Bottom line: If you want high-beta crypto exposure backed by real usage, major institutional interest amid flurry of Solana ETFs filings, sub-$0.01 fees, and a maturing ecosystem, Solana is a compelling buy-and-hold; just size it prudently and respect key risk levels. Consider a 5–12% long-term allocation and be ready for ~15–30% pullbacks. If that’s not your style, run it as a tactical trade — buy 8–12% dips, cut on 10–15% breaks of support, and harvest profits into 20–30% extensions.

- Price & ATH gap: SOL ≈ $104.08 today, about 64.64% below its $294.33 ATH on Jan 19, 2025 (CMC).

- Size & supply: $128.9B market cap (rank #6), 543.03M circulating / 610.03M total supply; $144.8B FDV (CMC).

- Trend snapshot: 30D ≈ +27.6%, 90D ≈ +73.1%, YTD ≈ +26.7% (cross-check CoinGecko).

- Network health: avg non-vote fee (last epoch) ≈ 0.00011 SOL with ~70% of user txs paying a priority tip (Solana Compass); realized throughput typically ~3.3–3.7k TPS total with ~1k user TPS (Compass, Explorer).

- Uptime (last 12 months): No incidents posted for Aug–Sep 2025; last officially reported full halt was Feb 6, 2024 (status.solana.com).

Snapshot taken Feb. 3, 2026. Always verify live figures before investing.

Methodology & Disclosures

Before digging into Solana’s performance metrics, it’s important to explain how we arrive at an investment verdict. Our framework blends fundamentals, technology, adoption, and risk, giving readers a transparent view of the criteria behind every score.

Criteria & Weights

We don’t treat all factors equally. Fundamentals carry the most weight, but network traction and technology are close behind. Here’s the breakdown:

| Criterion | Weight |

|---|---|

| Fundamentals | 25% |

| Tech & Roadmap | 20% |

| Ecosystem Traction | 20% |

| Tokenomics | 15% |

| Market/Technical Analysis | 10% |

| Risk & Regulation | 10% |

This structure keeps the focus on what drives long-term value, protocol strength, and helps increase its adoption while still factoring in short-term trading signals and regulatory exposure.

Data Sources & Update Cadence

We pull real-time market stats from CoinMarketCap and CoinGecko, network performance from Solscan and Validator.app, and outage/uptime data from Solana Status. Developer activity is tracked via GitHub commits in core Solana repos, while ecosystem traction comes from DeFiLlama dashboards and NFT marketplaces like Magic Eden.

Conflicts & Disclaimers

This analysis is independent. We don’t hold paid relationships with Solana or its affiliates. Numbers are drawn from public, verifiable data sources, but they should not be taken as financial advice. Investing in crypto remains highly volatile, and readers should do their own diligence before acting.

What Is Solana? (Quick Refresher)

Solana’s design goal is simple: throughput without breaking costs. The chain combines Proof-of-History (PoH) to give every validator a shared clock with Proof-of-Stake (PoS) for finality. PoH reduces the chatter required to order transactions; PoS secures the ledger. In practice, this lets Solana confirm blocks in sub-second slots and keep fees close to zero for most actions.

Origins & Design Goals

Solana was founded in 2017 by Anatoly Yakovenko (ex-Qualcomm), joined early by Greg Fitzgerald, Raj Gokal, and others. Their idea came especially from a problem Yakovenko saw in distributed systems: agreeing on the order of transactions (time) adds overhead and latency. The solution proposed was Proof of History (PoH): a cryptographic clock of sorts built using a verifiable delay function so that transactions can be stamped in time without needing validator consensus for each ordering.

The design goals then were clear:

- Enable low latency (fast block/slot times, minimal delay),

- High throughput (parallel execution under load),

- Low transaction fees, so usage is frictionless even for small transfers. The hybrid PoH + Proof-of-Stake consensus, plus optimizations like Tower BFT, Turbine (block propagation), Sealevel (parallel runtime), meet those goals.

Launched as Mainnet Beta in 2020, Solana’s early metrics already impressed in testnets: 50,000+ transactions per second under controlled test settings with GPU-backed nodes.

Core Components

Validator Clients & Client Diversity

The original Solana Labs client (now Agave under Anza) remains the foundation. Most validators run on Agave or its forks. Jito-Solana, a fork of Agave that adds MEV (block builder) infrastructure, commands a large share of stake by offering validators & delegators extra reward opportunities. The term MEV is often used when referring to the infrastructure of any ecosystem,

Firedancer (Jump Crypto) is under active development. It aims to be a high-performance client in C/C++, modular, and expected to handle extremely high TPS when deployed fully. Its predecessor, “Frankendancer,” which blends Firedancer and Agave components, has been run in test & early mainnet hybrid mode.

PoH + PoS + Supporting Systems

Proof of History (PoH) is central. The SHA-256-based verifiable delay function creates a hash chain (tick count) that becomes part of the ledger, enabling all validators to agree on ordering without repeated inter-validator messaging. Combined with Tower BFT (Solana’s PoS consensus layer), this lets the chain avoid delay penalties common in other distributed consensus protocols.

Sealevel runtime enables parallel execution: smart contracts (programs) can operate on disjoint sets of accounts and state, so many transactions are processed simultaneously across different cores/nodes. This is opposed to sequential execution in many other blockchains.

Fee Model & MEV Integration

Base fee per signature is extremely low; priority fees can be added by users/dapps to move ahead when the network gets congested. The Compute Budget Program lets developers specify compute limits and price, improving predictability.

MEV (miner/validator extractable value) infrastructure has expanded. Clients like Jito-Solana introduce block-engine features and bundle auctions, sharing MEV rewards with stakers. These features encourage validator client forks (new clients) to include MEV logic, which affects both network economics and fairness.

Read our full Solana review for an in-depth look.

Technology & 2025 Roadmap Reality Check

Consensus & Performance

Design: PoH clock over PoS validator set; rapid leader rotation, sub-second slots.

Client/Throughput Upgrades

Firedancer: independent client by Jump; phased mainnet adoption (Frankendancer) with a live bug bounty and a delegation program launched in 2025.

MEV (Jito): bundles, private orderflow, and tip sharing; fewer failed txs during congestion; fairness debates around orderflow access.

Performance vs L1/L2 Peers (Realized TPS • live snapshot)

Uptime & Incidents (Last 12–24 Months)

Editor Notes (live values populated)

Footnotes (sources)

Solana fee/priority docs; Compass/Explorer live TPS & fees; Basescan, Arbiscan, OP Etherscan, Etherscan current TPS; Firedancer program + bounty; 2024 outage postmortem; 2025 status history.

Tokenomics & Staking Economics

Solana’s tokenomics model is designed to incentivize staking, gradually reduce inflation, and ensure utility for every SOL through transaction fees, rent, and collateral.

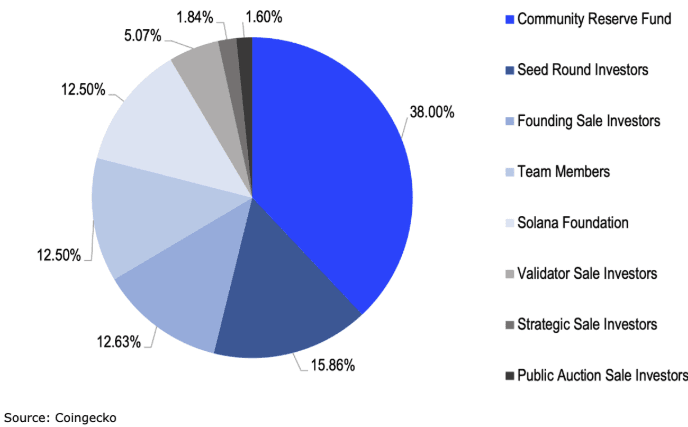

Solana Tokenomics Highlight Supply Dynamics And Inflation Control. Image via Coinbase

Solana Tokenomics Highlight Supply Dynamics And Inflation Control. Image via CoinbaseSupply mechanics

Here’s how it looks in mid-2025.

- Total Supply: ~610 million SOL.

- Circulating Supply: ~543 million SOL (~89% of total).

- Non-Circulating: ~67 million SOL (~11%), often tied to ecosystem or locked allocations.

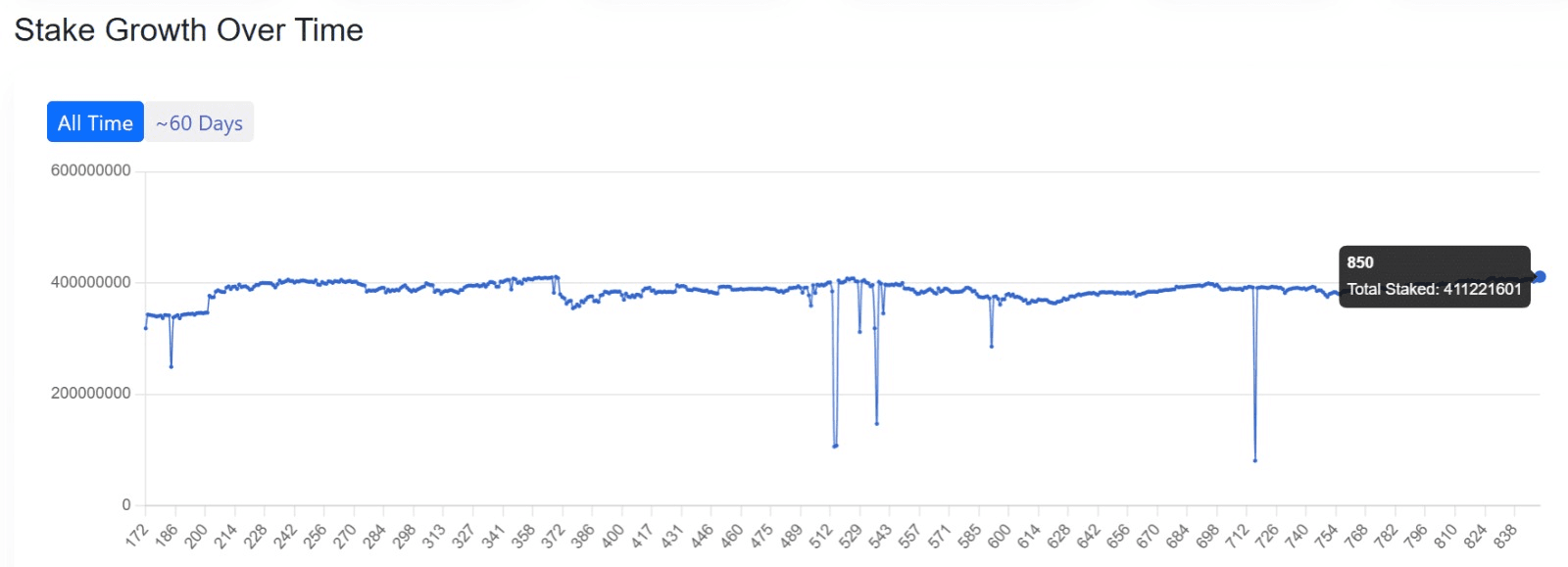

- Staked Share: ~411 million SOL (~67.4% of circulating), showing strong staking participation.

- Locked Stake: ~25.9 million SOL (~6.3% of staked), unavailable for withdrawal until lock expiration.

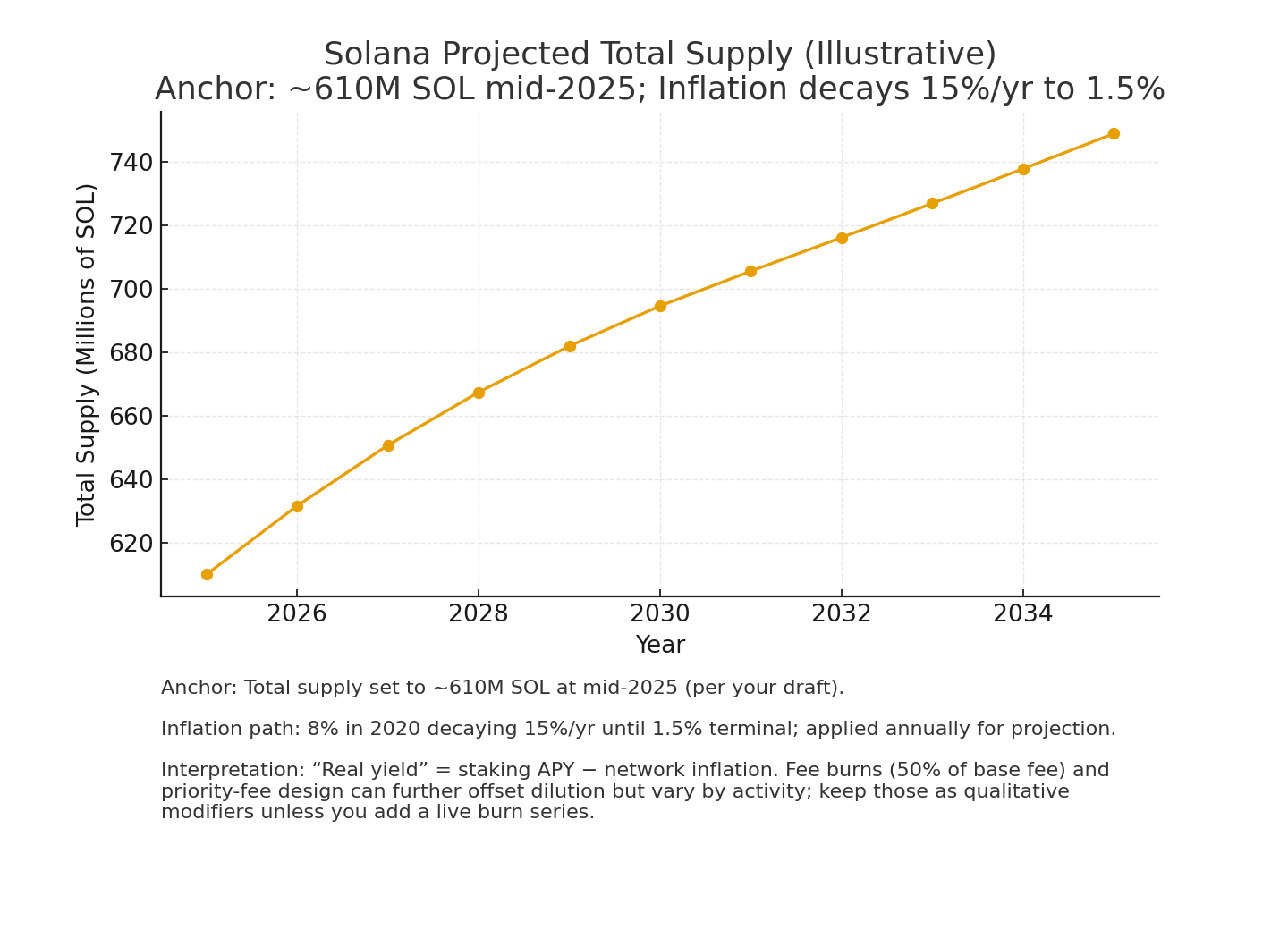

Solana uses an inflationary model that started near 8% annual issuance, decaying by 15% per year until reaching a ~1.5% terminal rate. Half of all base transaction fees are burned, introducing mild deflationary pressure as activity scales.

Fee design matters too: Each transaction pays a small base fee (5,000 lamports per signature). Today, 50% of that base fee is burned, and 50% goes to the leader. Priority fees are optional tips set per compute unit; since the SIMD-0096 change, validators receive 100% of priority fees (they were previously 50/50 burn/split).

Circulating supply fluctuates with emissions, staking, and fee burns, so reference a live tracker when you publish. Solana Compass keeps an up-to-date circulating/total supply and inflation dashboard.

Why it matters: decreasing inflation + fee burns offset dilution over time, while priority-fee routing aligns validator incentives and reduces off-chain side deals during congestion.

Staking for investors

Native staking on Solana typically yields mid-single-digits APY that compounds each epoch. Unstaking follows a cooldown that completes at epoch boundaries (roughly 2–3 days), after which SOL can be withdrawn; warm-up/cool-down can stretch over multiple epochs depending on network-wide limits.

Liquid staking options (e.g., Marinade’s mSOL, JitoSOL) remove the cooldown and keep capital liquid while delegating across many validators; both projects publish current APY and methodology.

On slashing: Solana’s documentation emphasizes unstake delays and validator performance; contemporary foundation materials state there is no slashing of principal on mainnet for typical misbehavior, so the main investor risk is missed rewards from a poor validator, not loss of stake. Always verify this stance against the current docs before publishing.

Demand drivers for SOL

SOL is the unit for:

- Paying base and priority fees on every transaction

- Rent-exempt reserves to create/hold on-chain accounts and

- Staking to secure consensus and earn rewards.

- Priority fees and the compute-budget program price scarce blockspace under load.

These mechanics tie activity in DeFi, NFTs, and payments back to SOL demand via fees and staking.

Solana Staking Yield vs. Inflation (illustrative)

| Year | Staking APY % | Inflation % | Real Yield % |

|---|---|---|---|

| 2025 | 4.00 | 3.55 | 0.45 |

| 2025 | 6.00 | 3.55 | 2.45 |

| 2025 | 8.00 | 3.55 | 4.45 |

| 2026 | 4.00 | 3.02 | 0.98 |

| 2026 | 6.00 | 3.02 | 2.98 |

| 2026 | 8.00 | 3.02 | 4.98 |

| 2027 | 4.00 | 2.56 | 1.44 |

| 2027 | 6.00 | 2.56 | 3.44 |

| 2027 | 8.00 | 2.56 | 5.44 |

| 2028 | 4.00 | 2.18 | 1.82 |

| 2028 | 6.00 | 2.18 | 3.82 |

| 2028 | 8.00 | 2.18 | 5.82 |

| 2029 | 4.00 | 1.85 | 2.15 |

| 2029 | 6.00 | 1.85 | 4.15 |

| 2029 | 8.00 | 1.85 | 6.15 |

| 2030 | 4.00 | 1.57 | 2.43 |

| 2030 | 6.00 | 1.57 | 4.43 |

| 2030 | 8.00 | 1.57 | 6.43 |

| 2031 | 4.00 | 1.50 | 2.50 |

| 2031 | 6.00 | 1.50 | 4.50 |

| 2031 | 8.00 | 1.50 | 6.50 |

| 2032 | 4.00 | 1.50 | 2.50 |

| 2032 | 6.00 | 1.50 | 4.50 |

| 2032 | 8.00 | 1.50 | 6.50 |

| 2033 | 4.00 | 1.50 | 2.50 |

| 2033 | 6.00 | 1.50 | 4.50 |

| 2033 | 8.00 | 1.50 | 6.50 |

| 2034 | 4.00 | 1.50 | 2.50 |

| 2034 | 6.00 | 1.50 | 4.50 |

| 2034 | 8.00 | 1.50 | 6.50 |

| 2035 | 4.00 | 1.50 | 2.50 |

| 2035 | 6.00 | 1.50 | 4.50 |

| 2035 | 8.00 | 1.50 | 6.50 |

Solana Supply Curve

SOL's Path to 2035

SOL's Path to 2035Ecosystem Traction: Where the Demand Comes From

Expanding Ecosystem Positions Solana As Developer Favorite. Image via Shutterstock

Expanding Ecosystem Positions Solana As Developer Favorite. Image via ShutterstockThe Solana ecosystem’s demand is not something that just came from its docs; it shows up in DeFi TVL, NFT volume, and growing enterprise/payout integrations. Below are the key areas, along with what the numbers reveal.

DeFi

As of September 2025, Solana’s DeFi TVL stands at $12.49 billion, according to DeFiLlama.

Top protocols by TVL:

- Jupiter leads Solana with around $3.65 billion locked

- Jito ($3.61 billion)

- Kamino (~$3.46 billion)

- Sanctum (~$3.23 billion)

- Raydium (~$2.6B)

Stablecoins on Solana (especially USDC) are significant in liquidity pools and lending protocols. A large portion of value locked comes from stablecoin-denominated assets, which reduces volatility for users in those protocols.

Implication: DeFi is the backbone of SOL demand. TVL growth implies real, repeat usage, not just speculation. Protocols combining staking, liquidity, lending, and aggregation are pulling in capital and retaining users.

If you are already staking on Solana and using the Solflare wallet, then master it with our beginner's guide to staking on Solflare.

NFTs & Consumer Apps

Consumer apps and DApps are leveraging the speed: wallet tools like Phantom (in-wallet swaps), simplified NFT launchpads (via Magic Eden), and web3 games are increasing user counts. Quicker mint fees and low transaction costs make it viable for smaller creators.

Implication: NFTs and consumer-facing apps add breadth to Solana’s demand and not just big money in DeFi, but many everyday users doing drops, trades, and minting. That gives more organic demand for SOL via transaction fees and gas usage.

Payments / Enterprise

Solana Pay has made inroads: Shopify merchants can accept USDC over Solana, benefiting from low fees and faster settlement. This shows real enterprise interest in using Solana not just for DeFi or NFTs but for real commerce.

Stablecoin settlement rails (via Circle’s USDC) are increasingly favored for cross-border transfer use cases, due to Solana’s finality and low transaction costs. Companies piloting fiat-off ramps in certain regions are also testing Solana as a backend rail. (Though data here is thinner, enterprise use cases are growing.)

Implication: Payments and enterprise integrations bring recurring demand and volume, which helps SOL’s value beyond speculative or purely crypto-native uses. Growth here helps stabilize network usage and demand for SOL through settlement, on-ramps, and trading.

Takeaway

Solana’s demand comes from three pillars that each reinforce one another:

- DeFi (deep liquidity, trust protocols),

- NFTs / everyday user apps (large base of small volume users),

- Enterprise and payments (merchant onboarding, real-world usage).

These layers of activity generate both transaction/gas demand and coin demand (staking, fees, priority fees), which are structural drivers for SOL’s value. If outages or performance degradations are minimized, that demand looks sustainable in 2025 under current growth trends.

Market Performance & Price History

Solana Market Performance Signals Strong Q2 Recovery Momentum. Shutterstock

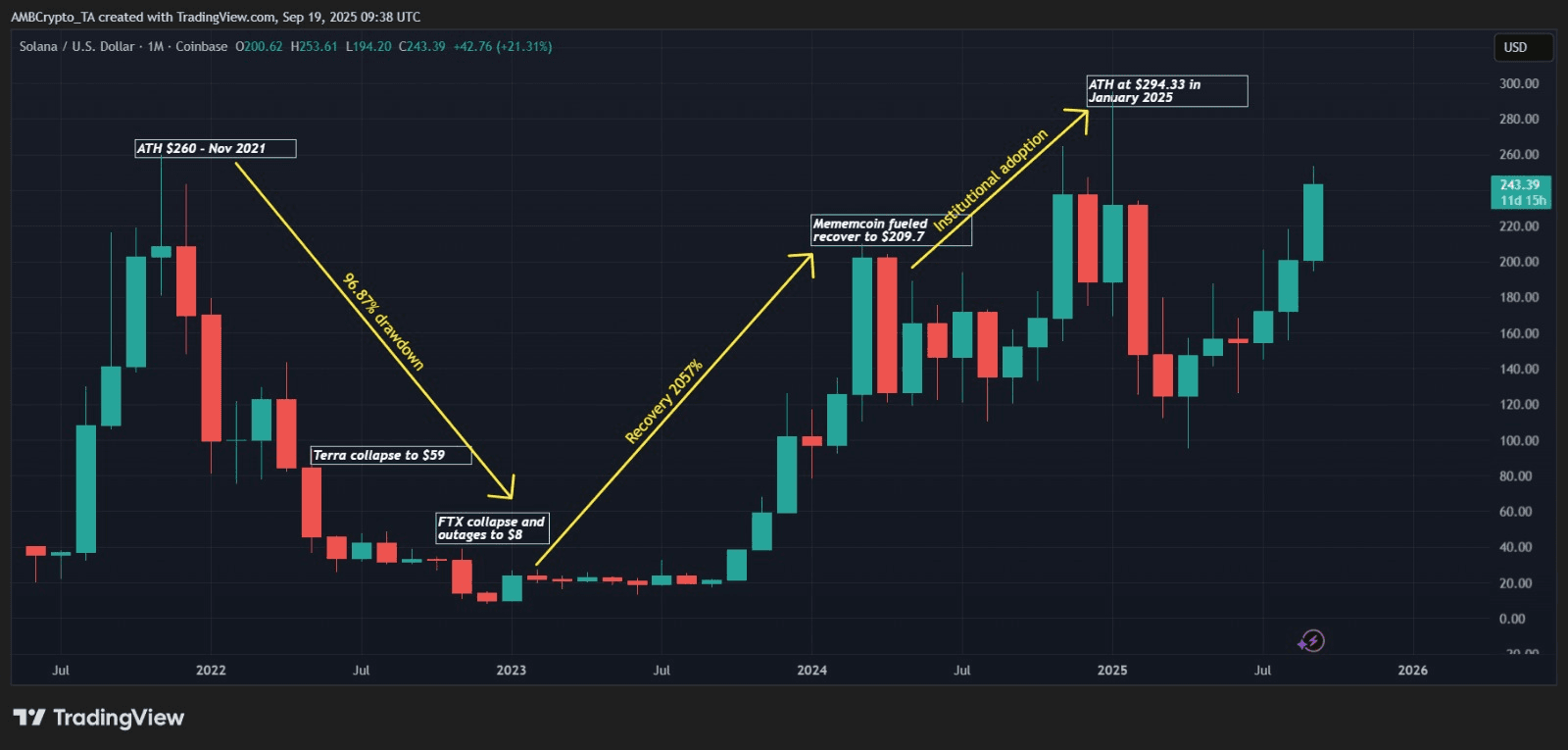

Solana Market Performance Signals Strong Q2 Recovery Momentum. ShutterstockSolana’s market path has seen some extreme cycles, massive rallies, deep crashes, and rapid rebounds. Each phase is a representation of both macroeconomic crypto shocks and Solana-specific catalysts.

Major Drawdowns and Recovery Cycles

The Great Crypto Winter (November 2021 – December 2022): -95% drawdown

From its ~$260 all-time high in November 2021, SOL fell to ~$8 intra-day by Dec 29, 2022 (closing ~$9.6). The drawdown was amplified by the FTX/Alameda collapse and eroded confidence from 2022’s network outage. Together, these events drove disproportionate selling versus bluechips.

Solana’s ATH Chart. Image via Trading View

Solana’s ATH Chart. Image via Trading ViewTerra Luna Contagion (May 2022): -40% decline

During Terra’s collapse (May 7–12, 2022), SOL slid from ~$79 to a ~$36 intraday low (closing ~$45 on May 12), then rebounded to ~$59 by May 15, illustrating how L1 tokens were vulnerable to system-wide DeFi shocks.

Memecoin-Fueled Recovery (2023–2024): +3,000% surge

From the December 2022 bottom near $8, Solana rebounded over 3,000% to a new all-time high in January 2025 of $294. Momentum came from the BONK memecoin airdrop and Saga phone buzz, PYUSD launching on Solana in May 2024, and escalating Solana ETF filings through 2024–2025.

Long-term Stake Growth Showing Stability Despite Market Volatility. Image via Solana Compass

Long-term Stake Growth Showing Stability Despite Market Volatility. Image via Solana CompassCurrent Cycle (2025): Testing old highs

As of September 2025, SOL trades around $244–$250, approaching its ~$294 January ATH. Roughly 70% of the supply is staked, leaving only ~85M liquid tokens. That locked float, paired with growing institutional accumulation, Solana treasuries, and ETF filings/updates by Invesco, VanEck, Bitwise, Grayscale, Franklin Templeton, Fidelity, 21Shares and CoinShares, is underpinning this rally.

Quarterly Narrative (2025)

Q1 2025 – Ecosystem boom

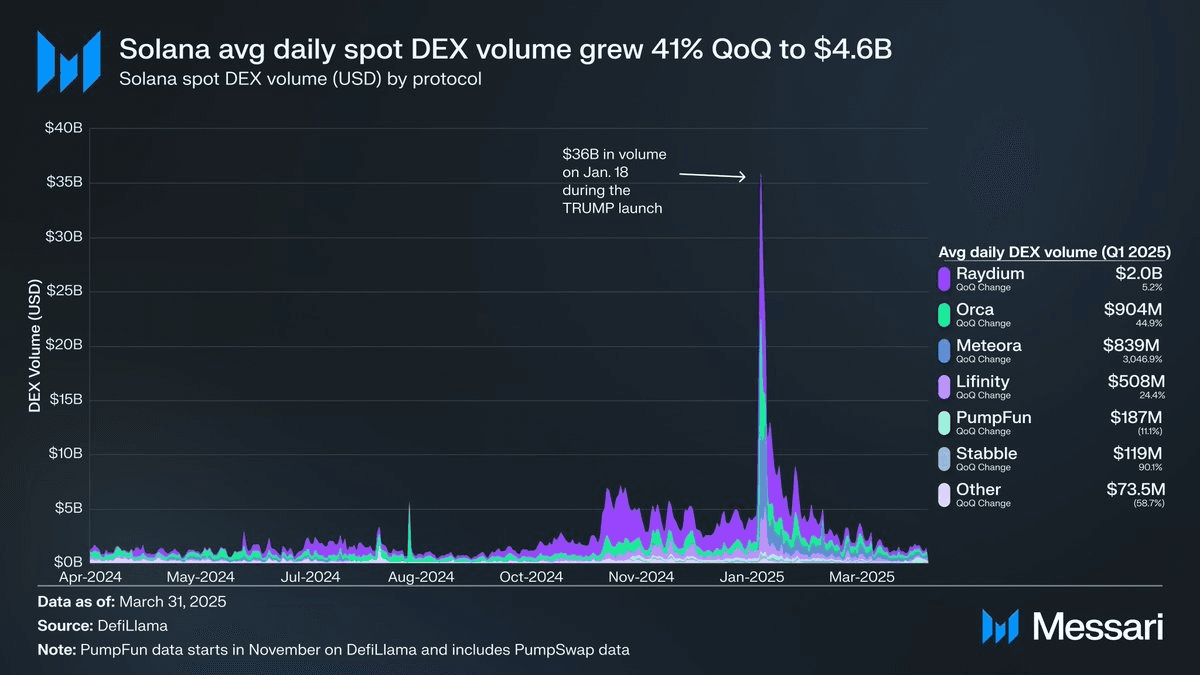

Chain GDP expanded 20% QoQ to $1.2B, stablecoin supply soared 145% to $12.5B, and DEX volumes hit $4.6B daily averages, peaking at $36B in a single day.

Q1 2025 Solana DEX Volumes with Protocol-Level Breakdown. Image via Messari

Q1 2025 Solana DEX Volumes with Protocol-Level Breakdown. Image via MessariQ2 2025 – Redistribution & volatility

Dormant wallets reactivated, driving Coin Days Destroyed (CDD) spikes and triggering profit-taking waves. After each surge, SOL stabilized in tighter ranges, hinting at accumulation phases before the next leg.

Solana Correlation Dynamics

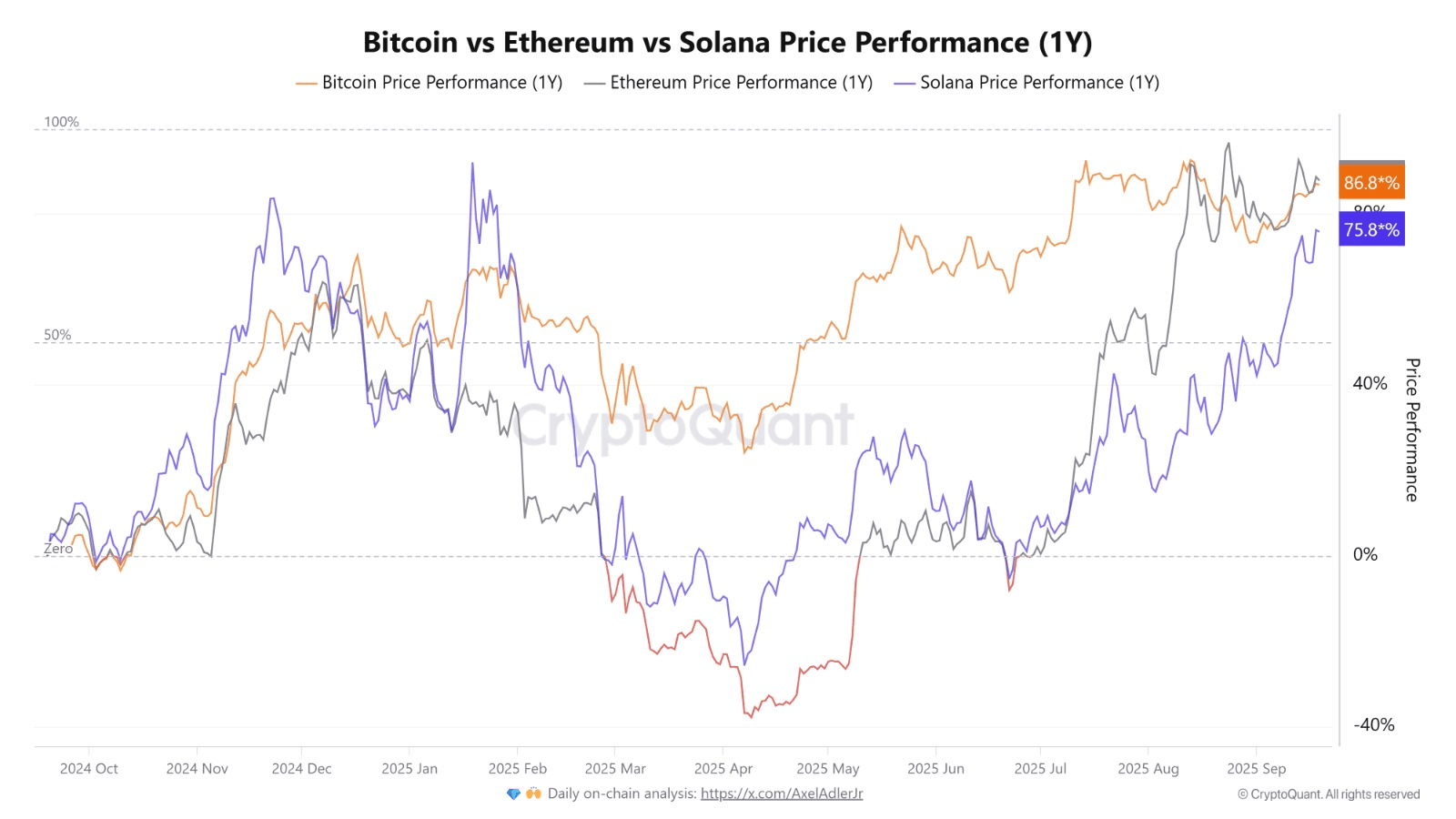

One-year BTC, ETH, and SOL Performance Comparison Showing Divergences. Image via CryptoQuant

One-year BTC, ETH, and SOL Performance Comparison Showing Divergences. Image via CryptoQuant- BTC/ETH: 0.57 correlation, showing macro forces move them in tandem.

- BTC/SOL: 0.40 correlation, reflecting Solana’s independence via network catalysts (e.g., memecoin rallies, upgrades).

- ETH/SOL: 0.76 correlation, driven by overlapping DeFi demand.

For most of 2025, BTC and ETH have been near lockstep (96–100% correlation). Solana diverged sharply in Feb, rallying +80% vs BTC/ETH’s modest gains, proving how catalysts create tactical windows for SOL positioning.

| Pair | Correlation Coefficient |

|---|---|

| BTC / ETH | 0.572 |

| BTC / SOL | 0.398 |

| ETH / SOL | 0.756 |

Pairwise correlation coefficients clearly highlight SOL’s decoupling from BTC.

Solana Technical Analysis

Technical Analysis Shows Solana Strengthening Across Key Levels. Image via Shutterstock

Technical Analysis Shows Solana Strengthening Across Key Levels. Image via ShutterstockSolana is currently at a hinge point. Price action shows consolidation under resistance zones, with support levels being tested. Momentum indicators are mixed; some suggest bounce risk, others point to further downside if key levels fail.

The reason that Solana is pumping is way simpler than you think.

Trend & Momentum

Between October 2024 and mid-April 2025, Solana was trapped in a firm downtrend, with the 20-day SMA stuck under the 50- and 200-SMAs. MACD confirmed the weakness, flashing repeated bearish crossovers and histogram bars below zero.

That picture flipped in mid-April when the 20-SMA climbed over the 50-SMA, and by early May, it crossed the 200-SMA in a golden cross that fueled a powerful rally. Buyers defended the 50-SMA in late May and July, while MACD bullish crossovers and expanding histograms confirmed strengthening momentum. Into September, the widening gap between the SMAs shows the uptrend remains intact, with price consolidating near $240–250.

Solana Trend Momentum With Moving Averages And MACD Crossovers. Image via TradingView

Solana Trend Momentum With Moving Averages And MACD Crossovers. Image via TradingViewKey Support / Resistance Levels

Momentum tells us where the wind is blowing, but key levels show where the market actually takes its stand. Solana’s critical support rests around $200–205, tested multiple times since July. Resistance has formed near $260–265, with the January 2025 ATH of $293.31 as the main ceiling. The heaviest trading volume clusters around $230, creating a strong demand zone. A decisive move above $265 could open the path to new highs, while losing $200 risks pulling SOL back to the $180 range.

Volatility & Liquidity

Price levels alone don’t tell the full story. To see how durable these moves are, liquidity and derivatives activity come into play. Over the past week, open interest climbed alongside price without triggering liquidation spikes, showing that leverage growth was steady rather than reckless. Funding rates hovered just above zero, reflecting bullish bias but not froth.

Toward the week’s close, open interest leveled off while price consolidated, pointing to measured profit-taking instead of forced unwinds. The absence of sudden funding surges or collapses suggests traders are handling risk responsibly, and that recent volatility is being driven more by spot demand than leveraged speculation. This healthier setup reduces the chance of sharp reversals and leaves the market better positioned to extend trends if demand persists.

Solana Funding Rates And Open Interest Showing Derivatives Stability. Image via TradingView

Solana Funding Rates And Open Interest Showing Derivatives Stability. Image via TradingViewExpert Price Predictions & Consensus (2025–2030)

Looking at both short- and long-term projections gives us a sense of whether current valuations align with institutional conviction or speculative hype.

2025-2027 Targets - Analytics Insight

| Forecast Range for SOL (2025–2027) | Bull / Base / Bear Viewpoint & Rationale |

|---|---|

| $250–$300 by end-2025 | Bullish scenario: if SOL breaks above resistance around $193-200; adoption & NFTs/DeFi drive demand. (Analytics Insight) |

| ≈ $300 by late 2025 | Believes institutional inflows + ETF speculation can push SOL back toward or beyond its previous ATH. (The Economic Times) |

| $255–$480, stretch target ~$555 | Base-case mid-hundreds if ecosystem growth and macro trends are favorable; stretch depends on liquidity & sentiment. (InvestingHaven) |

| $186-$200 (conservative/base) | If regulatory headwinds or macro downturns suppress gains; technology & network improvements only marginally priced in. (Brave New Coin) |

| High target ~ $903.78 by 2030 | Their bullish scenarios lean long; but for 2025–2027, they expect more modest gains unless major catalysts occur. (Cryptonews) |

2030 Long-Range Scenarios

- Base case: SOL could average $400-$700 if adoption continues steadily, upgrades are successful (Firedancer & client diversity), usage in DeFi, NFTs, payments scale well, and regulatory frameworks are moderate/stable.

- Bull case: Potential upside in $900-$1,200+ if SOL becomes a major settlement layer, institutionally adopted, with Web3/NFT/gaming usage dramatically higher. Also depends on macro tailwinds (crypto-friendly regulations, liquidity inflows).

- Bear case: If many Layer-1 competitors overtake SOL, or if outages/regulatory pressures intensify, SOL could struggle to stay above current resistance, possibly trading in $100-$220 range long term.

Forecast Quality Notes

- Model assumptions: Many forecasts assume “ideal” conditions (ETF approval, regulatory clarity, macro liquidity, high usage). If any of those falter, triggers can cascade negatively (bearish returns).

- Data recency & track record: Forecasts drawn from 2025 data, but some institutions published predictions earlier (2023-24), which may have missed intermediate events (e.g., rate hikes, macro shocks).

- Error bars are wide: The gap between lowest and highest predictions is large — this reflects uncertainty in regulatory regimes, competition, scaling issues, and network reliability.

- Bias risk: Some bullish forecasts may lean on hype (memecoins, TVL growth) rather than sustained fundamentals; others may be overly conservative if slow adoption is assumed.

Solana vs Ethereum (and L2s) — 2025 Scorecard

Solana Challenges Ethereum With Speed And Cost Advantage. Image via Shutterstock

Solana Challenges Ethereum With Speed And Cost Advantage. Image via ShutterstockSolana and Ethereum now serve distinct jobs. Ethereum anchors high-value settlement and a sprawling L2 stack. Solana concentrates throughput and UX on one L1. Comparing them cleanly means looking at three levers: what it costs to transact, how much activity and revenue they capture, and where builders/liquidity are concentrating.

Throughput & Fees

The gist: Solana’s realized user-facing throughput sits in the ~1k TPS band in normal conditions and can burst far higher under stress. Median fees are sub-cent. Ethereum L1 is far slower with higher L1 fees, but L2s drive routine costs into the cents range.

- Solana fees: Base fee = 5,000 lamports (0.000005 SOL) per signature. Priority (tip) fees dominate during congestion. Typical user fees remain < $0.01 even in busy periods; recent epochs show average total fees ~3–5e-5 SOL per tx, with 65–75% of user txs adding a priority tip.

- Solana throughput. Effective, user-driven TPS commonly ~1,000–1,400. Peak stress tests (noop-heavy) hit ~107,540 TPS on mainnet in Aug 2025; treat that as an upper-bound showcase, not day-to-day reality.

- Ethereum & L2 fees: Ethereum L1 hovering around $1–$6 per tx (volatile). Popular L2s typically $0.05–$0.30 to send/swap as of this writing.

Cost to transact (indicative, USD):

| Network | Simple transfer | Swap |

|---|---|---|

| Solana (L1) | ≪ $0.01 (base + small priority) | Usually < $0.01 |

| Ethereum (L1) | ~$1–$2 | ~$5+ |

| Arbitrum / Optimism / Base (L2) | ~$0.07–$0.15 | ~$0.18–$0.60 |

Revenue, Fees & Users

The gist: Both chains are healthy by raw activity, but the mix differs. Ethereum commands the deepest fee market; Solana sees massive user counts and low-fee volume. Current on-chain trackers show:

- Solana chain dashboard (DeFiLlama): TVL ~$12B+ in September 2025; daily fees ~$3.2M and daily revenue ~$1.6M at snapshot; ~4.7M daily active addresses on recent reads. (Numbers vary by day; use the dashboard for the latest.)

- Ethereum chain dashboard (DeFiLlama): TVL ~$95B; daily chain fees ~$54M and chain revenue ~$1–3M depending on window; ~540k daily active addresses at snapshot. (Again, check the live panel for drift.)

Dev & Liquidity Gravity

The gist: Ethereum still leads in total devs and deep, sticky liquidity. Solana captured the most new developers in 2024 and is competing for share in 2025 while pulling in fast-twitch liquidity (DEX, memecoins, LSTs).

- Developers Electric Capital’s 2024 report: 7,625 new devs joined Solana (most of any chain), an 83% YoY jump. Ethereum remains No.1 in total developer base across continents, but Solana led new joiners.

- TVL share: Ethereum still holds ~55–60% of DeFi TVL; Solana’s share climbed with a 2025 resurgence past $12B.

- Stablecoin base and depth: Ethereum keeps the largest stablecoin float and deepest money markets; Solana’s stablecoin cap and DEX share rose meaningfully through 2025 as per DeFiLlama and industry trackers.

Quick comparison table (2025 snapshot)

| Dimension | Solana (L1) | Ethereum (L1) | L2s (ETH rollups) |

|---|---|---|---|

| Typical user fee | ≪ $0.01 | ~$1–$6 | ~$0.05–$0.60 |

| Realized user TPS | ~1k–1.4k | ~10–15 | 100s (rollup-level) |

| Peak headline TPS | 107k (stress test) | N/A (L1) | N/A (varies) |

| Daily active addresses | ~4–5M recent reads | ~0.5–0.6M recent reads | Varies by L2 |

| TVL (chain) | ~$8.5–10B | ~$95B | Fragmented across L2s |

| 2024 new devs (EC report) | #1 by new joiners | #2 by new joiners | N/A (rolled into ETH stack) |

How to read this

If you need ultra-low fee, high-throughput consumer UX, Solana fits. If you need institutional liquidity depth, risk tooling, and long-tail DeFi markets, the Ethereum + L2 universe still dominates. Most teams straddle both: settle value on ETH/L2s, chase growth on SOL.

When weighing Solana against Ethereum and its Layer-2 stack, the core question is simple: does Solana’s speed and cost advantage outweigh Ethereum’s network effects and institutional dominance? Looking at both sides helps cut through the noise.

Solana Pros

- Transaction fees are consistently below $0.01, making it far cheaper for users and developers than most chains.

- High realized throughput, averaging tens of thousands TPS with benchmarks over 65k under stress tests.

- Rapid user growth in DeFi, NFTs, and gaming is strengthening network demand.

- Expanding developer activity with Firedancer and other client diversity efforts, reducing single-client dependency.

- Institutional pilots in payments and stablecoin settlement signal growing mainstream confidence.

Solana Cons

- Past outages still weigh on credibility, even with recent stability improvements.

- High validator hardware requirements raise concerns about centralization.

- Fee spikes during NFT mints or high activity undermine predictability.

- DeFi liquidity depth trails Ethereum, limiting capital efficiency.

- Ongoing regulatory uncertainty around SOL’s classification (commodity vs security).

Ethereum Pros

- Deepest liquidity base in crypto with $70B+ TVL and dominant stablecoin pools.

- Institutional adoption is bolstered by ETFs, regulated custodians, and long-standing market trust.

- Modular L2 scaling expands capacity without overloading the Ethereum mainnet.

- Most mature risk management tools, oracles, and derivatives ecosystems.

- A broad developer community ensures continuous upgrades and security strength.

Ethereum Cons

- Fragmented user experience across L2s, creating liquidity silos and bridging friction.

- Mainnet fees still spike to $10–$50 during congestion.

- Cross-rollup bridging is a frequent security weak point.

- Value accrues mostly to Ethereum L1, limiting upside for L2 tokens.

- Governance risks tied to sequencer centralization remain unresolved.

Catalysts, Headwinds & Risk Matrix

Solana’s Growth Balanced By Risks Investors Must Watch. Image via Shutterstock

Solana’s Growth Balanced By Risks Investors Must Watch. Image via ShutterstockSolana’s trajectory into 2025 depends on how quickly it can convert technical upgrades and ecosystem momentum into durable stability. While near-term catalysts are lining up, risks remain—from outages to external competition.

Near-Term Catalysts (3–9 months)

The most immediate driver is Firedancer, Jump Crypto’s independent validator client, expected to hit key public milestones in 2025. Firedancer promises to reduce single-client risk and improve throughput resilience. Alongside this, Solana is seeing major app launches: integrations like Helium Mobile expanding, new DeFi protocols experimenting with localized fee markets, and NFT/gaming apps such as Tensor and Star Atlas re-gaining traction.

Exchange listings of SOL perpetuals on CME or additional ETF inflows (if regulators approve) would also serve as liquidity catalysts.

Structural Tailwinds (12–24 months)

Beyond 2025, Solana benefits from larger UX upgrades like localized fee markets already in production, reducing transaction conflicts for end users. And Solana's ecosystem funding is full-proof. Solana Foundation continues to deploy ecosystem grants, and venture capital is flowing into Solana-native startups, particularly around DeFi and gaming.

Institutional adoption is another tailwind, with payment experiments like Visa’s USDC settlement pilot on Solana and Shopify/Stripe integrations proving real-world traction. These create a foundation for Solana’s longer-term sustainability.

Risks & Unknowns

The biggest risk remains outage relapses. Solana’s history of downtime still colors investor confidence, and until Firedancer + QUIC implementations are fully battle-tested, reliability is not guaranteed. There’s also client monoculture risk if Firedancer adoption lags, keeping the ecosystem over-dependent on the current Solana Labs client. Regulatory uncertainty looms as well: Solana could face stricter classification debates in the U.S. or EU, especially if staking rewards are framed as securities.

Externally, competitive pressure from ETH rollups and newer high-throughput L1s like Aptos and Sui could siphon developers and liquidity. Finally, there come macro risks. A liquidity squeeze or ETF outflows could dampen Solana’s bullish cycle regardless of tech execution.

| Likelihood \ Impact | Low Impact | Medium Impact | High Impact |

|---|---|---|---|

| Low Likelihood | Minor UX bugs from fee markets rollout | Isolated regulatory inquiries (non-core markets) | Isolated outage (hours, not days) |

| Medium Likelihood | Competitive app launches on ETH L2s | Delay in Firedancer rollout | Major ETF outflows reducing liquidity |

| High Likelihood | Short-term volatility tied to memecoin rotations | Prolonged support delays (user reputation impact) | Multi-day outage relapse or Firedancer adoption lag |

Is Solana a Good Long-Term Investment?

Different investors have different goals. Some want buy-and-hold growth, others trade momentum, and stakers want income. Here’s how Solana stacks up for three personas: Long-Term Allocators, Active Traders, and Yield-Seekers (Stakers). Use the decision checklist at the end to figure out which fits you best.

Long-Term Allocators

If you’re building a diversified portfolio where you want exposure to smart contract platforms, SOL can be appealing under certain allocation bands. Evidence of ecosystem maturity, adoption, and technical upgrades suggests SOL might serve as a substantial growth engine—but comes with higher volatility than blue-chip assets.

Suggested Allocation Bands & Rebalancing:

| Portfolio Size Tier | Suggested SOL Allocation | Rebalancing Cadence |

|---|---|---|

| Conservative (20-50% crypto) | 5-7% | Semi-annually |

| Moderate (50-80% crypto) | 8-12% | Quarterly or after 20% move |

| Aggressive (80-100% crypto) | 12-20% | Quarterly or upon key triggers |

- What works in SOL’s favor: large developer inflows, strong DeFi + NFT demand, upgrades like Firedancer and MEV improvements, and relatively low transaction costs compared to Ethereum L1.

- What to watch out for: reliability issues, macro risks (interest rates, regulatory changes), competition from ETH L2s and other L1s, and potential periods of stagnation if adoption or utility doesn’t grow as projected.

Active Traders

For active trading, Solana offers volatile swings, which means potential profit but also risk. You need rules and guardrails: know when price action invalidates your thesis, understand liquidity, and watch technical signals closely.

Trade & Momentum Playbooks:

- Use range trading between key support ($155-160) and resistance (~$178-$200) zones; several recent breakouts stall at these levels.

- Watch RSI(14) for overbought/oversold extremes; MACD crossover signal line breaks; volume spikes to confirm moves.

Invalidation Rules & Liquidity Considerations:

- If price drops below critical support (for example, $145-$150) on high volume, invalidate any bullish trade setup in favor of protection or exit.

- Liquidity is decent within popular zones, but outside that (below ~$125 or above ~$200), thin order books can lead to sharp slippage.

Real-world example: After SOL broke resistance near $180 in late Aug 2025, price rejected with heavy volume, RSI over 70, MACD bearish divergence; active traders who waited for confirmation or scaled out avoided sharp retracements.

Yield-Seekers (Stakers)

If you aim to generate income rather than pure capital appreciation, staking SOL provides a steady yield, but true return depends on inflation, validator commission, risk of lockups, and whether you use liquid staking.

Staking vs Liquid Staking Options & Real Yield:

| Option | Yield Range (2025) | Lock / Cooldown & Flexibility | Risk & Trade-Offs |

|---|---|---|---|

| Native Staking (solo/delegated) | ~6-8% APY (before inflation effects) | 2-3 epochs (~2-4 days) cooldown for unstake; delegation flexible | Validator selection matters; rewards drop if validator underperforms |

| Liquid Staking (e.g. Marinade, JitoSOL) | ~5.8‐7.5% after fees/commissions | no direct cooldown; tokens are tradeable but slightly less secure (contract risk) | Smart contract risk; potential decreased reward if liquidity becomes strained |

Real-Yield vs Inflation: With inflation falling (see earlier yield vs inflation table), staking yields are staying above inflation in many cases—especially in the short-to-medium term. That means real yield (after inflation) for good validators or liquid staking pools can be positive, but practitioners must monitor validator health and fees closely.

Decision Checklist (Persona Cards)

Use this mini checklist to figure out if Solana is a good investment for you, or what posture to take (Trade vs Hold).

| Persona | Key Question to Ask | If Yes, You Lean Towards… |

|---|---|---|

| Long-Term Allocator | Am I comfortable with price volatility and possible outages? | Hold / Buy; consider ~5-12% allocation |

| Active Trader | Do I have time to monitor key support/resistance & liquidity? | Trade with tight stop losses; watch invalidation zones |

| Yield-Seeker (Staker) | Do I value steady income over maximal price gains? | Stake (native or liquid) but diversify validator risk |

How to Invest in Solana

Leading Exchanges Offer Solana Access To Global Buyers. Image via Shutterstock

Leading Exchanges Offer Solana Access To Global Buyers. Image via ShutterstockWhen approaching Solana as an investment, the process should cover three pillars: acquisition, custody, and participation in staking. Each step comes with its own risks, trade-offs, and best practices. Below is a breakdown that balances accessibility with investor security.

Where to Buy SOL

The first step is finding a trusted exchange. While most tier-1 platforms list SOL, fees, liquidity depth, and compliance regimes vary significantly.

| Exchange | SOL Availability | Trading Fees | Security Features (2FA, Insurance) | Regulatory Status |

|---|---|---|---|---|

| Binance | Yes | 0.1% spot | 2FA, Proof of Reserves | Licensed in major regions (Binance Licenses) |

| Coinbase | Yes | 0.6% spread | Insurance, Segregated Custody | FinCEN MSB, FCA, MiCA prep (Coinbase Licenses) |

| Kraken | Yes | 0.16–0.26% | Cold storage insurance, 2FA | U.S., EU regulated (Kraken Licenses) |

| Crypto.com | Yes | 0.075% maker | $750M insurance, withdrawal locks | U.S., EU regulated (Crypto.com Licenses) |

| OKX | Yes | 0.08% spot | PoR, hardware key integrations | MiCA, FinCEN MSB, Dubai's VARA |

- Binance: Known for global liquidity and low spot fees (~0.1%). Offers SOL pairs across multiple fiat currencies and stablecoins.

- Coinbase: Easy fiat on-ramp, especially in the U.S., but comes with higher retail spreads (~0.6%). Regulatory profile is strong.

- Kraken: Competitive maker/taker fee range (0.16–0.26%) and one of the longest regulatory track records in both the U.S. and EU.

- Crypto.com: Expansive global reach with 0.075% maker rebates and integration with its Visa card. Particularly attractive for retail users.

- OKX: Low trading fees (~0.08%), robust derivatives market, and integrations with Web3 wallets, making it appealing for active traders.

Regional note: Always confirm fiat pairs and compliance coverage. For instance, Coinbase/Kraken dominate in the U.S., while Binance/OKX are preferred in Asia.

Read: How To Buy Solana in the U.K./How To Buy Solana in the U.S.

Wallets & Security

Purchasing SOL is only the beginning. Custody strategy determines how much control you retain and how well-protected your assets are.

- Hardware wallets (Ledger, Trezor): Best suited for long-term holders. Provide offline storage, resistant to hacks, and allow staking through integrated apps.

- Non-custodial hot wallets (Phantom, Solflare): Convenient for daily interactions with DeFi and NFTs. Require rigorous seed-phrase hygiene, device-level security, and phishing awareness.

- Custodial wallets (on exchanges): Easiest to manage, but expose assets to exchange risk. Should only be used for short-term liquidity or trading balances.

Read: Best Solana Wallets

Best practice: split holdings between hardware (long-term storage) and non-custodial hot wallets (active DeFi/NFT usage). Always enable 2FA, whitelisting, and trusted-device features where available.

Staking Setup

Staking SOL is both an income stream and a way to secure the network. Investors must choose between native staking and liquid staking protocols.

Native Staking Steps

- Set up a compatible wallet such as Phantom, Solflare, or Ledger.

- Select a validator from dashboards like Solana Beach or StakeView. Avoid validators with excessive commission (>10%) or poor uptime.

- Delegate SOL directly. Rewards accrue automatically each epoch (~2 days).

- Track staking performance using Solscan or validator tools.

- If unstaking, note the cooldown period of 2–3 days before tokens become liquid.

Liquid Staking Options

Protocols like Marinade and Jito allow you to stake while keeping a tradable derivative token (mSOL, JitoSOL). This provides flexibility for DeFi but introduces additional smart contract and liquidity risk.

Security Checklist

- Stake via trusted wallets or hardware devices.

- Diversify delegation across multiple validators to reduce slashing and centralization risks.

- Confirm validator commission rates and uptime history.

- Bookmark official validator dashboards and avoid links from unverified sources.

For liquid staking, verify audit history, TVL strength, and whether protocols maintain insurance or slashing coverage.

Price Prediction Tables (At-a-Glance)

Price Predictions Suggest Possible Upside In Solana Value. Image via Shutterstock

Price Predictions Suggest Possible Upside In Solana Value. Image via ShutterstockNumbers tell the story best, so here’s a snapshot of monthly and yearly forecasts to ground the narrative.

Table A (2025 Monthly Forecast: CoinCodex)

| Month 2025 | Min Price ($) | Base Price ($) | Max Price ($) | %Δ from Today* | Catalyst Notes |

|---|---|---|---|---|---|

| Sep 2025 | 242.37 | 245.84 | 248.58 | 0.00% | ETF chatter; stablecoin traction; high staking share; no major 2025 outages reported |

| Oct 2025 | 249.71 | 257.59 | 263.64 | +4.78% | Firedancer delegation ramp; dev/event season; memecoin/liquidity pulses |

| Nov 2025 | 260.57 | 264.49 | 266.28 | +7.59% | Breakpoint-style ecosystem announcements; ETF headlines; app launches |

| Dec 2025 | 264.24 | 265.13 | 266.00 | +7.85% | Year-end rotation; LST growth; seasonal volumes & promos |

Note: Base case assumes steady staking adoption + no major outages. Bear/bull skew tied to macro liquidity and ETH ETF spillover.

Table B (2026–2030 Yearly Scenarios)

| Year | Bear Case | Base Case | Bull Case | Drivers & Assumptions |

|---|---|---|---|---|

| 2026 | $254.49 | $261.14 | $267.99 | Post-ATH consolidation; Firedancer/MEV tooling gradually improve UX; staking stays high; ETF path/speculation provides floor; risk: macro chop/reg delays. |

| 2027 | $250.62 | $259.88 | $270.52 | Re-accumulation year: more client diversity, app breadth; potential ETF inflows; risk: liquidity rotation, risk-off, builder fatigue. |

| 2028 | $260.77 | $335.37 | $402.86 | Expansion leg: throughput upgrades broadly deployed, stablecoin/payment growth, LST/LST-fi usage, institutional flows scaling; risk: overheating/memecoin excess. |

| 2029 | $382.42 | $422.73 | $441.66 | Maturation: growth decelerates, fee market stable, ETF flows normalize; risk: competitive L1/L2 innovations compressing spreads. |

| 2030 | $436.22 | $439.27 | $442.45 | Late-cycle compression/mean reversion; terminal inflation ≈1.5% backdrop; performance and fees steady; risk: macro tightening or tech shocks. |

Example:

- Investing $10,000 at a $250 SOL price (40 SOL) would be worth ≈ $10,446 (+4.5%) in the 2026 base case, ≈ $10,720 (+7.2%) in the 2026 bull case, and ≈ $17,698 (+77%) in the 2030 bull scenario if prices reach those peaks.