Bitcoin's birth couldn't have been perfectly timed.

In 2008, as millions lost their homes to foreclosures and banks received hundreds of billions in government bailout money during The Great Recession, a whitepaper was published without any fanfare. Unbeknownst to anyone at the time, this document, outlining a new peer-to-peer electronic cash system, would lay the foundation for a major shift in how we think about money, trust, and the role of financial institutions.

When Satoshi Nakamoto introduced Bitcoin in 2008, the original mission was clear: to create a P2P system that was decentralized and transparent. It aimed to empower individuals by enabling direct transactions without intermediaries like banks or governments, offering a system that could potentially shield users from inflationary policies and central authority control.

While the idea was groundbreaking, its impact would take years to unfold. The rise of cryptocurrencies since Bitcoin's infancy has been rapid. The OG still leads, but it has spawned thousands of other digital assets, each offering various forms of innovation or alternatives to existing systems. And everybody wants a piece of the action. As cryptocurrency has grown in popularity, it has attracted institutional investors, large corporations, and even governments.

The promise was intoxicating: decentralized, borderless transactions, a financial system built by the people, for the people. We were going to reclaim our financial sovereignty and cut out the middleman. But look around now. It's a gold rush.

So, the question hits you: has this whole crypto thing gone off the rails? Has the relentless chase for profit and the desperate grab for mainstream acceptance turned the original dream into a hollow shell?

That's what we're here to unpack. For this article, we reached out to a number of experts in the crypto industry and asked them five questions:

- Has the pursuit of profit and speculation overshadowed the original goals of financial sovereignty and decentralization?

- To what extent has the focus shifted from "peer-to-peer electronic cash" to "digital assets" and investment vehicles?

- How has the increasing involvement of institutional investors and TradFi impacted the original vision of a decentralized financial system?

- Has the prevalence of scams, rug pulls, and hacks eroded public trust in the legitimacy of cryptocurrencies?

- What steps can be taken to restore the original ideals of decentralization and financial sovereignty?

This article explores the perspectives of various experts, examining the forces that have shaped the current landscape. Rather than a definitive conclusion, we present a balanced view of the ongoing debate, highlighting diverse interpretations and proposed solutions.

Profit and Speculation vs. Original Goals

Crypto may have been born out of ideals of decentralization and financial autonomy, but it has increasingly become a stage for profit-driven speculation. This has created a noticeable divergence from the original goals that fueled its inception. The volatile nature of crypto prices has attracted a large influx of speculators seeking quick profits. This has led to market fluctuations driven by hype, rather than fundamental value.

Look no further than the meme coin mania!

Dog Wif Hat (WIF), described as “literally just a dog wif a hat,” reached its all-time high of $4.83 in March 2024, driven by speculation (it is currently down over 90% from that price). A trader invested $310 and made $5 million. BONK, another meme coin, is currently down 79% from its all-time high in November 2024. And yes, a trader turned a $16,000 investment into $18 million.

What The Experts Think

Experts hold differing views on the impact of profit-driven speculation on cryptocurrency's original ideals. While some argue it fuels growth and expands access, others express concern about the potential erosion of decentralization. Regardless, a consensus emerges that financial motivations have been inherent in the crypto space since its inception, evolving alongside the technology itself.

“The debate surrounding profit and speculation's impact on cryptocurrency's original ideals is a complex one, with varied perspectives from industry leaders,” Daniel Polotsky, founder and chairman of crypto kiosks operator CoinFlip, told The Coin Bureau. He acknowledged the potential for deviation from initial goals but frames speculation as a necessary catalyst for growth. “Speculation is a crucial component in expanding the crypto market, and the industry innovation needs funding. While speculation may cause short-term volatility, in the long run, it’s through this process that the strongest companies and projects potentially emerge.”

This perspective is echoed by Joe McCann, founder and CEO of crypto hedge fund Asymmetric, who sees speculation as a means of expanding access rather than undermining core principles. "Crypto has always been about financial freedom, and part of that is having open markets where people can speculate, invest, and build wealth,' he said, emphasizing the role of open markets in achieving financial freedom.

Extending this point, Thomas Chen, CEO of Mantle's Function, argued that speculation is actively driving the evolution of financial sovereignty. “Bitcoin’s sovereignty is not undermined by financialization; rather, it is reinforced when BTC is not just held, but actively utilized in permissionless, trust-minimized environments,” he said, identifying infrastructure development as the key to realizing this potential.

Literally Just A Dog With a Hat. Image via WIF

Literally Just A Dog With a Hat. Image via WIFHowever, a contrasting view is presented by Daniel Keller, CEO and co-founder of decentralized cloud infrastructure company InFlux Technologies, who expressed concern that the allure of rapid profit has overshadowed the original decentralization goals. “The only thing that moves faster than technology is candlesticks, so it wasn’t long before profit speculation surpassed the progression of blockchain development,” he noted, lamenting the potential neglect of projects with genuine decentralization value.

Shifting to a historical perspective, Andrew Lunardi, head of growth at crypto gaming platform Immutable, acknowledged that Bitcoin's creation stemmed from a reaction to government policy failures during the Great Recession. However, he also pointed out that financial motivations were present from the beginning, referencing Hal Finney's early price speculation. Lunardi concluded that financial motives have always been a component of cryptocurrency, and have just become more apparent over time.

This perspective is further reinforced by Mukarram Mawjood, chief investment officer of Blackstone Commodity Group, who argued that “as soon as people recognized the potential for generating multiples in both price and returns, along with substantial increases in value, the focus naturally shifted toward profit and speculation.” He tied this directly to the rise of meme coins, illustrating the continued drive for financial gain.

David Seroy, head of ecosystem at Strata & decentralized bitcoin financial infrastructure company Alpen Labs, acknowledged that profit and speculation have indeed overshadowed the original goals, but he framed this as an inherent part of human nature and Bitcoin's design. He argued that Bitcoin is not a utopian ideal, but a system that thrives on aligned incentives, where "greed and self-interest aren’t bugs; they’re features of the system that enable sovereignty and decentralization."

Peer-to-Peer Cash vs. Digital Asset Narrative

Bitcoin was conceived as a decentralized, peer-to-peer electronic cash system. The goal? To enable direct transactions between individuals without the need for intermediaries like banks.

Over time, the focus has shifted significantly towards viewing cryptocurrencies as digital assets and investment vehicles.

- Store of Value: Bitcoin’s scarcity (21 million cap) and resilience led to comparisons with “digital gold.”

- Tokenization: Blockchain allows for the fractional ownership of real-world assets (RWAs).

What The Experts Think

Experts across the cryptocurrency sector are split on whether the focus has moved away from simple peer-to-peer transactions. They also diverge on whether this shift to digital assets and investment vehicles is a natural progression or a deviation from Bitcoin's original purpose. Some see stablecoins as a modern fulfillment of that initial vision, and others highlight the role of market forces and institutional influence.

CoinFlip's Polotsky recognizes the continued importance of fiat currency and sees Bitcoin as a hybrid of a growth stock and digital gold. He observes the rise of stablecoins like USDT and USDC as a solution for seamless global transactions. Polotsky believes that as cryptocurrencies mature, they will become more stable, making them more suitable for everyday payments. "Bitcoin currently acts as a blend between a growth stock and digital gold, but its potential volatility makes it less ideal for some people as the primary medium of exchange. This is why we’re seeing the rise of stablecoins like USDT and USDC for seamless global transactions."

McCann further challenged the idea that Bitcoin was ever solely intended as peer-to-peer cash. He argued it serves more as a store of value and inflation hedge, noting that the market prioritizes investable digital assets. He uses meme coins and the Solana network to illustrate that crypto has evolved into a cultural and financial phenomenon, and a full-fledged investment ecosystem, rather than a system for everyday transactions.

From Peer-to-Peer Cash to Digital Gold: The Evolution of Cryptocurrency. Image via Shutterstock

From Peer-to-Peer Cash to Digital Gold: The Evolution of Cryptocurrency. Image via ShutterstockBuilding on this, Chen sees Bitcoin's initial role as peer-to-peer cash as a starting point, not its final form. He drew historical parallels, noting that assets typically evolve from stores of value to collateral and then liquidity. "Its evolution into a structured financial asset is not a betrayal of its origins –– it is only a natural progression."

Keller reinforced the idea of a significant shift, noting that DeFi "emerged entirely to bring stock market fundamentals—perpetuals, futures, and derivative contracts—on-chain." While peer-to-peer concepts remain, the scope of investment has broadened considerably, he said.

Lunardi noted a shift towards viewing cryptocurrencies as investment vehicles, partly due to Bitcoin's volatility hindering its use as a medium of exchange. He argued that this volatility has led to Bitcoin being framed more as "digital gold." He also mentioned stablecoins as potentially fulfilling the peer-to-peer cash vision, although he acknowledged that their fiat backing contradicts the original goal of mitigating sovereign risk.

Mawjood underscored this trend, observing a clear shift towards digital assets and investment vehicles, with the original concept of peer-to-peer electronic cash taking a backseat. However, he also noted that peer-to-peer transactions still occur, but with larger sums and higher-net-worth individuals, indicating mainstream adoption.

Seroy sees the shift towards digital assets and investment vehicles as a natural evolution. "People don’t spend what they expect to appreciate." He highlighted Bitcoin's strength as a global store of value. Seroy clarified that the peer-to-peer cash vision is not dead, but requires further infrastructure and incentives.

Involvement of Institutional Investors And TradFi

The involvement of institutional investors and traditional finance (TradFi) has created a tension with the original, foundational visions.

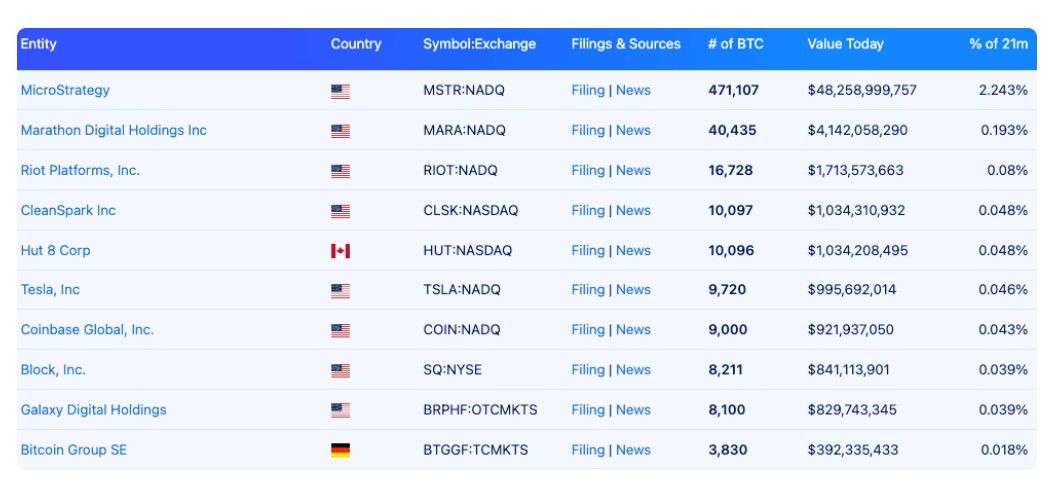

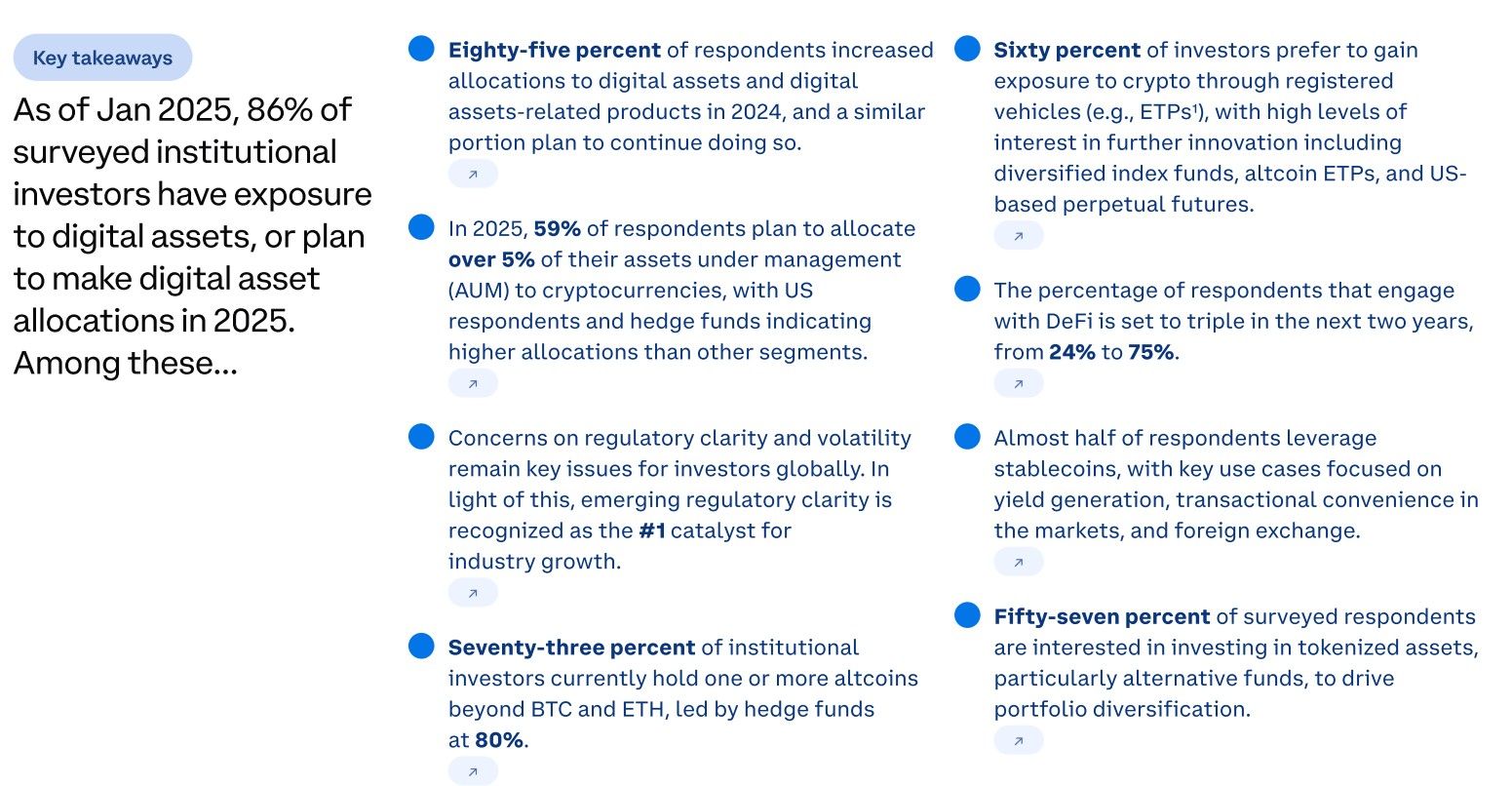

Institutional investors are rapidly increasing their crypto allocations, with over three-quarters of those polled planning to expand holdings in 2025, according to a survey by Coinbase and EY-Parthenon of 352 institutional investors. They noted increased regulatory clarity as the catalyst.

Over 70 Public Companies Hold Bitcoin On Their Balance Sheets. Image via CoinDesk

Over 70 Public Companies Hold Bitcoin On Their Balance Sheets. Image via CoinDeskWhat The Experts Think

The influx of institutional investors and traditional finance (TradFi) into the cryptocurrency space puts into question the original vision of decentralization. While some experts believe this involvement is a necessary step for global adoption and can even reinforce decentralization, others express concern about the potential dilution of core principles and the introduction of regulatory influence.

Polotsky views institutional involvement as a necessary step for global adoption, even if it slightly reduces decentralization. He argues that widespread participation by institutions and nations can actually reinforce decentralization through game theory, preventing any single entity from controlling the market. "The trade-off of slightly reduced decentralization is global adoption. However, the participation of institutions and nations likely doesn’t mean decentralization will disappear entirely." He argues that if over 200 nations and thousands of institutions integrate crypto into their holdings, decentralization will remain intact.

McCann supported this view, emphasizing that institutional involvement scales rather than erodes crypto’s vision. "Crypto remains an open system – institutions are simply legitimizing it," he said, highlighting the increased transparency that TradFi brings to the space and framing it as an alternative, not a replacement.

Key Takeaways From A Survey. Image via EY

Key Takeaways From A Survey. Image via EYChen further refined this perspective, suggesting that institutional participation tests, rather than compromises, decentralization’s resilience. He emphasized that the goal is to integrate Bitcoin into global markets while maintaining its self-sovereignty. "The real question is not whether institutions should participate, but under what conditions they do so." He contends that the actual danger lies in confining Bitcoin to centralized, opaque structures.

Keller contributed to this narrative by asserting that institutional involvement can actually strengthen the original vision of decentralization by bringing regulation and increased awareness. He believes that as traditional finance players enter the crypto space, they are compelled to adopt its values of privacy and decentralization. He also believes that the presence of these institutions brings in new investors who will hold those institutions accountable to the values of the crypto space.

However, Andrew Lunardi offered a more nuanced view. He described institutional involvement as a "double-edged sword." While it has increased legitimacy and spurred regulation, it also clashes with the original Bitcoin vision, which aimed to avoid government and regulatory influence.

Mawjood expressed concern that institutional involvement is diluting the original vision of a decentralized system. While acknowledging the positive aspects of increased legitimacy and volume, he expresses concern about the market's growing reliance on ETFs and government actions. He highlights the interference of government regulation. "This is a positive development, yet it has resulted in the crypto community relying heavily on ETFs and government actions for price movement, which introduces volatility and disrupts typical seasonal trends." He also expressed hope that the market will adapt and find a balance.

Seroy recognized that institutional involvement was inevitable, but warned against the potential for control-oriented practices that undermine decentralization. He believes that "the fight isn’t about keeping them out; it’s about ensuring they don’t close the escape hatch," emphasizing the importance of preserving the option for freedom.

Scams, Hacks and Public Trust

The proliferation of scams and hacks in the crypto space poses a significant threat to public trust, hindering wider adoption and casting a shadow over the industry's legitimacy.

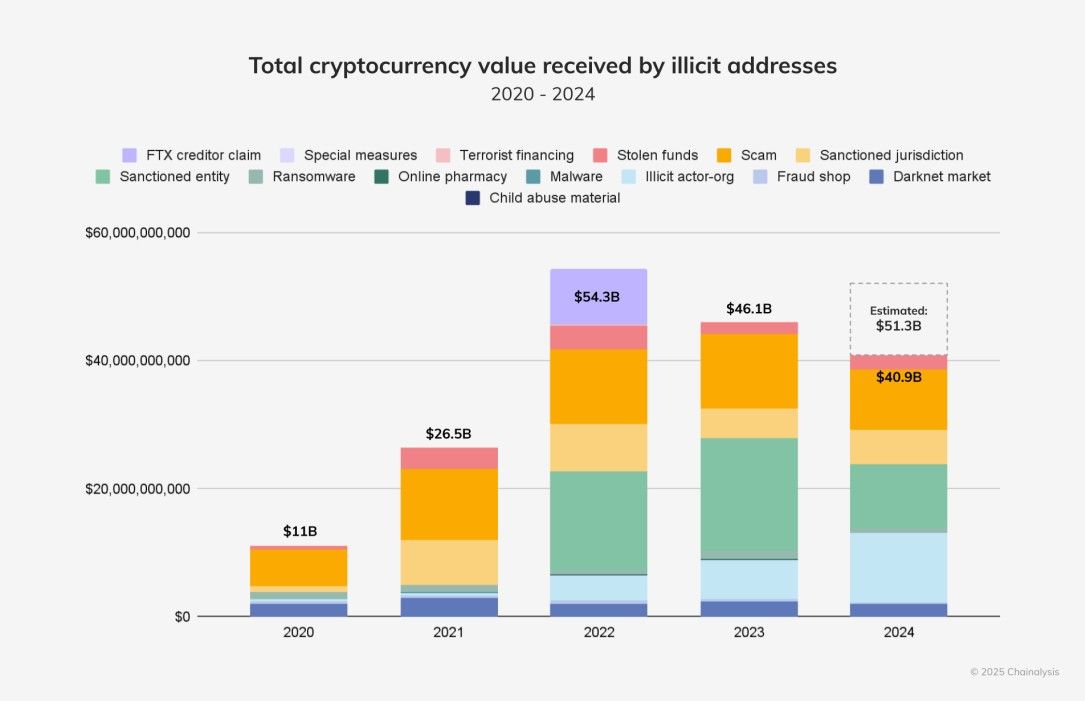

According to Chainalysis, 2024 saw a drop in value received by illicit cryptocurrency addresses to a total of $40.9 billion. Chainalysis expects this number to rise as it identifies more illicit addresses.

This Number Is Expected To Rise. Image via Chainalysis

This Number Is Expected To Rise. Image via ChainalysisWhat The Experts Think

The prevalence of scams and fraudulent schemes within the cryptocurrency market has impacted public trust, raising concerns about the legitimacy of digital assets. While some experts argue that these issues are a natural part of an emerging financial system, others highlight the significant damage to investor confidence and the need for robust regulatory measures to restore trust.

CoinFlip's Polotsky acknowledges the problem of scams but insists they don't invalidate the technology. He highlights blockchain's transparency, which can aid law enforcement. He advocates for collaboration between industry leaders, regulators, and consumer advocates to protect users. "Scams and rug pulls don’t undermine the value of crypto or blockchain, they expose those exploiting it for personal gain by creating a transparent open ledger that everyone can see."

Chen took a broader view, saying that the presence of scams is a sign of growth, common in emerging financial systems. He stressed that the industry's response to these issues is crucial, highlighting the move towards regulated stablecoins and institutional-grade custody. “The presence of bad actors isn’t a sign of failure—it’s a sign of growth.”

However, the impact of these scams on public trust is undeniable, as highlighted by Keller of InFlux Technologies. "Legislators leverage the dangers of rugging as the number one reason against investing in cryptocurrency." This, he said, has negatively impacted new projects' ability to gain early traction.

First Quarter 2025 Was The Worst Quarter For Hacks In Crypto's History. Image via Immunefi

First Quarter 2025 Was The Worst Quarter For Hacks In Crypto's History. Image via ImmunefiLunardi echoed this sentiment, asserting that scams and rug pulls have significantly damaged public trust, particularly in areas like NFTs. He said that this is a major factor in the slow adoption of NFTs. He stated that the previous NFT cycle, "still leave a sour taste in most people's mouth despite having utility across a range of different sectors and use cases."

Mukarram acknowledged that scams have been a persistent issue in the crypto space, citing early examples like Mt. Gox and Silk Road. He emphasized that mainstream adoption has amplified the impact of scams, leading to larger market drops and increased volatility. He differentiated between experienced crypto investors, who understand the inherent volatility, and newer investors, who are more easily frightened. “A knowledgeable crypto investor, however, should remain unfazed by these fluctuations, as understanding what you own cultivates confidence in turbulent times,” he said.

Seroy, too, thinks that scams have significantly eroded public trust. He observed a growing divide between ideological builders and speculative elements, and advocated for building credible use cases to restore legitimacy. "Over time, the hope is this can be walled off and not all conflated under a single umbrella industry."

Restoring The Original Vision

Restoring the original vision of decentralization and financial sovereignty requires a multifaceted approach. Experts emphasize the importance of education, self-custody, and transparent infrastructure, while also acknowledging the need to adapt to mainstream adoption and mitigate the impact of scams. The path forward involves balancing core principles with practical solutions for a sustainable and inclusive future.

Polotsky stressed the importance of education and self-custody. He said that the "not your keys, not your coin" adage is key to preserving decentralization and advises diversification of asset storage. "The principles of decentralization and self-custody need to be emphasized to every new entrant in the space to uphold the essential spirit of crypto’s history." He said it is important to "consider diversifying where you store your assets." A balanced approach to crypto security is essential. He cautioned against placing complete trust in any single storage method, whether it's an exchange, fund, or self-custody.

To Restore Crypto's Roots, We Must Return To Its Core Principles. Image via Shutterstock

To Restore Crypto's Roots, We Must Return To Its Core Principles. Image via ShutterstockBuilding on this, Chen defined decentralization as an evolving set of principles, advocating for building a more efficient, transparent, and inclusive alternative to traditional finance. He promoted modular financial infrastructure and transparent, verifiable systems. "Financial sovereignty is not just about keeping Bitcoin outside the system—it’s about ensuring it moves freely within a system that remains open, trustless, and composable."

Keller further emphasized the importance of supporting projects that prioritize financial sovereignty. He called for increased investment in initiatives focusing on fair token launches, user anonymity, and decentralized governance, urging the community to focus on core principles despite the noise of scams and negative headlines.

While acknowledging the challenges, Immutable's Lunardi offered a perspective of long-term optimism. He highlighted the continuing growth of crypto adoption, especially in developing countries. He believed that the current hesitancy will eventually fade as people become more accustomed to the technology, similar to the early days of the internet.

Mawjood addressed the evolving nature of decentralization and financial sovereignty. He argued that the original ideals of decentralization are evolving, particularly concerning financial sovereignty. He believes the challenge is to reconcile these ideals with mainstream acceptance, which requires adapting to new market trends and enhancing risk management skills. "Moving forward, it's crucial to find a way to blend the principles of decentralization and financial sovereignty with mainstream acceptance," he concluded.

Seroy emphasized the importance of building practical tools like privacy solutions and self-custody infrastructure. He stressed user responsibility, reiterating the "not your keys, not your coins" mantra. He concluded that decentralization is protected by ensuring “the tools exist for those who choose freedom.” The best method to achieve this, he said, is to continue to build and support those tools.

Closing Thoughts

So, has crypto lost its way? The answer isn’t a simple yes or no, but rather a "it’s complicated."

What started as a rebellion against centralized power has grown into a sprawling, often contradictory ecosystem. The dream of financial sovereignty still flickers, but it's surrounded by noise from memecoins, institutions, regulatory crackdowns, and yes, scammers and hackers.

And yet, this evolution doesn’t necessarily mean the death of Satoshi's vision. It might just be its messy maturation. Experts think that speculation, for all its chaos, has funded innovation. Institutions, while introducing TradFi dynamics, have also helped legitimize the space. Hacks and scams have shaken trust, but they've also led to better tools, better education, and more informed users.

The path forward isn’t about gatekeeping purity, they said, it's about building resilient infrastructure, championing self-custody, supporting projects that put people first, and ensuring that crypto remains open to anyone, anywhere — not just the whales and the insiders.

The original vision hasn’t disappeared. It’s just been buried under a lot of hype and dollar signs. It’s up to us to dig it back up and shape the next chapter.