This article explores the best DEXs on Solana, where they shine, how they differ, and which ones are best suited to your trading goals. From deep USDC-SOL liquidity on Raydium and Orca to perp trading on Jupiter, and speculative meme token plays on PumpSwap, each platform caters to a distinct audience.

Whether you're chasing yields or just want the lowest slippage on your swaps, knowing which DEX fits which strategy can save you time, fees, and frustration. Let’s break them down.

Before we begin, you'd want to check out these articles:

Key Takeaways

- The top DEXs on Solana include Jupiter for perpetual trading, Pump.fun and PumpSwap for memecoin activity, Raydium for liquidity depth, and Orca for user-friendly swaps.

- Meteora introduces dynamic CLMMs optimized for meme tokens and high-yield strategies.

- Solana wallets like Phantom, Backpack, and Solflare offer seamless DEX integration and DeFi access.

- To get started, fund your wallet using CEX withdrawals, bridges like Portal, or fiat on-ramps such as MoonPay.

- Always use slippage protection and avoid illiquid pools when swapping or trading perps.

- Security first: revoke old token approvals, avoid fake airdrops, and consider using a hardware wallet for large holdings.

Solana DEX Landscape — A Quick Snapshot

Solana's decentralized exchange (DEX) ecosystem has experienced remarkable growth in 2025, solidifying its position as a leading platform for DeFi activities.

Year-on-Year Growth in TVL and Trading Volume

Solana’s Total Value Locked (TVL) expanded from approximately $4.5–4.9 billion in early 2024 to $8.6 billion by Q4 2024, showing steady quarterly increases. By May 2025, TVL surpassed $8 billion, reflecting a 25% growth in just the past month and a nearly 100% year-on-year increase.

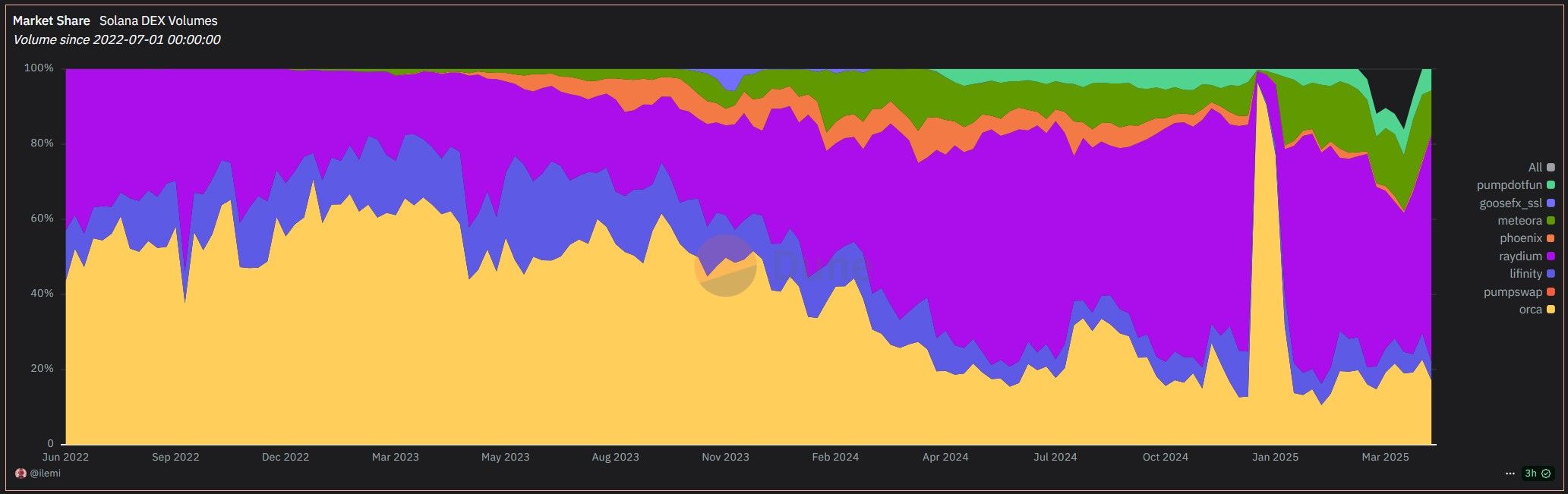

Daily DEX volumes averaged $3.3 billion in Q4 2024 (up 150% quarter-over-quarter), and by May 2025, daily volumes exceeded $3.14 billion, with weekly volumes hitting $21.6 billion, outpacing Ethereum Layer 2s. March 2025 saw Solana DEXs process $100 billion in monthly volume, commanding a 63% share among high-performance chains.

Shift from Order-Book to Concentrated-Liquidity AMMs

The ecosystem has shifted away from legacy Serum-style order-book DEXs toward concentrated-liquidity Automated Market Makers (AMMs) and aggregators. Platforms like Jupiter, Raydium, and new entrants such as SolFi and ZeroFi now dominate DEX volume, with aggregators and meta-aggregators sourcing liquidity across multiple AMMs for best execution. This transition is driven by the need for capital efficiency, lower slippage, and improved user experience, mirroring broader DeFi trends.

Solana DEX Market Share | Chart via Dune

Solana DEX Market Share | Chart via DuneCore Drivers of Growth

Firedancer Validator Client

Solana's new validator client, Firedancer, promises massive throughput and improved network reliability, further reducing latency and fees — key for high-frequency DEX trading. Firedancer has demonstrated the potential to process over 1 million transactions per second (TPS), far exceeding Solana's current ceiling of around 50,000 TPS.

ETF Hopes

Anticipation of a US spot Solana ETF drives institutional interest and user inflows, boosting TVL and trading activity.

Pump.fun

Pump.fun significantly influenced Solana's ecosystem growth in 2025. At its peak in January, it accounted for over 62% of all DEX transactions on Solana, generating $119 million in revenue within a 30-day period—surpassing both Solana and Ethereum individually. This surge attracted millions of new users, many of whom were first-time participants in DeFi, drawn by Pump.fun's ease of token creation and trading.

However, following regulatory scrutiny and market saturation, Pump.fun's daily trading volume declined sharply from $3.13 billion in January to $190 million by late February, highlighting the platform's volatility and its substantial impact on Solana's overall activity.

How We Ranked the “Best” DEXs

Each Solana DEX in this list has been evaluated based on both objective performance metrics and subjective ecosystem strengths. This breakdown allows you, not just us, to weigh what matters most to your trading style.

Objective Criteria

We looked at measurable, performance-driven factors:

- Liquidity Depth & Slippage: How much impact a $10k or $100k trade has on price—crucial for active traders.

- Security Track Record: Past smart contract audits and ongoing bug bounty programs to catch vulnerabilities.

- Fee Structure: Maker/taker fees, pool-specific charges, and the impact of impermanent loss for LPs.

- User Experience Signals: wallet support, fiat on-ramps, and the number of steps it takes to execute a basic swap.

Subjective Criteria

Beyond numbers, some traits are harder to quantify but equally important:

- Innovation Pace: Adopting capital-efficient models like concentrated liquidity (CLMM), RFQ systems, or perps.

- Community Governance: Whether token holders actively shape protocol direction or fee structures.

- Integrations: Compatibility with wallets, trading bots, and Solana-native DeFi building blocks like Jito or Jupiter.

Not every DEX will be perfect at everything, but understanding how they stack up across these dimensions can help you choose the right tool for the right strategy.

The Best Solana DEXs

This section will detail the most essential qualities of the Solana DEX we have shortlisted for this piece. Before the deep dive, is the TL;DR version of the following breakdown, condensed in a table:

| DEX | 30D Volume | Top Pool Liquidity | AMM Type | Fee Structure | Audit & Security | Wallet Support | Governance |

|---|---|---|---|---|---|---|---|

| Raydium | $35.6B | USDS-USDC: $78M, USX-USDT: $65M | Classic + CLMM | 0.25% AMM / 0.01%-2% CLMM | Cyberscope + Immunefi bounty | Phantom, Solflare, Ledger | RAY token holders vote |

| Orca | $22.8B | SOL-USDC: $31.3M, USDG-USDC: $20M | Whirlpools (CLMM) | 0.01%-0.3% depending on pool type | Neodyme audit + Immunefi | Phantom, Solflare, Fiat On-ramps | ORCA token holders vote |

| Meteora | $14B | TRUMP-USDC: $369M, MELANIA-USDC: $50M | DLMM (Dynamic CLMM) | Dynamic fee model | Multiple audits + Immunefi | Phantom, Solflare | MET governance proposal underway |

| Jupiter Perps | $266B (Perps) | SOL: $743M, USDC: $423M (JLP pool) | Perpetuals Engine | 0.06% per trade | Audited (name not disclosed) | Phantom, Backpack, OKX | JUP token holders vote |

| PumpSwap | $10B+ | TVL: $82.8M, 24h Vol: $474M | Classic Pools (for meme tokens) | 0.25% (0.2% to LPs) | 9 audits + bounty program | Phantom | Revenue share model in development |

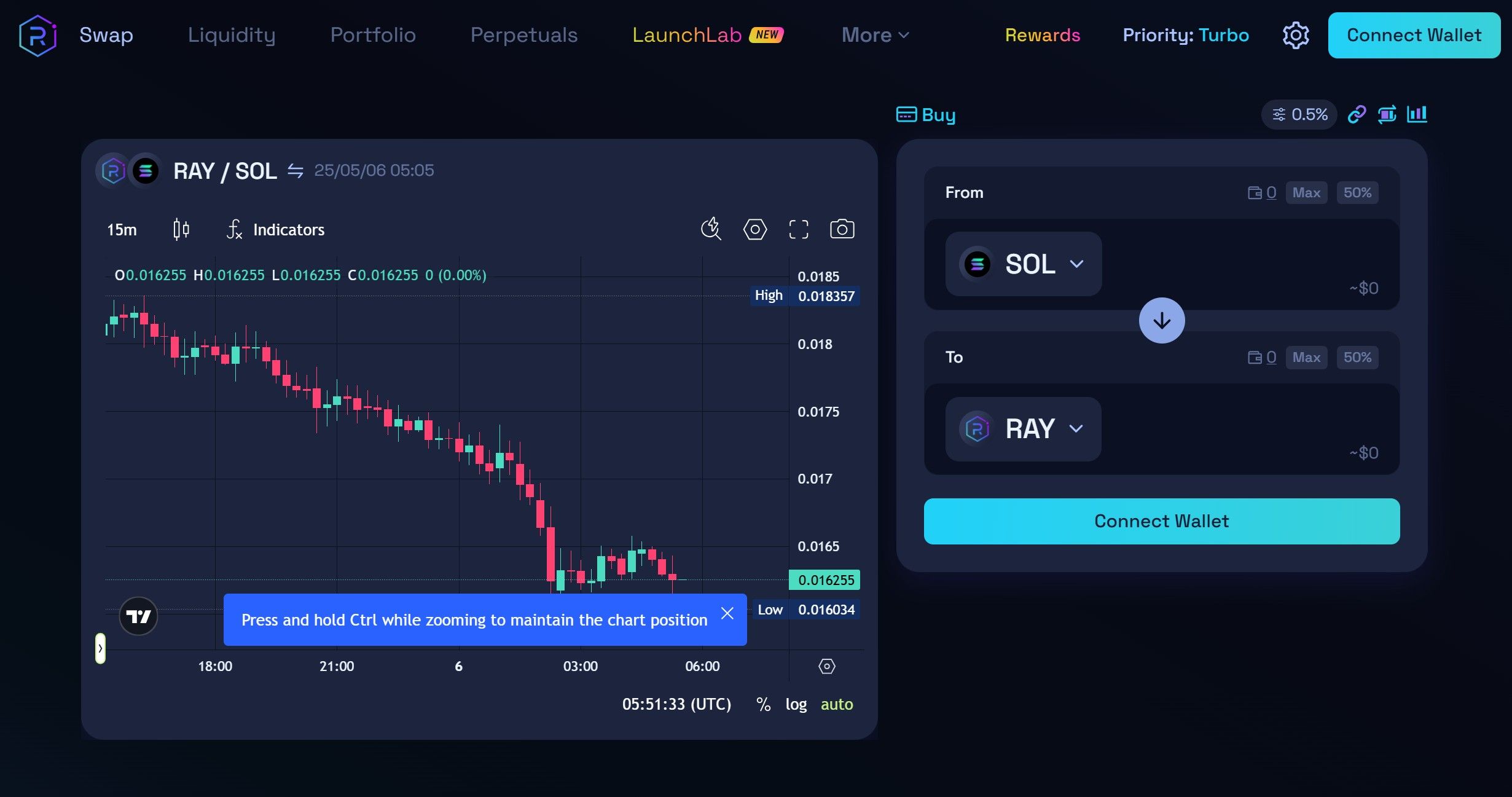

Raydium

Raydium is one of Solana’s most established DEXs, blending the familiarity of traditional AMMs with the capital efficiency of concentrated liquidity. Its high throughput and deep integrations make it a core pillar of Solana DeFi.

Raydium is Among the Oldest Solana DEXs | Image via Raydium

Raydium is Among the Oldest Solana DEXs | Image via RaydiumObjective Criteria

- Liquidity & Slippage: With $35.6B in 30-day volume in May 2025, Raydium ranks top among Solana DEXs. Top pools like USDS-USDC ($78M), USX-USDT ($65M), and SOL-USDC ($10.5M) support deep liquidity and low-slippage trading (data via Dune).

- Security: Audited by Cyberscope and backed by a $505k Immunefi bug bounty, Raydium maintains robust smart contract protections.

- Fees: Classic AMM pools charge 0.25% (0.22% to LPs, 0.03% to RAY buybacks). CLMMs offer flexible tiers from 0.01% to 2%.

- UX: Supports Phantom, Solflare, and Ledger wallets with a clean, mobile-friendly V3 interface and click-to-swap execution.

Subjective Weightings

- Innovation: Among the first Solana DEXs to support CLMMs, it is now also offering perps with 0% maker fees.

- Governance: RAY token enables community proposals and votes on key parameters.

- Integrations: Well-integrated with Solana DeFi protocols and bot trading frameworks.

Raydium’s combination of deep liquidity, layered features, and consistent UX upgrades position it as a well-rounded platform for casual traders and DeFi power users.

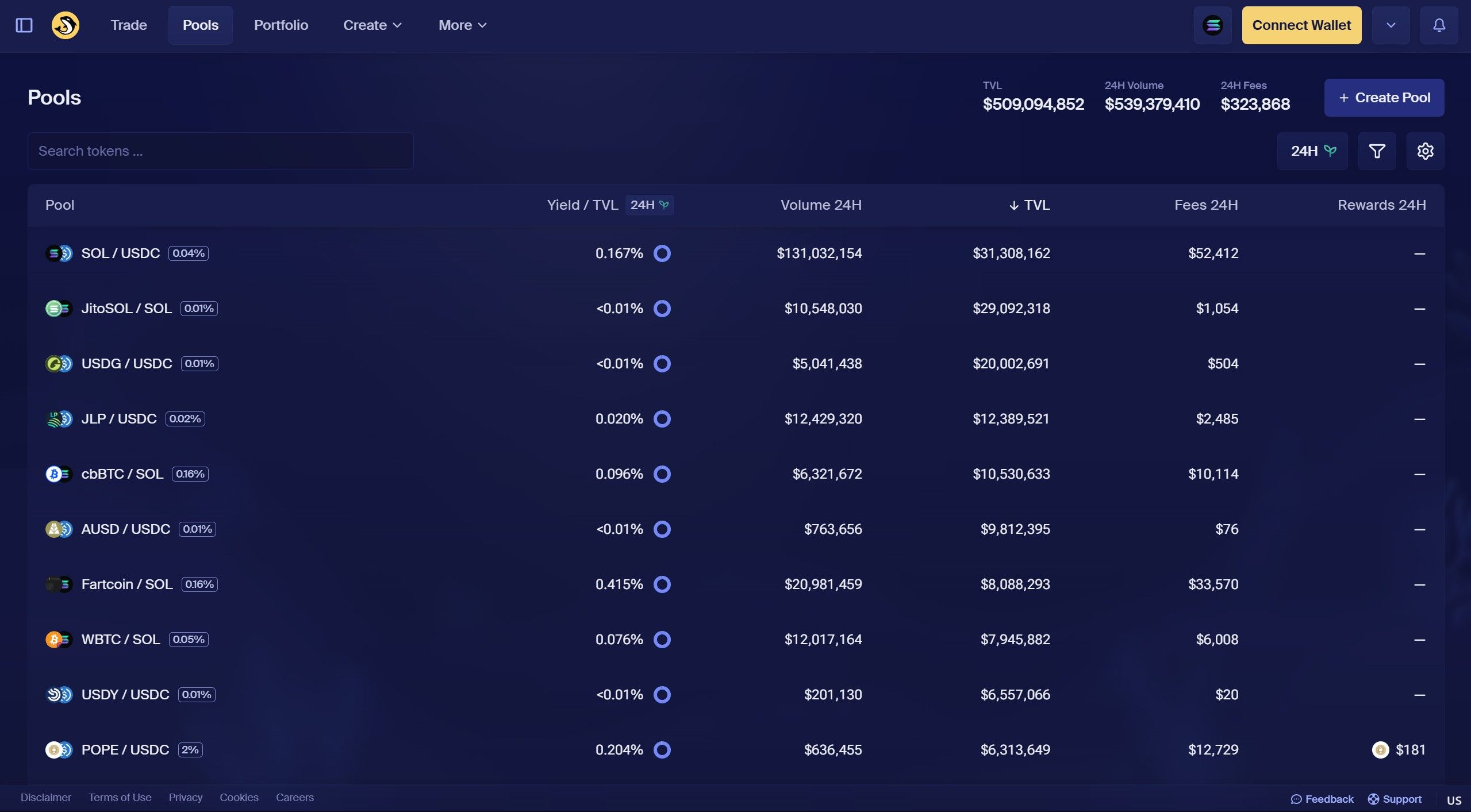

Orca

Orca stands out in the Solana ecosystem as a decentralized exchange (DEX) emphasizing user-friendly design and efficient trading. Leveraging Solana's high-speed infrastructure, Orca offers swift transactions and low fees, catering to both novice and experienced traders.

Many Users Find Orca The Most User-Friendly DEX on Solana | Image via Orca

Many Users Find Orca The Most User-Friendly DEX on Solana | Image via OrcaObjective Criteria

- Liquidity & Slippage: Orca's SOL/USDC pool boasts a Total Value Locked (TVL) of $31.3 million, with a 30-day trading volume of $22.8 billion in May 2025, ranking it second among Solana DEXs by TVL(data via Dune). The USDG/USDC stablecoin pair also holds a notable $20 million in liquidity, ensuring minimal slippage for substantial trades.

- Security: Orca's smart contracts have undergone rigorous audits, including a detailed security analysis by Neodyme, which identified and resolved key vulnerabilities. Additionally, Orca maintains an active bug bounty program through Immunefi, offering rewards of up to $500,000 for critical findings.

- Fee Structure: Trading fees on Orca vary based on the pool type: stable whirlpools at 0.01%, standard whirlpools at 0.2%, stable pools at 0.07%, and regular pools at 0.3%. This tiered structure allows traders to choose pools that best fit their strategies (via CoinMarketCap).

- User Experience (UX): Orca is renowned for its intuitive interface, which makes it accessible to users of all experience levels. The platform supports various wallets, including Phantom and Solflare, and has integrated fiat on-ramps through partnerships, enhancing the onboarding process for new users.

Subjective Weightings

- Innovation: Orca introduced "Whirlpools," its concentrated liquidity pools. These pools allow liquidity providers to allocate funds within specific price ranges, optimizing capital efficiency. This feature aligns with the latest trends in decentralized finance.

- Community Governance: Holders of the ORCA token can participate in governance decisions, influencing protocol developments and fee structures. This decentralized approach ensures that the community has a voice in Orca's evolution.

- Integrations: Orca seamlessly integrates with various Solana wallets and has established partnerships to enhance its ecosystem. Notably, the integration with Stripe allows users to purchase crypto assets directly with fiat, streamlining the user experience.

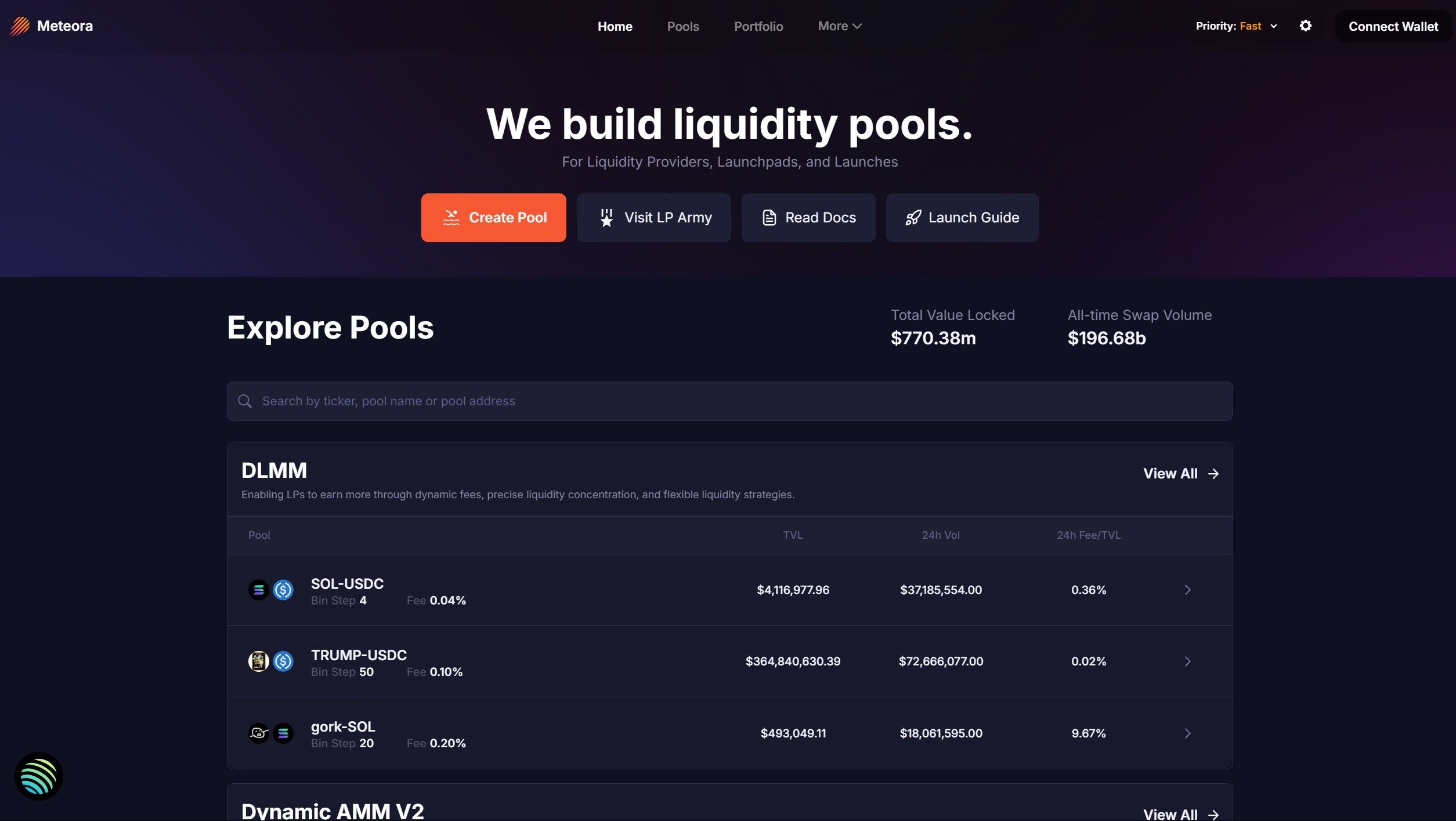

Meteora

Meteora has rapidly emerged as a pivotal player in Solana's DeFi landscape, distinguishing itself through innovative liquidity solutions and a focus on meme coin trading.

Meteora Has The High Liquidity For The TRUMP Token | Image via Meteora

Meteora Has The High Liquidity For The TRUMP Token | Image via MeteoraObjective Criteria

- Liquidity & Slippage: In May 2025, Meteora recorded a 30-day trading volume of approximately $14 billion, ranking it as the third-largest DEX on Solana. Notably, the TRUMP-USDC pool holds over $369 million in TVL, and the MELANIA-USDC pool exceeds $50 million, indicating significant activity in meme coin trading.

- Security: The documentation claims Meteora has undergone multiple external audits and prioritizes smart contract security. While these audits mitigate risks, they cannot eliminate them entirely.

- Fees: Meteora employs a dynamic fee structure in its DLMM pools, adjusting fees based on market volatility. This approach allows liquidity providers to optimize their returns.

- User Experience (UX): The platform offers a user-friendly interface, supports various wallets, and provides tools for efficient liquidity management.

Subjective Weightings

- Innovation: Meteora's Dynamic Liquidity Market Maker (DLMM) introduces real-time fee and liquidity adjustments, enhancing liquidity providers' capital efficiency and yield optimization.

- Community Governance: The platform has proposed a MET token to facilitate community governance, allowing users to participate in decision-making processes and protocol developments.

- Integrations: Meteora integrates seamlessly with various DeFi tools and protocols within the Solana ecosystem, expanding its utility and reach.

Jupiter

Jupiter has evolved from a leading swap aggregator into a comprehensive perpetuals trading platform on Solana, offering a centralized exchange-like experience with decentralized benefits.

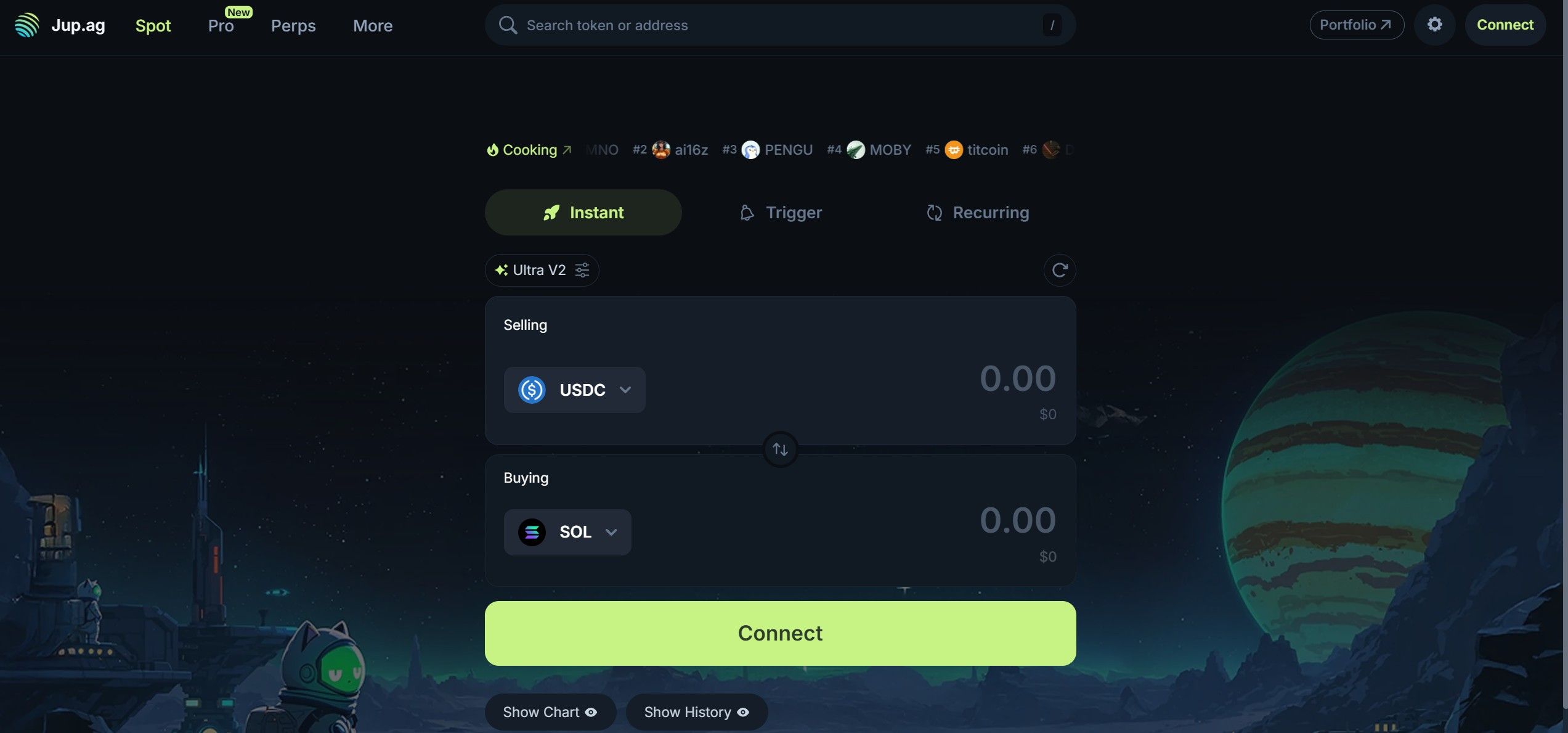

A Look At Jupiter Trading Interface | Image via Jupiter

A Look At Jupiter Trading Interface | Image via JupiterObjective Criteria

- Liquidity & Slippage: With monthly perpetual trading volumes consistently exceeding $25 billion, Jupiter ensures deep liquidity and minimal slippage for large trades.

- Security: Jupiter's smart contracts have undergone rigorous audits by respected blockchain security firms, ensuring the integrity of its perpetuals protocol.

- Fees: A flat rate of 0.06% is charged when opening or closing a position.

- User Experience (UX): Jupiter offers a user-friendly interface compatible with wallets like Phantom, Glow, Backpack, and OKX, facilitating seamless trading experiences.

Subjective Weightings

- Innovation: Jupiter's integration of perpetual contracts allows traders to take both long and short positions with varying degrees of leverage, catering to advanced trading strategies.

- Community Governance: The $JUP token empowers community members to participate in governance decisions, influencing the platform's future developments.

- Integrations: Jupiter seamlessly integrates with various Solana wallets and DeFi tools, enhancing its utility and reach within the ecosystem.

Pumpswap

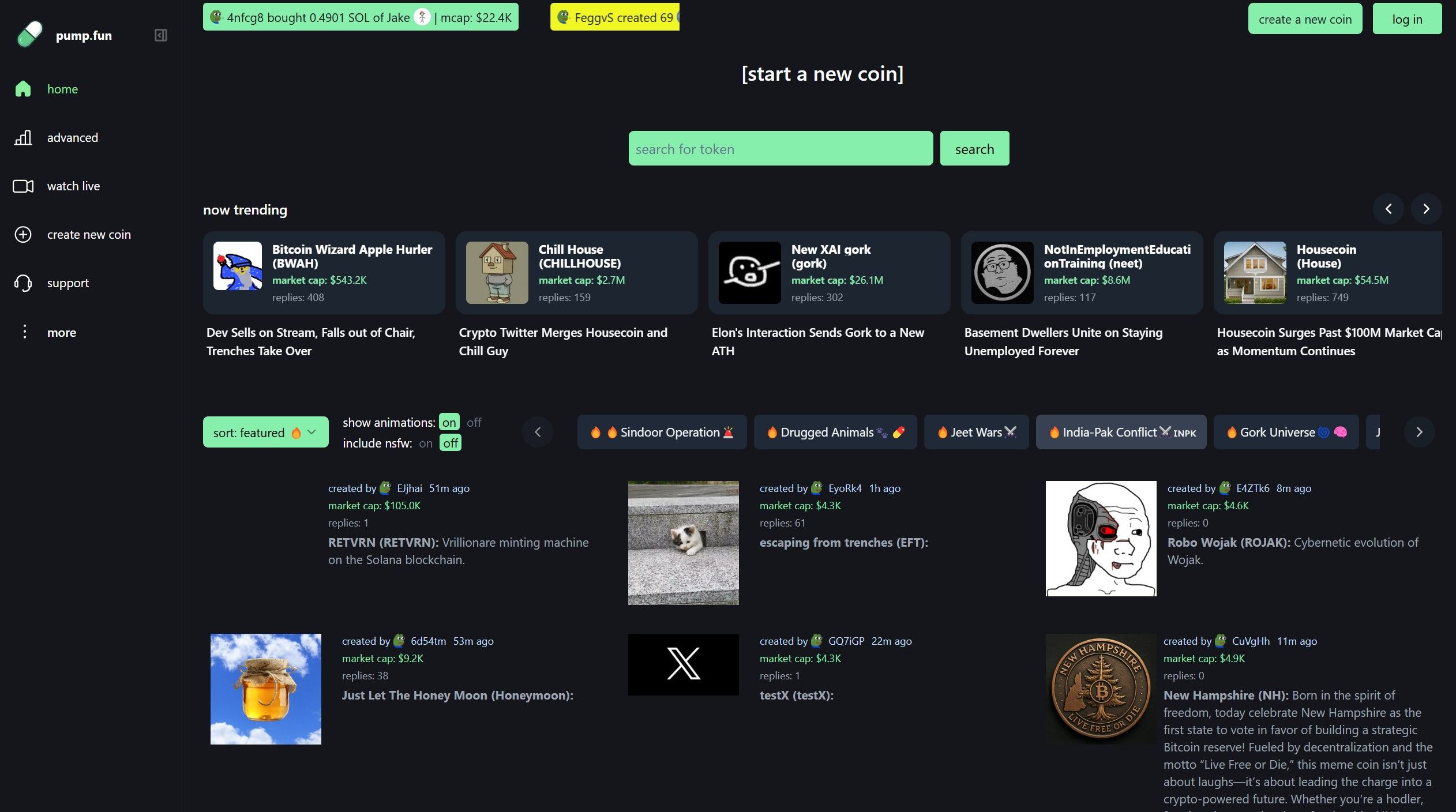

PumpSwap, launched by Pump.fun, is a decentralized exchange (DEX) on the Solana blockchain designed to streamline the trading of newly launched tokens, particularly memecoins. By integrating the token creation and trading processes, PumpSwap offers a seamless experience for both developers and traders.

Pump.fun is the Viral Memecoin Factory on Solana | Image via Pump.fun

Pump.fun is the Viral Memecoin Factory on Solana | Image via Pump.funObjective Criteria

- Liquidity & Volume: Within ten days of its launch, PumpSwap achieved over $10 billion in trading volume and surpassed $1.14 billion in Total Value Locked (TVL) . In May 2025, the platform maintains a TVL of approximately $82.82 million and a 24-hour trading volume of around $474.28 million.

- Security: PumpSwap has undergone nine independent security audits by Pashov Audit Group, OtterSec, Sec3, and bl0ckpain. Additionally, the platform has initiated a bug bounty program to incentivize the discovery and reporting of potential vulnerabilities.

- Fee Structure: Each trade on PumpSwap incurs a 0.25% fee, with 0.20% allocated to liquidity providers and 0.05% retained by the protocol. There are plans to introduce a revenue-sharing model to distribute a portion of the protocol fees to token creators.

- User Experience (UX): PumpSwap offers a user-friendly interface, allowing for the creation of liquidity pools without upfront costs. The platform supports integrations with popular wallets like Phantom, ensuring accessibility for a broad user base.

Subjective Weightings

- Innovation: PumpSwap streamlines the trading process by eliminating the need for tokens to migrate to external DEXs post-launch. This vertical integration reduces friction and costs for token creators and traders alike.

- Integrations: PumpSwap has partnered with platforms like MEXC's DEX+, enhancing its reach and providing users with access to a broader range of tokens within the Solana ecosystem.

PumpSwap's rapid growth and innovative approach to integrating token creation and trading position it as a significant player in Solana's DeFi landscape.

Getting Started—From Wallet Setup to First Trade

Now that you know where to DeFi, let’s cover how to DeFi. Solana’s DEX ecosystem is fast, cheap, and deeply liquid—but you’ll need the right wallet, reliable funding routes, and a strong safety net to get the most out of it. This section will walk you through everything from choosing a wallet to executing your first trade.

Choose & Secure a Solana Wallet

Solana wallets are your on-chain identity and your first line of defense. Three of the most widely used wallets in the ecosystem are Phantom, Backpack, and Solflare. Each has its own strengths:

| Feature | Phantom | Backpack | Solflare |

|---|---|---|---|

| Hardware Wallet Support | Ledger | Ledger, Keystone | Ledger, Trezor |

| 2FA / Passkey | No | Passkey Support | 2FA on mobile |

| Seedless Recovery (MPC / Social Recovery) | No | via xNFT system | No |

| Integrated Swap | Yes | Yes | Yes |

| User Base | Widely adopted | Gaining traction | Long-standing |

- Phantom is the go-to for most users, with a smooth UI and broad DApp compatibility.

- Backpack is feature-rich and supports executable NFTs (xNFTs), a unique Backpack-native format that allows apps to run within the wallet itself.

- Solflare is veteran-friendly, offering flexible recovery and integrations.

Want a deeper comparison? See our guide to the Top Solana Wallets.

Bridging & Funding Your Account

Once your wallet is set up, you’ll need to fund it with SOL (for gas) or USDC (for trading). Here are your options:

- Native on-ramps: Platforms like MoonPay, Coinbase Pay, and Ramp allow you to buy SOL or USDC directly using fiat, depositing the assets into your wallet.

- Bridging from Ethereum or other chains: Use bridges like Wormhole or Portal to transfer stablecoins or SOL-wrapped assets from Ethereum. Portal supports multiple asset types and has been battle-tested for large flows.

- CEX Withdrawal: For new users, buying SOL or USDC on centralized exchanges (Coinbase, Binance, Kraken) and withdrawing directly to their wallet is often the simplest path.

Here is a detailed Guide on Buying SOL globally or How to Buy SOL in the US.

Fees on Solana are extremely low (~$0.003–$0.05), but keep an eye out when bridging. Wrapped assets can carry higher risk—especially if the underlying bridge isn’t widely adopted or has a history of exploits. Stick to native SOL, native USDC, or widely used bridged assets like Wormhole-wrapped tokens.

Executing Your First Swap or Perp

Once your wallet is funded, you can execute your first trade at a DEX like Jupiter, Raydium, or Orca.

For swaps:

- Connect your wallet

- Select the token pair (e.g., SOL → USDC)

- Approve the transaction

- Confirm execution on-chain

For perpetuals:

- Choose a perps DEX like Jupiter Perps or Zeta Markets

- Fund the relevant margin account (usually with USDC or JLP shares)

- Choose long or short, set your leverage, and define your position size

- Always set a stop-loss to manage risk—perps move fast

Many interfaces offer slippage control, transaction previews, and execution routing across liquidity layers. When placing larger trades, avoid ultra-thin tokens with poor liquidity for safety.

Staying Safe

Solana DeFi is fast-paced and relatively young. Here are essential security tips to keep your assets safe:

- Revoke old approvals: Identify and clear unnecessary or stale token approvals, especially after interacting with unknown tokens or new DApps.

- Phishing & fake airdrops: Never click random “airdrop” links, especially those prompting you to connect your wallet. Only engage with known platforms.

- Meme coin mania: If you're experimenting with tokens on Pump.fun or Meteora, assume it’s play money. Don’t ape large sums into unverified memecoins. Rug pulls happen—often.

- Upgrade security: Use wallets that support passkeys or hardware devices for long-term holdings.

Final Thoughts

Solana’s DEX ecosystem in 2026 is more diverse and active than ever, ranging from deep-liquidity hubs like Raydium and Orca, to innovative trading platforms like Jupiter Perps, and meme-fueled arenas like PumpSwap. Each DEX brings a unique angle: some prioritize stablecoin depth and efficient routing, others focus on UX, perps, or grassroots speculation.

There’s no one-size-fits-all platform. The right DEX depends on your strategy—whether it’s stablecoin swaps, leveraged trades, or hunting the next 100x meme. By understanding what each protocol excels at, you can better match your intent with the right tool.

Want to further explore the Solana ecosystem? Check the Top Solana Projects.

As Solana continues to scale with upgrades like Firedancer and SIP-48, and retail interest remains strong, staying informed on where and how you trade is more important than ever.