So-called “pump-and-dump” schemes are understandably illegal in traditional markets, but in the still majorly unregulated crypto space, they occur seemingly on a daily basis now.

The thing about these nefarious moneymaking ploys is that a few get rich while the many, i.e. the investors not in on the ploy, typically lose everything.

That’s why today we’ll be walking you through the basics of this illicit phenomenon so you can better protect your portfolio from getting burned.

Pump-and-dumping crypto: what and why

First off, if you’re a stranger to the idiom, your memory of the phrase “pump and dump” may be jogged by the infamous Wall Street penny stock scams that cropped up in the early 1990s.

The scams involved brokers “in the know” intensively hyping up garbage microstocks they held stakes in as a means of artificially boosting these stocks’ worth before dumping them for major profits.

Then, as prices sagged from these profit dumps, all other investors watched their investments dissipate into the red. These other innocent investors would lose most, if not everything they’d put in, hence why performing a pump-and-dump scheme is brazenly illegal in traditional markets today.

Alas, the dynamic works the same for crypto: a group of large investors coordinates “shilling” campaigns for what the crypto community’s wiser minds have come to call scamcoins—coins that are all talk and no walk, lacking real devs, whitepapers, and so forth.

If you’ve been on the crypto scene for a while, you’ve surely seen no-name coins skyrocket several hundred percent in one day and for no apparent reason whatsoever: these are clearly pump-and-dumps coordinated for quick profits.

Even some less-than-promising ICOs, too, have been decried as inherent pump-and-dump schemes.

Jordan Belfort, the infamous “Wolf of Wall Street” who pioneered the penny stock scams of the 1990s, is of this line of thinking. He declared as much in past comments to the press:

[ICO] promoters are perpetuating a massive scam of the highest order on everyone. Probably 85 per cent of people out there don’t have bad intentions, but the problem is, if five or 10 per cent are trying to scam you, it’s a f***ing disaster.

What’s it look like?

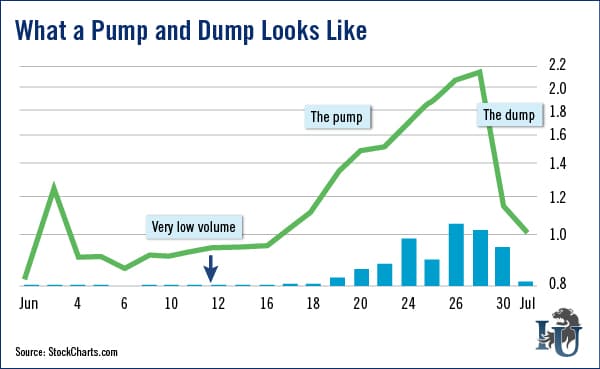

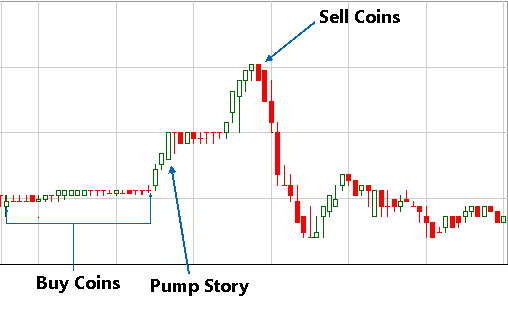

The tell-tale sign of a crypto pump and dump comes from looking at the charts: do you see a coin with a low price in an illiquid market that suddenly bursts in both price and volume?

That’s a pump-and-dump scheme at work by the looks of it.

Check out the insightful pic below to see what we’re talking about:

Notice the incredibly low volume that then begins to pump upwards, taking the price with it. Afterwards, the price crashes as the dump occurs.

If you see the beginning of this general formation, chances are something foul’s afoot.

Another thing that you might’ve seen or heard about and that you can look out for is “pumper” groups coordinating on Telegram and Signal chat groups. Many of these groups have been outed as coordinating with one another, amplifying their power in numbers. These types of coordination became even more popular after the Wall Street Bets movement that impacted GameStop stock in 2021, which highlighted just how powerful a “strength in numbers” coordinated market push can be.

There are also the phenomenon of automated pump-and-dump scams. To give you an example, there are crypto trading robots which are scams like the Bitcoin Code, which, as reported by Coincierge.de, was being advertised across diverse social Media in Germany.

Who’s pumping?

Aside from the public pump-and-dump groups that can be found on sites like Reddit and Telegram, no one definitively knows who is pumping and dumping these coins, but reasonable speculation points us in the direction of large investors and miners.

These are well-coordinated cons that necessitate anywhere from $15,000 to $100,000 in liquid capital to pull off properly (for the smaller coins at least), meaning miners and large investors are the likeliest culprits.

How to Avoid Pump and Dump Schemes

From the pictures above, it’s clear you definitely don’t want to get caught on the tail-end of a pump-and-dump scheme.

If you’re thinking about investing into a coin that’s really getting hyped on the forums right now, but you’re not so sure, go to the charts and check for yourself.

Are there abnormalities with the volume?

Was the coin’s market super illiquid just days ago but is now exploding?

If you see this sign, your best bet is to stay away—the dump could start any time, burning your investment in the process.

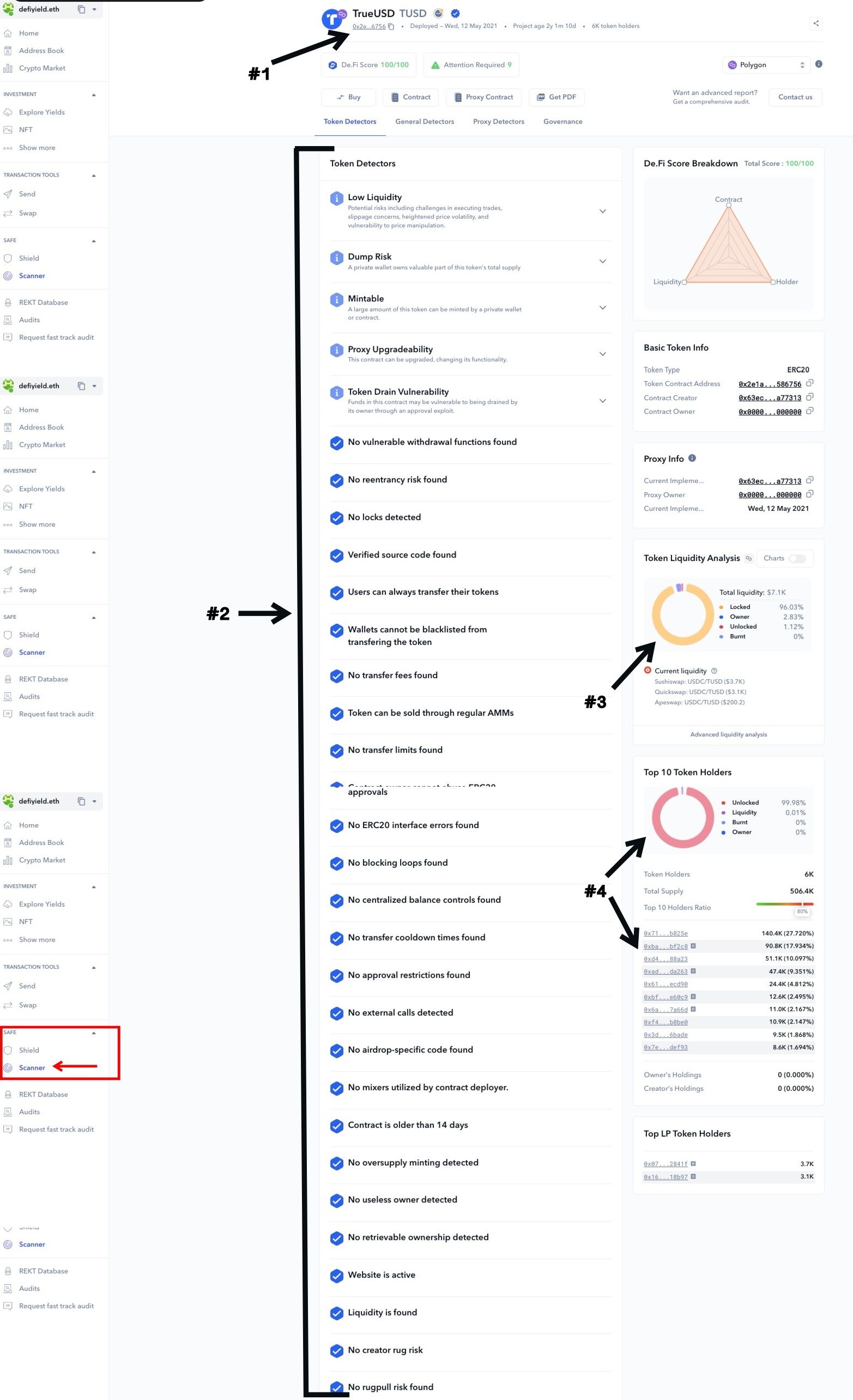

There are some helpful tools that can help prevent falling for pump-and-dumps scams, such as De.Fi, a free online platform that lets users gather in-depth valuable insights into tokens, DeFi platforms, and smart contracts.

De.Fi can help keep users safe in crypto with a contract address scanner where users can enter a token contract or smart contract, a risk shield, and a blockchain audit database, but to avoid pump-and-dump schemes, the first port of call should be the scanner where you can enter the specific token contract you are looking at scooping up.

Here is how that looks when I entered the token contract address for TrueUSD (TUSD) into the scanner:

A Look at the Token Scanner at De.Fi

A Look at the Token Scanner at De.FiWithin seconds, the De.Fi platform generates in-depth insight into the TUSD token. I added the numbered arrows to show information that is useful when trying to determine if a token could be at risk of a pump-and-dump.

#1- The token contract address. If you are looking to buy a token based on a token address, be sure to check it against the database to make sure it is a valid and official token and not some scam token someone made to appear like the real thing.

#2-De.Fi provides some comprehensive analytics about the token. If there are any red flags, they will be marked with a red exclamation point as opposed to the blue checks shown above.

#3- Token Liquidity Analysis. Remember earlier when we mentioned that low liquidity could be a warning sign, as this makes it easy for a token's price to be pumped? This section gives you valuable insight into a token's liquidity along with information regarding what percentage of the tokens are locked, held by the owners, unlocked and burnt.

#4- Top 10 token holders. This is often overlooked by beginners but can often reveal one of the biggest red flags. If a large percentage of the tokens are held by one or two addresses, this centralization of tokens held can lead to serious sell pressure if the majority token holders decide to sell everything at once and dump their tokens on the market. Concentrated token holdings can be a sign of an impending pump and dump or rug-pull.

And there you have it folks, some quick and easily actionable steps you can take to help defend yourself against being someone else's exit liquidity. Until next time, happy hodling.