Dogecoin began in 2013 as a lighthearted parody of Bitcoin, created largely as an internet meme. What started as a joke cryptocurrency quickly grew into a mainstream phenomenon, propelled by its Shiba Inu mascot, viral social media presence, and endorsements from high-profile figures. Over time, Dogecoin’s community evolved into one of the largest in the industry, ensuring the token’s survival through multiple market cycles.

Today, Dogecoin sits firmly among the top ten cryptocurrencies by market cap, widely listed across exchanges and still actively traded. But its rise from meme to market heavyweight raises an important question: Does Dogecoin’s popularity translate into real investment potential in 2025?

This article examines Dogecoin’s market performance, volatility, key value drivers, and risks, alongside expert forecasts, to help investors evaluate whether DOGE deserves a place in a modern crypto portfolio.

Quick Verdict: Is DOGE a Good Investment in 2025?

Verdict: Dogecoin is a speculative satellite asset, not a core holding. It can fit in a ≤5–10% “risk sleeve” of your portfolio if you accept that price is driven more by memes, hype, and short-term catalysts than fundamentals.

What could push it ↑

- Meme momentum and retail attention cycles

- ETF/trust headlines that legitimize exposure

- Elon-linked X Payments integration or pilots

- Rising futures open interest and whale accumulation

What could drag it ↓

- Unlimited supply (5B DOGE/year) diluting value

- 50–80% drawdowns typical of hype unwind

- Limited utility beyond payments; no smart contracts

- Risk-off macro or BTC downtrend

Position Sizing Guidance

Keep exposure small and tactical; consider it a short-to-mid-term, catalyst-tied trade rather than a long-term blue-chip allocation.

DOGE Catalyst Tracker (Updated Monthly)

Dogecoin’s price is less about long-term fundamentals and more about timely triggers. To help investors cut through the noise, this tracker highlights the key catalysts that can move DOGE in 2025, ranging from ETF and trust filings to progress on X Payments, whale activity, Bitcoin’s market regime, and macro policy shifts. Each item is updated with its latest status, why it matters, and what it could mean for DOGE in the near term.

| Catalyst | Latest Status | Why It Matters | Implication for DOGE |

|---|---|---|---|

| ETF / Trust Watch | Generic crypto ETP listing standards filed Jul 30, 2025; pending SEC action. DOGE ETF filings (Bitwise, REX Trust) exist but no launch yet. (Updated Sep 7, 2025) | Approval would make it easier to list single-asset ETPs; a live DOGE ETF would legitimize institutional access. | Bullish if approved or launched; neutral while pending. |

| X-Payments Progress | X Money teased in beta; no formal DOGE integration confirmed as of Sep 7, 2025. | Official DOGE support could drive real-world usage and boost sentiment. | Bullish if integration confirmed; neutral while unconfirmed. |

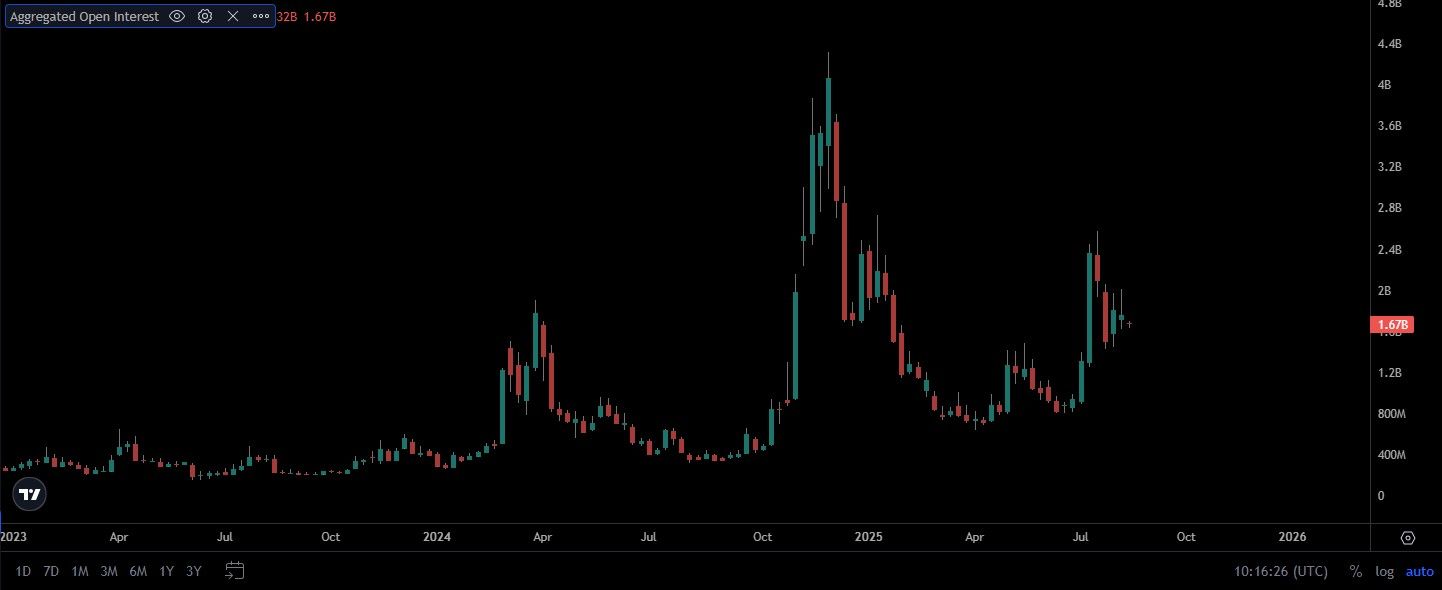

| Market Microstructure | OI topped ~$3B mid-Aug; pulled back ~8% but remains elevated. Whales accumulated >1B DOGE in early 2025. | High OI and whale buying amplify upside; OI unwinds accelerate downturns. | Bullish if OI and spot flows rise; bearish if OI unwinds. |

| BTC / ETH Regime | September event risk; DOGE path still closely tied to BTC moves. Correlation ~0.65 in 2025. | DOGE typically rallies harder than BTC in uptrends and sells off harder in downturns. | Bullish when BTC is strong; bearish when BTC declines. |

| Macro Levers | FOMC meeting Sep 16–17, 2025; markets lean toward rate cut but inflation risk persists. | Lower rates and liquidity tailwinds support risk assets; sticky inflation or hawkish policy hurts sentiment. | Bullish if cut + risk appetite improves; neutral/bearish if policy shocks markets. |

Last updated: Sep 7, 2025 (PT). Use this tracker as a catalyst lens, not as investment advice.

Pros & Cons Snapshot

Pros

- Deep liquidity across all major exchanges

- Loyal “Doge Army” community keeps cultural relevance high

- Proven survival across multiple market cycles since 2013

- Fast, low-fee transactions with Litecoin merge-mined security

Cons

- Unlimited supply dilutes long-term value (5B DOGE/year)

- Price driven more by hype and sentiment than fundamentals

- Limited utility — lacks smart contracts and DeFi/NFT integration

- High volatility; 50–80% drawdowns are common after rallies

Scenario Bands & Triggers (2025–2026)

These ranges are projections designed for planning and risk-sizing. The triggers are anchored to objectively verifiable events and market microstructure, so you can update the bias as new data arrives.

Bull Case — $0.60–$1.00

- ETF/Trust progress turns concrete: SEC framework shifts continue (e.g., in-kind creations/redemptions already authorized for crypto ETPs) and exchange generic listing standards move forward; a DOGE ETF actually goes effective and lists (Bitwise S-1 on file; analysts recently flagged a potential near-term launch window).

- X Payments (X “Money”) confirms DOGE support and shows early usage (official confirmation still absent as of Sep 7, 2025).

- Microstructure: OI & whales uptrend together. Futures open interest rises alongside spot demand/positive funding; recent mid-Aug OI levels near ~$3B show the capacity for leverage to amplify moves if it builds into catalysts. Whale net-buying sustains (CoinDesk reported ~680M DOGE accumulated by large cohorts in Aug).

- BTC risk-on regime: DOGE typically beta-leads BTC in uptrends; strength in BTC/ETH lifts meme-beta.

How to validate in real time:

Confirm an actual ETF listing date/ticker, official DOGE support on X Payments, rising OI + constructive funding, and a risk-on BTC backdrop. If these stack, a push into the upper band becomes plausible.

Base Case — $0.20–$0.40

What sustains this range:

- BTC chops (range-bound) and DOGE tracks with episodic sentiment pops. Correlation to BTC can fluctuate, but DOGE’s beta keeps it tethered to the broader regime. (Analyses this year put BTC–DOGE correlation anywhere from ~0.31 to ~0.65 depending on window and method.)

- Catalysts remain unconfirmed. ETF/trust stays pending; no official DOGE integration on X Payments yet.

- Microstructure mixed. OI/whales oscillate without a sustained trend; funding flips neutral/positive but not exuberant. (OI slid ~8% after the Aug spike—illustrating how quickly leverage cools without a fresh driver.)

Tell-tales:

Choppy price action with news-driven spikes that fade, OI that builds then stalls, and BTC sideways. Expect repeated tests of mid-range levels until a binary catalyst resolves.

Bear Case — $0.10–$0.18

What pushes us here:

- Meme fatigue/catalyst disappointments. No DOGE ETF listing despite filings; X Payments excludes DOGE or stays vague for longer.

- BTC drawdown / macro shock. Risk-off flows around events like FOMC or growth/inflation surprises typically hit meme-beta hardest. (September event risk is elevated; path is BTC-dependent.)

- Microstructure unwinds. OI rolls over and long liquidations accelerate; whale cohorts distribute rather than absorb. (Recent coverage shows how quickly OI can retrace from highs when momentum fades.)

What to watch:

Falling OI, negative funding, weak spot bid, BTC trending down, and the absence of affirmative ETF/X-Payments headlines.

Notes & Guardrails

- Ranges are conditional, not promises. They update as catalysts evolve and as the BTC regime changes.

- Validate with primary sources: SEC releases & filings for ETF/trust, exchange rule filings for generic standards, official platform announcements for X Payments, and CoinGlass/venue dashboards for OI, funding, and liquidations.

- Historical anchor: DOGE’s prior all-time high was ~$0.73 (May 2021), useful context for any upper-band discussions.

Data status: Sep 7, 2025. Update triggers/stance as filings become effective, products list, or BTC regime changes.

Current Dogecoin Market Snapshot

As of Aug. 22, 2025, Dogecoin trades around $0.22, according to CoinGecko, placing it firmly within the top 10 cryptocurrencies by market capitalization. Its market cap is roughly $32.8 billion, supported by daily trading volumes near $3 billion, and the circulating supply stands at about 150 billion DOGE. Unlike Bitcoin or many capped assets, Dogecoin has no maximum supply. Instead, it issues 5 billion new DOGE each year, which equates to an inflation rate of about 3.3% annually, a figure that gradually falls as supply grows.

Dogecoin reached its all-time high of $0.73 in May 2021, meaning the token is currently down more than 70% from its peak. The latest cycle saw DOGE touch $0.45 in December 2024 before retreating; since February 2025, it has mostly consolidated in the low $0.20s, with only a modest upward drift since June. These sideways patterns are typical of Dogecoin between hype cycles, though volumes remain steady.

Dogecoin (DOGE) Price

Figures auto-update via CoinGecko; always verify on your chosen exchange before trading.

Liquidity is Not an Issue

DOGE is still listed on every major exchange, including Binance, Coinbase, and Kraken, with deep order books and active spot trading. On the derivatives side, open interest recently hovered around $3.3 billion, with spikes above $3.7 billion in mid-August 2025. This confirms that despite price stagnation, traders continue to speculate on Dogecoin at scale.

High Open Interest Indicates Healthy Market Demand for $DOGE | Image via Coinalyze

High Open Interest Indicates Healthy Market Demand for $DOGE | Image via CoinalyzeIt’s also worth noting that Dogecoin relies on merge mining with Litecoin (AuxPoW), which anchors its security to Litecoin’s miner base. This technical design keeps the network secure despite its relatively modest standalone mining activity.

Overall, Dogecoin in 2025 remains liquid, widely traded, and culturally relevant, but it is still far from reclaiming its 2021 highs and shows the familiar pattern of drifting sideways until a fresh catalyst emerges.

Dogecoin Price Volatility and Historical Performance

Since its launch in 2013, Dogecoin has built a reputation for extreme volatility. Unlike Bitcoin or Ethereum, where fundamentals play a larger role, DOGE price swings are driven mostly by speculation, community hype, and external signals like celebrity endorsements.

Historical Cycles

Dogecoin’s past cycles illustrate its pattern of parabolic rallies followed by steep corrections:

- 2017–2018: DOGE surged over 6,400% during the broader altcoin boom, then fell more than 80% as the market cooled.

- 2020–2021: A defining cycle saw DOGE rally nearly 9,500%, peaking at $0.74 in May 2021. Fueled by social media buzz and Elon Musk’s tweets, it later crashed 74% in just one month.

- 2024–2025: The latest cycle mirrored this behavior. After peaking around $0.45 in December 2024, DOGE corrected below $0.20 before rebounding. As of mid-2025, it has gained more than 50% since June, showing accumulation patterns similar to past pre-rally phases.

Across these cycles, corrections have typically ranged 50-80%, wiping out rapid gains almost as quickly as they appeared.

External Influences

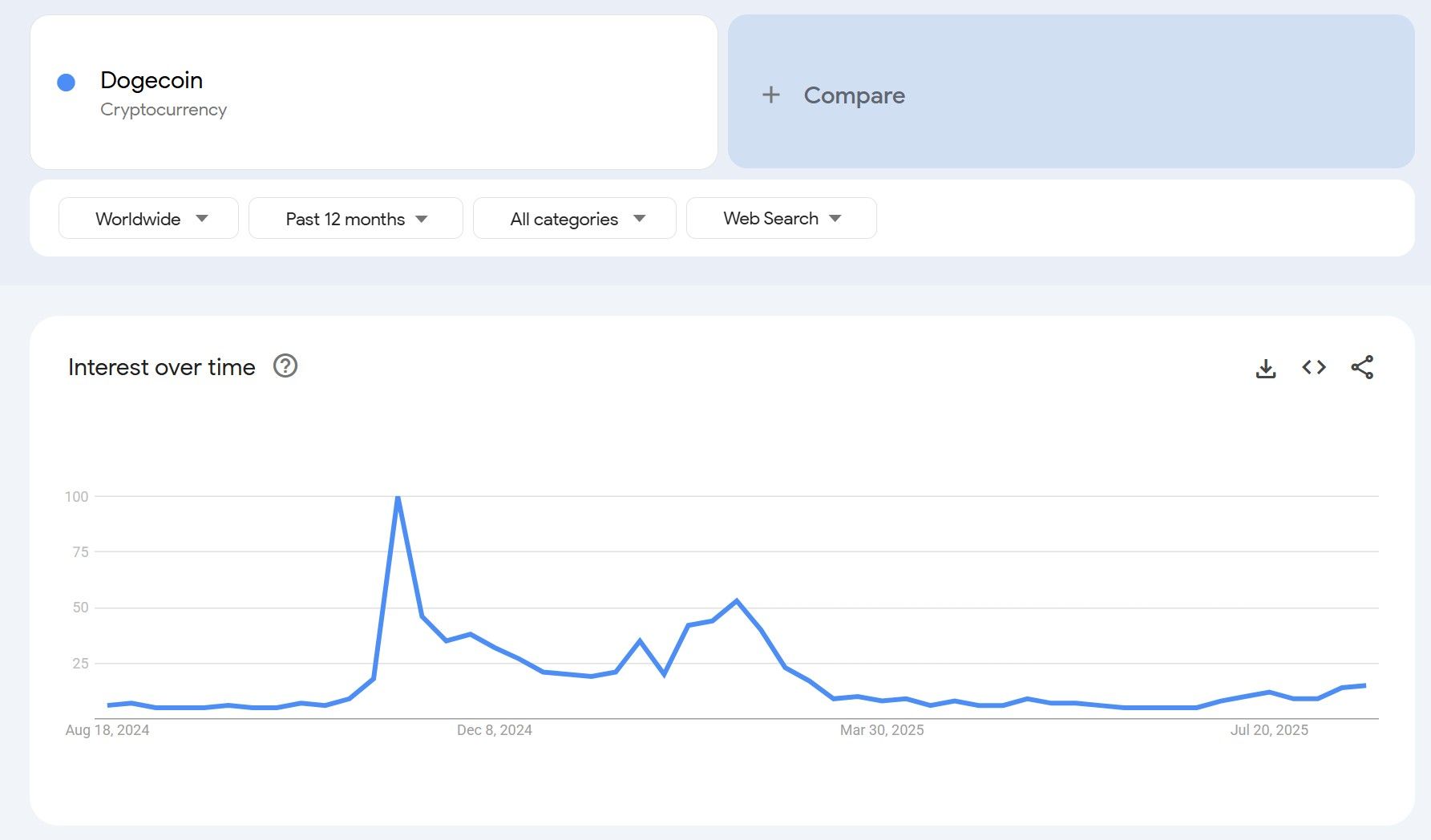

DOGE’s price history is inseparable from social media influence. Elon Musk’s comments once moved markets by 20-50% within hours, according to a Reuters analysis. While his impact has diminished in 2025, spikes still follow his mentions. Other events such as Bitcoin halving cycles, ETF approvals, or U.S. macro policy shifts also affect DOGE indirectly by moving the broader crypto market. Viral internet trends and sentiment shifts continue to drive short-term rallies but rarely sustain long-term growth.

Google Trends Shows Correlation of Mindshare with DOGE Price Uptick Beginning June, But The Effect is Diminishing | Image via Google Trends

Google Trends Shows Correlation of Mindshare with DOGE Price Uptick Beginning June, But The Effect is Diminishing | Image via Google TrendsComparison to Bitcoin and Ethereum

Relative to BTC and ETH, Dogecoin is more volatile and asymmetric. BTC provides a baseline, ETH carries volatility with underlying utility, while DOGE tends to mirror Bitcoin’s moves but exaggerates them, particularly during downturns. In 2025, DOGE’s trading volumes have climbed ~28% year-over-year, but swings remain sharper than its larger peers, an analysis by Brave New Coin revealed.

Investor Takeaways

For potential investors, Dogecoin’s history highlights several lessons:

- High upside, high risk: Gains of 1,000%+ have been possible with swift drawdowns, but its upside volatility has tamed in 2025.

- Track sentiment and news: External factors outweigh fundamentals. $DOGE flows with broader crypto cycles.

- Cycle-based strategy: Accumulation after corrections has historically offered better entry points than chasing peaks.

- Diversification is critical: DOGE lacks the utility of BTC or ETH, so it should be treated as a speculative allocation within a broader portfolio.

In short, Dogecoin’s performance remains cyclical, sentiment-driven, and highly unpredictable, offering potential windfalls for traders but significant risks for long-term holders.

Factors Driving Dogecoin’s Value

Speculation and sentiment rather than fundamentals still dominate Dogecoin’s price in 2025. Unlike Bitcoin or Ethereum, where protocol upgrades, adoption milestones, or utility expansion can shift value, Dogecoin’s meme-centric design means technological developments have little influence on its price trajectory. Instead, DOGE thrives on its community, speculative trading behavior, and broader macro conditions.

DOGE Community and General Speculation

The Doge community, often called the “Doge Army,” remains the single biggest force behind DOGE’s staying power. Loyal holders, social media campaigns, and meme-driven narratives amplify price action far beyond what on-chain usage would justify. Social sentiment and positive posts can lift prices by 10-30%, while negative narratives trigger quick sell-offs. In early 2025, large community-linked wallets accumulated over one billion DOGE, sparking a 21% price rally. On platforms like X, “diamond hands” memes and $1 price targets keep retail investors engaged, sustaining liquidity even during corrections.

At the same time, speculative trading remains the main driver of DOGE’s market value. Forecasts in 2025 highlight this speculative nature: some models project DOGE climbing toward $0.39–$1 by year-end, while bearish outlooks warn of retracements to $0.10 if retail hype fades, CoinPedia said. Price targets are driven more by chart patterns and sentiment than fundamentals, which means corrections of 50-80% remain common after rallies.

Despite limited adoption, community-driven use cases like tipping, charitable campaigns, and occasional merchant integrations support DOGE’s cultural relevance. Yet, these contributions are marginal compared to speculative flows. The community ensures DOGE stays visible, but it does not provide the depth of demand seen in utility-based assets.

Correlating Macro Factors

Beyond community influence, DOGE’s price often moves in sync with broader crypto and macroeconomic trends. Correlation with Bitcoin remains significant, though it has declined to about 0.65 in 2025, giving DOGE slightly more independence. When Bitcoin surged past $115,000 and Ethereum rallied above $4,300 earlier this year, Dogecoin rode the wave, amplifying those gains before retracing more sharply during downturns.

Macroeconomic conditions also play a role. The 2025 Fed rate cuts fueled optimism across risk assets, pushing liquidity back into speculative tokens like DOGE. Political narratives add further volatility: Musk’s comments tied to U.S. elections and regulatory debates have been enough to swing DOGE 10-20% in single sessions. Meanwhile, discussions of a potential DOGE ETF or integration into Musk-owned platforms such as X Payments have sparked rallies, though long-term follow-through remains uncertain.

Competition in the meme sector adds another macro layer. Tokens like Fartcoin and Pump.fun tokens continue to capture speculative flows, dampening Dogecoin's first-mover advantage.

In summary: Dogecoin’s 2025 value is shaped by two levers: community-driven speculation and macro market conditions. Together, they explain DOGE’s resilience despite its lack of utility, while also reinforcing its position as one of the most volatile large-cap cryptocurrencies.

Risks and Challenges of Investing in Dogecoin

Dogecoin may still sit among the top 10 cryptocurrencies by market cap, but its long-term investment case carries several structural weaknesses. Unlike Bitcoin or Ethereum, which have built ecosystems and utility beyond speculation, Dogecoin remains highly exposed to supply dynamics, hype cycles, and a lack of functional depth. Below are the main risks facing DOGE investors in 2025.

Even in 2025, Dogecoin Remains the Most Culturally Relevant Memecoin | Image via Shutterstock

Even in 2025, Dogecoin Remains the Most Culturally Relevant Memecoin | Image via ShutterstockLack of Fixed Supply Cap

Dogecoin has no maximum supply; instead, it issues a fixed 5 billion DOGE each year through mining rewards. At today’s ~150 billion circulating supply, this translates into an annual inflation rate of roughly 3.3-3.5%, which gradually declines as supply expands over time. In theory, such predictable issuance should stabilize DOGE as a medium of exchange, but in practice, it dilutes long-term value unless demand outpaces new issuance.

Market conditions can influence how this inflation is perceived. In bull markets, new issuance can be absorbed by speculative demand, making inflation a minor concern. In bear markets or during waning retail interest, the steady drip of supply becomes harder to offset, adding selling pressure. This makes forecasting DOGE’s long-term value complex, as inflation interacts with shifting market sentiment rather than organic, utility-driven demand.

High Susceptibility to Hype-Driven Price Swings

Even as the 9th largest cryptocurrency by market cap, Dogecoin continues to behave like a memecoin. While a larger market cap does dampen volatility compared to smaller meme coins, DOGE is still prone to wild swings in short timeframes, as seen in late 2024.

This speculative nature makes it notoriously difficult to time entries and exits. Investors risk chasing rallies only to face sharp corrections when the hype cycle fades, a pattern repeated across every major DOGE bull run. Unlike Bitcoin or Ethereum, where fundamentals guide long-term accumulation strategies, Dogecoin’s market timing is largely sentiment-dependent.

Limited Use Cases Beyond Speculation

Dogecoin’s blockchain remains basic: it supports low-fee, fast transfers but lacks smart contract capability, preventing it from participating in DeFi, NFTs, or broader Web3 ecosystems. Merchant adoption exists at the margins, with Tesla and some online platforms accepting DOGE, and integration into Musk’s X Payments platform has sparked renewed speculation. However, these cases are isolated rather than systemic.

By and large, DOGE’s role in 2025 is still that of a speculative vehicle. Its cultural significance sustains market interest, but its lack of programmability and real-world utility caps its long-term upside.

Regulatory Uncertainty Around Cryptocurrencies

Regulation remains a risk across the crypto sector, though the landscape is shifting. In 2025, proof-of-work (PoW) assets like Bitcoin and Dogecoin have gained relative clarity in the U.S. and EU, with regulators largely classifying them as commodities rather than securities. This reduces immediate existential risk for DOGE compared to newer token models. While regulatory pressure on Dogecoin is easing, it cannot be dismissed entirely as a potential drag on future adoption.

Expert Market Predictions and ROI Analysis

Dogecoin’s outlook continues to divide analysts. Because the asset is so heavily sentiment-driven, forecasts often swing between optimistic price targets fueled by hype and conservative estimates reflecting its lack of fundamentals. Expert panels and forecasting platforms highlight both possibilities across short-term (late 2025–mid 2026) and long-term horizons.

DOGE Prediction Table for 2025 | Image via Changelly

DOGE Prediction Table for 2025 | Image via ChangellyShort-Term Forecasts

Over the next 6–12 months, Dogecoin’s performance will largely depend on whether meme momentum holds and if catalysts such as X Payments or ETF approvals materialize.

Bull Case

- Finder’s Expert Panel: Predicts DOGE could climb to $0.37 by end-2025, citing community strength and potential integrations.

- DigitalCoinPrice: Sees an average of $0.49 in 2025, extending higher into 2026 on bullish momentum.

- Coinpedia: Offers one of the more aggressive calls at $1.07 by year-end, conditional on surging volumes and a clean breakout above resistance near $0.39.

- WalletInvestor: Projects highs of $0.38, assuming positive macro tailwinds such as lower rates.

Together, these bullish scenarios imply 50–300% upside from current levels (~$0.23).

Bear Case

- Finder’s Panel: Warns of downside toward $0.19 if retail attention fades.

- WalletInvestor: Models lows around $0.21 under weak market conditions.

- DigitalCoinPrice: Suggests a base near $0.20, assuming volatility resets.

- Coinpedia: Notes potential retraces to $0.13 support if breakouts fail, despite setting higher “negative” highs near $0.62.

The bearish short-term outlook suggests 10–40% downside, tied to meme fatigue or correlation with Bitcoin downturns.

Long-Term Projections

Looking beyond 2026, price targets widen significantly. Forecasts depend on whether Dogecoin evolves utility or continues to ride meme culture as its primary value driver.

Bull Case

- Finder’s Panel: Predicts DOGE could reach $0.75 by 2030, supported by ongoing community backing and celebrity interest.

- Coinpedia: Stretches projections to $3.00 by 2030, with an ultra-bull scenario of $25 by 2040 if DOGE gains real-world utility through integrations and partnerships.

- WalletInvestor: Models growth to $0.54 average by 2029, reflecting gradual maturity in the crypto sector.

Optimistic scenarios point to 200–1,000%+ returns over the next decade.

Bear Case

- Finder’s Panel: More cautious voices suggest lows near $0.14 by 2030 if Dogecoin remains purely speculative.

- WalletInvestor: Projects averages under $0.50 by 2029, with limited upside.

- Coinpedia: Acknowledges stagnation risk, implying DOGE could hover closer to $2.75 by 2030 but is vulnerable to meme fatigue.

Bearish long-term forecasts emphasize stagnation or mild growth if utility never develops, making Dogecoin dependent on hype cycles alone.

Takeaway: Expert predictions underscore Dogecoin’s dual identity: a cultural asset with potential for outsized short-term rallies, but a high-risk bet for the long haul unless its use cases expand.

Should You Buy Dogecoin Now?

The case for buying Dogecoin in 2025 depends less on price targets and more on how you view it within your portfolio. Dogecoin occupies an unusual space in the market: it is too large to deliver the explosive returns typical of newer memecoins, yet too speculative to be considered a reliable blue-chip asset alongside Bitcoin or Ethereum.

As the ninth-largest cryptocurrency, Dogecoin no longer has the capacity to multiply 1,000%+ in a single cycle, the kind of returns that make small-cap meme tokens attractive to risk-seeking traders. At the same time, its lack of a fixed supply cap, absence of smart contract functionality, and reliance on hype cycles make it the weakest choice among established large-cap assets for those seeking long-term fundamentals.

That said, Dogecoin is not without value. Its cultural status and broad exchange listings mean it is unlikely to disappear, even if it no longer dominates headlines. For conservative investors, a small allocation to DOGE can act as a risk-adjusted “flair” asset, adding exposure to speculative upside without exposing the portfolio to the full risks of chasing smaller, illiquid meme tokens. Conversely, investors seeking outsized gains may find Dogecoin too mature to meet their expectations.

Ultimately, the decision comes down to perspective. If you view DOGE as the largest memecoin, its upside looks limited. If you view it as the least reliable blue-chip, it may not offer the fundamentals you want. But for those looking to balance a primarily stable portfolio with a speculative edge, Dogecoin can still serve a role, as long as the position size reflects its high-risk, sentiment-driven nature.

Conclusion – Dogecoin’s Place in a Crypto Portfolio

Dogecoin remains one of the most recognizable cryptocurrencies, but recognition alone does not make it a strong investment. On the positive side, DOGE benefits from deep liquidity, constant visibility, and one of the most loyal retail communities in crypto. It has survived multiple market cycles, continues to rank in the top ten by market cap, and its merge-mined network with Litecoin provides security.

On the other hand, Dogecoin’s endless supply, dependence on hype, and limited utility restrict its long-term investment case. Unlike Bitcoin or Ethereum, it lacks the fundamentals that anchor value over time, and its outsized volatility makes it difficult to treat as a blue-chip holding.

For investors, Dogecoin’s role is best seen as a complement rather than a core position. It can add speculative exposure to a balanced portfolio, acting as a hedge against missing out on meme-driven market rallies, but it should not be relied upon for steady long-term growth. A modest allocation preserves upside participation without exposing the portfolio to disproportionate risk.

In short, Dogecoin is not a cornerstone investment, but it remains relevant as a cultural asset with speculative potential. For those who understand its limitations and size positions accordingly, DOGE can still have a place, but as part of a broader strategy built on stronger fundamentals.

Also Read

References

“Release No. 34-103596; File No. SR-NASDAQ-2025-056.” US Securities and Exchange Commission, https://www.sec.gov/files/rules/sro/nasdaq/2025/34-103596.pdf

"Amendment No. 1 to FORM S-1." US Securities and Exchange Commission, https://www.sec.gov/Archives/edgar/data/2053791/000121390025058120/ea0246815-s1a1_bitwise.htm

“Elon Musk’s X to offer investment and trading in ‘super app’ push.” Financial Times, https://www.ft.com/content/3615dfe2-f739-44f7-9823-a8acce6c0380

"Total DOGE Futures Open Interest." CoinGlass, https://www.coinglass.com/currencies/doge/futures

“September is a perilous month for the Fed and the US economy.” The Times, https://www.thetimes.com/us/business/article/federal-reserve-us-trump-tariffs-supreme-court-g0pf5xhhq

"SEC Permits In-Kind Creations and Redemptions for Crypto ETPs." US Securities and Exchange Commission, https://www.sec.gov/newsroom/press-releases/2025-101-sec-permits-kind-creations-redemptions-crypto-etps

“Dogecoin may see first-ever ETF launch next week: Analyst.” CoinTelegraph, https://cointelegraph.com/news/dogecoin-etf-united-states-launch-next-week-analyst

"Dogecoin Bulls Defend 16 Cent Support as Elon Musk’s X Payments Speculations Loom." CoinDesk, https://www.coindesk.com/markets/2025/06/26/dogecoin-bulls-defend-16-cent-support-as-elon-musks-x-payments-speculations-loom

“Whale Accumulation Drives Dogecoin’s V-Shaped Recovery From $0.21 Lows.” CoinDesk, https://www.coindesk.com/markets/2025/08/21/whale-accumulation-drives-dogecoin-s-v-shaped-recovery-from-usd0-21-lows

"US SEC unveils agenda to revamp crypto policies, ease Wall Street rules". Reuters, https://www.reuters.com/legal/government/us-sec-unveils-agenda-revamp-crypto-policies-ease-wall-street-rules-2025-09-04/