Few crypto projects have sparked as much debate as Pi Network. For some, it's a bold experiment in mobile-first crypto adoption. An app-powered gateway to a decentralized future. For others, it's a cleverly disguised pyramid scheme built on social referrals, vague promises, and delayed delivery.

In a space known for extremes, Pi Network may be one of the most polarizing. It claims over 60 million users, a live Open Mainnet, and ambitions to build a new digital economy. However, critics continue to question its centralized control, lack of token liquidity, and reliance on a trust graph model that seems to contradict the fundamentals of blockchain design.

So what is Pi, really? A quiet revolution in user-first crypto infrastructure? A sophisticated scheme with social engagement as its currency? Or something murkier—stuck somewhere between innovation and opportunism?

This article takes a clear-eyed look at Pi Network to assess its legitimacy, security model, and investment risks. We'll examine:

- What Pi Coin is and how its network operates

- Its history and claims around decentralization

- Security features and user protections

- Community feedback from Reddit, Trustpilot, and more

- Its ecosystem plans, future outlook, and governance roadmap

By the end, you'll have the context to decide if Pi is a meaningful experiment worth watching, or just another project fueled more by hype than delivery.

Key Takeaways

- Pi’s legitimacy is debated: it’s not an outright scam, but remains far from being a fully decentralized or trustless network.

- Pi Network claims to be a mobile-first, inclusive blockchain with 60M+ users, but its decentralization is heavily disputed.

- Its social mining model uses “Security Circles” and referrals instead of proof-of-work or stake, raising MLM-like concerns.

- While the Open Mainnet launched in 2025, Pi Coin still lacks exchange listings and external liquidity, limiting real-world utility.

- The project’s consensus relies on a modified Stellar protocol, but reports suggest the core team still controls validator nodes.

- KYC is mandatory to access mined Pi, and privacy concerns persist due to centralized user data storage.

- Critics highlight vague roadmaps, ad-heavy app design, and slow DApp rollout, despite ecosystem funding and Chainlink integration.

What is Pi Coin and the Pi Network?

Pi Network is a Layer 1 blockchain built for mobile users. It positions itself within the growing category of mobile-first crypto platforms by offering a lightweight, low-barrier mining model that works entirely through smartphones—no advanced hardware or high energy consumption required.

At the center of this ecosystem is Pi Coin (PI), the network’s native currency. Users earn it by contributing to the network’s growth, security, and app usage. Pi’s long-term goal is to support a decentralized economy powered by everyday users, not professional miners or early whales.

For a thorough understanding of how to buy Pi Coin, including platform options and security tips, check out our comprehensive guide.

Mobile-First Mining and “Social Security”

The standout feature of Pi Network is its approach to mining. Instead of relying on energy-intensive calculations like Bitcoin, Pi introduced a social mining model. Users mine Pi by simply tapping a button once every 24 hours and securing their “Security Circle," a group of trusted individuals who contribute to the network’s safety.

If you prefer to watch rather than read, we’ve also covered Pi Coin on our YouTube channel.

Participation in the network also includes inviting others to join and forming Referral Teams. This process gamifies network growth and keeps users engaged without technical friction. The mining mechanism is intentionally light to encourage broad, global participation, even in areas where hardware or stable electricity is limited.

Network Purpose and Ecosystem Vision

Pi Network’s stated mission is to create an inclusive, app-driven ecosystem that functions as a crypto-native online economy. Users earn Pi not just through mining but also by interacting with apps on the Pi Browser.

The network envisions a system where:

- Apps are built directly on Pi’s blockchain

- Users transact in Pi Coin across these apps

- Developers are rewarded based on usage

- Participation, not capital, drives value creation

Everything—from mining rewards to DApp usage incentives—is designed to keep Pi circulating within its own ecosystem rather than being dumped for external value. This internal focus is a key differentiator, though it also limits Pi’s external liquidity (as we’ll explore later).

How Pi Coin Is Mined

In its early stages, Pi mining was simple and mostly symbolic. Users earned Pi based on:

- A base mining rate is determined by how early they joined

- A Security Circle bonus for confirming trusted users

- A Referral Team bonus for inviting others

The global mining rate halved at network milestones (e.g., every time the user count crossed 10 million), creating scarcity over time.

If you're looking to sell Pi Coin, head over to our step-by-step guide.

Mainnet Phase

Once Pi moved to the Mainnet, mining became more dynamic and contribution-based. The new formula rewards a broader range of activities:

- Lockup Reward (L): Extra Pi for voluntarily locking your tokens post-KYC. Longer and larger lockups earn more.

- Node Reward (N): This is for users running Pi Nodes on desktops. Uptime, CPU strength, and open ports determine the reward.

- App Usage Reward (A): Based on time spent using DApps within the Pi Browser.

- Referral Bonus (E): Still active, but now tied to how actively your invitees contribute.

- Future Contribution (X): Placeholder for rewards like building apps or providing infrastructure.

Importantly, you must be actively mining to receive rewards. If you're not logged in and mining, your base rate drops to zero.

The systemwide mining rate (B) now adjusts in real time based on overall network activity and a fixed yearly supply cap. This keeps inflation in check while rewarding the most engaged users.

Consensus and Token Structure

Pi Network runs a modified version of the Stellar Consensus Protocol (SCP). SCP uses federated trust—users validate transactions through their trusted circles. This allows fast, energy-efficient consensus, though it also introduces questions about decentralization (covered in the next section).

Pi Network positions itself as a more inclusive alternative to traditional crypto networks, with a strong focus on participation over speculation. But accessibility alone doesn’t guarantee legitimacy, which is what we’ll assess in the next section.

History and Evolution of the Pi Network

Pi Network Founding Timeline

- 2019 Launch of the Pi Testnet and mobile app with tap-to-mine functionality. Mining was invite-only, focused on daily user engagement.

- 2021 Pi Browser launches, allowing simple decentralized apps (DApps) to be built and accessed within the Pi ecosystem.

- 2022–2024 Expansion of KYC rollout and infrastructure testing. Millions onboarded while Pi focused on app development and ecosystem funding.

- February 2025 Open Mainnet launches, enabling limited external interactions. Full trading and withdrawals remain restricted pending further updates.

- 2020 Introduction of Security Circles to reinforce trust and decentralization via user-created trust networks.

- Late 2021 Enclosed Mainnet goes live. Transfers are restricted to internal Pi wallets while users complete KYC and prepare for token migration.

- Early 2025 Chainlink integration announced, adding decentralized oracle support and boosting DApp development potential.

Pi Network was launched on March 14, 2019 (Pi Day) by a group of Stanford graduates—Dr. Nicolas Kokkalis, Dr. Chengdiao Fan, and Vincent McPhillip. The idea was straightforward: make cryptocurrency mining possible on smartphones, without relying on specialized hardware or high electricity costs.

Pi Network Founders | Image via Stanforddaily

Pi Network Founders | Image via StanforddailyFrom the beginning, the team pitched Pi as a mobile-first blockchain focused on accessibility and long-term ecosystem development. Its native asset, Pi Coin, would serve as the backbone for user incentives and application activity.

If you're ready to trade PI, our guide to the best Pi Coin exchanges covers everything you need to know.

Timeline and Key Milestones

- 2019 – Launch of Testnet and Mobile App

Pi’s initial rollout focused on user acquisition and refining the tap-to-mine mechanism. Users could mine coins once every 24 hours by opening the app and confirming activity. Participation was invite-only in the early phase. - 2020 – Introduction of Security Circles

To reinforce trust and decentralization, Pi introduced Security Circles. These were groups of trusted contacts that helped form the foundation for the network’s consensus model. - 2021 – Pi Browser and Developer Ecosystem

The release of the Pi Browser marked a shift from mining-only participation to early infrastructure for decentralized apps (DApps). This allowed developers to build simple web-based tools within the Pi environment. - Late 2021 – Enclosed Mainnet Goes Live

Pi moved to an Enclosed Mainnet, enabling wallet transfers inside the network but blocking external connectivity. This gave users time to complete KYC verification, migrate tokens, and participate in wallet lockups. - 2022–2024 – KYC Rollout and Network Scaling

The network expanded its KYC program, with millions of users onboarding and preparing for token migration. During this time, Pi focused on app testing, community tools, and ecosystem funding. - February 2025 – Open Mainnet Launch

Pi’s Mainnet opened to external interfaces. While full trading and withdrawals remain limited, the shift allowed for broader integration with external applications and services.

Community and Ecosystem Development

The number of active users of the Pi network has dropped from its high to a little over 35 million now, based on a Bitget article. However, a Reddit user claims that far fewer users hold more than a thousand Pi coins, valued at $1,200 as of May 2025 rates. The project has run hackathons, developer grants, and AMAs to encourage app building and feedback loops.

Activity is primarily concentrated in regions like Asia, Africa, and Latin America, where mobile-native tools are often the only practical entry point into crypto. While the DApp ecosystem is still in its early stages, Pi’s user engagement remains one of the network’s most consistent drivers.

Legitimacy and Trustworthiness Analysis

Key Points

- Despite claims of decentralization, a CNN report from 2025 revealed that Pi Network's mainnet nodes are operated centrally by the core team.

- Mandatory KYC creates a permissioned system and raises data privacy concerns due to centralized storage of sensitive user data.

- Pi tokens are not listed on any major exchanges, limiting liquidity and utility beyond the Pi Network ecosystem.

- Additional red flags include vague timelines, reliance on referrals, and the presence of in-app ads suggesting unclear monetization.

- Industry experts, including Ben Zhou and Justin Bons, have publicly questioned Pi Network’s legitimacy and business model.

While Pi Network encourages users to run full nodes on desktops to participate in consensus, reports suggest a different reality:

A CNN report from January 2025 indicates that all mainnet nodes are operated centrally by the Pi Network team, undermining the decentralized ethos of blockchain technology.

KYC Requirements and Privacy Concerns

Pi Network mandates Know Your Customer (KYC) verification for users to access their mined Pi tokens. This requirement introduces several issues:

- Permissioned Environment: Mandatory KYC creates a permissioned system, allowing the central authority to potentially censor or restrict user access.

- Data Privacy: Concerns have been raised about the storage of KYC data. A Cointrust report highlighted that user data is stored on centralized servers, posing risks regarding data security and misuse.

Token Utility and Exchange Listings

The utility of the Pi token is currently limited:

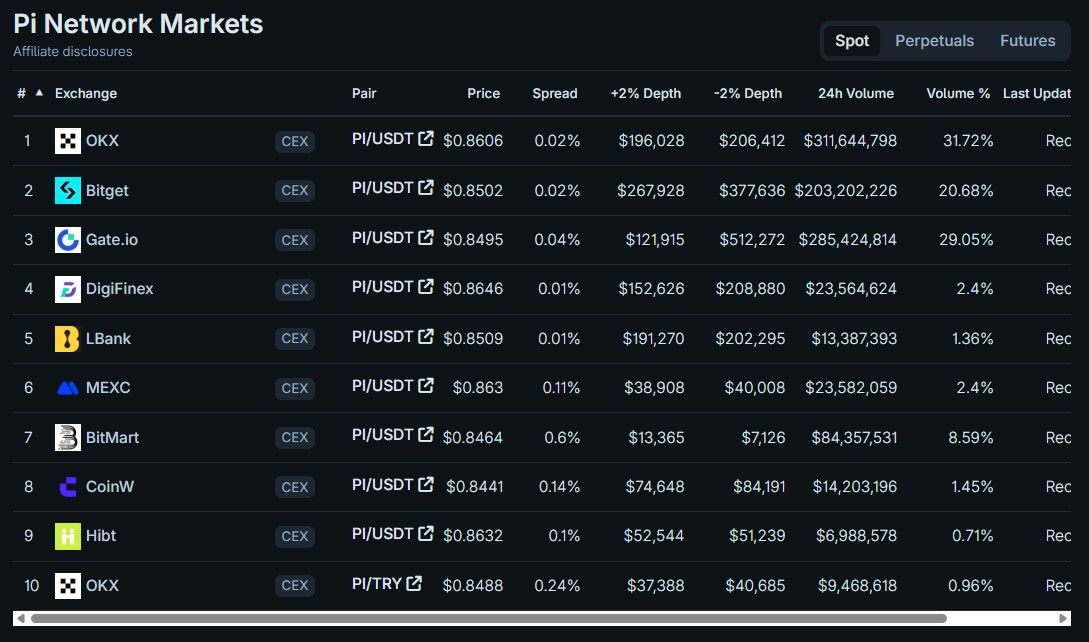

- Lack of Exchange Listings: Pi is not listed on major cryptocurrency exchanges, restricting its liquidity and real-world applicability.

While Pi isn't available on major exchanges, you can still buy it. OKX is among the few exchanges where you can buy Pi Coin. And we've got a sweet deal for you, too. Click here to buy Pi on OKX.

- Internal Ecosystem: The token's use is confined within the Pi Network's ecosystem, limiting its function as a medium of exchange in broader markets.

Pi Coin is Not Listed on Any Major CEX/DEX | Image via CoinGecko

Pi Coin is Not Listed on Any Major CEX/DEX | Image via CoinGeckoAdditional Concerns

Several other red flags have been identified:

- Lack of Transparency: The project lacks a detailed whitepaper, and the timeline for transitioning to an open network has been vague.

- Referral System: The incentive structure heavily relies on user referrals, drawing comparisons to multi-level marketing (MLM) schemes, which are often criticized for their pyramid-like structures.

- In-App Advertisements: Despite not being monetized through traditional means, numerous in-app ads raise questions about the project's revenue model and value proposition.

Industry Expert Opinions

Prominent figures in the cryptocurrency industry have expressed skepticism about Pi Network:

- Ben Zhou, CEO of Bybit, has publicly questioned the project's legitimacy.

- Justin Bons, founder of CyberCapital, has labeled Pi Network as a scam, citing its centralized control and questionable business model.

Security Features of Pi Coin

Key Points

- Pi Network’s blockchain uses the Stellar Consensus Protocol with trust-based Security Circles instead of traditional PoW or PoS systems.

- Despite claims of decentralization, all mainnet validators are reportedly operated by the Pi Core Team, undermining trust in its consensus model.

- Pi wallets store private keys locally with support for TEE, biometric login, MFA, and encrypted backups, but KYC data is stored on centralized servers.

- Security practices like encrypted transactions, HTTPS communication, and DNSSEC are in place, though past issues with KYC transmission remain a concern.

- Users are advised to use MFA, back up keys offline, stay on trusted networks, and monitor wallet activity for maximum protection.

Pi Network takes a layered approach to security, combining cryptographic standards, mobile wallet protections, and a trust-based consensus mechanism. However, much of its infrastructure still hinges on centralization, raising ongoing concerns about user autonomy and systemic risk.

Blockchain Security Infrastructure

Pi Network runs on a custom blockchain built using the Stellar Consensus Protocol (SCP), a variant of the Federated Byzantine Agreement (FBA). Instead of traditional PoW or PoS models, consensus is reached through Security Circles—small trust groups that form a global trust graph. This model is designed to prevent Sybil attacks and enable mobile-friendly mining with low resource demands.

The blockchain architecture includes:

- A layered structure with transaction and smart contract support (added in February 2025),

- DAG-based trust mapping to improve scalability,

- SHA3-512 and AES-256 encryption for hashing and secure communication,

- Public/private key cryptography to authenticate transactions using elliptic curve signatures.

While Pi claims to support thousands of community-run nodes, accusations that all mainnet validators are operated by the Pi Core Team undermine the decentralization claim, suggesting that consensus is currently fully permissioned.

User and Wallet Security

The Pi digital wallet is mobile-native and locally stores private keys on the user’s device, supported by secure enclaves like Apple’s TEE. Users back up their wallets using encrypted recovery phrases, and transaction signing happens locally before broadcasting.

Security features include:

- Multi-factor authentication (MFA) with SMS/email or biometrics,

- Secure HTTPS channels and DNSSEC protections,

- Rate limiting and session management on cloud infrastructure (reportedly Amazon-hosted).

However, KYC is mandatory to access Mainnet tokens, linking wallets to verified identities. While private keys remain device-based, user identity data is stored on centralized servers. Past reports of unencrypted KYC transmission (2021) raised alarm, and though improvements have been promised, server-side transparency is still lacking.

Best Practices for Users

Users can enhance their security by following basic precautions:

- Back up your seed phrase offline, not on cloud services.

- Enable biometric login and MFA inside the Pi app.

- Keep your device updated and avoid untrusted Wi-Fi when transacting.

- Only complete KYC via official Pi interfaces.

- Monitor wallet activity regularly and follow @PiCoreTeam for verified alerts.

Running a Pi Node adds another layer of transparency for those more technical, though current node roles are limited.

Looking for a Pi Coin wallet? Read our top picks, along with their features, as well as pros and cons.

Pi’s infrastructure combines strong cryptographic techniques with mobile usability, but much of the system still relies on centralized control over consensus and KYC data. This reduces user sovereignty and makes Pi’s security model more custodial than truly decentralized.

Community and User Experience

Key Points

- Pi Network’s user base exceeds 60 million, with growth driven by referral mining and social-based trust via Security Circles.

- Users praise its mobile-first, low-barrier mining approach, while critics flag concerns over privacy, KYC delays, and token utility.

- Governance features include in-app voting and proposal submissions, but transparency remains limited and communication inconsistent.

- Community sentiment is sharply divided—some view Pi as inclusive and promising, others label it an MLM-style system with unclear value.

With over 60 million users worldwide, Pi Network’s community is one of its most prominent assets—and also one of its most polarizing features. Community-driven growth has played a central role in shaping both the project’s legitimacy and public perception.

Trust, Growth, and Governance

Pi’s expansion has been fueled by its referral-based mining system and Security Circles, where users vouch for trusted peers to form a trust graph. This not only reinforces the network’s consensus model but also creates a self-validating social structure.

Governance includes community voting and proposal submission, with Pi soliciting feedback through its app. Events like hackathons and developer grants have helped foster early DApp development, creating the sense of a grassroots ecosystem.

That said, this same structure draws criticism for being overly reliant on user recruitment, with some likening it to a pyramid scheme. While defenders point to active engagement and global reach, critics question whether growth alone constitutes value.

User Feedback: Mixed Sentiment

Positive feedback tends to focus on accessibility. Users appreciate Pi’s mobile mining experience, which requires no capital investment and minimal technical effort. Reddit posts and Trustpilot reviews cite the platform’s inclusivity and low barrier to entry as standout features. Some users are hopeful about recent progress, including Mainnet migration and Chainlink integration.

Chainlink Integrating Pi Network Has Sparked Optimism Among “Pioneers” | Image via X

Chainlink Integrating Pi Network Has Sparked Optimism Among “Pioneers” | Image via XBut the negative sentiment remains strong:

- KYC delays and privacy concerns are recurring themes, with users reporting long wait times and discomfort over submitting personal data.

- Many highlight the lack of token utility, pointing to limited listings and few meaningful use cases beyond Pi’s internal apps.

- Others criticize Pi’s ad-supported model, vague roadmaps, and poor communication from the core team.

Reviews on Reddit are sharply divided. r/PiNetwork often acts as a pro-Pi echo chamber, while r/CryptoCurrency and r/phinvest are more skeptical, flagging MLM characteristics and questioning transparency. Trustpilot scores hover around 4.2/5, but the sample size is small and often shallow.

Impact on Security and Value

Pi’s Security Circle architecture and KYC enforcement are framed as user-led security mechanisms. Enthusiasts argue that community-run nodes, merchant adoption, and SDK-powered apps will eventually build real value. Others remain unconvinced, pointing to centralized infrastructure and speculative valuation.

In short, Pi’s community is highly engaged, often defensive, and central to the project’s identity. However, the same mechanisms that enable growth also raise concerns about transparency, utility, and long-term sustainability. Until Pi delivers tangible external utility, its legitimacy will remain contested, regardless of community size.

Future Outlook for Pi Network and its Ecosystem

Key Points

- As of May 2025, Pi Network has entered its Open Mainnet phase and is focusing on real-world utility and ecosystem expansion.

- Integration with Chainlink and a $100M venture fund aim to boost DApp development and merchant adoption, with over 125,000 vendors reportedly accepting Pi.

- Governance reforms are promised via new community tools, but delays in roadmap updates and exchange listings continue to frustrate users.

- While optimism remains, Pi’s future hinges on whether it can move beyond speculation and deliver transparent, decentralized infrastructure.

As of May 2025, Pi Network has completed its transition to Open Mainnet and is shifting focus toward ecosystem expansion, utility-building, and governance reform. Future progress will depend on whether the project can convert its large user base into meaningful usage, infrastructure, and value.

DApp Ecosystem and Real-World Use

The Pi Core Team launched Pi Network Ventures, a $100 million program in Pi and USD, to fund businesses building real-world applications. This marks a strategic push to anchor Pi in commerce and practical use. The team has emphasized this direction in recent communications, including X posts teasing new tools and ecosystem announcements.

Integration with Chainlink’s decentralized oracles, announced in May 2025, positions Pi to support more complex DApps and data-driven smart contracts. Meanwhile, the Pi App Suite—including the Pi Browser, Wallet, App Store, and the Fireside Forum—lays the groundwork for user-facing applications. Community-driven initiatives like Pi Commerce continue to scale, with over 125,000 merchants reportedly accepting Pi.

However, delays remain a concern. The community has voiced frustration over vague timelines for exchange listings and DApp rollouts. While Roadmap V1 listed past milestones and roadmap V2 was expected in late 2023, it was not delivered on time. This has fueled skepticism, even among long-time users.

Governance and Community Control

The Pi Core Team claims to be progressing toward decentralization, citing planned governance mechanisms and tools like PiNet and the Developer Portal. Pi Network Ventures is also expected to support community-led projects and governance initiatives. A planned Pi Foundation will manage 10% of the total token supply for ecosystem development.

Expectations on Reddit and X remain high. Some users hope for “Robin Hood-ification of crypto,” while others call for clear voting rights, transparent node distribution, and actual transitions away from core-team-led execution.

Conclusion and Final Recommendations

After years of development and hype, Pi Network’s legitimacy remains a divisive topic. Supporters point to its massive user base, mobile-first design, and recent moves toward Mainnet functionality. Critics highlight a disconnect between the project’s promises and its current reality.

Much of the skepticism stems from centralized decision-making, the team’s ongoing control over Mainnet infrastructure, and a referral-based model that emphasizes user acquisition over proven utility. While the Pi ecosystem is growing—on paper—real-world use, decentralization, and meaningful token liquidity are still lacking.

That said, participating in Pi doesn’t require financial investment. For those curious about the project, the barrier to entry is low. You can explore its features, experiment with apps, and follow its progress without risking capital—just time and personal data.

There is potential for Pi to evolve into something more aligned with crypto-native principles, but so far, the team’s roadmap and governance plans remain vague. Until the project delivers on decentralization, open infrastructure, and external integration, it’s difficult to treat Pi as a fully trustless or blockchain-native platform.

For now, Pi Network sits somewhere between ambition and execution—not an obvious scam, but not yet the revolution it claims to be. As always, approach with caution, verify information through official sources, and don’t mistake hype for product.