As we move through 2025, the cryptocurrency market has been on a remarkable run. Bitcoin surged to record highs, peaking at around $124,000 in mid‑August, driven by rising institutional demand and favorable regulatory shifts. Ether, too, overtook its previous peak, touching $4,900 and marking a new all-time high in value.

These milestones have helped lift the total cryptocurrency market capitalization past $4.18 trillion, a significant leap from the roughly $2.5 trillion recorded just months earlier. Put simply: crypto is back in the spotlight, attracting renewed interest from both seasoned and fresh investors alike.

Crypto Market Capitalization Cross $4T in August 2025 | Image via CoinGecko

Crypto Market Capitalization Cross $4T in August 2025 | Image via CoinGeckoThis latest ascent is prompting many people, especially those new to space, to take notice. That surge in price and visibility is fueling questions like: Does crypto offer real value? Is there tangible utility behind it? How does crypto investing compare to traditional financial assets like stocks or bonds? These are especially valid questions for the uninitiated.

That’s where this article comes in. It’s aimed at newcomers exploring the cryptocurrency landscape. We'll break down what crypto is, how it works, and most importantly, how investing in it aligns with or diverges from more familiar assets.

TL;DR — The Case For (and Against) Crypto Investing

- Yes, crypto can be a good investment, but only as a satellite allocation in a diversified portfolio. The upside potential is real, but so are the risks of volatility, regulation, and self-custody responsibility.

- Why it’s attractive: Crypto adds diversification, offers high return potential, runs 24/7, supports fractional investing, and opens doors to DeFi, tokenized assets, and new global financial rails.

- Main risks to weigh: Extreme price swings, uneven regulation, security threats (self-custody, hacks, scams), and fragmented liquidity mean investors must be cautious and size allocations modestly.

- Best way to approach: Treat BTC and ETH as “core” holdings for long-term exposure. Add only small positions in altcoins, DeFi, or NFTs as speculative “satellites.” Avoid leverage until experienced.

- Risk management: Use dollar-cost averaging, self-custody long-term holdings with hardware wallets, keep meticulous tax records, and rebalance periodically. Education and discipline matter as much as the assets themselves.

- Expert consensus: Analysts remain bullish on the long-term, pointing to institutional adoption, ETFs, tokenization of real-world assets, and DeFi growth. But they stress patience, sizing discipline, and avoiding FOMO-driven decisions.

Bottom line: Crypto is a legitimate asset class in 2025. It belongs in a portfolio if you understand the risks, keep allocations reasonable, and commit to a disciplined, long-term strategy.

Understanding Cryptocurrency as an Asset Class

A cryptocurrency is a digital asset that relies on cryptography and decentralized networks rather than central authorities. Unlike fiat money issued by governments, crypto is entirely digital and governed by code. Several key characteristics define this asset class:

- Entirely Digital: Cryptocurrencies exist in a digital form. Ownership and transactions are recorded on a digital ledger, accessible through cryptographic keys rather than paper or coins.

- Decentralized: No single bank, government, or corporation controls the system. Instead, networks are distributed across thousands of computers, making them resistant to censorship and single points of failure.

- Blockchain-Based: Transactions are logged on a distributed ledger known as a blockchain. This ensures transparency and immutability; once recorded, data cannot easily be altered.

- Secured by Cryptography: Cryptographic techniques validate transactions, secure wallets, and prevent double-spending, ensuring trust in a trustless environment.

Blockchain’s Role

Blockchain underpins the entire cryptocurrency ecosystem. At its simplest, it is a decentralized, distributed ledger maintained across nodes in a network. Each block of transactions is linked to the one before it, forming an immutable chain. Consensus mechanisms, such as Proof of Work (PoW) and Proof of Stake (PoS), ensure that all participants agree on the ledger’s state.

A blockchain transaction | Image via Geeksforgeeks

A blockchain transaction | Image via GeeksforgeeksThis structure provides security, transparency, and immutability: qualities that make blockchain suitable for digital money and beyond. Smart contracts, introduced by Ethereum, further expand blockchain’s role by enabling automated, programmable agreements.

Coin Bureau's Blockchain 101 will help you with a deeper understanding of this technology.

Bitcoin and Ethereum

Two projects highlight crypto’s evolution:

- Bitcoin (BTC): Launched in 2009, Bitcoin was the first blockchain-powered currency. It is often compared to digital gold, designed as a scarce and decentralized store of value and medium of exchange.

- Ethereum (ETH): Introduced in 2015, Ethereum extended blockchain’s utility with smart contracts and decentralized applications (DApps). While Bitcoin focuses on payments and value storage, Ethereum functions more like a global computing platform powering finance, gaming, and digital identity.

Cryptocurrencies vs. Traditional Investments

Although cryptocurrencies and traditional assets, such as stocks, index funds, and precious metals, share basic principles like supply and demand, liquidity, and speculation, their foundations diverge sharply.

- Ownership: In crypto, ownership is tracked on-chain via a public ledger; in stocks, it is recorded through regulated brokers and exchanges.

- Underlying Value: Stocks represent equity in a business with revenues and profits. Crypto assets may grant network utility (governance, staking, payments) but do not confer legal ownership.

- Trading Environment: Stocks trade on centralized, regulated exchanges during market hours. Cryptocurrencies trade globally, 24/7, on both centralized and decentralized platforms.

- Regulation and Protections: Stockholders benefit from strong investor protections and disclosure requirements. Crypto investors must rely on self-custody and bear direct security risks.

- Volatility: Crypto markets are typically more volatile due to lower liquidity and speculative trading. Stocks, while not immune to shocks, generally move within narrower ranges.

In short, while both can be used for wealth-building, crypto sits apart as a borderless, decentralized, and more speculative asset class, offering different opportunities and risks compared to equities or bonds.

How Cryptocurrency Investments Work

Blockchains run continuously, meaning the crypto markets never sleep; so neither do the platforms that trade them. Whether night or day, exchanges are always active, enabling perpetual crypto trading.

Centralized Exchanges (CEXs)

Centralized exchanges resemble traditional brokerages in both appearance and function, but for crypto. They offer:

- Familiar UX: Simple interfaces, order books, fiat onramps, a comfortable experience for traditional investors.

- Custodial Services: The exchange holds your crypto on your behalf, which is convenient, but that means you don’t maintain full control.

- Regulated and Accessible: Top platforms, such as Binance, Coinbase, OKX, and Kraken, offer deep liquidity, low fees, and enhanced regulatory compliance, making them relatively safe to use for new users.

- Easy Fiat-to-Crypto Access: They bridge traditional finance and the crypto world, allowing direct purchase with bank transfers, cards, or other means.

Learn about the Best Crypto Exchanges and find the ideal choice for you on the Coin Bureau.

Decentralized Exchanges (DEXs)

DEXs operate directly on the blockchain itself:

- Non-custodial & On-Chain: You trade from your own wallet, no middleman, full ownership.

- Automated Market Making: Trades are executed against liquidity pools, with prices determined algorithmically. Uniswap is a classic example of an AMM.

- Wallet Needed: You must connect your wallet to trade, making it slightly more technical.

- Higher Costs (sometimes): Higher gas fees on layer‑1 chains, but Layer‑2 solutions often bring costs down to just a few cents, sometimes matching or beating CEX fees.

Recommendation: Beginners are best served starting on a CEX for ease and simplicity. As comfort with crypto grows, migrating to Layer-2 DEXs offers lower fees, greater control, and decentralized power.

You can learn more about the nuances of CEXs and DEXs on The Coin Bureau blog.

Cryptocurrency Wallets and Security

A wallet stores your private keys, which are your direct access to your crypto. There are two main types:

- Hot Wallets: Online or app-based; convenient for daily use but more vulnerable.

- Cold Wallets: Offline devices or paper-based; far more secure for long-term storage, but adds more steps to UX.

Security best practices include using hardware wallets if convenient, strong passwords, two-factor authentication (2FA) in CEXs, and keeping backups safe.

Investment Vehicles Beyond Direct Purchase

The crypto space now offers traditional investment vehicles:

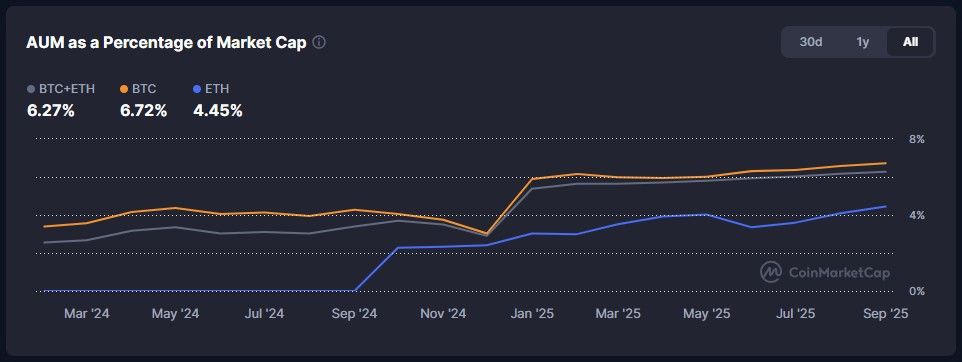

- ETFs & Futures: Crypto ETFs (like spot BTC or ETH funds) can be purchased directly on stock markets, offering regulated exposure without owning the crypto. Futures contracts also exist for sophisticated strategies. Major issuers include firms like BlackRock, Franklin Templeton, ProShares, VanEck, and Bitwise.

- Crypto Company Proxies: Firms such as MicroStrategy, which holds massive amounts of Bitcoin, act as indirect crypto investments and are popular crypto exposure tools without direct digital asset investment.

- Trusts: Options like Grayscale Bitcoin Trust exist but often trade at significant premiums and come with less flexibility compared to ETFs, generally not the most investor-friendly choice.

Crypto ETF’s Growing Dominance Prove They’re an Increasingly Popular Investment Vehicle | Image via CoinMarketCap

Crypto ETF’s Growing Dominance Prove They’re an Increasingly Popular Investment Vehicle | Image via CoinMarketCapThe Role of Global Market Demand & Price Dynamics

Prices are discovered primarily on major CEXs, reflecting global supply and demand. Institutional investors now play an outsized role:

- Institutional Expansion: As of Q1 2025, institutions funneled $21.6 billion into crypto. Digital assets AUM across institutions exceeds $235 billion, according to CoinLaw.

- More than 59% of institutions surveyed by Coinbase plan to allocate over 5% of their AUM to digital assets, seeking diversification and innovation.

- Institutional funds now influence about 46% of Bitcoin’s trading volume, and Binance alone commands roughly 39.8% of global spot volume, AI Invest reported.

Meanwhile, DEXs tend to respond more slowly to price shifts. Market makers and arbitrageurs help ensure liquidity and help align prices across CEXs and DEXs, providing passive price stabilization.

In summary:

- CEXs = user-friendly, custodial, robust liquidity.

- DEXs = non-custodial, wallet-based, increasingly cost-efficient on Layer-2s.

- Wallets = critical to security; hot for convenience, cold for safety.

- Investment vehicles = ETFs for accessibility, proxies like MicroStrategy, trusts (less ideal).

- Price dynamics = shaped by 24/7 market, institutional players, and automated arbitrage mechanisms.

Potential Benefits of Investing in Cryptocurrency

The benefits of familiarity with cryptocurrencies include enabling access to a new asset class and a new vertical of finance, where products are primarily designed for retail users and offer global access. In DeFi (decentralized finance), your location does not typically gatekeep access to any on-chain product. Major benefits include:

Portfolio Diversification

Cryptocurrency stands apart as its own asset class with unique fundamentals and market behaviors. Because crypto often moves independently from equities or bonds, adding it to a traditional portfolio has the potential to improve overall diversification. Some hedging firms even allocate to crypto to offset anticipated stock-market volatility after hours or during sudden market shifts.

High Return Potential

Crypto markets in 2025 have delivered remarkable gains, outpacing many traditional assets:

- Bitcoin has surged ~26 % year-to-date, recently reaching record highs near $124,500, while Ethereum has climbed about 36 % in the same period.

- In Q2 alone, Bitcoin was the best-performing major asset globally, according to BitWise, rising over 30% — nearly three times the returns of U.S. stocks and more than five times that of gold.

These figures highlight crypto’s potential for outsized returns, but it’s crucial to remember that such gains come with elevated volatility and risk, which is part of the territory of crypto investing.

Accessibility

Crypto democratizes finance in two powerful ways:

- 24/7 Market Access: Crypto markets never pause. Investors can trade at any time, even when stock exchanges are closed.

- Fractional Investment: You can buy portions of assets like Bitcoin or Ethereum, allowing you to tailor your exposure to any budget, even if the full token price is high.

These features make crypto uniquely inclusive, especially compared to many traditional assets that require higher minimums or limited trading windows.

Technological Innovation & Growth Opportunities

Getting involved in crypto opens the door to DeFi, a whole new financial ecosystem that’s far more accessible than its traditional counterpart. DeFi enables:

- Global savings-like products that offer competitive rates, bypassing geographical barriers.

- Prediction markets, peer-to-peer lending, and private credit access without the usual gatekeepers.

- Open, permissionless protocols that let users engage with financial services directly, often at lower cost and without centralized approval.

The Article Talks About How Maple Finance Unlocks Private Credit for Retail via Tokenization | Image via Blockworks

The Article Talks About How Maple Finance Unlocks Private Credit for Retail via Tokenization | Image via BlockworksThese capabilities, largely unreachable to most retail investors in TradFi, illustrate one of crypto’s most compelling long-term value propositions.

Risks and Challenges of Cryptocurrency Investing

A growing share of the most worrying crypto risks driven by uncertainty has eased with stronger market infrastructure, mainstream awareness, and clearer rules in major jurisdictions. That said, no asset class is risk-free, and crypto has its own set of challenges worth understanding before you allocate.

Volatility

For many investors, volatility is a feature, not a flaw. But you should know why crypto swings more than most markets:

- Global trading: Unlike equities, bonds, or real estate, which are mostly local or national, crypto is borderless. Capital flows from every timezone, compounding intraday moves.

- Perpetual markets: There are no closing bells and no exchange-imposed circuit breakers. Price discovery is continuous, so shocks propagate instantly.

- Open participation: There’s no central gatekeeper screening asset risk or leverage usage. Retail, pros, and quants speculate side by side; diligence is entirely on the participant.

- Small size, big players: Relative to FX or global equities, crypto is still smaller. Large holders (retail whales, funds, treasuries) can move markets quickly.

- Fragmentation: Liquidity is split across chains, centralized exchanges, and countless on-chain pools. Thin order books magnify moves when sentiment flips.

Regulatory Headwinds

Regulation is advancing, but the patchwork remains:

- Uneven progress: A global consensus is forming, yet rules still vary widely across countries, with differing licensing, disclosures, and product approvals.

- Granularity gaps: A blanket classification doesn’t fit thousands of tokens. Blue chips like BTC and ETH benefit from clearer treatment in many major markets, but smaller assets often face ambiguous status.

- Reporting complexity: Tax rules exist but can be intricate, and many professionals remain unfamiliar with on-chain activity (swaps, staking, airdrops), increasing the chance of filing errors.

Security Risk

Crypto shifts key responsibilities from institutions to individuals:

- Decentralized security model: In non-custodial setups, you secure your own private keys and recovery phrases. For newcomers used to bank logins and password resets, this is a paradigm shift.

- Digital attack surface: Phishing, spoofed websites, malware, and approval scams target wallets and smart-contract permissions. Lapses in basic security hygiene (2FA, allowlist usage, hardware wallets) are common causes of loss.

Market Risks

Market structure and behavior introduce additional hazards:

- Limited investor protection: Most consumer safeguards are national; crypto is global. When platforms fail or protocols break, legal recourse can be slow or impractical across borders.

- Manipulation risk: Smaller venues and thinner liquidity reduce the capital needed to influence prices. Wash trading, spoofing, and coordinated pumps can still occur, especially in long-tail tokens.

- Reactive crowd dynamics: Crypto participants skew shorter-term and more momentum-driven. Flows can become reflexive, funding, narratives, and social sentiment can accelerate both rallies and drawdowns.

Bottom line: Crypto’s upside potential is paired with distinct sources of risk: structural (24/7, fragmented liquidity), regulatory (uneven rulebooks), operational (self-custody), and behavioral (momentum-heavy flows). Understand these levers, size positions appropriately, and choose custody and venues that match your risk tolerance.

Factors to Consider Before Investing in Crypto

Crypto investing can be interesting and rewarding if done right. Here are some rules you must consider seriously:

Personal Risk Tolerance & Time Horizon

- Size your allocation to your risk: Higher volatility means that crypto should align with your comfort level with drawdowns and your ability to withstand them.

- Start simple: If you’re new, keep the position small and focus on BTC and ETH first. They’re the most liquid and widely understood.

- Scale with experience. As you gain confidence, you can increase the allocation gradually, move a portion on-chain, and experiment with DeFi in controlled amounts (using clear risk limits and a hardware wallet for long-term funds).

Research & Due Diligence

- Only buy what you understand: Read a project’s documentation (whitepaper, docs, roadmap, token design) before allocating.

- Use quality sources:

- YouTube (for explainers and walkthroughs): Coin Bureau, Finematics, Whiteboard Crypto, Bankless, Unchained.

- News (for market and policy updates): CoinDesk, Blockworks, The Block.

- Analytics: Messari for sector research and token screens; Token Terminal for protocol “financials” (revenue, fees, active users).

- Cross-verify. Compare claims across multiple sources, being mindful of incentive disclosures and potential conflicts of interest.

- Operational hygiene. Check smart-contract audits, treasury transparency, token unlock schedules, and team/VC vesting.

Diversifying Within Crypto

- Core vs. satellite: Treat BTC/ETH as core holdings; add large-cap altcoins for thematic exposure (L2s, infrastructure, stablecoin rails).

- DeFi exposure: Consider blue-chip protocols (DEXs, lending markets, and liquid staking) for yield and network participation. Size positions conservatively and prefer audited, battle-tested apps.

- Long-tail risks: NFTs, early-stage tokens, and points/airdrop farming are speculative; cap them as a small satellite sleeve and assume higher failure rates.

- Liquidity first: Favor assets and venues with deep liquidity to reduce slippage and exit risk.

Taxes & Reporting

Common treatments (general guidance, not advice):

- Capital gains typically apply when you sell, swap, or spend crypto.

- Income treatment often applies to staking rewards, mining, airdrops for services rendered, interest/yield, or token incentives at the time of receipt; later disposal can trigger capital gains on top.

- Record-keeping is essential: track acquisition dates, cost basis, proceeds, fees, and wallet/exchange addresses.

- Jurisdiction differences. Rules, rates, and reporting forms vary widely by country (e.g., short- vs. long-term gains, specific NFT treatment, DeFi nuances).

Do the homework: Review your local guidance, use reputable tax software that supports on-chain activity, and consult a licensed professional for complex cases (bridges, wrapped assets, MEV, cross-chain swaps).

Quick takeaway: Let your risk profile set the allocation, earn your way into complexity through research and small experiments, diversify inside crypto with a core-satellite approach, and get ahead of taxes with disciplined records and local advice.

Find more insights on Coin Bureau's Starter Guide and Trading Guide.

Strategies for Managing Risk in Crypto Investing

Familiarizing yourself with these strategies will make your crypto investing experience much smoother and also save you from events that potentially lead to losses:

Dollar-Cost Averaging (DCA)

DCA spreads entry risk by buying a fixed amount at regular intervals. It reduces the impact of bad timing and keeps you disciplined. You can tailor it:

- Calendar DCA: Buy weekly or monthly, no exceptions.

- Event-based DCA: Add only on corrections. For example, allocate tranches at −5%, −10%, and −15% drawdowns from a recent high, then pause until price recovers or a new signal triggers.

- Hybrid: Maintain a small calendar DCA and layer extra buys on deeper dips. Predefine limits to avoid catching falling knives indefinitely.

Use Exchanges for Access, Wallets for Storage

Centralized exchanges are great for on-ramps and liquidity, but are not ideal vaults. For holdings you do not plan to trade soon:

- Withdraw to non-custodial wallets. Use a hardware wallet for long-term storage and a reputable hot wallet for day-to-day on-chain use.

- Hygiene: Enable 2FA on exchange accounts, set withdrawal allowlists, and test a small withdrawal before moving size. Regularly review token approvals in your hot wallet and revoke stale permissions.

Logical Portfolio Construction

Structure positions so one mistake doesn’t sink the portfolio.

- Core and satellite: Make BTC and ETH your core for liquidity and network strength.

- Sizing rules: Limit higher-risk assets (smaller caps, experimental DeFi, NFTs) to a small satellite sleeve with strict position caps. Many investors keep any single long-tail bet below 1–2% of the total portfolio.

- Leverage sparingly: If you use leverage, keep it low, understand liquidation prices, and fund positions with stable collateral where possible. Avoid emotional traps and cross-collateral setups that can cascade.

- Rebalance on rules: Periodically take profits from outperformers back into core positions or stables. Use time-based or threshold-based rebalancing and stick to it.

Process and Tools

- Pre-trade checklist: Liquidity, slippage at intended size, token unlocks, smart-contract audits, team and treasury transparency, and counterparty risk.

- Position lifecycle: Define entry plan, risk limit, invalidation level, and exit criteria before buying. Use alerts instead of emotional monitoring.

Stay Current on Taxes, Regulation, and Product Risk

- Taxes: Track cost basis, holding periods, and income events like staking rewards or airdrops. Use software that supports on-chain activity, and keep exportable records from exchanges and wallets.

- Regulation: Rules change by jurisdiction and can affect product availability, leverage, staking, or ETF access. Subscribe to a few reliable policy and market briefings.

- New DeFi offerings: Many yield products are not risk-free. Start small, check TVL composition and prefer protocols with a track record. Treat unusually high yields as a signal to slow down, not speed up.

Bottom line: Automate entries, self-custody long-term assets, size risk with a core-satellite structure, keep leverage modest, and run a consistent research and record-keeping process.

Expert Insights: Weighing the Pros and Cons

A wide range of commentators see meaningful upside for crypto, while acknowledging ongoing risks such as volatility and uneven regulation. For example, Bitwise Investments forecasted new all-time highs for Bitcoin, Ethereum, and Solana in 2025, with Bitcoin “above $200,000” in their year-ahead outlook. DeVere Group has described a “perfect storm” setup that could see Bitcoin break records in 2025. InvestingHaven’s 2025 roadmap is “directionally bullish,” publishing high/low targets for 20+ large caps, and Raoul Pal has argued the next ~six years could be transformative for investors as AI and crypto reshape markets—his Diary of a CEO appearance captured the thrust of this view.

Key developments experts point to

- Private credit access (on-chain): Private debt AUM is projected to surpass $2.3 trillion by 2027, and tokenization is emerging as a way to broaden access and modernize the plumbing; typical direct-lending yields sit roughly in the high single digits to low teens range, depending on risk. (Morgan Stanley)

- RWAs: According to Ledger Insights, tokenization of illiquid assets could reach ~$16T by 2030, a scale frequently cited as a core driver for the next adoption wave.

- Prediction markets: Trading on Polymarket reached $9B in 2024 and $6B in H1 2025 alone, indicating rapid growth. With AI-assisted curation and broader event coverage, some analysts expect the category to surpass $ 10 billion in annual volume, although regulation remains a key factor.

Balanced view

- Pros: Strong institutional adoption, expanding regulated wrappers (spot ETFs), and clear use-cases (payments, programmable finance, tokenized assets) support a constructive long-term case. Bitwise’s call for new ATHs reflects that narrative.

- Cons: The same forces that fuel upside like 24/7 global trading, a retail-institutional mix also amplify volatility and leave pockets of regulatory uncertainty and operational risk (self-custody, smart-contract failures).

Bottom line: On a long horizon, many credible voices expect growth, but they also warn that the path is uneven. For most investors, that argues for a core-satellite approach (BTC/ETH core; selective satellites), modest sizing, and rule-based risk management while tracking macro, regulation, and real on-chain adoption (RWAs, private credit, prediction markets) as the key signals.

Final Thoughts

Crypto can add value to a portfolio: it diversifies traditional exposure, offers high return potential, runs 24/7 with fractional access, and unlocks new rails like DeFi and tokenized assets. The trade-off is clear: greater volatility, uneven regulation, operational responsibility, and fragmented liquidity. For most investors, a core-satellite approach works: keep BTC/ETH as the core, size speculative bets modestly, and use rules for entries, exits, and rebalancing.

Avoid the classic errors: sloppy key management (no hardware wallet, weak backups), skipping research, chasing FOMO without a plan, and using excessive leverage. Keep records for taxes, stay current on policy changes, and treat security as part of your edge.

Crypto may be fast-paced, but building wealth takes care, precision, and patience.