Blockchain interoperability is the technology that enables different blockchain networks to communicate and share information seamlessly. Initially, this concept was of interest primarily to blockchain enthusiasts. However, as the number of blockchain networks and users expanded, the need for these diverse systems to work together became essential.

Over time, solutions facilitating interoperability have significantly evolved. Early methods often involved multiple steps that were not user-friendly. Today, with advancements like chain abstraction, the landscape has transformed. Chain abstraction simplifies interactions across multiple blockchains by providing a unified interface, making it easier for users and developers to operate across various networks without dealing with the underlying complexities.

In this article, we'll explore the foundational concepts of blockchain interoperability, discuss the impact of projects driving this sector, and examine emerging trends shaping the future of interconnected Web3.

Definition of Blockchain Interoperability

TL;DR: Blockchain interoperability refers to the ability of different blockchains to interact with each other to communicate and share data, information, or value.

In our everyday internet experience, we seamlessly send emails from Gmail to Outlook, share files between Windows and Mac systems, and access websites across the globe regardless of the hosting service. This effortless exchange of information is possible because of interoperability—the ability of different systems to communicate and work together.

Imagine if this weren't the case: a fragmented internet where each service operated in isolation, unable to interact with others. Such a scenario would severely limit the internet's utility and convenience. Similarly, for Web3 to surpass Web2, achieving seamless interoperability among various blockchain networks is crucial.

Why Can’t Blockchains Interoperate?

While the idea of different blockchains working together sounds ideal, several technical challenges prevent this from happening naturally.

Blockchains are Isolated Ecosystems

Each blockchain operates as a self-contained network of nodes. These nodes collaborate through a peer-to-peer network, sharing essential transaction information to reach consensus and validate new blocks. They maintain a state database containing all smart contract data, account balances, and other relevant information necessary for independent block construction.

However, every blockchain has its separate network of nodes and state datasets. Consequently, nodes on one blockchain are unaware of activities outside their system, including those on other blockchains, the traditional Web2 Internet, or the real world. This isolation ensures security and integrity within each blockchain but poses a significant barrier to cross-chain communication.

Blockchains are Trustless Systems

In the blockchain realm, "trustless" means that the system operates without needing to place trust in an external party or data. All transactions and data are verified through predefined consensus mechanisms. We must transmit on-chain data from the source chain to the destination to connect two isolated blockchain ecosystems.

However, since blockchains are trustless, one blockchain cannot simply "trust" information from another chain without verification. Moreover, it lacks access to the necessary state and transaction data to authenticate this external information. Therefore, any interoperability solution must introduce a trust component—a system that can effectively vouch for the accuracy of information originating from outside the network.

In subsequent sections, we'll explore blockchain bridges, which are designed to address this very challenge.

Primary Goals of Blockchain Interoperability

Based on our discussion so far, the main objectives of blockchain interoperability include:

- Establishing a System for Sharing Block Information Between Blockchain Networks: Creating mechanisms that allow different blockchains to exchange data seamlessly.

- Ensuring the Shared Information is Correct and Complete: Implementing safeguards to guarantee that data transferred between chains remains untampered and uncensored.

- Creating a System of Liquidity Flow Between Chains While Eliminating Risks Like Double Spending: Facilitating the movement of assets across blockchains without the risk of the same asset being spent more than once.

- Allowing Smart Contracts from One Chain to be Called from Another Chain: Enabling smart contracts on different blockchains to interact broadens the scope of decentralized applications.

Achieving these goals is essential for building a cohesive and efficient blockchain ecosystem, which will pave the way for the next generation of decentralized applications and services.

The Evolution of Interoperability in Blockchain

Blockchain interoperability has evolved through distinct stages, each driven by specific limitations and demands that inspired new solutions. The progression from atomic swaps to intents and chain abstraction reflects how the industry has continuously adapted to enable more seamless and efficient cross-chain interactions.

Atomic Swaps (2013–2017): The First Step Toward Cross-Chain Transactions

Problem: Early blockchains were siloed ecosystems (as we learned previously), meaning assets could not move between chains without intermediaries (like CEXs, which is not ideal for privacy). The need for decentralized cross-chain transactions led to the development of atomic swaps.

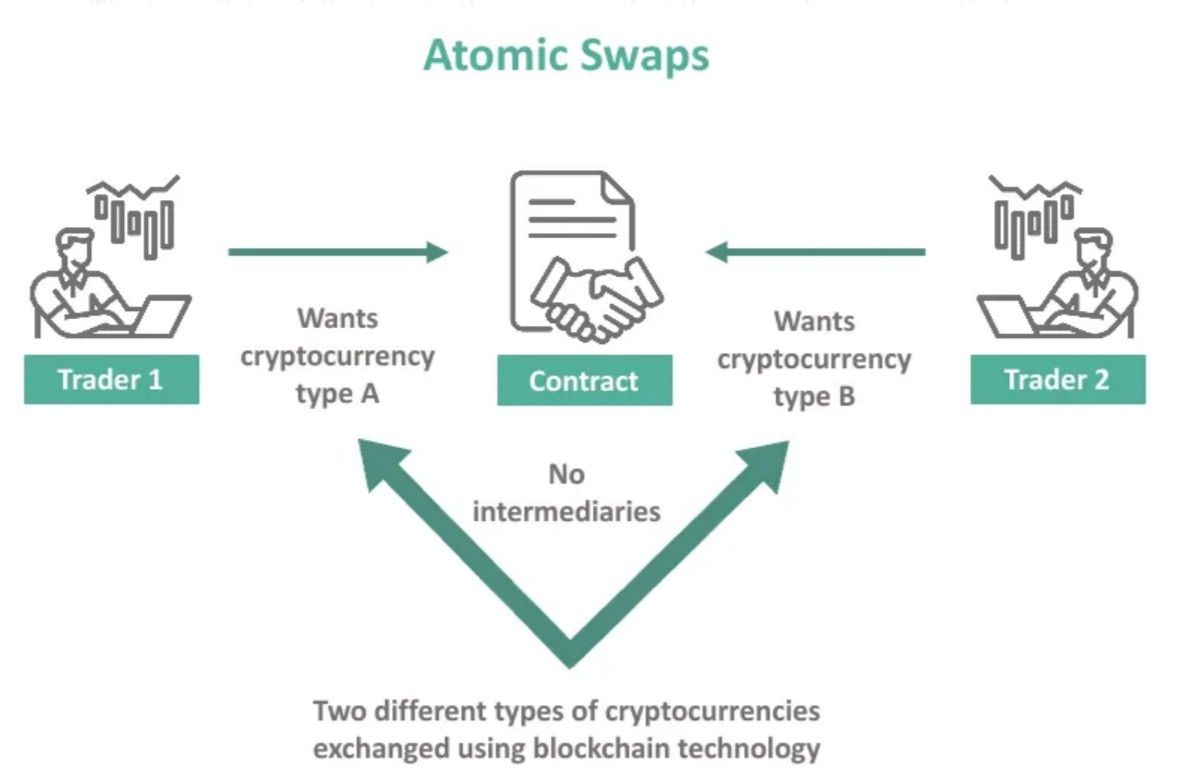

Atomic Swaps Were The First Attempt At Blockchain Interoperability | Image via Medium

Atomic Swaps Were The First Attempt At Blockchain Interoperability | Image via MediumInnovation Achieved: Atomic swaps used hashed time-locked contracts (HTLCs) to enable trustless peer-to-peer asset exchanges between two chains. This mechanism ensured that either both parties received their assets or the transaction was canceled.

An HTLC contract works like an escrow between two parties. The receiving party had to acknowledge receiving funds within a specific time, or the contract would cancel the entire exchange and return the assets to their original addresses.

New Problems and Demands:

- Limited usability: Atomic swaps were complex, requiring participants to be online simultaneously, limiting their applications.

- Low efficiency: They only worked for assets that supported the same hashing and scripting mechanisms.

- No general-purpose interoperability: Atomic swaps allowed asset transfers but did not enable smart contract interactions across chains.

Cross-Chain Bridges (2017–2020): Facilitating Asset and Data Transfers

Problem: Atomic swaps worked only for basic asset exchanges, but DeFi’s rise introduced the need for more fluid asset transfers and smart contract interactions across blockchains. While atomic swaps were limited to peer-to-peer cross-chain interaction, bridges enabled peer-to-contract exchange, allowing users to transfer funds cross-chain rather than an exchange.

Innovation Achieved:

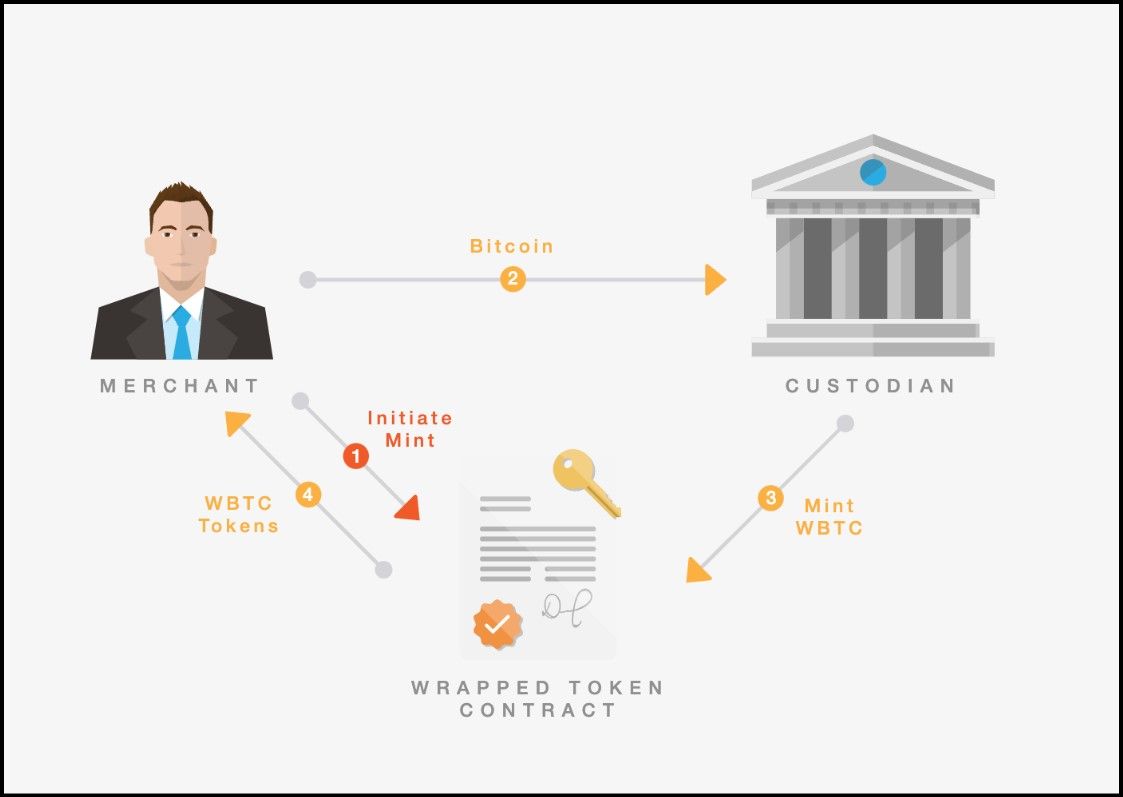

- Liquidity-backed bridges (e.g., Wrapped Bitcoin) allowed assets to be locked on one chain and minted as derivatives on another. Wrapped Bitcoin enabled users to lock BTC in a specific address and mint its synthetic derivative on another, smart contracts-enabled chain like Ethereum, enabling BTC-based DeFi strategies while the lock maintained Bitcoin’s intrinsic value.

- Light-client-based bridges (e.g., Interledger, Cosmos IBC) allow secure cross-chain messaging through Merkle proofs and on-chain verification. A light client is a node that tracks only a network’s block headers instead of the entire block, making it aware of network activity. Light clients can observe a cross-chain request and send the data to the destination chain.

WBTC Architecture | Image via INX

WBTC Architecture | Image via INXNew Problems and Demands:

- Centralization risks: Many bridges relied on trusted parties or federations to manage locked assets, creating honeypots for hacks. Bridges used mechanisms like multi-sig contracts to secure bridge contracts holding massive liquidity, attracting hackers and colluders.

- Security vulnerabilities: Bridges became prime targets for exploits, losing billions in hacks.

- High latency and costs: Verifying cross-chain transactions in a decentralized way was computationally expensive and slow.

Cross-Chain Messaging Protocols (2020–2022): Introducing Smart Contract Composability

Problem: Moving liquidity across chains wasn’t enough. Users demanded smart contract interoperability, the ability to access smart contracts on one chain by calling them from another.

Innovation Achieved:

- Generalized messaging protocols (e.g., LayerZero, Axelar, Wormhole) allowed smart contracts to communicate across chains using relayers, oracles, and multi-party validation.

- Cross-chain DApps: General purpose messaging enabled cross-chain DApps. Developers no longer needed to fork DApps to support multiple networks.

New Problems and Demands:

- Fragmented liquidity: Each rollup or cross-chain bridge had its own liquidity pools, creating inefficiencies.

- Lack of Standards: Same tokens (like stablecoins) on a network arriving form different bridges were not fungible, fragmenting liquidity and creating market inefficiency.

- Lack of user-friendly experiences: Users must manually bridge assets and interact with multiple networks, leading to poor UX.

- Security trade-offs: Some messaging protocols compromised on decentralization or relied on external relayers.

Intent-Based Interoperability (2022–Present): Automating Cross-Chain Execution

Problem: Cross-chain interactions remained user-initiated and manual, requiring users to bridge assets and execute transactions across different chains. This complexity hindered mass adoption.

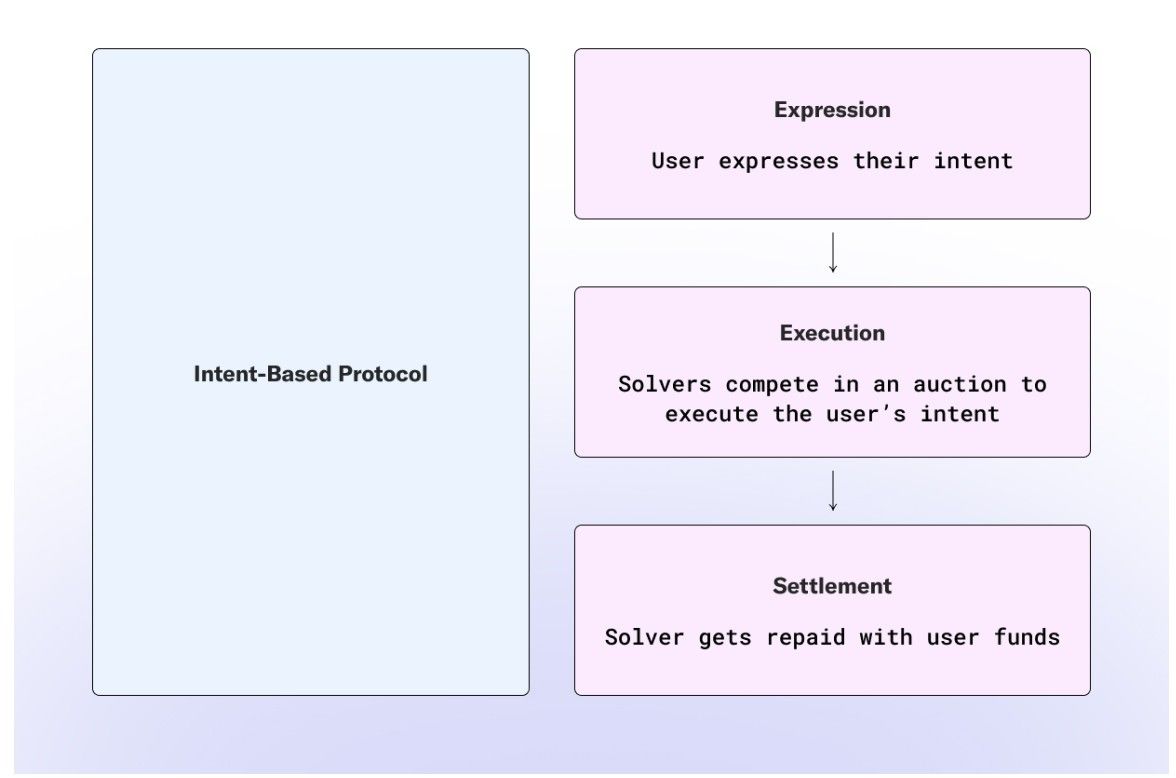

Structure of Intent-Based Protocols | Image via Li.Fi

Structure of Intent-Based Protocols | Image via Li.FiInnovation Achieved:

- Intent-based architectures (e.g., Anoma) shifted the paradigm from users signing every transaction to users expressing what they want to achieve (intent), and decentralized solvers would execute the transaction most optimally.

- Composable interoperability (e.g., Hyperlane, Chainlink CCIP) allowed chains to communicate at the smart contract level, making interoperability more seamless.

New Problems and Demands:

- Standardization challenges: No universal standard exists for how intents should be expressed and executed across chains.

- Trust assumptions: Some intent-based systems introduce new middlemen (solvers), requiring trust in off-chain computation.

- Efficiency constraints: Ensuring fast execution and MEV resistance remains an area of active development.

Chain Abstraction (Emerging Trend, 2024+): Erasing Blockchain Boundaries

Problem: Even with intents, users still need to know what chain they interact with. The end goal of interoperability is complete chain abstraction—where users interact with applications without worrying about which blockchain they are on.

Innovation Achieved:

- Omnichain execution layers (e.g., Omni Network, Particle Network) aim to make chains interoperable at the base layer, removing the need for bridges entirely.

- AI-driven solvers automate complex cross-chain transactions in a way that is invisible to users.

Next Challenges:

- Security trade-offs: Chain abstraction solutions rely on relayers and third-party execution layers, requiring robust security measures.

- Scalability: Handling seamless execution across multiple chains with low latency remains a technical challenge.

- Ecosystem adoption: For chain abstraction to succeed, wallets, apps, and developers must integrate these solutions.

Conclusion: Where Are We Headed?

The evolution of blockchain interoperability has consistently followed a cycle of demand, innovation, and new challenges:

- Atomic Swaps introduced basic trustless swaps but lacked flexibility.

- Cross-Chain Bridges enabled transfers but were security risks.

- Messaging Protocols & Rollups improved interoperability but led to liquidity fragmentation.

- Intent-based systems automated cross-chain execution but still required user knowledge of chains.

- Chain Abstraction is now eliminating blockchain barriers, making interactions chain-agnostic.

The endgame of blockchain interoperability is a fully unified ecosystem in which users interact with DApps without knowing which blockchain they are on—just as the Internet abstracts away underlying network protocols today.

Core Components of Blockchain Interoperability

Achieving seamless interaction between diverse blockchain networks involves several key components, each addressing specific challenges to ensure efficient and secure cross-chain operations. Let's investigate these core components and understand their roles in fostering blockchain interoperability.

Components of blockchain interoperability | Image via Li.Fi

Components of blockchain interoperability | Image via Li.FiOrchestration Projects

Role: Orchestration projects facilitate seamless interactions across multiple blockchain networks, enabling users to execute cross-chain operations without delving into the underlying complexities.

Subcomponents:

- Account Abstraction: This approach simplifies user interactions by decoupling the complexities of blockchain accounts from the end-user experience. Projects like Avocado and Turnkey focus on creating more intuitive interfaces, allowing users to manage assets across different chains without handling multiple private keys or understanding the intricacies of each blockchain.

- Wallet Abstraction: Wallet abstraction aims to unify the management of assets across various blockchains. Platforms such as OneBalance, Particle Network, Arcana Network, and Orb Labs provide solutions that allow users to access and manage their holdings on different chains through a single wallet interface, enhancing user experience and reducing friction.

- Orchestration Frameworks: Projects like Klaster, Light, Agoric, and Li.Fi develops frameworks that coordinate and manage cross-chain transactions. They ensure that a user's intent to perform operations across multiple blockchains is executed efficiently and securely, handling the complexities of communication and transaction validation between networks.

Orderflow Sources and Auctions

Role: These projects manage the flow of transactions across different blockchains, ensuring efficient liquidity distribution and optimal execution of cross-chain operations.

Key Projects:

- Socket: Facilitates seamless asset transfers between blockchains, ensuring liquidity is efficiently managed across networks.

- UniswapX: An extension of the Uniswap protocol, UniswapX enables cross-chain swaps, allowing users to trade assets across different blockchains seamlessly.

- Router Protocol: Provides infrastructure to facilitate cross-chain communication, enabling the exchange of assets and data between heterogeneous blockchains.

- Across+: Focuses on efficient bridging solutions, allowing quick and cost-effective transfers between Layer 2 networks and Ethereum.

- deBridge: Offers a decentralized platform for cross-chain interoperability, enabling the transfer of arbitrary data and assets between various blockchains.

- Anoma: Aims to provide a generalized framework for asset-agnostic, privacy-preserving transfers and interactions across multiple blockchains.

Solvers and Solver Networks

Role: Solvers are entities or algorithms that find optimal paths and methods to execute cross-chain transactions, ensuring efficiency and minimizing costs. Solver networks are collaborative platforms where multiple solvers work together to enhance transaction execution.

Achieving Interaction Between Blockchains Involves Several Components. Image via Shutterstock

Achieving Interaction Between Blockchains Involves Several Components. Image via ShutterstockKey Projects:

- Solver Networks: Platforms like Enso and Khalani create environments where multiple solvers can operate, providing diverse strategies for transaction execution and improving overall efficiency in cross-chain operations.

- Solvers: Entities such as Wintermute and Amber specialize in liquidity provision and market-making across various blockchain networks. They ensure that cross-chain transactions have the necessary liquidity and are executed at optimal prices.

Token Standards

Role: Standardized token protocols ensure consistency and compatibility of tokens across different blockchain networks, facilitating seamless transfers and interactions.

Notable Standards:

- ERC-7281 (Shared Security Vaults)

- Defines a cross-chain shared security vault mechanism, allowing multiple chains to collectively secure assets and provide staking-based security models.

- Interoperability Role: Facilitates cross-chain security sharing, enabling assets and protocols to leverage unified security pools across blockchains.

- ERC-7683 (Cross-Chain Order Flow Auctions - COFA)

- Standardizes a cross-chain transaction execution mechanism by introducing decentralized order flow auctions.

- Interoperability Role: Helps optimize cross-chain execution by allowing solvers to bid for transaction fulfillment, ensuring cost-effective and efficient asset transfers across blockchains.

- ERC-4337 (Account Abstraction for Smart Wallets)

- Enables smart contract wallets to operate like externally owned accounts (EOAs) by removing the need for private key-controlled accounts.

- Interoperability Role: Simplifies cross-chain user experiences by allowing smart wallets to function seamlessly across different blockchains without requiring changes to consensus rules.

- EIP-3074 (Transaction Sponsorship & Batch Execution)

- Allows EOAs to delegate transaction execution to smart contracts, enabling meta-transactions and sponsored transactions.

- Interoperability Role: Improves cross-chain composability by reducing gas fees and enabling seamless relayed transactions across L1s and L2s.

- EIP-7022 (Execution Layer-Triggerable Validator Withdrawals)

- Extends validator withdrawal capabilities by enabling execution layer-triggered exits, removing dependence on the consensus layer.

- Interoperability Role: Enhances cross-chain validator coordination, enabling smoother interactions between Ethereum staking and restaking systems integrated across multiple chains.

These standards contribute to Ethereum's cross-chain interoperability by reducing friction in security, execution, asset movement, and user interactions across blockchain ecosystems.

Settlement and Infrastructure Projects

Role: These projects provide the foundational infrastructure for cross-chain communication, transaction settlement, and smart contract interoperability.

Key Projects:

- LayerZero: Offers an omnichain interoperability protocol that enables decentralized applications to communicate across multiple blockchains efficiently.

- Hyperlane: Provides a platform for secure cross-chain messaging, allowing smart contracts on different blockchains to interact seamlessly.

- Axelar: Delivers a decentralized network and tools to facilitate secure cross-chain communication, enabling developers to build interoperable applications.

- Wormhole: A cross-chain messaging protocol that connects multiple blockchains, allowing the transfer of assets and information between them.

- Omni Protocol: Focuses on providing a unified interface for cross-chain interactions, simplifying the development of interoperable applications.

- Astria: Develops infrastructure to support cross-chain settlement and communication, enhancing the scalability and interoperability of blockchain networks.

- Polygon Agglayer: Part of the Polygon ecosystem, Agglayer aims to aggregate liquidity and facilitate seamless transactions across various Layer 2 solutions and Ethereum.

- Optimism Superchain: An extension of the Optimism Layer 2 solution, the Superchain focuses on creating a cohesive network of rollups that can interoperate seamlessly, enhancing scalability and user experience.

By integrating these components, the blockchain ecosystem moves closer to achieving true interoperability, where assets and data can flow freely across diverse networks, unlocking new possibilities for decentralized applications and services.

Benefits of Blockchain Interoperability

A New Era of Blockchain Interoperability with Chain Abstraction

Blockchain interoperability has come far from simple token swaps and cross-chain bridges. With the onset of chain abstraction, interoperability is no longer just about moving assets between networks—it’s about making blockchain boundaries invisible to users and developers. This new paradigm allows applications to function seamlessly across multiple chains, solving challenges once considered insurmountable.

Today, interoperability frameworks like generalized messaging layers, intent-based execution models, and universal smart contracts have redefined what’s possible in the blockchain space. Problems such as network congestion, liquidity fragmentation, complex account management, and developer silos are being tackled in ways that were inconceivable just a few years ago. Let’s explore the key benefits.

1. Reduced Congestion on the Ethereum Mainnet

One of the biggest challenges in blockchain scalability has been Ethereum’s network congestion, which leads to high gas fees and slow transaction times. In the past, users had no choice but to compete for block space on Ethereum, causing fees to skyrocket during periods of high demand (e.g., NFT minting booms or DeFi liquidations).

With cross-chain interoperability, transactions can now be offloaded to Layer 2 solutions (e.g., Arbitrum, Optimism, Starknet) or alternative chains (e.g., Polygon, Avalanche) while still maintaining Ethereum's security guarantees. Additionally, cross-rollup messaging protocols like LayerZero, Axelar, and Hyperlane allow smart contracts on Ethereum to interact with contracts on other chains without requiring users to manually bridge assets.

Example: Instead of executing all DeFi trades on Ethereum, users can swap assets on Arbitrum while settlement occurs on Ethereum, reducing congestion on the mainnet while maintaining security.

Blockchain Interoperability Has Come Far From Token Swaps And Bridges. Images via Shutterstock

Blockchain Interoperability Has Come Far From Token Swaps And Bridges. Images via Shutterstock2. Defragmenting Liquidity and Eliminating Liquidity Silos

Liquidity fragmentation has been a persistent issue in DeFi. Because assets are often locked in isolated pools across different chains, users face inefficiencies, slippage, and price discrepancies when swapping assets.

Interoperability solutions such as Omnichain Liquidity Protocols (e.g., THORChain, Stargate) enable liquidity to move freely across chains, ensuring deeper and more efficient trading markets. Cross-chain DEXs (e.g., Squid, LI.FI, Router Protocol) allow users to swap assets natively between chains without relying on centralized exchanges or traditional bridges.

Example: A trader looking to swap ETH on Ethereum for USDC on Solana can now do so in a single transaction using cross-chain DEXs, without manually bridging assets and swapping them separately.

3. Simplified Account Management with Account Abstraction and Wallet Abstraction

Managing wallets across multiple blockchains has traditionally been a nightmare for users. Different chains require different wallets, and users must manually switch networks, store multiple seed phrases, and remember which chain holds which assets.

With account abstraction (ERC-4337) and wallet abstraction, users can interact with multiple blockchains from a single smart contract wallet without worrying about chain-specific complexities. Additionally, interoperable wallets (e.g., Rabby, Squid, and Particle Wallet) allow users to execute transactions across chains from a single interface.

Example: A user holding assets on Ethereum, BNB Chain, and Avalanche can use a smart contract wallet to execute transactions without switching networks manually or remembering multiple private keys.

4. Reducing the Need to Maintain Multiple Gas Tokens for Different Networks

A major UX pain point in crypto is holding different gas tokens (ETH for Ethereum, MATIC for Polygon, AVAX for Avalanche, etc.) to pay for transactions on different chains. This adds unnecessary complexity, especially for new users.

Gas abstraction solutions now allow users to pay gas fees in any token or even have gas costs sponsored by third-party relayers. Projects like Biconomy, Pimlico, and Gelato enable gasless transactions and cross-chain gas payments, making blockchain interactions frictionless.

Example: A user sending USDC on Optimism can pay gas fees in USDC instead of needing ETH, simplifying the user experience.

5. Defragmenting Developer Mindshare Across Different Networks

In the past, blockchain developers had to choose a specific network to build on, leading to tooling, liquidity, and adoption fragmentation. Developers working on Ethereum were often isolated from those building on Solana, Avalanche, or Cosmos.

With interoperability solutions like cross-chain smart contract frameworks (e.g., Agoric, Hyperlane, Axelar VM, Omni Network, and Particle Network), developers can write applications once and deploy them across multiple blockchains without re-engineering them for each network.

Example: A DeFi protocol can now launch a single smart contract that interacts seamlessly with Ethereum, Solana, and Cosmos, ensuring a unified user base and liquidity pool across chains.

Conclusion: The Future is Chain-Agnostic

Blockchain interoperability has evolved from simple asset bridges to full-stack execution layers that abstract away blockchain differences entirely. As we move toward chain abstraction, users will no longer need to care about which chain they are using, which gas token they need, or how to manage multiple wallets. Ecosystem silos will no longer limit developers and can build applications that work seamlessly across chains.

In the near future, the blockchain experience will be as seamless as the internet, where users interact with applications without worrying about the underlying network.

Challenges to Blockchain Interoperability

While blockchain interoperability has made significant strides, it still faces several technical, structural, and security challenges that hinder seamless cross-chain interactions. As the blockchain ecosystem grows more complex, these challenges become even more pronounced.

Blockchain Interoperability Still Faces Several Challenges. Image via Shutterstock

Blockchain Interoperability Still Faces Several Challenges. Image via ShutterstockTechnical Barriers: The Trust Assumption Problem

Blockchain networks were never originally designed to communicate with each other, and forcing cross-chain interoperability always introduces some degree of trust.

Even in the most decentralized interoperability models—such as light-client bridges or zero-knowledge proofs for cross-chain messaging—there is no such thing as perfect trustlessness. Every interoperability solution must make trade-offs:

- Bridges rely on external relayers, validators, or multi-party computation to confirm cross-chain transactions.

- Messaging protocols depend on external oracles or quorum-based consensus.

- Cross-chain smart contracts introduce attack vectors where one network’s security assumptions don’t align with another.

Example: The Wormhole bridge hack ($320M lost) occurred because of a smart contract vulnerability in verifying cross-chain messages. Even trust-minimized solutions remain exposed to security flaws.

Ultimately, every interoperability mechanism introduces a trust model that must be evaluated, and while decentralization and cryptographic security have improved, truly trustless interoperability remains elusive.

Lack of Standards: Fragmentation Across Solvers and Abstraction Layers

The current landscape of solver networks, intent-based execution models, and interoperability frameworks is highly fragmented, creating compatibility issues across different solutions.

- Intent-based protocols like Anoma and CowSwap rely on solvers, but no universal way exists to define or execute intents across networks.

- Cross-chain messaging protocols (e.g., Axelar, LayerZero, Hyperlane) all have different architectures, making interoperability protocol-dependent.

- Liquidity fragmentation across omnichain DEXs like THORChain, Squid, and Stargate means cross-chain swaps require protocol-specific routes.

This lack of standardization hinders composability and forces developers to choose between siloed interoperability solutions.

Example: A DeFi protocol building a cross-chain application must decide whether to integrate with LayerZero’s OFT standard, Axelar GMP, or Hyperlane. Integration decisions lock projects into specific frameworks since no universal messaging standard exists.

Without widely adopted interoperability standards, solvers, relayers, and abstraction layers will remain fragmented, limiting efficiency and adoption.

Ever-Growing Network Webs: The Scaling Problem of Interoperability

The number of blockchains, consensus mechanisms, token standards, and execution layers is growing faster than ever, making it increasingly difficult to maintain a unified interoperability network.

Key factors driving this complexity:

- The rise of appchains (e.g., Cosmos SDK, Avalanche Subnets, Polkadot parachains) is increasing the number of sovereign networks that need interoperability.

- New consensus mechanisms (e.g., Move-based blockchains like Aptos and Sui) introduce architectural differences that complicate cross-chain integration.

- EVM and non-EVM ecosystems (e.g., Solana, Cosmos, Near, and Bitcoin) require entirely different interoperability solutions.

Example: Cross-chain messaging protocols that support Ethereum-based rollups must entirely rework their architecture to support non-EVM blockchains like Solana or Cosmos.

As more chains, rollups, and app-specific blockchains emerge, keeping pace with new integrations and ensuring secure, scalable interoperability will remain a continuous challenge.

Other Challenges: Smart Contract Risks and Security Threats

In addition to the structural challenges of interoperability, several obvious risks persist:

- Smart Contract Vulnerabilities: Cross-chain bridges, messaging protocols, and liquidity pools all rely on smart contracts that can be exploited (e.g., Ronin Bridge Hack - $600M).

- Economic Attacks: Cross-chain arbitrage, sandwich attacks, and MEV (Maximal Extractable Value) risks increase as assets move across chains.

- Oracle Manipulation: Cross-chain oracles introduce additional trust assumptions and can be manipulated in low-liquidity environments.

While interoperability unlocks a chain-agnostic future, these security and structural challenges must be addressed before cross-chain networks can reach full efficiency and reliability.

Future of Blockchain Interoperability: A Blockchain-Agnostic Web3

The ultimate vision for blockchain interoperability is to make Web3 completely blockchain-agnostic—where users no longer need to know, or even care, which blockchain they interact with while performing on-chain activities.

In this future, all blockchains interconnect so efficiently that assets, applications, and smart contracts operate as if they are part of a single unified system. This means:

- Perfect liquidity defragmentation: No more scattered liquidity pools across different chains—capital flows seamlessly across networks, ensuring the most efficient execution for users.

- Perfect cross-chain composability: Applications across different blockchains function as if they exist on the same network, eliminating manual bridging, fragmented ecosystems, and network-switching complexity.

- Invisible blockchain interactions: Users will simply sign transactions through smart wallets, and solvers will execute them optimally across any blockchain without requiring the user to choose a network or pay fees in multiple gas tokens.

With innovations in chain abstraction, solver networks, AI-driven execution layers, and unified liquidity models, the future of interoperability is not just cross-chain compatibility—it’s making Web3 as seamless as the internet, where blockchain boundaries disappear entirely.

Conclusion

Blockchain interoperability began as a systemic problem that needed fixing. Initially, the focus was on solving a fundamental need—moving liquidity from one chain to another without relying on centralized intermediaries.

However, as blockchain ecosystems expanded, interoperability evolved beyond just asset transfers. Today, it plays a crucial role in solving deep-rooted UX challenges, making Web3 more accessible, efficient, and seamless. Instead of just bridging tokens, interoperability now tackles issues like simplified account management, cross-chain composability, and liquidity fragmentation—all essential for mass adoption.

For Web3 to succeed, blockchains must become so intuitive that even our grandparents can use decentralized applications without confusion. This means eliminating technical barriers, abstracting network complexities, and ensuring users never have to think about which blockchain they are on. Interoperability is critical to that vision, bringing us closer to a future where Web3 is as effortless to use as the internet itself.