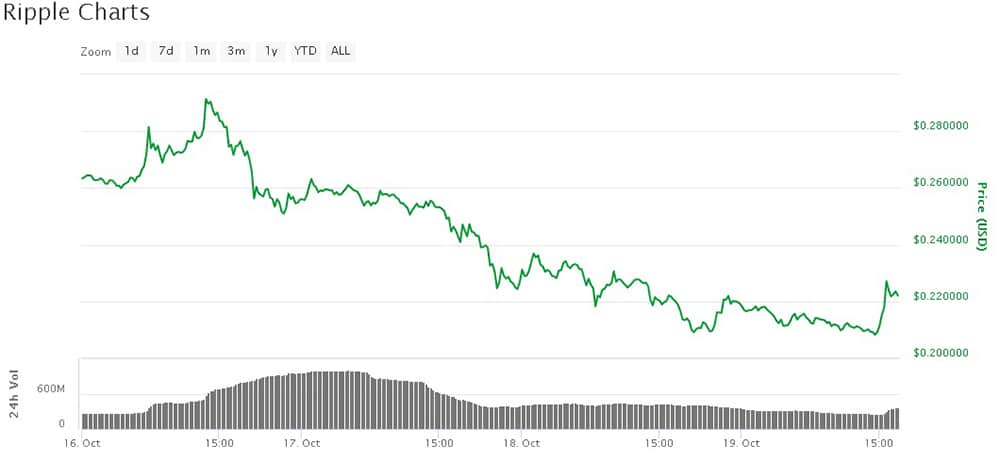

Wednesday was a tough day for the cryptocurrency markets with all the leading players seeing steep falls and prompting talk of a correction in some circles. Ripple took the largest hit of all, falling 12.56% and has yet to recover significantly. You can view the wild ride in the price with the below graph from coinmarketcap.

This is course begs the question: in a crowded market with plenty of other cryptocurrencies to choose from, is Ripple a good investment?

The Case for Ripple

For a start, it’s important to emphasise that Ripple is different to other cryptocurrencies. Whilst still decentralised, Ripple (XRP) is a transaction network with a digital currency (called ripples or XRP) contained within it, as opposed to a digital currency per se. It also works faster and more efficiently than Bitcoin and can track more varied information.

There are of course a great deal of similarities between Ripple and the likes of Bitcoin, Ethereum and others – they all function as anonymous, peer-to-peer platforms enabling individuals to bypass banks and other authorities. Ripple however is more adaptable across the spectrum than its rivals. For individuals it acts as a highly secure and effective platform for all types of monetary exchanges.

Whilst the rest of the cryptocurrency community is very much united in wanting to do business beyond the reach of banks, Ripple is instead working with traditional financial institutions, which are signing up in increasing numbers. This largely stems from the acceptance of the fact that the global financial system is going to evolve with cryptocurrencies rather than be changed by them overnight.

Ripple’s use of an Interledger Protocol gives it the ability to move any type of currency between individuals anywhere in the world. Banks have woken up to the fact that this can save them money on every transaction made, hence their growing eagerness to work with Ripple.

Large Endorsements

Then there’s the endorsement by the Bill and Melinda Gates Foundation which has using Ripple’s technology to develop its mobile payments platform. This is aimed at opening up financial services to some of the world’s poorest people and will push Ripple to the forefront in many countries left behind by the current system.

This push into untapped and emerging markets, enabling many millions of people to access financial services such as bank accounts for the first time, will give Ripple an exposure far beyond the current main markets. As Ethereum founder Vitalik Buterin says, ‘it’s not about the places where people are really rich.’ With this sort of exposure, Ripple could well be set to become a major global player.

Gates is not the only big name in tech awake to Ripple’s potential. Google has been a backer since the platform’s early days in 2012 and Ripple’s development team include many who worked on Bitcoin, as well as OpenCoin bigwigs Chris Larsen and Jed McCaleb. There’s undoubtedly a great deal of pedigree and know-how behind the scenes.

Ripple’s price and trading volume is still tiny compared to the big players in the crypto field and this offers potentially large investment returns for those who may have missed the boat with Bitcoin. Combined with the brains behind it, the increasing popularity it enjoys amongst the broader financial community and its strong potential for mass adoption, Ripple represents a highly promising investment opportunity.