Navigating the crypto markets can feel like a daunting task, especially for newcomers. Copy trading has revolutionized the investment landscape by providing newcomers and seasoned traders alike with the ability to replicate the success of experienced investors effortlessly, often with just a few clicks.

Whether you're a novice looking to piggyback on seasoned traders' success or an experienced investor aiming to broaden your portfolio, numerous platforms now offer copy trading features to assist you in reaching your financial goals.

In this article, we'll unveil the top crypto copy trading platforms, dissect its benefits and drawbacks, and provide insights into selecting the right platform. From user-friendly interfaces to avoiding common pitfalls, we'll cover everything you need to know to embark on your copy-trading journey with confidence and clarity.

What is Crypto Copy Trading?

You've likely heard tales of legendary traders who seem to have the Midas touch, turning every trade into gold. But here's the thing — you're not exactly a trading prodigy yourself (yet!). That's where crypto copy trading swoops in to save the day!

Copy trading is like having a talented friend who's a wizard in the kitchen. You know, the kind of pal who can whip up gourmet dishes with ease. So, every time this culinary genius cooks up something delicious, you eagerly ask for the recipe and follow it step by step.

Now, imagine applying this same concept to trading. Copy trading is basically that! Instead of slaving over charts and market trends, you find a seasoned trader whose moves you admire. Then, instead of making your own trading decisions, you simply mimic their trades.

Let's break it down a bit. Say you're copying a trader on Bybit. They decide to sell some Bitcoin, setting up a plan with a specific risk-to-reward ratio and exit point. With copy trading, you don't need to stress over the details. The copy trading software does all the heavy lifting, replicating the trade in your account according to your chosen risk settings. Easy peasy!

Now, there's also social trading, which is like gathering with friends to share cooking tips. Except, in this case, it's traders sharing investment insights and trade signals. You can join social trading groups on platforms like Facebook or Telegram to get advice from other traders. It's a great way to learn from the pros and connect with fellow traders, but it's not as hands-off as copy trading.

But here's the deal: just like following a recipe doesn't guarantee a five-star meal every time (hello, burnt cookies!), copy trading doesn't promise identical results to the original trader's performance. Market conditions can vary, just like ingredients or cooking techniques. But hey, it's still a fantastic way to benefit from the expertise of more experienced traders without having to spend years mastering the craft yourself.

Just remember to do your research, set your risk parameters, and enjoy the ride!

How to Choose a Crypto Copy Trading Platform

If you're on the prowl for the best crypto copy trading platform, here are a few things you should keep in mind.

- User-Friendly Interface: Clunky interface? We don't do that here. You should opt for a platform with a user-friendly interface that's easy on the eyes.

- Trade Execution Speed: The world of cryptocurrency trading is fast-paced and every second counts. That's why it's important to choose a platform that can execute trades quickly and efficiently. Look for a platform that offers high-speed execution, ensuring that you never miss out on a trading opportunity due to sluggish performance.

- Risk Management Tools: Protecting your investments is important, which is why it's essential to choose a platform that offers robust risk management tools. Features like stop-loss and take-profit levels can help you minimize losses and maximize gains.

- Customization Options: Every trader is unique, which is why it's essential to choose a platform that offers plenty of customization options. Whether you're looking to adjust parameters like leverage level, stop-loss levels, trade size, or maximum exposure, a platform with robust customization options allows you to tailor your trading strategy to suit your individual preferences and risk tolerance.

- Security Measures: Security should always be a top priority when it comes to choosing a copy trading platform. Look for a platform that prioritizes security and employs stringent measures to protect your funds, personal information, and sensitive details from potential threats. Additionally, ensure that the platform is compliant with relevant regulations.

- Customer Support: Reliable customer support is a cornerstone of any successful trading platform. Look for a platform that offers responsive and knowledgeable customer support, ensuring that you can get assistance and resolution for any issues or concerns that may arise during your trading journey. Whether you prefer live chat, email support, or phone assistance, choose a platform that offers multiple channels of communication for your convenience.

- Transparent Performance Metrics: Transparency is essential when evaluating the performance of potential traders to copy. Look for a platform that provides clear and transparent performance metrics, including historical returns, success rates, actual drawdown rates, risk levels, and trading history. These metrics can help you make informed decisions about which traders to copy, ensuring that you have all the information you need to maximize your chances of success.

- Diverse Pool of Traders: When it comes to copy trading, variety is key. Look for a platform that boasts a diverse pool of traders, ranging from seasoned veterans to up-and-coming newcomers. A diverse pool of traders increases your chances of finding someone whose trading style aligns with your preferences, allowing you to build a well-rounded and diversified copy trading portfolio.

Top Crypto Copy Trading Platforms

In this section, we'll highlight the best crypto copy trading platform. So, let's begin.

Bybit

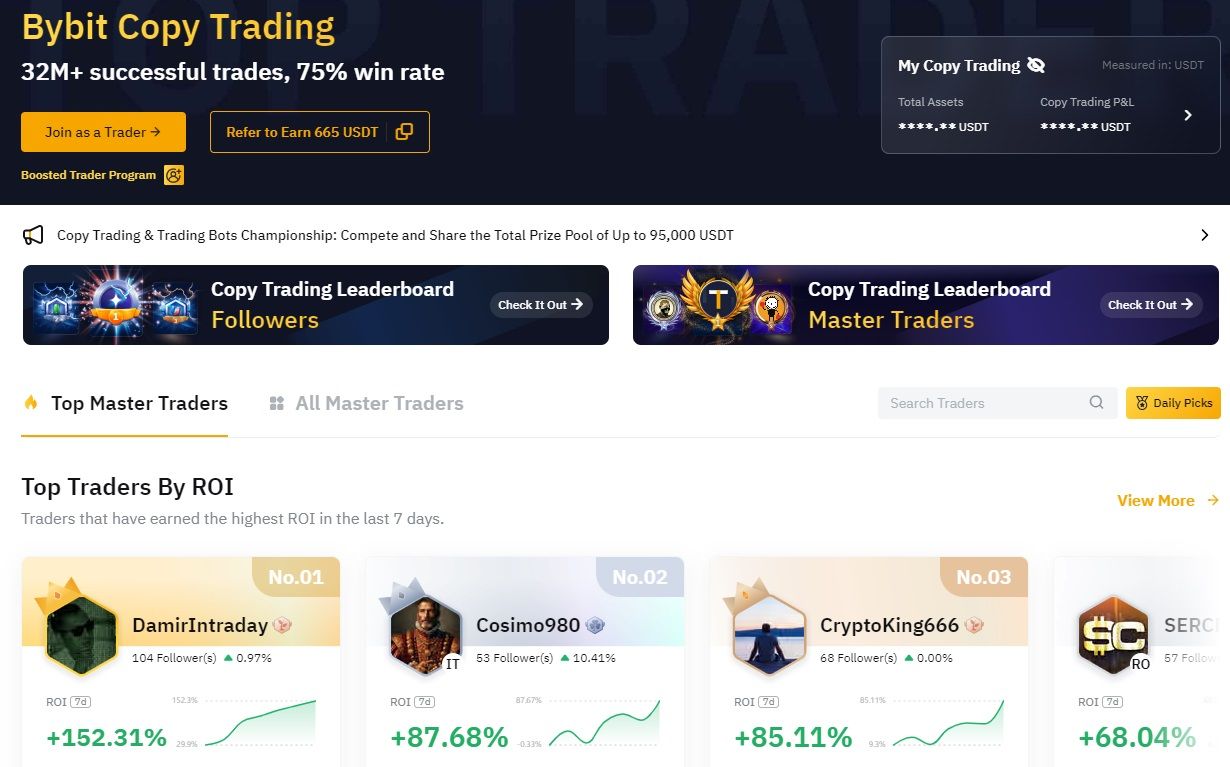

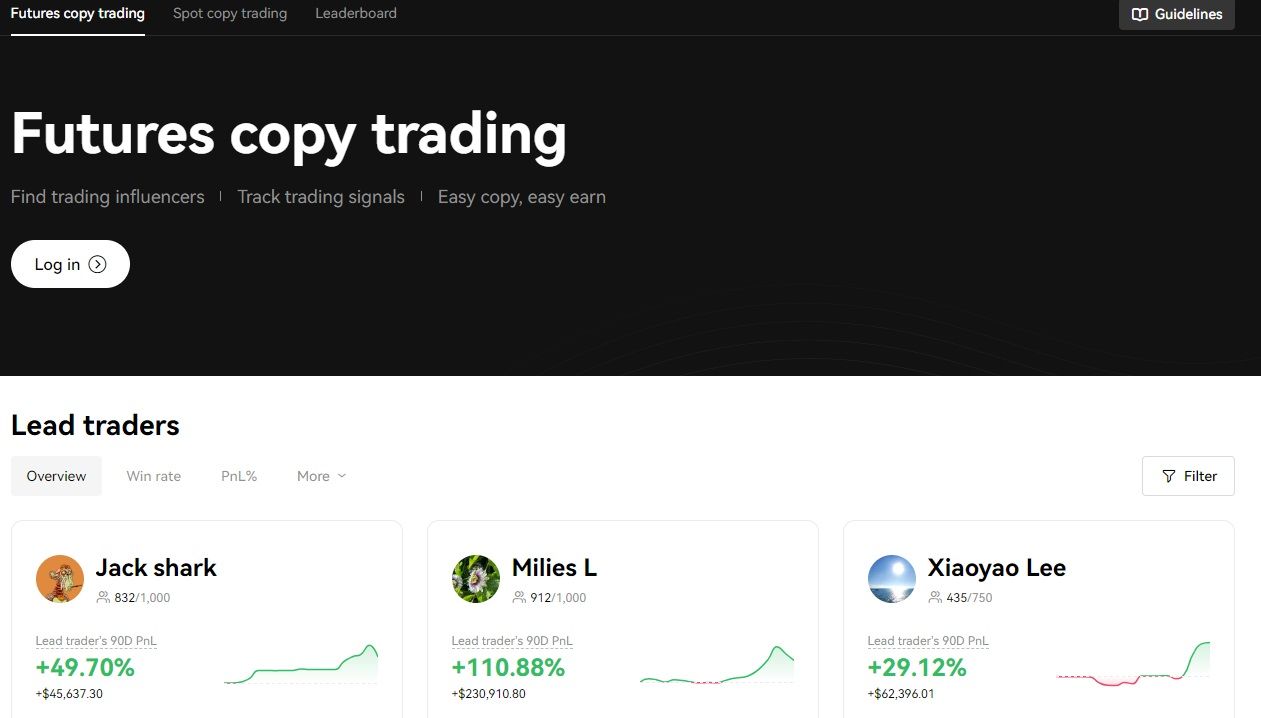

Bybit categorizes copy traders into two distinct groups, each with its own role and benefits within the platform ecosystem.

Bybit Copy Trading Homepage. Image via Bybit

Bybit Copy Trading Homepage. Image via BybitFirstly, there are the followers. These individuals opt to replicate the trading strategies employed by seasoned investors on the platform. By aligning themselves with these experienced traders, followers effectively delegate their trading decisions, placing trust in the expertise and established track records of those they choose to follow.

Then, we have the traders. These are the proficient and adept investors who have honed their skills over time and have garnered a following of interested individuals keen to emulate their trading strategies. Traders have the opportunity to showcase their approaches and methodologies, attracting new followers who seek to replicate their success.

Importantly, traders stand to earn a percentage of the profits generated by each follower who copies their trades, thereby incentivizing them to continue delivering successful outcomes for their followers. The amount they receive is contingent upon their level as a trader on the platform, which is determined by various factors including their trading performance and the size of their following.

Users engaging in copy trading on Bybit's derivatives platform are subject to the same trading and funding fees incurred by active traders. Bybit employs a fee structure that includes maker/taker fees of 0.02%/0.055%.

Check out our full review of Bybit copy trading and our in-depth Bybit review.

Bitget

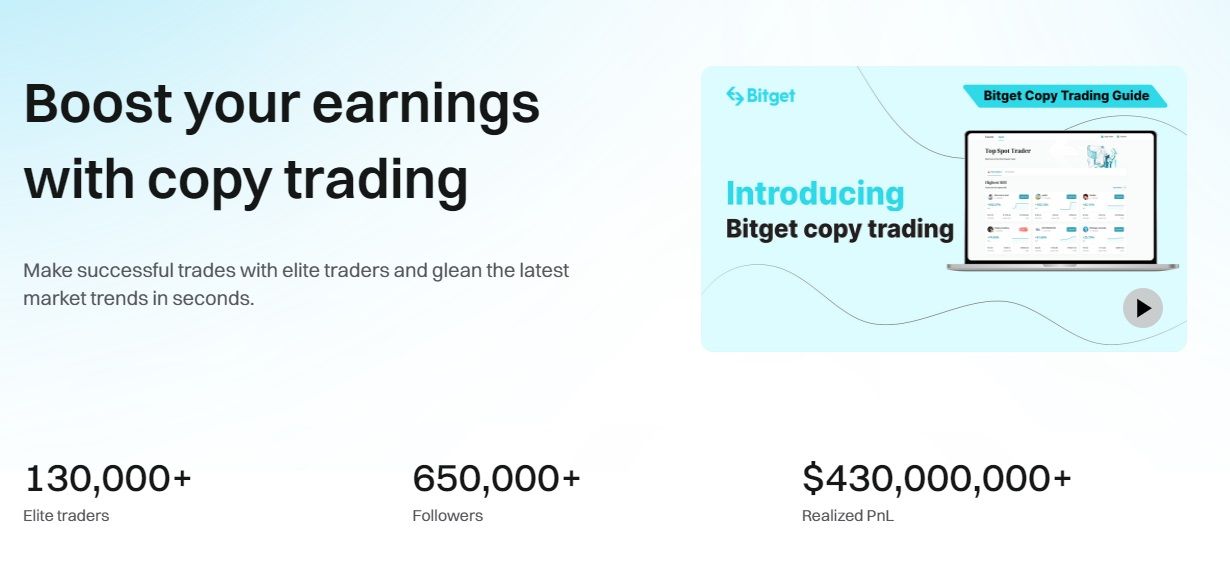

Bitget copy trading is another sought-after service within the crypto community. With over 100,000 registered traders on the Bitget exchange, users have access to a diverse pool of strategies to emulate.

Bitget Copy Trading Homepage. Image via Bitget

Bitget Copy Trading Homepage. Image via BitgetBitget offers four types of copy trading options:

- Futures Trading: Allows users to copy the strategies of futures traders.

- Spot Trading: Enables users to replicate the actions of spot traders.

- Bot Trading: Users can either copy existing trading bots or purchase them.

- Custom Bot Creation: Advanced users have the option to design their own trading bots.

Basic Bitget Copy Trading bots cater to beginners or individuals with simpler trading needs. These include options like Spot Auto-invest and Spot Grid for spot trading, as well as Futures Grid for futures trading.

For those seeking more sophisticated strategies, Bitget also provides advanced copy trading bots such as Spot Martingale, Futures Martingale, Spot CTA, and Futures CTA. However, it's worth noting that these advanced bots carry higher risk levels and may not be suitable for novice traders.

You can find out more in our Bitget copy trading review. Our full Bitget review covers everything you need to know about this exchange.

eToro

One of the key advantages of CopyTrader is its fee structure. Unlike traditional managed portfolios that often come with management fees, eToro's CopyTrader incurs no additional charges. Users can sign up for eToro and start copying other traders without worrying about hidden costs or management fees.

eToro Copy Trading Homepage. Image via eToro

eToro Copy Trading Homepage. Image via eToroThat's not to say there aren't any fees though — you will still be charged spreads on the trading and/or transaction fees where applicable. For reference, there is a 1% fee applied to both buying and selling cryptoassets. This fee is incorporated into the market price, also known as the bid-ask spread, which is the difference between the buying (bid) and selling (ask) prices.

Traders being copied through eToro's CopyTrader feature are compensated directly as part of the platform's Popular Investor Program, with an annual payment of 1.5% of assets under copy, paid out monthly.

Users retain full control over their portfolios when using CopyTrader. They can choose to copy one trader or up to 100 simultaneously, pause or stop copying at any time, and adjust their investment amounts as needed. Speaking of, the minimum amount required to copy a trader on eToro is $200, with a minimum amount for each copied position set at $1 to ensure efficient portfolio management.

For those interested in trying out CopyTrader risk-free, eToro offers a demo mode where users can practice with a virtual portfolio worth $100,000 before committing any real capital.

👉 Sign up for eToro and easily buy Bitcoin & Trade Stocks!

Disclaimer: Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Binance

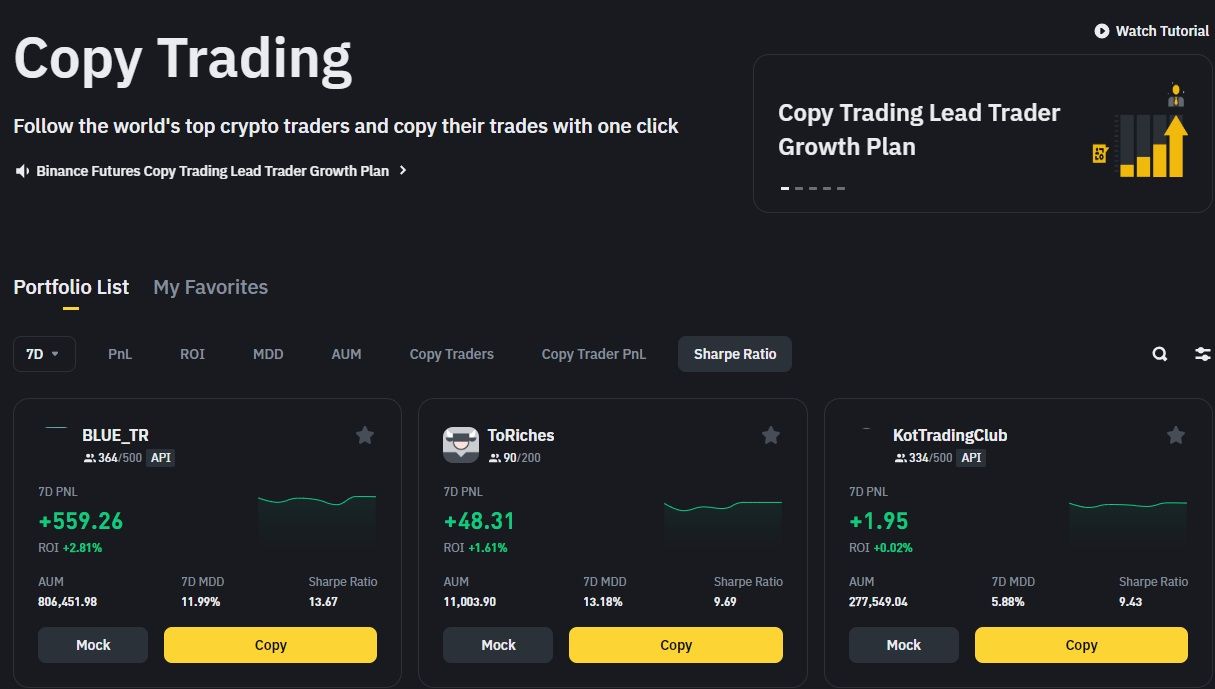

With Binance copy trading, you can invest a minimum copy amount of 10 USDT but it can go as high as 10,000 USDT. Binance copy trading supports over 100 USD-M futures contracts.

Binance Copy Trading Homepage. Image via Binance

Binance Copy Trading Homepage. Image via BinanceHere are some of its features:

- The lead trader's margin mode allows users to either follow the lead trader's margin mode or select a fixed margin mode.

- Users have the option to specify their desired leverage when copying trades. They can mirror the lead trader's leverage or opt for a fixed leverage ranging from 1x to 10x.

- After successfully copying a position, the system will automatically place a take profit/stop loss order for this position.

- Portfolio stop loss triggers the closure of all active positions in a portfolio when the overall portfolio margin reaches a specified stop loss point.

Copy traders pay 10% of their profit share with lead traders on Binance. In addition to this 10%, lead traders also get a 10% commission from their copy traders’ trading fees.

Also, check out our full Binance review.

OKX

With OKX copy trading, users gain access to a user-friendly interface where they can select and replicate trades from a diverse range of lead traders. With over 600 trading pairs to explore, there's no shortage of opportunities to learn and profit from the expertise of seasoned traders.

OKX Copy Trading Homepage. Image via OKX

OKX Copy Trading Homepage. Image via OKXWhether you're a novice looking to learn from the best or a seasoned pro eager to share your trading strategies, OKX has you covered. The platform caters to both new and experienced traders, providing a seamless experience from account setup to completing KYC registration in minutes.

Here are a few of its top features:

- For copy trading, OKX offers 114 pairs

- Comprehensive statistics of lead traders

- 24/7 customer support

- Up to 13% profit share for lead traders

More recently, OKX introduced a new feature called “Smart Sync.” Here's what it does: instead of you having to figure out all the technical stuff like margin and position size, 'Smart Sync' does it all for you. It copies the trades of the lead traders, matching their positions and margins to your available funds automatically. No need to mess around with settings — it's all done for you!

While you're here, you'd do well to read our full OKX review.

Benefits of Copy Trading

Let's now dive into the perks of copy trading.

Access to Expertise

Copy trading gives you a front-row seat to see how expert traders navigate the market in real-time. By copying their moves, you can learn from their experience and adapt your strategies accordingly. Plus, you get to benefit from their risk management techniques, helping you protect your investment and avoid big losses.

Reduced Emotional Bias

Say goodbye to sweaty palms and racing heartbeats! With copy trading, you can relax and enjoy the ride while experts handle the tough stuff. Emotions like fear and greed won't cloud your judgment because trades are automated based on proven strategies. It's like having a Zen master guiding you through market ups and downs with calm and clarity.

Learning Opportunity

Copy trading isn't just about following the crowd — it's a chance to become a savvy investor. By observing and copying expert traders, you'll learn valuable insights into market dynamics and decision-making processes. Think of it like attending a trading masterclass where every trade teaches you something new. As you gain experience, you can gradually become more confident and start making your own trading decisions.

Diversification

Diversification is the name of the game when it comes to investing. Copy trading lets you spread your risk by following multiple expert traders with different styles and strategies. You'll get a taste of different trading approaches, from rapid-fire day trading to patient long-term investing. This diversification not only helps protect your investment but also increases your chances of scoring big returns in different market conditions.

Drawbacks of Copy Trading

While copy trading offers some fantastic perks, it's essential to be aware of its potential drawbacks too. Here's a friendly heads-up on what to consider:

Dependency on Traders

Think of it like relying too much on your favourite chef to cook all your meals. While it's convenient, you might miss out on the joy of experimenting in the kitchen yourself.

When you're copy trading, it's easy to get comfortable following traders blindly. But this can make you overly reliant on their decisions, hindering your own growth as a trader. Plus, it might lead to a false sense of security, assuming that traders always have the winning recipe.

Limited Control

With copy trading, you sacrifice some control over your investment decisions. You're stuck with the strategies and styles of traders, even if they don't quite match your own preferences. Crypto markets move crazy fast and you might find your chosen trader reacting a bit slower than you'd like.

Risk of Overreliance

While it's great to have someone drive the car, this reliance on others also means you'll likely never learn how to drive a car.

Copy trading can make you overly dependent on traders, leading to a lack of independent thinking. You might find yourself following the crowd without fully understanding why. Plus, if your favourite trader hits a rough patch, you could be in for a bumpy ride.

Potential for Loss

While traders may have a track record of success, there's always the risk of losses in the unpredictable world of crypto trading. Copy trading doesn't assure profits, and in the event that the trader you're mirroring makes an incorrect decision, you may also incur losses.

It's crucial to recognize that trading inherently carries risks, and copy trading is no exception to this rule.

Lack of Personal Growth

Copy trading can hinder your personal development as a trader. Instead of learning to analyze the market and make decisions on your own, you might become dependent on others for trading ideas. This can limit your ability to grow and evolve as an investor over time.

Copy Trading Risks to Avoid

We'll now explore the potential risks involved in crypto copy trading and how you can mitigate them.

One of the most common pitfalls is solely relying on a trader's past performance when selecting who to follow. Although it may be tempting to be drawn to the trader boasting the fattest returns, it's important to remind yourself that short-term success could be the result of luck rather than skill. Therefore, it's advisable to invest time in understanding the trader's strategy thoroughly. Evaluate whether it resonates with your investment goals and aligns with your risk tolerance before making any decisions.

Although copy trading offers a relatively hands-off approach to investing, it's essential not to underestimate the importance of conducting thorough research. Before you take the plunge, it's advisable to gather a basic understanding of cryptocurrency trading fundamentals. This knowledge will enable you to differentiate between traders employing sound strategies and those taking unnecessary risks.

And what better resource than The Coin Bureau? From guides and tips for investing in crypto to building a cryptocurrency portfolio, we're with you every step of the way.

Another critical consideration is the level of commitment demonstrated by the trader you intend to copy. Ideally, you want to follow traders who have a personal stake in their trades, as this indicates a higher level of conviction and accountability. Look for platforms with a reputation for attracting dedicated traders who are genuinely invested in their trading activities.

Speaking of platforms, selecting the right one is paramount to your copy trading success. Take the time to evaluate various platforms based on factors such as fees, ease of use, and the quality of the trader community. Most platforms today offer intuitive interfaces tailored for beginners, along with access to a diverse pool of experienced traders whose strategies align with your investment goals.

Lastly, it's essential to cultivate patience and discipline when engaging in copy trading. While it may be tempting to bail out as the market flashes red, successful copy trading requires a long-term perspective. Trust in your chosen trader's abilities and resist the urge to make impulsive decisions based on short-term fluctuations.

Top Crypto Copy Trading Platforms: Final Thoughts

Copy trading lowers the barrier to entry for newcomers looking to navigate the complex world of cryptocurrency trading. By leveraging the expertise of experienced traders, copy trading offers a shortcut to success, allowing investors to replicate proven strategies and diversify their portfolios without the need for extensive market knowledge or analysis.

Platforms like Bybit, Bitget, eToro, Binance, and OKX offer diverse opportunities for investors to replicate the strategies of expert traders and diversify their portfolios.

However, it's essential to approach copy trading with caution and awareness of its potential drawbacks. Dependency on traders, limited control over investment decisions, and the risk of overreliance are all factors that investors should consider carefully. Additionally, while copy trading can offer significant benefits, it's not a foolproof strategy, and investors should be prepared for the possibility of losses.

So, while copy trading can be a handy tool in your trading arsenal, it's essential to strike a balance and not lean too heavily on others. After all, it's your journey to financial success, and a little independence can go a long way!