KuCoin has grown into one of the world’s largest crypto exchanges since its 2017 launch, now serving tens of millions of users across 200+ countries. Its long list of coin selection and trading features makes it a go-to platform for many, but its recent history raises hard questions about safety in 2025.

From a $300 million U.S. settlement to past security breaches, KuCoin’s record is a mix of strong technical safeguards and ongoing regulatory hurdles. This review breaks down its current security protocols, legal standing, and user reputation to answer the key question: How safe is KuCoin right now, and what should traders do to protect themselves?

Quick Verdict

Yes, KuCoin is safe in 2026 if you live in a supported region and use all protections. It runs cold storage with multi-sig, app 2FA, a trade password, anti-phishing codes, API IP whitelists, and monthly Proof of Reserves that show major assets over 100%. It also holds SOC 2 Type II, ISO 27001, ISO 27701, and an AAA rating on CER. Legal limits matter. The exchange exited the U.S. for two years in January 2025 and faces tighter rules in several markets. Use it if you want broad asset access and strong controls, and keep long-term funds in a hardware wallet.

Who It Is For

- Active traders and asset variety seekers

- API users who need IP whitelists and scoped permissions

Who Should Look Elsewhere

- U.S. residents and compliance-first users

- Beginners storing large balances on an exchange

KuCoin Security, 2025 Snapshot

| Item | Details |

|---|---|

| Wallet Design | Cold storage majority with multi-signature approvals, hot wallets capped and monitored |

| 2FA | App based 2FA recommended, email and SMS available, backup codes supported |

| Trade Password | Separate 6 digit code required for trades and withdrawals |

| Anti-Phishing | User set security phrase for emails and login pages |

| Device and IP Safety | Device risk checks and unfamiliar IP login protection |

| Withdrawal Controls | Address whitelist and alerting on login and withdrawals |

| Proof of Reserves | Monthly Merkle tree reports, major assets over 100% backing |

| Certifications | SOC 2 Type II, ISO 27001:2022, ISO 27701:2025 |

| External Rating | CER.live AAA in 2025, security score 100% |

| Bug Bounty | Up to 1,000,000 dollars for critical findings |

| API Controls | Role based scopes, no API withdrawals, IP whitelists, passphrase, auto disable on inactivity |

| Web3 Wallet | Self custodial option where you hold keys |

| Legal and Access | Two year U.S. exit from January 2025, regional restrictions, strict KYC since August 2023 |

| Asset Coverage | 700 plus listed assets, treat the exchange as a hot wallet for trading only |

KuCoin by the Numbers, 2025 Snapshot

Founded in 2017, KuCoin has grown into a global exchange ranked among the top 10 by trading volume. By early 2025, it served more than 40 million registered users across 200+ countries and regions. The platform lists over 700 cryptocurrencies, making it one of the most diverse markets available. This breadth of access is central to KuCoin’s appeal, though it also amplifies the importance of its security safeguards.

Snapshot (2025):

- Launch Year: 2017

- Global Reach: 200+ countries served

- User Base: 40M+ registered users (as of Q1 2025)

- Market Rank: Top 10 exchange by daily trading volume

- Assets Listed: 700+ cryptocurrencies

Core Security Features You Can Enable

KuCoin Safeguards Privacy With Strong Data And Account Protection. Image via Shutterstock

KuCoin Safeguards Privacy With Strong Data And Account Protection. Image via ShutterstockWhile wallet architecture forms the backbone of fund security, KuCoin also layers in additional security features that users can enable to further reduce risk.

Wallet Architecture, Cold vs Hot

KuCoin employs a tiered wallet system to balance liquidity with security, holding the vast majority of assets offline while keeping only a small portion in online wallets for transactions.

- Cold wallets (Offline storage): These wallets store the bulk of user funds and are completely isolated from the internet to protect against online attacks. All transfers from cold storage are protected by a multi-signature system, requiring multiple independent approvals to authorize a transaction.

- Hot wallets (Online storage): These wallets hold a smaller portion of assets to facilitate daily operations like user deposits and withdrawals. To mitigate the risk of being online, hot wallets are subject to strict withdrawal limits and continuous, real-time monitoring to detect suspicious activity.

- Web3 Wallet (Self-custodial): KuCoin also offers a self-custodial wallet that is separate from its centralized exchange architecture. In this case, users own their private keys and assets, eliminating the risk of exchange-level security incidents.

Here is a list of the most secure crypto wallets.

2FA and Trade Password

KuCoin supports several 2FA methods, with Google Authenticator being the recommended choice for a higher level of security. Other options include email and SMS verification. These methods require a unique, one-time code to be entered for sensitive actions like logging in, withdrawing funds, or modifying security settings.

In addition to the regular login password and 2FA, a separate 6-digit trading password is required to authorize critical actions like transactions and withdrawals. This adds a crucial layer of protection, as an attacker with your login credentials and 2FA code would still be blocked from moving funds.

Encryption, Device Safety, Anti-Phishing

To secure user data and protect against external attacks, KuCoin uses advanced technological and procedural measures.

- Encryption: KuCoin uses industry-standard encryption, including AES-256, to protect sensitive data such as personal information, transaction records, and account balances.

- Device Safety: The platform includes automatic device scanning to detect suspicious browser plugins, rooted or jailbroken phones, and other security risks.

- Anti-Phishing Safety Phrase: This feature allows users to set a custom security phrase that will appear in all official emails and on the website login page. If the phrase is missing, it alerts users that they are on a phishing site or have received a fraudulent email.

- Login IP Restriction: Users can enable a setting that triggers an account protection mechanism if a login is detected from an unfamiliar IP address.

API keys and permissions

For users and developers who use API keys for automated trading, KuCoin offers detailed security controls.

- Role-based permissions: API keys can be created with specific permissions, such as "General" (read-only) or "Trade." Importantly, users should disable permissions for "Transfer" (withdrawal) to prevent hackers from draining funds.

- IP Whitelisting: API key access can be restricted to specific, pre-approved IP addresses, effectively narrowing the attack surface even if the key is compromised.

- No API withdrawals: Withdrawals are not possible through third-party API applications for security reasons.

- Passphrase Protection: API keys are secured with a unique passphrase that is separate from your account's login and trading passwords.

- Inactivity policy: API keys that are inactive for a certain period are automatically disabled to prevent them from being exploited.

Incident Track Record and What Changed

KuCoin Protects Users With Advanced Anti-Phishing And Scam Filters. Image via Shutterstock

KuCoin Protects Users With Advanced Anti-Phishing And Scam Filters. Image via ShutterstockIn September 2020, KuCoin’s hot wallets were compromised after private keys were exposed. Let's see how KuCoin dealt with it.

The 2020 Hot Wallet Breach: A Test of Resilience

In September 2020, KuCoin experienced a significant hack where over $280 million in various cryptocurrencies were stolen from their hot wallets due to compromised private keys. A substantial portion of these funds was recovered with the help of other exchanges and blockchain projects, and the exchange pledged to cover all affected user losses from its insurance fund.

- User Impact: Users experienced a suspension of deposit and withdrawal services while the incident was investigated and security measures were reviewed.

- Changes After the Breach: KuCoin re-deployed its hot wallets, conducted a thorough security review, and collaborated with international law enforcement and other major crypto exchanges to track and freeze stolen assets. They also emphasized upgrading their wallet risk management system.

The 2023 Official X Account Compromise: Social Media Vulnerabilities

On April 24, 2023, KuCoin’s official X (formerly Twitter) account was hijacked for about 45 minutes. During this window, scammers used the account to promote a fake giveaway, tricking users out of more than $22,000 in BTC and ETH.

KuCoin moved quickly to regain control, open an investigation with X, and guarantee full reimbursement for all verified losses. The incident exposed weaknesses in platform-level protections and led KuCoin to harden its social media security beyond standard two-factor authentication.

Post-Incident Upgrades: Building a Safer Platform

These breaches accelerated KuCoin’s shift toward more comprehensive defenses. The exchange now works closely with international law enforcement under formal request guidelines and integrates blockchain analytics to track illicit flows, a practice highlighted in regulatory reviews such as FINTRAC’s findings.

It has also tightened withdrawal checks, introducing stricter verification steps, continuous monitoring for suspicious trading activity, and upgraded KYC requirements from August 2023 onward, including face verification for new accounts. Combined with a 24/7 security operations team and layered risk management controls, these measures reflect KuCoin’s effort to move from incident response to long-term resilience.

Closing Note

Together, these episodes highlight both KuCoin’s vulnerabilities and its willingness to adapt. The exchange’s response and subsequent improvements set the stage for a closer look at how its security has been validated by independent third parties.

Independent Security Validations

KuCoin Holds Multiple Certifications For Proven Security Standards. Image via KuCoin

KuCoin Holds Multiple Certifications For Proven Security Standards. Image via KuCoinIndependent audits and ratings give KuCoin credibility beyond its own claims. In 2025, the exchange added several heavyweight certifications and security benchmarks to its record.

Third-Party Certifications

In April 2025, KuCoin completed its SOC 2 Type II audit, conducted over 12 months by Decrypt Compliance. This standard evaluates five “Trust Services Criteria:” Security, availability, confidentiality, privacy, and processing integrity, assuring that KuCoin’s internal controls are not just in place but continuously monitored.

A month later, KuCoin earned ISO 27001:2022, the most widely recognized information security standard. This certification confirms a structured approach to managing cybersecurity and organizational risks. In September 2025, it went a step further with ISO 27701:2025, which focuses on privacy information management, aligning KuCoin’s practices with global data protection expectations.

For payment-related services, KuCoin is also PCI DSS compliant, meeting the requirements set by Visa, Mastercard, and other card networks for handling sensitive cardholder data in fiat on-ramps.

Security Ratings

In June 2025, KuCoin achieved an AAA rating from CER.live, placing it alongside the most secure exchanges globally. CER.live awarded KuCoin a perfect 100% security score, covering multiple fronts:

- Server Security: Infrastructure hardened against network intrusions.

- User Security: Strong authentication policies, including MFA and strict password requirements.

- Penetration Tests: Regular third-party testing ensures vulnerabilities are detected and closed.

- Bug Bounty Program: Rewards up to $1 million encourage ethical hackers to report flaws instead of exploiting them.

Together, these validations indicate that KuCoin has matured its security framework well beyond minimum compliance, presenting an image of an exchange that is now independently vetted across multiple international standards.

Legal Status and Restrictions, 2024–2025

KuCoin Aligns With Global Regulations To Support Compliance. Image via Shutterstock

KuCoin Aligns With Global Regulations To Support Compliance. Image via ShutterstockKuCoin remains headquartered in Seychelles but has diversified its registrations, including Malta, the Cayman Islands, and, more recently, India’s Financial Intelligence Unit.

Facing tightening regulations at home, KuCoin has joined peers in re-domiciling parts of its operations to lighter jurisdictions such as Turks and Caicos and Costa Rica. In Europe, KuCoin EU has filed a MiCAR application in Austria to secure a compliant foothold within the EEA.

While the platform still serves users in more than 200 countries, several major markets have either imposed strict penalties or forced KuCoin to retreat.

United States Actions

In January 2025, KuCoin pleaded guilty to operating an unlicensed money-transmitting business. The settlement involved penalties totaling nearly $300 million, split between a $112.9 million criminal fine and $184.5 million in forfeitures. As part of the agreement, KuCoin also agreed to exit the U.S. market for at least two years and cannot reopen without obtaining appropriate licenses.

On Jan. 23, 2025, all U.S. user accounts were closed, logins were disabled, and only asset withdrawals were permitted, often requiring direct assistance from customer support. New registrations from U.S. residents remain blocked.

Other Jurisdictions

KuCoin’s troubles extend beyond the U.S. In Canada, the Financial Transactions and Reports Analysis Centre (FINTRAC) imposed a C$19.6 million fine in September 2025 for failing to register as a foreign money services business and for lapses in reporting obligations.

KuCoin has appealed this penalty but faces ongoing restrictions, alongside a previous ban and $2 million fine from Ontario’s securities regulator in 2022.

In the Netherlands, the central bank declared in December 2022 that KuCoin was operating without proper registration and in violation of the Anti-Money Laundering and Anti-Terrorist Financing Act. The exchange has also been placed on the U.K. Financial Conduct Authority’s warning list for lacking local approval.

What This Means for Users

Regional restrictions now play a central role in KuCoin’s accessibility. Residents of the U.S., Mainland China, Hong Kong, Malaysia, Singapore, Thailand, Uzbekistan, and sanctioned countries are blocked from using core services. Elsewhere, access often depends on compliance with stricter Know Your Customer (KYC) rules.

Since August 2023, KuCoin has required KYC for deposits, spot trading, futures, and most new products. Users without verification face withdrawal caps and limited functionality. For global traders, this signals both a tightening regulatory environment and a clear shift toward stricter compliance standards across KuCoin’s operations.

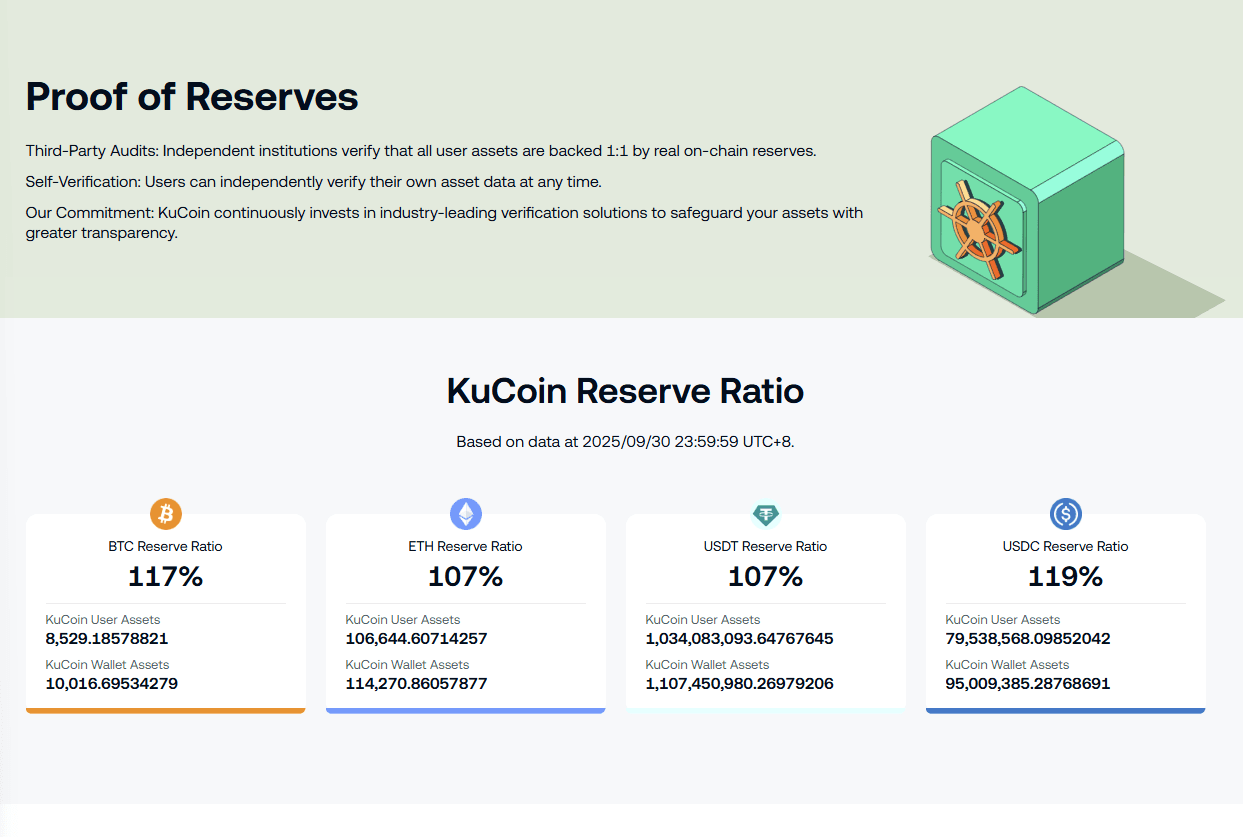

Proof of Reserves and Transparency

Proof of Reserves (PoR) has become a baseline requirement for exchanges after a series of high-profile collapses. KuCoin uses it both as a transparency tool and as a way to reassure users that their assets are fully backed.

KuCoin's PoR Assets Show More Than 100% Reserve Ratio. Image via KuCoin

KuCoin's PoR Assets Show More Than 100% Reserve Ratio. Image via KuCoin Merkle Tree Basics

At the heart of KuCoin’s PoR is the Merkle tree, a cryptographic structure that allows users to independently verify their balances. Every account balance is hashed, grouped with others, and rolled up into a single “Merkle root.”

This root serves as a fingerprint for the entire dataset. By comparing their own hash to the root, users can confirm that their funds are included without exposing the balances of others. What’s excluded is equally important: PoR audits typically cover liquid assets like BTC, ETH, and stablecoins, but may not always account for all tokens or liabilities.

Frequency and Asset Coverage

KuCoin has built consistency into its process, publishing monthly PoR reports that are independently audited, most recently by Hacken in mid-2025. The reports show reserve ratios above 100%+ for major assets such as BTC, ETH, USDT, and USDC, demonstrating that deposits are over-collateralized rather than underfunded. This cadence places KuCoin among the more transparent top-tier exchanges, where many rivals still report irregularly or only for select assets.

Gaps to Watch For

Despite these advances, PoR has limitations. Reports confirm asset backing but do not always account for liabilities, meaning they cannot prove solvency in every scenario. Some smaller or illiquid tokens may not be covered in KuCoin’s audits, leaving blind spots for users who hold niche assets. Transparency is improving, but investors should remain cautious and supplement PoR checks with best practices like hardware wallets for long-term storage.

KuCoin vs Safer Alternatives, 2026 Security Scorecard

For many traders, deciding whether KuCoin is the right platform comes down to weighing its features against more heavily regulated exchanges. A direct comparison highlights both its strengths and the trade-offs.

Security Scorecard (2025)

| Exchange | CER Rating | SOC 2 Status | Proof of Reserves | Bug Bounty Ceiling | U.S. Availability | Major Incidents |

|---|---|---|---|---|---|---|

| KuCoin | AAA | SOC 2 Type II | Monthly, >100% backed | $1M | 2-year U.S. exit | 2020 $280M hack, 2023 X account compromise |

| Coinbase | AAA | SOC 2 Type II | Quarterly, 1:1 verified | $250K | Available | No major breaches reported |

| Kraken | AAA | SOC 2 Type II | Regular PoR since 2022 | $1M+ | Available | Clean track record, strong regulation |

| Binance | AA | In progress | Irregular, asset-specific | $1M+ | Restricted (Binance.US only) | 2022 $570M BSC bridge hack |

KuCoin appeals to users who value breadth, 700+ assets, advanced trading tools, and a global footprint. Its independent certifications and bug bounty program make it technically secure, but its shaky regulatory history and U.S. exit pose risks. Traders who prioritize compliance, licensed oversight, and clearer legal protections may prefer Coinbase or Kraken, which carry fewer jurisdictional limitations and cleaner reputations.

Practical Security Playbook for KuCoin Users

Use this playbook to harden your KuCoin account fast. You will set app-based 2FA, add a trade password, turn on whitelists and alerts, and keep long-term funds in a hardware wallet. Follow the steps, run the weekly and monthly checks, and cut your risk from phishing, malware, and leaked API keys.

Lock down your account

- Use an authenticator app for 2FA. Do not use SMS. Save backup codes offline.

- Set a strong, unique password. Use a password manager. Minimum 16 characters.

- Create a trade password. Use a different value from your login password.

- Set your anti-phishing code. Verify this code on every KuCoin email.

Control where logins and withdrawals can happen

- Turn on withdrawal address whitelisting. Only allow preapproved addresses.

- Enable login and withdrawal alerts by email and app. Act fast on any alert you did not trigger.

- Review the trusted device list weekly. Remove devices you do not recognize.

- If your setup allows it, use IP restrictions for API keys. Bind to known IPs only.

Keep long-term funds off the exchange

- Store long-term holdings in a hardware wallet. Treat KuCoin as a hot wallet for trading only.

- Target split, for example, 90% cold storage, 10% on exchange. Adjust to your needs.

- Test your hardware wallet backup flow quarterly.

Clean up token approvals and API keys

- Revoke stale token approvals on chains you use. Use a reputable approval manager.

- Audit API keys monthly. Remove keys you do not use. Rotate active keys every 90 days.

- Scope API keys to the minimum needed. Read and trade only. Disable withdrawals on keys.

- Bind API keys to IP addresses when possible. Log access times and client names.

Harden your everyday environment

- Use a dedicated browser profile for crypto. Disable unneeded extensions.

- Keep your OS, browser, and mobile apps updated.

- Do not click links in DMs. Type the KuCoin domain directly. Check your anti-phishing code on emails.

- Use secure Wi-Fi. Avoid public networks for withdrawals.

Safe withdrawal routine

- Confirm the asset, network, and address. Match chain to chain. Do a small test send first.

- Verify the address against your whitelist. Recheck after any copy or QR scan.

- Confirm the fee and expected time. Watch for alerts while the transfer confirms.

Fast response plan

- If you suspect compromise, change your password, revoke API keys, and reset 2FA immediately.

- Freeze withdrawals if available. Contact KuCoin support with your case ID and logs.

- Move remaining funds to your hardware wallet. Review devices and sessions again.

Weekly and monthly cadence

- Weekly, check alerts, devices, and recent activity.

- Monthly, audit token approvals and API keys. Review your whitelist.

- Quarterly, practice recovery with your backup codes and seed backups.

Expert Verdict: Is KuCoin Safe in 2026?

KuCoin today is a story of two sides. On one hand, its security stack is among the strongest in the industry. The exchange now carries SOC 2 Type II, ISO 27001, and ISO 27701 certifications, alongside an AAA security rating from CER.live. Most funds sit in cold wallets with multi-signature approval, app-based 2FA is standard, and monthly Proof of Reserves reports show assets consistently over 100% backed. Past breaches, including the 2020 hot wallet hack and the 2023 X account compromise, were fully reimbursed, and both led to tighter controls and monitoring.

On the other hand, KuCoin’s regulatory standing lags behind its technical progress. In January 2025, it pleaded guilty in the U.S. to operating without a license, paid nearly $300 million in penalties, and agreed to a two-year market exit. Canadian regulators followed with AML-related fines, while the Netherlands and the U.K. flagged it as non-compliant. Though KuCoin has filed for MiCAR licensing in Europe and launched a regulated platform in Thailand, its global availability remains patchy.

For users in compliant regions, KuCoin offers premium security, a vast asset selection, and advanced tools. But in restricted markets such as the U.S. or Canada, risks of frozen accounts or limited access outweigh the benefits. Wherever you trade, enable all available protections and keep long-term holdings in cold storage. KuCoin is safe to use technically, but its overall safety in 2026 depends heavily on where you live and how you manage your funds.

Also On The Coin Bureau

Exchange Comparisons