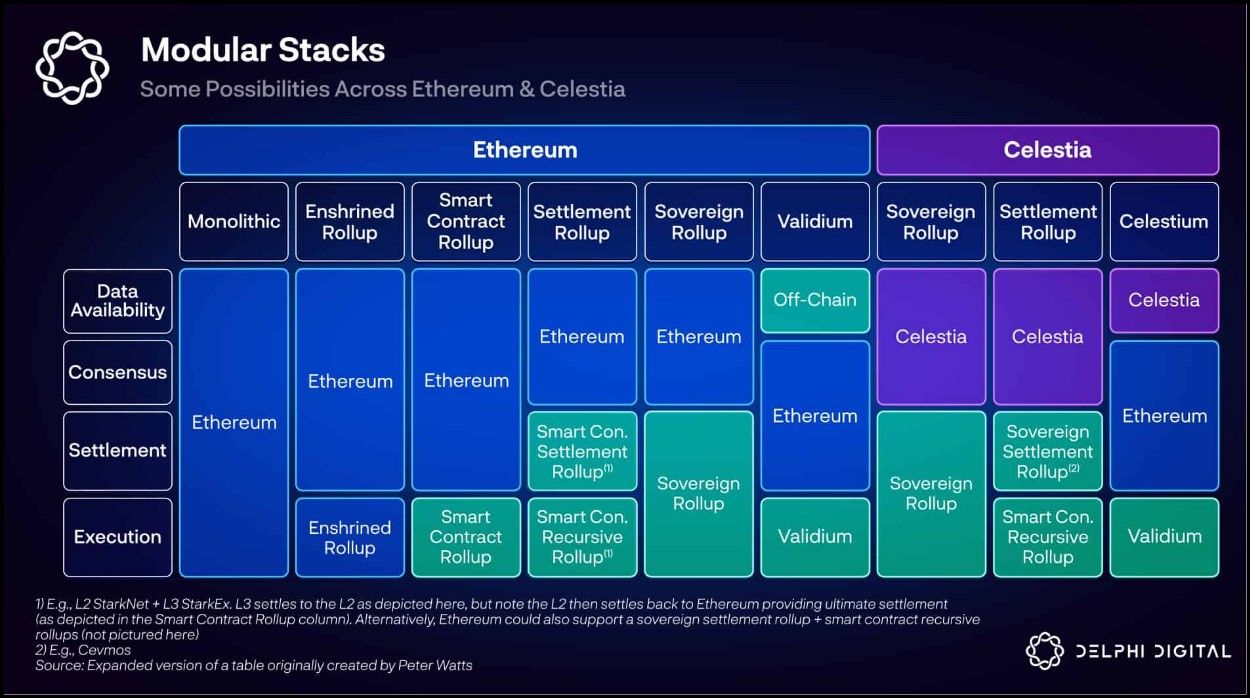

Blockchain networks are intricate systems that function through the interaction of four essential layers: Data Availability, Consensus, Settlement, and Execution. Each of these layers plays a crucial role in ensuring that a blockchain operates efficiently, securely, and in a decentralized manner.

Over the years, innovations in blockchain technology have primarily focused on enhancing these layers — whether by making them faster more efficient, or by integrating them with external modular systems. Understanding these layers is critical to grasping how blockchain networks evolve and adapt to meet the growing demands of users and developers alike.

Modular Layers Inspire New Blockchain Designs | Image via Delphi Digital

Modular Layers Inspire New Blockchain Designs | Image via Delphi DigitalData Availability (DA)

Data availability is the backbone of any blockchain network, and it is responsible for ensuring that all necessary data for validating transactions is accessible to the network participants. Without proper data availability, nodes in a blockchain would not be able to verify transactions, which could lead to inconsistencies and vulnerabilities in the system. Traditionally, blockchains handled data availability within their networks, but as the demand for scalability and efficiency grew, so did the need for specialized solutions.

Today, we see the rise of modular blockchains specifically designed to optimize data availability for other blockchain networks. These modular blockchains, such as EigenLayer and Celestia, excel in providing high-speed data availability services. They offer actively validated services (AVS), ensuring that the data is stored efficiently and actively validated across the network. This allows other blockchains to offload their data availability needs to these specialized networks, improving overall performance and scalability.

Consensus

The Consensus layer is the core mechanism that ensures all participants in a blockchain network agree on the state of the ledger. This layer determines how transactions are validated and added to the blockchain, making it crucial for maintaining the network's integrity and security. Over the years, several consensus protocols have been developed, each with unique characteristics tailored to different use cases.

The most well-known consensus mechanisms include Proof of Work (PoW), which underpins Bitcoin and relies on computational power to secure the network, and Proof of Stake (PoS), which is used by networks like Ethereum 2.0, where validators are chosen based on the amount of cryptocurrency they hold and are willing to "stake."

Other consensus mechanisms, such as Delegated Proof of Stake (DPoS) and Proof of Authority (PoA), offer variations that prioritize speed, energy efficiency, or centralization to different degrees, depending on the specific requirements of the blockchain network. Innovations in consensus protocols remain a focal point for developers as they seek to enhance security, reduce energy consumption, and increase transaction throughput.

Settlement

The Settlement layer is where transactions are finalized and recorded on the blockchain, making it critical to ensure that transactions are permanent and irreversible. In recent years, the blockchain landscape has seen the emergence of modular settlement layers and the use of existing networks like Ethereum as a settlement layer for other blockchains. This modularity allows for greater flexibility and efficiency in settling transactions across different blockchains.

Technologies such as fraud proofs and validity proofs, including zero-knowledge proofs (ZKPs), have significantly improved the efficiency and security of on-chain settlements. These technologies enable transactions to be verified without revealing sensitive information, ensuring privacy while maintaining trust. By decoupling the settlement layer from the other layers, developers can create more specialized and efficient settlement solutions that cater to the unique needs of different blockchain applications.

Execution

The Execution layer is responsible for processing transactions and running smart contracts, making it the engine that drives the functionality of decentralized applications (DApps) on the blockchain. As blockchain networks have evolved, there has been a growing emphasis on decoupling the execution layer from the other layers to achieve greater scalability and throughput.

Ethereum's Layer 2 ecosystem is a prime example of this approach. By separating execution from the consensus and settlement layers, Layer 2 solutions such as rollups enable Ethereum to handle a much higher volume of transactions without compromising security or decentralization. This modular approach to execution allows developers to innovate rapidly, creating more efficient and scalable Dapps that can operate seamlessly across various blockchain networks.

In summary, the evolution of blockchain networks is driven by continuous innovations across these four layers. By improving data availability, refining consensus mechanisms, optimizing settlement processes, and decoupling execution, developers are pushing the boundaries of what blockchain technology can achieve. These advancements enhance the performance and scalability of existing networks and pave the way for new applications and use cases that were previously unimaginable.

Blockchain 1.0: The Bitcoin Network

The blockchain industry began with the launch of the Bitcoin network in 2009, marking the birth of a revolutionary technology that would forever change the way we think about money and financial systems. The Bitcoin network was the first distributed ledger to leverage blockchain technology to create a decentralized digital currency known as Bitcoin (BTC). This innovation introduced a financial system that operates independently of centralized authorities like banks or governments, offering a secure, transparent, and immutable way to transfer value over the Internet.

Decentralized Digital Currency

At the heart of the Bitcoin network is the concept of a decentralized digital currency. Unlike traditional currencies, which are issued and controlled by central banks, Bitcoin is created and managed by a network of nodes spread across the globe. These nodes work together to validate and record transactions on a public ledger known as the blockchain. This decentralized structure ensures that no single entity controls the currency, making it resistant to censorship, fraud, and manipulation.

Bitcoin is Considered the New Gold. Image via Shutterstock

Bitcoin is Considered the New Gold. Image via ShutterstockBitcoin's decentralized nature is one of its most significant innovations. It allows individuals to send and receive money directly from one another without relying on intermediaries. This peer-to-peer system is powered by cryptographic principles, ensuring that transactions are secure and that the supply of Bitcoin is limited to 21 million coins, a feature embedded in its code to create scarcity and maintain value over time.

The Role of Satoshi Nakamoto

The creation of Bitcoin and its underlying technology is attributed to an individual or group known as Satoshi Nakamoto. In 2008, Nakamoto published the Bitcoin whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System," which outlined the principles and mechanics of the Bitcoin network. The whitepaper described a novel way to achieve consensus in a decentralized network through Proof of Work (PoW). This innovation solved the long-standing double-spending problem in digital currencies, ensuring that each Bitcoin could only be spent once.

Satoshi Nakamoto Remains Anonymous To This Day | Image via Forbes

Satoshi Nakamoto Remains Anonymous To This Day | Image via ForbesSatoshi Nakamoto's vision for Bitcoin was to create a digital currency that would operate independently of any central authority, providing people with a way to transfer value without relying on traditional financial institutions. Nakamoto's identity remains unknown, but their contribution to finance and technology is undeniable, as Bitcoin laid the groundwork for the entire blockchain industry.

What is Blockchain 1.0?

A Blockchain Transaction | Image via Geeksforgeeks

A Blockchain Transaction | Image via GeeksforgeeksBitcoin marked the first generation of blockchain technology, often called Blockchain 1.0. The primary purpose of the Bitcoin network is to support a decentralized digital currency. Unlike later generations of blockchain networks, which have expanded functionality, the Bitcoin network is designed with a narrow focus: to transfer and record transactions of Bitcoin securely. This design choice reflects the original intent of the network, which is to be a reliable, secure, and immutable ledger for digital currency transactions.

Data Availability

The Bitcoin network manages data availability through a peer-to-peer (P2P) system. Nodes within the network share information about transactions with one another, ensuring that all nodes have access to the same data. This sharing process is essential for verifying the validity of transactions and maintaining the integrity of the blockchain. When a Bitcoin transaction occurs, it is broadcast to the network, where nodes verify it by checking the sender's balance and confirming that the transaction adheres to the network's rules.

Consensus

The Bitcoin network uses the Proof of Work (PoW) consensus protocol to achieve agreement among its participants. In PoW, miners compete to solve complex mathematical puzzles, and the first one to solve the puzzle gets the right to add a new block of transactions to the blockchain. This process secures the network and ensures that all nodes agree on the state of the ledger. PoW is energy-intensive, requiring significant computational power, but it has proven to be highly effective in maintaining the security and decentralization of the Bitcoin network.

Settlement

The nodes settle in the Bitcoin network as they validate and record transactions on the blockchain. Once a transaction is included in a block and added to the blockchain, the transaction is considered settled. This settlement process ensures that transactions are final and cannot be reversed, providing the immutability that is a hallmark of blockchain technology. The decentralized nature of this process means that no single entity can alter the transaction history, making Bitcoin a secure and trustworthy system for transferring value.

Execution

The Bitcoin network does not have a dedicated execution layer, as it does not support the execution of complex smart contracts or programmable logic. Its sole function is to update the transaction ledger by recording Bitcoin transfers between addresses. The network's design is intentionally limited to this purpose, so it does not require a separate execution layer. Instead, the state of the Bitcoin blockchain is updated as each new block is added, reflecting the latest transactions and balances.

Conclusion

The scope of Blockchain 1.0, as exemplified by the Bitcoin network, is intentionally limited. While it excels at providing a secure and decentralized platform for transferring and storing value, it cannot execute arbitrary logic or support complex applications. Additionally, the consensus mechanism used by Bitcoin, Proof of Work, is resource-intensive and poses scalability challenges, as the need for computational power constrains the network's capacity.

The next phase of blockchain evolution began with the realization that blockchain technology could be used for more than just a distributed ledger. Developers started exploring the idea of building a layer that could execute arbitrary functions, allowing for programmability and the creation of decentralized applications. This exploration led to the emergence of Blockchain 2.0, where the focus shifted from simple value transfer to enabling smart contracts and state machines, setting the stage for a new era of blockchain innovation.

Blockchain 2.0: State Machines and Smart Contracts

The launch of the Ethereum network in 2015 marked a significant milestone in the evolution of blockchain technology, heralding the dawn of Web3. While Ethereum shared many similarities with Bitcoin, such as being a proof-of-work distributed ledger that recorded transactions in its native currency, Ether introduced a transformative concept that set it apart: the blockchain as a state machine. This innovation expanded the potential of blockchain networks beyond simple value transfer, enabling them to perform arbitrary computations and support complex applications.

What is Blockchain 2.0?

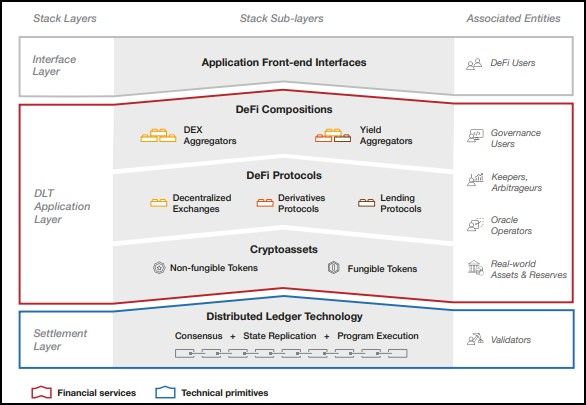

Blockchain 2.0 represents the evolution of blockchain networks from mere distributed ledgers to decentralized computers — state machines capable of executing a wide range of operations. The Ethereum network is the quintessential example of this new generation of blockchain technology, where the network's functionality extends beyond recording transactions to include processing and executing code, allowing for the creation of decentralized applications (DApps) and smart contracts.

Ethereum Enables DeFi | Image via BIS Working Papers

Ethereum Enables DeFi | Image via BIS Working Papers Critical Components of the State Machine

State

In the context of the Ethereum blockchain, the state represents all the information stored on the network, including account balances, the storage of smart contracts, and other relevant data. The state is a dynamic entity that evolves as new transactions are processed and new blocks are added to the blockchain. It is the collective memory of the Ethereum network, capturing the entire history and current status of all accounts and smart contracts.

State Transition

State transition is the process by which the state of the blockchain is updated. This process takes the current state, a set of transactions and operations from the new block, and other parameters such as gas fees as inputs and produces a new state as the output. The state transition function ensures that all operations are executed according to the rules of the Ethereum protocol, thereby maintaining the consistency and integrity of the blockchain.

EVM (Ethereum Virtual Machine)

The Ethereum Virtual Machine (EVM) is the computational engine that drives the state transitions on the Ethereum network. It acts like an operating system, executing the code of smart contracts, managing the state transitions, and ensuring that all operations are performed according to the network's consensus rules. The EVM is Turing-complete, meaning it can execute any computation that can be performed by a general-purpose computer, which is crucial for supporting the wide range of applications that run on Ethereum.

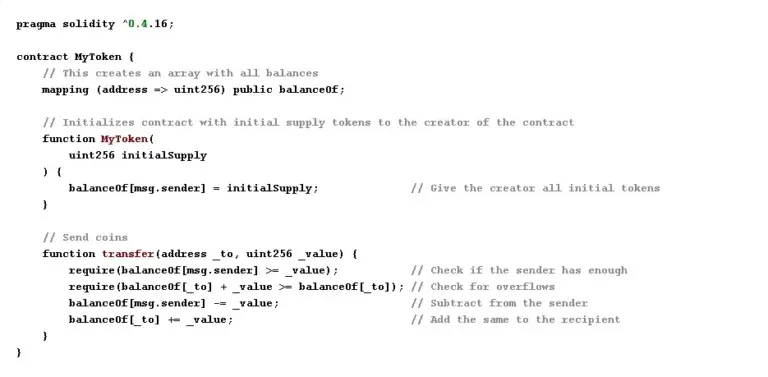

Smart Contracts

Smart contracts are the building blocks of decentralized applications on the Ethereum network. They are self-executing contracts with the terms of the agreement directly written into code. Once deployed on the blockchain, smart contracts automatically execute when the conditions encoded within them are met. This innovation paved the way for a new era of decentralized applications, allowing developers to create autonomous, trustless applications that run on the blockchain without intermediaries.

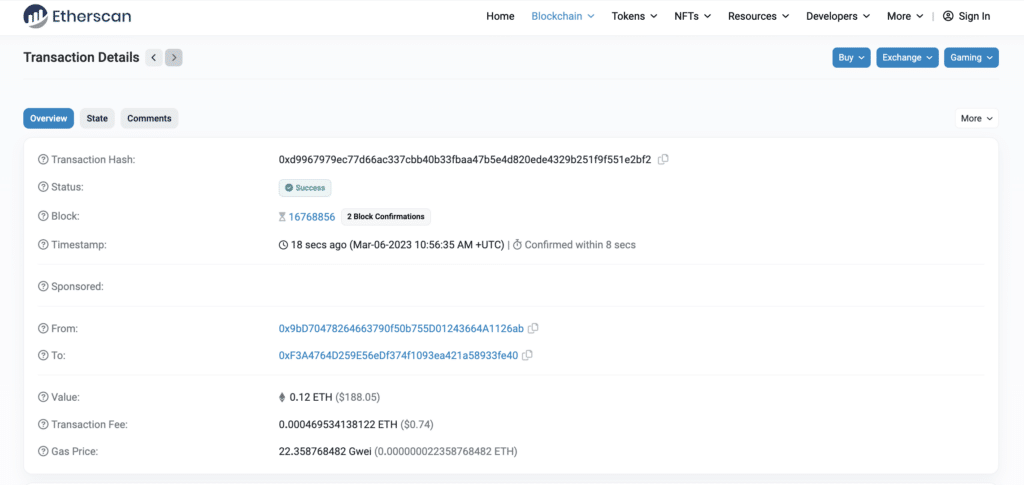

What an Ethereum Transaction Looks Like on the Blockchain Explorer. Image via Etherscan

What an Ethereum Transaction Looks Like on the Blockchain Explorer. Image via Etherscan Smart contracts revolutionized the blockchain space by enabling DApps that could operate across various use cases, from decentralized finance (DeFi) and gaming to supply chain management and identity verification. These DApps leverage the blockchain's security, transparency, and immutability, making them a powerful tool for creating decentralized systems resistant to censorship and fraud.

A Sample Smart Contract Code | Image via Ethereum

A Sample Smart Contract Code | Image via EthereumData Availability and Consensus

In Ethereum, data availability (DA) and consensus mechanisms initially remained similar to those of Bitcoin. Nodes on the network share transaction data and participate in the consensus process to validate and add new blocks to the blockchain. However, a significant update to this design came with Ethereum 2.0, where the network transitioned from Proof of Work to Proof of Stake. This shift improved the efficiency and scalability of the network by reducing the energy consumption associated with mining and enabling a more scalable approach to achieving consensus.

Settlement

The settlement layer in Ethereum is where the results of transactions and smart contract operations are calculated and finalized. This layer ensures that all transactions are valid and that the state transitions resulting from smart contract execution are accurately recorded on the blockchain. The settlement process in Ethereum is more complex than in Bitcoin, as it involves verifying simple transactions and ensuring that the execution of smart contracts adheres to the network's rules.

Execution

The execution layer in Ethereum is where the EVM operates, functioning like an operating system that executes smart contracts, decentralized applications, and transactions. This layer is what sets Ethereum apart from earlier blockchains like Bitcoin. By enabling the execution of arbitrary code, Ethereum allows for a much broader range of applications to be built on its platform, effectively turning the blockchain into a global decentralized computer.

The Impact of Blockchain 2.0

The innovations introduced with Blockchain 2.0, particularly the advent of smart contracts and state machines, have fundamentally transformed the blockchain industry. These developments enabled the creation of decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), and countless other applications that have reshaped the digital landscape. Blockchain 2.0 laid the foundation for a decentralized internet — Web3 — where users have greater control over their data and interactions.

Conclusion

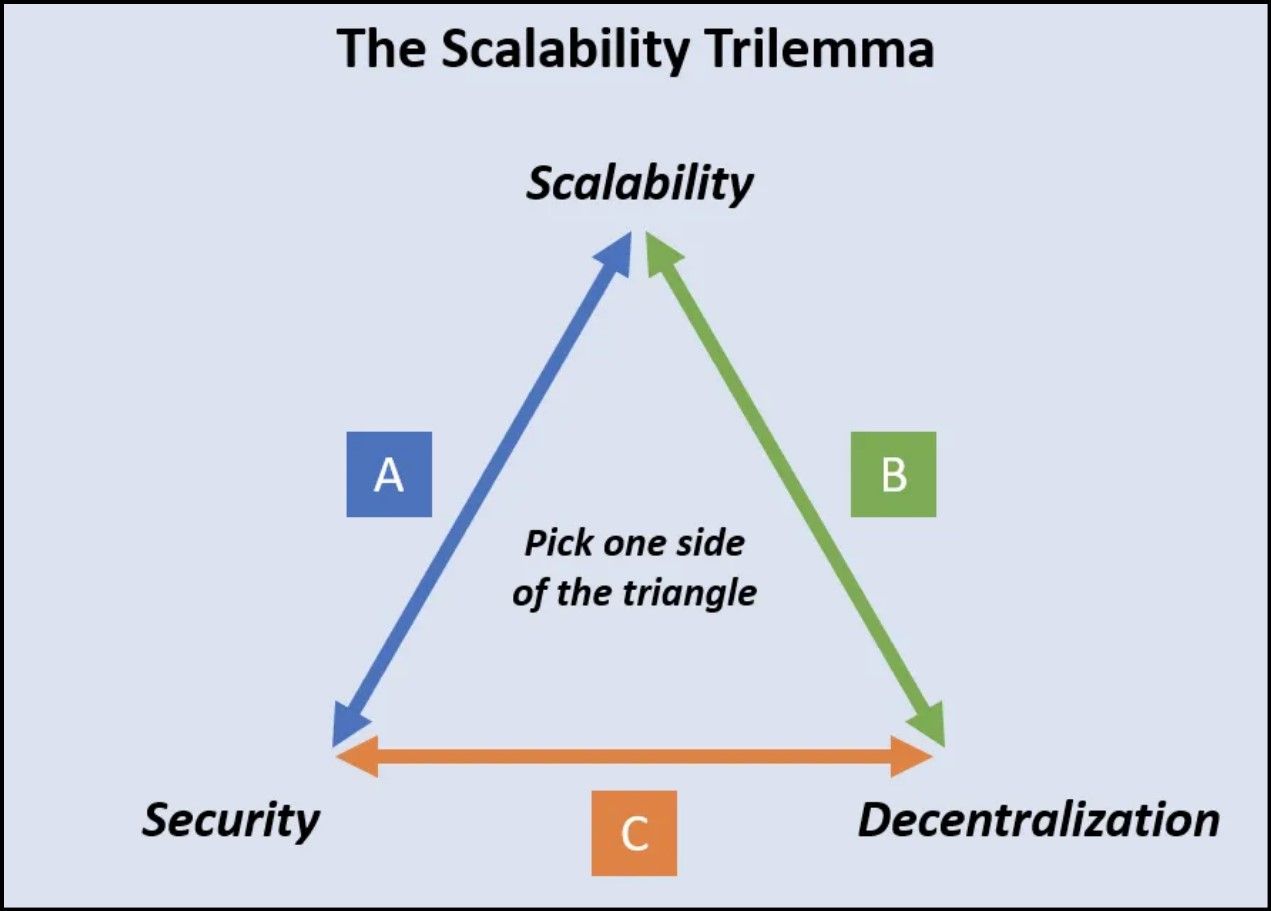

The Scalability Trilemma | Image via Medium

The Scalability Trilemma | Image via MediumHowever, as blockchains become more capable and complex, a new challenge emerged: the scalability trilemma. It refers to the problematic balance between achieving scalability, security, and decentralization in blockchain networks. As Ethereum and other smart contract platforms grew in popularity, they faced increasing pressure to scale while maintaining their decentralized nature and security. This challenge inspired the next phase of blockchain evolution — the modular blockchain thesis — where networks are designed to address scalability through specialized layers and modular components.

Age of Modular Blockchain Networks

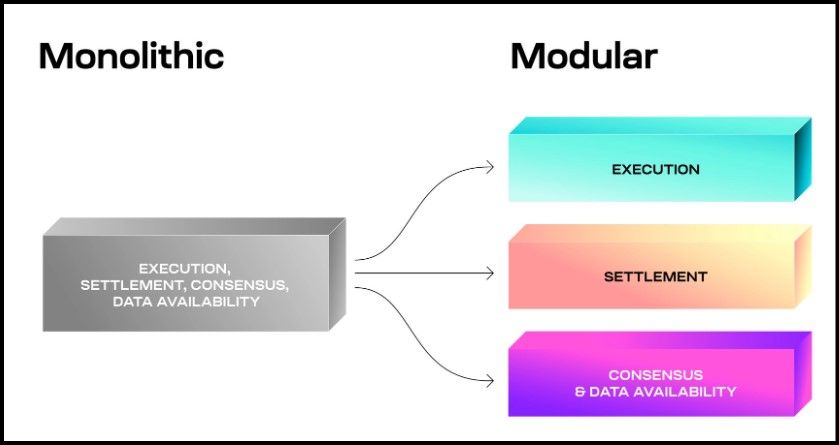

As the blockchain industry evolved, it became clear that monolithic blockchain networks — those that handle all core functions such as Data Availability (DA), Consensus, Settlement, and Execution within a single chain — were increasingly running into scalability issues.

These issues stem from hardware and network capacity limitations, leading to scalability trilemma. The modular blockchain thesis emerged by suggesting that these core tasks be decoupled into separate, specialized networks, each focusing on a specific function. This modular approach promises significantly higher scalability and performance than traditional monolithic networks.

What are Modular Blockchains?

Modular blockchains are networks designed to focus on specific aspects of the blockchain stack — such as DA, Consensus, Settlement, or Execution — rather than attempting to handle all tasks in a single chain. This specialization allows for configurations that prioritize different aspects, such as security, throughput, or decentralization, depending on the specific needs of the use case.

Modular Chains Decouple Core Tasks | Image via Celestia

Modular Chains Decouple Core Tasks | Image via CelestiaDifferent Modularity Configurations: Security vs. Throughput

Modular blockchains can be configured to enhance security by relying on a robust layer for DA, consensus, and settlement, or they can maximize throughput by offloading heavy tasks like execution to specialized layers. This flexibility enables developers to design blockchain networks tailored to specific use cases, balancing the trade-offs inherent in the scalability trilemma.

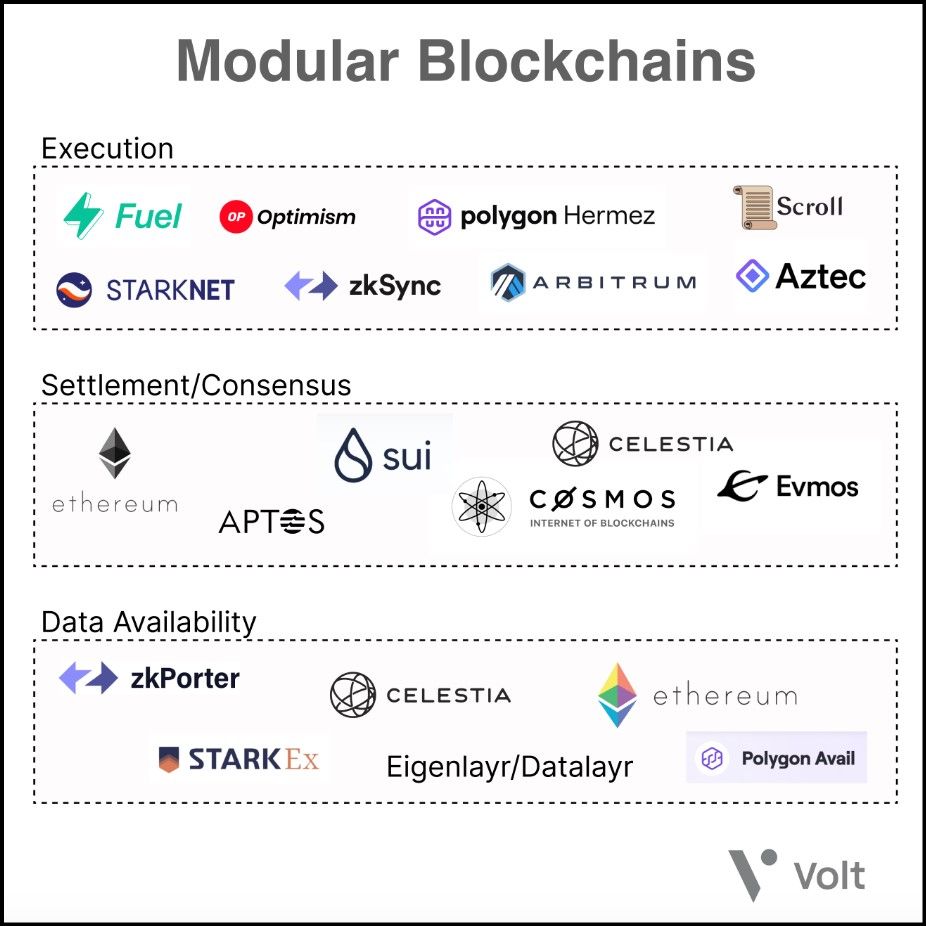

Ethereum Layer 2 Ecosystem: A Case Study in Modularity

The Ethereum Layer 2 (L2) ecosystem is perhaps the most successful example of modular blockchain networks. L2 solutions, such as rollups, are designed to handle execution — processing transactions and smart contracts — while relying on Ethereum's mainnet for other critical tasks like Data Availability, Consensus, and Settlement.

How L2s Work

- Execution through Sequencers: L2 networks employ sequencers to manage and order transactions off-chain. These transactions are then bundled together and periodically posted to the Ethereum mainnet, which provides the ultimate settlement and consensus. This design allows L2s to process a high volume of transactions quickly and at a lower cost while still benefiting from the security and decentralization of Ethereum's mainnet.

- Benefits of This Design: The modular approach of L2 solutions brings several advantages, including reduced congestion on the Ethereum mainnet, lower transaction fees, and increased transaction throughput. Prominent examples of L2 solutions include Optimism, Arbitrum, and ZKsync, each offering unique approaches to scaling Ethereum while maintaining compatibility with the mainnet.

Validium

Another modular configuration is found in Validium chains, which handle both Data Availability and Execution while relying on a Layer 1 (L1) blockchain for Settlement and Consensus. The Polygon zkEVM Validium is a notable example of this approach. By decoupling DA from the main chain, Validium chains can significantly increase throughput by lifting the storage burden from the L1. However, this design also requires the L2 to secure liveness guarantees through external mechanisms.

Sovereign Rollups

Sovereign rollups are L2 chains that manage both Execution and Settlement themselves while outsourcing Data Availability and Consensus to an L1 blockchain. The Celestia network is a pioneer of this approach, allowing rollups to retain sovereignty, meaning they can hard fork without disrupting compatibility with the L1. This modular settlement layer grants these rollups greater flexibility and independence, making them an attractive option for developers seeking to build highly customized blockchain solutions.

Different Modularity Projects | Image via Volt Capital

Different Modularity Projects | Image via Volt CapitalThe Resource Efficiency of Modularity

One of the significant advantages of modular blockchain networks is their resource efficiency. Modular blockchains can pool resources more effectively by decoupling core functions and specializing networks, leading to greater overall efficiency and resilience.

For instance, projects like Celestia and EigenLayer allow new blockchain projects to use a common Data Availability layer, pooling staking resources and utilizing common hardware through Actively Validated Services (AVS). This strategy makes the network more resilient by unifying resources and reducing the cost of securing the network. The pooled staking resources enhance the security of the DA layer. At the same time, shared hardware lowers operational costs, making it easier for new projects to launch and scale without compromising security.

Summary

The modular blockchain thesis offers a promising solution to the challenges of the scalability trilemma, enabling blockchain networks to achieve higher scalability, security, and efficiency. By decoupling core functions into specialized layers, modular blockchains can better meet the growing demand for on-chain space, which is crucial as the industry continues to expand. This phase of modularity represents where the blockchain industry currently stands, with many of these innovations taking place during the bear market of the last few years.

However, while the modular approach has shown great promise, it has yet to be fully tested in peak network traffic conditions, typically during bull markets. As the industry awaits these stress tests, the focus of upcoming innovations is on improving cross-chain interoperability with aggregated layers, such as the OP Stack and Polygon Supernets, and testing the viability of restaking layers. These advancements will play a crucial role in shaping the next phase of blockchain evolution, further refining and expanding the capabilities of modular networks.

Emerging Trends in Blockchain Network Design

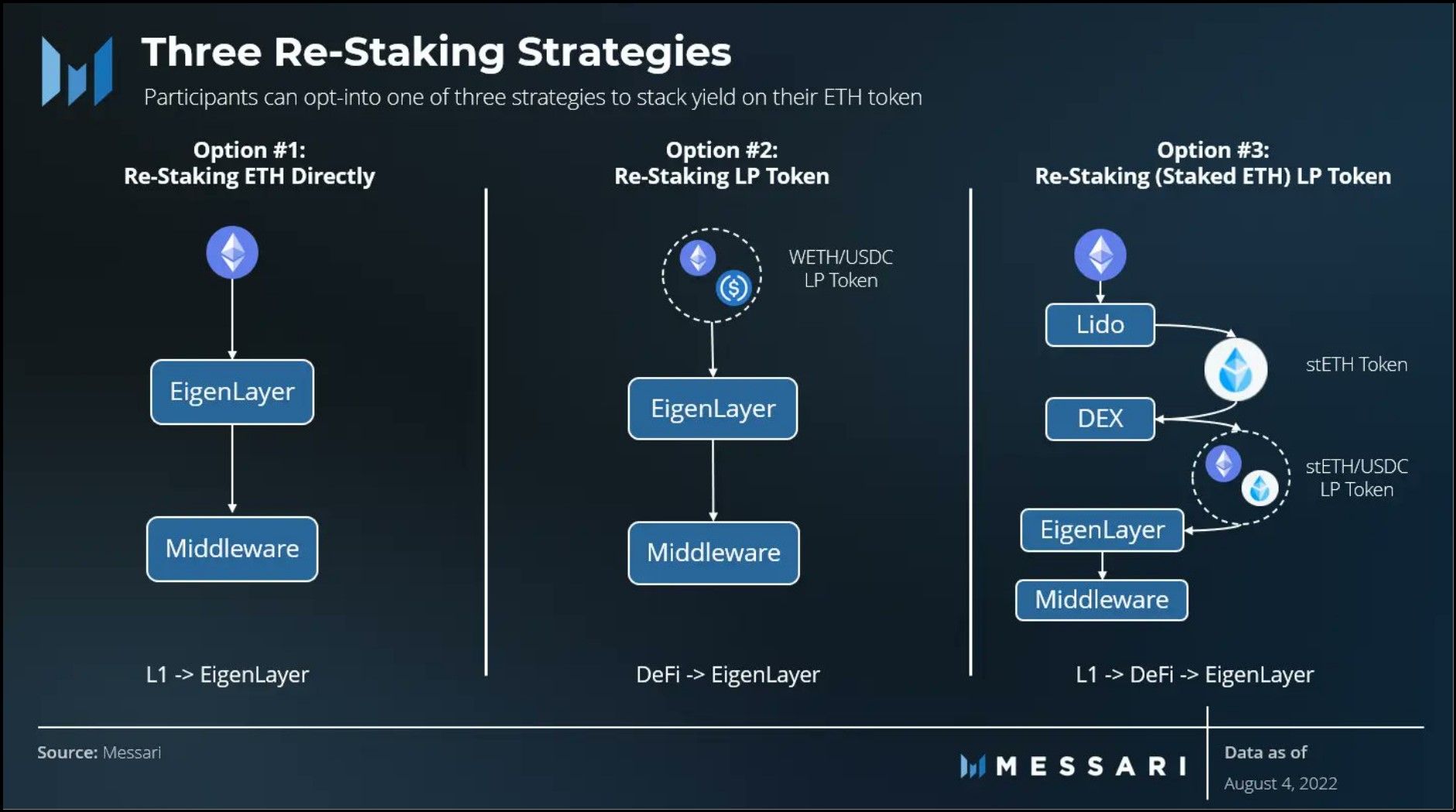

Two significant trends are shaping the future of blockchain network design: restaking on Ethereum and the development of Aggregated Layers (Layer 3).

Restaking on EigenLayer

Restaking on EigenLayer | Image via X

Restaking on EigenLayer | Image via XRestaking on Ethereum is gaining momentum through projects like EigenLayer, which offers innovative restaking services. Restaking allows Ethereum validators to enhance the security and functionality of other networks by restaking their assets, thereby participating in multiple protocols. One of the standout features of EigenLayer is its high data availability (DA) rate of 10 MB/s, which far surpasses Ethereum's native rate of 83.33 KB/s.

This increased capacity is crucial for supporting more complex applications and higher transaction throughput. According to Dune Analytics, EigenLayer's restaking ratio has reached approximately 17%. However, this rapid adoption has sparked concerns about the potential risk of overloading Ethereum's consensus mechanism as validators take on additional responsibilities across multiple networks.

The Aggregation Layer

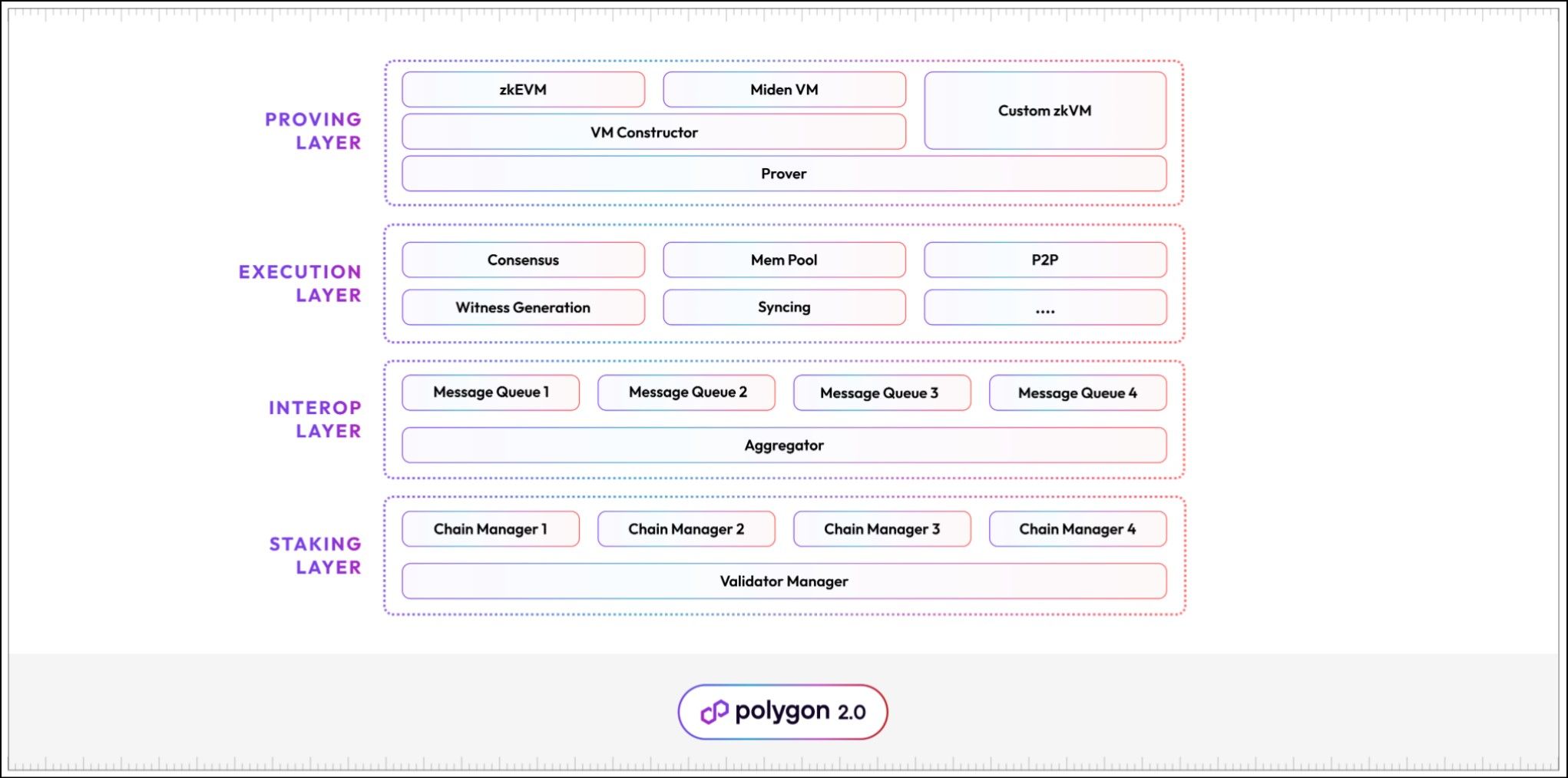

Polygon 2.0 Aggregates Layer Architecture | Image via Polygon Blog

Polygon 2.0 Aggregates Layer Architecture | Image via Polygon BlogAggregated Layers (Layer 3) represent a strategic evolution in blockchain architecture, focusing on the integration and interoperability of Layer 2 networks. Layer 2 solutions like Arbitrum, Optimism, ZKsync, and Polygon have successfully offloaded execution from Ethereum's base layer, enhancing scalability and reducing costs. However, their independent operation has led to heterogeneity, fragmentation, and communication inefficiencies.

Layer 3 addresses these challenges by creating a unified environment where multiple Layer 2 networks can interact seamlessly. It facilitates efficient communication, cross-chain smart contract execution, and resource sharing, effectively integrating these disparate entities into a cohesive system. Rather than being another scalability layer, Layer 3 is an integration layer that bridges Layer 1 and 2, mitigating fragmentation of liquidity and optimizing the use of blockchain space.

Together, these trends drive the evolution of a more robust, scalable, and interconnected blockchain ecosystem.

Evolution of Blockchain Networks: Closing Thoughts

In just 15 years since the inception of the Bitcoin network, the blockchain industry has transformed from a single distributed ledger into a vast, interconnected web of sophisticated blockchain networks. Numerous experiments and innovations occur as the space continues to evolve, particularly within the Web3 ecosystem.

These developments undeniably benefit users, with tangible outcomes such as a 90% reduction in gas costs for Layer 2 transactions on Ethereum following the implementation of protodanksharding. As the industry advances, these innovations are set to make blockchain networks even more efficient, scalable, and user-friendly, ensuring that users continue to reap the rewards of this dynamic and rapidly growing technology.