The crypto markets have good news to celebrate, with the announcement on the 21st October that online payments giant PayPal is to begin supporting the use of several cryptocurrencies across its global network.

PayPal customers will be able to use their accounts to buy, sell and hold crypto and then use those funds to pay any of the current 26 million merchants across the network. The service is due to become widely available by early 2021.

PayPal users’ crypto will be converted into fiat in order to pay merchants, so there will be no need for sellers to sign up for, or approve the service. In its press release, PayPal stated that transactions involving crypto would have:

certainty of value and no incremental fees. PayPal merchants will have no additional integrations or fees, as all transactions will be settled with fiat currency at their current PayPal rates

The supported cryptocurrencies will be Bitcoin, Ethereum, Litecoin and Bitcoin Cash, with PayPal hinting that more may be added in the future. Users will be able to transact them through their PayPal digital wallets, which will also provide real-time market information, as well as educational content for those new to the crypto space.

The announcement helped to push the price of BTC past $13,000, with the market as a whole registering a strong uptick.

The Fine Print

PayPal has partnered with Paxos Standard to bring its crypto services to US customers, though it does not say whether other platforms will be enlisted to provide trading and custodial services in other parts of the world. Paxos is a well-established crypto custodian and already provides a similar service for challenger bank Revolut.

New Money Meets Old Money. Image via Shutterstock

New Money Meets Old Money. Image via Shutterstock It’s worth pointing out the custodial nature of the service here. PayPal will hold the keys (through Paxos) to the crypto on its platform and users will not be able to move crypto from their PayPal app to other wallets they may have. PayPal itself will manage the risk from any price fluctuations and ensure merchants receive the correct payments in their native currencies.

The rollout of the service will start in the US before being expanded to the rest of the world. PayPal subsidiaries such as Venmo (a payments service popular in the US) will also be included.

Doing it by the Book

PayPal has clearly been working on this step for some time and there are some interesting details and intriguing possible consequences contained within the company’s announcement.

PayPal’s reach and stature meant it was hardly likely to cut corners when it came to getting the necessary regulation in place ahead of its move into crypto. As a result, it has secured a unique agreement with the New York State Department of Financial Services (NYDFS) in the form of the first-ever conditional ‘Bitlicence’ to allow it to offer cryptocurrency services to its users.

Image via Paxos

Image via Paxos This conditional Bitlicence obliges PayPal to offer those educational services mentioned above and to provide clear information regarding the risks involved when trading with crypto. It also helps explain the partnership with Paxos, which is fully verified and regulated by the NYDFS.

To see PayPal working closely with the NYDFS in this regard suggests that regulatory authorities are determined to play a central role in crypto’s moves towards the mainstream. We can almost certainly expect to see and hear more about Bitlicences in the coming months and years.

PayPal: A Global Force

It’s no surprise to see the crypto markets reacting positively to the news. PayPal is one of the biggest names in the online payments sphere, with nearly 350 million users across the world and billions of dollars in annual revenue. It processed $222 billion in payments in the second quarter of 2020 alone.

For many of us, PayPal is a part of our online lives and has been helping us buy and sell over the internet for years. The company began life in 1998 under the name Confinity, before merging with online banking service X.com in 2000. By this point, two of tech’s biggest names were steering the company forward, in the form of Peter Thiel and none other than a certain Elon Musk.

One Giant Buys another. Image via Shutterstock

One Giant Buys another. Image via Shutterstock In 2001 the Confinity/X.com partnership had been rebranded to PayPal and the company went public in 2002. In the wake of its hugely successful IPO, it was acquired by eBay for $1.5 billion and quickly became the dominant payment provider on the platform.

Over subsequent years it acquired numerous other online payment ventures and became a standalone company after spinning off from eBay in 2015. It currently sits comfortably inside the S&P 100 and operates in numerous territories across the globe.

PayPal is not first to the crypto party, however. Both Revolut and Jack Dorsey’s Square already offer similar crypto services, but PayPal carries a heftier clout. To have a player like this enter the game is a huge step forward for crypto and a sign that mass adoption has come significantly closer.

What Does The Move Mean for Crypto?

The bounce in prices that PayPal’s announcement caused says it all. The crypto community is generally excited by the news and rightly so. While crypto is gaining traction and popularity all the time, it is still some way from becoming mainstream. There are people all over the world who remain unconvinced, unimpressed or simply unaware of its existence and potential.

This will have to change if crypto wants to continue on its upward trajectory and reach the heights its advocates believe it is capable of reaching. The holy grail of mass adoption is still a long way off.

Spurring Global Adoption.

Spurring Global Adoption. For many of these non-believers, the news that PayPal is backing crypto’s future success will be a resounding vote of confidence in the technology. PayPal is well-established, recognisable and trusted by millions.

The world has seen thousands of fintech companies spring up since the late 90s, with the sector still growing as fast as it ever has. Almost all of these promise to revolutionise the way we spend, earn, hold or view money and only a select few actually make good on those promises.

PayPal can legitimately claim to have made a lasting impact and it has shown that it is still evolving to meet the needs of the future. It’s an unshowy service, one that generally runs quietly in the background, but for many of us, it’s hard to imagine doing without. Its adoption of cryptocurrency is a significant step.

A Long Time Coming

Wednesday’s announcement marks a notable shift in the company’s attitude towards crypto. PayPal has not always regarded Bitcoin and its descendants so favourably. As recently as 2018, Dan Schulman himself was bearish about, saying in an interview that:

I think right now, and we're seeing this maybe more than ever, the volatility of the cryptocurrency makes it actually unsuitable to be a real currency that retailers can accept

In 2014 PayPal took steps to crack down on traders selling Bitcoin and Bitcoin-related products on its platform. The move was interpreted by many as a response to peer-to-peer transactions threatening PayPal’s fee structure and business model.

Dan Schulman, PayPal CEO. Image via Wikipedia

Dan Schulman, PayPal CEO. Image via Wikipedia Moves such as this can be coupled with Schulman’s 2018 comments to paint a picture of a company institutionally hostile to Bitcoin and cryptocurrencies in general. While it isn’t entirely surprising that a company like PayPal should be wary of crypto and its disruptive potential, the evidence suggests that this was not the whole story.

In 2013 PayPal acquired Braintree, a payment gateway based in Chicago which provides e-commerce companies with mobile and web payment systems. Given Braintree’s interest in Bitcoin and the moves it was making to integrate it with own its platform, PayPal’s $800 million acquisition was billed by Braintree’s CEO as “a move to embrace Bitcoin”.

This was followed in 2014 by the announcement of a partnership between PayPal and three of the biggest names in Bitcoin payment processing: BitPay, Coinbase and GoCoin. PayPal cited the fact that all three companies protected customers against the risks of trading with crypto as one of the main reasons for signing the deal. Scott Ellison, PayPal’s senior director of corporate strategy went on the record to state that:

PayPal has always embraced innovation, but always in ways that make payments safer and more reliable for our customers. Our approach to Bitcoin is no different. That’s why we’re proceeding gradually, supporting Bitcoin in some ways today and holding off on other ways until we see how things develop

For all its apparent misgivings, it was clear that PayPal was not prepared to sit back and write Bitcoin off. While Schulman remained unconvinced, other board members such as Wences Casares were more bullish about its potential and the company continued work behind the scenes on possible future adoption.

PayPal drops Libra for Bitcoin

PayPal drops Libra for Bitcoin

In 2019 PayPal appeared to be cooling once again on crypto, when it pulled out of Facebook’s Libra project, citing concerns over possible regulation of the stablecoin. It may also have been concerned about possible overlaps between the two platforms.

However, PayPal subsequently began recruiting more blockchain experts in early 2020, a sign that crypto was not yet off the table as far as the future was concerned. The rumours about a joint venture with Paxos began circulating shortly after.

All of which brings us up to Wednesday’s revelations. In many ways, PayPal’s protracted deliberations over cryptocurrencies are an encouraging set of signs. This is not a big tech player jumping on the crypto bandwagon in an effort to stay relevant.

The company has spent time and money on researching and evaluating the role cryptocurrencies are likely to play and concluded that now is the time to get involved. We can be reasonably confident that the right safeguards have been put in place and the right partners found to ensure that PayPal users reap the benefits of the platform’s venture into crypto.

Eyes on the Future

Anyone with more than a passing interest in crypto will have been hearing more and more about the concept of central bank digital currencies (CBDCs). If you’re not familiar with these, then you can get up to speed with them right here. They are, as their name suggests, digital versions of national fiat currencies that a number of central banks across the world are considering introducing in the near future.

Central Bank Digital Currencies. Image via Shutterstock

Central Bank Digital Currencies. Image via Shutterstock The concept of CBDCs has sprung up largely in response to the growth of crypto since 2008 and shows the extent to which the financial world has been forced to take notice of the change happening under its nose. Many in both the crypto space and traditional financial circles now believe that the widespread introduction of CBDCs is a question of when not if.

Intriguingly, there are hints that this view appears to be shared by those at PayPal. Contained within the announcement of its move into crypto is an acknowledgement that, in recent years, the company ‘has increased its focus and resources on exploring the next generation of digital financial services infrastructure and enhancements to digital commerce’.

The acquisitions of cryptocurrency and blockchain-focused firms such as TRM Labs and Cambridge Blockchain underline PayPal’s commitment to the growth of these sectors and suggest that it will be at the forefront of change. PayPal states that it ‘intends to work hand-in-hand with regulators, governments and central banks in this quest.

TRM and Cambridge Blockchain Could be Targets

TRM and Cambridge Blockchain Could be Targets To hear a company of PayPal’s size and influence align itself with the financial authorities while promoting its expansion into the world of cryptocurrency is to get a sense that the two spheres are moving closer together. The mention of central banks is particularly eye-catching, as it suggests that PayPal believes that they are going to reach further into the digital currency ecosystem.

Dan Schulman, PayPal’s CEO, certainly thinks so. “The shift to digital forms of currencies is inevitable,” he says, “bringing with it clear advantages in terms of financial inclusion and access; efficiency, speed and resilience of the payments system; and the ability for governments to disburse funds to citizens quickly.”

What People Are Saying

PayPal’s announcement has not been greeted with universal approval by the crypto community. Some have been quick to point out the custodial element of the service, which prevents users from withdrawing their coins to other wallets. The cry of ‘not your keys, not your crypto’ has been echoing round many crypto forums since Wednesday.

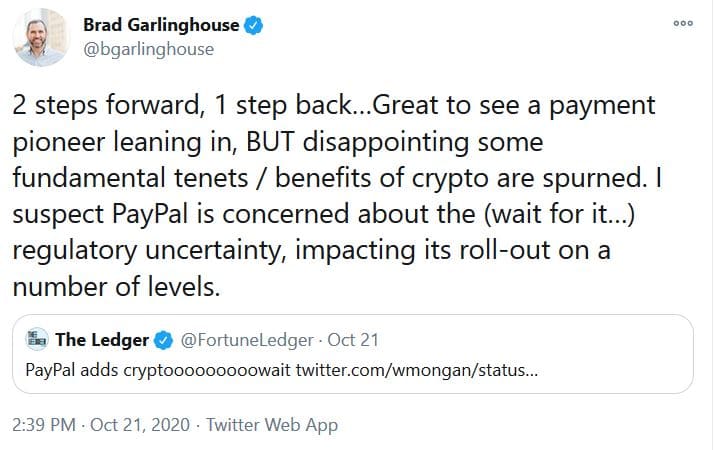

Ripple CEO Brad Garlinghouse is one such sceptic, who tempered his welcoming of the initiative by saying that it was “disappointing” to see “some fundamental tenets/benefits of crypto are spurned.” He also cited “regulatory uncertainty” as a potential hindrance to a full rollout.

Image via Twitter

Image via Twitter Others questioned the appeal of the service to those not already involved with crypto. Speaking to the BBC, author David Gerard said that, “I don't expect much of a market for this beyond existing crypto holders... I'm baffled that PayPal would offer this, and it's not clear what they're trying to do here.”

Yet there are many who have welcomed the announcement and hailed it as a big step forward for crypto. Mike Novogratz, the billionaire founder of Galaxy Digital was delighted, hailing the announcement as “the biggest news of the year in crypto,” and predicting banks would soon follow suit. ShapeShift’s Erik Voorhees was more laconic, tweeting “PayPal! Finally!” when he heard the news.

Image via Twitter

Image via Twitter As ever, consensus is hard to find, with opinions divided over whether PayPal’s decision is good, bad or indifferent for the future of crypto. For some, it doesn’t go far enough, while others see it as a great leap forward. The truth - as ever - is probably somewhere in between, though it’s hard to believe that PayPal’s decision will do anything other than give crypto a shot in the arm.

Conclusion: PayPalCoin?

This controversial venture into the crypto waters throws up one more question about PayPal’s future. Ever since its withdrawal from the Libra Association, there has been speculation that the company may be planning to launch its own token in the not-too-distant future.

Schulman’s belief in the inevitability of digital currencies becoming mainstream would suggest that the idea is at least under consideration at PayPal HQ. It would certainly mark a complete turnaround from PayPal’s position on cryptocurrencies just a few years ago and would make further waves in the crypto waters.

It is likely that PayPal will wait to see how successful its current crypto venture is before committing itself to such an undertaking. But the signs are all around us: crypto is winning over its doubters, including some of the biggest and most powerful companies and individuals out there.

CBDCs are looking more likely by the day, while new crypto projects and services are springing up like California wildfires. The future is being written before our eyes.