The math decides the headline: $1 BONK is not realistic under today’s supply. Even $0.01 would require a market cap rivaling the largest crypto assets in prior cycles. A more plausible band sits between $0.00003–$0.00010 across favorable windows, with upside driven by Solana risk-on, exchange depth, and fee-linked burns. Treat BONK as a tactical trade rather than a long-term compounder. Keep position sizes small, take profits into strength, and watch Solana trend, burn cadence, and unlock flow to avoid overstaying the move.

Forecast at a glance:

- 2025 Range: Min $0.000015 — Base $0.000035 — Max $0.000090.

- 2030 Base Case: $0.000085.

- $1 Target: Mathematically unfeasible at current supply. At ~81.2T–87.99T tokens, $1 implies roughly $81–$88 trillion market cap — that's 35× Bitcoin’s market cap today, ~148× Ethereum’s, ~20× the entire crypto market.

- Risk Label: High-risk, momentum-driven memecoin with high beta to Solana cycles.

Numbers reflect our research snapshot (Sep 18–19, 2025) and source ranges cited in the BONK price-prediction section. Always verify live data before trading.

Key BONK Metrics

Figures auto-update via CoinGecko; always verify on your chosen exchange before trading.

BONK’s realistic price ceiling is set by two anchors: the actual amount of supply in circulation and where meaningful liquidity sits. The numbers below establish that baseline before any price math or forecasts.

Supply & unlocks

- Initial supply: ~93T at launch (December 2022).

- Current total supply: 87.99T (post-burns).

- Circulating supply: 81.20T (≈92% unlocked).

- Emissions: None; design is deflationary via burns, not inflationary.

Snapshot, Sept. 18, 2025. Data via CoinGecko

Liquidity & coverage

Top CEX by recent 24h spot share:

Snapshot, Sept. 18, 2025

Order books are sufficiently deep for retail-sized trades; recent audits/reports flagged no significant wash-trading red flags, suggesting flows are primarily speculative but organic.

Top DEX by recent 24h share:

- PancakeSwap ~$1.9M

- Orca ~$863K

- Meteora ~$669K.

Trading note: Momentum is supported, but Solana congestion can widen DEX slippage; execution quality varies with network load.

With ~81–88T units outstanding and liquidity concentrated across a handful of venues, even small price moves translate into very large market-cap changes. All subsequent forecasts reference this supply-and-liquidity base.

Price History & Catalyst Timeline

BONK’s trajectory since launch follows the standard meme-coin pattern: early parabolic spikes at micro-caps, then smaller percentage swings as market cap scales.

As BONK moved from tens of millions to multi-billions, rallies required broader catalysts; tier-1 listings, ecosystem burns, and Solana cycle strengths, while profit-taking and liquidity walls tempered upside.

BONK's Price History Shows Classic Memecoin Volatility Patterns | Image via Coingecko

BONK's Price History Shows Classic Memecoin Volatility Patterns | Image via CoingeckoFigures below reflect closing prices and approximate market caps from the desk timeline snapshot; percentage changes are milestone-to-milestone.

-

Dec 25, 2022 Launch / Airdrop$0.00000084 ~$74M 50% airdropped

Airdrop to Solana users/NFTs; “Solana revival” narrative post-FTX.

-

Jan 15, 2023 Early Hype Peak$0.0000052 ~$465M +519%

First CEX listings (e.g., MEXC); meme season on X.

-

Oct 10, 2023 Bear-Market Trough$0.00000021 ~$18M −96%

Liquidity dries up with SOL drawdown.

-

Dec 20, 2023 Revival Surge$0.0000245 ~$2.2B +11,567%

SOL DeFi rebound; BONK DAO burn activity lifts sentiment.

-

Mar 4, 2024 First Major ATH$0.0000470 ~$4.3B +92%

Coinbase listing window drives U.S. access; Bonkbot launch; meme-coin mania.

-

Jun 15, 2024 Mid-Year Dip$0.0000105 ~$950M −78%

Halving-era cooldown; congestion fears; profit-taking.

-

Nov 20, 2024 Second ATH$0.0000592 ~$5.4B +414%

Strong Solana flows; integrations and wallet support.

-

Feb 10, 2025 Consolidation$0.0000187 ~$1.7B −68%

Regulatory FUD; softer social momentum.

-

Jul 24, 2025 Burn-Driven Rally$0.0000354 ~$2.9B +89%

Major burn headlines (incl. 1T on 1M-holders pledge); BONKSwap launch chatter.

-

Sep 18, 2025 Current$0.0000251 ~$2.0B −29%

Q3 range trade; cumulative burns (~5–6% supply reduction since launch) but no mega-catalyst.

Takeaway

BONK matured from airdrop-fueled moonshots to burn-and-ecosystem-anchored swings at ~$2B+. Upside increasingly depends on sustained Solana risk-on and recurring burn/flywheel catalysts rather than one-off hype.

Mathematics: Can BONK Realistically Reach $1?

The answer depends on one thing: market-cap math.

The Formula

For any token, Market Cap = Price × Circulating Supply. Rearranged, Price = Market Cap ÷ Circulating Supply. The hard limiter is supply: with tens of trillions of BONK in circulation, even small price targets imply colossal market caps. This is why $0.01 vs $1 is not “just 100× more” in difficulty; it’s 100× more market cap at the same supply.

Current context (Sep 19, 2025)

- Circulating supply: 81.20T (≈92% unlocked)

- BTC market cap: ~$2.32T

- ETH market cap: ~$548B

- Total global equities market cap (2024 full-year): ~$126.7T (latest SIFMA Fact Book).

$1 Scenario Math

Required market cap at $1:

$1 × 81.21T ≈ $81.2 trillion.

That’s roughly 35× Bitcoin’s market cap today, ~148× Ethereum’s, ~20× the entire crypto market, and ~64% of all global equities — for just one memecoin.

Useful reality checks at the current supply

- If BONK ever matched BTC’s cap today (~$2.32T), its price would be ≈ $0.0286 (about 2.86 cents), not $1.

- If it matched ETH’s cap today (~$548B), the price ≈ $0.00675.

- Even a $1T cap implies ≈ $0.0123 per BONK at today’s float. (Reference point only; not a forecast.)

| Target BONK Price | Implied BONK Market Cap |

|---|---|

| $0.001 | $81.2B |

| $0.01 | $812B |

| $0.10 | $8.12T |

| $1.00 | $81.2T |

What Would Need to Change

To get $1 without demanding an $81T+ valuation, the circulating supply must collapse. Target supply is:

Target Supply = Desired Market Cap ÷ $1

Examples:

- To keep BONK at a BTC-sized cap (~$2.32T) and still be $1, the target supply must be ~2.32T BONK. From ~81.21T today, that’s a ~97.1% reduction via burns/redenomination.

- For an ETH-sized cap (~$548B) at $1, the supply must shrink to ~0.55T BONK, a ~99.3% reduction.

- Even allowing a $1T cap, supply must fall to ~1T BONK, which would be~98.8% lower than today.

Burns vs. redenomination:

- Burns permanently remove units; requires massive, sustained mechanisms (fees redirected to burns, DAO-approved burn programs, etc.).

- Redenomination (reverse split) can make the per-unit price higher by changing units (e.g., 1000:1), but doesn’t change market cap, so it doesn’t make holders richer by itself. It only eases optics.

Bottom Line

At today’s ~81.21T circulating supply, $1 BONK implies an ~$81T valuation — orders of magnitude beyond crypto’s largest assets and most of global equities. Without extreme, credible, and persistent supply reduction (and world-historical demand), $1 is not a realistic base-case.

BONK Price Prediction (2025–2030)

Forecasts for 2025 generally project modest gains (≈2×–4× from current ~$0.000025), driven by Solana upgrades and meme-sector rotations, but capped by high supply and competition from newer tokens. Before we get into the weeds, here's a BONK forecast table:

| Source | Minimum Price | Average/Base Price | Maximum Price | Notes/Scenarios |

|---|---|---|---|---|

| Changelly | $0.000015 | $0.000020 | $0.000026 | Monthly peaks in Sep; base assumes steady Solana TVL growth. Bull: Hype cycles. |

| CoinCodex | N/A | $0.000035 | $0.000045 | Algorithmic forecast; bear: Market downturns; bull: +150% from listings. |

| Flitpay | $0.0000117 | $0.000037 | $0.000068 | Converted from INR; bull scenario includes burns and adoption spikes. |

| Cryptomus | $0.0000117 (Mar low) | $0.000029 (Dec avg) | $0.000035 (Dec high) | Monthly breakdown; base: U.S. economic optimism; bear: Regulatory FUD. |

| CoinLore | N/A | $0.000048 | N/A | Long-term algo; assumes momentum continuation. |

2025 Monthly Forecasts

Source basis: CoinCodex monthly projections for the remaining months of 2025; today’s spot ≈ $0.00002438. Sep–Dec rows include % change for the Base column vs. today.

| Month 2025 | Min (USD) | Base (USD) | Max (USD) | %Δ vs. today (Base) |

|---|---|---|---|---|

| September | 0.00001693 | 0.00001930 | 0.00002427 | −20.84% |

| October | 0.00001798 | 0.00001901 | 0.00001968 | −22.03% |

| November | 0.00001811 | 0.00001873 | 0.00001953 | −23.17% |

| December | 0.00001784 | 0.00001819 | 0.00001852 | −25.39% |

Notes:

- CoinCodex monthly table (Sep–Dec 2025) used for Min/Base/Max.

- Changelly also posts monthly blurbs for Q4 2025 (clustered near $0.000026), but we kept one-source consistency in the table and cite Changelly separately in the yearly scenarios below.

Inference (Q4-2025): The table’s Base track clusters tightly around $0.000018–$0.000019 (≈−21% to −25% vs today), with upside capped near $0.000024 unless a SOL-risk-on stretch, fresh CEX depth, or visible burn headlines appear. The soft floor sits around $0.000017–$0.000018 in risk-off tape. At today’s ~81T float, that base band translates to roughly $1.4–$1.6B in market cap, squarely low single-digit billions, consistent with a momentum-driven range rather than a structural re-rating.

BONK 3-Month Price Prediction | Image via Coincodex

BONK 3-Month Price Prediction | Image via Coincodex2026–2030 Yearly Scenarios

We triangulate across four public sources (CoinCodex, Changelly, Flitpay, CoinLore). “Bear” leans to the lowest credible range; “Base” takes conservative midpoints; “Bull” reflects the most optimistic cited ceiling. Assumptions are directional, not guarantees.

| Year | Bear (USD) | Base (USD) | Bull (USD) | Assumptions (cycle, liquidity, listings, sector flows) |

|---|---|---|---|---|

| 2026 | 0.00001666 (CoinCodex min) | ~0.000037 (Changelly avg) | 0.00008766 (Flitpay max) | Bear: SOL stalls; memecoin flows fade. Base: neutral SOL cycle, steady CEX/DEX liquidity. Bull: SOL risk-on, deeper listings + robust sector inflows. |

| 2027 | ~0.00002292 (CoinCodex lowest month) | ~0.000054 (Changelly avg) | 0.000063 (Changelly max) | Bear: post-cycle fade; liquidity fragments. Base: late-cycle chop; SOL apps stable. Bull: renewed meme season + larger venues. |

| 2028 | ~0.000024–0.000026 (CoinCodex avg band) | ~0.000026 (CoinCodex avg) | 0.000091 (Changelly max) | Bear: sideways market; SOL L2/infra demand muted. Base: gradual recovery, sustained volumes. Bull: strong Solana expansion + meme risk appetite. |

| 2029 | ~0.000033–0.000038 (CoinCodex avg) | ~0.000048 (CoinCodex Dec max) | 0.000126 (Changelly max) | Bear: late-cycle drawdown risk. Base: healthy depth + CEX coverage. Bull: peak cycle, heavy sector flows into meme cohort. |

| 2030 | ~0.000089–0.000103 (CoinCodex avg–max) | 0.000116 (CoinLore 2030) | 0.0005463 (Flitpay max; Changelly tops at ~0.000175) | Bear: mean-reversion after peak. Base: broad adoption, durable liquidity. Bull: euphoric cycle + major listings + sticky burns/lockups. |

Inference (2026–2030):

Ex-outliers, the cluster centers near $0.00008–$0.00010 (≈2.5–3× from September 2025). At today’s ~81T float, that implies roughly $6.5–$8.1B market cap — ambitious, but plausible at cycle highs for top-tier memes. Pushing into $0.00015–$0.00025 would mean ~$12.2–$20.3B, which assumes stronger-than-historical demand and/or credible float-tightening. Anything in the $0.004+ extreme (~$325B at today’s supply) effectively requires supply restructuring (major burns/redenomination) rather than just favorable market cycles.

Comparisons: BONK vs Other Memecoins

BONK is Solana’s flagship meme coin. The matrix below stacks it against DOGE, SHIB, PEPE, and WIF on supply scale, valuations, listings, and sector beta. Numbers reflect the supplied research snapshot (Sep 19, 2025). Use this as a positioning guide, not a ranking.

| Metric | BONK | DOGE | SHIB | PEPE | WIF |

|---|---|---|---|---|---|

| Supply (Circ./Total) | 81.21T / 87.99T | 151B / ∞ | 589.247T / 589.5T | 420.687T / 420.69T | 998.83M / 998.83M |

| FDV | $2.19B | $41.54B | $7.78B | $4.66B | $942M |

| ATH Market Cap | ~$5.4B (Nov 2024) | ~$90B (May 2021) | ~$40B (Oct 2021) | ~$7B (Dec 2024) | ~$4B (Mar 2025) |

| Exchange Coverage | 100+ (Gate.io, MEXC, Raydium) | 200+ (Binance, Coinbase, global merchants) | 150+ (Binance, Robinhood, ShibaSwap) | 120+ (Binance, OKX, Uniswap) | 90+ (Bybit, Raydium, Kraken) |

| Sector Beta (to SOL/BTC) | ~2.5x (high vol) | ~1.8x (mature) | ~2.2x (ecosystem-driven) | ~2.8x (hyper-sensitive) | ~3.0x (newest, wildest) |

BONK vs DOGE

- Maturity & adoption: DOGE’s decade of network effects and merchant penetration dwarf BONK’s DeFi-centric footprint.

- Liquidity profile: DOGE’s deeper books and steadier ~1.8x beta make it the “lower-variance” meme; BONK’s ~2.5x beta rides SOL cycles harder.

- Use case: DOGE tilts to payments/brand; BONK tilts to Solana trading culture and burn-driven narratives.

- Lens: DOGE for depth and staying power; BONK for higher-octane Solana exposure.

BONK vs SHIB

- Supply optics: Both run trillion-scale supplies; SHIB’s stack is larger, BONK’s burns have been more event-driven.

- Ecosystems: SHIB builds breadth (Shibarium, NFTs, wider listings). BONK leans into Solana speed, bots, and DEX flow.

- Beta & path: SHIB’s ~2.2x tracks ecosystem news; BONK’s ~2.5x magnifies SOL risk-on windows.

- Lens: SHIB for utility breadth and distribution; BONK for execution speed and Solana-native momentum.

BONK vs PEPE/WIF

- Narratives: PEPE and WIF carry fresher meme energy; BONK benefits from entrenched Solana ties.

- Liquidity corridors: PEPE’s multi-chain reach broadens fiat ramps; WIF competes head-to-head with BONK on Solana.

- Volatility: WIF’s ~3.0x is the wild card; PEPE ~2.8x is hypersensitive to meme rotations; BONK sits between stability and hype.

- Lens: PEPE/WIF favor short, hype-led rotations; BONK favors ecosystem lock-in and recurring burn/flywheel stories.

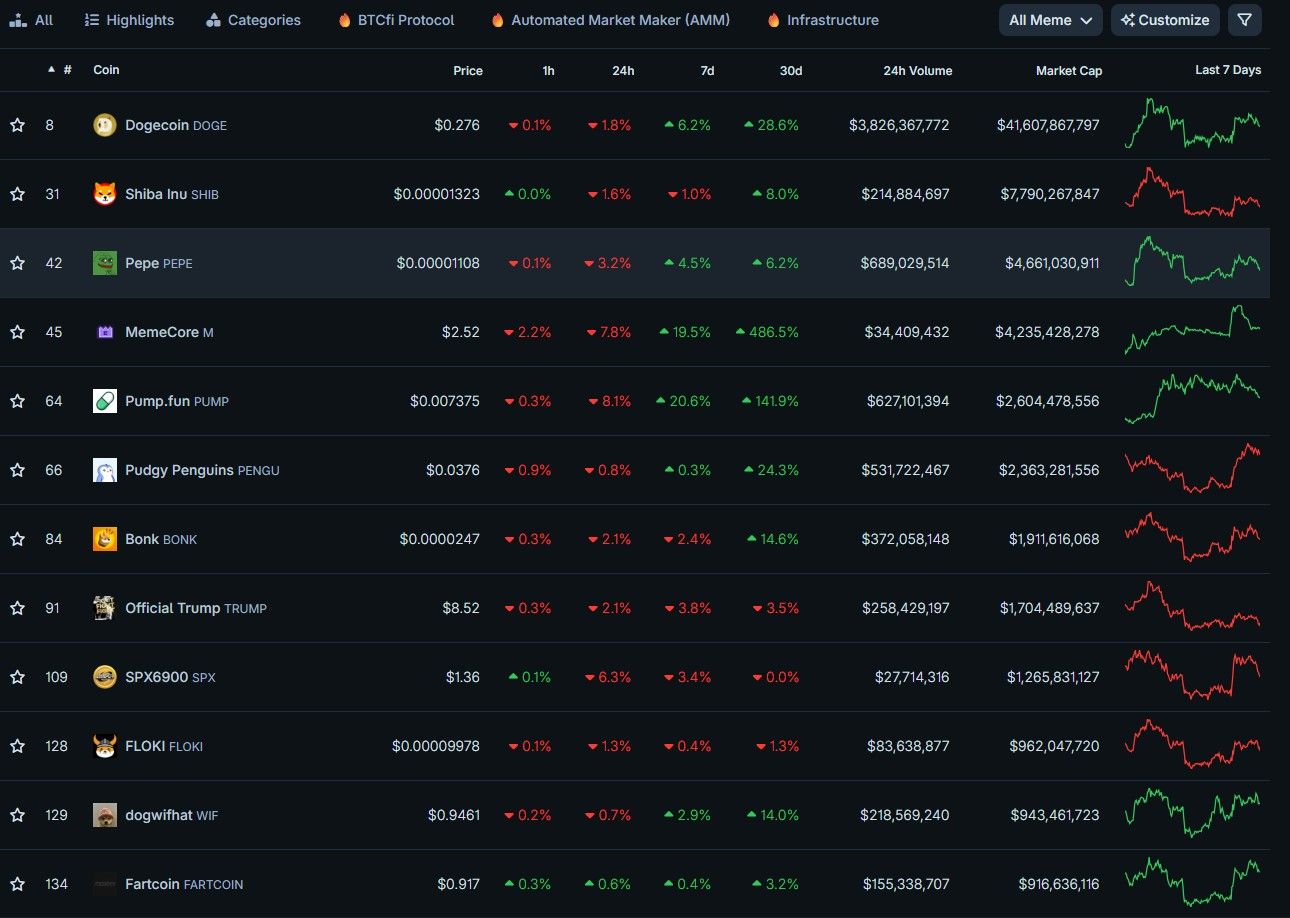

BONK Ranks Among the Top 10 Memecoins in Coingecko's List | Image via Coingecko

BONK Ranks Among the Top 10 Memecoins in Coingecko's List | Image via CoingeckoTakeaway: BONK’s edge is Solana speed, culture, and burn-linked reflexivity; its trade-off is trillion-scale supply and less real-world adoption than DOGE. It sits between DOGE’s durability and WIF’s chaos, with SHIB and PEPE bracketing it on distribution and narrative freshness.

Catalysts, Headwinds & Risk Matrix

| Likelihood | Impact: Low | Impact: Medium | Impact: High |

|---|---|---|---|

| High | Minor listing delays | Social fatigue / rotation → gradual bleed | SOL drawdown or liquidity drain → sharp selloffs |

| Medium | Derivative funding noise | Regulatory headline overhang → venue frictions | Whale distribution / large unlock → gap moves |

| Low | Temporary UI/infra quirks | Exchange incident (contained) | Bridge/wallet exploit or major venue delist → structural hit |

Reading it: Prioritize hedges and smaller size against the High-Likelihood/High-Impact quadrant (SOL drawdowns, liquidity vacuums). Prepare playbooks for Medium-Likelihood/High-Impact events (whale distribution, unlocks).

Bullish Catalysts

- Tier-1 listings & product placement: Deeper integration on major CEXs, inclusion in “earn,” “convert,” and retail-facing bundles increases passive flows and stickiness.

- Solana upgrades & throughput wins: Lower fees/latency + improved reliability can reignite SOL-ecosystem volumes, lifting meme beta.

- Big-account endorsements: Viral posts from high-reach accounts (traders, founders, creators) can trigger reflexive bursts of liquidity and follow-on listings.

- Ecosystem integrations: Wallet defaults, tipping rails, gaming/loyalty tie-ins, and retail on-ramps raise utility and distribution.

- Buyback/burn mechanics: DAO-approved burns, fee-to-burn routes, or lock/vest programs that persist across cycles tighten float and support higher cycle peaks.

- Derivatives depth: Healthy perp markets (with risk controls) can tighten spreads and attract larger traders, improving price discovery.

- Index/ETF inclusion (crypto-native): Appearance in curated meme or SOL ecosystem indices can create recurring demand.

Bearish Risks

- Liquidity drain: Rotation to new memes or majors; order book thins, slippage rises, and volatility spikes on sells.

- Regulatory headlines: Actions against exchanges or meme tokens can restrict venues, fiat ramps, or marketing.

- SOL drawdowns: Solana-wide risk-off (outages, exploits, macro) tends to compress meme valuations faster than majors.

- Social fatigue: Narrative decay after parabolic runs; engagement and new-holder inflows dry up.

- Concentration risk: Whale-heavy supply or exchange-custodied balances can amplify gap moves and overhang.

- Derivative imbalances: One-sided perp positioning + funding squeezes magnify drawdowns.

- Security/infra incidents: Bridge/wallet/exchange issues that touch BONK holders or the SOL stack can hit sentiment and flows.

Risk Management

- Position sizing: Cap speculative meme exposure (e.g., ≤1–3% core, 5% max risk bucket) relative to portfolio and time horizon.

- Defined invalidation: Use stop-losses (hard or mental) beneath key liquidity bands; avoid “averaging down” into thin books.

- Profit-taking ladders: Pre-set staggered sell targets (e.g., +50%, +100%, +200%) to harvest gains and de-risk into strength.

- Avoid high leverage: Especially on illiquid pairs; if using perps, keep low leverage and strict liquidation buffers.

- Venue diversification: Split holdings across reputable CEXs and self-custody; enable 2FA, withdrawal allowlists.

- Calendar awareness: Trim risk ahead of major unlocks, CPI/Fed prints, or SOL-specific upgrade windows with outage risk.

- Narrative checks: Track social/flow data; reduce size when engagement and volumes fade simultaneously.

Playbook

- Before entry: Define thesis + invalidation, set laddered exits, and choose a venue with depth.

- During pumps: Trail stops up; sell into strength at pre-set rungs; avoid adding on vertical candles.

- During chops: Keep size light; use alerts at liquidity nodes; don’t churn fees—wait for structure.

- During dumps: Honor stops; don’t revenge-trade; reassess narrative/flows before any re-entry.

- Ongoing: Monitor SOL health, CEX depth, funding/skews, and whale wallet trackers; rebalance monthly.

BONK Trading Approaches

BONK is a high-beta Solana meme asset. Treat it as speculative exposure where position size, predefined rules, and disciplined exits matter more than conviction.

Short-term Trading

- Trade levels and momentum, not headlines: breakouts, retests, and mean-reversion around clear support/resistance.

- Pre-plan entry, stop, and staggered take-profits; avoid averaging down.

- BONK’s beta tracks SOL; confirm setups with SOL trend, funding/OI, and spot–perp basis.

- Watch burn headlines (Bonkbot/bonk.fun) as flow catalysts, but treat them as timing inputs, not theses.

- Execution: prefer liquid CEX pairs; on Solana DEXs, network congestion widens slippage; use limits.

Long-term Holding

- Memes often run late in cycles as liquidity rotates. Potential exists, but drawdowns are large and recoveries uneven.

- Rules: cap size, trim into strength, and set invalidation (e.g., loss of weekly structure, SOL trend breaks, or negative funding with falling spot).

- Track vesting/large-wallet activity and burn cadence; persistent supply overhang can cap rallies.

Dollar-Cost Averaging (DCA)

- Generally not ideal for narrative-driven, volatile assets.

- If used, keep it small and finite, only during market strength (rising SOL + expanding volume), with a hard stop if key metrics stall.

Diversification and Risk Controls

- Treat BONK as a speculative sleeve of the portfolio. Typical guide: 0.5–2%; up to 3% only with higher risk tolerance.

- Rebalance on schedule or when allocation drifts; keep core exposure in BTC/ETH/stablecoins.

- Avoid leverage; maintain dry powder rather than forcing entries.

Use BONK for targeted, rules-based speculation tied to Solana’s risk cycle, keep sizing tight, and let exits, not opinions, govern outcomes.

Is BONK Investable vs. Tradable? (Thesis Check)

BONK behaves like a high-beta, narrative-driven asset that tracks Solana risk cycles. Supply sits in the tens of trillions, burns are incremental, and price discovery relies on social momentum and exchange liquidity. That profile suits tactical trading better than multi-year compounding. Use this checklist to decide trade vs hold.

Five-point checklist.

Use this to sanity-check a BONK position on Solana before you hit buy.

-

Time horizon & thesis— Weeks–months with predefined exits Trade; multi-year value without tokenomics change Not long-term.

-

Supply & valuation— Bands ~$0.00003–$0.00010 Trade / small hold; targets needing tens of trillions mcap Avoid long-term.

-

Catalyst pipeline— Track SOL breadth, burns, listings, app activity; exit if catalysts fade Trade. No monitoring Do not hold long-term.

-

Liquidity & execution— Route via liquid CEX pairs, manage DEX slippage, size for depth Trade. Thin pools / large tickets Small sleeve only.

-

Risk controls— ≤2–3% position, hard stops, staged profits, no leverage Eligible to trade. No rules / low drawdown tolerance Avoid / minimal.

Time horizon and thesis

- Seeking to capture Solana risk-on windows across weeks to months with predefined exits → Trade.

- Expecting multi-year value accrual without a structural tokenomics change → Not a long-term investable thesis.

Supply and valuation math

- Comfortable that realistic bands cluster near $0.00003–$0.00010 and that $1 is out of reach at current supply → Trade or small hold.

- Banking on price milestones that require tens of trillions in market cap → Avoid long-term investment.

Catalyst pipeline

- You track Solana breadth, fee-linked burns, listings, and app activity, and will exit if catalysts fade → Trade.

- No plan to monitor catalysts or unlock calendars → Do not hold long term.

Liquidity and execution

- You can route via liquid CEX pairs, manage DEX slippage during Solana congestion, and size positions for depth → Trade.

- Execution depends on thin pools or large tickets relative to liquidity → Limit to a small sleeve.

Risk controls

- Position size ≤2–3% of portfolio, hard stops, staged profit taking, no leverage → Eligible to trade.

- No strict rules or low drawdown tolerance → Avoid or keep minimal exposure.

Bottom line: For “is BONK a good investment” over the BONK long term, the case is weak without a supply overhaul. Treated as a rules-based, small-sized trade tied to Solana momentum, it can fit a speculative sleeve.