In recent months, the Island of Puerto Rico has become a focal point for the Crypto community.

Investors, Businesses and wealthy speculators are all flocking to the Island that presents itself as a tax haven for which they can build a Crypto Utopia, or “Puertopia”.

This relationship is not one-sided, as Puerto Rico has already created an advisory council to facilitate the development of new Blockchain businesses on the Island.

Why Puerto Rico? Well, the island offers a variety of perks that the crypto community can take advantage of.

The Tax Code

First, Puerto Rico has positioned itself as a beneficial location for new businesses; a tax-friendly extension of the US.

As a U.S commonwealth, Puerto Rico is considered part of the US, but is still somewhat independent. Their tax system, therefore, combine elements of the US tax code with their own.

In 2012, a legislative Act (Act 22 or the Individual investors' act) was passed that basically provides tax exemptions to eligible individuals residing in Puerto Rico. In order to receive these benefits, an individual needs to become a resident of Puerto Rico and apply for a tax exemption decree.

Image via Fotolia

Image via FotoliaBenefits include an income tax of only 4%, as well as zero tax on dividends and capital gains.

This may all sound perfect, but the caveat is that becoming a resident of Puerto Rico means you actually have to move there.

Many who choose to move to Puerto Rico make a full commitment by selling their home, moving their family, and cancelling memberships at local clubs or gyms, all to send a clear message to the IRS that although they still hold their US passports, they are now residents of Puerto Rico, and beneficiaries of their tax laws.

Furthermore, applicants must not have been a resident of Puerto Rico within the last 15 years, must reside there for 183 days of the year, and must complete the application process by December 2035.

Puerto Rico created these new tax advantages in order to drive companies to set up on the Island, but it’s not the first time they’ve attempted to draw new business by offering tax leniency.

An Economy on The Decline

Tax laws have always played a significant role in Puerto Rico’s economic prosperity.

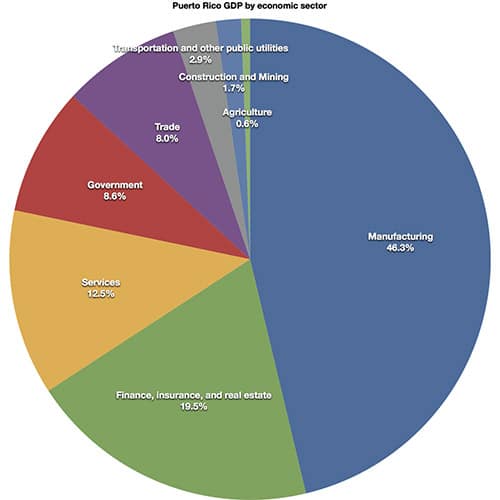

In the 1940’s and 50’s, Agriculture was the Islands main economic sector, with much of their Sugarcane being exported to the US. This sector employed 43% of Puerto Rico’s workers.

In the 1960’s and 70’s, Puerto Rico’s largest economic sector became manufacturing. ‘Operation Bootstrap’ opened the country to accepting outside investment, while growing the local labor force. Subsequently, Section 936 of the US tax code gave tax credits to US companies doing business in Puerto Rico. These tax credits were responsible for hiring over 100,000 people and helped sustain the Islands economy for many decades.

However, in 1993, President Clinton developed a plan to slowly cut Section 936 and replace it with Section 30A by 2006. Section 30A was a more moderate form of tax relief that allowed companies to claim 60% of wages and capital investment as non-taxable income.

By replacing the profit based tax system with a wage and investments one, many companies operating in Puerto Rico lost out on the benefits initially promised to them, and decided to close shop, resulting in the loss of half of all manufacturing jobs by 2014.

Puerto Rico’s current unemployment rate is 11%, which is more than twice that of the US, who the Island’s economy relies on more than ever today. Tourism remains the countries most stable contributor to its GDP, but has also been negatively affected by the recent hurricanes.

Hurrican Irma and Maria

In September 2017, Hurricane Irma and Maria destroyed large portions of the Islands infrastructure, cutting power for 1.5 million people, and causing as much as $100 billions in damages.

The underwhelming relief efforts put forth by the US only fueled the need to attract more businesses to invest and help the Island develop some semblance of independence.

As fate would have it, just around this devastating time, the price of cryptocurrencies began to soar, creating a window of opportunity for newly wealthy individuals to flock to the island and begin the rebuilding according to their vision.

New Arrivals

A handful of high profile crypto entrepreneurs made the first migration, purchasing property, rebuilding some damaged real estate, and even negotiating with the Puerto Rican Government to open up a crypto-currency bank.

A few of these people include:

- Brock Pierce, former child actor, now Chairman of Bitcoin foundation and advisor for Block.one.

- Halsey Minor, founder of Blockchain company Videocoin, who calls the opportunity to reside in Puerto Rico as a ‘godsend’ because of the perfect timing of the Storm

- Matt Clemenson, Co-Founder of lottery.com, which uses Blockchain in lotteries

- Bryan Larkin – CTO of Blockchain Industries, a publicly traded company now based in Puerto Rico

What tied these people together was their ability to see the potential of the Blockchain and Crypto-Currencies before the most of the tech community. Naturally, such people tend to be libertarian idealists who fantasize about living in societies of self-governance and the purest form of individual freedom.

Even though their wealth was created while living in the US, certain actions have led the crypto community to believe that the US is not an ideal location for pioneers of a decentralized revolution to flourish in.

Challenges

Despite the apparent advantages, crypto Hodlers settling in Puerto Rico will be faced with a number of challenges.

Ease of Doing Business

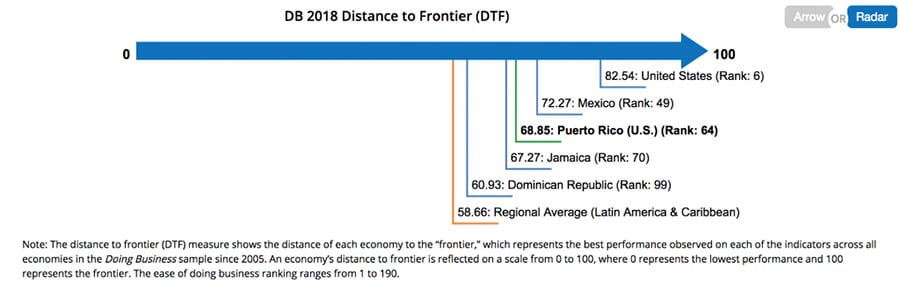

According to the World Bank Group, Puerto Rico is ranked number 64 out of 190 economies for ease of doing business.

Image Source.

Image Source.For Distance to the Frontier (which represents the best performance observed on each of the indicators across all economies in the Doing Business sample since 2005) Puerto Rico has a score of 68.85, putting it 10 points above the regional average (Latin America & Caribbean)

Lack of Infrastructure

The recent hurricane not only had a major impact on its electricity but also its Internet connectivity. According to Oracles Internet Intelligence blog, DNS query volumes (which accurately measure internet use) from the Island are still only a fraction of what they were on September 19th, 2017.

Blockchain businesses will need to invest heavily in repairing this area to avoid being at a huge disadvantage on the global stage.

Acceptance by Locals

Locals have been torn on what to expect from the new arrivals, some seeing it as a potential boost to the economy that will create new jobs, and others seeing it as just another form of exploitation by the rich, whose mining operations may be placing strains on Puerto Rico’s limited power supply.

Ultimately it comes down to expectations versus reality. The reality of this situation is that the Crypto community isn’t choosing Puerto Rico because it wants to make a humanitarian effort to save the Islands people. Nor is it looking to create a situation that will intentionally leave them worse off.

Crypto Hodlers are primarily there for the tax incentives, and it should be up to Puerto Rico’s Government officials to leverage the needs of these tech entrepreneurs in a way that benefits its people.

This situation (like many others where wealthy investors seek to ‘rebuild’ impoverished areas) is a negotiation process between 2 parties with opposing agendas, but far too often it gets misrepresented as a collaborative humanitarian effort.

An unfortunate reality is that in a disaster situation, local governments will often negotiate poorly with incoming businesses in order to receive the majority of the benefits these businesses bring in for themselves, while leaving their people with empty promises.

Image Source

Image SourceFor example, the promise of job growth in a highly specialized Blockchain industry simply doesn’t make sense for the majority of Puerto Ricans who work in manufacturing. At best, the crypto community can offer a boost to workers in the service industry, but only a rare few locals will actually be able to contribute anything of value as far as ‘technical capital’ to Blockchain businesses on the Island.

If the Government really wants to create a plan that would go a long way towards adding value at the local level, they should subsidize the cost of local residents learning how to code and becoming expert Blockchain developers over the next 10 years, then export those skills to incoming and local Blockchain companies.

Such a plan would take time, but would at least show that the Islands leaders are thinking long term about ways to uplift its people economically, reduce dependency on US aid, and support Blockchain businesses seeking access to cheaper coders.

Killing 2 Birds With One Stone

The greatest thing about Blockchain technology is its potential to uplift impoverished communities by creating token-based ecosystems that align peoples’ incentives towards performing any sort of task required to earn those tokens.

Following this thought, the biggest asset Crypto entrepreneurs can bring to Puerto Rico is their knowledge of how to build a Blockchain platform that would use tokens to pay local residents (as well as individuals or entities residing outside of the Commonwealth) to repair the land and rebuild its infrastructure.

They could call it the ‘Tokenized disaster relief program”.

The current Crypto pioneers could work with the local Puerto Rican government to develop and launch the application, get the ‘TDRP’ tokens listen on public exchanges and empower millions of people to rebuild the Island. All while avoiding the heavy tax burden imposed by the US mainland.

This solution could be especially useful for the previously cited 11% of Puerto Rico’s unemployed residents. Furthermore, TDRP tokens could have their value tied to the Islands GDP, creating an even greater long-term incentive to buy them, or earn them by contributing to the Islands disaster relief and infrastructure rebuilding efforts.

There's no reason why a technology that is poised to disrupt all industries and become the next Internet shouldn’t also be utilized to tackle the age-old problems of disaster relief and infrastructure redevelopment.

Moreover, there probably isn't a more fitting way to introduce the local population to how a Crypto Utopia should actually function.

Conclusion

Image via Fotolia

Image via FotoliaThe answer to whether Puerto Rico is the ideal home for the Crypto Hodler depends on what each individual wants to achieve.

If lowering your tax bill is the primary goal, then strictly following the rules in Act 22 of the tax code (which means relocating to Puerto Rico and residing on the Island for 183 days of the year) will make you successful.

But if your goal is to establish a Crypto Utopia, think first about what part the local population has to play in this Utopia.

Are they invited along to participate and experience the benefits of a tokenized economic model that creates monetary incentives to rebuild their Island? Or is Puerto Rico nothing more than a vessel for the new class of Blockchain elite to form gated communities under the guise of free-thinking libertarian ideals?

If the latter is true, then I suggest embracing the Hodler mindset, as you will be faced with a number of challenges, from poor infrastructure resulting in substandard internet connectivity, to resistance from some local residents who will scream ‘down with crypto colonialism!’

All of these problems will be yours to fix alone, as long as the local population remains ignorant of and excluded from the benefits of Blockchain technology can have on their lives.

It remains to be seen how the influx of the crypto rich will support those at the bottom of Puerto Rico’s society, and whether the early birds of this revolutionary technology can gather the foresight to apply it to the disaster relief and infrastructure problems the Island currently faces.

One thing is for sure; there isn’t much that’s going to keep a current or aspiring crypto millionaire away from taking a weekend trip over to the sunny tax haven that is Puerto Rico.