Quick Answer

Bitget Copy Trading is legitimate, but legitimacy does not mean guaranteed profits. You can copy a real trader on a real exchange and still lose money simply because markets move against the positions.

Copy trading is one of those ideas that sounds almost too convenient. Find a trader with a strong track record, hit follow, and let their buys and sells play out in your own account. For beginners, it can feel like training wheels. For busy traders, it can feel like outsourcing the hardest part of the job: timing.

But markets have a way of humbling shortcuts. Even when you copy a skilled “elite trader,” you are still exposed to volatility, execution quirks like slippage, and the simple fact that a strategy that worked last month can struggle next month. In this review, we break down how Bitget Copy Trading works, what it really costs, what can go wrong, and how to set it up with guardrails so you are not learning the hard lessons with oversized positions.

Editor’s Note (Feb. 27, 2026): We fully updated this guide to reflect Bitget’s latest copy-trading ecosystem stats, Proof of Reserves snapshots, and Protection Fund reporting, plus refreshed guidance on fees and profit-share mechanics. We’ve also expanded the risk section. Availability can vary by jurisdiction, and copy trading is not available in certain regions (including the U.S.). As always, this content is for informational purposes only and does not constitute financial advice.

Bitget Copy Trading is legitimate, but legitimacy does not mean guaranteed profits. You can copy a real trader on a real exchange and still lose money simply because markets move against the positions.

Yes. It is offered by a major exchange, with visible trader performance metrics and follower controls such as Stop Loss, Take Profit, and futures copy Maximum Slippage. Legit means the feature exists and works as described, not that the trades are safe or profitable.

Copy trading is risk transfer, not risk removal. You are borrowing someone else’s decisions, but the profits are not guaranteed and the losses still land in your account. Our own guide can help with a quick grounding on the risks of copied strategies, especially with copy trading.

Here are the numbers Bitget itself puts front and center for its copy trading ecosystem and transparency tooling.

| Stat | Snapshot |

| Elite traders | 190,000+ |

| Followers (copiers) | 800,000+ |

| Total copy trades | 100 million+ (since late 2020) — Bitget has stated the platform has completed at least 100 million trades since the inception of One-Click Copy Trade. |

| Total follower gains | $530,000,000+ “Realized PnL” |

| Protection Fund | Jan 2026 peak: $630M (Jan 14); Jan 2026 monthly avg: $588M. |

| Proof of Reserves headline ratios | Feb 2026 total: Average reserve ratio: 169%; BTC: 352%, ETH: 147%, USDT: 100%, USDC: 104%. |

Note: Data as of February 2026.

A Protection Fund is best thought of as an emergency reserve designed to strengthen platform resilience during extreme incidents. In plain English, it is closer to a “rainy day fund” than a promise that every user loss will be reimbursed.

What it is:

What it is not:

Proof Of Reserves is a transparency method meant to show that certain user balances are backed by on chain reserves at a point in time. It helps answer “are the assets there,” but it is not the same thing as a full financial audit of a company’s liabilities, controls, or business risks.

What it generally covers:

What it does not automatically cover:

If you want a verification angle, Bitget publishes the self check approach and tooling via its Merkle tree repository.

Bitget Copy Trading lets you mirror an experienced trader, often called an elite trader, inside your own Bitget account. An everyday way to picture it is following a skilled driver’s route with your own car and your own fuel. You may take the same turns, but your results can still differ because your position size, risk limits, and the market’s “traffic” are not the same.

Bitget Copy Trading lets You Mirror an Experienced Trader, often called an Elite Trader. Image via Bitget

Bitget Copy Trading lets You Mirror an Experienced Trader, often called an Elite Trader. Image via BitgetWhen the elite trader opens or closes a position, Bitget attempts to open or close a corresponding position for you, including how follower positions are handled on close in different situations.

In real markets, the “same” trade can still fill at a different price. Two common reasons are execution timing and slippage, especially during fast moves. Bitget applies follower side conditions and limits across Futures copy trading, different Futures copy modes, and Spot copy trading.

Bitget offers a few ways to “copy,” and they are not interchangeable. The same follower can take very different risks depending on whether they are copying spot trades, leveraged futures positions, or an automated bot strategy.

Copy type | Risk level | Who it’s for |

Spot Copy | Medium | People who want to copy without liquidation mechanics, but can still handle volatility. |

Futures Copy | High | Traders comfortable with leverage risk, liquidation, and faster drawdowns. |

Medium to very high | Users who prefer strategy automation, with outcomes tied to the bot type and market regime. |

Futures copy trading can unravel quickly because leverage magnifies both gains and losses, and positions can be liquidated if margin runs out during sharp moves. Holding perpetual futures can also involve funding rates, a periodic fee exchanged between long and short holders.

Margin mode matters. Isolated margin limits risk to the margin assigned to one position, while cross margin shares margin across positions, which can delay liquidation but can also let one bad trade pressure the whole account.

When bots fail most often:

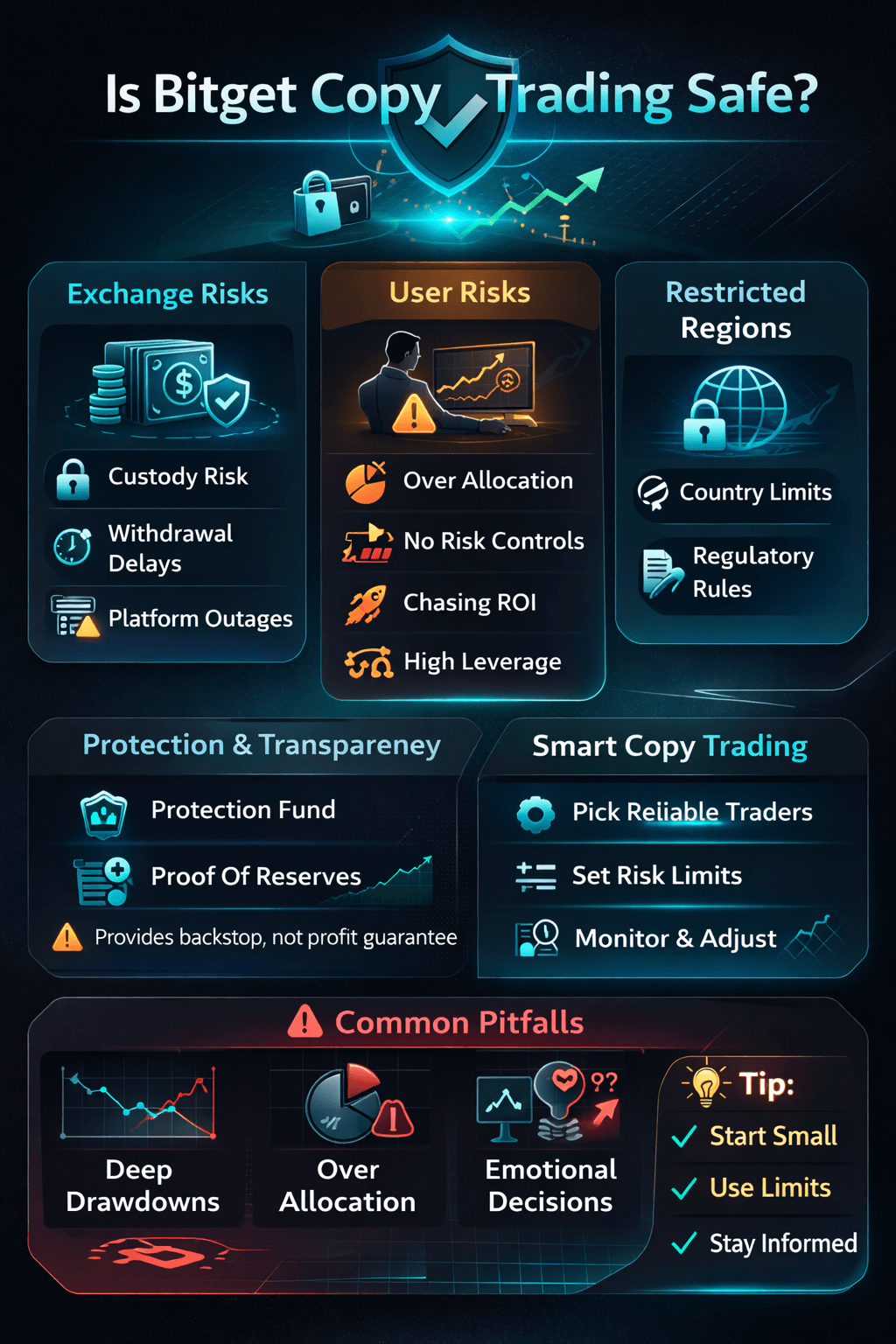

“Safe” in copy trading really means two things at once. First, whether the platform can safeguard access to your account and assets. Second, whether the strategy you are copying can avoid large losses in normal market conditions. A platform can be resilient and transparent, and you can still lose money simply because the market moves against the positions being copied, which is a core risk regulators repeatedly warn about in crypto markets like the SEC’s investor alerts.

A Platform can be Resilient and Transparent, and You can still Lose Money simply because the Market Moves against the Positions

A Platform can be Resilient and Transparent, and You can still Lose Money simply because the Market Moves against the PositionsSome risks sit at the platform layer. These include custody risk, withdrawal delays, and platform outages. Tools like the Protection Fund and Proof Of Reserves mentioned earlier, can improve transparency and provide an additional backstop for certain incidents, but they do not eliminate trading losses, and they do not guarantee you will avoid disruption during extreme market events. Proof of reserves also has limits, which is why Bitget publishes a self verification approach using Merkle tree tooling, as mentioned above, rather than presenting it as a full financial audit.

Most copy trading blowups are avoidable user mistakes: over allocation to one trader, skipping stop loss and drawdown controls, chasing short term ROI, using too much leverage, and switching traders mid drawdown. It is a lot like turning on cruise control in heavy rain. Automation reduces effort, but it does not replace judgment.

Eligibility is jurisdiction dependent. Bitget lists the United States in its prohibited countries. In the United Kingdom, crypto trading and marketing are shaped by the FCA’s cryptoasset financial promotion rules, so availability and how products are presented to users can vary by time and circumstance.

Yes, it is possible to make money copy trading. It is also possible to lose money quickly. Copy trading is just a way to automate decisions, not a way to remove risk. Bitget spells this out in its copy trading risk language around no guaranteed profits, and regulators repeatedly warn that crypto markets can be volatile and losses can be significant, including the risk of total loss in some cases.

A realistic range of outcomes includes losing money, breaking even, earning modest gains, or occasionally capturing strong upside during favorable market periods. The fantasy version is believing a top ranked trader can deliver steady, high returns in every market.

Results vary mainly because of trader selection, the market regime (trending vs choppy conditions), and your risk management settings, such as allocation caps and drawdown limits.

We suggest you check out our risk mitigation strategy guide to understand more about trading risks and staying safe.

The healthiest performance tends to look like a smoother equity curve over time, not a single spike in ROI that is followed by a deep slump. Consistency matters because copy trading often fails when users chase short term leaderboards.

Drawdown usually matters more than win rate. A trader can “win” often but still suffer large losses if the losing trades are much bigger than the winners, a risk IOSCO highlights when discussing retail imitative trading practices like copy trading.

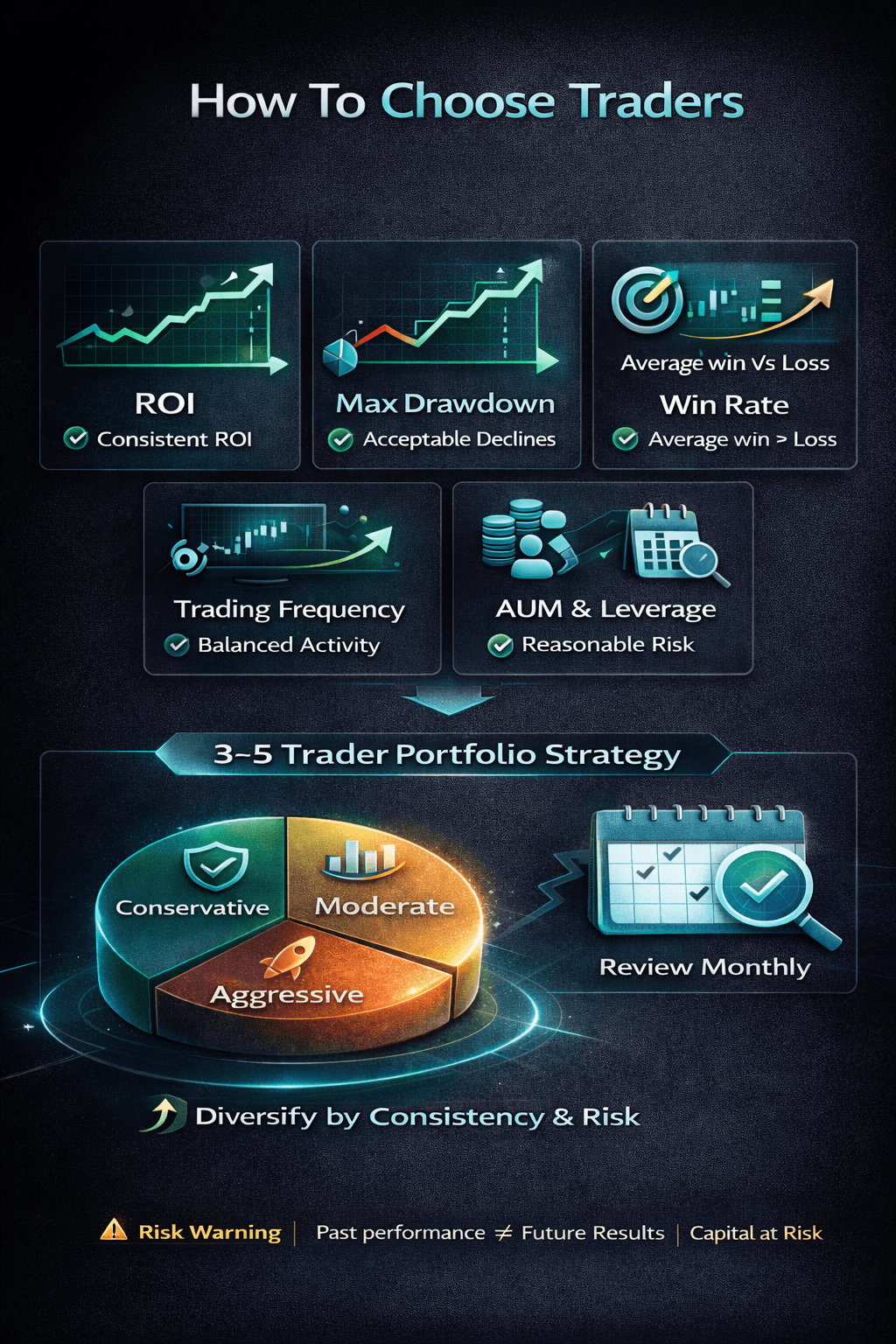

Picking who to copy is the real “strategy.” A trader with flashy returns can still be a bad fit if their risk profile does not match your tolerance. The goal is to choose traders whose style, risk, and consistency you can live with when the market turns ugly.

A Trader with Flashy Returns can still be a Bad Fit if their Risk Profile does not Match your Tolerance

A Trader with Flashy Returns can still be a Bad Fit if their Risk Profile does not Match your ToleranceMetric | What It Means | What To Look For |

ROI | Percentage return over a selected window. | Prefer 90 to 180 day consistency over a seven day spike. |

Max Drawdown | Largest peak to trough decline. | A drawdown you can tolerate without panic switching. |

Win Rate | Percent of winning trades. | Only meaningful next to average win and average loss. |

Trading Frequency | How often they trade. | Match your stress tolerance and monitoring ability. |

AUM / Copier Count | How much capital follows them and how many followers they have. | Useful as social proof, not proof of skill. |

Leverage Usage | How much borrowed exposure they take on. | If leverage is consistently high, treat it as a red flag. |

Instead of copying one “hero,” spread exposure across 3 to 5 traders with different styles. A simple example:

Review monthly and rebalance back to your target weights. This is the same basic idea as portion control in position sizing, so one trader does not dominate your account.

Good settings do not make copy trading “safe,” but they do make it harder to blow up your account by accident. The goal is simple: limit how much you can lose on a single trade, on a single trader, and across your whole account, using the same basic risk management principles you would use anywhere else.

Bitget’s futures copy setup typically gives you two sizing styles. Both can work, but each fails in a different way.

Fixed Amount: You set a fixed margin amount per copied trade.

Multiplier: Your margin is set proportionally to the elite trader’s margin.

Think of these like seatbelts and speed limits. They do not prevent crashes, but they reduce the damage when something goes wrong.

Margin mode changes how losses spread.

One practical note for readers following Bitget’s newer futures copy experience: the copier guide, referenced above, states that only cross margin is currently supported, with isolated margin planned for a later update.

Copy trading on Bitget follows the same basic flow as any exchange feature: set up your account, fund it, pick who to follow, then put guardrails in place before you let anything run on autopilot. If you are brand new to using a crypto exchange, treat this like setting up a direct debit. You want to double check the “limits” before the first payment goes out.

Open your Bitget account, then complete Identity Verification. The web flow for KYC verification generally asks you to select your country, choose an ID type, enter personal details, and upload the required documents.

Source: Bitget KYC (website guide)

Use Bitget’s deposit crypto flow to generate the correct deposit address, then send a small test amount first if you are moving funds from another wallet or exchange. If you are funding with fiat, Bitget also supports bank transfers depending on your region.

Go to the copy trading trader list and use the built in filter menu. Focus on metrics that reduce surprises, such as ROI Curve, Maximum Drawdown, and longer time windows rather than a short burst of performance.

Choose whether you are using Spot Copy Trading or Futures Copy Trading, then set your copy mode and limits before you follow. Futures copiers will see the key setup steps and risk controls inside the copier settings flow.

Once you are live, review the trader at a set cadence instead of reacting to every move. Use the same metrics you filtered with, plus position level behavior, such as whether risk is creeping up during volatility.

Source: How to do futures copy trading on Bitget (website guide)

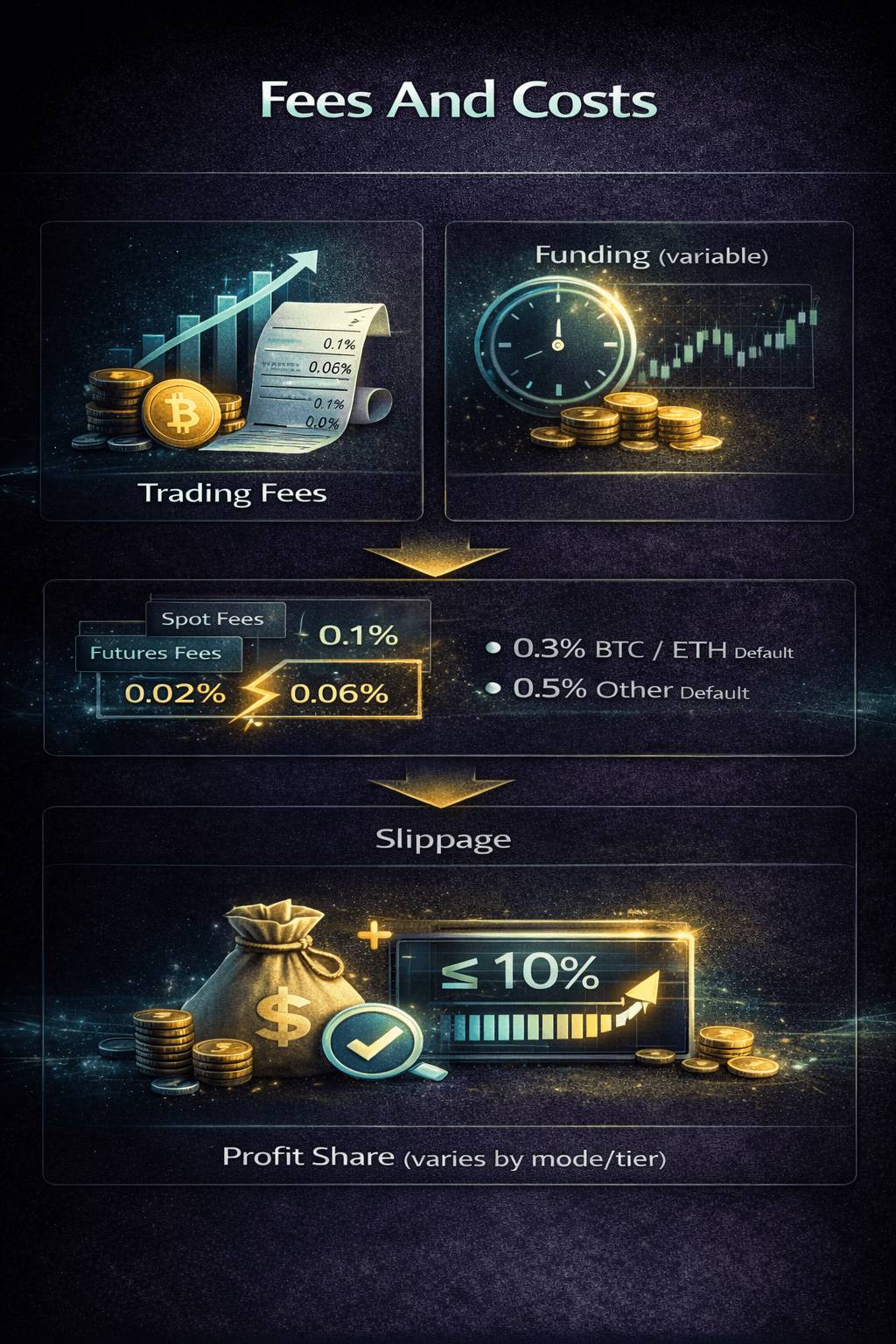

Copy trading can feel hands off, but the costs still run in the background. To understand your net result, separate costs that are explicitly charged from costs that show up indirectly in your fill price.

Slippage is the Gap between the Price you Expect and the Price you actually Get

Slippage is the Gap between the Price you Expect and the Price you actually GetThese are the direct “exchange charges” that show up as fee deductions on filled orders.

Perpetual Futures: The funding payment is not a fixed percentage like trading fees. It changes over time and is exchanged between long and short holders based on the live funding rate and how long you hold the position.

This is why two copied futures trades with the same profit can still end with different net results if they were held for different funding intervals.

Slippage is the gap between the price you expect and the price you actually get. In copy trading, Bitget also uses slippage thresholds that can block a copy if the market moves too far.

Futures Copy Trading: Maximum slippage is a follower setting with clear parameters.

Spot Copy Trading: Bitget applies default slippage limits of 0.3% for BTC and ETH, and 0.5% for other tokens.

Profit share is the portion of eligible profits paid to the elite trader when you are profitable under the settlement logic.

As per the New Futures Copy Trading guide referenced above, elite traders can set a profit share ratio, and settlement is based on eligible profits rather than simply “every winning trade.” The practical takeaway is that profit share is a real cost on profitable periods, but it is not designed to charge you again for recovering from prior losses inside the same settlement logic.

Spot copy trading profit share is also settled using a high water mark style approach, and Bitget has previously communicated profit share caps up to 10% for spot elite traders. However, it follows a tier based model and profit share ratio can be higher based on your tier.

Bot copy trading uses a fixed ratio model for profit sharing:

Following is a worked example to show the moving parts, not a promise of results:

Assume a futures copied trade that produces $1,000 profit on a $20,000 notional position, executed as taker on entry and exit, with one funding interval, and a 10% profit share.

A useful mental model is that:

Copy trading usually fails for one simple reason: people automate execution, then forget to automate discipline. Bitget gives copiers controls inside Futures Copy Trading and Spot Copy Trading, but the outcomes still depend on how you size risk and how consistently you stick to limits.

High leverage can make results look great until a sharp move forces a fast drawdown or liquidation. In practice, overleveraging often shows up as:

Short windows can hide the risk that created the return. The problem is not switching, it is switching based on noise rather than signals like consistency and drawdown across time in copy trading metrics.

Most blowups are a series of small losses with no circuit breaker. Follower side Stop Loss and Take Profit controls exist for a reason.

Drawdowns are normal even for skilled traders. If you switch mid drawdown, you can lock in losses and miss recoveries. Metrics like max drawdown help you judge whether a dip is typical for that trader.

More traders does not always mean more diversification. It can mean more overlap, more fees, and more stress, especially in Futures Copy Trading.

Copy trading platforms can look similar on the surface, but the experience changes a lot depending on what you can copy, what controls you get as a follower, what you pay in fees, and what backstops exist at the platform level.

Copy Trading can Look Similar on the Surface, but the Experience with Controls Varies Across Platforms

Copy Trading can Look Similar on the Surface, but the Experience with Controls Varies Across PlatformsAs of: February 2026

While you're at it, don't miss our exclusive reviews:

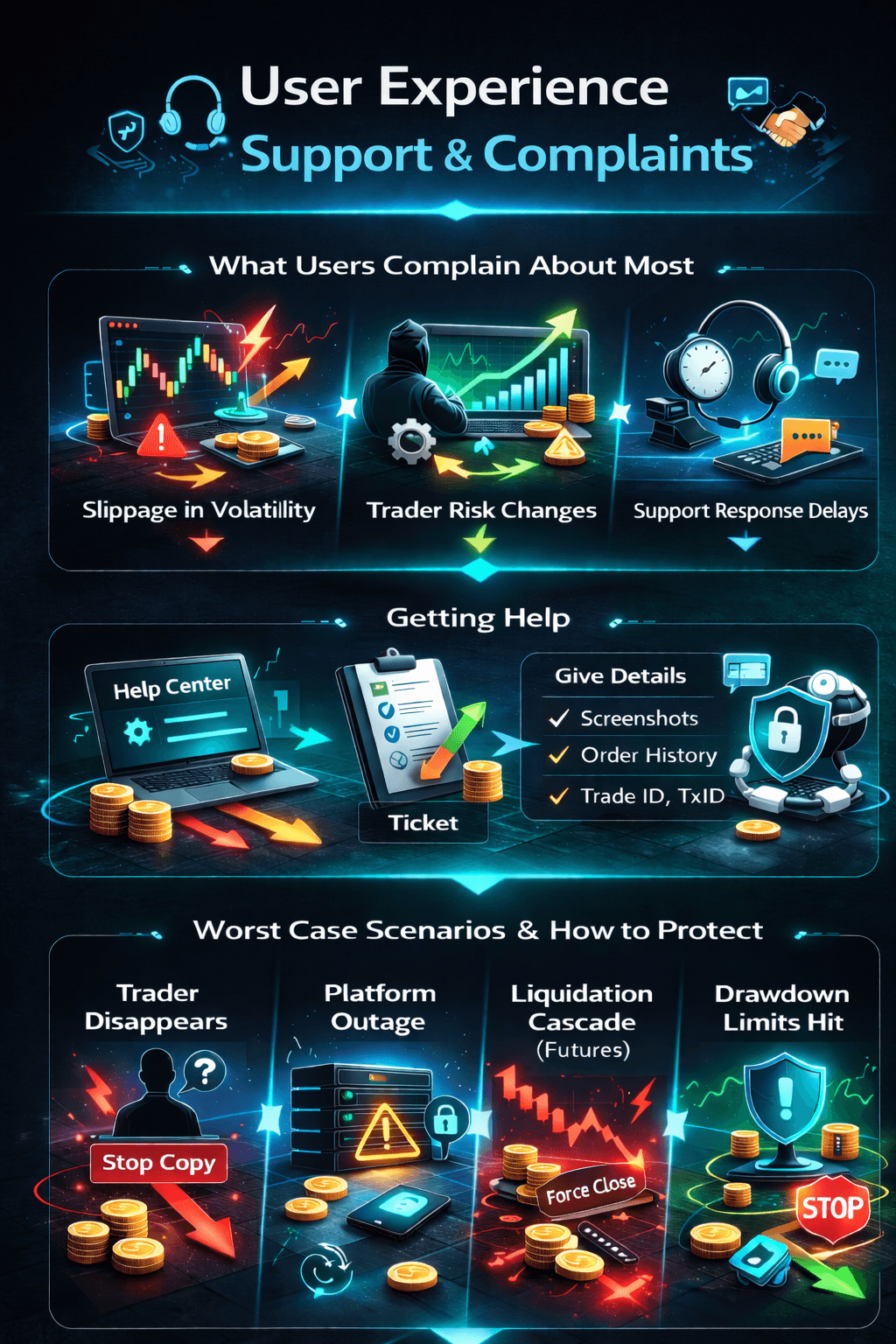

Copy trading is designed to feel simple, but the real world experience is usually defined by what happens during volatility, when traders change behavior, or when something goes wrong and you need help fast.

A Trader can sometimes Shift Style Quickly, which can Change your Risk Profile Overnight

A Trader can sometimes Shift Style Quickly, which can Change your Risk Profile OvernightUse Bitget’s Help Center and be ready to share:

Bitget’s Copy Trading can be a practical way to learn structure and participate more consistently, but it does not change the core reality of markets. You are still exposed to volatility, execution differences, and platform level risk. Your outcome will depend far more on who you copy and how you size risk than on the fact that the trades are automated.

Set drawdown limits, start small, and follow a 90 day consistency rule.

In practice, that means:

December 15th, 2024

The article introduces Bybit, a cryptocurrency and derivatives trading platform that offers copy trading as one of its services. Bybit provides leverage of up to 100x on certain assets but implements safeguards to mitigate the risks associated with high leverage, such as insurance funds and auto deleveraging. The platform boasts a wide selection of over 1000 cryptocurrencies and serves clients in 160 countries.Copy trading is a strategy where traders replicate the trades of experienced investors automatically. It gained traction in traditional finance and has now become popular in the crypto trading space. Bybit's copy trading feature allows users to mimic the trading strategies of skilled traders. Traders can choose to copy individual traders or join social trading groups to receive advice and trade signals.The article highlights the benefits of copy trading, including access to expertise, reduced emotional bias, learning opportunities, and diversification. It also mentions some drawbacks, such as dependency on master traders, limited control over strategies, and delayed reaction to market changes. Traders are encouraged to ask themselves questions regarding their investment goals, risk tolerance, and understanding of the master trader's strategy before engaging in copy trading.The article concludes by emphasizing that copy trading is not only for beginners but can also benefit traders of all skill levels. It offers convenience, efficiency, and the potential for collaboration and continuous improvement. However, traders should be aware of the risks and carefully consider their investment objectives before participating in copy trading.

By

September 5th, 2025

By

February 3rd, 2026

Copy trading has become a popular method for navigating the complex world of cryptocurrency trading. It allows both newcomers and experienced traders to replicate the success of expert investors with just a few clicks. There are now numerous platforms that offer copy trading features to assist investors in reaching their financial goals.Copy trading is essentially like having a talented friend who is a wizard in the kitchen. Instead of slaving over charts and market trends, you find a seasoned trader whose moves you admire and mimic their trades. It's a way to benefit from the expertise of more experienced traders without having to spend years mastering the craft yourself.There are two primary types of copy trading platforms: copy trading and social trading. Copy trading involves replicating the trades of a specific trader, while social trading entails joining groups to gain insights and advice from other traders. Social trading requires more active participation, while copy trading is more hands-off.When choosing a crypto copy trading platform, there are several factors to consider. Look for a user-friendly interface, fast trade execution speeds, robust risk management tools, customization options, strong security measures, reliable customer support, and transparent performance metrics. A diverse pool of traders is also important for creating a well-rounded and diversified copy trading portfolio.Some of the top crypto copy trading platforms include Bybit, Bitget, eToro, Binance, and OKX. Each platform has its own unique features and benefits, so it's important to research and choose the one that best suits your needs.While copy trading offers many benefits, there are also potential drawbacks to be aware of. These include becoming overly dependent on traders, sacrificing control over investment decisions, the risk of overreliance, and the potential for losses. It's important to approach copy trading with caution, conduct thorough research, and have a long-term perspective.In conclusion, copy trading has revolutionized cryptocurrency investing by allowing newcomers to replicate the strategies of expert traders. It offers a shortcut to success and diversification without the need for extensive market knowledge. However, it's important to strike a balance and not rely too heavily on others. Copy trading can be a valuable tool in your trading arsenal, but it's essential to approach it with awareness and caution.

By

Get exclusive access to premium content, member-only tools, and the inside track on everything crypto.