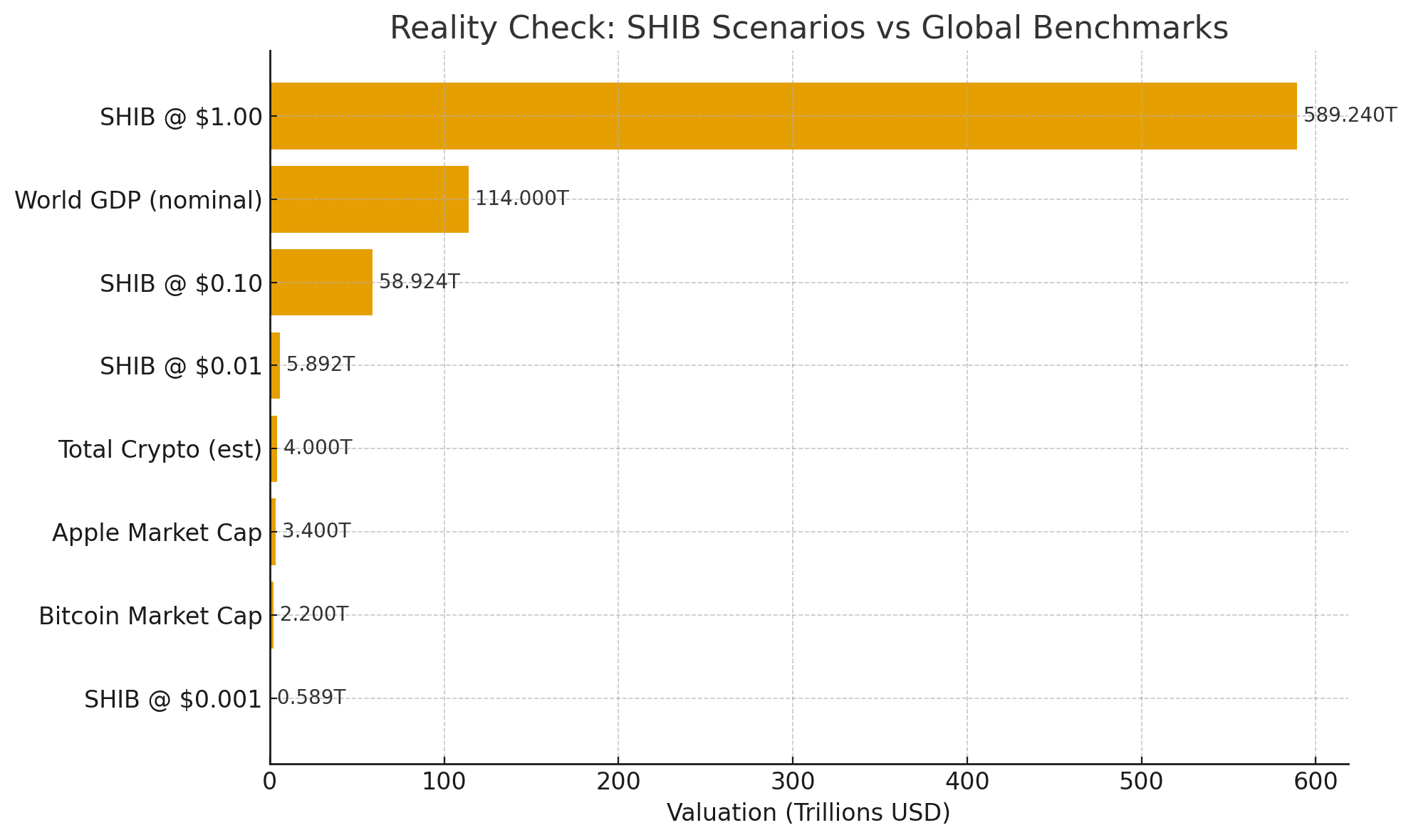

$1 SHIB is not realistic at today’s ~589T circulating supply. With price around ~$0.000012–0.000013 and market cap ~$7–8B, $1 implies ~$589 trillion valuation—far above the entire crypto market and ~5× world GDP. Even $0.001 needs ~$589B (≈15% of a $4T crypto market). Treat SHIB as a high-beta, tactical trade: keep sizes small, take profits into strength, and track Shibarium usage, burn cadence, and cycle liquidity.

Forecast at a glance

- 2025 Range: Min $0.0000097 — Base $0.000012–$0.000035 — Max (bull outliers) $0.000060–$0.000100.

- 2026 Base Case: $0.000013–$0.000031.

- 2030 Base Case: $0.00002–$0.00010 (aggressive outlier up to $0.000321).

- $1 Target: Mathematically implausible at current supply—~$589T implied market cap.

- Risk Label: High-risk, momentum-driven memecoin with burn-dependent narratives and broad crypto beta.

Numbers reflect our research snapshot (Feb. 3, 2026) and source ranges cited in the SHIB price-prediction section. Always verify live data before trading.

The Mathematical Impossibility of $1 SHIB

At ~589.24 trillion tokens outstanding, even tiny price moves balloon SHIB’s valuation. At this supply, $0.01 ≈ $5.9T and $1 ≈ $589T — figures that dwarf the entire crypto market (~$4T) and even world GDP (~$114T, nominal, 2025 IMF estimate). Below, we show the math step-by-step so you can see exactly why $1 isn’t realistic without an extreme (~99.999%) supply reduction.

Supply × Price = Market Cap (step-by-step)

Assumptions

- Circulating supply: 589.24T SHIB

- Total crypto market (baseline): $4T

Formulae

- Implied market cap = Target Price × (Supply in tokens)

= P × (589.24 × 10¹²) - % of total crypto = (Implied cap) / (Total crypto cap)

- (For reference later) Supply needed for $1 at today’s market cap M = M / $1 tokens

Scenario Table — Implied Market Caps & % of $4T Crypto

| Target Price | Implied Market Cap | % of $4T Crypto |

|---|---|---|

| $0.0001 | $58.924B | 1.47% |

| $0.001 | $589.24B | 14.73% |

| $0.005 | $2.9462T | 73.66% |

| $0.01 | $5.8924T | 147.31% |

| $0.02 | $11.7848T | 294.62% |

| $0.05 | $29.462T | 736.55% |

| $0.10 | $58.924T | 1,473.10% |

| $1.00 | $589.24T | 14,731% |

Quick read: Even $0.01 implies ~$5.9T, already bigger than a $4T total crypto market. $1 implies ~$589T.

Reality Check vs Global Benchmarks: Can SHIB Reach $1?

Even $0.01 Puts SHIB At ~$5.9T, Bigger Than Today’s ~$4T Crypto Market

Even $0.01 Puts SHIB At ~$5.9T, Bigger Than Today’s ~$4T Crypto MarketKey SHIB Metrics

This section keeps the numbers front and center so readers can anchor every claim in fresh data; use the widget for price/volume and the table below to see how SHIB stacks up against other top memecoins right now.

Figures auto-update via CoinGecko; always verify on your chosen exchange before trading.

Supply & Unlocks

- Initial supply: 1 quadrillion at launch (August 2020, creator “Ryoshi”).

- Current total supply: ~589.50T SHIB (post burns/donations).

- Circulating supply: ~589.24T SHIB (≈100% of supply in circulation).

- Emissions: None (no ongoing mint); deflationary intent via burns (a portion of BONE gas fees on Shibarium is converted to SHIB and burned).

Snapshot: Feb. 3, 2026. Data via CoinGecko and CoinMarketCap.

Liquidity & Coverage

Top CEX by recent 24h spot share:

Top DEX by recent 24h share:

- Shibaswap ~$87.8M

- Uniswap ~$30M

- ApeSwap ~$8.6M

On top CEXs, order books are generally deep enough for retail-sized orders; spreads and slippage vary by venue/pair. Always verify depth on your trading screen.

Positioning takeaway: With ~589T SHIB outstanding, even tiny price moves translate into very large market-cap changes. Anchor all forecasts to this ~589T circulating base and CEX-dominated liquidity profile.

Burn Mathematics: What Would Need to Happen

Even generous burn headlines barely dent a ~589T supply. Here’s what the current pace looks like versus what would be required to make common price targets plausible via burns alone (i.e., keeping valuation roughly where it is and shrinking supply to lift price).

Today's Burn Pace vs Required Pace

At the current run-rate (~10–20B SHIB/year), supply shrinks ~0.002–0.004%/yr. To hit $1 without adding value, the supply would need to drop ~99.999%.

What this chart shows:

- Columns = monthly SHIB burned in 2025 (tiny because burns are measured in billions, while the y-axis is in trillions of SHIB per month).

- Six horizontal lines = required monthly burn rates to reach $0.001 and $0.01 in 3 / 5 / 10 years via burns alone (i.e., keeping valuation roughly flat, price rises only by shrinking supply).

- The legend maps each line style to its scenario. Together, they illustrate how today’s burn pace compares to what would be needed for popular targets.

Assumptions & Method

- Current circulating supply (S₀): ~589.24T SHIB

- Market-cap band (M): $7.4B (single midpoint, same as the chart)

- Price target (P): $0.001 or $0.01

- Supply needed (S*): S* = M / P

- Total burn needed: ΔS = S₀ − S*

- Required monthly burn over Y years: ΔS / (12 × Y)

Burn-only scenarios: if valuation rises, required burns fall proportionally—but then you’re assuming a large, sustained re-rating rather than supply math.

Required Monthly Burns (Trillions of SHIB per month)

(Assumes S₀ ≈ 589.24T and M = $7.4B)

| Target via Burns Only | Supply Needed (T) | Burn Needed (T) | 3 Years | 5 Years | 10 Years |

|---|---|---|---|---|---|

| $0.001 | 7.40 | 581.84 | ~16.16 T/mo | ~9.70 T/mo | ~4.85 T/mo |

| $0.01 | 0.74 | 588.50 | ~16.35 T/mo | ~9.81 T/mo | ~4.90 T/mo |

Perspective vs current burns

Recent 2025 monthly burns have ranged roughly 0.000013–0.00231T/mo (i.e., 13M–2.31B SHIB), with a rough 9-month average ≈ 0.00084T/mo (~0.84B).

Against that, the required paths above are about ~5,800× to ~19,500× larger (using the ~0.00084T/mo average).

So What?

- Even the 10-year path needs ~4.9T SHIB every month, i.e., thousands of times today’s pace.

- With a ~589T base, episodic burn spikes barely register; only sustained, multi-trillion monthly burns (or a massive valuation re-rating from real utility) would move the needle.

Time-to-Target Under Different Burn Scenarios

Here’s a quick guide to reading the timeline chart.

Each row is a different burn pace:

- Current run-rate ≈ today’s monthly burns

- ‘Optimistic’ ×10 = ten times today’s pace

- Hypothetical burn = a very aggressive, illustrative pace

Each row has two bars:

- Grey bar = time to burn 90% of the supply

- Green bar = time to burn 99.999% of supply

Scales differ by row (noted at left of each row), so you can actually see the bars:

- Current: 0–50,000 years

- ×10: 0–5,000 years

- Hypothetical: 0–100 years

Labels at the right end of each bar show the approximate years required at that pace.

Takeaway: Even at 10× today’s pace, 90% takes millennia and 99.999% is even longer. Only an extreme, sustained burn rate compresses timelines to decades.

Utility Check — Shibarium & Ecosystem (BONE, LEASH)

Shibarium is where SHIB’s utility should translate into burns: real usage generates BONE gas fees, those fees are periodically converted to SHIB, and SHIB is burned.

In this section, we sanity-check the throughput (daily tx), depth (TVL), and the apps that actually move value to see whether the fee→burn flywheel is spinning fast enough to matter.

Shibarium Activity & Its Link to Burns

BONE is Shibarium’s gas token. A portion of gas fees accumulates in BONE, is converted to SHIB, then sent to burn addresses in batches. This is the core link from real usage → fees → burns.

What the data says

- Daily transactions have been choppy: late-August readings hit ~4.7M/day before slumping, according to ShibariumScan data. Mid-September readings rebounded from ~7k to ~17k day-over-day but remain far below August highs.

- TVL on Shibarium is ~$1.48M right now, per DeFiLlama.

How burns are actually funded:

BONE is Shibarium’s gas token. A portion of gas fees accumulates in BONE, is converted to SHIB, then sent to burn addresses in batches. This is the core link from real usage → fees → burns.

Why this matters: When daily tx and TVL are low, the fee pool is small, so burns remain tiny relative to SHIB’s ~589T supply. Big spikes help optics, but need to persist to change the math.

Apps That Actually Move Value

| App / Rail | What to show | Why it matters |

|---|---|---|

| ShibaSwap (DEX) | Note that fees accrue in BONE and are periodically converted to SHIB and burned. Link to the DEX and docs/announcements. | Trading/liquidity hub for SHIB/BONE/LEASH; any durable lift in on-chain activity can raise fee flow → raises periodic SHIB burns. |

| Cross-chain rail (Chainlink CCIP) | Purpose: Lets the ecosystem move value/invoke actions across 20+ chains; status: live/rolling out across the SHIB stack, incl. ShibaSwap integration updates. | If liquidity actually bridges in, it can deepen volumes and utility on Shibarium, prerequisite for meaningful fee-funded burns. |

| Identity / commerce (.shib & MoEI pilot) | .shib TLD effort with D3 (identity/branding rails); UAE MoEI + ShibOS public-sector pilot. Note this is branding/pilot, not TVL. | Helpful for narrative and footprint; direct price impact requires these efforts to convert into sticky usage/liquidity. |

Anchor app: ShibaSwap

ShibaSwap remains the primary DEX touchpoint for SHIB/BONE/LEASH liquidity and trading. The team has pushed multi-chain/V3-style upgrades (liquidity tools, scalability focus) and security notices, plus messaging around broader cross-chain connectivity. Impact to volumes/TVL on Shibarium is incremental so far.

Ecosystem enablers & pilots

- Chainlink CCIP: Adopted in the SHIB ecosystem to support cross-chain actions (e.g., Metaverse land purchases via Ethereum ↔ Shibarium paths); Chainlink’s public notes list Shibarium among CCIP integrations.

- .shib Domain initiative (D3 Global): Pursuit of a top-level domain to standardize identity/branding for the ecosystem. Still early for measurable usage.

- Public-sector pilot (UAE MoEI / ShibOS): Partnership announcements position SHIB tech for Web3 services; promising, but on-chain liquidity effects aren’t evident yet.

Technicals That Traders Care About (Levels, Not Vibes)

SHIB trades around $0.00001278 – $0.00001360 in September 2025, after a brief uptick, still inside a broad range. Price recently broke out of a falling wedge, then retested trendlines from prior highs. Structure remains accumulation with room for a sharp move if key levels give way.

SHIB Breaking Out of a Falling Wedge Pattern | Image via X

SHIB Breaking Out of a Falling Wedge Pattern | Image via XKey Supports/Resistances

Key support and resistance levels are as follows:

- Supports: $0.00001187 (critical), $0.00001194 (lower Bollinger Band), $0.00001200 (multi-test bounce since July), $0.00001221 (pivot).

- Resistances: $0.00001320 (first trigger), $0.00001350 (liquidity magnet), $0.00001382–$0.00001397 (upper Band), $0.00001450 (descending trendline), $0.00001500.

Momentum Indicators

Key technical indicators show these levels:

- RSI (14): swinging 34.7 to 46.1. Sub-50 keeps momentum neutral to soft. A sustained push above 50 would confirm recovery. Recent bullish divergence supports that case.

- MACD: weak-bearish read with flattening histograms, consistent with consolidation.

- Moving averages/Bands: alignment still cautious. Price near the middle Band after a lower-band bounce suggests a short-term relief bid, not a confirmed trend.

Volume & Whale Activity

Here is a summary of volume and whale activity:

- Volume: intermittent surges, but Shibarium daily transactions recently slipped to a two-month low (~624k), muting on-chain follow-through.

- Whales: mixed signals. Reports show 132.3B SHIB moved to cold storage in August; earlier rebounds saw multi-trillion transfers and large stacking episodes, yet whale prints have recently dried up. That points to cautious accumulation rather than aggressive risk-on.

- Sentiment: social gauges lean slightly positive, with alerts rising into the mid-60s, but broader fear metrics remain stressed.

Read: The setup is neutral to mildly bearish until $0.00001320 breaks with volume. Above it, momentum can extend toward $0.000015–$0.000016. Below $0.00001187, risk shifts to a deeper pullback.

The Trigger Map

Upside confirmation

- Primary break: 4H or daily close above $0.00001320 with ≥2× 20-day median volume.

- Hold/retest: Flip $0.00001320 → support on the next 4H retest.

- Path/targets: $0.00001350 → $0.00001385–$0.00001397 → $0.00001450 → $0.00001500.

- Invalidation: A 4H close back below $0.00001320 on rising volume = failed breakout.

Extension trigger

- After tagging $0.00001450, a tight 4H flag that resolves up and keeps OBV rising = continuation to $0.00001500–$0.00001580.

- Invalidation: Lose flag low or OBV diverges while price pushes new highs.

Range continuation (neutral)

- While price is between $0.00001200–$0.00001320, fade edges: buy dips near $0.00001200–$0.00001220, sell rips near $0.00001310–$0.00001320—only if volume stays average/sub-average and RSI sits ~40–60.

- Invalidation: Volume expansion + RSI >60 (or <40) = range likely ending → switch to trend plan.

Downside confirmation

Primary break: 4H close below $0.00001200, then below $0.00001187 with ≥1.5× 20-day median volume.

- Path/targets: $0.00001150 → $0.00001120 → $0.00001080.

- Invalidation: Quick reclaim of $0.00001200 on strong volume (bear trap).

Fakeout filters (use together)

- Volume: Don’t chase breaks without the volume rules above.

- Retest: Prefer trades after a clean retest/hold of the broken level.

- RSI/MA confluence: Breaks that align with RSI >50 (bull) or <50 (bear) and a 4H close above/below the 50/200-MA stack have higher follow-through.

Risk rules (plug-and-play)

- Stops: 0.8–1.2× 14-period ATR beyond the invalidation level.

- Size: Risk a fixed 0.5–1.0% of equity per idea; scale only after the retest holds.

- Timer: If no follow-through within 2–3 candles of your entry timeframe, trim or exit.

SHIB Price Prediction (2025-2030)

Below is a synthesis of the forecasts, grouped by year, with an editorial “working range” that reflects the cluster (not the outliers). Current price context: ~$0.000012.

Year-by-Year Consensus Cluster

| Year | Bullish highs (USD) | Bearish lows (USD) | Working range (USD) |

|---|---|---|---|

| 2025 | CoinStats 0.00006392 InvestingHaven 0.0000445 SwapSpace 0.00003126 | AMBCrypto 0.0000097 InvestingHaven 0.0000101 CoinDCX risk 0.00001150 | 0.000012–0.000035 (base) 0.00006–0.00010 as bullish outliers |

| 2026 | DigitalCoinPrice up to 0.0000306 | Binance 0.000013 | 0.000013–0.000031 |

| 2030 | CoinStats up to 0.000321 Benzinga up to 0.00010 | Binance 0.000016 | 0.00002–0.00010 0.00032 as an aggressive outlier |

Forecasts: Retrieved Sept. 21, 2025. Not financial advice; models can be wrong and may change.

Most external calls cluster around incremental upside in 2025 (~$0.000012–$0.000035) with episodic spikes possible. Outlier targets (e.g., $0.00010 in 2025 or $0.000321 by 2030) require a step-change in utility-driven demand and sustained transaction-funded burns, conditions not yet in evidence.

What Would Need to Change to Reach the Upper Bands

- Sustainably higher on-chain usage (tx growth): Aim for multi-quarter daily transactions in the 1–3M+ range (vs. sporadic spikes) with no drop-offs after news cycles. Watch: active addresses, failed tx rate, gas paid in BONE, and retention (7/30/90-day returning users).

- Sticky DApps (real product-market fit): One or two anchor apps on Shibarium (DEX + a non-trading app like payments, gaming, or identity) that hold $50–$150M+ TVL combined and keep DAU/MAU > 25–35%. Evidence: consistent volumes, repeat users, and partner integrations—not just incentives.

- Fee-funded burn flywheel (not ad-hoc burns): Make burns programmatic and frequent (e.g., weekly) from protocol fees so they scale with usage. North star: push from billions → tens/hundreds of billions SHIB/month burned on an ongoing basis. Public dashboards should reconcile BONE fees → SHIB conversions → burn tx hashes.

- Deeper liquidity + spread compression: Broaden market-maker coverage so $1–5M clips move price minimally across majors (Binance/Coinbase/OKX) and top Shibarium DEXes. Track: order-book depth at 10–50 bps, realized spreads, and cross-venue price divergence.

- Distribution & listings (access, not hype): Incremental uplift from more fiat on-ramps, regional exchanges, and payment rails (BitPay/NOWPayments partners actually settling in SHIB). Success = measurable jumps in fiat pairs’ share of volume, not just announcement spikes.

- Credible cross-chain pipes (CCIP et al.): Seamless asset movement into Shibarium that shows up as net inflows (bridge TVL rising, not churning) and stable liquidity residency. Metrics: bridged assets outstanding, time-on-chain, and reduced “in-and-out” volatility around events.

- Security/ops reliability: Zero material incidents for 12+ months, quick patch cadence, transparent post-mortems, and third-party audits. Traders re-risk when the infrastructure feels boring and safe.

- Macro & cycle beta: Upper bands usually need risk-on macro (looser liquidity, crypto total mkt cap expanding) plus a memecoin rotation phase. Corroborate with BTC/ETH trend strength, stablecoin supply growth, and rising alt breadth.

- Narrative maturity (beyond meme): Clear messaging that ties identity/commerce pilots, CCIP, ShibaSwap v3 into a single story: “use → fees → burns → tighter supply.” Deliverables and numbers beat roadmaps.

Comparisons: SHIB vs Other Memecoins

Shiba Inu (SHIB) is the #2 meme coin by market value. The matrix below stacks it against DOGE, PEPE, and FLOKI on supply scale, valuations, listings, and sector beta.

| Metric | SHIB | DOGE | PEPE | FLOKI |

|---|---|---|---|---|

| Supply (Circ./Total) | ~589.24T / ~589.5T (deflation intent via burns) | ~145–160B / uncapped (≈5B/yr inflation) | ~420.69T / 420.69T (fixed) | ~9–10T (post-burn; mostly circulating) |

| Token Model | ERC-20 on Ethereum + Shibarium L2; burn mechanisms | Native L1 (PoW/Scrypt); simple payments; no burns | ERC-20 (ETH); pure meme/speculative | ERC-20 multi-chain; marketing/utility pushes |

| FDV (Snapshot) | Mid-single-digit $T at $0.01; actual FDV varies by price | Tens of $B (price-dependent) | Low-single-digit $T at $0.01; price-dependent | Tens of $B at prior peaks; price-dependent |

| ATH Market Cap (cycle) | ~$40–52B (Oct 2021) | ~$80–90B (May 2021) | ~$6–7B (late 2024/early 2025) | ~$3–4B (Q1 2025) |

| Exchange Coverage | 150+ incl. Binance, Coinbase/Robinhood (varies), ShibaSwap | 200+ incl. Binance, Coinbase; widest fiat rails | 100–120+ incl. Binance/OKX; Uniswap depth | 80–100+ incl. Bybit/Kraken; strong on CEX+DEX |

| Sector Beta (to BTC/ETH) | ~2.0–2.4× (ecosystem-driven beta) | ~1.6–1.9× (more mature/liquid) | ~2.5–2.9× (rotation-sensitive) | ~2.7–3.1× (higher volatility) |

| Narrative Core | Burns + Shibarium utility (BONE/LEASH) | OG payments + brand reach | Fresh meme momentum + high beta | Aggressive marketing + community activations |

SHIB vs DOGE

- Maturity & adoption: DOGE’s decade of brand and merchant mindshare dwarfs SHIB’s, which relies more on DeFi/L2 utility.

- Liquidity profile: DOGE’s deeper books and ~1.7× beta make it the “lower-variance” meme; SHIB’s ~2× beta leans on ecosystem headlines.

- Use case: DOGE = simple payments/brand; SHIB = programmability via Ethereum + Shibarium (DEX, staking, burns).

- Lens: Choose DOGE for depth and durability; SHIB if you want programmable surface area with burn optics.

SHIB vs PEPE

- Supply & optics: Both massive supplies, but PEPE’s “pure meme” positioning invites faster rotations.

- Distribution: PEPE’s multi-chain liquidity and social virality drive sharp, short bursts; SHIB’s distribution is broader but moves slower.

- Beta: PEPE typically runs hotter (~2.6–2.9×) vs SHIB’s ~2×.

- Lens: PEPE for high-beta momentum trades; SHIB for bigger-cap meme exposure with an ecosystem angle.

SHIB vs FLOKI

- Narrative: FLOKI leans on marketing, sponsorships, and utility pushes; SHIB leans on burns + L2/tooling.

- Coverage: FLOKI’s listings have expanded but are still a notch below SHIB’s global breadth.

- Volatility: FLOKI often shows a higher realized beta (~2.8–3.1×) than SHIB.

- Lens: FLOKI for higher-octane swings and narrative campaigns; SHIB for scale, liquidity, and a deeper product stack.

Takeaway

SHIB’s edge is scale, liquidity, and a programmable ecosystem (Shibarium + burns); its trade-off is trillion-scale supply that caps multiples versus smaller memes. It sits between DOGE’s durability and FLOKI/PEPE’s high-beta chaos, offering a middle ground for meme-sector exposure.

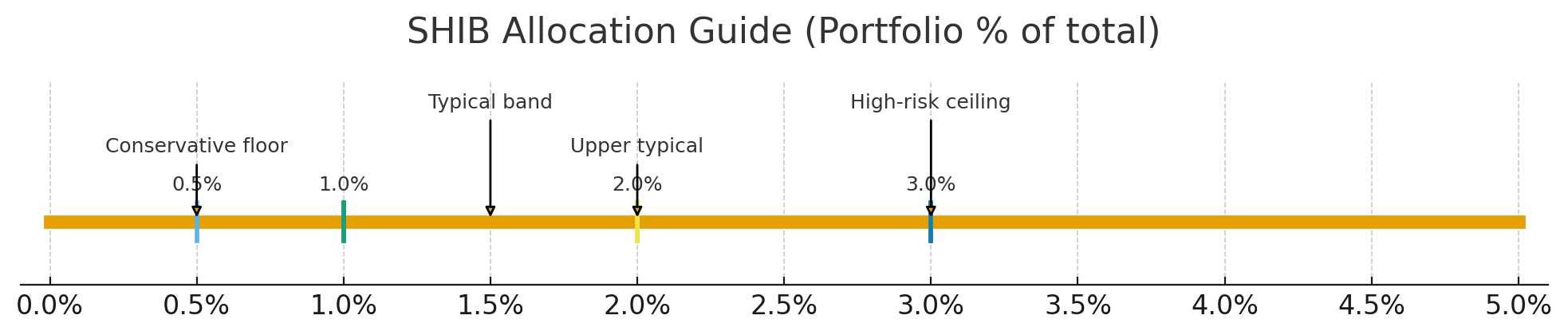

Portfolio Strategy: Where (If Anywhere) SHIB Fits?

SHIB is a high-beta bet. If you use it at all, treat it as a small satellite sleeve with strict sizing, pre-planned exits, and zero dependency on it for core returns.

Position Sizing & Rules

Decide your max % first, then let the chart dictate entries/exits.

Allocation guide

- Typical sleeve 0.5–2% of portfolio; up to 3% only for high risk tolerance. Keep core in BTC/ETH/stables.

Execution rules

- Laddered takes: Scale in/out at predefined levels; avoid all-in entries.

- Hard stops: Place stops beyond invalidation (≈ 0.8–1.2× ATR) and honor them.

- No leverage on illiquid pairs: Stick to deep books; avoid off-hours slippage.

- Trim winners: Build profit ladders (e.g., 25–33% tranches) to prevent round-trips.

- Position cap: If price pumps your sleeve above the max %, rebalance; don’t add.

Use This Chart To Decide Shiba Inu Entries/Exits

Use This Chart To Decide Shiba Inu Entries/ExitsPersonas & Playbooks

Match tactics to temperament; your rules should fit how you actually trade or hold.

Trader (levels & alerts)

- Enter on break + retest with volume confirmation; exit on failed retest.

- Use time stops (e.g., 2–3 candles of your entry timeframe without follow-through).

- Keep risk per idea 0.5–1.0%; scale only after the level holds.

Speculative holder (time-boxed thesis)

- Define a thesis window (e.g., “Q4–Q1 product/usage catalysts”).

- Pre-set trim points into strength; keep a hard invalidation (e.g., loss of key support or catalysts slipping).

- No averaging down outside your pre-planned max allocation.

Avoid/Diversify (if you need cash-flow or blue-chip risk)

- Prefer BTC/ETH/stables, yield from on-chain majors, or blue-chip L2s.

- If you still want exposure, use a tiny tracker position (≤0.5%) and revisit quarterly.

Risks You Can’t Ignore

- Liquidity rotation: Capital churns to fresher memes; rallies can fade fast.

- Narrative fatigue: Attention half-life is short; announcements without usage don’t stick.

- Large supply & valuation ceiling: With ~589T outstanding, tiny price moves imply giant market-cap jumps.

- Regulatory & ops headlines: Exchange actions, bridge/incidents, or policy shifts can hit liquidity in hours.

- Venue depth & slippage: Smaller venues = worse fills; stick to deep books and avoid illiquid pairs/times.

- Volatility clustering: Big moves bunch together; position sizing and stops matter more than conviction.

Myths vs Reality

| Claim | What the Math/Data Shows |

| “SHIB to $1 is just a matter of time.” | At today’s ~589T circulating supply, $1 implies ~$589 trillion market cap—orders of magnitude bigger than global crypto and major asset classes. Hitting $1 via burns alone needs a ~99.999% supply cut. |

| “Burns are accelerating to infinity.” | Recent pace ≈ 10–20B SHIB/year (that’s ~0.002–0.004% of supply). Even “good months” barely register against ~589T outstanding. |

| “Shibarium usage guarantees huge burns.” | Burns come from fees. With low TVL (~low single-digit millions) and tx counts well below peaks, the fee pool is small, so conversions to SHIB and burns are modest. |

| “Price can 10× on hype alone.” | A 10× at current supply needs ~$70–80B market cap—heavy, sustained inflows and liquidity depth, not just a trend day on social media. |

| “Supply is constantly dropping fast.” | Net supply is nearly flat; periodic burn spikes don’t change the annual picture much. |

| “Big partnerships/listings = immediate moon.” | Listings and integrations improve access and narrative, but without sticky usage and fees, they rarely drive persistent re-ratings. |

| “$0.01 is realistic next cycle.” | $0.01 implies ~$5.9T market cap at current supply—larger than the entire crypto market today; requires a radical supply cut or a historic re-valuation. |

| “Whale accumulation guarantees upside.” | Whale flows can move price short term, but without improving on-chain activity and TVL, gains often fade as liquidity rotates. |

| “Burn proposals can fix everything quickly.” | Unless they’re programmatic, frequent, and usage-scaled, proposals don’t change the need for multi-trillion SHIB/month burns to hit popular targets on realistic timelines. |

| “TA levels don’t matter for memes.” | Liquidity is concentrated; break/hold at key levels with volume often determines whether moves stick or mean-revert. |