Bitcoin has never been part of the staking conversation until now.

While the Bitcoin network itself doesn’t support staking, a growing ecosystem of protocols is unlocking new ways to put BTC to work. From native staking frameworks on Bitcoin-adjacent chains to liquid restaking protocols on Ethereum, Bitcoin holders today have more options than ever to earn yield, enhance capital efficiency, and contribute to decentralized security models.

In this guide, we’ll break down how Bitcoin staking and restaking works, explore the top protocols, and examine the risks you need to know before getting started.

Key Takeaways

- Top BTC staking and restaking protocols include Babylon, Sovryn, Stacks, Core, EigenLayer and Pendle, each offering ways to earn yield on Bitcoin through staking, wrapped tokens, and DeFi integrations.

- Bitcoin doesn’t support staking natively, but Layer-1/2 solutions like Stacks and Core, and Ethereum-based protocols using wrapped BTC (e.g., tBTC, uniBTC) unlock staking and restaking options.

- Protocols like Babylon and Core allow BTC to remain in self-custody while earning yield, whereas EigenLayer and Pendle use wrapped tokens for restaking and DeFi yield strategies.

- Wrapped BTC mechanisms vary in trust and security, ranging from centralized custodians to trust-minimized bridges using multisig or cryptographic proofs.

- Restaking platforms like EigenLayer amplify returns by letting BTC holders re-delegate wrapped tokens into AVSs, earning rewards beyond base staking.

- Risks include smart contract vulnerabilities, bridge exploits, slashing penalties, and fluctuating reward rates, all of which require ongoing monitoring.

Understanding Bitcoin Staking and Restaking

Bitcoin’s original proof-of-work design does not support staking and has no roadmap for adopting staking or any proof-of-stake mechanism. All so-called “Bitcoin staking” methods are third-party inventions, layering additional functionality on top of Bitcoin without altering its core protocol.

This bifurcates into two primary ecosystems:

- Bitcoin-based L1/L2 protocols: These use upgrades like Taproot to introduce smart contracts enabling native BTC staking, such as Stacks (sBTC), Core (CLTV staking), and Rootstock/Sovryn (RBTC).

- Ethereum ecosystem using wrapped BTC: Platforms like Babylon and restaking protocols like EigenLayer rely on wrapped BTC tokens (wBTC, tBTC, uniBTC) deployed on Ethereum to enable staking and restaking services.

Why Wrapping BTC is Essential

Native Bitcoin lacks smart contract capabilities and programmability. To stake or restake, BTC must often be wrapped, typically involving:

- Custodial wrapping: BTC is sent to a custodian address and equivalent ERC‑20 tokens are issued like wBTC.

- Trust-minimized protocols: Systems like tBTC or sBTC use multi-sig or SPV-based bridges, retaining on-chain BTC custody via cryptographic guarantees.

- Platform-specific pegging: Chains like Stacks utilize multisig signer sets to mint sBTC tied to BTC locked on Bitcoin, preserving decentralization.

This process enables BTC to participate in DeFi, staking, and modular blockchain ecosystems where its native protocol cannot tread.

Benefits of BTC Staking

- Activating idle capital: BTC that would otherwise sit unused can now earn yield.

- Driving protocol growth: Staking demands increase TVL, spurring liquidity and adoption across Bitcoin-adjacent DeFi.

- Enhancing cryptoeconomic security: Native staking (Stacks, Core, Sovryn) extends Bitcoin’s influence across ecosystems. Wrapped staking (Babylon, EigenLayer) crowdsources BTC security for other chains.

- Expanding utility: With staking, BTC holders gain governance rights, liquidity, and access to DeFi ecosystems, enabling them to do more with their already owned BTC.

What Is Restaking in the Crypto Ecosystem?

Restaking emerged as an innovation in the Ethereum ecosystem. It allows holders of ETH or Liquid Staking Tokens (LSTs), like stETH or rETH, to redelegate their already-staked assets into new services. Key points:

- ETH is first locked in Ethereum’s proof-of-stake system.

- The corresponding LST (e.g., stETH) can then be restaked into services like EigenLayer, earning extra yield.

- This earns users rewards from both Ethereum’s base staking and the security of Actively Validated Services (AVSs). Think oracles, bridges, rollups, etc.

Role of LSTs

LSTs are key enablers of restaking:

- They retain liquidity, representing ownership of staked ETH.

- LST holders can participate in DeFi and also restake into AVSs, compounding yields.

- Protocols like Lido, Rocket Pool, and Liquid Collective issue LSTs supported in restaking platforms.

Benefits of Restaking

- Cost-effective security: AVSs or layer-2 protocols can tap into existing staked capital instead of building standalone validator communities, reducing time, cost, and complexity.

- Yield amplification: Stakers earn base ETH rewards and additional AVS token incentives, potentially doubling or tripling yield.

- Security pooling: By pooling staked assets across multiple AVSs, EigenLayer and others create a richer cryptoeconomic security layer that propagates Ethereum’s strength into new realms.

Bitcoin itself remains immutable proof-of-work with no staking support; any BTC staking is a layered construct. Many techniques involve wrapping BTC or using smart contract chains derived from Bitcoin (Stacks, Core, Sovryn) to deliver native staking yield and utility. Benefits include unlocking idle funds, driving TVL growth, and enabling multi-layer yield generation.

Combined, these practices represent a significant shift: doing more with the Bitcoin you already own, expanding its financial utility while preserving trust and decentralization.

Key Benefits of Bitcoin Staking and Restaking

Bitcoin Staking Allows Holders To Put Their Assets To Work. Image via Shutterstock

Bitcoin Staking Allows Holders To Put Their Assets To Work. Image via Shutterstock1. Yield Generation from Idle BTC

Bitcoin staking allows holders to put their assets to work instead of holding passively. By staking BTC, whether natively on Bitcoin-adjacent protocols or via wrapped tokens, users can earn yield in the form of staking rewards, protocol fees, or token incentives. Though rates vary, even modest annual returns can compound over time, creating an alternative to traditional passive holding strategies.

2. Enhanced Capital Efficiency

Staking models, especially those involving liquid staking derivatives (LSDs), unlock new layers of capital efficiency. With liquid staking, users can stake BTC while simultaneously using its derivative token in DeFi applications, enabling yield stacking strategies. This dual utility maximizes the potential of each BTC, allowing participation in multiple protocols without sacrificing staking rewards.

3. Access to DeFi and New Use Cases

Staking protocols expand Bitcoin’s role within decentralized finance ecosystems. Through staking platforms and wrapped token systems, BTC holders gain access to lending, borrowing, liquidity provision, and governance participation — use cases not available through Bitcoin alone. This broadens the utility of BTC beyond a store of value.

4. Contributing to Network Security

In many staking ecosystems, including restaking protocols like EigenLayer and Babylon, staked BTC helps secure networks or decentralized services. Whether by supporting validators, securing consensus, or providing economic guarantees, staking transforms passive BTC holdings into active contributors to blockchain infrastructure.

5. Doing More with Bitcoin You Already Own

Perhaps the most compelling advantage is the ability to unlock additional financial utility without liquidating holdings. Staking lets BTC holders amplify their asset’s productivity — earning yield, participating in governance, or supporting new networks — while retaining exposure to Bitcoin’s long-term value proposition.

In essence, Bitcoin staking bridges the gap between Bitcoin’s security ethos and the evolving demands of decentralized finance, making BTC a more versatile financial instrument.

Comparison of Top BTC Staking Protocols

Here’s a summary table capturing the key Bitcoin staking and restaking protocols we’re about to discuss, along with their yield sources, estimated APR, and BTC handling method:

| Protocol | BTC Handling | Yield Source | Est. APR (as of July 2025) | Custody Type |

|---|---|---|---|---|

| Babylon | Native BTC locked via EOTS on Bitcoin | Rewards from securing PoS networks (split with $BABY stakers) | ~0.42% | Non-custodial (BTC remains on-chain) |

| Sovryn | Wrapped BTC (RBTC) on Rootstock | Lending interest, liquidity pool fees, SOV incentives | ~0.29% (lending) | Non-custodial (via Rootstock two-way peg) |

| Stacks (sBTC) | sBTC pegged via multisig signer set | Bitcoin paid to sBTC holders + DeFi yields (Zest, Bitflow, Velar) | ~5% (base) up to ~30% (DeFi boosted) | Non-custodial (multisig controlled peg) |

| Core | BTC locked via CLTV time-lock on Bitcoin | CORE token rewards from validator elections and block rewards | Up to ~5.4% (max with dual staking) | Non-custodial (BTC remains in wallet) |

| EigenLayer | Wrapped BTC (e.g., tBTC) restaked on Ethereum | AVS service fees on top of base staking rewards | ~4–5% (on top of BTC LST yields) | Custodial (depends on BTC derivative) |

| Pendle Finance | Yield tokens derived from BTC staking platforms (e.g., uniBTC, SolvBTC) | PT/YT token trading fees + yield exposure via AMM | Varies: ~1–5% (depending on token) | Varies by token (non-custodial if LSD-backed) |

Top Bitcoin Staking Protocols to Explore in 2025

In this section, we’ll break down the top staking protocols for Bitcoin worth exploring this year, so you can earn while you HODL.

Babylon

Babylon is a non‑custodial protocol that enables native BTC staking on the Bitcoin blockchain—no bridging, wrapping, or custodians involved. You stake BTC directly using Extractable One‑Time Signatures (EOTS) to strengthen security for Proof‑of‑Stake chains, known as “Bitcoin‑Secured Networks” (BSNs). This occurs via the Babylon Genesis chain, a Cosmos‑SDK Layer‑1 network, powered by Cosmos IBC interoperability.

Babylon Enables Securing Other Networks With Staked BTC | Image via Babylon

Babylon Enables Securing Other Networks With Staked BTC | Image via BabylonHow staking in Babylon works & how it earns yield

- Lock BTC via EOTS on Bitcoin’s UTXO set, designating a Finality Provider (validator). BTC remains on‑chain in your self‑custody wallet.

- Delegation: Your locked BTC supports BSNs, contributing to their consensus security.

- Reward distribution: Yield is sourced from:

- BSNs paying native token rewards (e.g., $BABY)

- Staking rewards on Babylon Genesis itself

- Rewards split: Babylon’s model distributes rewards 50/50 between BTC stakers and BABY token stakers on the Genesis chain.

This architecture allows native, flexible BTC staking with built‑in security measures and liquidity.

Yield estimates & protocol stats

- APR: ~0.41–0.42% (current BTC staking yield)

- TVL: ($4.6–5.6 billion) staked on Babylon Genesis

- Finality Providers: ~60–250 globally distributed validators securing the protocol

- Phase‑2: Launched Q1 2025 with the Babylon Genesis chain and BABY token distribution

Babylon delivers true native BTC staking, retaining on‑chain custody and enabling multi‑chain security. While current yield is modest (~0.4% APR), protocol TVL (≈57,000 BTC) reflects strong adoption. Upcoming features like multi‑staking across BSNs and enhanced liquidity will boost yield and utility.

Sovryn

Sovryn is a non‑custodial, permissionless DeFi platform built on the Bitcoin sidechain Rootstock (RSK). It offers a full suite of DeFi services — trading, lending, borrowing, margin trading, liquidity provisioning — all using BTC and other assets via RBTC (Rootstock‑pegged Bitcoin) and ERC‑20–style tokens (e.g., USDT, ETH, DLLR, SOV).

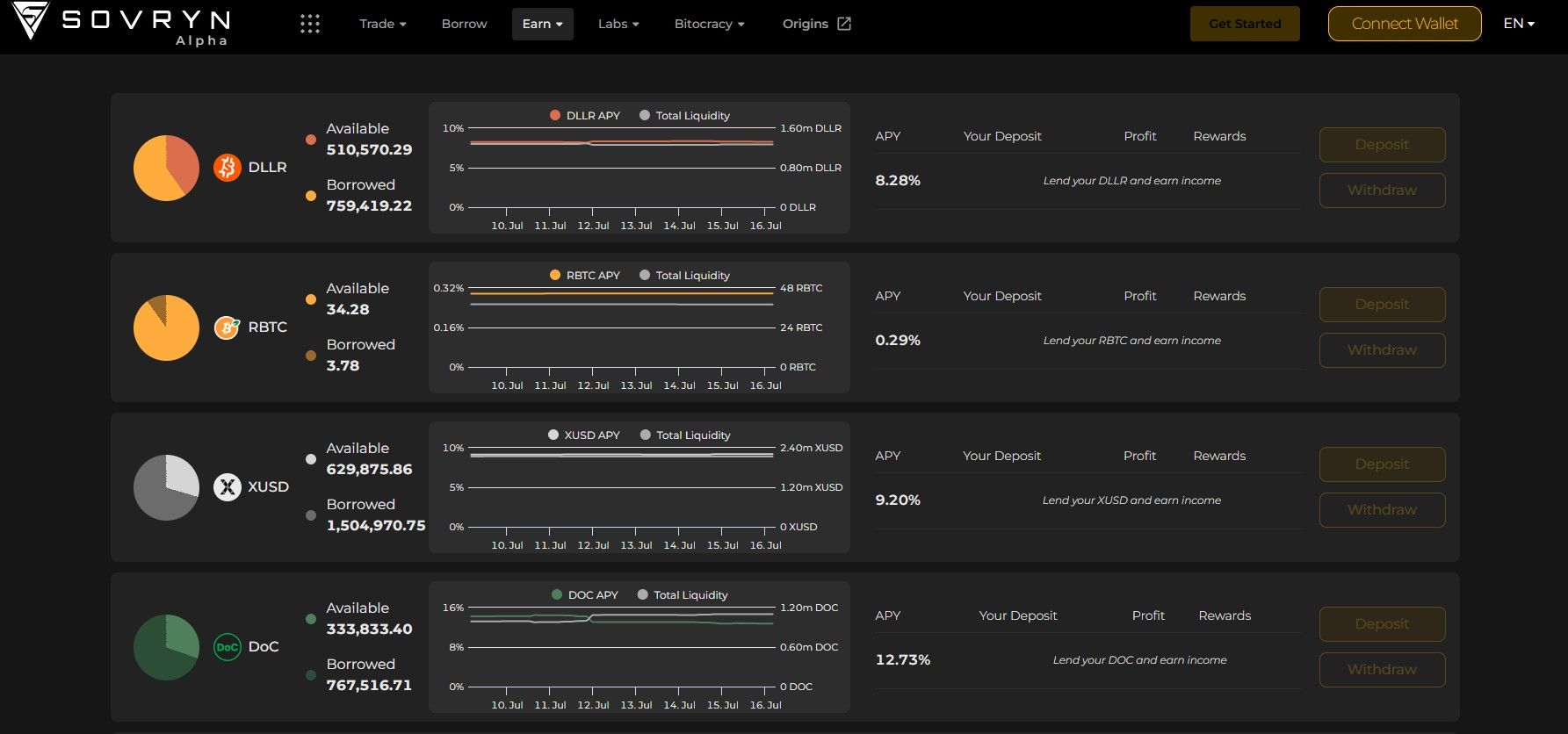

You Can Lend RBTC on Sovryn to Earn Yield | Image via Sovryn

You Can Lend RBTC on Sovryn to Earn Yield | Image via SovrynIt operates as a DAO, with its native SOV token granting holders governance rights, revenue sharing, and fee‑earning capabilities.

How Sovryn is Built on Rootstock

- Sovryn runs entirely on RSK, a Bitcoin‑secured, EVM‑compatible sidechain that enables smart contracts, fast transactions, and low fees via merge-mining.

- BTC is bridged into the network as RBTC, a 1:1 pegged token minted through a PoW‑peg mechanism protected by federated nodes and SPV proofs.

How Users Stake & Earn Yield

- Lending RBTC in Sovryn’s lending pools pays varying APYs.

- Providing liquidity on Sovryn’s AMMs earns fees plus SOV token incentives.

- Staking SOV tokens via Sovryn’s “Bitocracy” DAO framework allows holders to earn a share of protocol revenue, including borrowing and redemption fees, AMM revenue, and early redemption penalties.

Yield Estimates & Protocol Metrics

- RBTC Lending APR: ~0.29% (July 2025)

- TVL: approximately 103 BTC locked in RSK-based Sovryn pools.

- Security & decentralization:

- Operates on an audited, Immunefi-backed bug bounty program with rewards up to $1 million.

- Protocol governance follows a community-driven Bitocracy DAO.

Sovryn delivers a robust Bitcoin-native DeFi experience—built on RSK—to enable lending, trading, margin, and revenue-sharing staking, all in a non-custodial fashion. While RBTC lending yields are modest (~0.3% APR), the DAO structure and multiple revenue streams (AMM fees, borrowing fees, token incentives) offer flexibility and governance participation.

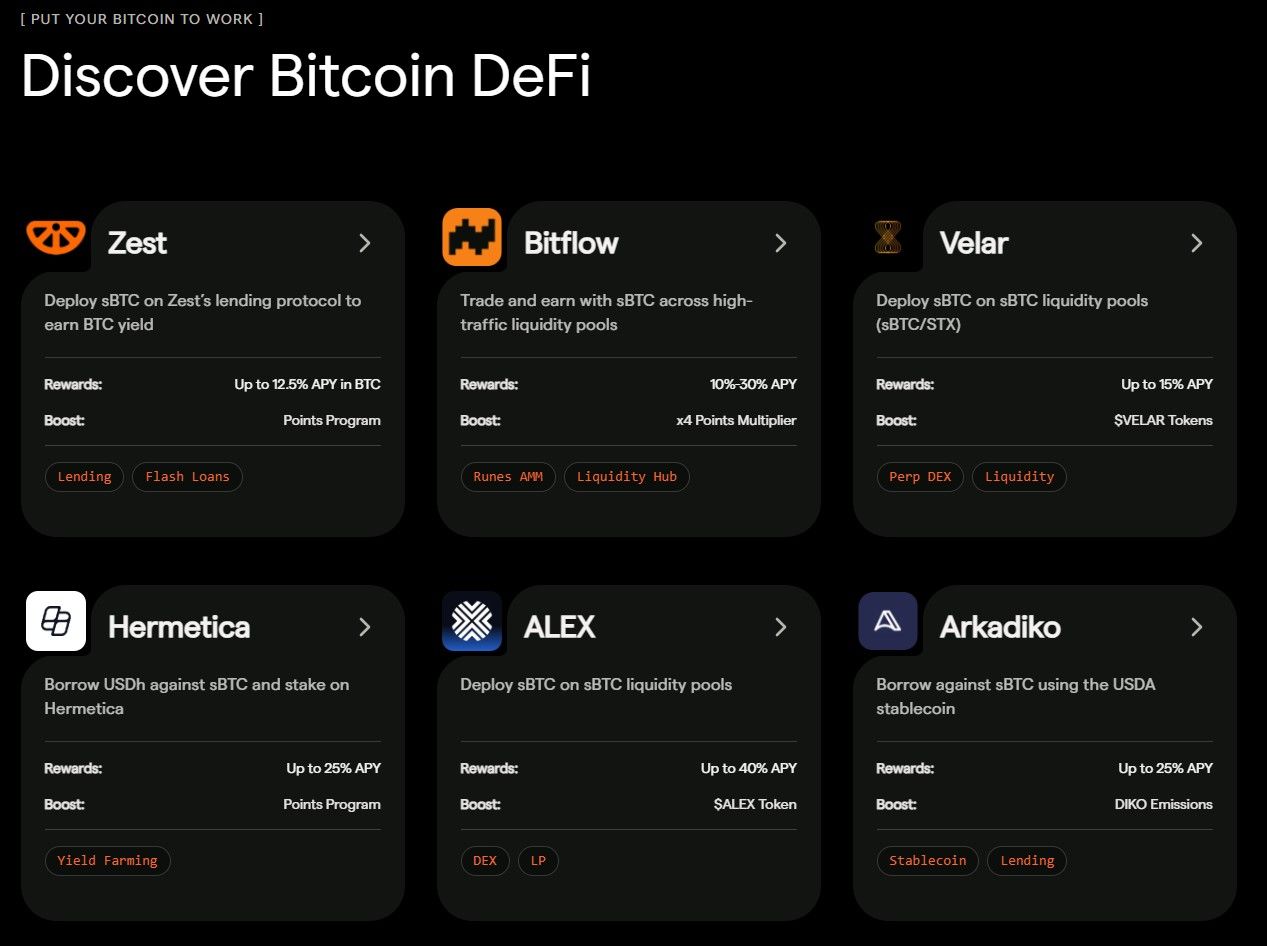

Stacks

Stacks (formerly Blockstack) is a Bitcoin layer-2 smart contract platform that enables decentralized applications and smart contracts, anchored to Bitcoin’s security via its Proof-of-Transfer (PoX) consensus model. Users lock BTC to mine or “stack” STX tokens and earn Bitcoin–denominated rewards. The network fully preserves Bitcoin finality while extending programmability.

Some Yield Opportunities With sBTC | Image via Stacks

Some Yield Opportunities With sBTC | Image via StacksHow Stacks Creates and Maintains sBTC

- sBTC is a 1:1 decentralized, Bitcoin-pegged asset managed via a multisig signer set composed of STX stackers.

- To mint sBTC, users lock BTC in the multisig contract monitored by signers; peg-out returns are governed similarly.

- This design retains 100% Bitcoin finality, with no central custodian, ensuring decentralization and transparency.

Yield Opportunities With sBTC

- Holding sBTC — yields ~5% APY, paid in sBTC every two weeks. Reward sources include Bitcoin paid to STX stackers and redirected to sBTC holders.

- Zest Protocol — deploy sBTC for up to 12.5% APY: ~5% base + 7.5% bonus.

- Bitflow Finance — stake sBTC in liquidity pools with yields between 10–30% APY, depending on pool boosts and volume.

- Velar — earn up to 15% APY via sBTC liquidity pools and potential additional token rewards.

Stacks enables trust-minimized, liquid Bitcoin exposure with strong security. Holding sBTC alone generates passive ~5% APY, while leveraging DeFi apps like Zest, Bitflow, and Velar yields 10–30%.

Users should balance smart contract and multisig risks against attractive returns. Stacks offers a compelling option for Bitcoin holders seeking yield within a Bitcoin-secured DeFi environment.

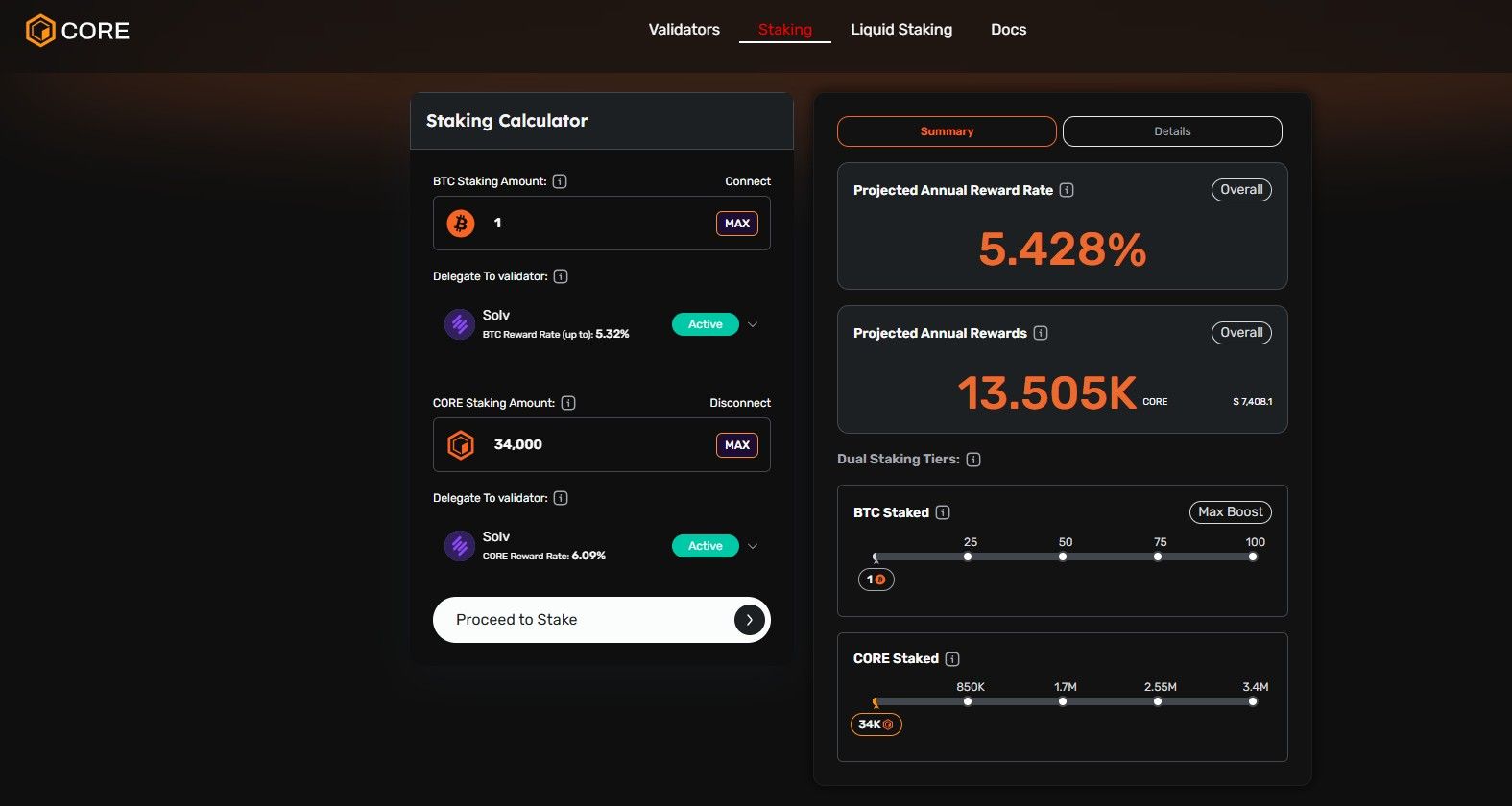

Core Chain

Core is an EVM-compatible Layer-1 blockchain secured by Bitcoin through its innovative Satoshi Plus consensus model, which combines Bitcoin mining (via hash power delegation) and Delegated Proof-of-Stake (DPoS) by CORE token holders. Users non-custodially time-lock BTC in their own wallets using CLTV to earn voting power in validator elections and receive CORE token rewards.

A Snapshot of APR on Core in July 2025 | Image via Core

A Snapshot of APR on Core in July 2025 | Image via CoreHow Core Creates and Maintains BTC Staking via Satoshi Plus

- Users lock BTC using CLTV, keeping full custody, and designate validator candidates on Core.

- Bitcoin miners, by signaling hash power, also participate in validator selection.

- The dual mechanism draws on Bitcoin’s PoW security and DPoS dynamics to protect the network and award CORE tokens from block emissions and transaction fees.

- BTC never leaves user wallets; all staking is enforced via Bitcoin’s timelock protocols—no wrapping or bridges required.

Yield Mechanism & Dual Staking

- Base staking yields CORE tokens funded by:

- Block rewards are gradually distributed over an 81‑year emission schedule

- Transaction fees within the Core chain.

- Dual Staking unlocks higher BTC yields when users stake both BTC and CORE. Yield tiers (Boost, Super, Satoshi) are determined by the CORE-to-BTC ratio.

- Delegated hashing by miners can further enhance yield for CORE stakers.

Yield Estimates & Protocol Stats: Base APR for BTC staking: around 5.4%, rising to max yield (~5.65%) when participating in Dual Staking.

Core is the first truly non‑custodial Bitcoin staking platform that marries Bitcoin security with DeFi usability, offering 5–6% APR in CORE rewards, boosted further via Dual Staking. Its Satoshi Plus model leverages both Bitcoin miners and CORE staking, creating a robust hybrid consensus.

Best Liquid Restaking Protocols Accepting Bitcoin

Liquid restaking has become one of the hottest trends in crypto. Thanks to innovative cross-chain solutions and Bitcoin Layer 2s, you can now restake BTC and earn additional rewards without giving up liquidity.

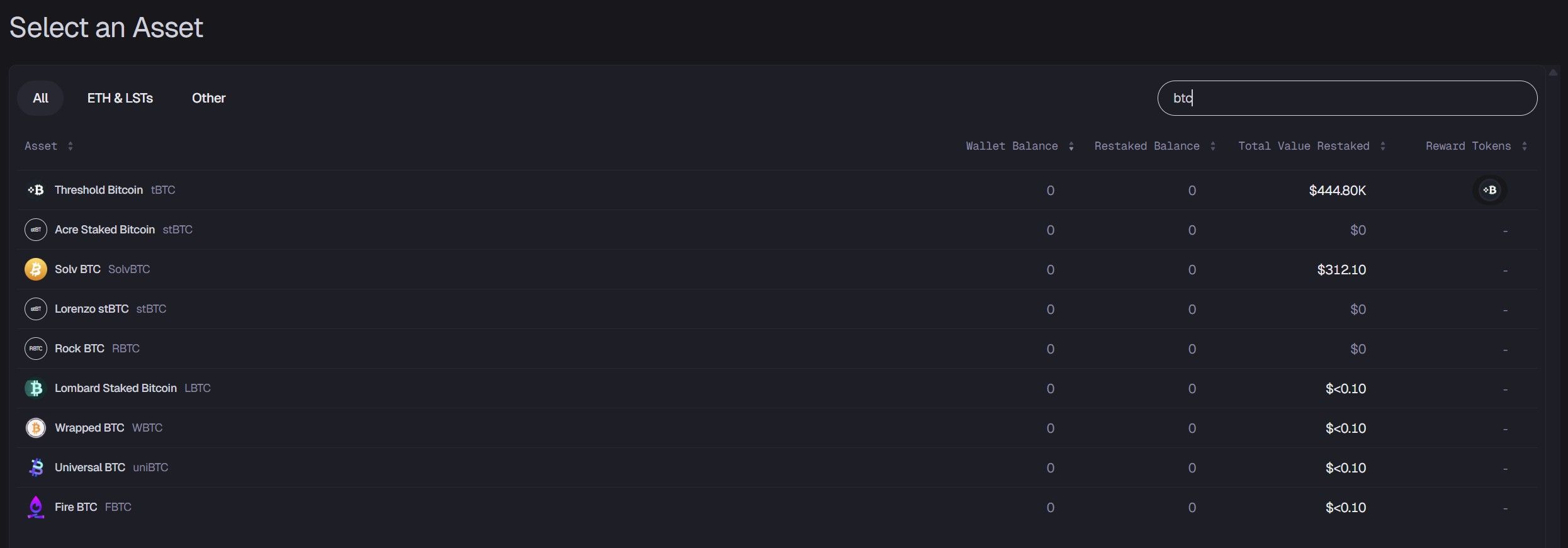

EigenLayer

EigenLayer is an Ethereum-based restaking protocol that enables users to delegate previously staked assets—ETH, liquid staking tokens (LSTs), and select wrapped tokens like BTC derivatives—to operators securing Actively Validated Services (AVSs). Restaking essentially “reuses” existing staked collateral to fund additional services beyond Ethereum.

- Users lock ETH or LSTs (e.g., stETH, rETH) into EigenLayer smart contracts.

- Delegation is sent to operators (often Ethereum validators), who run AVSs like bridges, oracles, or rollups.

- Operators assume extra slashing risk—if they misbehave or fail, the restaked collateral can be slashed.

- In return, restakers earn extra yield from AVS reward programs while keeping base staking returns.

- EigenLayer thus creates a marketplace for cryptoeconomic security; restakers choose operators and services based on yield vs. risk, and AVSs tap into shared security capital without bootstrapping their own validator networks.

Supporting BTC Derivatives

- EigenLayer has expanded beyond ETH/LSTs to accept vetted wrapped Bitcoin tokens, such as tBTC, for restaking. This allows BTC holders to earn additional yield by restaking tBTC into services that leverage EigenLayer’s infrastructure, combining native staking and AVS yield opportunities.

- As of July 2025, users have restaked approximately $443,300 worth of tBTC on EigenLayer.

- This demonstrates early adoption and confidence among BTC holders looking to leverage their assets further.

tBTC is the Only Bitcoin-Based Asset With Significant Restaked Liquidity on EigenLayer | Image via EigenLayer

tBTC is the Only Bitcoin-Based Asset With Significant Restaked Liquidity on EigenLayer | Image via EigenLayerEigenLayer offers a powerful way for BTC holders to restake wrapped BTC derivatives like tBTC into an expanding ecosystem of Ethereum-based AVSs. With $443k already restaked as of July 2025, it's a growing but cautious use case.

While additional yield is attractive, users must weigh complex slashing risks and system-level vulnerabilities. Still, if you're looking to boost yield beyond holding tBTC and trust the AVS operators, EigenLayer is one of the most accessible restaking routes for Bitcoin-backed assets.

Pendle Finance

Pendle Finance is a complex DeFi platform focused on yield tokenization, enabling users to separate yield-bearing assets into two parts: the Principal Token (PT) and Yield Token (YT). This structure supports fixed yield exposure, speculation, and liquidity through a tailored AMM. For a deeper dive, check Coin Bureau’s Pendle Finance Review and How to Use Pendle Finance.

Why It's on the List

Pendle doesn’t stake assets directly; instead, it offers isolated exposure to the yield component of yield-bearing tokens, including those with Bitcoin roots, without having to stake them yourself. This makes it a powerful tool for BTC-based yield exposure via tradable tokens.

Bitcoin-Derived Yield Tokens on Pendle

- uniBTC: A liquid yield token based on Babylon Chain’s sBTC mechanism. Minted on Ethereum, it provides yield exposure to Babylon staking without needing direct interaction.

- SolvBTC.BNB: A BTC-stable token deriving yield from Binance’s yield pools, featuring a Solv Finance second-layer. Through Pendle, users can buy or trade its future yield separately from principal.

Pendle’s AMM structure allows users to swap PT and YT tokens, giving precise control over yield exposure and capital allocation.

Risks to Consider

- Yield expectations are often embedded in token prices: PT or YT may trade at a premium or discount that reflects market views on future yield.

- Successful profit requires market-timing and understanding price-yield divergence.

- Smart contract & protocol risk: Multi-layer dependencies (Source platform → Pendle → AMM) amplify potential vulnerabilities, especially for niche BTC yield tokens.

Pendle Finance offers a versatile tool for isolating, trading, or locking yield on Bitcoin-based assets, without direct staking. However, navigating this market requires a sophisticated understanding of token pricing and yield risks, making it ideal for informed, strategic users.

Risks and Considerations for Bitcoin Staking

While staking Bitcoin can open the door to passive income, it’s not without risks. From smart contract vulnerabilities and bridge exploits to slashing penalties and custodial risks, staking BTC requires careful due diligence.

Smart Contract and Bridge Risks

Most Bitcoin staking methods—especially those involving wrapped BTC or cross-chain staking—introduce smart contract and bridge risks.

Wrapped BTC (like wBTC, tBTC, RBTC) depends on custodians, multi-signature setups, or bridge contracts to maintain the token's peg and redeemability. This creates potential vulnerabilities to smart contract bugs, governance attacks, or validator collusion.

Even platforms claiming non-custodial models rely on complex contract logic or off-chain signer coordination (e.g., Stacks multisig, Babylon EOTS).

Historical exploits—such as bridge hacks on Wormhole, Multichain, or Poly Network—show that bridges and smart contracts remain high-risk attack surfaces.

Security audits and bug bounty programs reduce risk but do not eliminate it. Therefore, users should evaluate the track record of each protocol, the transparency of its security model, and the presence of active audit programs or slashing mechanisms before staking.

Volatility and Reward Variability

Bitcoin’s price is inherently volatile, and this impacts staking returns in two ways. First, any yield denominated in BTC or platform tokens may fluctuate sharply in USD terms. A staking reward of 5% APY in BTC may look attractive, but adverse price swings could reduce its real-world value or profitability.

Second, staking rewards are often subject to governance decisions. Platforms may adjust reward rates, slashing penalties, or validator incentives based on market conditions or DAO votes.

This means Bitcoin staking returns are rarely fixed and can decrease over time, especially in newly launched protocols or those relying on token emissions.

For users, this underlines the need for continuous monitoring of both market conditions and protocol governance updates when staking Bitcoin.

How to Start Staking Bitcoin Today

Unlike Ethereum staking, there’s no universal method for staking Bitcoin. Each protocol uses its system, ranging from direct Bitcoin time-locks to wrapped token staking on other chains. Some require specialized wallets, others interact via DeFi platforms.

Here’s a quick look at how it works across the protocols we covered:

- Babylon: Stake BTC directly by locking it via Extractable One-Time Signatures (EOTS) using supported wallets. You delegate to Finality Providers on the Babylon Genesis Chain and earn rewards after a ~2-day staking round.

- Stacks (sBTC): Use Stacks-compatible wallets like Hiro or Xverse. You mint sBTC by locking BTC in a signer-governed multisig and can deploy sBTC on platforms like Zest, Bitflow, or Velar to earn yield.

- Sovryn: Bridge BTC to RBTC using the RSK peg system, then lend, stake, or provide liquidity via Sovryn’s dApp. Access via Rootstock-compatible wallets.

- Core: Lock your BTC using Bitcoin’s CLTV function via compatible tools, designate validators on the Core Chain, and optionally dual-stake CORE for higher yields.

- Pendle & EigenLayer: Acquire wrapped BTC tokens like tBTC or uniBTC and deposit them directly on Ethereum-based platforms like EigenLayer or Pendle via standard Web3 wallets like MetaMask.

In all cases, it’s critical to follow the official platform guides to ensure correct staking setup and avoid errors that could lock your funds.

Choosing the Right Platform

Selecting a Bitcoin staking or restaking platform hinges on three factors:

- Understanding the Yield Source — Are rewards from protocol emissions, validator fees, or DeFi yields?

- Custody Model — Does BTC stay in your wallet, go into a multisig, or require bridge custody?

- Risk vs. Reward Tradeoff — Are you comfortable with the smart contract, bridge, or price risks relative to the yield offered?

Each protocol presents its own balance of these factors, so a careful, informed evaluation is essential before committing your BTC.

Closing Thoughts

Bitcoin staking is shaping up to be a fast-evolving extension of Bitcoin’s utility, not a replacement for its core role, but a way to unlock new financial applications. Protocols like Babylon and Core focus on Bitcoin-native security layers, while platforms like Pendle and EigenLayer offer restaking and DeFi-based opportunities.

Each option comes with its own balance of custody, yield potential, and risk exposure. To make the most of this space, it’s crucial to understand the source of returns and the risks tied to each protocol. As the ecosystem grows, so do the ways to deploy BTC effectively.