Hashrate is a pivotal metric in cryptocurrency mining, integral to the functioning of Proof of Work (PoW) consensus mechanisms. It not only gauges the security robustness of a blockchain network but also significantly influences the profitability of mining operations. This article will educate readers about the essence of hashrate, elucidating its role and impact on mining performance.

As cryptocurrency adoption and mining operations continue to expand, understanding the concept of hashrate becomes increasingly essential for anyone involved in or interested in blockchain technology. This article will delve deeper into the essence of hashrate, elucidating its critical role in maintaining the integrity of blockchain networks, how it affects mining performance, and why it has such a significant impact on mining profitability.

What is Hashrate?

In cryptocurrency mining, Proof of Work (PoW) is a consensus mechanism that ensures the integrity and security of blockchain networks. Miners compete to solve complex mathematical puzzles, requiring substantial computational resources. The first miner to solve the puzzle validates a new block of transactions and is rewarded with cryptocurrency.

Hashrate refers to the computational power used in this process. It measures the number of hash computations a miner or the entire network can perform per second. A higher hashrate increases the likelihood of solving the puzzle and earning rewards, directly impacting mining performance.

Hashrate is measured in hashes per second (H/s), with common units including:

- Kilohash per second (kH/s): 1,000 hashes per second

- Megahash per second (MH/s): 1 million hashes per second

- Gigahash per second (GH/s): 1 billion hashes per second

- Terahash per second (TH/s): 1 trillion hashes per second

- Petahash per second (PH/s): 1 quadrillion hashes per second

- Exahash per second (EH/s): 1 quintillion hashes per second

In the Bitcoin network, the hashrate is a key factor in adjusting mining difficulty. Approximately every two weeks, the network assesses the total computational power and modifies the difficulty of mining new blocks to maintain a consistent block generation time of about 10 minutes. If the hashrate increases, the difficulty rises; if it decreases, the difficulty lowers.

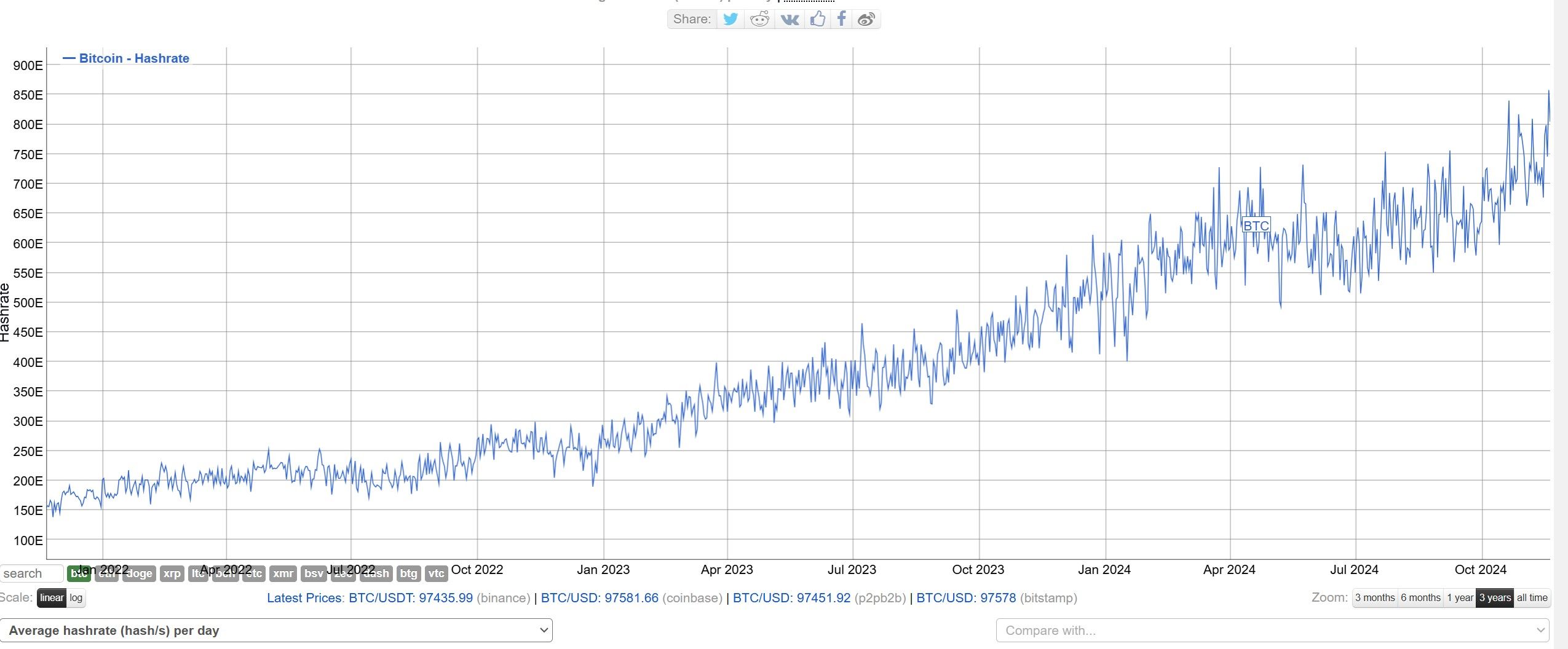

Bitcoin Historical Hashrate | image via bitinfocharts

Bitcoin Historical Hashrate | image via bitinfochartsThe significance of hashrate in mining is multifaceted:

- Network Security: A higher hashrate enhances the security of the blockchain by making it more challenging for malicious actors to alter the network. This increased computational power is a deterrent against attacks, such as the 51% attack, where an entity gains control over most of the network's hashrate.

- Mining Competition: The hashrate reflects the level of competition among miners. A higher network hashrate indicates more miners are participating, increasing competition and reducing the probability of any single miner solving the puzzle first.

- Profitability: For individual miners, a higher personal hashrate improves the chances of earning rewards. However, as more miners join the network and the total hashrate increases, the difficulty adjusts upward, which can reduce profitability unless miners invest in more efficient hardware or access cheaper energy sources.

Understanding hashrate is crucial for miners to evaluate their potential earnings and for stakeholders to assess the security and health of a blockchain network.

How Hashrate Works

In cryptocurrency mining, particularly within Bitcoin's Proof of Work (PoW) system, hashrate is a fundamental concept that influences both the efficiency of mining operations and the security of the blockchain network.

Technical Functionality

Mining involves solving cryptographic puzzles to validate and add new blocks to the blockchain. In Bitcoin, this process utilizes the SHA-256 hash function, transforming input data into a fixed-length string of characters. Miners aim to find a hash value that meets a specific condition: it must be less than or equal to the current network difficulty target. This is achieved by varying a nonce—a random value—within the block's data and repeatedly hashing until the desired outcome is reached. Modern mining rigs automate this process, performing trillions of hash computations per second to expedite the discovery of a valid hash.

Beyond block validation, hashrate serves as a metric for assessing the computational power of individual miners and the network as a whole. It also plays a role in determining mining rewards and influences the overall energy consumption of mining activities.

Role in Blockchain Security

Hashrate is integral to maintaining the integrity and security of the blockchain. A higher network hashrate signifies greater computational power, making it more challenging for malicious entities to alter the blockchain's history. In Bitcoin, the network aims for an average block time of 10 minutes. To maintain this consistency, the network adjusts the mining difficulty approximately every two weeks (every 2,016 blocks). If blocks are mined faster than the 10-minute target, the difficulty increases; if slower, it decreases. This self-regulating mechanism ensures a stable issuance rate of new bitcoins and fortifies the network against potential attacks.

Hashrate vs. Mining Power

The relationship between hashrate, mining difficulty, and mining power is pivotal in the mining ecosystem. As the network's hashrate increases, the mining difficulty adjusts upward, necessitating more computational effort to solve the cryptographic puzzles. Consequently, miners must invest in more powerful hardware to maintain or improve their chances of successfully mining new blocks.

An ASIC is a specalized mining hardware | Image via bitbo

An ASIC is a specalized mining hardware | Image via bitboApplication-Specific Integrated Circuits (ASICs) are specialized hardware designed explicitly for mining cryptocurrencies like Bitcoin. Unlike general-purpose processors, ASICs are optimized for hash computations, offering significantly higher efficiency and performance. The adoption of ASICs has led to a substantial increase in the network's hashrate, intensifying competition among miners and contributing to the overall security and resilience of the blockchain.

Why Does Hashrate Matter?

Hashrate is a critical factor in cryptocurrency mining, influencing individual miner rewards and the overall security of the blockchain network.

Impact on Mining Rewards

For individual miners, increasing their hashrate enhances the probability of solving cryptographic puzzles and earning block rewards. A higher hashrate means more computational attempts per second, improving the chances of success. However, as the total network hashrate grows due to more miners or more powerful equipment, the competition intensifies. This increased competition can reduce the share of rewards for each miner, potentially impacting profitability.

Network Security

The total network hashrate is directly linked to the blockchain's security. A higher hashrate makes it more challenging for malicious entities to execute attacks, such as the 51% attack, where an attacker gains control of most of the network's mining power. As the network's hashrate increases, the computational resources required for such an attack become prohibitively expensive and complex, thereby enhancing the network's resistance to attacks.

Difficulty Adjustments

Blockchain networks like Bitcoin aim to maintain a consistent block generation time (e.g., 10 minutes for Bitcoin). To achieve this, the network periodically adjusts the mining difficulty based on the total hashrate. If blocks are being mined faster than the target time due to a high hashrate, the difficulty increases; if blocks are slower, the difficulty decreases. This self-regulating mechanism ensures a stable and predictable issuance of new coins, maintaining the network's balance and security.

Factors Influencing Hashrate

Several factors influence the hashrate in cryptocurrency mining, affecting both individual miners and the overall network.

The Efficiency of Mining Hardware is a Primary Determinant of Hashrate. Image via Shutterstock

The Efficiency of Mining Hardware is a Primary Determinant of Hashrate. Image via Shutterstock1. Hardware Efficiency

The efficiency of mining hardware is a primary determinant of hashrate. Advanced equipment, such as Application-Specific Integrated Circuits (ASICs), is designed specifically for mining tasks, offering higher computational power and energy efficiency than general-purpose hardware. For instance, the Bitmain Antminer S19 Pro delivers a hashrate of 110 TH/s with a power consumption of 3,250 watts, making it one of the most efficient miners available.

Upgrading to more efficient hardware allows miners to achieve higher hashrates, enhancing their chances of earning rewards.

2. Energy Costs

Energy expenses significantly impact mining profitability and, consequently, the hashrate. Mining operations require substantial electricity to power and cool the hardware. Regions with lower electricity costs enable miners to operate more profitably, often leading to higher local hashrates. Conversely, mining may become unprofitable in areas with high energy prices, causing miners to reduce operations or shut down, thereby decreasing the network's hashrate. For example, in 2024, the U.S. became the largest Bitcoin mining industry globally, representing 38% of the global Bitcoin network’s hash rate, partly due to favorable energy costs.

3. Geopolitical Factors

The regulatory environment and availability of energy resources in a region significantly influence mining activities and the network's hashrate.

- Regulatory Environment: Regions with favorable regulations attract mining operations, leading to increased local hashrates. Conversely, stringent regulations or outright bans can force miners to relocate or cease operations, reducing the hashrate. For instance, China's crackdown on cryptocurrency mining in 2021 led to a significant drop in the global hashrate as miners moved to more accommodating regions.

- Energy Availability: Access to cheap and renewable energy sources makes mining more cost-effective and sustainable. Regions rich in renewable energy, such as hydroelectric power, often become hubs for mining activities, contributing to higher local and global hashrates. For example, certain areas in Russia have become attractive for miners due to the availability of cheap electricity, despite regulatory challenges.

Hashrate and Mining Profitability

Understanding the interplay between hashrate and mining profitability is essential for optimizing their operations.

1. Profitability Equation

Mining profitability hinges on balancing hashrate, electricity costs, and mining rewards. The fundamental equation is:

Profit=(Mining Rewards×Cryptocurrency Price)−(Electricity Costs+Operational Expenses)

- Hashrate: A higher hashrate increases the probability of solving cryptographic puzzles, leading to more frequent mining rewards. However, achieving a higher hashrate often requires more powerful hardware, which can be costly and consume more energy.

- Electricity Costs: Energy consumption is a significant expense in mining operations. Efficient hardware delivering a higher hashrate per watt can reduce electricity costs, improving profitability.

- Mining Rewards: These are influenced by block rewards and transaction fees, which can fluctuate based on network conditions and protocol changes.

Balancing these elements is crucial for maintaining a profitable mining operation.

2. Market Trends

Cryptocurrency prices directly impact the value of mining rewards. When prices rise, the fiat value of mining rewards increases, potentially enhancing profitability even if operational costs remain constant. Conversely, declining cryptocurrency prices can erode profits, making efficient operations vital.

Market trends also influence network hashrate. During bullish periods, more miners may join the network, increasing competition and difficulty and affecting individual miners' profitability.

3. Strategies for Optimization

Enhancing profitability involves improving hashrate efficiency through several strategies:

- Hardware Upgrades: Investing in energy-efficient mining equipment can provide a higher hashrate with lower power consumption. For example, Application-Specific Integrated Circuits (ASICs) are designed for specific mining algorithms and offer superior performance compared to general-purpose hardware.

- Energy Management: Utilizing renewable energy sources or locating operations in regions with lower electricity costs can significantly reduce expenses. Some miners are exploring partnerships with energy providers to secure favorable rates.

- Operational Efficiency: Implementing effective cooling solutions and regular maintenance can prevent hardware failures and downtime, ensuring consistent hashrate performance.

- Mining Pool Participation: Joining mining pools allows miners to combine their computational resources, leading to more consistent rewards. However, it's essential to consider pool fees and the pool's reliability.

By adopting these strategies, miners can optimize their operations, balancing hashrate and costs to achieve sustainable profitability.

The Global Hashrate Distribution

As of November 2024, the global Bitcoin hashrate distribution reflects both the dominance of specific mining pools and the concentration of mining activities in particular geographical regions.

Mining Pools and Hashrate Concentration

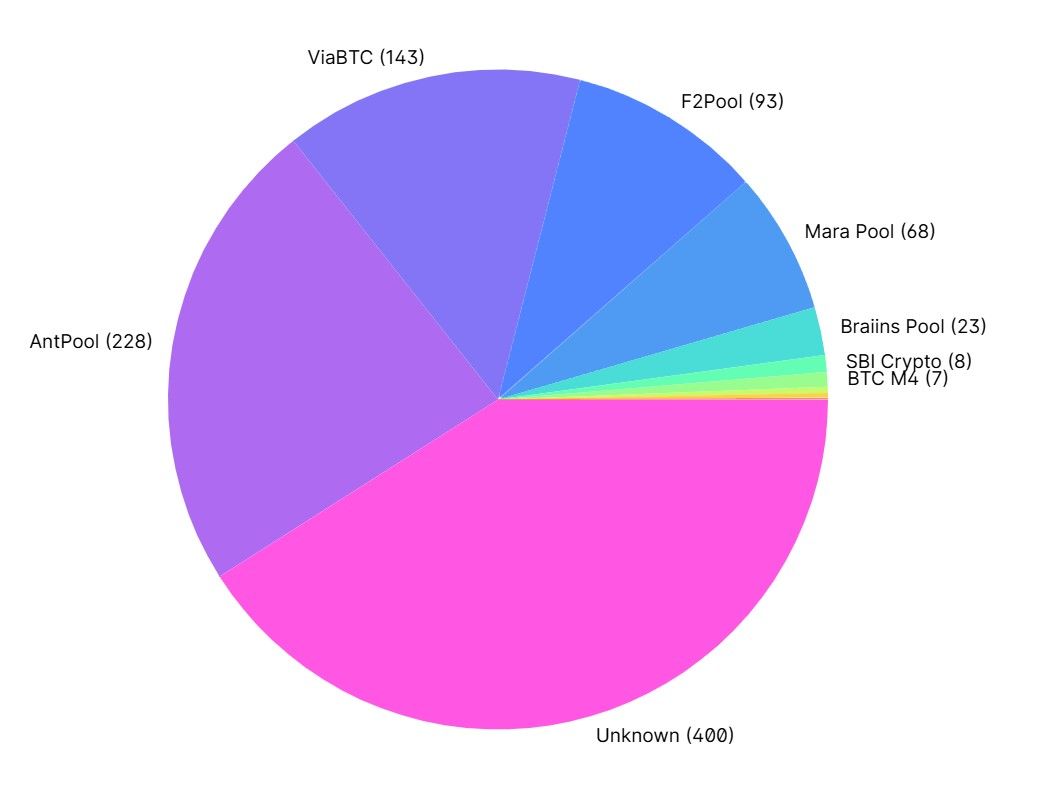

A few major mining pools predominantly control the Bitcoin network's hashrate. According to data from Blockchain.com, the leading pools and their respective shares of the total hashrate are:

- AntPool: 24.47%

- Unknown: 39.848%

- ViaBTC: 14.042%

- F2Pool: 9.298%

- Mara Pool: 7.97%

- Braiins Pool: 2.467%

- SBI Crypto: 0.38%

- Ultimus: 0.38%

- Poolin: 0.19%

- BTC.com: 0.19%

Global Bitcoin Hashrate Distribution via Blockchain.com

Global Bitcoin Hashrate Distribution via Blockchain.comThese 10 pools collectively account for approximately 97% of the total network hashrate, indicating a high concentration level among a limited number of entities.

Geographical Distribution

Geographically, Bitcoin mining is concentrated in specific countries, primarily due to factors such as energy costs, regulatory environments, and infrastructure availability. Data available online provides insights into the average monthly hashrate share by country:

- United States: 38%

- China: Data not available post-2021 due to regulatory crackdowns (speculated around 21%)

- Kazakhstan: 13%

- Russia: 5%

- Canada: 7%

- Germany: 3%

- Ireland: 2%

The United States has emerged as the leading nation in Bitcoin mining, largely attributed to favorable energy prices and regulatory conditions.

Implications of Hashrate Centralization and Decentralization

The concentration of hashrate within a few mining pools and specific geographical regions carries significant implications for the Bitcoin network:

- Security Risks: Centralization increases the risk of a 51% attack, where a single entity or a colluding group gains majority control over the network's hashrate, potentially compromising the integrity of the blockchain.

- Regulatory Vulnerability: Geographical concentration makes the network susceptible to country-specific regulations. For instance, China's 2021 crackdown on cryptocurrency mining led to a substantial drop in global hashrate, highlighting the network's vulnerability to regional policy changes.

- Network Resilience: Decentralization enhances the network's resilience by distributing mining power across diverse entities and locations, reducing the impact of localized disruptions.

Promoting Hashrate Decentralization

Individual miners can contribute to a more decentralized network by:

- Joining Smaller Pools: Participating in less dominant mining pools to distribute computational power more evenly.

- Solo Mining: For those with sufficient resources, solo mining can further decentralize the network, though it comes with increased reward variance.

- Geographical Diversification: Establishing mining operations in underrepresented regions to reduce geographical concentration.

- Advocating for Favorable Policies: Supporting policies that encourage diverse and decentralized mining practices globally.

In conclusion, while certain mining pools and countries currently dominate Bitcoin's hashrate distribution, efforts toward decentralization are crucial to maintaining the network's security, stability, and resistance to external influences.

Challenges in Maintaining Hashrate

Maintaining a competitive hashrate in cryptocurrency mining presents several challenges:

Hardware Obsolescence

Advancements in mining technology render older equipment less efficient, leading to increased operational costs and reduced profitability. The rapid development of more powerful and energy-efficient mining hardware necessitates continuous investment to stay competitive. For instance, introducing Application-Specific Integrated Circuits (ASICs) has significantly increased mining efficiency, making older hardware obsolete.

Environmental Concerns

High energy consumption in mining operations raises sustainability issues. The substantial electricity demand contributes to carbon emissions, especially when powered by fossil fuels. This environmental impact has led to regulatory scrutiny and calls for greener mining practices. For example, Bitcoin mining's energy consumption has been compared to that of entire countries, prompting debates about its environmental footprint.

Economic Viability

Balancing operational costs with returns is crucial for long-term success. Fluctuating cryptocurrency prices, energy costs, and hardware expenses affect profitability. Miners must optimize operations and adapt to market conditions to remain economically viable. For instance, mining may become unprofitable during low cryptocurrency prices, leading some miners to cease operations.

Addressing these challenges requires strategic planning, investment in efficient technologies, and consideration of environmental impacts to sustain a competitive hashrate in the evolving mining landscape.

The Future of Hashrate Mining

Cryptocurrency mining landscape is poised for significant transformation, influenced by technological advancements and shifts in consensus mechanisms.

Innovations in ASICs and Emerging Technologies

Application-Specific Integrated Circuits (ASICs) have been central to enhancing mining efficiency. Companies are continually developing more powerful and energy-efficient ASICs to maintain competitiveness. For instance, Canaan, a leading manufacturer, has announced plans to release next-generation ASICs with improved performance metrics.

Beyond ASICs, quantum computing presents a potential paradigm shift in Proof of Work (PoW) mining. Quantum computers could theoretically solve cryptographic puzzles exponentially faster than classical computers, potentially rendering current mining hardware obsolete. However, practical quantum computing applications in mining remain speculative and are likely years away from realization.

Shift to Proof of Stake (PoS) and Its Implications

The cryptocurrency industry is significantly transitioning from PoW to PoS consensus mechanisms. Ethereum's successful shift to PoS in 2022, known as "The Merge," has set a precedent for other networks considering similar moves. This transition reduces energy consumption and diminishes the reliance on hashrate for network security.

Bitcoin remains the most prominent network committed to PoW, with no immediate plans to transition to PoS. As other networks adopt PoS, Bitcoin's mining ecosystem may experience increased centralization, with a concentration of hashrate among fewer participants.

Future Predictions for Hashrate in Cryptocurrency Mining

The role of hashrate in cryptocurrency mining is expected to evolve:

- Technological Advancements: Continued innovation in ASIC technology will drive higher hashrates and improved energy efficiency. However, the potential advent of quantum computing could disrupt current mining paradigms, necessitating adaptations in mining strategies and hardware.

- Environmental Considerations: Growing environmental concerns and regulatory pressures may lead to developing more sustainable mining practices, including adopting renewable energy sources and more efficient hardware.

- Economic Dynamics: Fluctuations in cryptocurrency prices, energy costs, and hardware availability will continue to influence mining profitability and the distribution of hashrate across the network.

In summary, while hashrate remains a critical component of PoW mining, its significance is being reshaped by technological innovations and the industry's gradual shift toward PoS consensus mechanisms.

The Role of Hashrate in Mining: Closing Thoughts

Hashrate is a measure of computational power and plays a major role in the functioning of Proof of Work (PoW) consensus mechanisms, ensuring blockchain integrity and resisting malicious attacks. The dynamics of mining, coupled with the interplay of hashrate, energy consumption and hardware efficiency, create a complex yet fascinating ecosystem.

Understanding hashrate's multifaceted role is essential for miners, investors, and blockchain enthusiasts alike. It provides a lens through which to assess the security, health, and economic dynamics of blockchain networks.