Celebrity coins are the latest trend that has captivated not just the crypto space but also the few fans these washed-up celebrities still have.

From one-hit wonders and forgotten reality TV stars to athletes past their prime and influencers nobody follows anymore, many of these Z-listers are diving into the crypto market, giving their faded fame the crypto spin.

While the allure of celebrity-backed coins is strangely compelling, this new frontier of digital finance is fraught with both opportunities and significant risks.

In this article charting the wild world of celebrity coins, we explore the motivations behind these ventures, as well as the legal and financial pitfalls celebrities face. We also examine the top celebrity coins and provide insights from industry experts on the future of this questionable trend.

Also, here is Guy's take on celebrity coins:

Understanding Memecoins

Memes have become a staple of digital culture, serving as humorous, relatable expressions that spread rapidly online. From images to catchy phrases, memes resonate globally, evolving continuously as they are shared and remixed. Platforms like Reddit, Twitter, and Instagram have popularized memes like "Rickrolling," "LOLCats," and "Doge."

Memecoins blend internet culture with cryptocurrency, embracing humor over serious imagery. They are the jesters of the cryptoverse, thriving on social media hype and embodying the speculative nature of the crypto market. Memecoins can skyrocket or crash based on market sentiment, making them both exciting and volatile. The memecoin industry now boasts a market cap of about $45 billion.

Memecoins Blend Internet Culture with Cryptocurrency. Image via Shutterstock

Memecoins Blend Internet Culture with Cryptocurrency. Image via ShutterstockIn 2013, Dogecoin emerged as the first meme-based cryptocurrency, inspired by the "Doge" meme featuring a Shiba Inu dog with humorous captions. Initially conceived as a joke, Dogecoin gained significant traction, becoming a cultural phenomenon with a large market cap. It also demonstrated the potential for positive social impact, with the Dogecoin community raising funds for various causes, such as sending the Jamaican bobsled team to the Olympics and supporting clean-water projects in Kenya.

Check out our article charting the evolution of memecoins.

Fame Through the Ages

Back in the day, being a celebrity meant you were a true icon — consider Beethoven, whose musical genius captivated the world.

As we moved into the modern era, mass media birthed stars like Audrey Hepburn and Elvis Presley. They had genuine talent, but their public images were meticulously crafted to perfection. Then came the tabloids, turning celebrities into commodities and their lives into a series of public dramas. Suddenly, their scandals were more captivating than their work.

In the 1500s and 1600s, celebrity culture kicked off with a bang as the printing press allowed everyone to gossip about politicians, philosophers, performers, and playwrights. Fast forward to the 18th and 19th centuries, when London's gossip sheets were all the rage. These papers dished on the scandals of the elite, giving the public their first taste of celebrity dirt. Suddenly, even aristocrats and intellectuals were tabloid fodder.

Come the 1830s, newspapers got cheaper and flooded the market, boosting celebrity coverage. With steamships and railways, gossip wasn't just local anymore — it went global. Celebrities couldn't hide from the prying eyes of the press, no matter where they were.

Today, Celebrities' Faces Are Plastered Across Maganizes. Image via Shutterstock

Today, Celebrities' Faces Are Plastered Across Maganizes. Image via ShutterstockThen reality TV crashed the party, turning everyday folks into instant celebrities just for existing on camera. Fame no longer required talent; simply being notorious was enough.

Hollywood didn't invent celebrity culture, but it sure perfected it. Film stars lost control over their lives as studios managed their images down to the last detail. Case in point: Marilyn Monroe. Known as a "dumb blonde" sex symbol, her public persona was a PR creation, not reality. For reference, her IQ was said to be 165, higher than famed theoretical physicist Albert Einstein.

The came the paparazzi in the 1950s. No longer satisfied with staged photos, magazines paid big bucks for candid, often humiliating pics, making celebrities more accessible — and more miserable — than ever. However, it wasn't until the birth of TMZ in November 2005 that the hunt for celebrity snapshots turned into a full-blown sport.

Today, the explosion of social media apps like TikTok and Instagram has democratized fame, allowing anyone to become a "celebrity." These platforms have made it possible for ordinary people to amass huge followings by sharing snippets of their lives, talents, or simply entertaining content.

In some ways, this has returned celebrity culture to its roots, where recognition is based on creativity and connection rather than just manufactured images. However, this also means the market is saturated with fleeting internet stars, and the lines between “influencers” and attention-seekers are blurrier than ever.

The Psychological Appeal of Celebrity Endorsements

Madonna hyped NFTs featuring bored ape cartoons, Tom Brady endorsed the now-defunct crypto exchange FTX and Kim Kardashian promoted EMAX tokens on Instagram.

Celebrity endorsements have been around forever, but why do these endorsements work? Forbes took a crack at this question.

Celebrity Endorsements Have Been Around Forever. Image via Shutterstock

Celebrity Endorsements Have Been Around Forever. Image via ShutterstockFirst off, we're hardwired to recognize faces, which is a throwback to our survival days when recognizing a friendly or threatening face was crucial. Jeff Stibel, who has written extensively about the human brain, notes that while this ability helped us survive, it's not great at distinguishing between real-life friends and TV faces. So, when celebrities endorse products, our brains automatically trust those familiar faces, even if they’re selling snake oil.

According to an article in Knowledge at Wharton, humans and primates alike tend to follow high-status individuals. If a celebrity uses a product, we’re more likely to think it’s worth buying because, well, they’re successful, and success must mean good choices, right? Michael Platt, a neuroscientist, explains that this behavior is rooted deep in our brains, making us more likely to choose products endorsed by people we admire.

Then there's the halo effect. This cognitive bias makes us transfer our admiration for a celebrity to the products they endorse. If we think a celeb is stunning and charming, we’ll assume their endorsed facial cream has the same qualities. Professor Richard Lehman and Simon Moore, a consumer psychologist, highlight that the more we believe a celebrity genuinely likes the product, the stronger the halo effect. Moore notes that if we think a celeb endorses a product because they truly like it, not just for the cash, our positive attitude towards the brand increases.

To top it off, Platt shares an experiment with monkeys to prove this point. They found that monkeys preferred brands endorsed by sexy or powerful monkeys. So, apparently, even our primate cousins fall for celebrity marketing tricks.

If only being a celebrity meant you were immune to mistakes!

Promising Dreams, Delivering Nightmares

With their legions of fans and endless resources, you'd think these stars have it all figured out. But no, they’re as prone to blunders as the rest of us mere mortals — sometimes even more so.

Take Madonna, for instance. The Queen of Pop decided to jump on the NFT bandwagon and proudly endorsed Bored Apes. At one point, she was “hellbent” on buying Bored Ape #3756 for $1.3 million but ended up paying $466,000 for Bored Ape #4988. The singer also holds two World of Women NFTs, paying about $13,000 for each. In addition, she also partnered with digital artist Beeple to launch her own NFTs, which were sold and the proceeds went to charity.

But Madonna's and other celebrities' foray into these NFTs didn't turn out so well for them.

Madonna Developed a Liking for Bored Apes. Image via Shutterstock

Madonna Developed a Liking for Bored Apes. Image via ShutterstockAccording to a class-action lawsuit filed in L.A., these stars allegedly teamed up to pull a fast one on unsuspecting investors. The list of accused celebs is like a who's who of Hollywood and sports, featuring Kevin Hart, Gwyneth Paltrow, Madonna, Justin Bieber, Serena Williams, Jimmy Fallon, Paris Hilton, Snoop Dogg, The Weeknd, Post Malone, and Steph Curry, among others. The plaintiffs demanded at least $5 million in damages, claiming these celebs pumped up NFT prices and conveniently forgot to mention they were getting paid for their promotions.

Apparently, these celebs used social media and other platforms to hype up Bored Ape NFTs, causing their prices to skyrocket. They even roped in MoonPay to help transfer ownership of these digital doodads, making it all seem very high-tech and legit. Jimmy Fallon, who once dubbed MoonPay the “PayPal of crypto” on his show, is among those caught in this digital drama.

Yuga Labs, of course, denies everything, calling the claims “opportunistic and parasitic.”

The 2021 bullrun brought celebs out from the woodwork to promote blockchain-related projects — from exchanges to little-known tokens, everything was fair game. Here are a few other famous faces and their crypto crashes:

- Athletes Tom Brady, Steph Curry, Shaquille O'Neill, Naomi Osaka, and Shohei Otani, along with supermodel Gisele Bundchen, all hopped onto the crypto bandwagon, featuring in ads for the now-infamous exchange FTX. “I’m getting into crypto with FTX. You in?,” Brady asked, inviting everyone to join the party. Unfortunately, FTX crashed spectacularly in 2022, taking many dreams with it, after co-founder Sam Bankman-Fried and Caroline Ellison were caught in a massive fraud scandal.

- Not to be outdone in the crypto calamity, Matt James teamed up with BlockFi, an exchange heavily tied to FTX. When FTX went down, BlockFi quickly followed, declaring bankruptcy soon after.

- Then we have the boxing legend Mike Tyson, whose NFT collection turned out to be a knockout — just not in the way he hoped. With some NFTs plummeting over 99%, they became nearly worthless.

- Backstreet Boys member Nick Carter crooned the praises of the SafeMoon token, which also plummeted by over 98%. Adding to the drama, the U.S. Securities and Exchange Commission and the Department of Justice slapped SafeMoon and its execs with fraud, unregistered securities, and money laundering charges.

- Basketball star Paul Pierce boasted about making more money with the EthereumMax token than he ever did at ESPN. Fast forward a bit, and that token tanked too. Disgruntled investors didn't take it lying down — they sued Kim Kardashian, Floyd Mayweather Jr., Pierce and others for allegedly misleading them in promoting the token.

- Billionaire Mark Cuban, ever the risk-taker, dabbled in liquidity providing with the TITAN token. It soared to an all-time high, only to crash and burn, becoming worthless.

- And let’s not forget Mayweather and DJ Khaled, who were charged by the SEC for promoting Centra, a project whose co-founder ended up behind bars for fraud.

In this star-studded saga of crypto endorsements gone wrong, it makes you wonder why so many celebrities are still rushing to launch their own coins. Are they hoping to strike gold, or just itching for another headline?

The Rise of Celebrity Coins

The latest crypto mutation kicked off in late May 2024, and now celebrities like Caitlyn Jenner and Iggy Azalea are diving headfirst into the world of digital tokens.

They’re riding the wave of Solana-based memecoin mania fueled by the politically themed Doland Tremp and Jeo Boden tokens. Thanks to the Pump.fun platform, creating a new memecoin is as easy as pie. Thousands are being churned out daily, mostly by scammers, skyrocketing for a few hours before crashing or, in classic fashion, rug-pulling minutes after launch.

Jenner made headlines by launching her JENNER token on the Solana blockchain. It quickly hit a market cap of over $40 million, thanks to social media buzz and wild speculation. Not wanting to miss out on the fun, rapper Iggy Azalea launched her MOTHER token, also on Solana, which soared in value despite a rocky start.

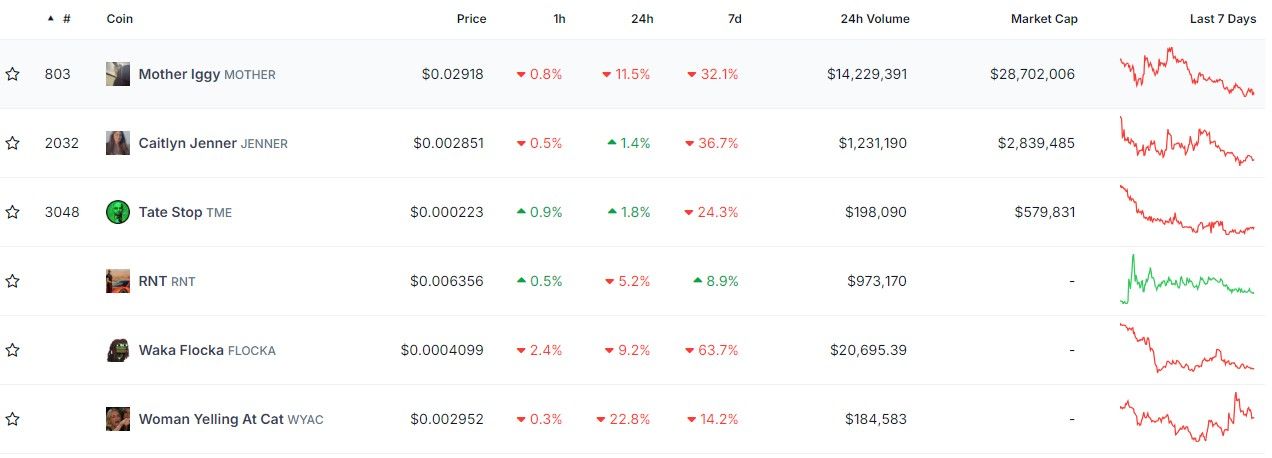

The Top Celebrity Coins. Image via CoinGecko

The Top Celebrity Coins. Image via CoinGeckoBut the celebrity memecoin craze didn't stop with Jenner and Azalea. Nigerian singer Davido joined the party with his DAVIDO token. However, critics claimed it was pre-mined and dumped, raising serious eyebrows. Even minor celebs like rapper Soulja Boy have jumped on the bandwagon amidst the growing hype. Boxer Ryan Garcia is also planning to launch his own coin.

Top Celebrity Coins

So, how are these coins doing now? Not good.

MOTHER

Australian rapper Iggy Azalea has been actively promoting her celebrity memecoin, MOTHER, on social media platform X. It is currently the largest celebrity-themed token. The MOTHER/SOL pair was launched on May 28, 2024, following controversy over a previous token associated with her. Despite rumors of involvement with Sahil Arora, Azalea clarified that MOTHER was a solo effort. The Solana and crypto community have responded positively to the token.

MOTHER, Like Other Such Tokens, Isn't Doing So Well These Days. Image via CoinGecko

MOTHER, Like Other Such Tokens, Isn't Doing So Well These Days. Image via CoinGeckoAt the time of writing, MOTHER boasts a market cap of over $28.7 million. It is currently down 87.3% from its all-time high of $0.2306, which it achieved on June 6, 2024, when it was bolstered by promotion from Azalea and support from influencers and projects like Solana-based Kamino Finance, which added MOTHER to its liquidity vaults. Azalea holds 3% of the total token supply and has pledged to burn part of her holdings whenever a celebrity memecoin rugs. The token's success is driven by active community involvement and listings on centralized exchanges like HTX, MEXC, Gate, and LBank.

JENNER

Caitlyn Jenner, the American celebrity and former athlete, launched the JENNER memecoin on May 26, 2024, using Pump.fun and later listing it on the Raydium Dex. The coin initially soared to a market cap of over $43 million, outpacing the trading volume of the Solana meme coin WIF, largely due to Jenner's active social media promotion. It is currently down 68.4% from its all-time high of $0.00782, which it hit on June 2, 2024.

JENNER is Currently Down 68.4% from Its ATH. Image via CoinGecko

JENNER is Currently Down 68.4% from Its ATH. Image via CoinGecko The market cap of JENNER is currently $2.8 million. Expanding her reach, Jenner introduced the JENNER memecoin to the Ethereum blockchain on May 29, 2024, and pledged some of the revenue from the Ethereum-based coin to support Donald Trump’s re-election bid. Currently, JENNER is traded on HTX exchange, MEXC, Gate Exchange, and various decentralized exchanges on both Solana and Ethereum.

Why Solana?

Solana houses memecoins with some of the wildest names I've come across. Here's a sampling:

- Jeo Boden

- Doland Tremp

- Harambe on Solana

- ADA the Dog, which has the same ticker symbol as Cardano's ADA

- Pepe Uwu

The Solana ecosystem has emerged as a prime platform for memecoins due to its fast transaction speeds, low fees, and vibrant community. Key factors include:

- Onchain Program Development: Solana allows developers to deploy programs directly on the blockchain, eliminating the need for intermediaries and enhancing decentralization.

- 400ms Slot Times: Rapid transaction confirmations with a target slot time of 400 milliseconds ensure quick user interactions.

- Low Fees: With a median fee of just 0.00015 SOL per transaction, Solana is accessible to users worldwide.

- High Throughput: Capable of processing thousands of transactions per second, Solana can handle large-scale applications efficiently.

Solana's performance has attracted developers and investors since the 2020-2021 crypto bull market. Unlike other networks that faced rising costs and slower processing times, Solana maintained efficiency and affordability, making it ideal for launching memecoins.

The Solana community also plays a crucial role, providing a supportive environment for launching and promoting new tokens. Developers leverage this community to coordinate PR campaigns and social media activities, boosting the visibility and virality of memecoins. Platforms like Twitter, Telegram, and Discord buzz with discussions, driving continuous innovation and the emergence of new memecoins on Solana.

Commodifying Fame: Why Celebrities Are Creating Tokens

With the global adoption of cryptocurrency on the rise, fueled by popular Telegram games and increased recognition from traditional markets via ETFs, it’s no surprise that crypto has become a new tool for self-promotion, Becky Sarwate, head of communications at CEX.io, told The Coin Bureau. However, launching a token is vastly different from endorsing a product. While both can raise brand awareness, only one can create an entire economy. Unfortunately, this distinction often goes unconsidered by celebrities entering the crypto market.

This commodification of celebrity targets fans, encouraging them to demonstrate their commitment by turning popularity into a tradeable asset. "Unfortunately, this doesn’t appear to be a consideration for celebrities dipping a toe into market-making. Rather, this commodification of celebrity targets fans to prove their commitment by turning popularity itself into an object of exchange," Becky added.

Launching a Token is Vastly Different From Endorsing a Product. Image via Shutterstock

Launching a Token is Vastly Different From Endorsing a Product. Image via ShutterstockFor many celebrities, she said, entering the crypto market is akin to chasing a trend, opting for the quickest and cheapest route to profit. "Choosing the quickest and cheapest route to a profit is just Business 101. However, updating this concept for the current market sheds helpful clarity: Why endorse products when celebrity itself can be the product?" Becky questions.

Despite potential long-term harm to the industry, the appeal to celebrities is clear. "Experience and past events suggest these gambits will hurt the industry in the long run, but their appeal to celebrities can be easily summed up in one word: profit," Becky added.

As celebrities continue to dive into the crypto market, the broader implications for both the industry and the fans who invest in these tokens remain a critical concern. The trend of commodifying fame through celebrity tokens underscores the need for more cautious and informed approaches to crypto investments, she concluded.

The Regulatory Angle

Celebrity coins, often endorsed by high-profile public figures, are emerging as speculative assets linked to social media influence and public endorsements. However, this trend is not without its pitfalls and regulatory concerns.

Opportunism in the Crypto Space

Becky said the crypto culture's embrace of innovation often leaves participants vulnerable to questionable projects. "There’s always been an element of opportunism in the crypto space," Becky remarked. "Its mechanics, and in some ways the culture itself, encourage a certain credulity that can leave trusting participants vulnerable to questionable projects." She compares the current celebrity token frenzy to the initial NFT boom, the metaverse, and the surge in "AI" solutions, noting that such trends often result in unsustainable hype due to oversold promises and uninspiring functionality.

Becky further questioned the necessity of celebrity tokens, emphasizing that their creation appears to prioritize greed-driven aspects of digital asset exchange. "The question remains: Why does a celebrity need a token? Where the SEC fines levied at Kim Kardashian, Steven Segall, et al. resulted from improper disclosure, selling unlicensed securities is historically a much bigger issue for regulators."

Experts Have No Doubt That The SEC Will Go After Celeb Coins. Image via Shutterstock

Experts Have No Doubt That The SEC Will Go After Celeb Coins. Image via ShutterstockThe SEC's Continued Vigilance

David Chung, founding director of Creo Legal, echoes Becky's concerns and highlights the considerable legal risks celebrities face when promoting crypto tokens. "The SEC will continue their crusade against celebrities who promote crypto tokens. Celebrities have a huge influence on the general public and an outsized ability to persuade people to spend their money," Chung notes. He underscores that the SEC views most crypto assets as securities and will not hesitate to enforce securities laws against non-compliant individuals.

Chung elaborates on the complexities and regulatory requirements involved if a token is considered a security. "If a celebrity sells crypto tokens to the public and those tokens are considered securities, they must comply with securities regulations by registering those securities, providing public disclosure, and complying with numerous other requirements. It’s a lot of work to comply with these rules and I’m not seeing any celebrity doing it."

Potential Consequences and Legal Repercussions

Both experts agree on the severe consequences celebrities could face if they fail to comply with regulations. Becky points out that "unless Caitlyn Jenner or Iggy Azalea filed the proper paperwork to create a financial instrument from which they directly benefit, a knock at the door from the SEC feels inevitable." She emphasizes that the lack of oversight in these projects often disproportionately benefits project leaders while passing risks to retail consumers.

Chung highlights past SEC actions as a warning to current celebrities. “To give you an idea of the size of the fines, Kim Kardashian agreed to pay $1.26 million to settle with the SEC after she failed to publicly disclose that she was paid to promote a crypto project. It’s uncertain what the fine would have been if she had not settled and been found guilty, but it could certainly have been more than what she paid.”

Celebrity Coins: The Good, The Bad And The Ugly

Behind the buzz lies a landscape fraught with risks — from manipulation tactics to regulatory uncertainties. This overview explores the influence of figures like Sahil Arora, the impact of social media on token volatility, and the broader implications for both investors and the crypto market at large.

- The Influence of Sahil Arora: Sahil Arora has played a pivotal role in orchestrating and promoting celebrity memecoins, often without their full knowledge, leading to accusations of manipulation and price crashes. His involvement includes using manipulated screenshots to promote these tokens, which contravenes platform regulations. Azalea has distanced herself from Arora, while Jenner and rapper Rich the Kid have accused him of scams related to memecoins bearing their endorsements.

- Impact of Social Media: Platforms like Instagram, Twitter (X), and TikTok amplify the reach of celebrity memecoins, enabling rapid price increases but also making them vulnerable to manipulation and short-lived hype cycles.

- Criticism from Vitalik Buterin: Ethereum co-founder Vitalik Buterin criticized celebrity memecoins for lacking substance and societal value, contrasting them with purpose-driven projects like Stoner Cats that fund tangible initiatives.

- Pursuing Real-World Applications: Efforts to integrate celebrity influence with real-world applications aim to add utility and longevity to celebrity memecoins by leveraging their fanbase for broader adoption. For example, Azalea has announced that holders of the MOTHER and SOL tokens can use them to buy phones or monthly cell plans.

- Regulatory Scrutiny and Investor Protection: Growing regulatory scrutiny focuses on influencer-driven projects to safeguard investors, demanding clearer guidelines and better transparency to mitigate risks associated with scams and market volatility.

- Risks of Volatility: Celebrity memecoins, like all cryptocurrencies, are highly volatile assets prone to rapid price swings. Their value often hinges on community sentiment rather than robust tokenomics, leading to heightened instability in trading.

- Copyright Challenges: Many celebrity tokens operate without the explicit consent of the individuals they reference, raising copyright concerns. Unauthorized use of images or intellectual property can result in legal actions that impact both the project's viability and investors' financial outcomes.

Echoes of 2021: Celebrity Coins and the NFT Craze

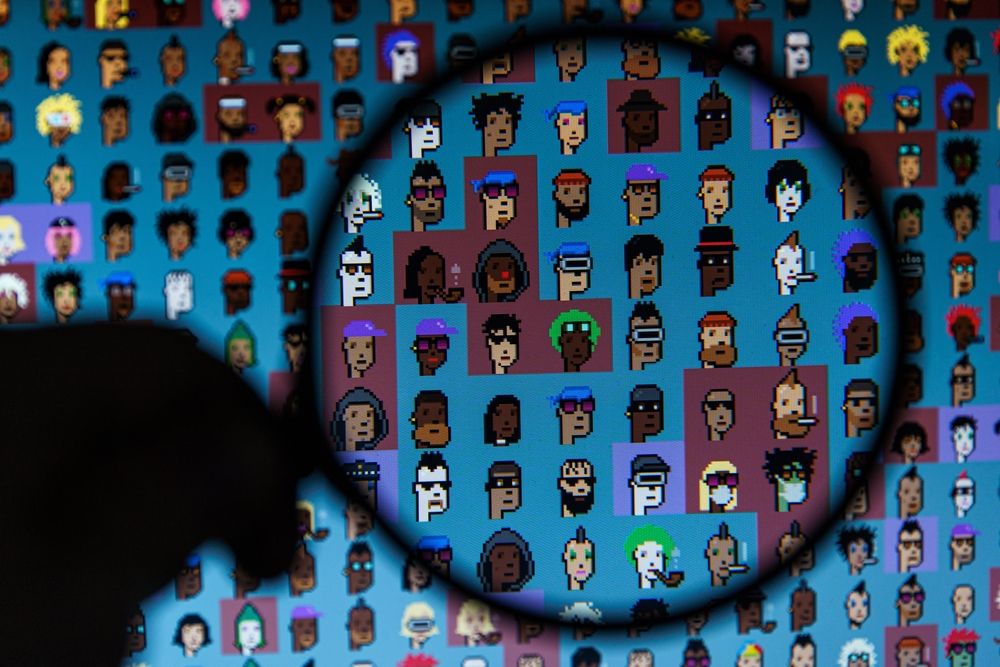

The current frenzy surrounding celebrity memecoins mirrors the speculative fervor that characterized the NFT craze of 2021. Just as non-fungible tokens surged in popularity as digital collectibles tied to celebrities, artists, and cultural moments, celebrity memecoins have emerged as speculative assets linked to public figures' endorsements and social media influence.

The Current Celeb Memecoin Mania Draws Parallels to the 2021 NFT Craze. Image via Shutterstock

The Current Celeb Memecoin Mania Draws Parallels to the 2021 NFT Craze. Image via ShutterstockSimilar to the initial NFT boom, which saw a rush of creators and investors into the market without clear valuation metrics or sustainable utility, celebrity memecoins are often launched without robust tokenomics or real-world utility. Both phenomena highlight a trend where the perceived association with fame and social influence drives rapid price appreciation, attracting investors hoping to capitalize on hype rather than intrinsic value.

However, both markets also face scrutiny for sustainability and regulatory concerns. The oversaturation of NFTs with little demand and the subsequent market correction served as a cautionary tale for speculative investments. Likewise, the volatility and susceptibility to scams in the celebrity memecoin market raise similar red flags about investor protection and market integrity.

Despite these challenges, the parallels suggest that lessons learned from the NFT craze can inform a more nuanced approach to celebrity memecoins. Just as the success of NFTs became increasingly tied to their association with reputable brands and tangible assets like real estate, future developments in the celebrity memecoin space may benefit from integrating more substantial value propositions and regulatory clarity.

While the current excitement around celebrity memecoins echoes the speculative frenzy of NFTs, the path to sustainable growth and broader market acceptance may require a shift towards more structured tokenomics, genuine utility and responsible endorsement practices by celebrities and influencers alike.

Celebrity Coins: Closing Thoughts

The emergence of celebrity coins signifies a fascinating yet turbulent intersection of fame and cryptocurrency.

The motivations behind celebrities launching their own coins are varied. Some see it as a new avenue for monetizing their fame, while others may be chasing the latest trend in digital finance. However, the regulatory landscape is complex and fraught with challenges, as celebrities must navigate securities laws and the potential for legal repercussions if they fail to comply.

The current craze for celebrity memecoins bears a striking resemblance to the NFT boom of 2021, characterized by speculative investments driven by hype rather than intrinsic value. As with the NFT market, the celebrity coin market faces challenges related to sustainability, regulatory scrutiny, and investor protection. The ease of creating tokens and the potential for manipulation add to the volatility and risk.

Despite these challenges, the phenomenon of celebrity coins underscores a broader trend of commodifying fame in the digital age. For celebrities, the potential for profit is clear, but the long-term impact on their brand and the crypto industry remains uncertain.

While celebrity coins offer a novel and captivating aspect of the crypto market, they require careful consideration and a clear understanding of the associated risks. The future of this trend will likely depend on greater regulatory clarity, more robust tokenomics, and a shift towards genuine utility and responsible endorsements.