Cryptocurrencies offer exciting opportunities but often come with wild price swings, leaving many wondering how to balance risk and reward.

Stablecoins, like USDC and USDT, promise the best of both worlds: the innovation of crypto with the stability of traditional currency. But how do they really work? Which one is safer? Which should you choose for trading, saving, or sending money abroad?

In this USDC vs. USDT analysis, we will dive deep into these two stablecoins, exploring their key differences, use cases, and what you need to know to make the best choice for your financial needs.

What are Stablecoins?

Stablecoins like USDC or USDT are a type of cryptocurrency designed to maintain a stable value, typically pegged to the US dollar. Unlike traditional cryptocurrencies like Bitcoin, which are prone to significant price volatility, stablecoins offer price stability, making them a reliable medium of exchange and store of value within the crypto ecosystem.

The primary purpose of stablecoins is to combine the stability of fiat currencies with the benefits of cryptocurrencies. By pegging their value to a stable asset, stablecoins allow users to engage in the crypto market with reduced exposure to price swings. This stability is achieved through various mechanisms:

- Fiat-Collateralized: Backed by reserves of fiat currencies like the US dollar, these stablecoins maintain a 1:1 peg. Examples include USDC and USDT.

- Crypto-Collateralized: Backed by other cryptocurrencies, these stablecoins are often over-collateralized to account for the volatility of their reserves. An example is DAI.

- Algorithmic: These stablecoins use algorithms and smart contracts to manage their supply and maintain their peg, without relying on collateral.

Stablecoins play a crucial role in the cryptocurrency market by enabling seamless transactions, facilitating trading, and serving as a safe haven during market turbulence. They are also central to the decentralized finance (DeFi) ecosystem, where they are used for lending, borrowing, and earning interest.

Importance of Stablecoins in the Crypto Ecosystem

Stablecoins have quickly become the Swiss Army knife of the cryptocurrency world, offering a versatile toolset that enhances how we interact with digital assets. Whether you’re trading, hedging against volatility, sending remittances, or diving into the world of DeFi, stablecoins are a great option.

Use Cases: Trading, Hedging, and Remittances

Stablecoins like USDT (Tether) and USDC are the MVPs. Traders love them because they can swiftly move in and out of positions without the hassle of converting assets back to fiat. This means more flexibility, faster trades, and better portfolio management. Plus, when the market turns into a rollercoaster ride, stablecoins are a trader’s safety harness. By converting volatile assets into stablecoins, investors can ride out the storm without watching their portfolios plummet.

But stablecoins aren’t just for the trading pros — they’re revolutionizing remittances too. Sending money across borders has traditionally been slow and expensive, but stablecoins are changing the game. They allow people to transfer value across the globe at lightning speed and at a fraction of the cost, making them a no-brainer for individuals and businesses alike.

Role in DeFi and Lending Platforms

In DeFi, stablecoins provide the liquidity that powers everything from lending to staking. Imagine earning interest on your stablecoins or taking out a loan without ever dealing with a bank — that’s the magic of DeFi. Stablecoins make it all possible, giving users the freedom to participate in a financial system that’s open to everyone, 24/7.

Adoption by Crypto Exchanges and Wallets

Stablecoins have also won the hearts of cryptocurrency exchanges and wallets. Major exchanges offer trading pairs with stablecoins, making it easier for users to trade in a stable environment. Meanwhile, digital wallets are embracing stablecoins, allowing users to store, send, and receive them just like traditional currencies, but with all the benefits of crypto.

Overview of USDC

USDC is a stablecoin developed and issued by Circle and was officially launched in September 2018. USDC is currently supported on 16 blockchain networks, including Ethereum, Solana, and Polygon, among others. This wide blockchain integration has enabled USDC to become a significant player in the global crypto market, with the token now available in over 100 countries.

USDC is a Fiat-Collateralized Stablecoin. Image via USDC

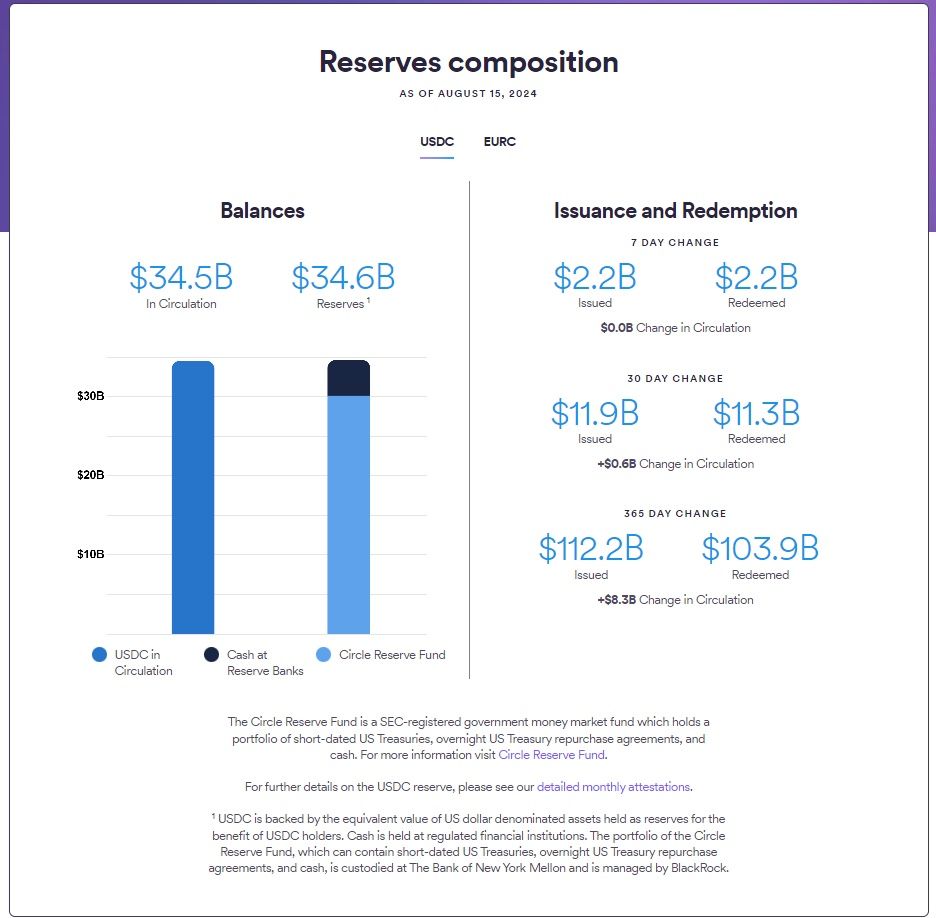

USDC is a Fiat-Collateralized Stablecoin. Image via USDCUSDC is a fiat-collateralized stablecoin, meaning it is backed by a reserve of US dollars and U.S. Treasury instruments held in custody by regulated financial institutions. Since its launch, USDC has grown rapidly, with over $17 trillion in on-chain transactions and a circulating supply of around $34.85 billion as of 2024. One notable milestone is that USDC overtook (USDT) in transaction volume in 2024, highlighting its increasing adoption and importance in the crypto space.

Key Features of USDC

- Fiat-Collateralized Stability: USDC is backed 100% by highly liquid cash and cash-equivalent assets and is always redeemable 1:1 for US dollars. For more information, you can check Circle's transparency page.

- Regulatory Compliance: USDC is designed with compliance in mind. Circle works closely with regulators and financial institutions to ensure the stablecoin adheres to all relevant regulations, making it a trustworthy option for businesses and individuals.

- Multi-Blockchain Support: USDC operates on multiple blockchains, including Ethereum, Solana, and Algorand. This broad support enables cross-chain compatibility and integration with various decentralized applications, enhancing its utility.

- Wide Adoption: USDC is widely accepted on major cryptocurrency exchanges and platforms, offering high liquidity and ease of conversion between digital assets. This widespread adoption also facilitates its use in various trading strategies and DeFi applications.

How USDC Works

The issuance and redemption process for USDC involves the conversion between US dollars and USDC tokens. When a user sends USD to the issuer's bank account, an equivalent amount of USDC is created using a smart contract. The replaced US dollars are then held in reserve.

To redeem USDC for USD, the process is reversed. The user requests an exchange of USDC for USD, and the issuer burns the tokens while releasing the corresponding amount of USD from the reserves to the user's bank account.

USDC operates primarily on the Ethereum blockchain as an ERC-20 token. However, it is also available on other blockchains, including Algorand, Solana, and Stellar, enabling cross-chain compatibility and enhancing its utility in various decentralized applications.

Overview of USDT (Tether)

Tether (USDT) was launched in 2014, originally under the name "Realcoin," by Brock Pierce, Reeve Collins, and Craig Sellars. The idea was to create a digital asset pegged to the US dollar, bringing the stability of fiat currency to the fast-paced world of cryptocurrency. Not long after, the project rebranded as Tether.

Tether is Backed by a Reserve of US dollars. Image via Tether

Tether is Backed by a Reserve of US dollars. Image via TetherTether’s growth has been nothing short of explosive. From a modest circulating supply of $10 million in January 2017, USDT ballooned to almost $2.8 billion by September 2018. Fast forward to 2024, and Tether's circulating supply has surpassed $117 billion, solidifying its position as the most widely used stablecoin. As of Aug. 1, 2024, Tether reported a substantial $118.4 billion in reserves, with a market capitalization exceeding $114 billion. Additionally, Tether's net equity stands at $11.9 billion, reflecting its strong financial position within the stablecoin market.

However, Tether’s journey hasn’t been without its bumps. The company has been dogged by controversy, especially around the transparency of its reserves. In 2017, questions about whether Tether was fully backed by US dollars sparked widespread concern. Things escalated in 2019 when the New York Attorney General accused Tether and its sister company Bitfinex of using reserves to cover up an $850 million loss. Tether settled the case by paying an $18.5 million fine in 2021.

Key Features of USDT

- Multi-Blockchain Support: USDT isn't confined to a single blockchain. It operates across multiple blockchains, including Algorand, Avalanche, Celo, Cosmos, Ethereum, EOS, Liquid Network, Near, Polkadot, Solana, Tezos, Ton, and Tron. This versatility allows USDT to be used on a wide array of platforms and applications, making it highly accessible and integrated across the crypto ecosystem.

- High Liquidity: USDT is one of the most liquid stablecoins available, with massive daily trading volumes. This makes it a preferred choice for traders who need quick and efficient conversion between cryptocurrencies without worrying about slippage or lack of liquidity.

- Wide Adoption: USDT is accepted on nearly every major cryptocurrency exchange and is used in various trading pairs, making it easy for users to trade, send, and receive value. Its widespread use also extends to DeFi platforms, where it serves as a reliable asset for lending, borrowing, and other financial activities.

- Stable Value Pegged to the USD: While this is inherent to all stablecoins, USDT’s value remains consistently pegged to the US dollar, making it a reliable option for hedging against market volatility or transferring value without the fluctuations seen in other cryptocurrencies.

- Transaction Speed and Costs: Thanks to its presence on multiple blockchains, users can choose the network that best suits their needs, balancing transaction speed and costs. For example, USDT on the Tron network often offers faster and cheaper transactions compared to Ethereum.

How USDT Works

The issuance and redemption process for USDT involves the conversion between US dollars and USDT tokens. When a user sends USD to Tether's bank account, an equivalent amount of USDT is created using a smart contract. The replaced US dollars are then held in reserve.

To redeem USDT for USD, the process is reversed. The user requests an exchange of USDT for USD, and Tether burns the tokens while releasing the corresponding amount of USD from the reserves to the user's bank account.

USDT operates on multiple blockchain networks, including Omni, Ethereum, Tron, Algorand, and EOS. This multi-blockchain support allows for greater flexibility and integration with various decentralized applications and platforms.

You can check out our wallet guide to help you decide how to store your USDT securely. And by the way, Tether is about to launch a new stablecoin pegged to UAE's Dirham. We will definitely be keeping an eye on that too.

USDC vs. USDT: A Side-by-Side Comparison

While both are designed to maintain a stable value pegged to the US dollar, they differ significantly in terms of market capitalization, transparency and regulatory compliance. This USDC vs Tether comparison will explore these differences in detail, focusing on market dynamics and compliance measures.

| Feature | USDC | USDT (Tether) |

|---|---|---|

| Launch Year | 2018 | 2014 |

| Issuer | Circle | Tether Limited |

| Reserve Management | Fully backed by US dollars and U.S. Treasuries, with regular attestations | Claims full backing, but transparency has been questioned |

| Transparency | Monthly audits by independent firms | Limited transparency, periodic attestations |

| Regulatory Compliance | High - adheres to U.S. regulations, fully compliant | Limited, with a history of legal challenges |

| Blockchain Support | Ethereum, Solana, Polygon, Algorand, Stellar, etc. | Ethereum, Tron, Algorand, Omni, and many others |

| Market Capitalization (2024) | $34.9 billion | $117 billion |

| Primary Use Cases | DeFi, lending, remittances, long-term holding | Trading, liquidity, remittances, arbitrage |

| Adoption & Liquidity | Widely adopted, but slightly less liquid compared to USDT | Highest liquidity among stablecoins |

| Transaction Speed & Costs | Varies by blockchain | Varies by blockchain |

| Preferred by | Users seeking compliance, transparency, and security | Traders seeking high liquidity and trading pairs |

| Reserve Currency | Primarily US dollars | Mixed reserves including cash and other assets |

| Regulatory Challenges | Few, proactive in compliance | Faced legal challenges, including NY Attorney General case |

| Popularity in Trading | Lower liquidity, fewer trading pairs compared to USDT | Most traded stablecoin, with extensive pairs |

| Security Incidents | Reserves held in reputable financial institutions | Hacking incident in 2017 ($30 million loss) |

Market Capitalization and Adoption

As of August 2024, USDT holds a commanding market capitalization of over $117 billion, making it the largest stablecoin by a substantial margin. In contrast, USDC currently has a market cap of around $34.9 billion, positioning it as the second-largest stablecoin in the market. This difference in market capitalization can be attributed to USDT's longer presence in the market, having launched in 2014 compared to USDC's introduction in 2018.

Both stablecoins have achieved significant adoption across various cryptocurrency exchanges and platforms. USDT is widely integrated into trading pairs, allowing users to trade against it on virtually all major exchanges. Its high liquidity makes it a preferred choice for traders looking to quickly enter and exit positions.

The liquidity pools involving both USDC and USDT are essential for the functioning of DeFi platforms. However, USDT's higher liquidity generally leads to more competitive trading conditions, attracting a broader range of users and applications.

Transparency and Regulatory Compliance

When comparing Tether vs USDC, transparency plays a key role, with USDC often seen as more transparent due to regular audits.

USDC is known for its robust auditing practices, providing monthly reports from independent accounting firms that verify its reserves. This commitment to transparency helps build trust among users and regulators alike.

USDC is Known For its Robust Auditing Practices. Image via Circle

USDC is Known For its Robust Auditing Practices. Image via CircleIn contrast, Tether has faced scrutiny regarding its auditing practices. While it has made efforts to publish attestations of its reserves, the frequency and detail of these reports have been questioned. Tether's historical lack of transparency has led to concerns about its credibility, especially in light of past controversies and legal challenges.

Regulatory compliance is another area where USDC stands out. It adheres to U.S. money transmission laws and works closely with regulators to ensure compliance, which enhances its reputation as a secure and reliable stablecoin. Tether, on the other hand, has faced legal challenges, including investigations by the New York Attorney General, which have raised questions about its operational practices and reserve management.

Fiat-Backing and Reserve Management

Both USDC and USDT are fiat-collateralized stablecoins, meaning they are backed by a reserve of US dollars. However, the transparency and management of these reserves differ between the two as we already highlighted.

USDC is known for its commitment to full reserve backing, with regular attestations from independent auditors confirming that the reserves are sufficient to back all USDC tokens in circulation. Circle, the company behind USDC, holds the reserves in accounts at regulated financial institutions in the United States. This transparency helps maintain confidence in USDC's stability and reduces the risk of a loss of peg.

In contrast, Tether's reserve management practices have been a source of controversy. While Tether claims its reserves are fully backed, it has faced allegations of only partially backing USDT with fiat reserves. Tether has been slow to provide detailed audits, relying instead on periodic attestations that do not provide the same level of assurance as a full audit. This lack of transparency has led some to question the stability of USDT and its ability to maintain its peg during times of market stress.

Speed and Cost of Transactions

USDC and USDT both operate on multiple blockchain networks, allowing for flexibility in transaction speed and cost. USDC is available on Ethereum, Algorand, Solana, and Stellar, while USDT can be found on Ethereum, Tron, Omni, and other networks.

The speed and cost of transactions depend on the specific blockchain being used. For example, transactions on the Ethereum network may take longer and incur higher fees compared to transactions on Tron or Algorand. However, both stablecoins generally offer fast and low-cost transactions, making them suitable for a wide range of use cases, including remittances, trading, and DeFi applications.

Security and Risk Factors

USDC and USDT both employ standard security measures to protect against hacking and fraud, such as multi-signature wallets and regular security audits. However, no system is entirely immune to risk, and both stablecoins have faced challenges in the past.

In 2017, USDT was the target of a hacking attack that resulted in the loss of $30 million worth of tokens. While the incident did not directly impact the stability of the peg, it highlighted the potential risks associated with holding digital assets. USDC, on the other hand, faced a challenge in 2023 when Silicon Valley Bank, where a portion of its reserves were held, collapsed. However, Circle was able to quickly transfer the affected reserves to a new banking partner, minimizing the impact on USDC's peg.

Counterparty risk is another concern for both stablecoins. As centralized entities, USDC and USDT rely on the stability and trustworthiness of the companies behind them. The risk of mismanagement, fraud, or regulatory action could potentially impact the stability of the stablecoins. However, USDC's commitment to transparency and regulatory compliance may help mitigate this risk compared to USDT's historical opacity.

Use Cases: When to Use USDC vs. USDT

Below, we explore the key scenarios where one might be more advantageous than the other.

Trading on Cryptocurrency Exchanges

When it comes to trading on cryptocurrency exchanges, liquidity is king. USDT, with its massive market capitalization and widespread acceptance, is the go-to stablecoin for many traders. Its deep integration across exchanges means more trading pairs and better arbitrage opportunities, which can lead to better price execution and lower slippage during trades. USDT’s liquidity makes it a favorite among those who need quick and efficient trades.

On the other hand, while USDC is gaining traction, it typically has fewer trading pairs and slightly lower liquidity compared to USDT.

DeFi and Yield Farming

In the DeFi space, both USDC and USDT are heavy hitters, but they cater to different crowds. USDC is often the preferred choice for those diving into DeFi, thanks to its strong integration with various platforms. Whether you’re staking, lending, or yield farming, USDC provides attractive opportunities, especially in liquidity pools where you might earn governance tokens or additional yields.

Of course, the risks associated with DeFi — like smart contract vulnerabilities and market volatility — apply to both stablecoins. USDC’s transparency and regular audits might offer some peace of mind, but remember that the DeFi ecosystem is still fraught with risks, regardless of which stablecoin you choose.

Cross-Border Transactions and Remittances

For cross-border transactions and remittances, both USDC and USDT offer significant advantages over traditional methods. USDC stands out for its speed and low cost, making it a practical option for international transfers. Many remittance companies are adopting USDC, allowing users to send funds quickly and at a fraction of the cost compared to traditional services, which often come with high fees and slow processing times.

USDT also excels in this space, especially for users who want easy access to fiat conversions. However, keep in mind that depending on the network, USDT can have higher transaction fees, which might be a drawback compared to USDC's typically lower costs. You might want to keep an eye on the varying fees on different networks to make better decisions regarding your investment.

Hedging Against Volatility

Both USDC and USDT are great tools for hedging against market volatility, but they appeal to different preferences. In turbulent markets, USDC is often seen as the safer bet due to its transparency and strict regulatory compliance. Investors looking to preserve their capital during downturns might prefer USDC, trusting its full backing and regular audits.

Meanwhile, USDT’s sheer market presence and liquidity make it a favorite for traders who need to move quickly in and out of positions. While it can also act as a safe haven, ongoing concerns about its reserve management and transparency might lead some users to choose USDC for long-term value storage.

Regulatory Landscape and Future Outlook

The stablecoin space has been under increasing scrutiny from regulators worldwide. Both USDC and USDT are impacted by evolving regulations, particularly in the United States and Europe.

Current Regulatory Environment

In the U.S., regulations surrounding stablecoins are still in flux. The 2024 bipartisan Lummis-Gillibrand Payment Stablecoin Act aims to establish clear rules for stablecoin issuers, requiring stablecoins to maintain 100% reserves in liquid assets. This legislation specifically bars algorithmic stablecoins and mandates that only regulated financial institutions can issue stablecoins, driving higher transparency and security expectations across the board.

Across the Atlantic, the European Union has implemented its Markets in Crypto Assets (MiCA) regulation. MiCA enforces a 1:1 reserve ratio for stablecoins like USDT and USDC and requires at least 30% of their reserves to be held with independent credit institutions. These moves reflect a trend towards tighter control and consumer protection, requiring stablecoins to align with stringent liquidity and transparency standards.

Despite these advancements, the U.S. regulatory framework remains fragmented. Agencies like the SEC and CFTC have yet to issue comprehensive guidance for stablecoins, which poses ongoing compliance challenges for issuers.

Future of Stablecoins

Looking ahead, the stablecoin market is expected to evolve in response to regulatory pressures. Circle's emphasis on transparency and regulatory compliance may position USDC as the stablecoin of choice for institutions and businesses. In contrast, USDT, with its wider market adoption, could still dominate trading volumes, particularly in more speculative areas of the crypto market.

Technological developments such as enhanced reserve management and blockchain interoperability will further shape the stablecoin landscape. Central Bank Digital Currencies (CBDCs) could also play a pivotal role. Although CBDCs might present competition, USDC and USDT are likely to retain their importance in DeFiand cross-border transactions.

USDC vs. USDT: Which Stablecoin Should You Choose?

Choosing between USDC and USDT ultimately depends on your specific needs and priorities in the cryptocurrency space. Both stablecoins offer distinct advantages, but they cater to different user profiles and use cases.

Summary of Key Differences

USDC and USDT, while both pegged to the U.S. dollar, differ significantly in their approach to transparency, regulatory compliance, and market presence. USDT boasts higher liquidity and wider adoption, making it the go-to choice for traders who value fast execution and access to numerous trading pairs. However, it has faced criticism for its reserve management and lack of transparency. In contrast, USDC is lauded for its rigorous regulatory compliance and transparency, regularly audited to ensure full backing. This makes USDC more appealing to users who prioritize security and regulatory adherence.

Recommendations Based on Use Case

If your primary focus is on trading, particularly on major exchanges, USDT is the clear winner. Its extensive integration and high liquidity mean you can trade with minimal slippage and access a broad range of trading pairs.

For those who prioritize regulatory compliance and transparency, USDC stands out. Its commitment to maintaining full reserves, coupled with regular audits, makes it a more secure option, especially for institutional users or those who prefer a stablecoin with a strong regulatory standing.

If you're considering long-term holding or using stablecoins as a safe haven during market volatility, USDC's transparency and regulatory backing offer peace of mind. While USDT is widely used, ongoing concerns about its reserve practices might make USDC a more prudent choice for long-term safety.

Final Thoughts

As the stablecoin market continues to evolve, it’s crucial to stay informed about regulatory developments and the technological advancements that could impact the utility and safety of these assets. While USDC may gain a regulatory edge in the future, USDT's liquidity and market dominance are hard to ignore. Users should weigh these factors carefully, staying agile and cautious in a rapidly changing environment. Ultimately, the best stablecoin for you will depend on balancing the need for liquidity with the desire for security and compliance.