Crypto is exciting and risky. From exchange hacks and rug pulls to phishing scams and lost private keys, it demands more from users than traditional finance ever has. Security isn’t optional; it’s essential. If you’re going to buy, sell, or hold crypto, you need a platform that takes safety seriously.

That’s why choosing the right exchange matters. A secure platform can’t guarantee you’ll never face risks, but it can stack the odds in your favor. Things like cold storage, two-factor authentication, regulatory oversight, and transparent operations can make the difference between peace of mind and a painful loss.

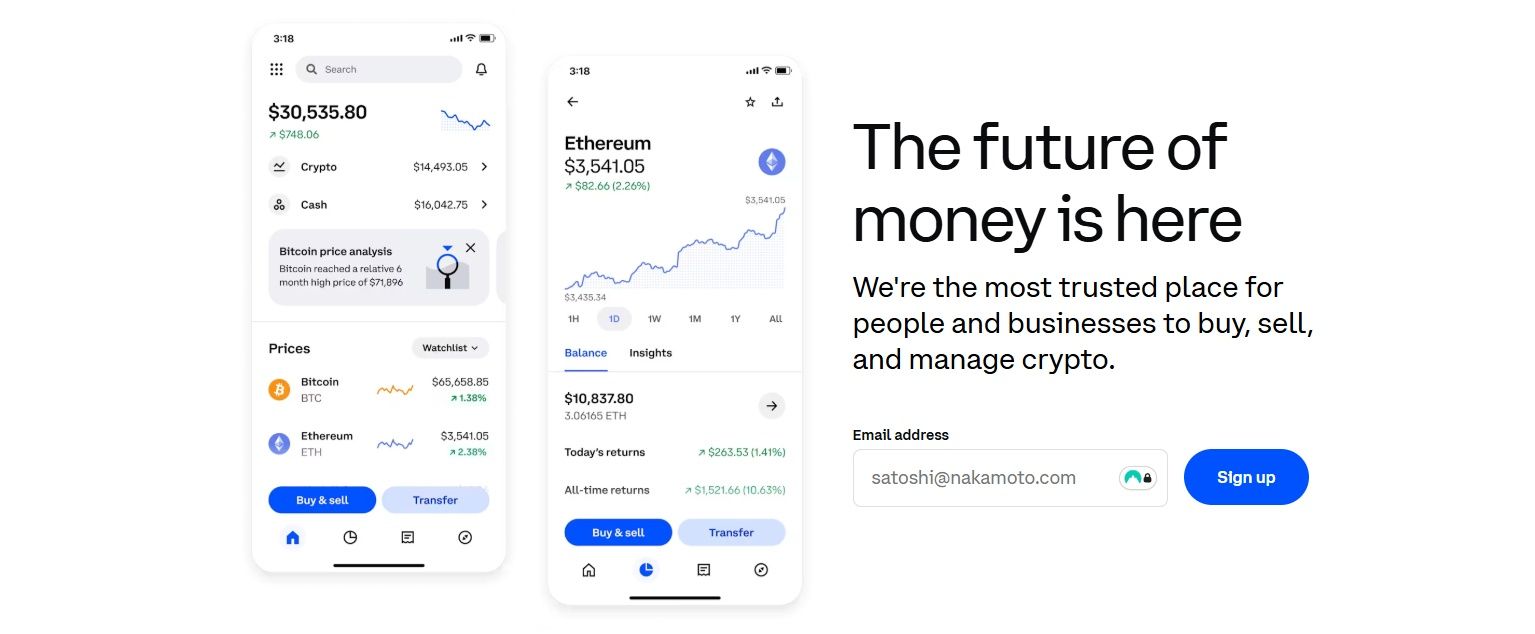

Coinbase is not only one of the most well-known platforms in the space, but it's also one of the most regulated.

In this guide, we’ll examine just how safe Coinbase really is. We’ll explore its security measures, regulatory history, user complaints, and the recent data breach.

Key Takeaways

- Yes, Coinbase is one of the safest crypto exchanges available. It's backed by cold storage, strict compliance, robust encryption, and the accountability of being a public company.

- 98% of user funds are held in cold storage, and AES-256 encryption protects all sensitive user data, mirroring top banking standards.

- Mandatory two-factor authentication (2FA), biometric logins, address whitelisting, and bug bounty programs all add extra layers of security.

- Coinbase complies with global regulations, holds multiple licenses, and underwent public scrutiny after being fined and later cleared by regulators in the US and UK.

- A 2025 data breach exposed personal user data but no funds were stolen; Coinbase refused to pay ransom and pledged full cooperation and reimbursement for affected users.

- While no exchange is bulletproof, Coinbase’s transparency, legal compliance, and strong infrastructure make it a reliable choice, especially for beginners and risk-averse investors.

Want to compare Coinbase with other exchanges? We've got you covered.

Understanding Coinbase – A Quick Overview

Coinbase was founded in 2012 by Brian Armstrong and Fred Ehrsam with a simple goal — to make crypto easy and safe for everyone. The goal was simple, but a great effort was required to achieve this. Starting with just Bitcoin, the platform has since evolved into a major gateway for buying, selling, and holding a wide array of digital assets.

From the start, Coinbase took regulation seriously. It’s registered with FinCEN as a Money Services Business and follows anti-money laundering and consumer protection laws. But it's had its run-ins too. In 2023, the SEC accused Coinbase of running an unregistered securities exchange. Fast forward to 2025, the case was dropped — huge win for Coinbase and, frankly, the entire U.S. crypto scene.

Then there’s its public status. Coinbase went public in 2021, trading under the ticker COIN. That means it has to spill the beans on finances regularly, giving users and investors a clear look at what’s going on under the hood. CoinGecko shows a 24-hour trading volume of $2.5 billion. So yeah, it's doing just fine.

And let’s talk reach. As of 2025, Coinbase operates in over 100 countries with 9.7 million monthly transacting users as per its most recent Form 10-Q filing with the US SEC. So, Coinbase is a strong force to be reckoned with in the crypto world, and we will go deeper and explore how trustworthy and safe it is despite the odds favoring it.

If you're considering Coinbase as your cryptocurrency exchange, our comprehensive Coinbase review offers an in-depth look at its features, fees, and overall user experience to help you make an informed decision.

Is Coinbase Secure? Breaking Down Its Safety Measures

When it comes to securing your crypto, Coinbase doesn't just talk the talk. Let's break down the layers of protection they've put in place.

Data Security Infrastructure

Coinbase employs AES-256 encryption, the gold standard used by banks, to safeguard sensitive user information like bank account numbers and routing details. This ensures that even if data were intercepted, it would be virtually unreadable without the proper keys.

To further protect assets, Coinbase stores about 98% of customer funds offline in cold storage. This means the majority of digital assets are kept in environments disconnected from the internet, significantly reducing exposure to online threats.

Additionally, Coinbase maintains a bug bounty program through HackerOne, inviting security researchers to identify and report vulnerabilities. This proactive approach helps them stay ahead of potential security issues.

Coinbase stores about 98% of Customer Funds Offline in Cold Storage. Image via Freepik

Coinbase stores about 98% of Customer Funds Offline in Cold Storage. Image via FreepikAccount Protection & Authentication Features

Security isn't just about backend measures; user account protection is equally vital. Coinbase requires Two-Factor Authentication (2FA) for complete access, adding an extra layer of security beyond just a password.

They also offer address whitelisting, allowing users to restrict withdrawals to pre-approved addresses, minimizing the risk of unauthorized transfers.

For added convenience and security, Coinbase supports biometric logins and passkeys, enabling users to access their accounts using fingerprint or facial recognition, reducing reliance on traditional passwords.

Insurance & Asset Protection

In the unfortunate event of a breach, Coinbase carries crime insurance that covers a portion of digital assets held in their storage systems against losses from theft, including cybersecurity breaches. However, it's important to note that this insurance does not cover losses resulting from unauthorized access to individual accounts due to compromised credentials.

Recent Data Breach

Recent events underscore the importance of these measures. In May 2025, Coinbase disclosed a data breach where attackers bribed customer support agents to access sensitive user information. While no passwords or funds were compromised, the incident affected less than 1% of users. We have some more details on this ahead.

Coinbase and User Privacy: How Is Your Data Handled?

When it comes to handling user data, Coinbase takes a structured approach to privacy, aligning with global standards and regulations.

What Data Does Coinbase Collect?

To comply with financial regulations and ensure platform security, Coinbase collects a range of personal information. This includes:

- Identity Verification Data: Such as your name, date of birth, and government-issued identification documents.

- Contact Information: Include your email address and phone number.

- Financial Details: Like linked bank account numbers and transaction histories.

- Usage Data: Encompassing device information, IP addresses, and geolocation data.

This information is essential for fulfilling Know Your Customer (KYC) and Anti-Money Laundering (AML) obligations, as well as for safeguarding against fraudulent activities.

Coinbase takes a Structured Approach to Privacy, Aligning with Global Standards. Image via Coinbase

Coinbase takes a Structured Approach to Privacy, Aligning with Global Standards. Image via CoinbaseHow Is Your Personal Information Used and Stored?

Coinbase utilizes your data to:

- Provide Services: Facilitating transactions and account management.

- Enhance Security: Monitoring for suspicious activities to protect user accounts.

- Comply with Legal Requirements: Reporting to regulatory bodies as mandated.

- Improve User Experience: Personalizing services and communications.

Importantly, Coinbase states that it does not sell your personal information to third parties without your consent. Users have control over certain data-sharing preferences, such as opting out of sharing information with third-party partners for advertising purposes.

GDPR Compliance and User Data Control

For users in the European Union and the United Kingdom, Coinbase adheres to the General Data Protection Regulation (GDPR). This compliance grants users rights, including:

- Data Access: Requesting a copy of the personal data Coinbase holds.

- Data Correction: Amending inaccurate or incomplete information.

- Data Deletion: Requesting the removal of personal data under certain conditions.

- Consent Withdrawal: Revoking consent for data processing activities.

These measures ensure that users have significant control over their personal information, aligning with global expectations for data privacy.

Coinbase Fraud Prevention Measures

When it comes to keeping your crypto safe, Coinbase employs a multi-layered approach to detect and prevent fraudulent activities. Let's break down the key components of their fraud prevention strategy.

Anti-Money Laundering (AML) Protocols

Coinbase adheres to stringent Anti-Money Laundering (AML) regulations to prevent illicit activities on its platform. This includes implementing policies and procedures designed to detect and report suspicious transactions, thereby ensuring compliance with global financial standards. In 2023, Coinbase agreed to a $100 million settlement with New York regulators over deficiencies in its AML program, highlighting the importance of robust compliance measures.

Coinbase Balances Regulatory Compliance with Proactive Fraud Detection. Image via Freepik

Coinbase Balances Regulatory Compliance with Proactive Fraud Detection. Image via FreepikKnow Your Customer (KYC) Requirements

To verify the identity of its users, Coinbase employs Know Your Customer (KYC) procedures. This process involves collecting personal information such as full legal name, date of birth, and address, as well as verifying government-issued identification documents. KYC helps Coinbase assess the risk profile of its users and comply with legal requirements.

Monitoring for Suspicious Activities and Account Freezes

Coinbase utilizes advanced monitoring systems to detect unusual account activities that may indicate fraudulent behavior. This includes tracking transaction patterns and login attempts. If suspicious activity is detected, Coinbase may temporarily freeze the account to prevent potential losses and conduct a thorough investigation. Users are encouraged to keep their identity verification documents up to date and monitor their account activity regularly to avoid unnecessary disruptions.

By implementing these measures, Coinbase aims to create a secure environment for its users, balancing regulatory compliance with proactive fraud detection.

User Reviews & Complaints: What Are Customers Saying?

Coinbase's reputation among users is a mixed bag, reflecting both its strengths and areas needing improvement. Let's delve into the feedback from various platforms and real-world incidents to get a comprehensive view.

Trustpilot and App Store Ratings

On Trustpilot, common praises highlight the platform's user-friendly interface and ease of use, especially for beginners entering the crypto space. Users appreciate the straightforward process of buying and selling cryptocurrencies, as well as the educational resources available.

However, a significant number of complaints focus on customer service issues, including delayed responses and difficulties in resolving account-related problems. Users have reported frustrations with account lockouts and withdrawal delays, which can be particularly concerning when dealing with volatile crypto markets. However, it is also important to note that while some users may not be happy with something because of their experience, many are quite satisfied, pointing to how the experiences also vary from case to case.

In contrast, the Coinbase app fares better. The App Store and Google Play Store reviews are generally positive, with users praising the app's functionality and design. Nevertheless, some users have noted occasional glitches and a desire for more advanced features within the app.

User Trust remains a Critical Factor in the Platform's ongoing Reputation. Image via Freepik

User Trust remains a Critical Factor in the Platform's ongoing Reputation. Image via FreepikReal-World Scenarios

As we mentioned before, in May 2025, Coinbase disclosed a significant security breach where cybercriminals bribed customer support agents to access sensitive user data. The stolen information included names, email addresses, and partial social security numbers. Although no passwords or funds were compromised, the incident affected less than 1% of users.

Coinbase refused to pay the $20 million ransom demanded by the attackers and instead offered a $20 million reward for information leading to their capture. The company also pledged to reimburse affected customers who were a victims of the attack.

This breach led to at least six lawsuits against Coinbase, with plaintiffs alleging inadequate security measures and mishandling of the incident.

Regulatory Status and Legal Standing of Coinbase

As one of the most visible crypto platforms in the world, Coinbase’s legal standing and regulatory posture are critical to how it’s perceived by users and investors alike. Let’s explore how it handles the rules of the road.

How Being a Public Company Affects Security and Trust

When Coinbase went public on the Nasdaq in 2021, it brought a new level of legitimacy and scrutiny. As a public company, Coinbase must publish detailed financial reports and uphold strict operational standards. This transparency helps build user trust, but also means any security mishaps or legal troubles quickly become headline news.

As a Public Company, Coinbase must Publish Detailed Financial Reports and uphold Strict Operational Standards. Image via Freepik

As a Public Company, Coinbase must Publish Detailed Financial Reports and uphold Strict Operational Standards. Image via FreepikCompliance with US and International Laws

In the U.S., Coinbase is registered with FinCEN and holds a BitLicense in New York. It’s bound by AML and KYC regulations and has faced penalties, like a $100 million fine in 2023 for AML lapses. Internationally, Coinbase is licensed in the UK and the Netherlands, letting it serve European users while complying with local laws. It's important to mention that it faced fines from the Dutch Central Bank in the past as well, a matter that was later resolved.

In 2024, Coinbase’s UK arm was fined £3.5 million by the Financial Conduct Authority for failing to comply with a voluntary agreement on onboarding high-risk customers. The fine highlighted lapses in Coinbase’s financial crime controls at the time. However, by early 2025, Coinbase secured VASP registration from the FCA, signaling improved regulatory compliance in the UK.

Relationships with Regulatory Bodies

Coinbase isn’t just reacting to regulations—it’s trying to shape them. The company regularly engages with the SEC and other global regulators, and it even proposed a dedicated crypto regulatory framework. With a full-time public policy team, Coinbase is positioning itself as a bridge between traditional finance rules and the rapidly evolving crypto world.

Bottom line? Coinbase is playing the long game, betting on compliance as a cornerstone of trust.

Coinbase vs Other Exchanges: Is It Safer Than the Rest?

Choosing a crypto exchange is similar to picking a vault for your digital gold—you want more than just convenience; you want rock-solid security, clear rules, and a reputation that doesn’t raise eyebrows. So, how does Coinbase compare to the likes of Kraken, OKX, and Binance? Let’s stack them up.

| Exchange | Security Features | Regulatory Transparency | Public Perception of Trustworthiness |

|---|---|---|---|

| Coinbase | AES-256 encryption, 2FA, 98% of funds in cold storage, bug bounty program | Publicly listed on Nasdaq, FinCEN-registered, licensed in US and EU | Generally high due to transparency and focus on compliance |

| Kraken | 2FA, cold storage, withdrawal whitelists, proof-of-reserves audits | US-based, regulated in various jurisdictions, some past regulatory challenges | Well-regarded among experienced users, strong operational track record |

| OKX | 2FA, cold storage, less detailed public disclosures on security protocols | Operates globally, registered in Seychelles, limited clarity on full regulatory compliance | Growing user base, but trust is cautious due to transparency concerns |

| Binance | 2FA, cold storage, SAFU insurance fund, past breaches reported | Registered in multiple countries but faced bans and fines in US, UK, and EU; CEO resigned in 2023 amid legal settlements | Mixed reputation—widely used but scrutinized for regulatory run-ins and past security breaches |

While no platform is bulletproof, Coinbase’s transparent regulatory approach and strong security practices give it a slight edge, especially for users who value compliance and trust. Kraken follows closely with its security-first mindset, while Binance and OKX offer broader features but come with a few more asterisks. The safest choice really depends on what kind of crypto journey you're on.

While we are here doing some comparisons, don't miss out on our detailed reviews on these exchanges:

Speaking of, check out our top picks for the best Coinbase alternatives.

Tips for Staying Safe While Using Coinbase

Even with Coinbase's robust security infrastructure, the safety of your crypto assets heavily relies on your personal vigilance. Let's explore some best practices to enhance your account security and know when to seek support.

The Safety of your Crypto Assets heavily relies on your Personal Vigilance. Image via Freepik

The Safety of your Crypto Assets heavily relies on your Personal Vigilance. Image via FreepikBest Practices for Account Security

- Enable Strong Two-Factor Authentication (2FA): Opt for the most secure form of 2FA available. Hardware security keys like YubiKey offer superior protection, followed by authenticator apps such as Google Authenticator. SMS-based 2FA is less secure but better than nothing.

- Utilize Cold Wallets for Long-Term Storage: For assets you don't plan to trade frequently, consider transferring them to a cold wallet. These offline wallets are less susceptible to online threats.

- Be Wary of Phishing Scams: Always verify the authenticity of emails or messages claiming to be from Coinbase. Check URLs carefully and avoid clicking on suspicious links. Remember, Coinbase will never ask for your password or 2FA codes.

- Regularly Update Your Passwords: Use complex, unique passwords for your Coinbase account and change them periodically. Consider using a reputable password manager to keep track of them.

When to Contact Support

- Detecting Suspicious Activity: If you notice unfamiliar transactions, login attempts, or receive unexpected security alerts, it's crucial to act promptly.

- Reporting Issues Quickly: Use Coinbase's official support channels to report any concerns. Avoid third-party contacts claiming to be Coinbase representatives.

- Ensuring Secure Support Interactions: Coinbase will never initiate unsolicited calls or request sensitive information like passwords or 2FA codes. Always verify you're communicating through official channels.

Pros and Cons of Using Coinbase for Crypto Investments

When deciding whether to park your crypto on Coinbase, the question isn't just "Is it safe?"—it’s also "Is it safe enough for me?" Security isn't one-size-fits-all, and your comfort level will depend on how you plan to use the platform.

Here's a quick look at the key strengths and limitations of Coinbase’s security setup, so you can judge if it's the right fit for your crypto journey.

Coinbase is best Suited for Users who Value a Well-Regulated, easy-to-use Platform. Image via Freepik

Coinbase is best Suited for Users who Value a Well-Regulated, easy-to-use Platform. Image via FreepikKey Benefits from a Security Standpoint (Pros):

- AES-256 encryption ensures user data is securely stored and difficult to breach.

- 98% of customer funds are held in cold storage, minimizing online attack exposure.

- Two-factor authentication (2FA) is mandatory, adding a critical layer beyond passwords.

- Biometric login and passkey support enhance personal account security.

- Withdrawal whitelisting prevents unauthorized asset transfers to unknown addresses.

- Bug bounty programs and regular security audits help proactively identify vulnerabilities.

- Insurance covers online-held digital assets in the event of platform-level breaches.

- Dedicated anti-phishing tools and user education reduce susceptibility to scams.

- Public company status mandates regular security disclosures, increasing accountability.

Potential Risks and Limitations (Cons):

- Insurance does not protect against user-side breaches, like phishing or poor password hygiene.

- Customer service delays during security incidents can prolong exposure and user anxiety.

- Coinbase has experienced data breaches, most recently in 2025, exposing user info (though no funds were lost).

- Accounts may be frozen automatically during fraud detection, causing temporary loss of access.

- Security-focused features require user activation, meaning those who skip setup remain vulnerable.

We also curated a guide on risk management recently to help you stay safe.

Final Verdict: Is Coinbase a Safe Place to Store and Trade Crypto?

Coinbase has earned its stripes as one of the most secure crypto platforms out there. With strong encryption, cold storage, and 2FA baked in, it’s a fortress by crypto standards. Its status as a publicly traded company means more transparency than most, and that’s a big deal in an industry that often operates in the shadows.

But even fortresses have weak spots. Coinbase has faced breaches and customer data exposure, thankfully, not involving lost funds, but still unsettling. Plus, their customer support can feel glacial, especially when you need fast help during a security scare.

So, should you use Coinbase? If you’re just stepping into crypto or you value regulation and peace of mind, Coinbase is a solid, secure pick. It's not the cheapest or the most private, but it's reliable.

The bottom line: Coinbase is safe, as long as you meet it halfway. Set up strong 2FA, keep your email locked down, and consider moving your long-term holdings to a cold wallet.