Few phenomena online capture the essence of digital culture quite like memes — expressions of humour and creativity that have transcended their humble origins to become a cornerstone of online communication.

From viral images to catchy phrases, memes resonate with diverse audiences across the globe. As internet culture continues to evolve, memes have begun to infiltrate new territories, including cryptocurrencies.

Enter the appropriately called memecoins — digital currencies inspired by internet memes that blend humour and blockchain technology.

In this exploration, we embark on a journey through the evolution of memecoins, tracing their trajectory from the emergence of altcoins to the birth of meme-inspired tokens. Along the way, we'll delve into their speculative nature and shine a light on the darker side of memecoins, examining the prevalence of pump-and-dump schemes and rug pulls. Finally, we'll explore the technological advancements that have propelled memecoins into the mainstream.

What is a Meme?

Memes are those funny, relatable things you see all over the internet. They're jokes that everyone's in on, but with a twist — they spread like wildfire! Memes can be anything from hilarious imagery to catchy phrases or even short videos that capture a moment or an idea perfectly.

Can't Get More Relatable Than This. Image via Coindoo

Can't Get More Relatable Than This. Image via CoindooIn today's digital world, memes have become an integral part of internet culture, serving as a means of communication, expression and social commentary. A well-crafted meme wields so much power that even corporate companies have started to use them as a means of advertising.

Memes are always changing and evolving. They start off one way, but as more people share them, they get remixed and reshaped into something new. This constant evolution is what keeps memes fresh and relevant, allowing them to resonate with diverse audiences across the globe.

Platforms like Reddit, Twitter and Instagram are breeding grounds for internet memes, giving rise to viral sensations like "Rickrolling," "LOLCats," and, this may sound familiar, “Doge.”

What Are Memecoins?

Memecoins fuse internet culture and cryptocurrency. As a result, while traditional cryptocurrencies often feature serious or professional imagery, memecoins embrace humour as a core component of their appeal. This is why you come across memecoins with images such as this:

Memecoins Don't Take Themselves Too Seriously. Image via Yahoo Finance

Memecoins Don't Take Themselves Too Seriously. Image via Yahoo FinanceMemecoins are like the class clowns — the jesters of the cryptoverse. They scoff at convention, thumb their noses at tradition, and dance to the beat of their own decentralized drummers. Born from the depths of internet culture, where humour knows no bounds, these digital currencies embody the very essence of irreverence.

Beneath the lulz, however, memecoins represent the convergence of technology and culture. They thrive on the sheer absurdity of their existence, drawing power from the meme magic that permeates the digital landscape. Fuelled by social media hype and propelled by the internet hive mind, these coins can soar to dizzying heights or plummet to the depths of obscurity with a mere tweet.

Memecoins embrace volatility, embodying the speculation that's prevalent in the crypto space. They ride the rollercoaster of market sentiment, leaving traders both giddy with excitement and nervous. In the blink of an eye, a memecoin can skyrocket to the moon or crash back down to Earth, leaving investors scrambling to make sense of the madness.

Today, the memecoin industry has a market cap of over $50 billion, according to CoinGecko.

Origins of Memecoins

Bitcoin introduced us to the concept of a decentralized digital currency, challenging the traditional notions of money, banking and centralized controls. Its distributed ledger system, which records transactions across a network of computers that cannot be altered, solved the age-old problem of trust in money matters.

As Bitcoin rose to prominence, it captured everyone's imagination — technologists, libertarians, average Joes, you name it. Soon it was being compared with traditional safe-haven assets like gold due to its limited supply.

Emergence of Altcoins

As Bitcoin gained traction, it paved the way for alternative cryptocurrencies, or “altcoins” as they're commonly called. Today, the term “altcoins” refers to every cryptocurrency other than Bitcoin.

Altcoins began popping up shortly after Bitcoin's emergence. They sought to build upon Bitcoin's foundation by introducing new features, functionalities, and use cases tailored to specific niches. Altcoins were created for a variety of reasons — higher transaction speeds, more privacy and more environment friendly by choosing proof of stake as the consensus

Litecoin was one of the first altcoins. Launched in 2011 by former Google engineer Charlie Lee and positioned as the "silver to Bitcoin's gold," it offered faster transaction times and lower fees. Then came Ethereum in 2015 and it remains a tour de force in the crypto realm today.

Ethereum pioneered smart contracts, which allowed for the creation of decentralized applications (DApps) and decentralized finance (DeFi), laying the groundwork for a diverse ecosystem built on top of the Ethereum blockchain. As the crypto market continued to expand, so too did the diversity of altcoins. From privacy-focused coins like Monero to utility tokens like Ripple's XRP, each altcoin brought its own unique value proposition and vision for the future of finance.

The Diverse Ethereum Ecosystem. Image via Coin98

The Diverse Ethereum Ecosystem. Image via Coin98Amidst this backdrop of experimentation, meme-based tokens emerged as an unconventional offshoot of the crypto movement.

The Birth of Meme-Based Tokens

In 2013, Dogecoin became the first cryptocurrency to capture the essence of internet memes and online humour.

Inspired by the popular "Doge" meme, considered by many to be one of the best Internet memes of the 2010s, it featured a Shiba Inu dog with humorous, often nonsensical captions written in broken English. With its "much wow, such currency" catchphrase, Dogecoin was initially conceived as a joke by software engineers Billy Markus and Jackson Palmer. It stood in stark contrast to the more serious and technical projects dominating the crypto landscape at the time. For reference, Ripple was launched in 2013 as well.

Dogecoin Was Inspired By a Shiba Inu Dog with Humorous, Often Nonsensical Captions. Image via Vox

Dogecoin Was Inspired By a Shiba Inu Dog with Humorous, Often Nonsensical Captions. Image via VoxDespite tracing its roots to a humorous experiment between friends, Dogecoin quickly gained traction among internet users and crypto enthusiasts. Soon, it transformed into a bona fide cultural phenomenon with Dogecoin achieving significant market capitalization and attracting mainstream media attention.

With a market cap of $2.24 billion, it is currently the largest memecoin by market cap and 9th overall, rubbing shoulders with crypto greats like XRP and Cardano.

Beyond its comedic appeal, Dogecoin also demonstrated the potential for meme-based tokens to foster positive social impact. For example, the Dogecoin community raised 26.5 million Dogecoin (worth around $30,000 at the time) in 2014 to send the Jamaican bobsled team to the Sochi Winter Olympics. In March of that year, the Dogecoin community also raised over 40 million Dogecoin (worth around $30,000 at the time) to help with the effort of building clean-water wells in Kenya.

Most recently, the Dogecoin Foundation partnered with popular YouTubers Mr Beast and Mark Rober for their TeamSeas initiative with the ambitious aim to raise a combined $30 million to remove 30 million pounds of trash from the world's oceans.

Scepticism and Curiosity

While a darling now, Dogecoin's launch was initially met with a blend of scepticism and curiosity. While the idea of basing a cryptocurrency on internet memes seemed novel and amusing to some, others questioned the legitimacy and long-term viability of such projects.

Many doubters viewed meme coins as little more than gimmicks or publicity stunts, lacking the technological sophistication and utility of their more established peers like Bitcoin or Ethereum. They argued that memecoins lacked intrinsic value and were driven primarily by hype and speculation rather than genuine demand or use cases.

Then there were reputational concerns — critics argued that memecoins tarnished the reputation of the broader cryptocurrency industry, which even today grapples with volatility, regulatory scrutiny and security vulnerabilities. There was a general fear that the proliferation of meme coins could attract unwanted attention from regulators and undermine the credibility of legitimate projects in the space.

These concerns appear to have been overblown as the US Securities and Exchange Commission largely flexes its regulatory muscles against crypto exchanges where these coins change hands.

Amid this scepticism, memecoins piqued users' curiosity too. Supporters argued that meme coins represented a novel experiment in community-driven finance, leveraging the power of internet culture to create inclusive and engaging ecosystems around digital assets.

Indeed, memecoins quickly garnered attention for their viral marketing tactics and novel approach to engaging with users. The Dogecoin community, in particular, embraced its meme status with enthusiasm, leveraging social media platforms like Reddit and Twitter to promote the coin.

The story today is very different, however.

Just Another Memecoin Trader Making Millions. Image via Beincrypto

Just Another Memecoin Trader Making Millions. Image via BeincryptoAs the meme coin phenomenon gained momentum and evolved, perceptions began to shift. What was once viewed as a fringe niche within the crypto space has become a mainstream sensation, with new meme coins launching occasionally and attracting widespread attention.

Today, it seems that everyone wants a piece of the newest meme coin, eager to ride the wave of viral hype and potential profits. The scepticism of yesteryear has given way to FOMO (fear of missing out), as investors clamour to jump on board the latest meme coin craze before it's too late. With every new memecoin today, there are dozens of headlines plastered across the internet of the newest crypto millionaire.

On Twitter, memecoin communities have mastered the art of viral marketing, using catchy hashtags, eye-catching memes, and cleverly crafted tweets to generate buzz around their projects. Crypto “influencers” play an important role in amplifying the message and reaching a broader audience. By retweeting, liking, and commenting on tweets related to meme coins, these influencers help to increase visibility and credibility, lending legitimacy to projects that might otherwise be dismissed as mere hype.

This evolution in sentiment — from scepticism and curiosity to just hype — reflects the ever-changing nature of the crypto where trends can emerge and fade in the blink of an eye. What started as a quirky experiment in internet culture has blossomed into a phenomenon!

Memecoins and Speculation

Who needs logic and reason when you've got FOMO fueling every trade?

The crypto market has long been accused of being driven by speculation, which isn't a bad thing in itself. After all, it's a legit investment strategy and is common in the stock, forex and commodity markets.

Investment Frenzy and Volatility

Today, the investment frenzy surrounding memecoins creates a whirlwind of excitement and uncertainty. Fueled by the relentless buzz on social media platforms like X, Reddit and Telegram, memecoins have captured the imagination of investors seeking quick returns and a taste of internet fame.

Celebrity endorsements and influencer promotions only serve to add fuel to the fire, with high-profile figures touting the potential riches to be found in memecoins to their legions of followers. This combination of social media hype and celebrity endorsement creates a perfect storm of speculation, driving prices to unprecedented heights and fueling a frenzy of buying activity.

Celebrities Marketing a Crypto Then Getting Sued is a Vicious Cycle. Image via Forbes

Celebrities Marketing a Crypto Then Getting Sued is a Vicious Cycle. Image via ForbesHowever, with great hype comes great volatility!

Memecoins' prices can swing wildly in response to the latest tweet. Investors, caught up in the euphoria of the moment, have poured money into meme coins, driving prices to dizzying heights before witnessing crashes as the hype inevitably fades. This rollercoaster ride of speculation has left many investors exhilarated by their gains but equally wary of the inherent risks involved in chasing meme-based investments.

Still, the allure of meme coins remains strong today. Open Twitter or YouTube and you're sure to see influencers serving as hype-men promising 1,000x return on a coin. But remember: for every success story of overnight riches, there are countless tales of investors who have been burned by the volatile nature of meme coins.

Pump-and-Dump Schemes and Rug Pulls

Memecoins' hype and speculative nature provide fertile ground for bad actors looking to exploit unsuspecting investors. Pump-and-dump schemes and rug pulls are two of the most prevalent scams in the meme coin ecosystem.

Pump-and-dump schemes are a classic tactic designed to artificially inflate the price of a meme coin before selling off holdings at the peak, leaving unsuspecting investors with worthless tokens. Rug pulls involve developers abandoning a meme coin project after raising funds from investors.

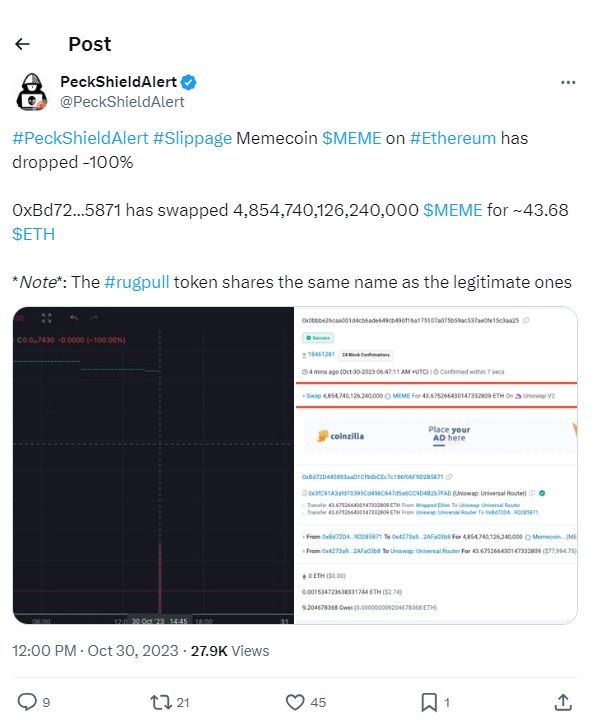

In October 2023, blockchain security company PeckShield issued a rug pull alert for three memecoins: MEME, MEMEPAD and TITANX, whose value dropped by 100% with those behind them swapping the native tokens to ETH. These coins bore a name that mimicked another existing meme coin.

The PeckShield Alert of a Rug Pull For Three Memecoins. Image via X

The PeckShield Alert of a Rug Pull For Three Memecoins. Image via XAnother example is the SafeMoon token, whose founders withdrew crypto assets worth more than $200 million from the project, and misappropriated investor funds for personal use, the SEC said in a complaint. In marketing SafeMoon, its creator assured investors that funds were safely locked and could not be withdrawn by anyone. However, large portions of the liquidity pool were never locked, and the defendants misappropriated millions of dollars to purchase luxury cars, extravagant travel and luxury homes.

A lawsuit alleged that while the project wasn't explicitly labelled as a "pump and dump" scheme, involved parties engaged in a gradual "rug pull" strategy. This involved periodically selling off tokens to prevent a sudden collapse in price, thereby slowly draining value from the project over time.

Memecoins in Popular Culture

Will Smith's unexpected outburst at the Oscars sent shockwaves through Hollywood and beyond. Little did anyone know, it would also give birth to a memecoin. Rising from the ashes of controversy, Will Smith Inu emerged, riding the coattails of the internet's insatiable appetite for the absurd.

One investor poured $5,000 into the memecoin. Soon, Will Smith Inu skyrocketed to the moon and fell back to Earth faster than you can say "Oscar-worthy slap," leaving investors scrambling to salvage what they could of their initial investment. In the end, our hero investor walked away with a tidy profit.

Will Smith's Oscars Slap Turned Into a Memecoin. Image via The Washington Post

Will Smith's Oscars Slap Turned Into a Memecoin. Image via The Washington PostMemecoins have evolved from obscure digital assets into cultural touchstones, and have become symbols of the digital age's ethos. With their whacky branding and vibrant communities, memecoins have captured the imaginations of millions worldwide, inspiring memes and jokes.

Here's another example: Consider the "Stonks" meme, which sparked the creation of Stonks Coin (STONK), a memecoin capitalizing on the meme's popularity to lure investors.

Memecoins have spawned their own subculture of enthusiasts who revel in the chaos of the meme coin market, fueling its growth and evolution. This integration highlights memecoins' ability to capture the collective imagination of online communities, solidifying their status as cultural phenomena.

Technological Advancements

The integration of DeFi features marks a significant shift in the evolution of memecoins.

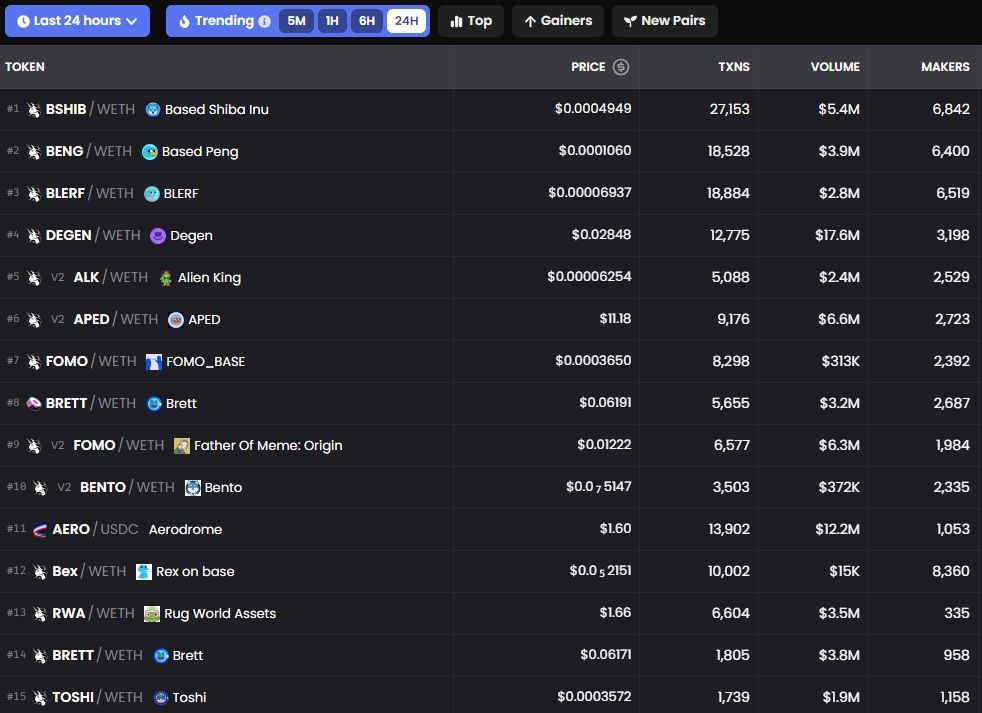

The memecoin mania is in full swing over at Base, the blockchain launched by crypto exchange Coinbase. The Layer 2 blockchain has a total value locked (TVL) of about $1.5 billion, according to DefiLlama, largely driven by memecoins.

The top-three tokens on Base in the past 24 hours were:

- Based Shiba Inu

- Based Peng

- Blerf

The Top Coins on Base Are Memecoins. Image via DEX Screener

The Top Coins on Base Are Memecoins. Image via DEX ScreenerA software upgrade on Ethereum in March has been credited with fueling the growth. One impact of the upgrade, known as Dencun, is significantly lower costs for trading on L2 blockchains.

More recently, Solana generated media buzz for leading the crypto market in terms of network activity, growth, and adoption, thanks to, you guessed it, memecoins. Over the past month, thousands of new memecoins launched on Solana, driving billions of dollars in trading volume. While some of these memecoins have made headlines for their rapid rise in market value, others have faced controversy, including instances of rug pulling and racist incidents.

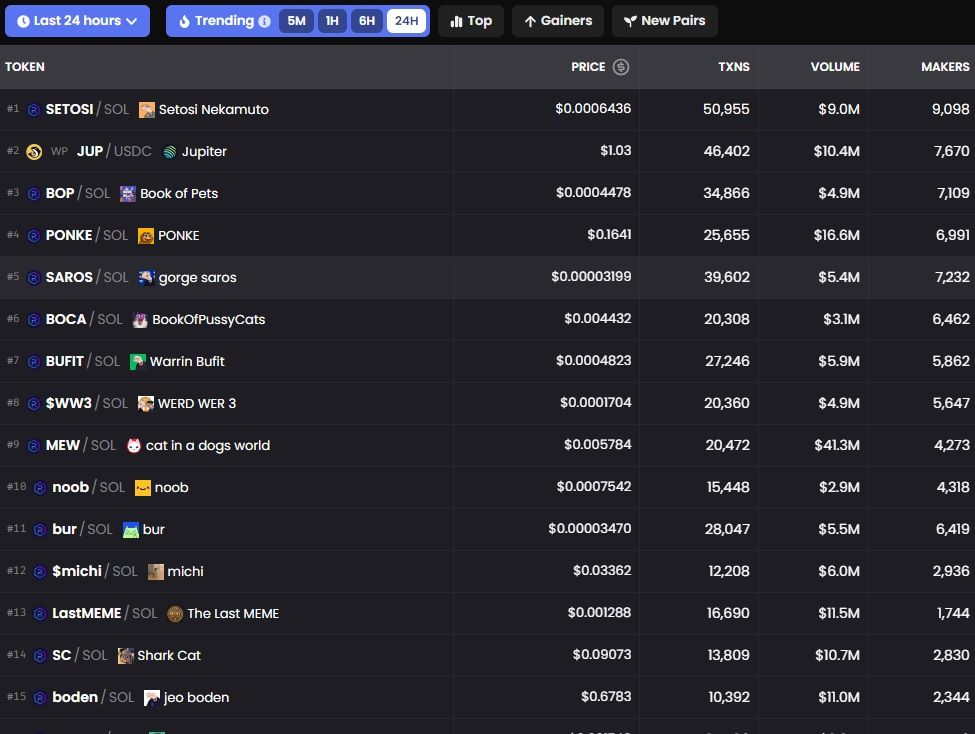

Hold on to your seats for here are some of the memecoins in the Solana ecosystem:

- Setosi Nekamuto

- Gorge Saros

- Warrin Bufit

- Noob

- The Last Meme

The Top Coins on Solana are Memecoins. Image via DEX Screener

The Top Coins on Solana are Memecoins. Image via DEX ScreenerThe memecoin sector has proven to be the most lucrative narrative of the year, according to a recent CoinGecko report. On average, memecoins boasted staggering returns of 1,312.6% across the top tokens by market capitalization.

Notably, memecoins launched as recently as March managed to secure spots in the top 10 largest memecoins list by market value by the end of the quarter. Among these, BRETT saw the highest returns, soaring by an astonishing 7,727.6% by the end of Q1 2024. Following behind was Dogwifhat (WIF), which experienced a 2,721.2% growth year-to-date, fueled by viral attention during the Solana-based memecoin frenzy.

Overall, the integration of DeFi features represents a paradigm shift in the way memecoins operate and interact with users.

Evolution of Memecoins: Final Thoughts

Memecoins may have started as a joke, but they've proven to be more than just a passing fad. From the birth of Dogecoin to the rapid rise of meme-inspired tokens on various blockchain platforms, memecoins have become a tour de force in the crypto landscape.

But memecoins are not without their challenges. Their frenzied speculation and volatility can be both exhilarating and unpredictable. On top of that, pump-and-dump schemes, rug pulls, and other scams remain persistent threats. Nevertheless, their ability to capture internet culture and harness the power of community-driven finance continues to draw new participants into the fold.

As we look to the future, one thing is certain: the memecoin mania appears to be here to stay!