The cryptocurrency space was hit with a bombshell on December 21st when news broke that the SEC would be suing Ripple, the company behind XRP. The next day, the SEC officially announced their lawsuit against not just Ripple, but also Ripple CEO Brad Garlinghouse, and Ripple co-founder Chris Larsen.

This has put the price of XRP in a freefall as many investment firms, exchanges, and partners have begun to distance themselves from Ripple and its native cryptocurrency. To the average onlooker it may not be entirely clear why this is happening, nor why this lawsuit may have implications on the entire cryptocurrency space. We are here to give you the TLDR.

Why is the Ripple lawsuit important?

The Ripple lawsuit is important because if the SEC wins their case, XRP will be treated as a security and not a currency in the United States. This will broaden the definition of the Howey test, setting a legal precedent that could result in other similar cryptocurrencies also being classified as securities.

XRP: Going from Long to Short. Image via Shutterstock

XRP: Going from Long to Short. Image via Shutterstock Most of you have probably read some version of this explanation in various news articles already. As you can imagine, it does not really provide any clarification to anyone unfamiliar with this sort of jargon. However, there is no getting around these terms. Knowing what they are is both necessary to understand this case and any others that may arise as the bull market draws attention to crypto.

What are securities?

In plain English, a security is anything that represents a portion of some entity’s value. This includes things such as stocks in a company or government debt via government bonds. Securities are subject to much stricter regulations than currencies or commodities (think gold, oil, food, etc.). In the United States, securities regulations are set and upheld by the Securities and Exchange Commission (SEC).

Image via The Balance

Image via The Balance Many cryptocurrencies are in fact securities, namely those that were sold to investors by means of an initial coin offering (ICO). This is because most cryptocurrency projects with ICOs do not actually have a functioning product at the outset.

As such, the tokens they sell become a sort of promise to the people who purchased them – a promise that the company will create whatever technology they claim to be building, thus giving value to the tokens they issued. While these tokens are not a share in a stock per se, they have similar properties and are therefore considered securities under US law.

Many cryptocurrency whitepapers note ICO restricted countries at the beginning, in this case Efforce

Many cryptocurrency whitepapers note ICO restricted countries at the beginning, in this case Efforce This is why many ICOs tend to be off-limits to investors in the United States, Canada, and a few other countries that have strict securities laws or are illegal to sell things to (e.g. North Korea). For most, it is simply not worth jumping through the hoops required to sell the token to US investors, much less convince US-based cryptocurrency exchanges to list them for trading.

One of the core claims of the SEC suit against Ripple is that XRP is a security, specifically an unregistered security, that has been illegally sold by Ripple since it was first distributed to investors almost 8 years ago. Many consider this security designation to be a stretch and would significantly broaden the definitions found in the Howey Test.

What is the Howey Test?

The Howey Test is what the SEC and other relevant regulatory bodies use to determine whether an asset is a security or not. The Howey Test boils down to one simple question: is monetary value of the asset being invested in dependent on the efforts of a third party?

An example of a third party influencing the price of an asset. Image via Yahoo Finance

An example of a third party influencing the price of an asset. Image via Yahoo Finance If you feel you are raising an eyebrow, take a second to consider what makes a stock go up or down. In theory, it is the actions of the company which the stock represents. This means the price action of the asset (the stock) is tied at the hip to the efforts of a third party (the company).

While this sort of threshold works for regular assets, you can probably see how it becomes a bit problematic when you start applying it to digital currencies. This is because it is hard to say that a cryptocurrency is not dependent on a third party when many have prolific creators behind them that could arguably influence the price of that asset (Bitcoin, Ethereum, Cardano, Litecoin etc.).

The SEC does not consider Bitcoin to be a security. Image via Investopedia

The SEC does not consider Bitcoin to be a security. Image via Investopedia The argument from the cryptocurrency side is that unlike stocks, the ownership and operation of a network like Bitcoin’s is distributed and decentralized – there is technically no single entity behind the project. Even though the XRP network is more centralized than other cryptocurrencies, some have argued it is still decentralized enough to warrant being put in the same legal category as Bitcoin.

However, the SEC suit is alleging that XRP is a security based on the internal correspondence and marketing efforts of Ripple, Brad Garlinghouse, and Chris Larsen. All three were aware that XRP was dangerously close to being classified as a security under the Howey Test, yet they went on to engage in practices which constitute the efforts of a third party in relation to the value of the asset (XRP).

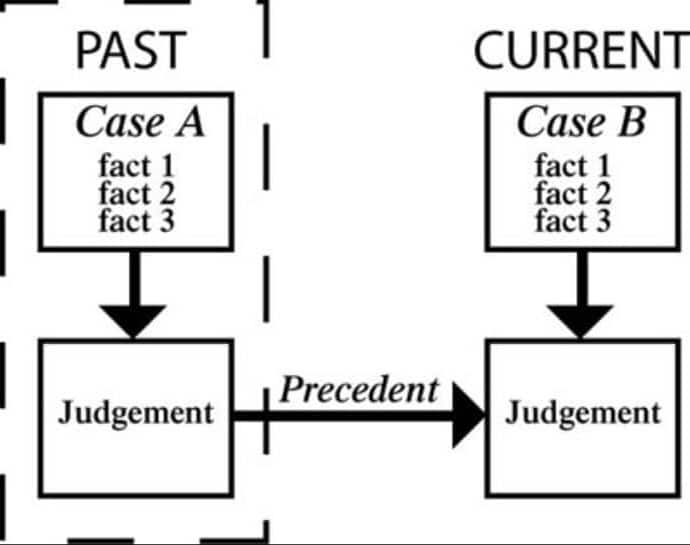

What is legal precedent?

Most legal systems around the world make their decisions based on legal precedent. This means that they look at earlier rulings on similar cases (if there are any) to come to a conclusion on a current case. Although there have already been many SEC suits against various cryptocurrency projects, the suit against Ripple is a bit different.

A simple visualization of legal precedent. Image via LawGovPol

A simple visualization of legal precedent. Image via LawGovPol As mentioned in the previous section, XRP’s designation as a security could come as a consequence of the actions of Ripple and two of its top executives. Some believe that if this happens, it will broaden the threshold of the Howey Test enough to make it fair game to go after other cryptocurrencies similar to XRP. But how did we get here? A quick recap is in order.

Ripple SEC Lawsuit History

The news of an incoming suit from the SEC was broken by Brad Garlinghouse in a tweet on December 21st. Very little was known about the suit at that time, and some noted that it was unusual for a company to come out and reveal an SEC suit before the SEC themselves.

Brad Garlinghouse Comments on the SEC. Image via Twitter.

Brad Garlinghouse Comments on the SEC. Image via Twitter.On December 22nd, Ripple released a summary of their Wells Submission. This is a document which is given to the SEC in response to something called a Wells Notice, a document which explains that the SEC will be seeking legal action and on what grounds it is doing so.

The SEC is having none of it. Image via Twitter

The SEC is having none of it. Image via Twitter The Wells Submission gave the impression that the SEC’s suit was baseless and that it would be a slam dunk win for Ripple if the SEC had the gall to go forward with it. This was until the SEC released the full suit a few hours later. It contained some very explicit details which has since cast doubt on whether Ripple can actually win this case, consequently sending XRP to the shadow realm.

Ripple SEC Lawsuit Summary

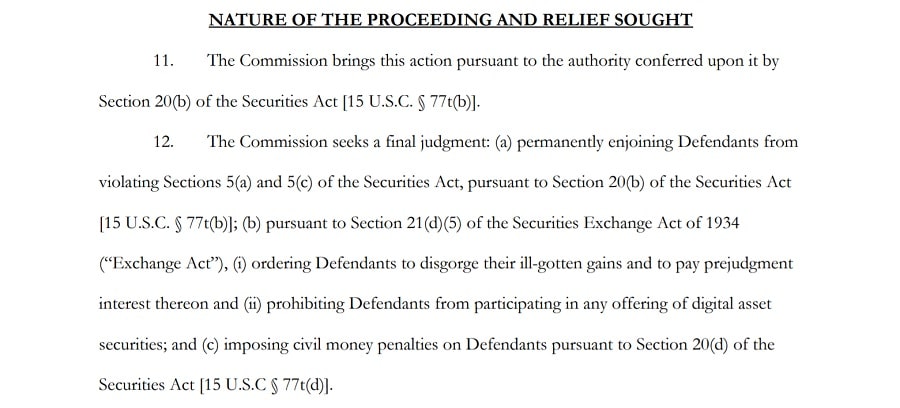

It is critical to keep in mind that the SEC suit against Ripple is also against Ripple CEO Brad Garlinghouse and Ripple co-founder Chris Larsen. What the SEC is arguing is that XRP is an unregistered security that was sold by Ripple, Brad and Chris, and that all three parties engaged in bad business practices to enrich themselves in the process.

What the SEC wants is three things: for Ripple, Brad, and Chris to forfeit the 1.38 billion dollars they raised from selling XRP, for all three parties to stop selling XRP, and for all three to pay additional fines as deemed adequate by the court.

The first few pages of the SEC suit outlines any entities relevant to the arguments in the suit (Ripple, a few subsidiaries, Brad, Chris, other co-founders, etc.). It also details a few of the securities laws relevant to the suit and gives a breakdown of key terms related to digital currencies.

The carnage starts on page 8, when the suit goes into incredible detail about the history of Ripple and XRP and how it was distributed. In 2012 and 2013 before any XRP had been sold, Ripple, Brad, and Chris had all been warned by their own legal experts that XRP could be classified as a security. They also advised them to contact the SEC for clarification, which was not done.

Instead, internal correspondence suggests that Brad and Chris tip-toed around this possibility and continued on as normal, promoting XRP and its price potential. Ripple also began selling large amounts of XRP under market value to companies with no lock up conditions.

Most of these companies promptly sold the XRP they bought as soon as they receive it. Since they bought the XRP for as much as 30% below the market prices, they were able to resell it for a nice profit to hyped up retail investors like you and me who were completely unaware this was happening behind the scenes.

Ripple also used XRP to pay cryptocurrency exchanges to list it for trading. On page 14, the SEC confirms a long-held belief by critics of Ripple that its only profits come from its selling of XRP behind the scenes to large investors at a discount.

After detailing how Chris Larsen and Brad Garlinghouse handled the XRP they received, the SEC suit explains how Ripple, Brad, and Chris kept retail investors in the dark. In short, they were touting XRP as the best investment ever while simultaneously selling large amounts of it under the table (or more accurately, over the counter).

Pages 34 to 56 of the suit are perhaps the most important. Here the SEC presents numerous arguments as to why XRP is a security, citing the words and actions of Ripple, Brad, and Chris as evidence. The silver bullet argument can be found on page 44 and reads as follows:

“Economic Reality Dictates that XRP Purchasers Have No Choice But to Rely on Ripple’s Efforts for the Success or Failure of Their Investment”

Having established that XRP is a security, the SEC then briefly explains that Ripple did not register XRP as a security, and that Ripple, Brad, and Chris all played a role in selling XRP. The suit concludes by restating the claim it made at the beginning: XRP is an unregistered security that was sold by Ripple, Brad, and Chris under false pretenses to enrich themselves.

Will Ripple win the SEC lawsuit?

This fundamentally depends on how interrelated the two core accusations of the Ripple case are. Again, these are that XRP is an unregistered security, and that Ripple, Brad Garlinghouse, and Chris Larsen used XRP to enrich themselves.

Image via Cryptonary

Image via Cryptonary Given the incredible amount of evidence to the fact, it is quite clear that Ripple, Brad, and Chris engaged in bad business practices that warrant some degree of legal repercussion. The question is whether this retribution depends on whether or not XRP is a security.

As noted by Cardano founder Charles Hoskinson, XRP is not a security even though it comes dangerously close to that classification. This is because the XRP ledger would continue to exist and operate even if Ripple were shut down and both Brad and Chris were put in prison.

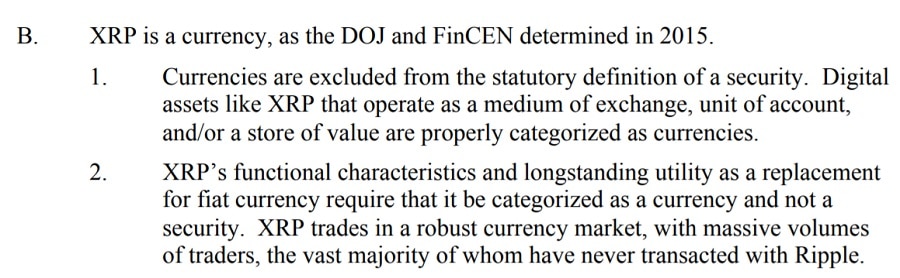

Ripple’s summary of their Wells Submission also states that the DOJ and FinCEN consider XRP to be a virtual currency as per their 2015 suit against Ripple. Ripple also claims to have empirical data showing that the efforts and selling behavior of Ripple, Brad, and Chris were not nearly sufficient to impact the price of XRP.

Ripple’s strongest counterargument is that XRP is no different to Ripple than oil is to Exxon or Bitcoin is to Bitmain. All three companies are reliant on those commodities, but nobody would say that holding oil represents a share in an oil company.

Cardano founder Charles Hoskinson covered the news of the Ripple suit in real time as news came out.

Cardano founder Charles Hoskinson covered the news of the Ripple suit in real time as news came out. However, even if Ripple successfully argues that XRP is not a security, it does not necessarily absolve it nor its head honchos from any wrongdoing. As Charles Hoskinson also noted, other regulatory bodies could step in and seek to press charges for their actions. This seems likely given the high-profile nature of the case, and the inexcusable actions of its defendants.

What will happen to XRP?

There is one thing that investors do not like and that is uncertainty. This lawsuit against Ripple will likely drag on for a year or more. Until the SEC suit against Ripple is resolved, XRP will be one of the most uncertain investments in cryptocurrency.

For the time being, the backlash has been arguably tame given the facts noted in the suit. This is because XRP is one of the most traded cryptocurrencies and rushing to delist it as an exchange is a bad call at this point in time. However, this could change as time marches on.

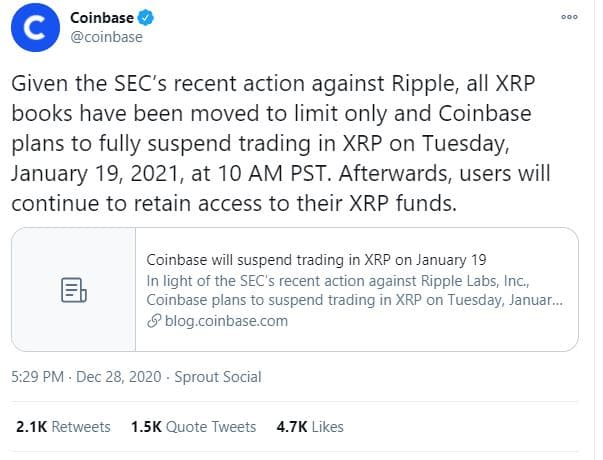

There is almost no question that the SEC will uncover even more bad practices by Ripple before the suit concludes. Whether institutions affiliated with Ripple can brave that storm is questionable. It was recently announced that Coinbase was going to be suspending trading for XRP on account of the SEC action against the company.

The Dreaded Tweet From Coinbase. Image via Twitter

The Dreaded Tweet From Coinbase. Image via Twitter As you can see with the price reaction of XRP, the market has reacted negatively to the news. The only thing keeping XRP alive seems to be the dedication Ripple fanbase which has seen this as the perfect opportunity to buy XRP at a discount. Whether they will still be fans of Ripple once all has been said and done is likewise questionable.

In sum, XRP will not go to zero anytime soon, though it is in an incredibly vulnerable position because of the SEC’s suit against Ripple. By the time the suit concludes there may not be enough interest left in the project to keep it relevant.

For XRP to survive, it needs to stay in the top 100 cryptocurrencies by market cap – the higher the better. If XRP falls out of the top 100, it may also never get seriously picked up by retail investors during this bull run and could fade into irrelevance as a consequence.