One of the key trends often mentioned by analysts and observers, including us at the Coin Bureau team through our Crypto Trends 2024 video, is the tokenization of real-world assets.

It could easily become the buzzword of 2024 and many see it as the next logical move in the digital evolution. With all the talk floating around, it's time we get to the nuts and bolts of what it is, why it matters, the benefits and risks it carries, and some crystal ball gazing into a future with it at the forefront.

We will also discuss several blockchain projects that are working on real-world asset tokenization. Who knows, maybe one of them might become the next household name that would help onboard the next cohort of crypto enthusiasts.

What are Real-World Assets (RWAs) in Blockchain?

How do assets in the real world appear on the blockchain? These two concepts appear to be contradictory but that is not the case.

Real-world assets can be represented on the blockchain by tokenization. I'm not proposing building a replica of your house in a metaverse like Decentraland or The Sandbox. Rather, it's the paperwork and legality that comes with owning property that is being digitized and information placed on the blockchain. At the most basic level, it means that physical properties will be represented by a digital token. This makes the transfer of ownership easy, and you can trace the provenance of an asset online with relative ease, given the right permissions.

In short, tokenization has to do with everything related to the ownership of a real-world asset. With records kept on the blockchain, it can prove the transfer of assets between two parties.

Does that mean everything I own can be tokenized? Technically, yes. But, it makes more sense to tokenize items that have value in the secondary market. A photo album of my childhood pics probably won't be very valuable to anyone else other than me (unless hackers want to use them to create new identities, but that's a topic for another day). However, my collection of rare stamps or old coins and notes might be of value to those who collect them. There are two types of real-world assets for your consideration, some of which are no-brainers:

Physical Assets

- Real Estate - owning any kind of property anywhere these days is a measurement of having achieved a certain level of wealth, even if the property in question is a rundown one in a very rural area. It's still worth something.

- Artworks including paintings, sculptures, pottery etc. Basically, anything easy to establish ownership and subsequent transference. Living art performances probably don't fall into this category. It'll be a series of NFTs at best.

- Commodities - gold, silver, oil or wheat, soybeans, coffee beans, olives etc, you get the picture. I'd also include any jewellery or heirlooms you got from your grandparents in this category. PAXG would be a good example of a tokenized commodity.

Non-physical assets

- Treasury bonds - especially the US ones because of the dollar being the world's reserve currency (though it may have some “friends” joining it in the not-so-far future), but really, any country's bonds.

- Debt - can be an individual's debt but more likely institutional debt from companies.

- Shares/Stocks

- Investment opportunities - this is what can be owned with tokenization, as we will see later in the article.

The Tokenization of Assets

ERC3643

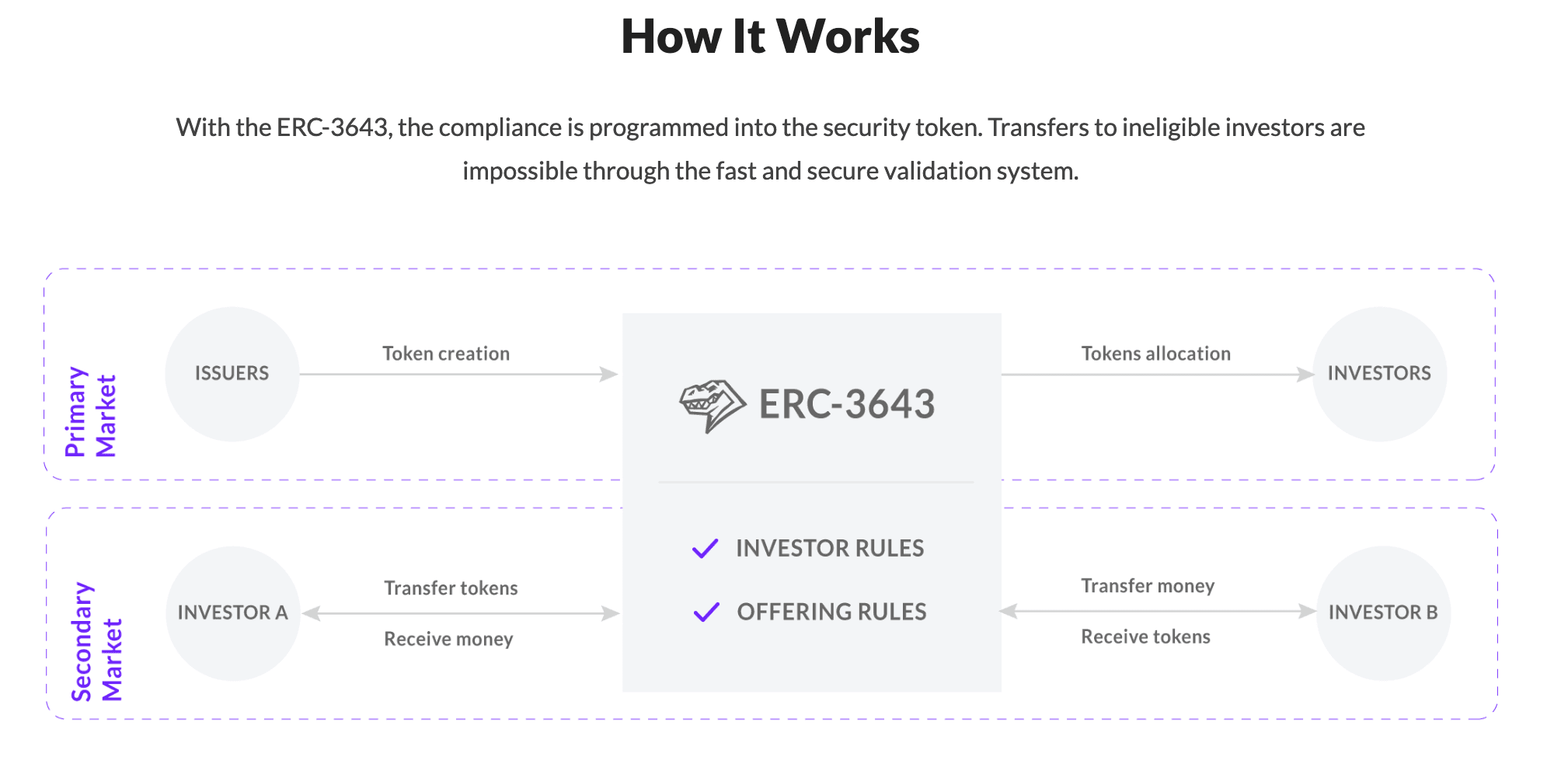

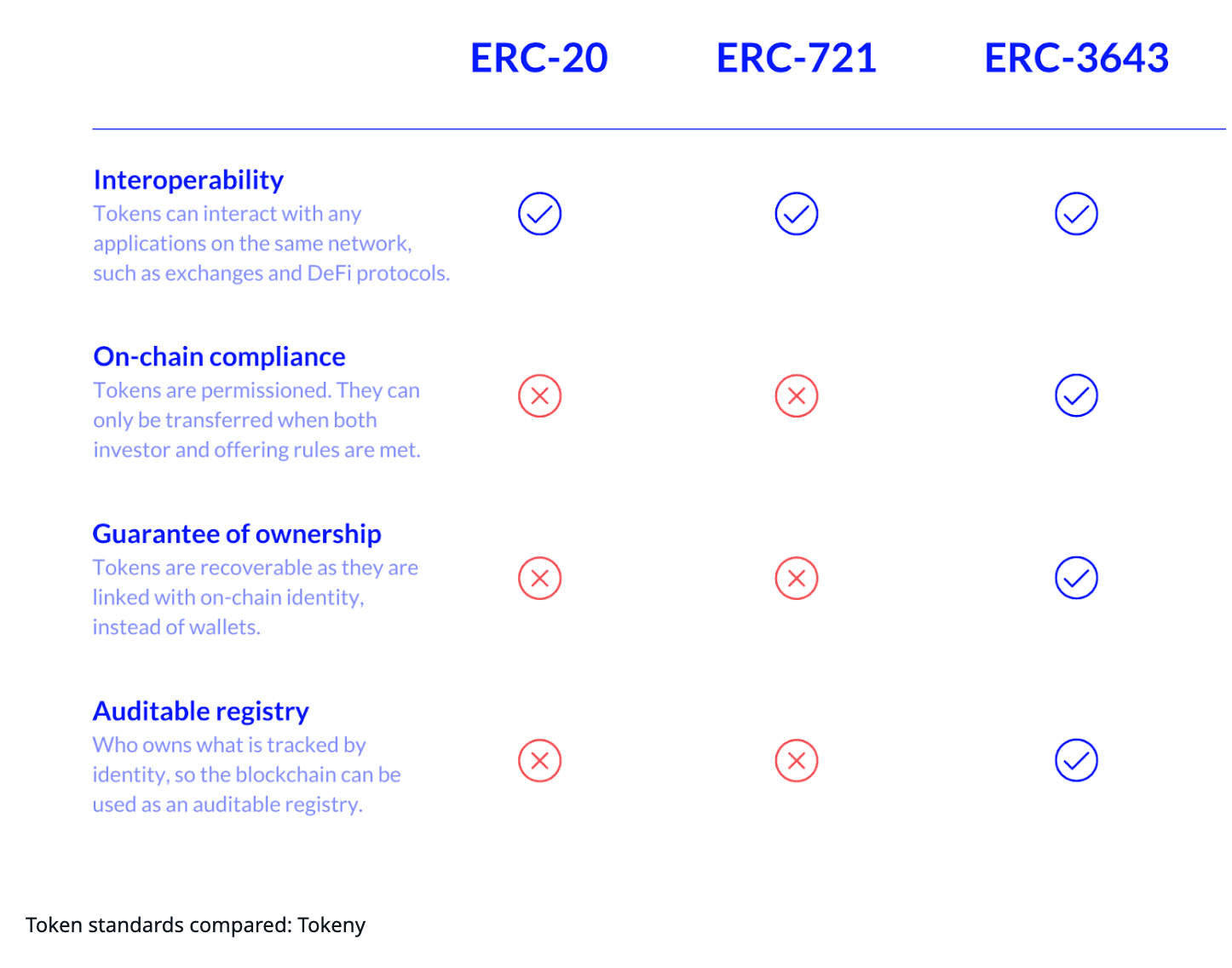

Just like ERC20 and NFTs with ERC721, RWA tokens also have their standards, known as ERC3643. Unlike previous token standards which are permissionless, this is a permissioned token where eligibility as a token holder is determined through pre-defined conditions baked into the smart contract. There is an additional component known as ONCHAINID, a decentralized identity framework, like an on-chain version of KYC, that verifies the token holder's identity. This set of standards allows for the issuance, management, and transfer of the RWA tokens from one party to another.

Token issuers can also track ownership as it passes from one token holder to another. Imagine the time, working hours, fees and paperwork (not to mention the trees) saved by insurance companies when all the information they need can simply be pulled up from a database. Lengthy waits for claims processing could very well be a thing of the past.

This makes sense because you might not care who has a monkey picture but the law cares if a house is being used as a meth lab as liability might fall on the homeowner, not to mention the repairs that go with the place being trashed as a consequence. We need some safeguards in place for an orderly transition that allows real-world assets to move to the on-chain digital infrastructure. Tokenization standards also help to promote its usability. Just look at what ERC721 did for NFTs and ERC20 did for DeFi.

Previously known as the T-Rex Protocol, the proposal was first unveiled on July 9th 2021 by Joachim Lebrun, Tony Malghem, Kevin Thizy, Luc Falempin, and Adam Boudjemaa. Since we mentioned that RWA tokens are security tokens, a different set of rules govern their usage, including being compliant with regulations.

This token standard uses the ERC20 as the base but with 10x more functions built-in to cater to the various regulatory needs.

How ERC3643 works. Image via Tokeny

How ERC3643 works. Image via TokenyHere is a brief comparison of ERC3643 with the other token standards for your reference:

How ERC3643 stacks up with the other token standards. Image via Tokeny

How ERC3643 stacks up with the other token standards. Image via TokenyIf you are interested in finding out more about this token standard, feel free to check out the whitepaper. The original proposal is also available as public reading material for those who want to geek out on the code.

When it comes to tokenizing a real-world asset, the general outline is as follows:

- Select the asset you want to tokenize. It would be a good idea to tokenize something that has a certain level of demand in the secondary market.

- Choose a DApp that can offer you tokenization services. Take note of which blockchain it's on because this will affect the transaction fees.

- The DApp/tokenization provider works with an Oracle provider to check and maintain the value of the asset over time with real-world data provided by the Oracle.

- Once all the boxes have been checked, the token can now be issued.

Benefits of RWA Tokenization

An important thing that tokenization brings to the ownership of real-world assets is partial or fractional ownership. This kind of ownership is already beginning to gain acceptance in the art world with NFTs of artworks sold to art enthusiasts who want to own a piece of Banksy or Andy Warhol. Fractional ownership of shares is common these days so it is a matter of time before fractional ownership of property is going to be on the table.

Another benefit of tokenization of real-world assets is allowing retail investors access to investment instruments traditionally reserved for institutions and the ultra-rich. The gap between the haves and have-nots has never been wider. Part of that is because capital attracts capital. The more deployable dry powder you have, the more ways you can use it to get even more. For regular folk, ways to gain capital are limited. Tokenization allows for the ability to have some piecemeal action that, with enough accumulation, can attract decent-sized capital in the long run.

Small businesses also stand to benefit from tokenization. Small business owners looking to expand have limited resources in their immediate vicinity that they can draw upon. Tokenization can be a valuable way to raise capital to fund their businesses. Investors can be from anywhere around the world. On-chain credit profiles can be developed, similar to the credit history required by banks in securing loans. In this case, though, the credit history is available to anyone with permission to view the data, so the business owners don't need to establish credit histories with multiple parties.

Conversely, investors can have the option of investing in other businesses in another country if they so wish. Currently, the only way for investors to invest in another country is through government bonds issued by that country or buying ETFs of particular sectors that are chosen by asset managers. If let's say, you visited a great neighbourhood as a tourist or had the good fortune to spend some time in a community in a foreign country, and you want to continue investing in that community, tokenization of the community's businesses allows you to invest in them. This is useful in regions where corruption is rampant and a lot of the official investments from overseas do not necessarily make it back to the community but rather, into some government officer's pockets.

Issuers of tokenized RWAs can set conditions on the saleability of the asset, perhaps even including what types of investors are preferable depending on the nature of the asset in question. Programmability, while not desired in CBDCs by users (only by issuers), could be a welcome feature for tokenized RWAs.

Other advantages also include:

- Transparency - anyone with permission can see all data related to the tokenized asset, thus improving trust and accountability for all parties involved.

- Efficiency - not only will the tokens be traded 24/7, greatly reducing settlement times, middlemen are practically eliminated, which improves the speed of the transactions.

- Ease of transference of ownership - provenance can be easily established (similar to NFTs)

Drawbacks of Asset Tokenization

Asset tokenisation is, simply put, another way for people to invest and make money. When it comes to contributing to the productivity of an economy, its effects are indirect and perhaps minimal in some cases. Here are some risks to consider before jumping in:

Fractional ownership

Fractional ownership works only in terms of investment. If you own 1/16th of a piece of artwork, like a painting or a sculpture, you might not get to hang the actual artwork in your living room, but you can still get a copy done and say you own 1/16th of the original. Who gets the original artwork in their living room for how long? Or does no one get it because it stays in a security vault? If that is the case, who pays for the security? Is the insurance price also included in the price of the artwork?

When it comes to housing, it's even trickier. You can collect rent even if you own 1/16th of a London penthouse and be OK with getting 1/16th of the rent. This is purely an investment property because there's no way any of the owners can stay in it unless the owners decide to divide up the time they can spend in the property. Conversely, if no tenant can be found, everyone contributes to the mortgage price proportional to how much they paid for the property, if there is an outstanding mortgage on it. Things can get complicated if one of the owners wants to live in it. Will they be staying as an owner or as a tenant? These are the terms and conditions that will need to be defined at the time of token creation.

Degens can literally gamble their property away by using the tokenized version as collateral. Previously, they could only borrow money from the bank/money lender/loan sharks, while the lenders would hold onto the deed or any kind of legal paperwork. This process can take quite a while but with tokenization, the processing for all this will be sped up.

Regulatory issues and legal risks

The rules for governing tangible assets are well-defined as they have been around for a long time and long improved. However, not all these rules can be applied wholesale to tokenized RWAs. Investors will need to tread very carefully in order to stay within the law. These laws themselves are subject to scrutiny and changes to adapt to the new reality of what a holder of a tokenized RWA truly means.

Operational and market valuation risks

Mismanagement and other delays associated with the RWA may adversely affect the tokenised version in a direct manner. There's also the handling of the tokens themselves that could be cause for concern. When it comes to market valuation risks, even the methodology used to value the asset may be called into question as to how proper it can be. Other factors such as liquidity conditions and price fluctuations should also be considered.

Oracle risks

Oracles play a key role as they are the bridge between the real-world and the blockchain. If there is an auction happening for a property, oracles would have access to the latest sold price and post this on the blockchain so that properties of similar characteristics can be defined by the new “market price”. Protocols such as Chainlink have already stepped up to provide the required services and even built a protocol that works cross-chain, anticipating the need for such transactions in the not-so-far future. However, they can also be vulnerable to external attacks.

One way for oracles to safeguard themselves is by operating in a Trusted Execution Environment (TEE), a type of hardware system that lets programs execute in total isolation from other parts of the network. This makes it difficult for unknown parties to tamper with the programming since the hardware system itself is isolated.

Security risks

Risks of this nature affect both the tangible asset and the tokenized version. Any form of calamity, be it a market crash or extreme weather may seriously jeopardize the asset itself. Meanwhile, its digital counterpart may encounter smart contract bugs, and hacks to the platforms storing or issuing the tokens.

Last but not least, liquidity risk determines how quickly/easily investors can convert their investments into cash based on the level of demand for the underlying asset. There are also KYC and AML risks as these processes are still done by humans so biases may still exist.

How are RWAs Used in DeFi?

There has never been an easier time to lend and borrow money than now. Since DeFi burst onto the scene, investors suddenly found a new way to put their money to work. In its heyday, DeFi products were generating insane yields, giving rise to “yield farming." If you know anyone who quit their day job to yield-farm, you know what I'm talking about. (wink wink). To be fair, the conditions for that to happen were also circumstantial. The key reason was the zero interest rates that banks in the world were offering (or not).

Since then, with rising interest rates aimed at curbing inflation worldwide, other less risky ways to make a decent buck and the YOLO ways that DeFi offered became something that warranted a second (or a third) look. DeFi itself also went through a growth spurt and gradually steadied itself while looking for its footing in the new environment it finds itself in. What can be done in DeFi has pretty much been milked dry at this point, so DeFi is looking for fresh inspiration. Enter the RWA.

A key use of RWA is as collateral for DeFi lending and borrowing. Previously, most DeFi platforms utilized over-collateralization to safeguard lenders' capital. However, that limited DeFi users to crypto-only participants because only on-chain assets were accepted. With RWA tokenisation, not only does the act of tokenization bring on more crypto participants, it vastly opens up the types of collateral available. This is great news for both lenders and borrowers. Borrowers have access to a wider range of liquidity sources and lenders get more choices in where they want to put their money.

RWAs can also act as a gateway for TradFi folk to get into DeFi and for DeFi investors to get a piece of the TradFi action. TradFi has more capital in its corner than DeFi. For even a smidgen of that capital to make its way to DeFi would be champagne-popping days for everyone.

The settlement time of illiquid assets has long been a pain for many investors. The amount of time it takes to settle a transaction for ownership transference, not to mention the middlemen involved, all taking a cut of fees, leaves both the buyer and seller crying their eyes out. With smart contracts, most of the middlemen can be eliminated, costly fees go flying out the window and the settlement times are greatly reduced.

Top RWA Crypto Projects

RWA projects haven't gotten to the point of being a dime a dozen… yet. Nevertheless, there are already a few visionaries who foresee the potential opportunities this new space offers and have braved the waters. Besides being first movers, they are also contributing to the development of the space with their services and garnering feedback from their users to make improvements. Anyone who is interested to join in this experiment can refer to the projects in this section for starters. Just know that it's still early days so there are lots of kinks to be ironed out, therefore there are still considerable risks involved.

The projects listed here are by no means exhaustive.

Centrifuge (CFG)

I first came across Centrifuge two years ago when it was applying for a parachain slot on the Polkadot network. If you've not heard of parachains, Guy's got a great video for you. The project was built on Parity substrate, a toolkit and framework developed by the Polkadot/Kusama team for blockchain developers to get a blockchain up and running in no time. Centrifuge is also compatible with Ethereum.

That was the first time I came across RWAs. The concept made sense to me at the time: transform your actual assets into a token so that you can use it as collateral. Alternatively, you can get investors to invest in your project through a platform like Centrifuge. So I plopped down some DOT into their parachain auction. Disclaimer: I hold some CFG in my portfolio.

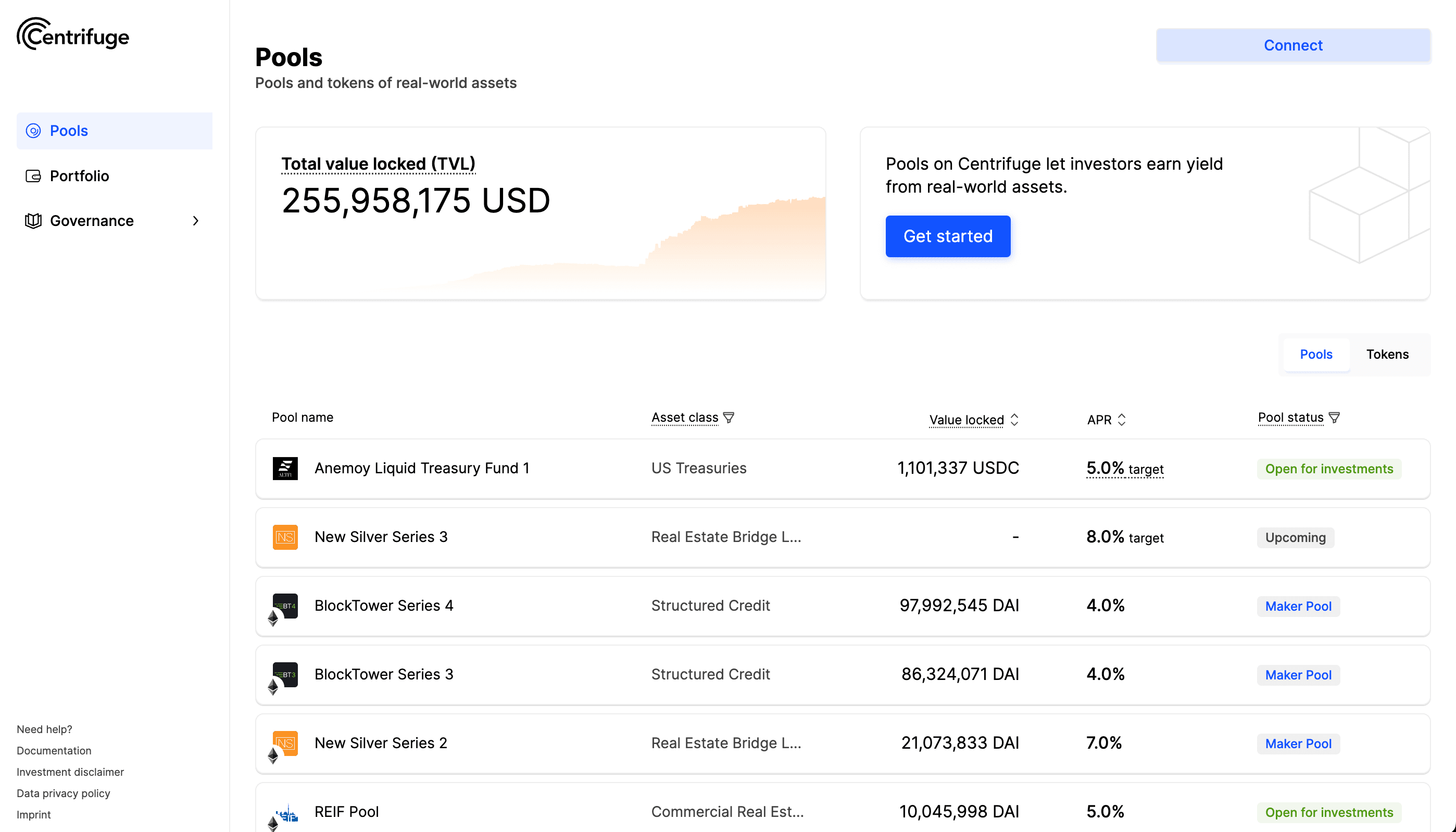

The Centrifuge DApp is where investors and businesses, known as asset originators, come together to make each other happy. Asset originators can mint an NFT token on Centrifuge that represents the asset they want to use as collateral. It can be a mortgage, royalties, rental income etc. They hand over these tokens to the Issuer, a legal entity known as SPV, which manages the pools and issues senior/junior tokens to investors. The NFTs can have their own private pool or be mixed in with other assets to create a single pool.

Investors can choose which pool they want to invest in based on the description provided. They can also choose the risk level they are most comfortable with. Senior tokens (previously known as DROP) are less risky and offer a more stable but lower yield compared to Junior (TIN) tokens. The latter bears the higher risk but also the higher rewards when things go right. The types of investments currently available include but are not limited to: tokenized US Treasury bills, cargo and freight Invoices, and commercial real estate.

Take Your Pick Of Which Pool to Invest in Based on Your Risk Profile. Image via Centrifuge

Take Your Pick Of Which Pool to Invest in Based on Your Risk Profile. Image via CentrifugeThe Centrifuge team works with multiple partners in setting up these pools for investors to invest in. Some of them are high-profile like AAVE, MakerDAO, and Frax Finance to name a few. Investors can choose to deposit via Base, Arbitrum, and Ethereum networks.

The protocol itself has also been audited by several well-known crypto audit companies such as Trail of Bits and Consensys Diligence.

Centrifuge Prime is the latest product from the team, targeted at DAO treasuries. The idea is to help the treasuries grow their yield through the investments of RWAs.

The CFG token is the utility and governance token for the Centrifuge protocol. Aside from giving token holders voting rights, they can also be staked to help secure the network.

Some stats for consideration:

- $496 million worth of assets financed

- 1,378 tokens issued

- 121% TVL growth (YoY)

- CFG market cap $233.34 million

- CFG TVL $481,211.00

Goldfinch (GFI)

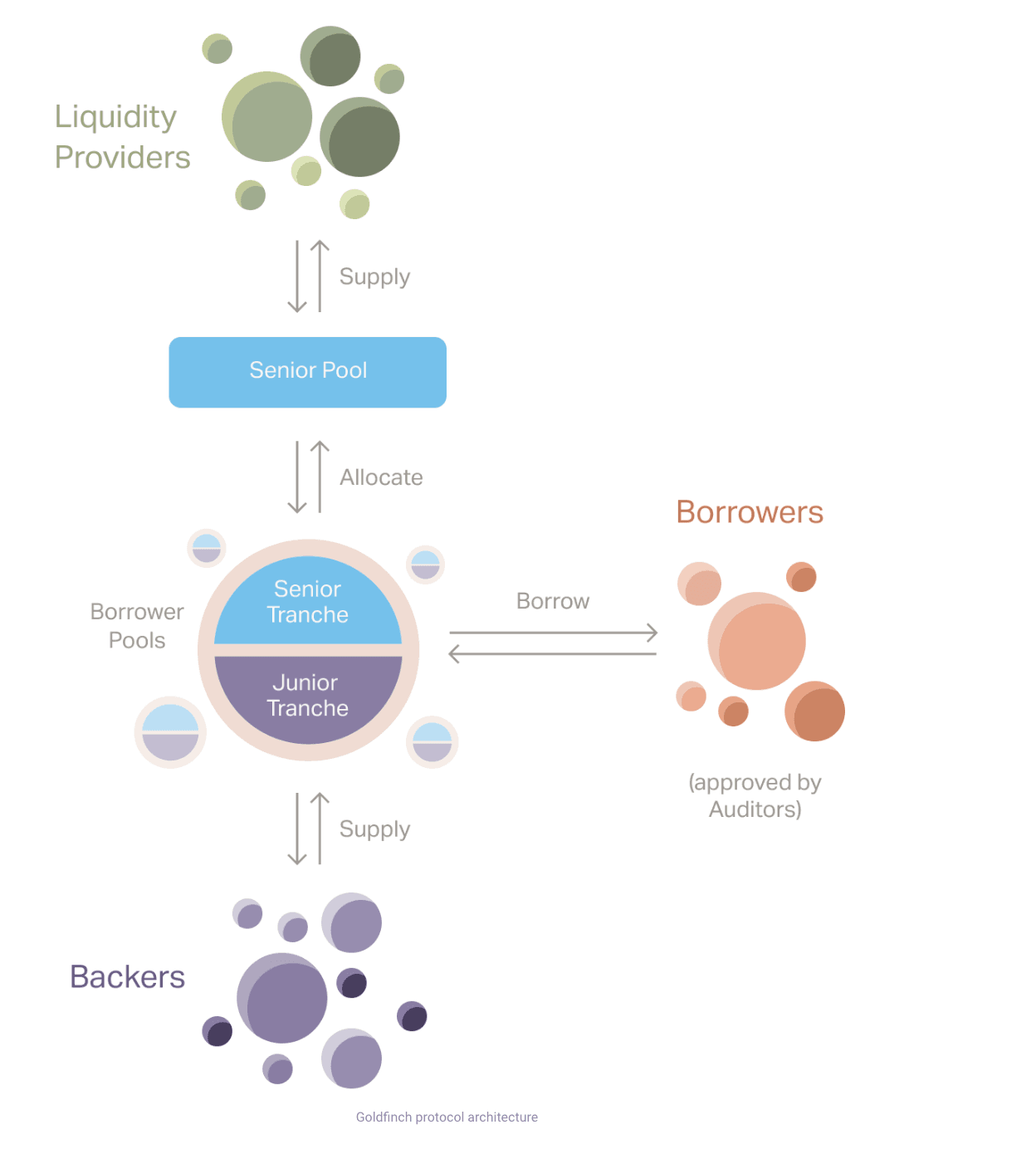

One of Centrifuge's competitors is Goldfinch, a lending and borrowing platform for institutions. Unlike most DeFi protocols that rely on overcollateralized collateral to secure loans, Goldfinch allows for the complete collateralization of loans using assets and income in the real world. In addition, it uses a “trust through consensus” mechanism, essentially a credit scoring system to assess the borrower's creditworthiness based on past behaviour. Instead of trusting a handful of individuals, the mechanism is based on the collective assessment made by other participants of the borrower, not just the strength of the borrower's crypto assets.

Here's how it works: Borrowers talk to an Auditor who will do the necessary checks before allowing them to proceed. Once they pass the checks, Borrowers can propose a Borrowers Pool where the terms and conditions of the loan are defined in the smart contract.

Those who want to invest can do it either as a Backer or a Liquidity Provider. The former reviews the individual Borrowers Pool to determine the risk of ploughing their funds in, with the understanding that they stand to lose their capital if things go pear-shaped but they can also make very nice gains if things go right. The money goes into what's called a Junior tranche (kinda like the Junior tokens in CFG). Backers get an NFT representing their share of the investment and track how much is redeemed, which can be done at any time.

If that's too risky, then they can become a Liquidity Provider by chucking their money into the Senior Pool (with a Senior tranche), which then distributes the funds to the various Borrowers Pool. The risk is less, i.e. not putting all your eggs in one basket, but lower yields. LPs get a token called FIDU which is then put into a Withdrawal Request when the investor wants their money back.

How Lending and Borrowing Works at Goldfinch Together With KYC Done On-Chain. Image via Goldfinch

How Lending and Borrowing Works at Goldfinch Together With KYC Done On-Chain. Image via GoldfinchGoldfinch also uses something called the “leverage model” that plays a key role in the “trust through consensus" mechanism. Basically, the more Backers invest in a particular Borrower Pool, the pool will also get a higher ratio of funds from the Senior pool. This type of mechanism mustn't fall prey to Sybil attacks. hence every Backer, Borrower, and Auditor needs to go through a process known as Unique Entity Check. This process utilises Unique Identity (UID), the world’s first NFT for identity verification.

GFI is Goldfinch's governance token held by Members who stake them in Membership Vaults to secure the network and earn rewards for doing so. They can vote on protocol changes, auditor staking, and various other activities that govern the protocol.

The protocol has quite an impressive line-up of investors in its protocol, including a16z, Bill Ackman, and Coinbase Ventures, where the founders used to work before starting Goldfinch in 2020. The target recipients of the protocol's loans are focused on emerging markets like Nigeria, Kenya, Uganda, and the Phillippines. This is where real growth can happen and these investors are happy to jump on the bandwagon.

Some stats for the project for consideration:

- Active loan value - $99.470. 695

- 30-day Protocol revenue - $100,138

- GFI Market Cap $85.51 million

- GFI TVL $5.59 million

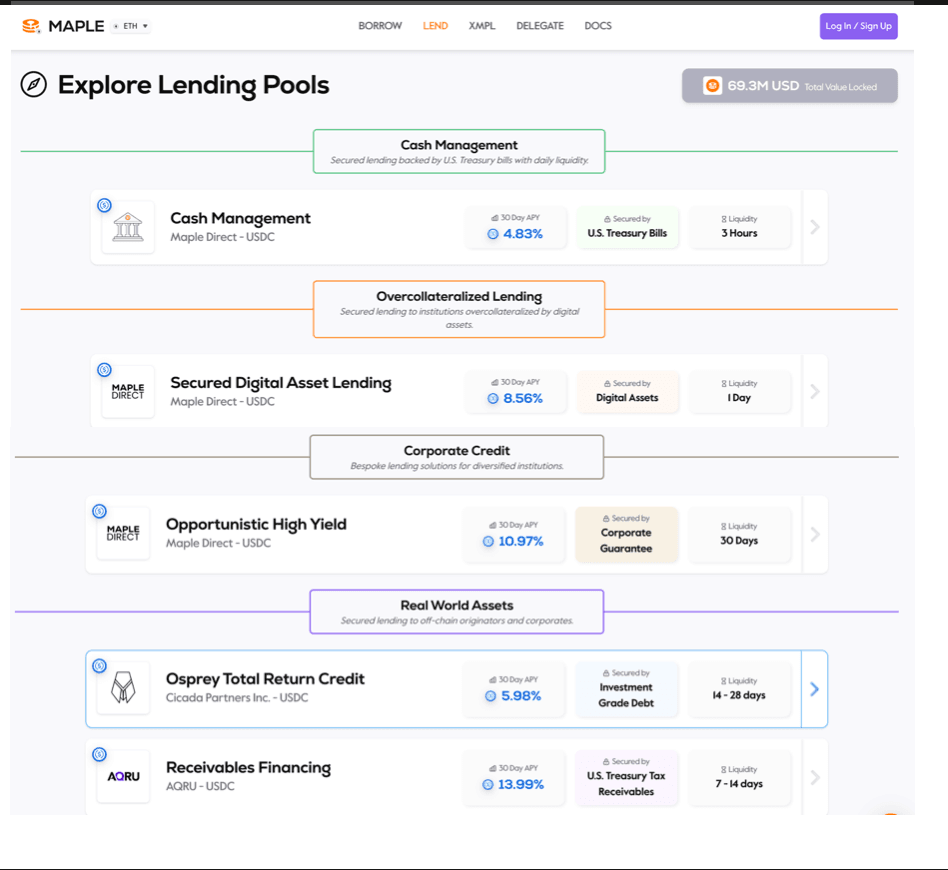

Maple Finance (MPL)

Similar to Goldfinch, Maple Finance also serves institutions on its platform. While Goldfinch goes full collateralization, Maple heads the other direction with undercollateralization. This already sounds a bit risky and it is because Maple has had loans defaulted whereas Goldfinch has yet to suffer from the same fate. The protocol overhauled its withdrawal process in 2022 to prevent similar future occurrences.

Let's dive a bit deeper into how the protocol works to understand how the default could have happened.

Pool delegates play a key role in Maple Finance. These are individuals handpicked by the Maple Finance team and their job is to vet the institutional borrowers. This is done by checking up on their creditworthiness and will influence what kind of loan they will get. Once they pass the required checks, their pool is open to receive investments and the borrower pays an “establishment fee” that goes towards the DAO and the pool delegates. Here, we can see that pool delegates are incentivized to pass through as many borrowers as they can because they get a kind of kickback from the fees paid by borrowers.

Lenders are accredited investors and only lend in USDC. They go through their own onboarding process, verifying they are who they say they are. Their wallets are also checked for anti-money laundering. The minimum lending amount is USDC100,000 for their Cash Management Pool and the APY they get is the same, regardless of loan size. Then, there are permissioned pools that require special access. Loans are made up of Open Term (no fixed date to repay) and Fixed Term.

Maple Finance works on both Ethereum and Base. They used to also support Solana but that got discontinued during their overhaul. They were indirectly part of the collateral damage from the FTX implosion as two of its borrowers, Auros Global and Orthogonal Trading became insolvent.

The Base network only has the Cash Management Pool available for investment whilst the Ethereum network has 5 pools.

The Offerings from Maple Finance on Ethereum. Image via Maple Finance

The Offerings from Maple Finance on Ethereum. Image via Maple FinanceThe MPL token is the platform's governance token. It used to be that you could stake MPL to earn yield and the lending pools would accept both USDC and MPL tokens. However, what the team has found is that token holders dump the MPL token when things don't go well, thus causing the token to lose its value, which affects the lending amount.

The platform's basic stats are as below:

- Total loans issued - $3,196,525,723

- Total deposited - $82,748,228

- Lending Pool TVL on the Ethereum network - $69.5 million

- Lending Pool TVL on the Base network - $503,800

- MPL Market Cap - $105.12 million

- MPL TVL $42.29 million

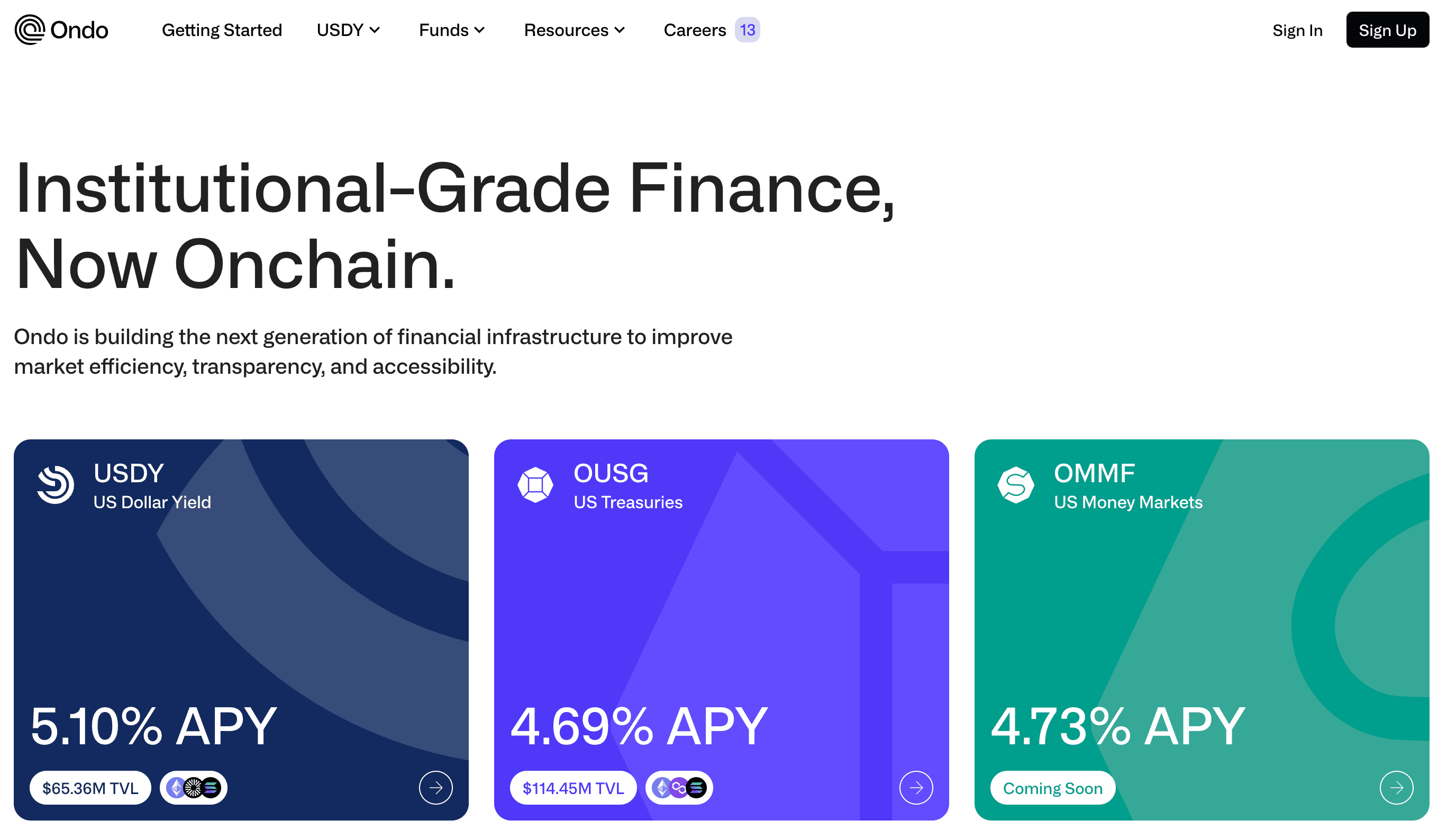

Ondo Finance

The three previous platforms we covered are in the credit and lending space, which explains the similarity you may find in their modus operandi. Ondo Finance plays in a different corner of the RWA sandbox. This platform's main offerings are tokenized securities, in particular US Treasury Bills, and most recently, their own stablecoin USDY, known as US Dollar Yield. What truly makes Ondo stand out from the pack is its array of strategic partnerships with other heavy hitters in both the DeFi and the TradFi world.

One of its star products is the OUSG fund, a tokenized version of BlackRock's iShares Short Treasury Bond ETF. Needless to say, BlackRock is intimately involved in this product. Accredited investors deposit USDC or USD to the fund (min $100,000 as stipulated by the SEC), which are then converted to USD (where applicable) to buy the shares in the ETF, mint new tokens and deposit them back to the investors' wallet addresses, which would've passed AML scrutiny before being used. Once the tokens are redeemed, they are burnt. The USDC/USD conversion is handled by Coinbase.

The latest offering, USDY, is a tokenized note secured by short-term US Treasuries and bank demand deposits. This product is only available to non-US investors and there is also a list of countries that are not eligible to participate. The assets are transferable 40-50 days after purchase. While this wouldn't be super innovative, using short-term securities and bank deposits as the assets underpinning the stablecoin gives holders confidence in the value of the token. At the very least, it wouldn't do a UST cliff-dive and the collateral itself isn't stagnant.

The platform is available on Ethereum and Polygon. Last December, it also launched on the Solana chain, which gives that network quite a boost.

Get Yer Tokenised T-Bills Here! Image via Ondo Finance

Get Yer Tokenised T-Bills Here! Image via Ondo FinancePolymath (POLY)

Many people got into crypto through ICOs, especially back in 2017 when it was all the rage. Due to the unregulated nature of these offerings, coupled with bad actors taking advantage of the situation, more than half the ICOs failed. Two guys from Canada with fintech and legal knowledge saw an opportunity to provide a more robust offering to both investors and lenders while also cutting down the amount of red tape and middlemen involved. This is how Polymath was founded, as the brainchild of Trevor Korvekos and Chris Housser. They designed Polymath to be a one-stop platform for all things related to the issuance and sale of security tokens.

Polymath was the first platform to offer security tokens and introduced the ERC1400 standard for the standardization of the tokens. Issuers need to fill out a detailed questionnaire with the relevant information regarding the token. This information will also be used by investors to assess the token for investment purposes. The next step is choosing a Legal Delegate to work with to bring the product to market, so to speak. Issuers will need to do their research in deciding who to choose to assist them. This is a key role as the delegate also works with the smart contract developers to craft a tailor-made smart contract for that token.

The platform leverages the Accredited Investor structure to ensure that all participants are fully KYC'ed and known to the regulators. This greatly reduces any unforeseen external regulatory risks that could pose a threat to their offerings or even to the platform itself. You could say that compliance and regulation are baked into the token from day one.

The POLY token is very much the de rigueur token for transactions on the Polymath network. It is used for Legal Delegates to pay the developers and receive POLY from the issuers. Anywhere that involves payment on the Polymath network uses POLY, thus keeping it at a certain level of demand. There is a limited supply of 1 billion tokens created at the launch of the platform and roughly about a quarter was sold at its own ICO.

The Polymesh network is part of the Polymath platform. It's a Layer-1 permissioned blockchain that runs on the Polkadot network. It stands out from other blockchains with its forkless architecture. This is important as you don't want multiple copies of a property to be claimable on various blockchains. This is one of the few blockchains designed with compliance for security tokens in mind. POLYX is the blockchain's native utility token. There's also a POLY:POLYX Upgrade Bridge that allows users to migrate their POLY tokens to POLYX.

We've got a fantastic in-depth review of Polymath for those who are interested in finding out more about this OG platform in RWA tokenisation.

The Future of RWA Tokenization

Total Value Locked, which is how much money is invested in the DeFi space, is $56.274 billion, according to DeFi Llama. Any of the “Magnificent Seven” companies in the S&P dwarf that amount many times over. Numbers speak the loudest and here is some for context:

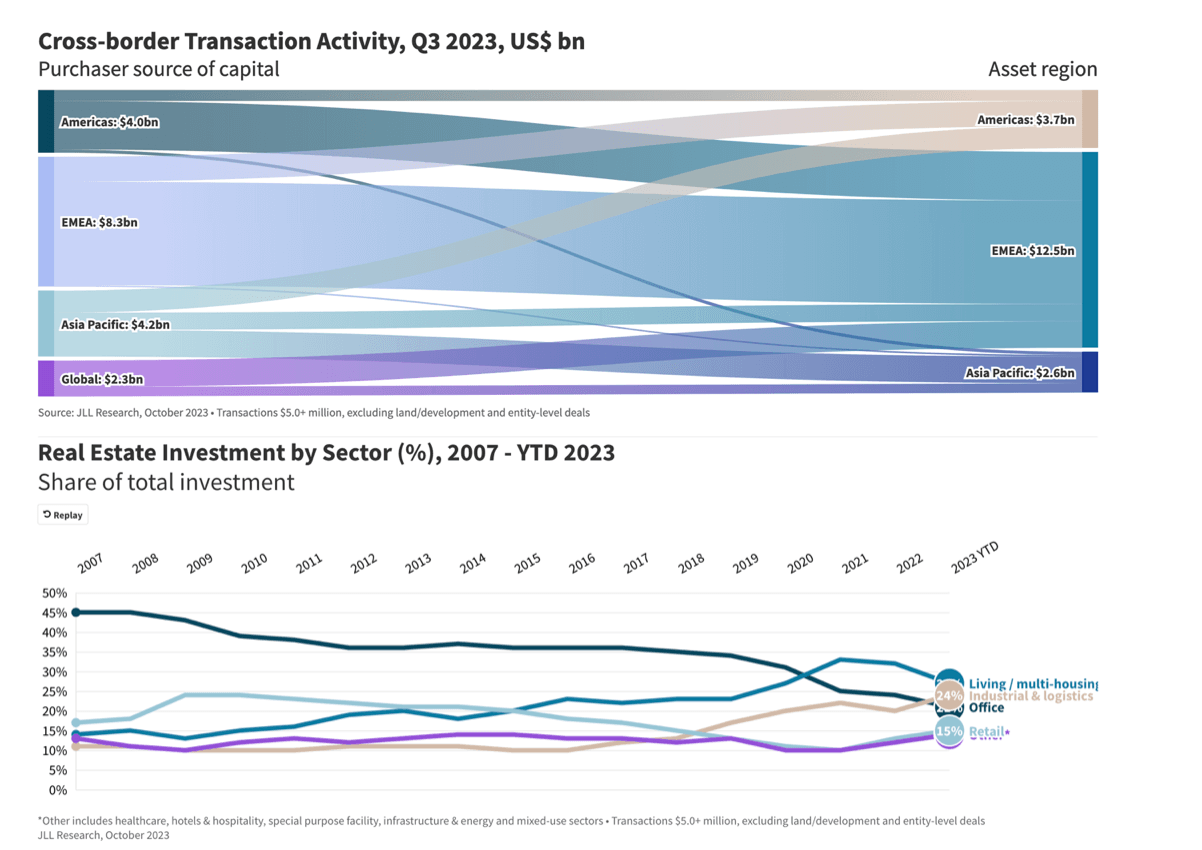

As of 2021, the global real estate market was worth about $3.69 trillion. Between 2022 and 2030, it's expected to grow at a compounded annual rate of 5.2%, according to a report issued by Grandview Research, a marketing and consultancy company based in the US. Jones Lang and LaSalle, commonly known as JLL, also issued a report stating that cross-border transactional activity in real estate was around $18.8 billion as of Q3 2023, with the majority in the EMEA region. The lion's share, 27% of it, is in worldwide residential property followed closely by industrial/logistics at 24%.

The Amount of Money Sloshing Around in the Real-estate sector. Images via JLL

The Amount of Money Sloshing Around in the Real-estate sector. Images via JLLThe value of other global markets, presented in this visually-arresting graph, is as below:

- Derivatives - $12.4 trillion

- Gold - $11.5 trillion

- Equities - $95.9 trillion

Meanwhile, the entire cryptocurrency market is only $1.85 trillion. If even 1% of what's in the markets above combined makes its way into the crypto space, it'll make the all-time highs of 2021 look like chump change. There is no doubt that the tokenisation of real-world assets is going to be an important part of crypto in the coming years.

RWA tokenisation is still very much in its early days right now. How much longevity the projects that we covered in this article have in the long run is still anyone's guess. First-mover advantage is important, but it also needs the legs to finish the marathon. In the meantime, there will be other upstarts chomping at their heels. This kind of friendly competition bodes well for the overall development of the space. I can easily imagine a future where RWA tokenisation is the norm. Mortgages, rental leases (ohhh..totally tokenise that!), and all manner of paperwork will one day all be replaced by digital tokens. Future generations will look back and wonder how we stood living in a paper-based world for so long. Who knows, we might even be able to tokenise our time but that's something I'll leave to sci-fi authors to ponder over.