Yes, Bybit remains a trusted cryptocurrency exchange in 2026. Despite experiencing what is now regarded as the largest hack in crypto history, the platform didn’t just survive — it demonstrated a level of resilience and transparency rarely seen in this industry. Operations continued without interruption, user funds were protected, and reserves were fully replenished within days. In a space where confidence can collapse in an instant, Bybit proved it could absorb a catastrophic blow, and come out stronger on the other side.

As the crypto industry matures, trust has become the most valuable currency of all. We’ve seen exchanges collapse under the weight of poor risk management, regulatory pressure, or outright fraud. And while decentralisation remains a long-term goal, most users still rely on centralised platforms to trade, invest, and store assets. This makes the security practices of those platforms not just important, but essential.

This article is written for those who take that responsibility seriously. Whether you’re a seasoned trader managing leveraged positions or a new investor looking for a secure way to enter the market, understanding Bybit’s approach to security could make all the difference.

We’ll explore Bybit’s rise to prominence, examine what really happened during the 2025 hack, and break down the platform’s security architecture — from cold storage and 2FA to real-time risk engines and post-incident response protocols. We’ll also look at regulatory compliance, user protection policies, and how Bybit stacks up against competitors in terms of trust and transparency.

Looking to explore more about Bybit? You may also find the following articles helpful:

Key Takeaways

- Despite experiencing the largest hack in crypto history ($1.5B ETH in 2025), Bybit fully recovered funds within 72 hours without halting withdrawals — a rare feat in the industry.

- Bybit’s security architecture includes cold wallet storage, multi-signature authorization, TEE (Trusted Execution Environments), and TSS (Threshold Signature Schemes) to protect assets from internal and external threats.

- Users benefit from 2FA, anti-phishing codes, address whitelisting, and session monitoring, with optional one-click account freezes for added self-protection.

- The platform conducts real-time risk monitoring and uses AI to detect anomalies in high-value transactions — a system enhanced after the 2025 incident.

- Bybit maintains a public Proof of Reserves via Merkle Tree, though these audits are currently self-attested rather than independently verified.

- A dedicated insurance fund protects derivatives traders from extreme liquidation losses, though it does not currently cover all user funds by default.

- Strong crisis response and transparency — including live updates from the CEO — helped maintain user trust during and after the breach.

- While already among the most resilient exchanges, Bybit’s security posture would benefit further from independent reserve audits and expanded user insurance coverage.

Brief History of Bybit

Bybit was founded in 2018 by Ben Zhou, a former forex broker with a sharp eye for inefficiencies in the early crypto exchange landscape. At the time, many platforms were plagued by server outages, clunky interfaces, and poor customer support. Ben’s goal was simple — build a trading venue that could match the speed and sophistication of traditional financial platforms while staying true to the spirit of crypto.

The result was Bybit — a derivatives-first exchange with an ultra-fast matching engine, a user-friendly interface, and a clear focus on performance. From the outset, Bybit positioned itself as a serious contender to the likes of Binance, offering up to 100x leverage on perpetual contracts and a suite of tools aimed squarely at professional traders.

Despite regulatory pressures and regional restrictions, Bybit continued to grow rapidly. It relocated its headquarters from Singapore to Dubai in 2022 to benefit from the UAE's more favourable regulatory environment. That move also signalled a broader ambition: to become a global hub for crypto trading, not just another offshore player.

Currently, Bybit consistently ranks among the top five exchanges by derivatives volume and has become a go-to platform for retail and institutional traders alike. It now offers more than just derivatives, including spot trading, copy trading, an earn program, and even an NFT marketplace. In short, it has evolved from a niche derivatives venue into a comprehensive crypto trading ecosystem.

What’s more is that Bybit has managed to build a reputation for both performance and transparency — a rare combination in an industry where many exchanges still hide behind opaque operations. But as we’ll see next, even the most trusted platforms can face existential threats.

Is Bybit Safe After The Hack?

In February 2025, Bybit faced what can only be described as a watershed moment — a sophisticated exploit that resulted in the theft of over $1.5 billion in ETH, making it the largest hack in crypto history. And yet, the platform survived. More than that, it stabilised, recovered, and retained user confidence in the process. But what exactly happened?

The Bybit Hack Was The Largest Hack of a Crypto Exchange Ever. Image via CoinDesk

The Bybit Hack Was The Largest Hack of a Crypto Exchange Ever. Image via CoinDeskThe breach occurred during what should have been a routine cold-to-warm wallet transfer. As part of Bybit’s standard protocol, multiple signatories were required to authorise the transaction from a multi-signature Ethereum wallet. Everything appeared normal — until the funds didn’t show up in the warm wallet.

It soon emerged that the transfer had been intercepted via a malicious alteration to the user interface of Safe Wallet, a widely used frontend for Ethereum-based multisig contracts. The attacker had injected custom code via a compromised developer machine, modifying a crucial but subtle parameter — operation = 1 instead of 0. This seemingly minor switch effectively transferred ownership of the wallet to the attacker.

In total, 401,346 ETH were drained in a single transaction. The scale and precision of the attack pointed to a nation-state actor, and indeed, blockchain analysis later linked the exploit to the Lazarus Group, a notorious hacking organisation allegedly backed by North Korea.

What followed, however, set a new benchmark for crypto crisis management.

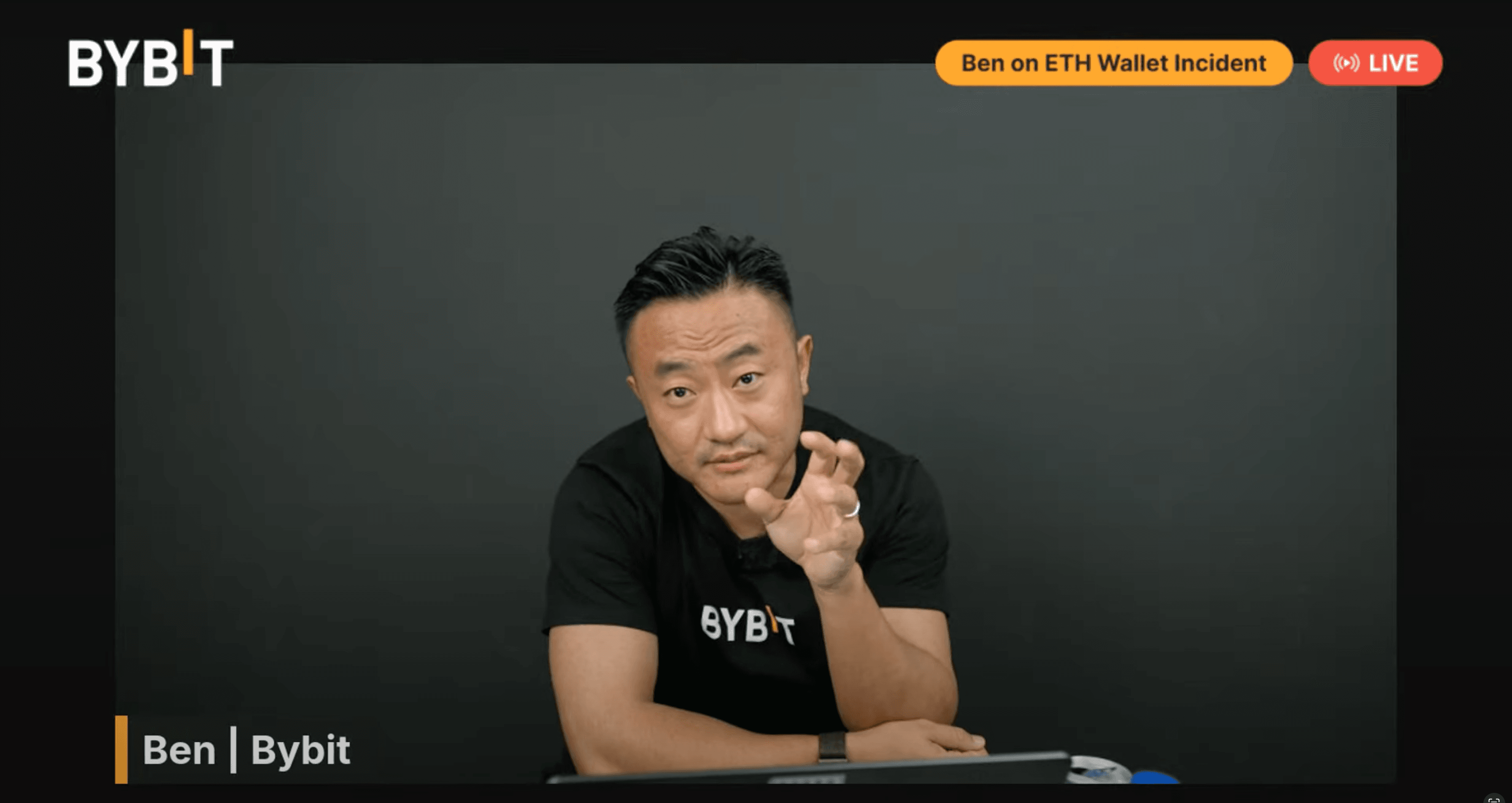

Within hours, Bybit’s CEO Ben Zhou addressed the incident publicly, first via X, then on a live stream in multiple languages. He confirmed that the platform remained fully solvent and that user funds were safe. Bybit processed over $4 billion in withdrawals within the first 12 hours and replenished its reserves through a combination of bridge loans, OTC deals, and whale reinvestments. By the third day, the stolen ETH was fully accounted for.

Importantly, no users were impacted. No withdrawals were paused. And the platform remained operational throughout.

In a space where platforms have collapsed under far lesser pressure, Bybit’s response was nothing short of remarkable. The exchange turned a catastrophic breach into a showcase of resilience — and in doing so, reaffirmed its position as one of the most trusted names in crypto.

That said, a breach is still a breach. So, what’s changed since then? Let’s take a closer look at how Bybit is now hardening its defences for the future.

Detailed Analysis of Bybit’s Security Measures

While no exchange can ever claim to be invulnerable, Bybit has gone to great lengths to minimise attack surfaces and prepare for the worst. Let’s unpack the core components of its security stack and how these measures have evolved since the 2025 breach.

Core Security Protocols and Technologies

At the heart of Bybit’s security architecture is a triple-layered system that combines cold wallet storage, multi-signature authentication, and advanced encryption. The majority of user funds are stored offline in cold wallets, isolated from internet exposure and inaccessible via external breach attempts. These wallets are secured using multi-signature access controls, meaning that multiple independent approvals are required to initiate transactions.

To complement this, Bybit employs Trusted Execution Environments (TEE) and Threshold Signature Schemes (TSS)— two cutting-edge cryptographic tools designed to prevent private key leakage and unauthorised transaction execution. These tools significantly reduce the risk of internal compromise or social engineering, both of which played a role in the 2025 incident.

On the user side, two-factor authentication (2FA) is not only supported, but it’s also strongly recommended for all account actions — including logins, withdrawals, and trading API access. Bybit also integrates anti-phishing codes, withdrawal address whitelisting, and device management controls to give users more control over account security.

Bybit User Protection Measures. Image via Bybit

Bybit User Protection Measures. Image via Bybit All web traffic is encrypted using SSL (Secure Sockets Layer) technology, and sessions are monitored continuously for suspicious behaviour, such as irregular login attempts, unusual trading patterns, or location mismatches.

In short, Bybit’s technical stack is designed to create layered protection, both for its users and its operational wallets. But security isn’t just about prevention — it’s about preparation. And that brings us to how Bybit responds when things go wrong.

Risk Management and Incident Response

The February 2025 hack was a stress test that no platform wants, but every platform needs to be ready for. Bybit’s response wasn’t just swift — it was decisive.

Immediately after discovering the breach, Bybit’s team identified the compromised vector, froze all interactions with the affected wallet, and launched a real-time blockchain analysis of the stolen funds. The exchange published the transaction data on-chain, opened communication channels with major security firms, and coordinated with law enforcement agencies around the world.

Within 72 hours, Bybit had secured emergency liquidity through a mix of bridge loans and OTC transactions, replenishing the full amount of stolen ETH — a move that protected users from any downstream risk. Withdrawals remained uninterrupted throughout the ordeal, and a full post-mortem was made public within days.

Since the attack, Bybit has implemented additional transaction screening layers for high-value transfers, including AI-driven anomaly detection, enhanced signer verification workflows, and a one-click account freeze feature to empower users in the event of suspected compromise.

Insurance Coverage and Financial Safeguards

One of the more common misconceptions about crypto exchanges is that user funds are insured in the traditional sense. In reality, most platforms — including Bybit — do not offer blanket FDIC-style protection. However, Bybit does operate a dedicated insurance fund, primarily designed to manage losses from liquidations in high-leverage derivatives trading.

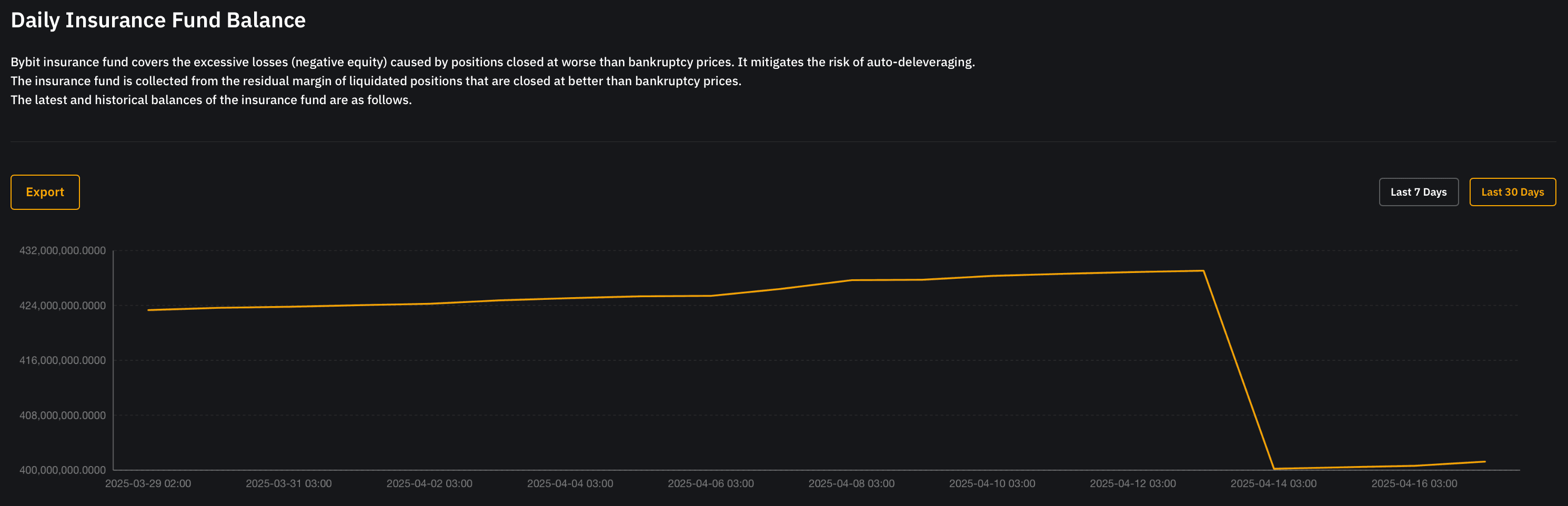

This fund acts as a financial buffer, stepping in when a trader's losses exceed their initial margin, thereby protecting the broader trading ecosystem and reducing the risk of auto-deleveraging (ADL). Importantly, Bybit makes the balance of this insurance fund publicly viewable, offering a level of transparency that not all competitors provide.

Bybit Insurance Fund. Image via Bybit

Bybit Insurance Fund. Image via BybitWhile the fund is not designed to cover spot balances or platform-wide insolvencies, its visibility and purpose-specific design put it on par with mechanisms like Binance’s SAFU and Bitget’s $300 million reserve.

What’s worth noting is that Bybit's full replenishment of $1.5 billion in stolen ETH after the 2025 hack, without any disruption to user withdrawals, revealed the platform’s operational capacity to absorb losses, even in extreme scenarios.

Legal Compliance and Regulatory Framework

In the post-FTX era, security and solvency alone aren't enough. Regulatory clarity has become just as critical, not just to meet compliance requirements, but to build user trust. So, where does Bybit stand in 2026?

Global Legal Status and Regional Variations

Bybit operates under the umbrella of Bybit Fintech Limited, which is registered in the British Virgin Islands, but its operational presence has evolved significantly in recent years. After encountering regulatory friction in Singapore, Bybit relocated its headquarters to Dubai in 2022 — a strategic move that positioned the exchange in a jurisdiction with a far more crypto-forward regulatory framework.

Bybit Security and Compliance Initiatives. Image via Bybit

Bybit Security and Compliance Initiatives. Image via BybitBybit now holds an in-principle license from the Dubai Virtual Assets Regulatory Authority (VARA), which governs its operations in the United Arab Emirates. Additionally, Bybit is regulated in Cyprus, giving it a degree of legitimacy within the European Economic Area.

However, the exchange is not available to users in the United States, Canada, the United Kingdom, or several EU countries. This exclusion is due to stringent regulatory frameworks in those jurisdictions — a common limitation for offshore platforms.

Regulatory Compliance and Transparency

From a compliance standpoint, Bybit enforces Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols across all user tiers. Two verification levels exist:

- Level 1 enables basic access with a withdrawal cap of 1 million USDT per day

- Level 2 raises the limit to 2 million USDT, unlocking access to features like the Bybit Card

The platform also provides Proof of Reserves through Merkle Tree audits, allowing users to independently verify that their assets are backed 1:1. While this adds a layer of transparency, it’s worth noting that Bybit’s audits are currently self-published, rather than independently verified.

Customer Support and Its Impact on Trust

Security isn’t just about firewalls and cold storage — it’s also about being able to speak to a human when something goes wrong. In this area, Bybit performs surprisingly well.

The platform offers 24/7 multilingual customer support via live chat and email, and has developed an extensive Help Center filled with tutorials, troubleshooting guides, and platform walk-throughs. Languages supported include English, Chinese, Japanese, Korean, and more, making it accessible for a global user base.

During the 2025 hack, the transparency and responsiveness of Bybit’s communications team were widely praised. The CEO went live just hours after the breach was discovered, and real-time updates were posted on social media and official channels throughout the recovery process.

In a space where users are often left in the dark during critical moments, Bybit’s approach to communication helped restore confidence and mitigate fear, arguably one of the most important elements of security in practice.

Comparative Analysis with Competitor Platforms

With dozens of centralised exchanges competing for trader loyalty, it’s important to understand where Bybit stands — not just on its own, but in relation to its peers. So, how does it measure up when it comes to trust, transparency, and overall security?

Security and Trust Benchmarks Across Major Exchanges

To get a clearer picture, let’s compare Bybit against three major platforms: Binance, Kraken, and Bitget.

| Exchange | Security Rating (CER) | Cold Wallet Use | Proof of Reserves | Major Hacks | Insurance Fund | KYC/AML |

|---|---|---|---|---|---|---|

| Bybit | Top 20 | Yes | Yes (Merkle Tree, self-audited) | Yes (2025, $1.5B, fully recovered) | Yes (for derivatives) | Yes |

| Binance | Top 5 | Yes | Yes (Merkle Tree + zk-SNARKs) | Yes (2019, $40M, covered by SAFU) | Yes (SAFU Fund) | Yes |

| Kraken | Top 10 | Yes | Yes (externally audited) | No major breach | No formal fund | Yes |

| Bitget | Top 3 | Yes | Yes (self-audited) | No major breach | Yes ($300M fund) | Yes |

Bybit shines in terms of technical competence and crisis response, but falls slightly behind Kraken in audit transparency. Its use of Merkle Tree PoR is a strong start, but the absence of external verification means users must take Bybit’s word on reserve backing.

Kraken, while less aggressive in features, maintains a spotless security record and transparent, independently verified reserves. Binance, despite its 2019 hack, earns points for its SAFU fund and evolving compliance standards. Meanwhile, Bitget offers a substantial protection fund and ranks the highest on CER’s security index.

In terms of security features alone, Bybit’s response to its own crisis arguably sets a new standard — but independent reserve audits and an explicit user-focused protection fund could elevate its standing even further.

Unique Selling Points and Areas for Improvement

What sets Bybit apart isn’t just its speed or product diversity — it’s how it handled the worst-case scenario. The 2025 hack would have crippled a lesser exchange, but Bybit’s transparent leadership, immediate liquidity response, and platform stability turned a potential death blow into a long-term trust signal.

Additionally, the platform’s use of TEE, TSS, real-time monitoring, and AI-powered risk engines places it ahead of many competitors in pure tech sophistication. Its one-click account freeze, multi-layer transaction verifications, and global customer support also give users meaningful tools to protect their funds.

That said, there are still gaps:

- Proof of Reserves would benefit from independent audits to boost trust.

- The insurance fund is focused on leveraged trading, not general user protection.

- No support for US, UK, and Canadian users, limiting access in major regions.

Bybit’s potential is clear, but if it aims to set the gold standard, greater transparency, audit assurance, and user-side insurance mechanisms would push it to the top tier of trusted exchanges.

Next, let’s shift gears and look at what you can do to keep your crypto secure, both on Bybit and beyond.

Best Practices for Secure Trading and Self-Custody

Even the most secure exchange in the world can only do so much. As the saying goes, “not your keys, not your coins” — and in the current threat landscape, your personal security habits are just as important as any platform protocol. Let’s explore how to keep your crypto safe while using Bybit or any other centralised exchange.

Tips for Traders to Safeguard Their Assets

If you’re trading or storing funds on Bybit, here are a few essential steps you should take to tighten your security posture:

- Enable Two-Factor Authentication (2FA)

- It should go without saying, but many still ignore this. Always activate 2FA using an authenticator app (like Google Authenticator or Authy). Avoid SMS-based 2FA — it’s better than nothing, but still vulnerable to SIM-swapping attacks.

- It should go without saying, but many still ignore this. Always activate 2FA using an authenticator app (like Google Authenticator or Authy). Avoid SMS-based 2FA — it’s better than nothing, but still vulnerable to SIM-swapping attacks.

- Use a Strong, Unique Password

- Your Bybit login should not share a password with any other service. Make it long, complex, and random — and store it using a secure password manager.

- Your Bybit login should not share a password with any other service. Make it long, complex, and random — and store it using a secure password manager.

- Whitelist Withdrawal Addresses

- Bybit allows you to restrict withdrawals to pre-approved wallet addresses. If an attacker gains access to your account, this feature could be the last line of defence.

- Bybit allows you to restrict withdrawals to pre-approved wallet addresses. If an attacker gains access to your account, this feature could be the last line of defence.

- Monitor Account Activity Regularly

- Bybit provides real-time access logs and session management. Make it a habit to check for unfamiliar IP addresses, devices, or withdrawal attempts.

- Bybit provides real-time access logs and session management. Make it a habit to check for unfamiliar IP addresses, devices, or withdrawal attempts.

- Avoid Public Wi-Fi and Unsecured Devices

- Don’t log in to your account on public networks or shared computers. And never store private keys, passwords, or recovery phrases on cloud services or email accounts.

- Don’t log in to your account on public networks or shared computers. And never store private keys, passwords, or recovery phrases on cloud services or email accounts.

- Set Up Notifications

- Turn on email or SMS alerts for logins, withdrawals, and security changes. This gives you an immediate heads-up if something goes wrong.

Bybit CEO Ben Zhou Addresses The Community Live Just Hours After The Breach Was Discovered. Image via YouTube

Bybit CEO Ben Zhou Addresses The Community Live Just Hours After The Breach Was Discovered. Image via YouTubeEvaluating Security Tools and Self-Custody Solutions

While Bybit offers a wide range of security features, serious crypto users should also consider moving long-term holdings off-exchange — especially assets not actively being traded.

Here are some ways to complement your exchange setup:

- Use a Hardware Wallet

- Devices like the Ledger Nano X or Trezor Model T allow you to store crypto offline, away from internet-based threats. These are ideal for HODLing large balances.

- Devices like the Ledger Nano X or Trezor Model T allow you to store crypto offline, away from internet-based threats. These are ideal for HODLing large balances.

- Leverage MPC Wallets or Multi-Sig for Institutions

- If you’re managing assets on behalf of others or operating at scale, consider third-party custodial services or wallets that support Multi-Party Computation (MPC) or multi-signature access.

- If you’re managing assets on behalf of others or operating at scale, consider third-party custodial services or wallets that support Multi-Party Computation (MPC) or multi-signature access.

- Consider a VPN for Additional Privacy

- A virtual private network (VPN) can help mask your IP address and protect your connection when interacting with crypto platforms.

- A virtual private network (VPN) can help mask your IP address and protect your connection when interacting with crypto platforms.

- Educate Yourself on Phishing Attacks

- Bookmark Bybit’s official site and avoid clicking links from emails or social media. Familiarise yourself with common phishing tactics and always verify URLs.

- Bookmark Bybit’s official site and avoid clicking links from emails or social media. Familiarise yourself with common phishing tactics and always verify URLs.

- Plan for Emergencies

- In the event of a lost device, forgotten password, or compromised email, having a recovery plan — including backup 2FA codes and identity verification — can mean the difference between recovery and total loss.

Ultimately, your exchange is only as secure as the habits you bring with you. So stay sharp, think long-term, and treat every crypto login like you're opening the vault.

Conclusion

All things considered, Bybit has earned its place among the most resilient and security-conscious platforms in crypto — even in the wake of its most serious challenge to date.

The February 2025 hack was a sobering moment, not just for Bybit but for the industry as a whole. And yet, what could have spelled disaster turned into a real-world demonstration of operational strength, leadership transparency, and platform solvency. Bybit responded in record time, maintained user access, restored stolen reserves, and introduced additional security layers — all without skipping a beat.

From a technical standpoint, the platform combines cold storage, multi-sig wallets, TEE and TSS technology, real-time risk engines, and AI-powered fraud detection. On the compliance front, it holds regulatory standing in both Dubai and Cyprus, with mandatory KYC/AML, regular Proof of Reserves disclosures, and a growing culture of transparency.

That said, there’s still room to grow. Independent reserve audits, user-focused insurance coverage, and expanded regional access would all help push Bybit to the top tier of global exchanges.

In the meantime, Bybit offers one of the most advanced trading environments in the market — from high-frequency derivatives and spot markets to copy trading, staking, and fiat support. And for traders who take security seriously, it remains a strong choice in 2026.

Of course, no platform can fully protect users who neglect their own security. So, whether you’re trading on Bybit or elsewhere, enable 2FA, use secure devices, and practice smart custody. Because in crypto, vigilance is the only true guarantee.